financial risk management on:

[Wikipedia]

[Google]

[Amazon]

Financial risk management is the practice of protecting

Financial Management - Risk Management

MIT OCW relating to "Risk Management" and

Banks and other wholesale institutions face various

Banks and other wholesale institutions face various

''

"Basic Concepts and Techniques of Risk Management"

"Quantitative Risk Management: VaR and Others"

UNC Charlotte is, as outlined, simultaneously concerned with (i) managing, and as necessary hedging, the various positions held by the institution — both trading positions and long term exposures; and (ii) calculating and monitoring the resultant

Review of Financial Risk Management... for Dummies

/ref> *

"Risk mitigation techniques in credit portfolio management"

/ref> against thresholds set for various types of risk. (iv) Leverage will be monitored - at very least re regulatory requirements - as leveraged positions could lose large amounts for a relatively small move in the price of the underlying. (v) Periodically, these all are estimated under a given stress scenario, and risk capital - together with these limits - is correspondingly revisited. Middle office also maintains the following functions, often overlapping the above Groups:

"The Evolution of XVA Desk Management"

/ref> Achieving the above requires that banks maintain a significant investment in sophisticated infrastructure, finance / risk software (often built

In corporate finance and

In corporate finance and

Ch. 20 in financial risk management, as above, is concerned more generally with business risk - risks to the business’ value, within the context of its

"Business Risk"

in Esther Baranoff, Patrick Brockett, Yehuda Kahane (2012). ''Risk Management for Enterprises and Individuals''.

''Financial Risk Management for Management Accountants''

What Is Financial Risk Management?

chron.com — see following description — and is coupled with the use of insurance, managing the net-exposure, as above:

Quantifying Corporate Financial Risk

archived 2010-07-17. in some cases, employing sophisticated stochastic models, in, for example, financing activity prediction problems, and for risk analysis ahead of a major investment. # Firm exposure to long term market (and business) risk is a direct result of previous capital investment decisions. Where applicable here — usually in large corporates and under guidance from their investment bankers — risk analysts will manage and hedge their exposures using traded

Fund managers, classically, define the risk of a

Fund managers, classically, define the risk of a

What Is Finance?

/ref> these may relate to the portfolio as a whole or to individual stocks. *Fund managers may engage in portfolio insurance, a hedging strategy developed to limit the losses an investor might face from a declining index of stocks without having to sell the stocks themselves. This strategy involves selling Stock market index futures during periods of price declines. The proceeds from the sale of the futures help to offset paper losses of the owned portfolio. Alternatively, and more commonly,Staff (2020)

What is index option trading and how does it work?

CERA - The Chartered Enterprise Risk Analyst Credential - Society of Actuaries (SOA)

Financial Risk Manager Certification Program - Global Association of Risk Professional (GARP)

Professional Risk Manager Certification Program - Professional Risk Managers' International Association (PRMIA)

* ttp://www.risk.net/journal Risk Journals Homepage {{DEFAULTSORT:Financial Risk Management Mathematical science occupations

economic value

In economics, economic value is a measure of the benefit provided by a goods, good or service (economics), service to an Agent (economics), economic agent. It is generally measured through units of currency, and the interpretation is therefore ...

in a firm

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared go ...

by using financial instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form ...

to manage exposure to financial risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial ...

- principally operational risk, credit risk

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

and market risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility.

There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the mos ...

, with more specific variants as listed aside.

As for risk management more generally, financial risk management requires identifying its sources, measuring it, and the plans to address them.

See for an overview.

Financial risk management as a "science" can be said to have been born

with modern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversificat ...

, particularly as initiated by Professor Harry Markowitz

Harry Max Markowitz (born August 24, 1927) is an American economist who received the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences.

Markowitz is a professor of finance at the Rady School of Managemen ...

in 1952 with his article, "Portfolio Selection";

see .

Financial risk management can be qualitative and quantitative.

As a specialization of risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environme ...

management, financial risk management focuses on when and how to hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoin ...

using financial instruments to manage costly exposures to risk.

*In the banking sector worldwide, the Basel Accords

The Basel Accords refer to the banking supervision accords (recommendations on banking regulations) issued by the Basel Committee on Banking Supervision (BCBS).

Basel I was developed through deliberations among central bankers from major countr ...

are generally adopted by internationally active banks for tracking, reporting and exposing operational, credit and market risks.Van Deventer, Donald R., and Kenji Imai. Credit risk models and the Basel Accords. Singapore: John Wiley & Sons (Asia), 2003.Drumond, Ines. "Bank capital requirements, business cycle fluctuations and the Basel Accords: a synthesis." Journal of Economic Surveys 23.5 (2009): 798-830.

