History of insurance on:

[Wikipedia]

[Google]

[Amazon]

The history of insurance traces the development of the modern

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own

In the late 19th century, "accident insurance" began to become available. This operated much like modern ''disability'' insurance. The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent

In the late 19th century, "accident insurance" began to become available. This operated much like modern ''disability'' insurance. The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent

business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for ...

of insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

against risks, especially regarding cargo

In transportation, cargo refers to goods transported by land, water or air, while freight refers to its conveyance. In economics, freight refers to goods transported at a freight rate for commercial gain. The term cargo is also used in cas ...

, property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, re ...

, death

Death is the end of life; the irreversible cessation of all biological functions that sustain a living organism. Death eventually and inevitably occurs in all organisms. The remains of a former organism normally begin to decompose sh ...

, automobile accidents, and medical treatment

A therapy or medical treatment is the attempted remediation of a health problem, usually following a medical diagnosis. Both words, ''treatment'' and ''therapy'', are often abbreviated tx, Tx, or Tx.

As a rule, each therapy has indications an ...

.

The insurance industry

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

helps to eliminate risks (as when fire-insurance providers demand the implementation of safe practices and the installation of hydrants), spreads risks from individuals to the larger community, and provides an important source of long-term finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

for both the public

In public relations and communication science, publics are groups of individual people, and the public (a.k.a. the general public) is the totality of such groupings. This is a different concept to the sociology, sociological concept of the ''Öf ...

and private sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The private sector employs most of the workfo ...

s.

Ancient era

In December 1901 and January 1902, at the direction of archaeologistJacques de Morgan

Jean-Jacques de Morgan (3 June 1857 – 14 June 1924) was a French mining engineer, geologist, and archaeologist. He was the director of antiquities in Egypt during the 19th century, and excavated in Memphis and Dahshur, providing many dra ...

, Father

A father is the male parent of a child. Besides the paternal bonds of a father to his children, the father may have a parental, legal, and social relationship with the child that carries with it certain rights and obligations. A biological fat ...

Jean-Vincent Scheil

Father Jean-Vincent Scheil (born 10 June 1858, Kœnigsmacker – died 21 September 1940, Paris) was a French Dominican scholar and Assyriologist. He is credited as the discoverer of the Code of Hammurabi in Persia. In 1911 he came into possessio ...

, OP found a 2.25 meter

The metre (or meter in US spelling; symbol: m) is the base unit of length in the International System of Units (SI). Since 2019, the metre has been defined as the length of the path travelled by light in vacuum during a time interval of of ...

(or 88.5 inch

The inch (symbol: in or prime (symbol), ) is a Units of measurement, unit of length in the imperial units, British Imperial and the United States customary units, United States customary System of measurement, systems of measurement. It is eq ...

) tall basalt

Basalt (; ) is an aphanite, aphanitic (fine-grained) extrusive igneous rock formed from the rapid cooling of low-viscosity lava rich in magnesium and iron (mafic lava) exposed at or very near the planetary surface, surface of a terrestrial ...

or diorite

Diorite ( ) is an intrusive rock, intrusive igneous rock formed by the slow cooling underground of magma (molten rock) that has a moderate content of silica and a relatively low content of alkali metals. It is Intermediate composition, inter ...

stele

A stele ( ) or stela ( )The plural in English is sometimes stelai ( ) based on direct transliteration of the Greek, sometimes stelae or stelæ ( ) based on the inflection of Greek nouns in Latin, and sometimes anglicized to steles ( ) or stela ...

in three pieces inscribed with 4,130 lines of cuneiform law

Cuneiform law refers to any of the legal codes written in cuneiform script that were developed and used throughout the ancient Middle East among the Sumerians, Babylonians, Assyrians, Elamites, Hurrians, Kassites, and Hittites. The Code of Hammurab ...

dictated by Hammurabi

Hammurabi (; ; ), also spelled Hammurapi, was the sixth Amorite king of the Old Babylonian Empire, reigning from to BC. He was preceded by his father, Sin-Muballit, who abdicated due to failing health. During his reign, he conquered the ci ...

(c. 1792–1750 BC) of the First Babylonian Empire

The Old Babylonian Empire, or First Babylonian Empire, is dated to , and comes after the end of Sumerian power with the destruction of the Third Dynasty of Ur, and the subsequent Isin-Larsa period. The Chronology of the Ancient Near East, chrono ...

in the city of Shush, Iran

Shush () is a city in the Central District (Shush County), Central District of Shush County, Khuzestan province, Khuzestan province, Iran, serving as capital of both the county and the district. Shush is beside ancient Susa.

Demographics ...

. Code of Hammurabi Law 100 stipulated repayment by a debtor

A debtor or debitor is a legal entity (legal person) that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this ...

of a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the deb ...

to a creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some propert ...

on a schedule

A schedule (, ) or a timetable, as a basic time-management tool, consists of a list of times at which possible tasks, events, or actions are intended to take place, or of a sequence of events in the chronological order in which such thing ...

with a maturity date

Maturity or immaturity may refer to:

* Adulthood or age of majority

* Maturity model

** Capability Maturity Model, in software engineering, a model representing the degree of formality and optimization of processes in an organization

* Developme ...

specified in written

Writing is the act of creating a persistent representation of language. A writing system includes a particular set of symbols called a ''script'', as well as the rules by which they encode a particular spoken language. Every written language ...

contractual term

A contractual term is "any provision forming part of a contract". Each term gives rise to a contractual obligation, the breach of which may give rise to litigation. Not all terms are stated expressly and some terms carry less legal gravity as ...

s. Laws 101 and 102 stipulated that a shipping agent, factor

Factor (Latin, ) may refer to:

Commerce

* Factor (agent), a person who acts for, notably a mercantile and colonial agent

* Factor (Scotland), a person or firm managing a Scottish estate

* Factors of production, such a factor is a resource used ...

, or ship charterer was only required to repay the principal of a loan to their creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some propert ...

in the event of a net income

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (a ...

loss or a total loss

In insurance claims, a total loss or write-off is a situation where the lost value, repair cost or salvage cost of a damaged property exceeds its insured value, and simply replacing the old property with a new equivalent is more cost-effect ...

due to an Act of God

In legal usage in the English-speaking world, an act of God, act of nature, or damnum fatale ("loss arising from inevitable accident") is an event caused by no direct human action (e.g. Severe weather, severe or extreme weather and other natur ...

. Law 103 stipulated that an agent, factor, or charterer was by ''force majeure

In contract law, force majeure ( ; ) is a common clause in contracts which essentially frees both parties from liability or obligation when an extraordinary event or circumstance beyond the control of the parties, such as a war, strike, riot, ...

'' relieved of their liability for an entire loan in the event that the agent, factor, or charterer was the victim of theft

Theft (, cognate to ) is the act of taking another person's property or services without that person's permission or consent with the intent to deprive the rightful owner of it. The word ''theft'' is also used as a synonym or informal shor ...

during the term of their charterparty

A charterparty (sometimes charter-party) is a maritime contract between a shipowner and a hirer ("charterer") for the hire of either a ship for the carriage of passengers or cargo, or a yacht for leisure.

Charterparty is a contract of carria ...

upon provision of an affidavit

An ( ; Medieval Latin for "he has declared under oath") is a written statement voluntarily made by an ''affiant'' or ''deposition (law), deponent'' under an oath or affirmation which is administered by a person who is authorized to do so by la ...

of the theft to their creditor.

