Greeks (finance) on:

[Wikipedia]

[Google]

[Amazon]

In

Gamma is greatest approximately at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM). Gamma is important because it corrects for the convexity of value.

When a trader seeks to establish an effective delta-hedge for a portfolio, the trader may also seek to neutralize the portfolio's gamma, as this will ensure that the hedge will be effective over a wider range of underlying price movements.

Gamma is greatest approximately at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM). Gamma is important because it corrects for the convexity of value.

When a trader seeks to establish an effective delta-hedge for a portfolio, the trader may also seek to neutralize the portfolio's gamma, as this will ensure that the hedge will be effective over a wider range of underlying price movements.

/ref> (sometimes rhova) measures the rate of change in rho with respect to volatility. Vera is the second derivative of the value function; once to volatility and once to interest rate. : The word 'Vera' was coined by R. Naryshkin in early 2012 when this sensitivity needed to be used in practice to assess the impact of volatility changes on rho-hedging, but no name yet existed in the available literature. 'Vera' was picked to sound similar to a combination of Vega and Rho, its respective first-order Greeks. This name is now in a wider use, including, for example, the Maple computer algebra software (which has 'BlackScholesVera' function in its Finance package).

Vanilla Options - Espen Haug

* Volga, Vanna, Speed, Charm, Color

Vanilla Options - Uwe Wystup

Vanilla Options - Uwe Wystup

Online tools

R package to compute Greeks for European-, American- and Asian options {{DEFAULTSORT:Greeks (Finance) Mathematical finance Financial ratios Options (finance)

mathematical finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that req ...

, the Greeks are the quantities (known in calculus

Calculus is the mathematics, mathematical study of continuous change, in the same way that geometry is the study of shape, and algebra is the study of generalizations of arithmetic operations.

Originally called infinitesimal calculus or "the ...

as partial derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant (as opposed to the total derivative, in which all variables are allowed to vary). P ...

s; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameter

A parameter (), generally, is any characteristic that can help in defining or classifying a particular system (meaning an event, project, object, situation, etc.). That is, a parameter is an element of a system that is useful, or critical, when ...

s on which the value of an instrument or portfolio of financial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

s is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters.

Use of the Greeks

The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised model of certain financial markets) are relatively easy to calculate — a desirable property of financial models — and are very useful for derivatives traders, especially those who seek to hedge their portfolios from adverse changes in market conditions. For this reason, those Greeks which are particularly useful for hedging—such as delta, theta, and vega—are well-defined for measuring changes in the parameters spot price, time and volatility. Although rho (the partial derivative with respect to the risk-free interest rate) is a primary input into the Black–Scholes model, the overall impact on the value of a short-term option corresponding to changes in the risk-free interest rate is generally insignificant and therefore higher-order derivatives involving the risk-free interest rate are not common. The most common of the Greeks are the first order derivatives:delta

Delta commonly refers to:

* Delta (letter) (Δ or δ), the fourth letter of the Greek alphabet

* D (NATO phonetic alphabet: "Delta"), the fourth letter in the Latin alphabet

* River delta, at a river mouth

* Delta Air Lines, a major US carrier ...

, vega, theta and rho

Rho (; uppercase Ρ, lowercase ρ or ; or ) is the seventeenth letter of the Greek alphabet. In the system of Greek numerals it has a value of 100. It is derived from Phoenician alphabet, Phoenician letter resh . Its uppercase form uses the same ...

; as well as gamma, a second-order derivative of the value function. The remaining sensitivities in this list are common enough that they have common names, but this list is by no means exhaustive.

The players in the market make competitive trades involving many billions (of $, £ or €) of underlying every day, so it is important to get the sums right. In practice they will use more sophisticated models which go beyond the simplifying assumptions used in the Black-Scholes model and hence in the Greeks.

Names

The use of Greek letter names is presumably by extension from the common finance termsalpha

Alpha (uppercase , lowercase ) is the first letter of the Greek alphabet. In the system of Greek numerals, it has a value of one. Alpha is derived from the Phoenician letter ''aleph'' , whose name comes from the West Semitic word for ' ...

and beta, and the use of sigma

Sigma ( ; uppercase Σ, lowercase σ, lowercase in word-final position ς; ) is the eighteenth letter of the Greek alphabet. In the system of Greek numerals, it has a value of 200. In general mathematics, uppercase Σ is used as an operator ...