*Within non-financial corporates,John Hampton (2011). ''The AMA Handbook of Financial Risk Management''. American Management Association

The American Management Association (AMA) is an American non-profit educational membership organization for the promotion of management, based in New York City. Besides its headquarters there, it has local head offices throughout the world.

It ...

. the scope is broadened to overlap enterprise risk management Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives. ERM provides a framework for risk management, which typi ...

, and financial risk management then addresses risks to the firm's overall strategic objectives.

*In investment management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be instit ...

risk is managed through diversification and related optimization; while further specific techniques are then applied to the portfolio or to individual stocks as appropriate.

In all cases, the last "line of defence

A defense line or fortification line is a geographically-recognizable line of troops and armament, fortified and set up to protect a high-value location or defend territory.

A defense line may be based on natural difficult terrain features, s ...

" against risk is capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used fo ...

, "as it ensures that a firm can continue as a going concern

A going concern is a business that is assumed will meet its financial obligations when they become due. It functions without the threat of liquidation for the foreseeable future, which is usually regarded as at least the next 12 months or the spe ...

even if substantial and unexpected losses are incurred".

Economic perspective

Neoclassical finance theory - i.e.,financial economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financia ...

- prescribes that a firm should take on a project if it increases shareholder

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal ...

value. Finance theory also shows that firm managers cannot create value for shareholders or investors

An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Type ...

by taking on projects that shareholders could do for themselves at the same cost.

See Theory of the firm

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market. Firms are key drivers in ec ...

and Fisher separation theorem

In economics, the Fisher separation theorem asserts that the primary objective of a corporation will be the maximization of its present value, regardless of the preferences of its shareholders. The theorem therefore separates management's "product ...

.

There is therefore a fundamental debate

Jonathan Lewellen (2003)Financial Management - Risk Management

MIT OCW relating to "Risk Management" and

shareholder value

Shareholder value is a business term, sometimes phrased as shareholder value maximization. It became prominent during the 1980s and 1990s along with the management principle value-based management or "managing for value".

Definition

The term "shar ...

. The discussion essentially weighs the value of risk management in a market versus the cost of bankruptcy in that market: per the Modigliani and Miller framework, hedging is irrelevant since diversified shareholders are assumed to not care about firm-specific risks, whereas, on the other hand hedging is seen to create value in that it reduces the probability of financial distress.

When applied to financial risk management, this implies that firm managers should not hedge risks that investors can hedge for themselves at the same cost. This notion is captured in the so-called "hedging irrelevance proposition":

"In a perfect market, the firm cannot create value by hedging a risk when the price of bearing that risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environme ...

within the firm is the same as the price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in t ...

of bearing it outside of the firm."

In practice, however, financial markets are not likely to be perfect markets.

This suggests that firm managers likely have many opportunities to create value for shareholders using financial risk management, wherein they have to determine which risks are cheaper for the firm to manage than the shareholders.

Here, market risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility.

There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the mos ...

s that result in unique risks for the firm are commonly the best candidates for financial risk management.

Application

As outlined, businesses are exposed, in the main, to market, credit and operational risk. A broad distinction exists though, betweenfinancial institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial inst ...

s and non-financial firms - and correspondingly, the application of risk management will differ.

Respectively:

For Banks and Fund Managers, "credit and market risks are taken intentionally with the objective of earning returns, while operational risks are a byproduct

A by-product or byproduct is a secondary product derived from a production process, manufacturing process or chemical reaction; it is not the primary product or service being produced.

A by-product can be useful and marketable or it can be consid ...

to be controlled".

For non-financial firms, the priorities are reversed, as "the focus is on the risks associated with the business" - ie the production and marketing of the services and products in which expertise is held - and their impact on revenue, costs and cash flow, "while market and credit risks are usually of secondary importance as they are a byproduct of the main business agenda".

(See related discussion re valuing financial services firms as compared to other firms.)

In all cases, as above, risk capital is the last "line of defence

A defense line or fortification line is a geographically-recognizable line of troops and armament, fortified and set up to protect a high-value location or defend territory.

A defense line may be based on natural difficult terrain features, s ...

".

Banking

financial risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial ...

s in conducting their business, and how well these risks are managed and understood is a key driver behind profitability, as well as of the quantum of capital they are required to hold.