Code of Hammurabi Law 104 stipulated that a carrier (agents, factors, or charterers) issue a waybill and invoice

An invoice, bill, tab, or bill of costs is a commercial document that includes an itemized list of goods or services furnished by a seller to a buyer relating to a sale transaction, that usually specifies the price and terms of sale, quanti ...

for a contract of carriage to a consignee

A consignee is a person or entity to which goods are consigned. In a contract of carriage, the consignee is the entity who is financially responsible (the buyer) for the receipt of a shipment.

If a sender dispatches an item to a receiver via ...

outlining contractual terms for sales

Sales are activities related to selling or the number of goods sold in a given targeted time period. The delivery of a service for a cost is also considered a sale. A period during which goods are sold for a reduced price may also be referred ...

, commissions, and laytime __NOTOC__

In commercial shipping, laytime is the amount of time allowed, measured in days (or portions thereof), hours, or even tides, within a voyage charter for the loading and unloading of cargo.

Under a voyage charter or time charter, the s ...

and receive a bill of parcel and lien

A lien ( or ) is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the ''lienee'' and the pers ...

authorizing consignment

Consignment is a process whereby a person gives permission to another party to take care of their property while retaining full ownership of the property until the item is sold to the final buyer. It is generally done during auctions, shipping, ...

from the consignee. Law 105 stipulated that claims for losses filed by agents, factors, and charterers without receipts were without standing

Standing, also referred to as orthostasis, is a position in which the body is held in an upright (orthostatic) position and supported only by the feet. Although seemingly static, the body rocks slightly back and forth from the ankle in the ...

. Law 126 stipulated that filing a false claim of a loss was punishable by law. Law 235 stipulated that a shipbuilder

Shipbuilding is the construction of ships and other Watercraft, floating vessels. In modern times, it normally takes place in a specialized facility known as a shipyard. Shipbuilders, also called shipwrights, follow a specialized occupation th ...

was liable within one year of construction for the replacement of an unseaworthy vessel to the ship-owner

A shipowner, ship owner or ship-owner is the owner of a ship. They can be merchant vessels involved in the sea transport, shipping industry or non commercially owned. In the commercial sense of the term, a shipowner is someone who equips and expl ...

that was lost during the term of a charterparty. Laws 236 and 237 stipulated that a sea captain

A sea captain, ship's captain, captain, master, or shipmaster, is a high-grade licensed mariner who holds ultimate command and responsibility of a merchant vessel. The captain is responsible for the safe and efficient operation of the ship, inc ...

, ship-manager, or charterer was liable for the replacement of a lost vessel and cargo to the shipowner and consignees respectively that was negligently operated during the term of a charterparty. Law 238 stipulated that a captain, manager, or charterer that saved a ship from total loss was only required to pay one-half the value of the ship to the shipowner. Law 240 stipulated that the owner of a cargo ship

A cargo ship or freighter is a merchant ship that carries cargo, goods, and materials from one port to another. Thousands of cargo carriers ply the world's List of seas, seas and Ocean, oceans each year, handling the bulk of international trade. ...

that destroyed a passenger ship

A passenger ship is a merchant ship whose primary function is to carry passengers on the sea. The category does not include cargo vessels which have accommodations for limited numbers of passengers, such as the ubiquitous twelve-passenger freig ...

in a collision

In physics, a collision is any event in which two or more bodies exert forces on each other in a relatively short time. Although the most common use of the word ''collision'' refers to incidents in which two or more objects collide with great for ...

was liable for replacement of the passenger ship and any cargo it held upon provision of an affidavit of the collision by the owner of the passenger ship.

In 1816, an archeological excavation in Minya, Egypt

MinyaAlso spelled '' el...'' or ''al...'' ''...Menia, ...Minia'' or ''...Menya'' ( ) is the capital of the Minya Governorate in Upper Egypt. It is located approximately south of Cairo on the western bank of the Nile River, which flows north ...

(under an Eyalet

Eyalets (, , ), also known as beylerbeyliks or pashaliks, were the primary administrative divisions of the Ottoman Empire.

From 1453 to the beginning of the nineteenth century the Ottoman local government was loosely structured. The empire was a ...

of the Ottoman Empire

The Ottoman Empire (), also called the Turkish Empire, was an empire, imperial realm that controlled much of Southeast Europe, West Asia, and North Africa from the 14th to early 20th centuries; it also controlled parts of southeastern Centr ...

) produced a Nerva–Antonine dynasty

The Nerva–Antonine dynasty comprised seven Roman emperors who ruled from AD 96 to 192: Nerva (96–98), Trajan (98–117), Hadrian (117–138), Antoninus Pius (138–161), Marcus Aurelius (161–180), Lucius Verus (161–169), and Co ...

-era tablet from the ruins of the Temple of Antinous in Antinoöpolis

Antinoöpolis (also Antinoopolis, Antinoë, Antinopolis; ; ''Antinow''; , modern , modern ''Sheikh 'Ibada'' or ''Sheik Abāda'') was a city founded at an older Egyptian village by the Roman emperor Hadrian to commemorate his deified young belov ...

, Aegyptus

In Greek mythology, Aegyptus or Ægyptus (; ) was a legendary king of ancient Egypt. He was a descendant of the princess Io through his father Belus, and of the river-god Nilus as both the father of Achiroe, his mother and as a great, great-g ...

that prescribed the rules and membership dues of a burial society

A burial society is a type of benefit/ friendly society. These groups historically existed in England and elsewhere, and were constituted for the purpose of providing by voluntary subscriptions for the funeral expenses of the husband, wife or chi ...

''collegium

A (: ) or college was any association in ancient Rome that Corporation, acted as a Legal person, legal entity. Such associations could be civil or religious.

The word literally means "society", from ("colleague"). They functioned as social cl ...

'' established in Lanuvium

Lanuvium, modern Lanuvio, is an ancient city of Latium vetus, some southeast of Rome, a little southwest of the Via Appia.

Situated on an isolated hill projecting south from the main mass of the Alban Hills, Lanuvium commanded an extensive view ...

, Italia

Italy, officially the Italian Republic, is a country in Southern Europe, Southern and Western Europe, Western Europe. It consists of Italian Peninsula, a peninsula that extends into the Mediterranean Sea, with the Alps on its northern land b ...

in approximately 133 AD during the reign of Hadrian

Hadrian ( ; ; 24 January 76 – 10 July 138) was Roman emperor from 117 to 138. Hadrian was born in Italica, close to modern Seville in Spain, an Italic peoples, Italic settlement in Hispania Baetica; his branch of the Aelia gens, Aelia '' ...

(117–138) of the Roman Empire

The Roman Empire ruled the Mediterranean and much of Europe, Western Asia and North Africa. The Roman people, Romans conquered most of this during the Roman Republic, Republic, and it was ruled by emperors following Octavian's assumption of ...

. In 1851, future U.S. Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

Associate Justice

An associate justice or associate judge (or simply associate) is a judicial panel member who is not the chief justice in some jurisdictions. The title "Associate Justice" is used for members of the Supreme Court of the United States and some ...

Joseph P. Bradley

Joseph Philo Bradley (March 14, 1813 – January 22, 1892) was an American jurist who served as an Associate Justice of the Supreme Court of the United States, associate justice of the Supreme Court of the United States from 1870 to 1892. He ...

(1870–1892), once employed as an actuary

An actuary is a professional with advanced mathematical skills who deals with the measurement and management of risk and uncertainty. These risks can affect both sides of the balance sheet and require investment management, asset management, ...

for the Mutual Benefit Life Insurance Company

The Mutual Benefit Life Insurance Company was a life insurance company that was chartered in 1845 and based in Newark in Essex County, New Jersey, United States. The company was headed by Frederick Frelinghuysen (1848–1924). The company ...