(the standard deviation of logarithmic returns) and tau (time to expiry) in the Black–Scholes option pricing model. Several names such as "vega" (whose symbol is similar to the lower-case Greek letter ''nu''; the use of that name might have led to confusion) and "zomma" are invented, but sound similar to Greek letters. The names "color" and "charm" presumably derive from the use of these terms for exotic properties of quarks in particle physics

Particle physics or high-energy physics is the study of Elementary particle, fundamental particles and fundamental interaction, forces that constitute matter and radiation. The field also studies combinations of elementary particles up to the s ...

.

First-order Greeks

Delta

Delta

Delta commonly refers to:

* Delta (letter) (Δ or δ), the fourth letter of the Greek alphabet

* D (NATO phonetic alphabet: "Delta"), the fourth letter in the Latin alphabet

* River delta, at a river mouth

* Delta Air Lines, a major US carrier ...

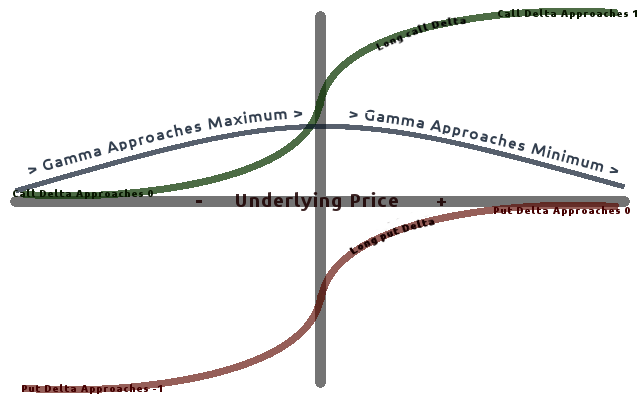

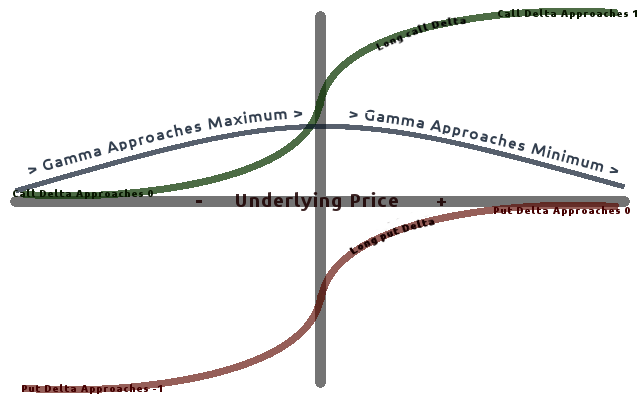

, , measures the rate of change of the theoretical option value with respect to changes in the underlying asset's price. Delta is the first derivative of the value of the option with respect to the underlying instrument's price .

:

Practical use

For a vanilla option, delta will be a number between 0.0 and 1.0 for a long call (or a short put) and 0.0 and −1.0 for a long put (or a short call); depending on price, a call option behaves as if one owns 1 share of the underlying stock (if deep in the money), or owns nothing (if far out of the money), or something in between, and conversely for a put option. The difference between the delta of a call and the delta of a put at the same strike is equal to one. By put–call parity, long a call and short a put is equivalent to a forward ''F'', which is linear in the spot ''S,'' with unit factor, so the derivative dF/dS is 1. See the formulas below. These numbers are commonly presented as a percentage of the total number of shares represented by the option contract(s). This is convenient because the option will (instantaneously) behave like the number of shares indicated by the delta. For example, if a portfolio of 100 American call options on XYZ each have a delta of 0.25 (= 25%), it will gain or lose value just like 2,500 shares of XYZ as the price changes for small price movements (100 option contracts covers 10,000 shares). The sign and percentage are often dropped – the sign is implicit in the option type (negative for put, positive for call) and the percentage is understood. The most commonly quoted are 25 delta put, 50 delta put/50 delta call, and 25 delta call. 50 Delta put and 50 Delta call are not quite identical, due to spot and forward differing by the discount factor, but they are often conflated. Delta is always positive for long calls and negative for long puts (unless they are zero). The total delta of a complex portfolio of positions on the same underlying asset can be calculated by simply taking the sum of the deltas for each individual position – delta of a portfolio is linear in the constituents. Since the delta of underlying asset is always 1.0, the trader could delta-hedge his entire position in the underlying by buying or shorting the number of shares indicated by the total delta. For example, if the delta of a portfolio of options in XYZ (expressed as shares of the underlying) is +2.75, the trader would be able to delta-hedge the portfolio by selling short 2.75 shares of the underlying. This portfolio will then retain its total value regardless of which direction the price of XYZ moves. (Albeit for only small movements of the underlying, a short amount of time and not-withstanding changes in other market conditions such as volatility and the rate of return for a risk-free investment).As a proxy for probability

