A fixed exchange rate, often called a pegged exchange rate, is a type of

exchange rate regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many ...

in which a

currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

's value is fixed or pegged by a

monetary authority

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monet ...

against the value of another currency, a

basket of other currencies, or another measure of value, such as

gold

Gold is a chemical element; it has chemical symbol Au (from Latin ) and atomic number 79. In its pure form, it is a brightness, bright, slightly orange-yellow, dense, soft, malleable, and ductile metal. Chemically, gold is a transition metal ...

or

silver

Silver is a chemical element; it has Symbol (chemistry), symbol Ag () and atomic number 47. A soft, whitish-gray, lustrous transition metal, it exhibits the highest electrical conductivity, thermal conductivity, and reflectivity of any metal. ...

.

There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a

floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of their

GDP.

A fixed exchange rate system can also be used to control the behavior of a currency, such as by limiting rates of

inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

. However, in doing so, the pegged currency is then controlled by its reference value. As such, when the reference value rises or falls, it then follows that the values of any currencies pegged to it will also rise and fall in relation to other currencies and commodities with which the pegged currency can be traded. In other words, a pegged currency is dependent on its reference value to dictate how its current worth is defined at any given time. In addition, according to the

Mundell–Fleming model, with perfect

capital mobility, a fixed exchange rate prevents a government from using domestic

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

to achieve

macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP ...

stability.

In a fixed exchange rate system, a country's

central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

typically uses an open market mechanism and is committed at all times to buy and sell its currency at a fixed price in order to maintain its pegged ratio and, hence, the stable value of its currency in relation to the reference to which it is pegged. To maintain a desired exchange rate, the central bank, during a time of private sector net demand for the foreign currency, sells foreign currency from its reserves and buys back the domestic money. This creates an artificial

demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

for the domestic money, which increases its exchange rate value. Conversely, in the case of an incipient appreciation of the domestic money, the central bank buys back the foreign money and thus adds domestic money into the market, thereby maintaining market equilibrium at the intended fixed value of the exchange rate.

In the 21st century, the currencies associated with large economies typically do not fix (peg) their exchange rates to other currencies. The last large economy to use a fixed exchange rate system was the

People's Republic of China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

, which, in July 2005, adopted a slightly more flexible exchange rate system, called a

managed exchange rate. The

European Exchange Rate Mechanism is also used on a temporary basis to establish a final conversion rate against the

euro

The euro (currency symbol, symbol: euro sign, €; ISO 4217, currency code: EUR) is the official currency of 20 of the Member state of the European Union, member states of the European Union. This group of states is officially known as the ...

from the local currencies of countries joining the

Eurozone

The euro area, commonly called the eurozone (EZ), is a Monetary union, currency union of 20 Member state of the European Union, member states of the European Union (EU) that have adopted the euro (Euro sign, €) as their primary currency ...

.

History

Chronology

Timeline of the fixed exchange rate system:

Gold standard

The gold standard is a monetary system where a country's currency or paper money has a value directly linked to gold. With the gold standard, countries agreed to convert paper money into a fixed amount of gold

Bretton Woods system

The Bretton Woods System is a set of unified rules and policies that provided the framework necessary to create fixed international currency exchange rates. Essentially, the agreement called for the newly created IMF to determine the fixed rate of exchange for currencies around the world

Current monetary regimes

A current monetary system is a system by which a government provides money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks.

Mechanisms

Open market trading

Typically, a government wanting to maintain a fixed exchange rate does so by either buying or selling its own currency on the open market. This is one reason governments maintain reserves of foreign currencies.

If the exchange rate drifts too far above the fixed benchmark rate (it is stronger than required), the government sells its own currency (which increases supply) and buys foreign currency. This causes the price of the currency to decrease in value (Read: Classical Demand-Supply diagrams). Also, if they buy the currency it is pegged to, then the price of that currency will increase, causing the relative value of the currencies to approach what is intended.

If the exchange rate drifts too far below the desired rate, the government buys its own currency in the market by selling its reserves. This places greater demand on the market and causes the local currency to become stronger, hopefully back to its intended value. The reserves they sell may be the currency it is pegged to, in which case the value of that currency will fall.

Fiat

Another, less used means of maintaining a fixed exchange rate is by simply making it illegal to trade currency at any other rate. This is difficult to enforce and often leads to a

black market

A black market is a Secrecy, clandestine Market (economics), market or series of transactions that has some aspect of illegality, or is not compliant with an institutional set of rules. If the rule defines the set of goods and services who ...

in foreign currency. Nonetheless, some countries are highly successful at using this method due to government monopolies over all money conversion. This was the method employed by the Chinese government to maintain a currency peg or tightly banded float against the US dollar. China buys an average of one billion US dollars a day to maintain the currency peg. Throughout the 1990s, China was highly successful at maintaining a currency peg using a government monopoly over all currency conversion between the yuan and other currencies.