, submitted an article to the '' Journal of the Institute of Actuaries'' detailing an historical account of a Severan dynasty

The Severan dynasty, sometimes called the Septimian dynasty, ruled the Roman Empire between 193 and 235.

It was founded by the emperor Septimius Severus () and Julia Domna, his wife, when Septimius emerged victorious from civil war of 193 - 197, ...

-era life table

In actuarial science and demography, a life table (also called a mortality table or actuarial table) is a table which shows, for each age, the probability that a person of that age will die before their next birthday ("probability of death"). In ...

compiled by the Roman jurist Ulpian

Ulpian (; ; 223 or 228) was a Roman jurist born in Tyre in Roman Syria (modern Lebanon). He moved to Rome and rose to become considered one of the great legal authorities of his time. He was one of the five jurists upon whom decisions were to ...

in approximately 220 AD during the reign of Elagabalus

Marcus Aurelius Antoninus (born Sextus Varius Avitus Bassianus, 204 – 13 March 222), better known by his posthumous nicknames Elagabalus ( ) and Heliogabalus ( ), was Roman emperor from 218 to 222, while he was still a teenager. His short r ...

(218–222) that was included in the second volume of the codification of laws ordered by Justinian I

Justinian I (, ; 48214 November 565), also known as Justinian the Great, was Roman emperor from 527 to 565.

His reign was marked by the ambitious but only partly realized ''renovatio imperii'', or "restoration of the Empire". This ambition was ...

(527–565) of the Eastern Roman Empire

The Byzantine Empire, also known as the Eastern Roman Empire, was the continuation of the Roman Empire centred on Constantinople during late antiquity and the Middle Ages. Having survived the events that caused the fall of the Western Roman E ...

, the '' Digesta seu Pandectae'' (533).

Additionally, the ''Digesta'' included a legal opinion

In law, a legal opinion is in certain jurisdictions a written explanation by a judge or group of judges that accompanies an order or ruling in a case, laying out the rationale and legal principles for the ruling.

Opinions are in those jurisdi ...

written by the Roman jurist Paulus at the beginning of the Crisis of the Third Century

The Crisis of the Third Century, also known as the Military Anarchy or the Imperial Crisis, was a period in History of Rome, Roman history during which the Roman Empire nearly collapsed under the combined pressure of repeated Barbarian invasions ...

in 235 AD on the '' Lex Rhodia'' ("Rhodian law") that articulates the general average principle of marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance a sub-branch of mari ...

established on the island of Rhodes

Rhodes (; ) is the largest of the Dodecanese islands of Greece and is their historical capital; it is the List of islands in the Mediterranean#By area, ninth largest island in the Mediterranean Sea. Administratively, the island forms a separ ...

in approximately 1000 to 800 BC as a member of the Doric Hexapolis

The Doric or Dorian Hexapolis () was a federation of six cities of Dorians, Dorian Colonies in antiquity#Greek colonies, foundation in southwest Asia Minor and adjacent islands, largely coextensive with the region known as Doris or Doris in Asia ...

, plausibly by the Phoenicia

Phoenicians were an Ancient Semitic-speaking peoples, ancient Semitic group of people who lived in the Phoenician city-states along a coastal strip in the Levant region of the eastern Mediterranean, primarily modern Lebanon and the Syria, Syrian ...

ns during the proposed Dorian invasion

The Dorian invasion (or Dorian migration) is an ancient Greek myth and discredited archaeological hypothesis describing the movement of the Dorian people into the Peloponnese region of Greece. According to the myth, the Dorians migrated from c ...

and emergence of the purported Sea Peoples

The Sea Peoples were a group of tribes hypothesized to have attacked Ancient Egypt, Egypt and other Eastern Mediterranean regions around 1200 BC during the Late Bronze Age. The hypothesis was proposed by the 19th-century Egyptology, Egyptologis ...

during the Greek Dark Ages

The Greek Dark Ages ( 1180–800 BC) were earlier regarded as two continuous periods of Greek history: the Postpalatial Bronze Age (c. 1180–1050 BC) and the Prehistoric Iron Age or Early Iron Age (c. 1050–800 BC). The last included all the ...

(c. 1100–c. 750) that led to the proliferation of the Doric Greek

Doric or Dorian (), also known as West Greek, was a group of Ancient Greek dialects; its Variety (linguistics), varieties are divided into the Doric proper and Northwest Doric subgroups. Doric was spoken in a vast area, including northern Greec ...

dialect

A dialect is a Variety (linguistics), variety of language spoken by a particular group of people. This may include dominant and standard language, standardized varieties as well as Vernacular language, vernacular, unwritten, or non-standardize ...

. The law of general average constitutes the fundamental principle

A principle may relate to a fundamental truth or proposition that serves as the foundation for a system of beliefs or behavior or a chain of reasoning. They provide a guide for behavior or evaluation. A principle can make values explicit, so t ...

that underlies all insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

.

Insurance in some forms dates back to prehistory. Initially, people sold goods in their own villages or gathering places. However, with the passage of time, they turned to nearby villages to sell. Two types of economies existed in human societies: natural

Nature is an inherent character or constitution, particularly of the ecosphere or the universe as a whole. In this general sense nature refers to the laws, elements and phenomena of the physical world, including life. Although humans are part ...

or non-monetary economies (using barter

In trade, barter (derived from ''bareter'') is a system of exchange (economics), exchange in which participants in a financial transaction, transaction directly exchange good (economics), goods or service (economics), services for other goods ...

and trade

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market.

Traders generally negotiate through a medium of cr ...

with no centralized nor standardized set of financial instruments) and monetary economies (with markets, currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

, financial instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

and so on). Insurance in non-monetary economies entails agreements of mutual aid. Such economies can potentially foster institutions such as co-operative

A cooperative (also known as co-operative, coöperative, co-op, or coop) is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democr ...

s, guild

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular territory. The earliest types of guild formed as organizations of tradespeople belonging to a professional association. They so ...

s and proto-states - institutions functioning to provide mutual protection

and to encourage mutual survival in adverse circumstances.

The "pay-off" for such "insurance" need not involve financial transactions. If one family's house gets destroyed, the neighbors are committed to helping rebuild it. Public granaries

A granary, also known as a grain house and historically as a granarium in Latin, is a post-harvest storage building primarily for grains or seeds. Granaries are typically built above the ground to prevent spoilage and protect the stored grains o ...

embodied another early form of insurance to indemnify against famines.

Babylonia

Babylonia (; , ) was an Ancient history, ancient Akkadian language, Akkadian-speaking state and cultural area based in the city of Babylon in central-southern Mesopotamia (present-day Iraq and parts of Kuwait, Syria and Iran). It emerged as a ...

n, Chinese, and Indian traders practiced methods of transferring or distributing risk in a monetary economy in the 3rd and 2nd

A second is the base unit of time in the International System of Units (SI).

Second, Seconds, The Second, or (The) 2nd may also refer to:

Mathematics

* 2 (number), as an ordinal (also written as ''2nd'' or ''2d'')

* Minute and second of arc, ...

millennia

A millennium () is a period of one thousand years, one hundred decades, or ten centuries, sometimes called a kiloannum (ka), or kiloyear (ky). Normally, the word is used specifically for periods of a thousand years that begin at the starting p ...