The (absolute value of) Delta is close to, but not identical with, the percent moneyness of an option, i.e., the ''implied'' probability that the option will expire in-the-money (if the market moves under Brownian motion in the risk-neutral measure). For this reason some option traders use the absolute value of delta as an approximation for percent moneyness. For example, if an out-of-the-money call option has a delta of 0.15, the trader might estimate that the option has approximately a 15% chance of expiring in-the-money. Similarly, if a put contract has a delta of −0.25, the trader might expect the option to have a 25% probability of expiring in-the-money. At-the-money calls and puts have a delta of approximately 0.5 and −0.5 respectively with a slight bias towards higher deltas for ATM calls since the risk-free rate introduces some offset to the delta. The negative discounted probability of an option ending up in the money at expiry is called the dual delta, which is the first derivative of option price with respect to strike.Relationship between call and put delta

Given a European call and put option for the same underlying, strike price and time to maturity, and with no dividend yield, the sum of the absolute values of the delta of each option will be 1 – more precisely, the delta of the call (positive) minus the delta of the put (negative) equals 1. This is due to put–call parity: a long call plus a short put (a call minus a put) replicates a forward, which has delta equal to 1. If the value of delta for an option is known, one can calculate the value of the delta of the option of the same strike price, underlying and maturity but opposite right by subtracting 1 from a known call delta or adding 1 to a known put delta. : For example, if the delta of a call is 0.42 then one can compute the delta of the corresponding put at the same strike price by 0.42 − 1 = −0.58. To derive the delta of a call from a put, one can similarly take −0.58 and add 1 to get 0.42.Vega

Vega measures sensitivity to volatility. Vega is the derivative of the option value with respect to the volatility of the underlying asset. : ''Vega'' is not the name of any Greek letter. The glyph used is a non-standard majuscule version of the Greek letter ''nu'' (), written as . Presumably the name ''vega'' was adopted because the Greek letter ''nu'' looked like a Latin ''vee'', and ''vega'' was derived from ''vee'' by analogy with how ''beta'', ''eta'', and ''theta'' are pronounced in American English. The symbol kappa, , is sometimes used (by academics) instead of vega (as is tau () or capital lambda (), though these are rare). Vega is typically expressed as the amount of money per underlying share that the option's value will gain or lose as volatility rises or falls by 1percentage point

A percentage point or percent point is the unit (measurement), unit for the difference (mathematics), arithmetic difference between two percentages. For example, moving up from 40 percent to 44 percent is an increase of 4 percentage points (altho ...

. All options (both calls and puts) will gain value with rising volatility.

Vega can be an important Greek to monitor for an option trader, especially in volatile markets, since the value of some option strategies can be particularly sensitive to changes in volatility. The value of an at-the-money option straddle, for example, is extremely dependent on changes to volatility.

See Volatility risk.

Theta

Theta, , measures the sensitivity of the value of the derivative to the passage of time (see Option time value): the "time decay." : As time passes, with decreasing time to expiry and all else being equal, an option's extrinsic value decreases. Typically (but see below), this means an option loses value with time, which is conventionally referred to as long options typically having short (negative) theta. In fact, typically, the literal first derivative w.r.t. time of an option's value is a ''positive'' number. The change in option value is typically negative because ''the passage of time'' is a negative number (a ''decrease'' to , time to expiry). However, by convention, practitioners usually prefer to refer to theta exposure ("decay") of a long option as negative (instead of the passage of time as negative), and so theta is usually reported as -1 times the first derivative, as above. While extrinsic value is decreasing with time passing, sometimes a countervailing factor is discounting. For deep-in-the-money options of some types (for puts in Black-Scholes, puts and calls in Black's), as discount factors increase towards 1 with the passage of time, that is an element of ''increasing'' value in a long option. Sometimes deep-in-the-money options will gain more from increasing discount factors than they lose from decreasing extrinsic value, and reported theta will be a positive value for a long option instead of a more typical negative value (and the option will be an early exercise candidate, if exercisable, and a European option may become worth less than parity). By convention in options valuation formulas, , time to expiry, is defined in years. Practitioners commonly prefer to view theta in terms of change in number of days to expiry rather than number of years to expiry. Therefore, reported theta is usually divided by number of days in a year. (Whether to count calendar days or business days varies by personal choice, with arguments for both.)Rho

Rho

Rho (; uppercase Ρ, lowercase ρ or ; or ) is the seventeenth letter of the Greek alphabet. In the system of Greek numerals it has a value of 100. It is derived from Phoenician alphabet, Phoenician letter resh . Its uppercase form uses the same ...