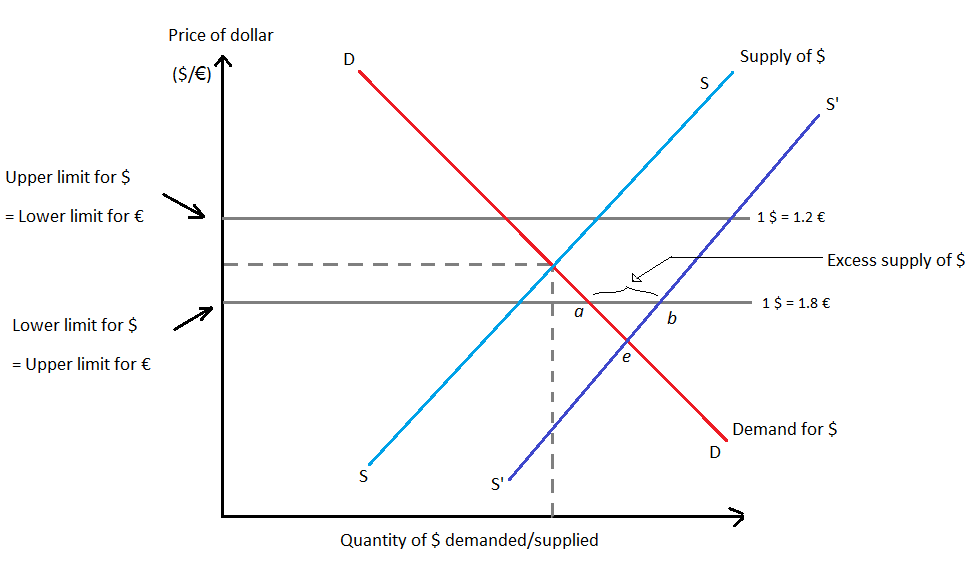

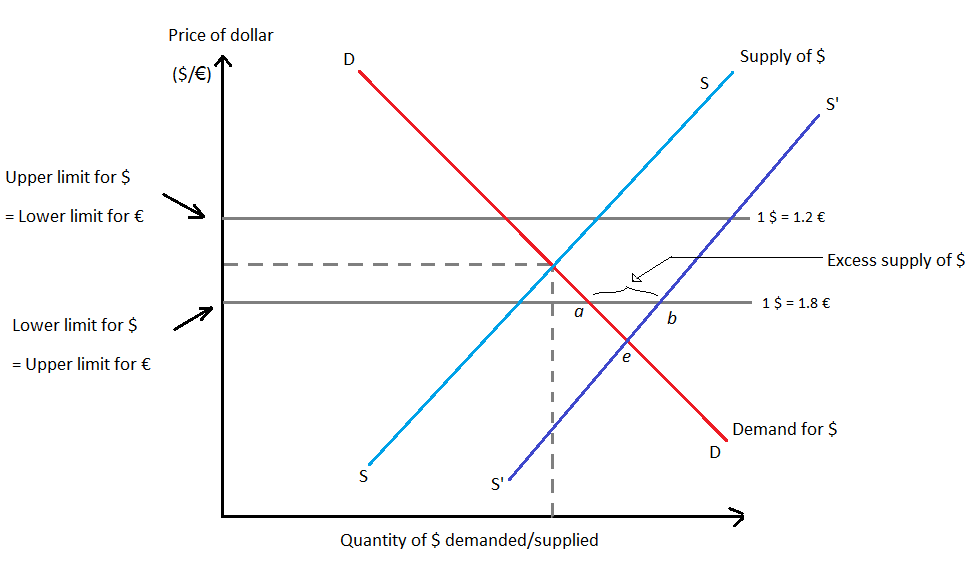

Open market mechanism example

Excess demand for dollars

Excess supply of dollars

Types of fixed exchange rate systems

The gold standard

The gold standard is the pegging of money to a certain amount of gold.

Price specie flow mechanism

Reserve currency standard

Currency board arrangements are the most widespread means of fixed exchange rates. Currency boards are considered hard pegs as they allow central banks to cope with shocks to money demand without running out of reserves.

CBAs have been operational in many nations including:

*

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

(since 1983);

*

Argentina

Argentina, officially the Argentine Republic, is a country in the southern half of South America. It covers an area of , making it the List of South American countries by area, second-largest country in South America after Brazil, the fourt ...

(1991 to 2001);

*

Estonia

Estonia, officially the Republic of Estonia, is a country in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the Baltic Sea across from Sweden, to the south by Latvia, and to the east by Ru ...