Financial risk management in banking has grown markedly in importance since the Financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

.

The Rise of the Chief Risk Officer''

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked co ...

'' (March 2017).

(This has given rise to dedicated degrees and professional certifications.)

The major focus here is on credit and market risk, and especially through regulatory capital

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital a ...

, includes operational risk.

Credit risk is inherent in the business of banking, but additionally, these institutions are exposed to counterparty credit risk. Both are to some extent offset by margining and collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

; and the management is of the net-position.

Large banks are also exposed to Macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy

An economy is an area of the production, distributio ...

systematic risk

In finance and economics, systematic risk (in economics often called aggregate risk or undiversifiable risk) is vulnerability to events which affect aggregate outcomes such as broad market returns, total economy-wide resource holdings, or aggre ...

- risks related to the aggregate economy the bank is operating in

(see Too big to fail

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the grea ...

).

The discipline

Martin Haugh (2016)"Basic Concepts and Techniques of Risk Management"

Columbia University

Columbia University (also known as Columbia, and officially as Columbia University in the City of New York) is a private research university in New York City. Established in 1754 as King's College on the grounds of Trinity Church in Manha ...

Roy E. DeMeo (N.D."Quantitative Risk Management: VaR and Others"

UNC Charlotte is, as outlined, simultaneously concerned with (i) managing, and as necessary hedging, the various positions held by the institution — both trading positions and long term exposures; and (ii) calculating and monitoring the resultant

economic capital

In finance, mainly for financial services firms, economic capital (ecap) is the amount of risk capital, assessed on a realistic basis, which a firm requires to cover the risks that it is running or collecting as a going concern, such as market r ...

, as well as the regulatory capital

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital a ...

under Basel III

Basel III is the third Basel Accord, a framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements. Augmenting and superseding parts of the Basel II standards, it was developed in response ...

- with the latter as a floor.

The calculations here are mathematically sophisticated, and within the domain of quantitative finance.

Broadly, calculations are built

for (i) on the "Greeks", the sensitivity of the price of a derivative to a change in its underlying parameters, as well as on the various other measures of exposure to market factors, such as DV01

In finance, the duration of a financial asset that consists of fixed cash flows, such as a bond, is the weighted average of the times until those fixed cash flows are received.

When the price of an asset is considered as a function of yield, ...

for the sensitivity of a bond or swap

Swap or SWAP may refer to:

Finance

* Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another

* Barter

Science and technology

* Swap (computer programming), exchanging two variables in the ...

to interest rates;

and for (ii) on value at risk

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by ...

, or "VaR", an estimate of how much the investment or area in question might lose with a given probability in a set time period, and the bank holds economic “risk capital” correspondingly.

The regulatory capital quantum is calculated via specified formulae: risk weighting the exposures per highly standardized asset-categorizations, applying the aside frameworks, and the resultant capital - at least 12.9% of these Risk-weighted asset

Risk-weighted asset (also referred to as RWA) is a bank's assets or off-balance-sheet exposures, weighted according to risk. This sort of asset calculation is used in determining the capital requirement or Capital Adequacy Ratio (CAR) for a finan ...

s - must then be held in specific "tiers" and is measured correspondingly.

In certain cases, banks are allowed to use their own estimated risk parameters here; these "internal ratings-based models" typically result in less required capital, but at the same time are subject to strict minimum conditions and disclosure requirements.

As the financial crisis exposed holes in the mechanisms used for hedging, the methodologies employed have had to evolve

(see FRTB, and ):

*A core technique continues to be Value at Risk — applying the traditional parametric and "Historical" approaches — but now supplemented with the more sophisticated Conditional value at risk

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the ...

/ expected shortfall

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the wor ...

, Tail value at risk

Tail value at risk (TVaR), also known as tail conditional expectation (TCE) or conditional tail expectation (CTE), is a risk measure associated with the more general value at risk. It quantifies the expected value of the loss given that an event ...

, and Extreme value theory

Extreme value theory or extreme value analysis (EVA) is a branch of statistics dealing with the extreme deviations from the median of probability distributions. It seeks to assess, from a given ordered sample of a given random variable, the ...

(and PFE and EE for regulatory). For the underlying mathematics, these may utilize mixture models, PCA, volatility clustering, copulas, and other techniques.

*For the daily direct analysis of the positions at the desk level, as a standard, measurement of the Greeks now inheres the volatility surface

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expi ...

— through local- or stochastic volatility models — while re interest rates, discounting and analytics are under a "multi-curve framework

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations wit ...