, , measures sensitivity to the interest rate: it is the derivative of the option value with respect to the risk-free interest rate (for the relevant outstanding term).

:

Except under extreme circumstances, the value of an option is less sensitive to changes in the risk-free interest rate than to changes in other parameters. For this reason, rho is the least used of the first-order Greeks.

Rho is typically expressed as the amount of money, per share of the underlying, that the value of the option will gain or lose as the risk-free interest rate rises or falls by 1.0% per annum (100 basis points).

Lambda

Lambda, , omega, , or elasticity is thepercentage

In mathematics, a percentage () is a number or ratio expressed as a fraction (mathematics), fraction of 100. It is often Denotation, denoted using the ''percent sign'' (%), although the abbreviations ''pct.'', ''pct'', and sometimes ''pc'' are ...

change in option value per percentage change in the underlying price, a measure of leverage, sometimes called gearing.

:

It holds that .

It is similar to the concept of delta but expressed in percentage terms rather than absolute terms.

Epsilon

Epsilon, (also known as psi, ), is the percentage change in option value perpercentage

In mathematics, a percentage () is a number or ratio expressed as a fraction (mathematics), fraction of 100. It is often Denotation, denoted using the ''percent sign'' (%), although the abbreviations ''pct.'', ''pct'', and sometimes ''pc'' are ...

change in the underlying dividend yield, a measure of the dividend risk. The dividend yield impact is in practice determined using a 10% increase in those yields. Obviously, this sensitivity can only be applied to derivative instruments of equity products.

:

Numerically, all first-order sensitivities can be interpreted as spreads in expected returns. Information geometry offers another (trigonometric) interpretation.

Second-order Greeks

Gamma

Gamma, , measures the rate of change in the delta with respect to changes in the underlying price. Gamma is the secondderivative

In mathematics, the derivative is a fundamental tool that quantifies the sensitivity to change of a function's output with respect to its input. The derivative of a function of a single variable at a chosen input value, when it exists, is t ...

of the value function with respect to the underlying price.

:

Most long options have positive gamma and most short options have negative gamma. Long options have a positive relationship with gamma because as price increases, Gamma increases as well, causing Delta to approach 1 from 0 (long call option) and 0 from −1 (long put option). The inverse is true for short options. Gamma is greatest approximately at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM). Gamma is important because it corrects for the convexity of value.

When a trader seeks to establish an effective delta-hedge for a portfolio, the trader may also seek to neutralize the portfolio's gamma, as this will ensure that the hedge will be effective over a wider range of underlying price movements.

Gamma is greatest approximately at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM). Gamma is important because it corrects for the convexity of value.

When a trader seeks to establish an effective delta-hedge for a portfolio, the trader may also seek to neutralize the portfolio's gamma, as this will ensure that the hedge will be effective over a wider range of underlying price movements.

Vanna

Vanna, also referred to as DvegaDspot and DdeltaDvol, is a second-order derivative of the option value, once to the underlying spot price and once to volatility. It is mathematically equivalent to DdeltaDvol, the sensitivity of the option delta with respect to change in volatility; or alternatively, the partial of vega with respect to the underlying instrument's price. Vanna can be a useful sensitivity to monitor when maintaining a delta- or vega-hedged portfolio as vanna will help the trader to anticipate changes to the effectiveness of a delta-hedge as volatility changes or the effectiveness of a vega-hedge against change in the underlying spot price. If the underlying value has continuous second partial derivatives, thenCharm

Charm or delta decay measures the instantaneous rate of change of delta over the passage of time. : Charm has also been called DdeltaDtime. Charm can be an important Greek to measure/monitor when delta-hedging a position over a weekend. Charm is a second-order derivative of the option value, once to price and once to the passage of time. It is also then the derivative of theta with respect to the underlying's price. The mathematical result of the formula for charm (see below) is expressed in delta/year. It is often useful to divide this by the number of days per year to arrive at the delta decay per day. This use is fairly accurate when the number of days remaining until option expiration is large. When an option nears expiration, charm itself may change quickly, rendering full day estimates of delta decay inaccurate.Vomma