(1992 to 2010);

*

Lithuania

Lithuania, officially the Republic of Lithuania, is a country in the Baltic region of Europe. It is one of three Baltic states and lies on the eastern shore of the Baltic Sea, bordered by Latvia to the north, Belarus to the east and south, P ...

(1994 to 2014);

*

Bosnia and Herzegovina

Bosnia and Herzegovina, sometimes known as Bosnia-Herzegovina and informally as Bosnia, is a country in Southeast Europe. Situated on the Balkans, Balkan Peninsula, it borders Serbia to the east, Montenegro to the southeast, and Croatia to th ...

(since 1997);

*

Bulgaria

Bulgaria, officially the Republic of Bulgaria, is a country in Southeast Europe. It is situated on the eastern portion of the Balkans directly south of the Danube river and west of the Black Sea. Bulgaria is bordered by Greece and Turkey t ...

(since 1997);

*

Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest.

Bermuda is an ...

(since 1972);

*

Denmark

Denmark is a Nordic countries, Nordic country in Northern Europe. It is the metropole and most populous constituent of the Kingdom of Denmark,, . also known as the Danish Realm, a constitutionally unitary state that includes the Autonomous a ...

(since 1945);

*

Brunei

Brunei, officially Brunei Darussalam, is a country in Southeast Asia, situated on the northern coast of the island of Borneo. Apart from its coastline on the South China Sea, it is completely surrounded by the Malaysian state of Sarawak, with ...

(since 1967)

Gold exchange standard

Hybrid exchange rate systems

Basket-of-currencies

Crawling pegs

Pegged within a band

Currency boards

Currency substitution

Monetary co-operation

Monetary co-operation is the mechanism in which two or more

monetary policies or

exchange rates are linked, and can happen at regional or international level. The monetary co-operation does not necessarily need to be a voluntary arrangement between two countries, as it is also possible for a country to link its

currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

to another countries currency without the

consent

Consent occurs when one person voluntarily agrees to the proposal or desires of another. It is a term of common speech, with specific definitions used in such fields as the law, medicine, research, and sexual consent. Consent as understood i ...

of the other country. Various forms of monetary co-operations exist, which range from fixed parity systems to

monetary unions. Also, numerous institutions have been established to enforce monetary co-operation and to stabilise

exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

s, including the

European Monetary Cooperation Fund (EMCF) in 1973 and the

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

(IMF)

Monetary co-operation is closely related to

economic integration, and are often considered to be reinforcing processes.

[Berben, R.-P., Berk, J. M., Nitihanprapas, E., Sangsuphan, K., Puapan, P., & Sodsriwiboon, P. (2003). Requirements for successful currency regimes: The Dutch and Thai experiences: De Nederlandsche Bank] However, economic integration is an economic arrangement between different regions, marked by the reduction or elimination of

trade barriers and the coordination of monetary and

fiscal policies, whereas monetary co-operation is focussed on currency linkages. A

monetary union is considered to be the crowning step of a process of monetary co-operation and

economic integration.

[ In the form of monetary co-operation where two or more countries engage in a mutually beneficial exchange, capital among the countries involved is free to move, in contrast to capital controls.]economic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

and monetary stability, but can also work counter-effectively if the member countries have (strongly) differing levels of economic development

In economics, economic development (or economic and social development) is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals and object ...

.

Example: The Snake

In 1973, the currencies of the European Economic Community

The European Economic Community (EEC) was a regional organisation created by the Treaty of Rome of 1957,Today the largely rewritten treaty continues in force as the ''Treaty on the functioning of the European Union'', as renamed by the Lisbo ...

countries, Belgium, France, Germany, Italy, Luxemburg and the Netherlands, participated in an arrangement called ''the Snake''. This arrangement is categorized as exchange rate co-operation. During the next 6 years, this agreement allowed the currencies of the participating countries to fluctuate within a band of plus or minus 2¼% around pre-announced central rates. Later, in 1979, the European Monetary System (EMS) was founded, with the participating countries in ''‘the Snake’'' being founding members. The EMS evolves over the next decade and even results into a truly fixed exchange rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a currency basket, basket of other currenc ...

at the start of the 1990s.European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

over three phases [ Economic and Monetary Union of the European Union on Wikipedia]

Example: The baht-U.S. dollar co-operation

In 1963, the Thai government established the Exchange Equalization Fund (EEF) with the purpose of playing a role in stabilizing exchange rate movements. It linked to the U.S. dollar by fixing the amount of gram of gold

Gold is a chemical element; it has chemical symbol Au (from Latin ) and atomic number 79. In its pure form, it is a brightness, bright, slightly orange-yellow, dense, soft, malleable, and ductile metal. Chemically, gold is a transition metal ...

per baht as well as the baht per U.S. dollar. Over the course of the next 15 years, the Thai government decided to depreciate the baht in terms of gold three times, yet maintain the parity of the baht against the U.S. dollar. Due to the introduction of a new generalized floating exchange rate system by the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

(IMF) in 1978 that gave a smaller role to gold in the international monetary system, this fixed parity system as a monetary co-operation policy was terminated. The Thai government amended its monetary policies to be more in line with the new IMF policy.