BC, respectively. Chinese merchants traversing treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel's capsizing. The Babylonians developed a system recorded in the famous Code of Hammurabi

The Code of Hammurabi is a Babylonian legal text composed during 1755–1750 BC. It is the longest, best-organized, and best-preserved legal text from the ancient Near East. It is written in the Old Babylonian dialect of Akkadian language, Akkadi ...

, c. 1750 BC, and practiced by early Mediterranean

The Mediterranean Sea ( ) is a sea connected to the Atlantic Ocean, surrounded by the Mediterranean basin and almost completely enclosed by land: on the east by the Levant in West Asia, on the north by Anatolia in West Asia and Southern ...

sailing merchant

A merchant is a person who trades in goods produced by other people, especially one who trades with foreign countries. Merchants have been known for as long as humans have engaged in trade and commerce. Merchants and merchant networks operated i ...

s. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen or lost at sea. Concepts of insurance has been also found in 3rd century BCE Hindu scriptures such as Dharmasastra, Arthashastra

''Kautilya's Arthashastra'' (, ; ) is an Ancient Indian Sanskrit treatise on statecraft, politics, economic policy and military strategy. The text is likely the work of several authors over centuries, starting as a compilation of ''Arthashas ...

and Manusmriti

The ''Manusmṛti'' (), also known as the ''Mānava-Dharmaśāstra'' or the Laws of Manu, is one of the many legal texts and constitutions among the many ' of Hinduism.

Over fifty manuscripts of the ''Manusmriti'' are now known, but the earli ...

.

Achaemenian

The Achaemenid Empire or Achaemenian Empire, also known as the Persian Empire or First Persian Empire (; , , ), was an Iranian peoples, Iranian empire founded by Cyrus the Great of the Achaemenid dynasty in 550 BC. Based in modern-day Iran, i ...

monarchs in Ancient Persia

The history of Iran (also known as Persia) is intertwined with Greater Iran, which is a socio-cultural region encompassing all of the areas that have witnessed significant settlement or influence exerted by the Iranian peoples and the Iranian ...

received annual gifts (tribute

A tribute (; from Latin ''tributum'', "contribution") is wealth, often in kind, that a party gives to another as a sign of submission, allegiance or respect. Various ancient states exacted tribute from the rulers of lands which the state con ...

) from the various ethnic groups under their control. This would function as an early form of political insurance, and officially bound the Persian monarch to protect the group from harm.

The ancient so-called “Rhodian Sea-Law”, applying to seafarers and merchants, included a stipulation that if a seafarer was forced to throw cargo overboard to save the ship from sinking, the loss would be reimbursed collectively by his colleagues. This is often cited as one of the earliest examples of insurance law, with some putting its origin in the Greek island of Rhodes

Rhodes (; ) is the largest of the Dodecanese islands of Greece and is their historical capital; it is the List of islands in the Mediterranean#By area, ninth largest island in the Mediterranean Sea. Administratively, the island forms a separ ...

as early as 1000 BCE. However, the earliest references to the “Rhodian Sea-Law” appear in late Roman

Roman or Romans most often refers to:

*Rome, the capital city of Italy

*Ancient Rome, Roman civilization from 8th century BC to 5th century AD

*Roman people, the people of Roman civilization

*Epistle to the Romans, shortened to Romans, a letter w ...

legal sources.

The ancient Athenian "maritime loan" advanced money for voyages with repayment being canceled if the ship was lost. In the 4th century BC, rates for the loans differed according to safe or dangerous times of year, implying an intuitive pricing of risk with an effect similar to insurance.

During the Peloponnesian Wars

The Second Peloponnesian War (431–404 BC), often called simply the Peloponnesian War (), was an ancient Greek war fought between Athens and Sparta and their respective allies for the hegemony of the Greek world. The war remained undecided ...

, some Athenian slave-owners volunteered their slaves to serve as oarsmen in warships. These slave-owners paid a small yearly premium to the Athenian State, which, in case the slave was killed in action, would pay out the owner for the value of the slave.

The Greeks

Greeks or Hellenes (; , ) are an ethnic group and nation native to Greece, Greek Cypriots, Cyprus, Greeks in Albania, southern Albania, Greeks in Turkey#History, Anatolia, parts of Greeks in Italy, Italy and Egyptian Greeks, Egypt, and to a l ...

and Romans 600 BC set up guilds called "benevolent societies", which cared for the families of deceased members, as well as paying funeral

A funeral is a ceremony connected with the final disposition of a corpse, such as a burial or cremation, with the attendant observances. Funerary customs comprise the complex of beliefs and practices used by a culture to remember and respect th ...

expenses of members. Guilds in the Middle Ages

In the history of Europe, the Middle Ages or medieval period lasted approximately from the 5th to the late 15th centuries, similarly to the post-classical period of global history. It began with the fall of the Western Roman Empire and ...

had similar practices. The Jewish Talmud

The Talmud (; ) is the central text of Rabbinic Judaism and the primary source of Jewish religious law (''halakha'') and Jewish theology. Until the advent of Haskalah#Effects, modernity, in nearly all Jewish communities, the Talmud was the cen ...

deals with several aspects of insuring goods

In economics, goods are anything that is good, usually in the sense that it provides welfare or utility to someone. Alan V. Deardorff, 2006. ''Terms Of Trade: Glossary of International Economics'', World Scientific. Online version: Deardorffs ...

. Before modern-style insurance became established in the late 17th century, "friendly societies" existed in England, in which people donated amounts of money to a general sum that could be used for emergencies.

Medieval era

Sea loans (''foenus nauticum'') were common before the traditional marine insurance in medieval times, in which an investor lent his money to a traveling merchant, and the merchant would be liable to pay it back if the ship returned safely. In this way, credit and sea insurance were provided at the same time. To offset the sea risk involved, the merchant was obligated to pay a high rate of interest, in contrast to overland merchants who merely divided the profits. Pope Gregory IX condemned the ''foenus nauticum'' as usury in hisdecretal

Decretals () are letters of a pope that formulate decisions in canon law (Catholic Church), ecclesiastical law of the Catholic Church.McGurk. ''Dictionary of Medieval Terms''. p. 10

They are generally given in answer to consultations but are some ...

Naviganti of 1236 ( Decretales, V, XIX, 19) and commenda The commenda was a medieval contract which developed in Italy around the 13th century, and was an early form of limited partnership. The commenda was an agreement between an investing partner and a traveling partner to conduct a commercial enterpris ...

contracts were introduced in response. Under commenda contracts, investors provided funds to an entrepreneur to carry out a trade, bearing the risk of loss in exchange for a favorable share of the profits when the entrepreneur returned. By the late thirteenth century Italian merchants had begun to separate risk management from finance, accomplishing the latter with ''cambium'' contracts based on the purchase of discounted bills of exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a ...

from merchants who did not personally go to sea. To manage the sea risk, the merchants developed the insurance loan: the merchant paid a premium to a shipowner in the form of an unenforceable loan, under an agreement that the shipowner would pay the merchant's losses if his goods did not reach their destination.

In 1293, Denis of Portugal

Denis (, ; 9 October 1261 – 7 January 1325), called the Farmer King (''Rei Lavrador'') and the Poet King (''Rei Poeta''), was King of Portugal from 1279 until his death in 1325.

Dinis was the eldest son of Afonso III of Portugal by his second ...

advanced the interests of the Portuguese merchants, and set up by mutual agreement a fund called the ''Bolsa de Comércio'', the first documented form of marine insurance in Europe, approved on 10 May 1293.