". Derivative pricing now embeds credit and other considerations through the CVA and XVA "valuation adjustments".

*Additional to these, are various forms of stress test and scenario analytics, and related economic capital

In finance, mainly for financial services firms, economic capital (ecap) is the amount of risk capital, assessed on a realistic basis, which a firm requires to cover the risks that it is running or collecting as a going concern, such as market r ...

optimization. These tests are typically linked to the macroeconomics, and provide an indicator of how sensitive the bank is to changes in economic conditions, and of its ability to respond to market events. And here, more generally, “preparing for anything that might happen,” rather than worrying about precise likelihoods. David AldousReview of Financial Risk Management... for Dummies

/ref> *

Model risk

In finance, model risk is the risk of loss resulting from using insufficiently accurate models to make decisions, originally and frequently in the context of valuing financial securities. However, model risk is more and more prevalent in activitie ...

is addressed through regular validation of the models used by the bank's various divisions; for VaR models, backtesting.

Re implementation, Investment bank

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

s, particularly, employ dedicated "Risk Groups", i.e. Middle office teams monitoring the firm's risk exposure to, and the profitability and structure of, its various businesses, products, asset classes, desks, and / or geographies.

By increasing order of aggregation:

(i) Financial institutions will typically

set limit values for each of the Greeks, or other measures, that their traders must not exceed, and traders will then hedge, offset, or reduce periodically if not daily - see below.

(ii) Desks, or areas, will similarly be limited as to their VaR quantum (total or incremental, and under various calculation regimes), corresponding to their allocated economic capital; a loss which exceeds the VaR threshold is termed a "VaR breach".

(iii) Their concentration risk will be checkedInternational Association of Credit Portfolio Managers (2022)"Risk mitigation techniques in credit portfolio management"

/ref> against thresholds set for various types of risk. (iv) Leverage will be monitored - at very least re regulatory requirements - as leveraged positions could lose large amounts for a relatively small move in the price of the underlying. (v) Periodically, these all are estimated under a given stress scenario, and risk capital - together with these limits - is correspondingly revisited. Middle office also maintains the following functions, often overlapping the above Groups:

Corporate Treasury

Treasury management (or treasury operations) includes management of an enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a fi ...

is responsible for monitoring overall funding, capital structure, and liquidity risk, and for the FTP framework allowing for comparable performance evaluation among business units;

Product Control is primarily responsible for insuring traders mark their books to fair value (a key protection against rogue traders) and for "explaining" the daily P&L;

Credit Risk monitors the bank's debt-clients on an ongoing basis, re both exposure and performance.

See .

In their Front office, Banks employ specialized XVA-desks tasked with centrally monitoring and managing their CVA and XVA exposure, typically with oversight from the above Groups.International Association of Credit Portfolio Managers (2018)"The Evolution of XVA Desk Management"

/ref> Achieving the above requires that banks maintain a significant investment in sophisticated infrastructure, finance / risk software (often built

in-house

Outsourcing is an agreement in which one company hires another company to be responsible for a planned or existing activity which otherwise is or could be carried out internally, i.e. in-house, and sometimes involves transferring employees and ...

), and dedicated staff. Risk software often deployed is from FIS

FIS or fis may refer to:

Science and technology

* '' Fis'', an ''E. Coli'' gene

* Fis phenomenon, a phenomenon in linguistics

* F♯ (musical note)

* Flight information service, an air traffic control service

* Frame Information Structure, a ...

, Kamakura

is a city in Kanagawa Prefecture, Japan.

Kamakura has an estimated population of 172,929 (1 September 2020) and a population density of 4,359 persons per km² over the total area of . Kamakura was designated as a city on 3 November 1939.

Kama ...

, Murex

''Murex'' is a genus of medium to large sized predatory tropical sea snails. These are carnivorous marine gastropod molluscs in the family Muricidae, commonly called "murexes" or "rock snails".Houart, R.; Gofas, S. (2010). Murex Linnaeus, 1 ...

, and Numerix

Numerix is a global financial technology company that provides capital markets software and solutions that enable clients to analyze and manage complex trade portfolios that consist of financial instruments, derivatives, and structured products. It ...

.

Corporate finance

In corporate finance and

In corporate finance and financial management

Financial management is the business function concerned with profitability, expenses, cash and credit, so that the "organization may have the means to carry out its objective as satisfactorily as possible;"

the latter often defined as maximizi ...