Fixed exchange rate system advantage

Disadvantages

Lack of automatic rebalancing

One main criticism of a fixed exchange rate is that flexible exchange rates serve to adjust the balance of trade.

Currency crisis

Another major disadvantage of a fixed exchange-rate regime is the possibility of the central bank running out of foreign exchange reserves when trying to maintain the peg in the face of demand for foreign reserves exceeding their supply. This is called a currency crisis or balance of payments crisis, and when it happens the central bank must devalue the currency. When there is the prospect of this happening, private-sector agents will try to protect themselves by decreasing their holdings of the domestic currency and increasing their holdings of the foreign currency, which has the effect of increasing the likelihood that the forced devaluation will occur. A forced devaluation will change the exchange rate by more than the day-by-day exchange rate fluctuations under a flexible exchange rate system.

Freedom to conduct monetary and fiscal policy

Moreover, a government, when having a fixed rather than dynamic exchange rate, cannot use monetary or fiscal policies with a free hand. For instance, by using reflationary tools to set the economy growing faster (by decreasing taxes and injecting more money in the market), the government risks running into a trade deficit. This might occur as the purchasing power of a common household increases along with inflation, thus making imports relatively cheaper.

Additionally, the stubbornness of a government in defending a fixed exchange rate when in a trade deficit will force it to use deflationary measures (increased taxation and reduced availability of money), which can lead to unemployment. Finally, other countries with a fixed exchange rate can also retaliate in response to a certain country using the currency of theirs in defending their exchange rate.

Fixed exchange rate regime versus capital control

The belief that the fixed exchange rate regime brings with it stability is only partly true, since speculative attacks tend to target currencies with fixed exchange rate regimes, and in fact, the stability of the economic system is maintained mainly through capital control. A fixed exchange rate regime should be viewed as a tool in capital control.

FIX Line: Trade-off between symmetry of shocks and integration

*The trade-off between symmetry of shocks and market integration for countries contemplating a pegged currency is outlined in Feenstra and Taylor's 2015 publication "International Macroeconomics" through a model known as the FIX Line Diagram.

*This symmetry-integration diagram features two regions, divided by a 45-degree line with slope of -1. This line can shift to the left or to the right depending on extra costs or benefits of floating. The line has slope= -1 is because the larger symmetry benefits are, the less pronounced integration benefits have to be and vice versa. The right region contains countries that have positive potential for pegging, while the left region contains countries that face significant risks and deterrents to pegging.

*This diagram underscores the two main factors that drive a country to contemplate pegging a currency to another, shock symmetry and market integration. Shock symmetry can be characterized as two countries having similar demand shocks due to similar industry breakdowns and economies, while market integration is a factor of the volume of trading that occurs between member nations of the peg.

*In extreme cases, it is possible for a country to only exhibit one of these characteristics and still have positive pegging potential. For example, a country that exhibits complete symmetry of shocks but has zero market integration could benefit from fixing a currency. The opposite is true, a country that has zero symmetry of shocks but has maximum trade integration (effectively one market between member countries). *This can be viewed on an international scale as well as a local scale. For example, neighborhoods within a city would experience enormous benefits from a common currency, while poorly integrated and dissimilar countries are likely to face large costs.

See also

* List of circulating fixed exchange rate currencies

*Exchange rate regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many ...

* Floating exchange rate

* Linked exchange rate

* Managed float regime

*Gold standard

A gold standard is a backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

* Bretton Woods system

* Nixon Shock

* Smithsonian Agreement

* Foreign exchange fixing

* Currency union

* Black Wednesday

* Capital control

* Convertibility

* Currency board

* Impossible trinity

* Speculative attack

* Swan diagram

References

{{Reflist, 30em, refs=

[{{cite book , last1=Dornbusch , first1=Rüdiger , author-link=Rüdiger Dornbusch , last2=Fisher , first2=Stanley , author2-link=Stanley Fischer , last3=Startz , first3=Richard , title=Macroeconomics , edition=Eleventh , publisher=McGraw-Hill/Irwin , location=New York , year=2011 , isbn=978-0-07-337592-2]

[{{cite book, last=Salvatore, first=Dominick, title=International Economics, publisher=John Wiley & Sons, year=2004, isbn=978-81-265-1413-7]

Foreign exchange market

Gold standard

fr:Régime de change#Régime de change fixe