In the thirteenth and early fourteenth centuries, the European traders traveled to sell their goods across the globe and to hedge the risk of theft or fraud by the Captain or crew also known as Risicum Gentium. However, they realized that selling this way, involves not only the risk of loss (i.e. damage, theft or life of trader as well) but also they cannot cover the wider market. Therefore, the trend of hiring commissioned base agents across different markets emerged. In 1310 the Chamber of Assurance was established in the Flamish commercial city of Bruges.

The traders sent (exported) their goods to the agents who on the behalf of traders sold them. Sending goods to the agents by road or sea involves different risks i.e. sea storms, pirate attack; goods may be damaged due to poor handling while loading and unloading, etc. Traders exploited different measures to hedge the risk involved in the exporting. Instead of sending all the goods on one ship/truck, they used to send their goods over number of vessels to avoid the total loss of shipment if the vessel was caught in a sea storm, fire, pirate, or came under enemy attacks but this was not good practice due to prolonged time and efforts involved.

Insurance is the oldest method of transferring risk, which was developed to mitigate trade/business risk. Marine insurance is very important for international trade and makes large commercial trade possible. The risk hedging instruments used to mitigate risk in medieval times were sea/marine (Mutuum) loans, commenda contract, and bill of exchanges. Nelli (1972) highlighted that commenda contract and sea loans were almost the closest substitute of marine insurance. Furthermore, he pointed out that for a half century, it was considered that the first marine insurance contract was floated in Italy on October 23, 1347; however, professor Federigo found that the first written insurance contracts date back to February 13, 1343, in Pisa. Furthermore, Italian traders spread the knowledge and use of insurance into Europe and The Mediterranean. In the fifteenth century, word policy for insurance contract became standardized. By the sixteenth century, insurance was common among Britain, France, and the Netherlands. The concept of insuring outside native countries emerged in the seventeenth century due to reduced trade or higher cost of local insurance. According to Kingston (2011), Lloyd's Coffeehouse was the prominent marine insurance marketplace in London during the eighteenth century and European/American traders used this marketplace to insure their shipments.

The rules and regulations of insurance were adopted from Italian merchants known as “Law Merchant” and initially these rules governed the marine insurance across the globe. In case of dispute, policy writer and holder choose one arbitrator each and these two arbitrators choose a third impartial arbitrator and parties were bound to accept the decision made by the majority. Because of the inability of this informal court (arbitrator) to enforce their decisions, in the sixteenth century, traders turned to formal courts to resolve their disputes. Special courts were set up to solve the disputes of marine insurance like in Genoa, insurance regulation passed to impose fine, on who did not obey the Church's prohibitions of usury (Sea loans, Commenda) in 1369. In 1435, Barcelona ordinance issued, making it mandatory for traders to turn to formal courts in case of insurance disputes. In Venice, “Consoli dei Mercanti”, specialized court to deal with marine insurance were set up in 1436. In 1520, the mercantile court of Genoa was replaced by more specialized court “Rota” which not only followed the merchant's customs but also incorporated the legal laws in it.

Separate insurance contracts (i.e., insurance policies not bundled with loans or other kinds of contracts) were invented in Genoa

Genoa ( ; ; ) is a city in and the capital of the Italian region of Liguria, and the sixth-largest city in Italy. As of 2025, 563,947 people live within the city's administrative limits. While its metropolitan city has 818,651 inhabitan ...

in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa

Genoa ( ; ; ) is a city in and the capital of the Italian region of Liguria, and the sixth-largest city in Italy. As of 2025, 563,947 people live within the city's administrative limits. While its metropolitan city has 818,651 inhabitan ...

in 1347, and in the next century maritime insurance developed widely and premiums were intuitively varied with risks.

These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance a sub-branch of mari ...

. The first printed book on insurance was the legal treatise ''On Insurance and Merchants' Bets'' by Pedro de Santarém

Pedro is a masculine given name. Pedro is the Spanish, Portuguese, and Galician name for ''Peter''. Its French equivalent is Pierre while its English and Germanic form is Peter.

The counterpart patronymic surname of the name Pedro, meaning ...

(Santerna), written in 1488 and published in 1552.

Modern insurance

Insurance became more sophisticated inEnlightenment era

The Age of Enlightenment (also the Age of Reason and the Enlightenment) was a Europe, European Intellect, intellectual and Philosophy, philosophical movement active from the late 17th to early 19th century. Chiefly valuing knowledge gained th ...

Europe

Europe is a continent located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south, and Asia to the east ...

, and specialized varieties developed. Some forms of insurance developed in London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

in the early decades of the 17th century. For example, the will of the English colonist Robert Hayman

Robert Hayman (14 August 1575 – November 1629) was a poet, colonist and Proprietary Governor of Bristol's Hope colony in Newfoundland.

Early life and education

Hayman was born in Wolborough near Newton Abbot, Devon, the eldest of nine c ...

mentioned two "policies of insurance" taken out with the diocesan Chancellor of London, Arthur Duck. Of the value of £100 each, one related to the safe arrival of Hayman's ship in Guyana

Guyana, officially the Co-operative Republic of Guyana, is a country on the northern coast of South America, part of the historic British West Indies. entry "Guyana" Georgetown, Guyana, Georgetown is the capital of Guyana and is also the co ...

and the other was in regard to "one hundred pounds assured by the said Doctor Arthur Ducke on my life".

Property insurance

Hamburger Feuerkasse () is 1676 became the first officially establishedfire insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boi ...

company in the world,Anzovin, p. 121 ''The first fire insurance company was the Hamburger Feuerkasse (a.k.a. Hamburger General-Feur-Cassa), established in December 1676 by the Ratsherren (city council) of Hamburg (now in Germany).'' and the oldest existing insurance enterprise available to the public.Evenden, p. 4

Property insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or bo ...

as we know it today can be traced to the Great Fire of London

The Great Fire of London was a major conflagration that swept through central London from Sunday 2 September to Wednesday 5 September 1666, gutting the medieval City of London inside the old London Wall, Roman city wall, while also extendi ...

, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren

Sir Christopher Wren FRS (; – ) was an English architect, astronomer, mathematician and physicist who was one of the most highly acclaimed architects in the history of England. Known for his work in the English Baroque style, he was ac ...

's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667". A number of attempted fire insurance schemes came to nothing, but in 1681, economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this ...

Nicholas Barbon

Nicholas Barbon ( 1640 – 1698) was an English economist, physician, and financial speculator. Historians of mercantilism consider him to be one of the first proponents of the free market.

In the aftermath of the Great Fire of London, he b ...

and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own fire department

A fire department (North American English) or fire brigade (English in the Commonwealth of Nations, Commonwealth English), also known as a fire company, fire authority, fire district, fire and rescue, or fire service in some areas, is an organi ...

to prevent and minimize the damage from conflagrations on properties insured by them. They also began to issue 'fire insurance mark

Fire insurance marks are metal plaques marked with the emblem of the insurance company which were affixed to the front of insured buildings as a guide to the insurance company's fire brigade. These identification marks were used in the eighteenth ...

s' to their customers. These would be displayed prominently above the main door of the property and allowed the insurance company to positively identify properties that had taken out insurance with them. One such notable company was the Hand in Hand Fire & Life Insurance Society

The Hand in Hand Fire & Life Insurance Society was one of the oldest British insurance companies.

History

The company was founded in 1696 at Tom's Coffee House in St Martin's Lane in London. It was one of three fire insurance companies started aft ...

, founded in 1696 at Tom's Coffee House in St Martin's Lane

St Martin's Lane is a street in the City of Westminster, which runs from the church of St Martin-in-the-Fields, after which it is named, near Trafalgar Square northwards to Long Acre. At its northern end, it becomes Monmouth Street, London, Mo ...

in London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

. It was structured as a mutual society, and for 135 years it operated its own fire brigade and played an important part in shaping fire fighting and prevention. The Sun Fire Office is the earliest still existing property insurance company, dating from 1710.