Vomma, volga, vega convexity, or DvegaDvol measures second-order sensitivity to volatility. Vomma is the second derivative of the option value with respect to the volatility, or, stated another way, vomma measures the rate of change to vega as volatility changes. : With positive vomma, a position will become long vega as implied volatility increases and short vega as it decreases, which can be scalped in a way analogous to long gamma. And an initially vega-neutral, long-vomma position can be constructed from ratios of options at different strikes. Vomma is positive for long options away from the money, and initially increases with distance from the money (but drops off as vega drops off). (Specifically, vomma is positive where the usual ''d''1 and ''d''2 terms are of the same sign, which is true when ''d''1 < 0 or ''d''2 > 0.)Veta

Veta, vega decay or DvegaDtime measures the rate of change in the vega with respect to the passage of time. Veta is the second derivative of the value function; once to volatility and once to time. : It is common practice to divide the mathematical result of veta by 100 times the number of days per year to reduce the value to the percentage change in vega per one day.Vera

VeraDerivatives – Second-Order Greeks – The Financial Encyclopedia/ref> (sometimes rhova) measures the rate of change in rho with respect to volatility. Vera is the second derivative of the value function; once to volatility and once to interest rate. : The word 'Vera' was coined by R. Naryshkin in early 2012 when this sensitivity needed to be used in practice to assess the impact of volatility changes on rho-hedging, but no name yet existed in the available literature. 'Vera' was picked to sound similar to a combination of Vega and Rho, its respective first-order Greeks. This name is now in a wider use, including, for example, the Maple computer algebra software (which has 'BlackScholesVera' function in its Finance package).

Second-order partial derivative with respect to strike ''K''

This partial derivative has a fundamental role in the Breeden–Litzenberger formula, which uses quoted call option prices to estimate the risk-neutral probabilities implied by such prices. : For call options, it can be approximated using infinitesimal portfolios of butterfly strategies.Third-order Greeks

Speed

Speed measures the rate of change in Gamma with respect to changes in the underlying price. : This is also sometimes referred to as the gamma of the gamma or DgammaDspot. Speed is the third derivative of the value function with respect to the underlying spot price. Speed can be important to monitor when delta-hedging or gamma-hedging a portfolio.Zomma

Zomma measures the rate of change of gamma with respect to changes in volatility. : Zomma has also been referred to as DgammaDvol. Zomma is the third derivative of the option value, twice to underlying asset price and once to volatility. Zomma can be a useful sensitivity to monitor when maintaining a gamma-hedged portfolio as zomma will help the trader to anticipate changes to the effectiveness of the hedge as volatility changes.Color

Color, gamma decay or DgammaDtime measures the rate of change of gamma over the passage of time. : Color is a third-order derivative of the option value, twice to underlying asset price and once to time. Color can be an important sensitivity to monitor when maintaining a gamma-hedged portfolio as it can help the trader to anticipate the effectiveness of the hedge as time passes. The mathematical result of the formula for color (see below) is expressed in gamma per year. It is often useful to divide this by the number of days per year to arrive at the change in gamma per day. This use is fairly accurate when the number of days remaining until option expiration is large. When an option nears expiration, color itself may change quickly, rendering full day estimates of gamma change inaccurate.Ultima

Ultima measures the sensitivity of the option vomma with respect to change in volatility. : Ultima has also been referred to as DvommaDvol. Ultima is a third-order derivative of the option value to volatility.Parmicharma

Parmicharma measures the rate of change of charm over the passage of time. : Parmicharma has also been referred to as DcharmDtime. Parmicharma is a third-order derivative of the option value, twice to time and once to underlying asset price. In order to better maintain a delta-hedge portfolio as time passes, the trader may hedge charm in addition to their current delta position. Parmicharma can be a useful sensitivity to monitor when maintaining such a charm-hedged portfolio as parmicharma will help the trader anticipate changes to the effectiveness of the hedge as time passes.Greeks for multi-asset options

If the value of a derivative is dependent on two or more underlyings, its Greeks are extended to include the cross-effects between the underlyings. Correlation delta measures the sensitivity of the derivative's value to a change in the correlation between the underlyings. It is also commonly known as cega. Cross gamma measures the rate of change of delta in one underlying to a change in the level of another underlying. Cross vanna measures the rate of change of vega in one underlying due to a change in the level of another underlying. Equivalently, it measures the rate of change of delta in the second underlying due to a change in the volatility of the first underlying. Cross volga measures the rate of change of vega in one underlying to a change in the volatility of another underlying.Formulae for European option Greeks