This system was soon exposed as terribly flawed, as rival brigades often ignored burning buildings once they discovered that it had no insurance policy with their company. Eventually, a solution was agreed upon in which all the insurance companies would supply money and equipment to a municipal authority charged with stationing fire prevention assets and firefighter

A firefighter (or fire fighter or fireman) is a first responder trained in specific emergency response such as firefighting, primarily to control and extinguish fires and respond to emergencies such as hazardous material incidents, medical in ...

s equally around the city to respond to all fires. This did not solve the problem entirely, as the brigades still tended to favor saving insured buildings to those without any insurance at all.

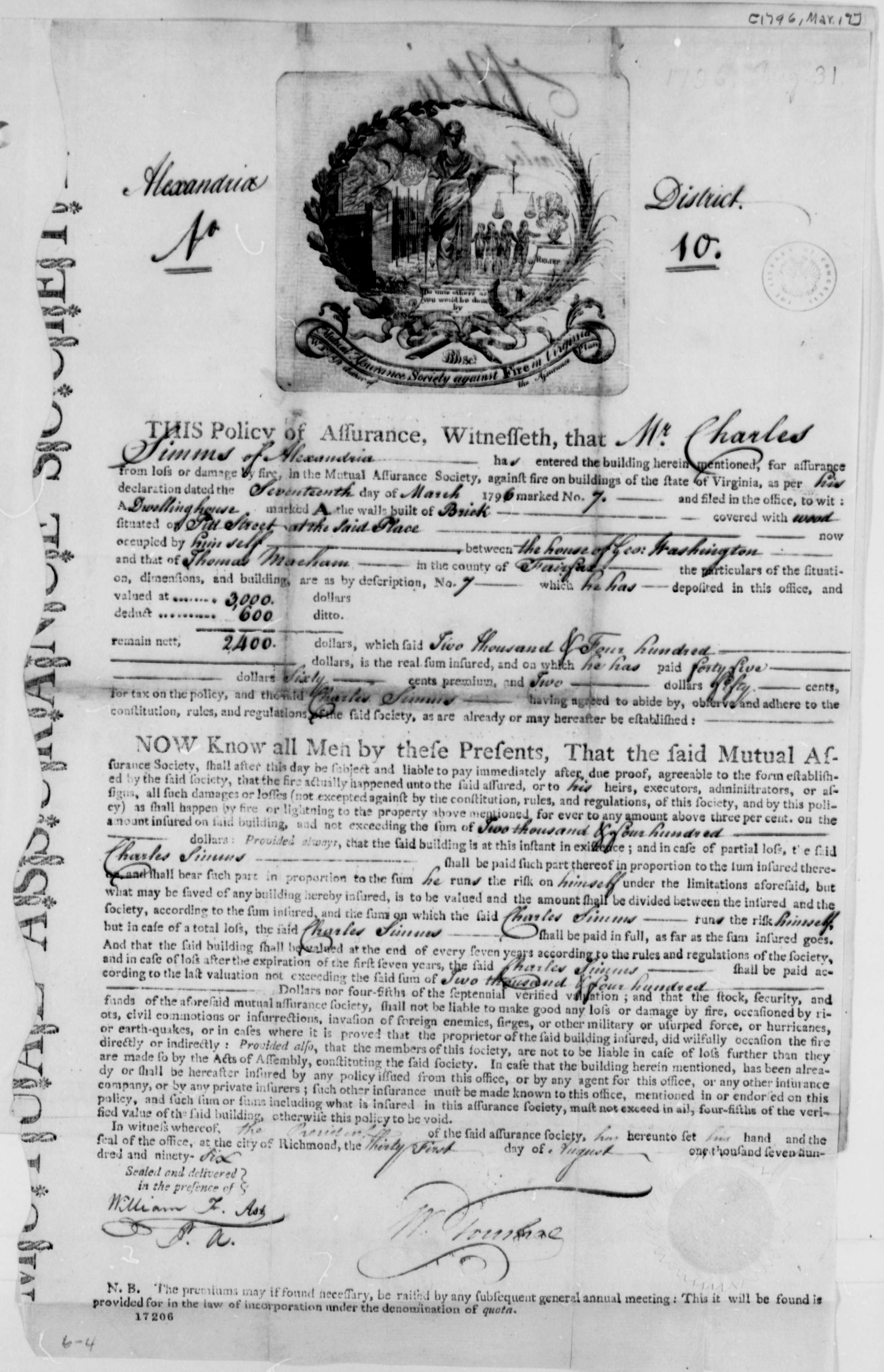

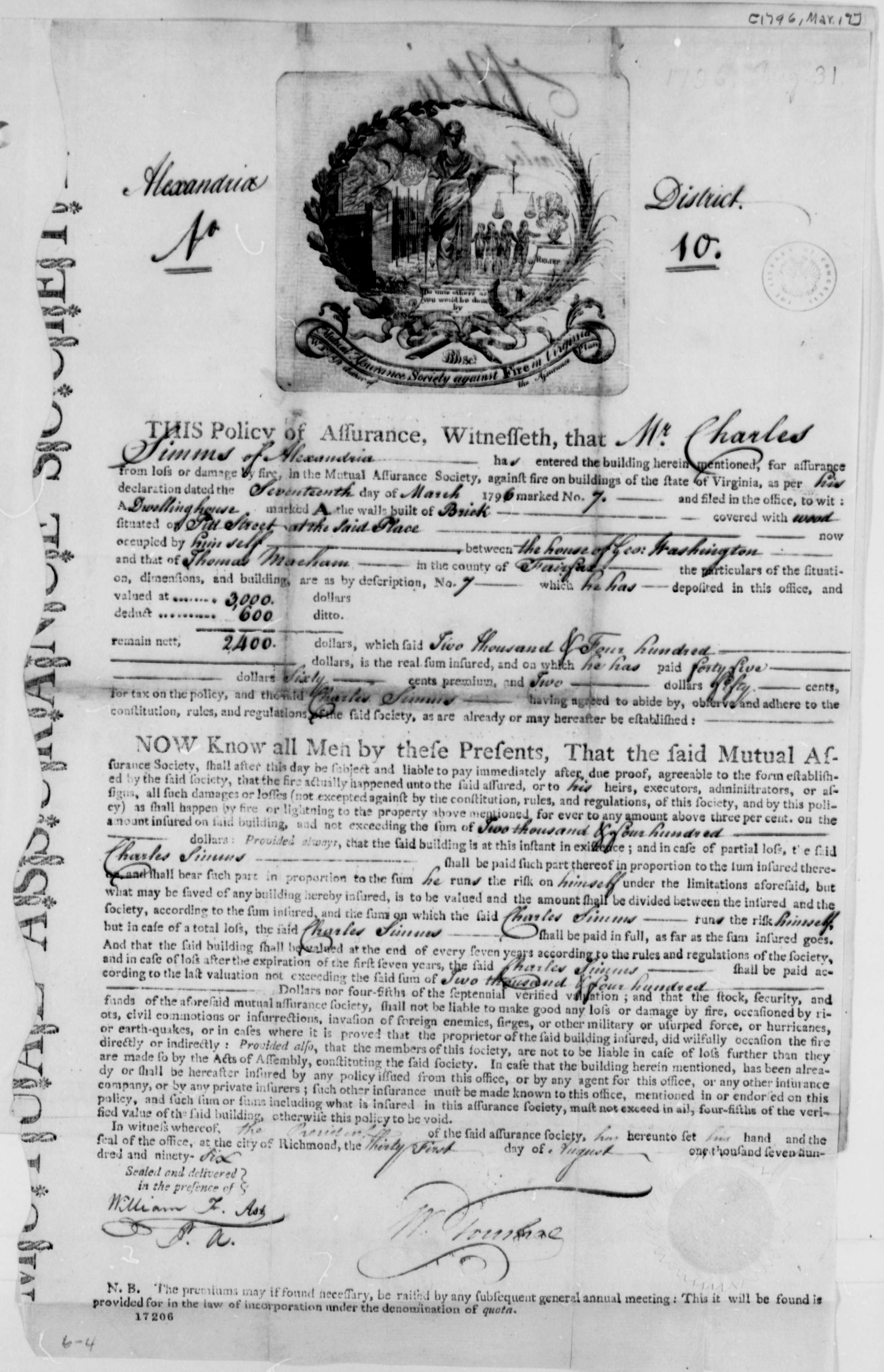

In Colonial America

The colonial history of the United States covers the period of European colonization of North America from the late 15th century until the unifying of the Thirteen British Colonies and creation of the United States in 1776, during the Re ...

, the first insurance company that underwrote fire insurance was formed in Charles Town (modern-day Charleston), South Carolina

South Carolina ( ) is a U.S. state, state in the Southeastern United States, Southeastern region of the United States. It borders North Carolina to the north and northeast, the Atlantic Ocean to the southeast, and Georgia (U.S. state), Georg ...

in 1732. Benjamin Franklin

Benjamin Franklin (April 17, 1790) was an American polymath: a writer, scientist, inventor, statesman, diplomat, printer, publisher and Political philosophy, political philosopher.#britannica, Encyclopædia Britannica, Wood, 2021 Among the m ...

helped to popularize and make standard the practice of insurance, particularly property insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or bo ...

to spread the risk of loss from fire, in the form of perpetual insurance

Perpetual insurance is a type of homeowner's insurance policy written to have no term, or date, when the policy expires. From the effective start date, the coverage exists for perpetuity. The insured deposits money, called a deposit premium, wi ...

. In 1752, he founded the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire

The Philadelphia Contributionship for the Insurance of Houses from Loss by Fire is the oldest property insurance company in the United States. It was organized by Benjamin Franklin in 1752 and incorporated in 1768.

The Contributionship's buil ...

. Franklin's company made contributions toward fire prevention. Not only did his company warn against certain fire hazards, but it also refused to insure certain buildings where the risk of fire was too great, such as all wooden houses.

Business insurance

At the same time, the first insurance schemes for theunderwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability ...

of business venture

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in ...

s became available. By the end of the seventeenth century, London's growing importance as a center for trade was increasing demand for marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance a sub-branch of mari ...

.

In the late 1680s, Edward Lloyd opened a coffee house on Tower Street in London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

. This was during a boom of several hundred coffee house gathering places in London, many catering to certain social groupings of clientele. Lloyd's clientele tended to be ship owners, merchants, and ships' captains. This enabled Lloyd's Coffee House to become a reliable source of the latest shipping news. Such news included information about the sinking of ships and other ship/cargo losses. Because of this, Lloyd's became the meeting place for parties in the shipping industry to do business for having their cargoes and ships insured, with those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd's of London

Lloyd's of London, generally known simply as Lloyd's, is a insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body gover ...

and several related shipping and insurance businesses. In 1774, long after Edward Lloyd's death in 1713, the participating members of the insurance arrangement formed a committee and moved to the Royal Exchange on Cornhill as the Society of Lloyd's. Since its inception, Lloyd's has operated not as an insurance company but as a gathering place of individuals (and more recently, small groups of individuals) issuing insurance policies.

In 1720 the Royal Exchange Assurance Corporation

The Royal Exchange Assurance, founded in 1720, was a British insurance company. It took its name from the location of its offices at the Royal Exchange, London.

Origins

The Royal Exchange Assurance emerged from a joint stock insurance enterpri ...

received its royal charter under the Royal Exchange and London Assurance Corporation Act 1719

The Bubble Act 1720 ( 6 Geo. 1. c. 18) (also Royal Exchange and London Assurance Corporation Act 1719) was an act of the Parliament of Great Britain passed on 11 June 1720 that incorporated the Royal Exchange Assurance Corporation and London As ...

. The act established this corporation as Great Britain's exclusive corporate insurer of marine property but allowed individuals in and outside of the Lloyd's consortium to underwrite insurance if unincorporated. From 1741 to 1750 the corporation was headed by multinational merchant, attorney, and author Nicholas Magens.

Once established, insurance underwriters such as those at Lloyd's gradually over many decades moved into other lines of insurance business. In this same very gradual manner, most fire insurers have expanded their scope of business to insure against other causes of loss to buildings and their contents. Many have also filled a need for insuring business and personal liabilities, such as injuries caused by defective products and premises. This fuller range of insurance lines has become today's worldwide modern market of property-liability insurance.

Life insurance

The firstlife insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typical ...

policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office

Amicable Society for a Perpetual Assurance Office ( Amicable Society) is considered the first life insurance company in the world.Anzovin, p. 121. "The first life insurance company known of record was founded in 1706 by the Bishop of Oxford and t ...

, founded in London in 1706 by William Talbot and Sir Thomas Allen. The first plan of life insurance was that each member paid a fixed annual payment per share on from one to three shares with consideration to age of the members being twelve to fifty-five. At the end of the year a portion of the "amicable contribution" was divided among the wives and children of deceased members and it was in proportion to the amount of shares the heirs owned. Amicable Society started with 2,000 members.

The first life table

In actuarial science and demography, a life table (also called a mortality table or actuarial table) is a table which shows, for each age, the probability that a person of that age will die before their next birthday ("probability of death"). In ...

was written by Edmund Halley

Edmond (or Edmund) Halley (; – ) was an English astronomer, mathematician and physicist. He was the second Astronomer Royal in Britain, succeeding John Flamsteed in 1720.

From an observatory he constructed on Saint Helena in 1676–77, H ...

in 1693, but it was only in the 1750s that the necessary mathematical and statistical tools were in place for the development of modern life insurance. James Dodson, a mathematician

A mathematician is someone who uses an extensive knowledge of mathematics in their work, typically to solve mathematical problems. Mathematicians are concerned with numbers, data, quantity, mathematical structure, structure, space, Mathematica ...

and actuary

An actuary is a professional with advanced mathematical skills who deals with the measurement and management of risk and uncertainty. These risks can affect both sides of the balance sheet and require investment management, asset management, ...

, tried to establish a new company that issued premiums aimed at correctly offsetting the risks of long term life assurance policies, after being refused admission to the Amicable Life Assurance Society because of his advanced age. He was unsuccessful in his attempts at procuring a charter from the government

A government is the system or group of people governing an organized community, generally a State (polity), state.

In the case of its broad associative definition, government normally consists of legislature, executive (government), execu ...

before his death in 1757.