The Greeks of European options ( calls and puts) under the Black–Scholes model are calculated as follows, where (phi) is the standard normal probability density function and is the standard normal cumulative distribution function. Note that the gamma and vega formulas are the same for calls and puts. For a given: * Stock price , * Strike price , * Risk-free rate , * Annual dividend yield , * Time to maturity (represented as a unit-less fraction of one year), and * Volatility . where : Under the Black model (commonly used for commodities and options on futures) the Greeks can be calculated as follows: where : (*) It can be shown that Micro proof:let Then we have: : So

Related measures

Some related risk measures offinancial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

s are listed below.

Bond duration and convexity

In trading bonds and other fixed income securities, various measures of bond duration are used analogously to the delta of an option. The closest analogue to the delta is DV01, which is the reduction in price (in currency units) for an increase of onebasis point

A basis point (often abbreviated as bp, often pronounced as "bip" or "beep") is one hundredth of 1 percentage point. Changes of interest rates are often stated in basis points. For example, if an existing interest rate of 10 percent is increased ...

(i.e. 0.01% per annum) in the yield, where yield is the underlying variable;

see .

(Related is CS01, measuring sensitivity to credit spread.)

Analogous to the lambda is the modified duration, which is the ''percentage'' change in the market price of the bond(s) for a ''unit'' change in the yield (i.e. it is equivalent to DV01 divided by the market price). Unlike the lambda, which is an elasticity (a percentage change in output for a percentage change in input), the modified duration is instead a ''semi''-elasticity—a percentage change in output for a ''unit'' change in input.

See also Key rate duration.

Bond convexity is a measure of the sensitivity of the duration to changes in interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s, the second derivative

In calculus, the second derivative, or the second-order derivative, of a function is the derivative of the derivative of . Informally, the second derivative can be phrased as "the rate of change of the rate of change"; for example, the secon ...

of the price of the bond with respect to interest rates (duration is the first derivative); it is then analogous to gamma. In general, the higher the convexity, the more sensitive the bond price is to the change in interest rates. Bond convexity is one of the most basic and widely used forms of convexity in finance.

For a bond with an embedded option

An embedded option

is a component of a financial bond or other security, which provides the bondholder or the issuer the right to take some action against the other party. There are several types of options that can be embedded into a bond; comm ...

, the standard yield to maturity

The yield to maturity (YTM), book yield or redemption yield of a fixed-interest security is an estimate of the total rate of return anticipated to be earned by an investor who buys it at a given market price, holds it to maturity, and receives ...

based calculations here do not consider how changes in interest rates will alter the cash flows due to option exercise. To address this, effective duration and effective convexity are introduced. These values are typically calculated using a tree-based model, built for the entire yield curve (as opposed to a single yield to maturity), and therefore capturing exercise behavior at each point in the option's life as a function of both time and interest rates; see .

Beta

The beta (β) of astock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporatio ...

or portfolio is a number describing the volatility of an asset in relation to the volatility of the benchmark that said asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

.

An asset has a Beta of zero if its returns change independently of changes in the market's returns. A positive beta means that the asset's returns generally follow the market's returns, in the sense that they both tend to be above their respective averages together, or both tend to be below their respective averages together. A negative beta means that the asset's returns generally move opposite the market's returns: one will tend to be above its average when the other is below its average.

Fugit

The fugit is the expected time to exercise an American or Bermudan option. Fugit is usefully computed for hedging purposes — for example, one can represent flows of an American swaption like the flows of a swap starting at the fugit multiplied by delta, and then use these to compute other sensitivities.See also

* Alpha (finance) * Beta (finance) * Delta neutral *Financial risk management

Financial risk management is the practice of protecting Value (economics), economic value in a business, firm by managing exposure to financial risk - principally credit risk and market risk, with more specific variants as listed aside - as well ...

* Greek letters used in mathematics, science, and engineering

*

* Vanna–Volga pricing

References

External links

Theory * Delta, Gamma, GammaP, Gamma symmetry, Vanna, Speed, Charm, Saddle GammaVanilla Options - Espen Haug

* Volga, Vanna, Speed, Charm, Color

Vanilla Options - Uwe Wystup

Vanilla Options - Uwe Wystup

Online tools

R package to compute Greeks for European-, American- and Asian options {{DEFAULTSORT:Greeks (Finance) Mathematical finance Financial ratios Options (finance)