His disciple, Edward Rowe Mores

Edward Rowe Mores, FSA (; 24 January 1731 OS: 13 January 1730">Old_Style_and_New_Style_dates.html" ;"title="/nowiki> OS: 13 January 1730/nowiki> – 22 November 1778) was an English people">English antiquarian and scholar">antiquarian.ht ...

was finally able to establish the Society for Equitable Assurances on Lives and Survivorship in 1762. It was the world's first mutual insurer

A mutual insurance company is an insurance company owned entirely by its policyholders. It is a form of consumers' co-operative. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders ...

and it pioneered age based premiums based on mortality rate

Mortality rate, or death rate, is a measure of the number of deaths (in general, or due to a specific cause) in a particular Statistical population, population, scaled to the size of that population, per unit of time. Mortality rate is typically ...

laying "the framework for scientific insurance practice and development" and "the basis of modern life assurance upon which all life assurance schemes were subsequently based".

Mores also specified that the chief official should be called an actuary

An actuary is a professional with advanced mathematical skills who deals with the measurement and management of risk and uncertainty. These risks can affect both sides of the balance sheet and require investment management, asset management, ...

—the earliest known reference to the position as a business concern. The first modern actuary was William Morgan, who was appointed in 1775 and served until 1830. In 1776 the Society carried out the first actuarial valuation of liabilities and subsequently distributed the first reversionary bonus (1781) and interim bonus (1809) among its members. It also used regular valuations to balance competing interests. The society sought to treat its members equitably and the directors tried to ensure that the policyholders received a fair return on their respective investments. Premiums were regulated according to age, and anybody could be admitted regardless of their state of health and other circumstances.

The sale of life insurance in the U.S. began in the late 1760s. The Presbyterian

Presbyterianism is a historically Reformed Protestant tradition named for its form of church government by representative assemblies of elders, known as "presbyters". Though other Reformed churches are structurally similar, the word ''Pr ...

Synods in Philadelphia and New York founded the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759; Episcopalian

Anglicanism, also known as Episcopalianism in some countries, is a Western Christian tradition which developed from the practices, liturgy, and identity of the Church of England following the English Reformation, in the context of the Protes ...

priests created a comparable relief fund in 1769. Between 1787 and 1837 more than two dozen life insurance companies were started, but fewer than half a dozen survived.

Accident insurance

In the late 19th century, "accident insurance" began to become available. This operated much like modern ''disability'' insurance. The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent

In the late 19th century, "accident insurance" began to become available. This operated much like modern ''disability'' insurance. The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway

Rail transport (also known as train transport) is a means of transport using wheeled vehicles running in railway track, tracks, which usually consist of two parallel steel railway track, rails. Rail transport is one of the two primary means of ...

system. It was registered as the Universal Casualty Compensation Company to:

The company was able to reach an agreement with the railway companies

This is an incomplete list of the world's railway operating companies listed alphabetically by continent and country. This list includes companies operating both now and in the past.

In some countries, the railway operating bodies are not compan ...

, whereby basic accident insurance would be sold as a package deal along with travel ticket

Ticket or tickets may refer to:

Slips of paper

* Lottery ticket

* Parking ticket, a ticket confirming that the parking fee was paid (and the time of the parking start)

* Toll ticket, a slip of paper used to indicate where vehicles entered a to ...

s to customers. The company charged higher premiums for second and third class travel due to the higher risk of injury in the roofless carriage

A carriage is a two- or four-wheeled horse-drawn vehicle for passengers. In Europe they were a common mode of transport for the wealthy during the Roman Empire, and then again from around 1600 until they were replaced by the motor car around 1 ...

s.

National insurance

Germany

By the late 19th century, governments began to initiate national insurance programs against sickness and old age.Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor Otto von Bismarck

Otto, Prince of Bismarck, Count of Bismarck-Schönhausen, Duke of Lauenburg (; born ''Otto Eduard Leopold von Bismarck''; 1 April 1815 – 30 July 1898) was a German statesman and diplomat who oversaw the unification of Germany and served as ...

introduced old age pensions, accident insurance and medical care that formed the basis for Germany's welfare state

A welfare state is a form of government in which the State (polity), state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal oppor ...

. His paternalistic programs won the support of German industry because its goals were to win the support of the working classes for the Empire and reduce the outflow of immigrants to America, where wages were higher but welfare did not exist.

Great Britain

In Britain more extensive legislation was introduced by the Liberal government, led byH. H. Asquith

Herbert Henry Asquith, 1st Earl of Oxford and Asquith (12 September 1852 – 15 February 1928) was a British statesman and Liberal Party (UK), Liberal politician who was Prime Minister of the United Kingdom from 1908 to 1916. He was the last ...

and David Lloyd George

David Lloyd George, 1st Earl Lloyd-George of Dwyfor (17 January 1863 – 26 March 1945) was Prime Minister of the United Kingdom from 1916 to 1922. A Liberal Party (United Kingdom), Liberal Party politician from Wales, he was known for leadi ...

. The National Insurance Act 1911

The National Insurance Act 1911 (1 & 2 Geo. 5. c. 55) created National Insurance, originally a system of health insurance for industrial workers in Great Britain based on contributions from employers, the government, and the workers themselves. ...

gave the British working classes the first contributory system of insurance against illness and unemployment.

All workers who earned under £160 a year had to pay 4 pence a week to the scheme; the employer paid 3 pence, and general taxation paid 2 pence. As a result, workers could take sick leave and be paid 10 shillings a week for the first 13 weeks and 5 shillings a week for the next 13 weeks. Workers also gained access to free treatment for tuberculosis, and the sick were eligible for treatment by a panel doctor. The National Insurance Act also provided maternity benefits. Time-limited unemployment benefit was based on actuarial

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, pension, finance, investment and other industries and professions.

Actuaries are professionals trained in this discipline. In m ...

principles and it was planned that it would be funded by a fixed amount each from workers, employers, and taxpayers. It was restricted to particular industries, cyclical/seasonal industries like construction of ships, and neither made any provision for dependants. By 1913, 2.3 million were insured under the scheme for unemployment benefit and almost 15 million insured for sickness benefit.

This system was greatly expanded after the Second World War

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

under the influence of the Beveridge Report

The Beveridge Report, officially entitled ''Social Insurance and Allied Services'' ( Cmd. 6404), is a government report, published in November 1942, influential in the founding of the welfare state in the United Kingdom. It was drafted by the Lib ...

, to form the first modern welfare state

A welfare state is a form of government in which the State (polity), state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal oppor ...

.

United States

In the United States, until 1935, the federal government did not mandate any form of insurance upon the nation as a whole. However there had been generous benefits for military veterans, and this became a model for the American welfare state. The passage of theNew Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

's 1935 Social Security Act

The Social Security Act of 1935 is a law enacted by the 74th United States Congress and signed into law by U.S. President Franklin D. Roosevelt on August 14, 1935. The law created the Social Security (United States), Social Security program as ...

expanded the concept and acceptance of insurance as a means to achieve the individual financial security for all older workers. That expansion experienced its first boom market immediately after the World War II. With the original G.I. Bill

The G.I. Bill, formally the Servicemen's Readjustment Act of 1944, was a law that provided a range of benefits for some of the returning World War II veterans (commonly referred to as G.I. (military), G.I.s). The original G.I. Bill expired in ...

of 1944 came large-scale programs that greatly expanded the ideal that educational expenses and affordable housing mortgages were benefits of having served. The mortgages that were underwritten by the federal government during this time included an insurance clause as a means of protecting the banks and lending institutions involved against avoidable losses. During the 1940s there was also the GI life insurance policy program that was designed to ease the burden of military losses on the civilian population and survivors.Lindsey Cormack, ''Congress and US veterans: From the GI Bill to the VA crisis'' (Bloomsbury, 2018) ch. 1-4.

Notes

References

Primary sources * Secondary sources * * * * * * * * * * * * * * * * {{DEFAULTSORT:History Of InsuranceInsurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...