,

Risk Management and the Financial ManagerCh. 20 in financial risk management, as above, is concerned more generally with business risk - risks to the business’ value, within the context of its

business strategy

In the field of management, strategic management involves the formulation and implementation of the major goals and initiatives taken by an organization's managers on behalf of stakeholders, based on consideration of resources and an assessment ...

and capital structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the ...

.

Will Kenton (2022)"Business Risk"

Investopedia

Investopedia is a financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products such as securities accounts. Investopedia ...

The scope here - ie in non-financial firms - is thus broadened

"Risk Management and the Firm’s Financial Statement — Opportunities within the ERM"in Esther Baranoff, Patrick Brockett, Yehuda Kahane (2012). ''Risk Management for Enterprises and Individuals''.

Saylor Academy

The Saylor Academy, formerly known as the Saylor Foundation, is a non-profit organization headquartered in Washington, DC. It was established in 1999 by its sole trustee, Michael J. Saylor. Since 2008, the focus of the foundation has been its Fr ...

(re banking) to overlap enterprise risk management Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives. ERM provides a framework for risk management, which typi ...

, and financial risk management then addresses risks to the firm's overall strategic objectives, incorporating various (all) financial aspects Margaret Woods and Kevin Dowd (2008)''Financial Risk Management for Management Accountants''

Chartered Institute of Management Accountants

The Chartered Institute of Management Accountants (CIMA) is the global professional management accounting body based out of the UK. CIMA offers training and qualification in management accountancy and related subjects. It is focused on accountan ...

of the exposures and opportunities arising from business decisions, and their link to the firm’s appetite for risk, as well as their impact on share price

A share price is the price of a single share of a number of saleable equity shares of a company.

In layman's terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

B ...

.

In many organizations, risk executives are therefore involved in strategy formulation: "the choice of which risks to undertake through the allocation of its scarce resources is the key tool available to management."

Don Chance and Michael Edleson (2021). ''Introduction to Risk Management''. Ch 10 in "Derivatives". CFA Institute

The CFA Institute is a global, not-for-profit professional organization that provides investment professionals with finance education. The institute aims to promote standards in ethics, education, and professional excellence in the global investme ...

Investment Series.

Re the standard framework, the discipline largely focuses on operations, i.e. business risk, as outlined.

Here, the management is ongoing Jayne Thompson (2019)What Is Financial Risk Management?

chron.com — see following description — and is coupled with the use of insurance, managing the net-exposure, as above:

credit risk

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

is usually addressed via provisioning

In telecommunication, provisioning involves the process of preparing and equipping a network to allow it to provide new services to its users. In National Security/Emergency Preparedness telecommunications services, ''"provisioning"'' equates to ...

and credit insurance;

likewise, where this treatment is deemed appropriate, specifically identified operational risks are also insured.

Market risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility.

There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the mos ...

, in this context,See "Market Risk Management in Non-financial Firms", in Carol Alexander, Elizabeth Sheedy eds. (2015). ''The Professional Risk Managers’ Handbook 2015 Edition''. PRMIA. is concerned mainly with changes in commodity prices, interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, t ...

s, and foreign exchange rates, and any adverse impact due to these on cash flow

A cash flow is a real or virtual movement of money:

*a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected ...

and profitability

In economics, profit is the difference between the revenue that an economic entity has received from its outputs and the total cost of its inputs. It is equal to total revenue minus total cost, including both explicit and implicit costs.

It ...

, and hence share price.

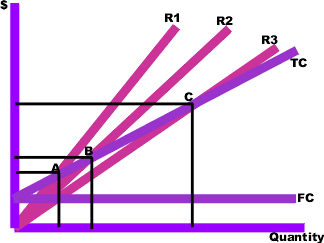

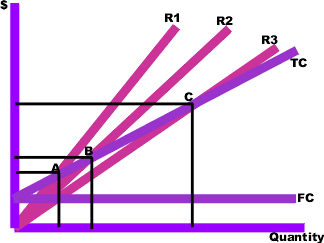

Correspondingly, the practice here covers two perspectives; these are shared with corporate finance more generally:

# Both risk management and corporate finance share the goal of enhancing, or at least preserving, firm value. Here, businesses devote much time and effort to (short term) liquidity-, cash flow- and performance monitoring, and Risk Management then also overlaps cash- and treasury management

Treasury management (or treasury operations) includes management of an enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a fi ...

, especially as impacted by capital and funding as above. More specifically re business-operations, management emphasizes their break even dynamics, contribution margin Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. "Contribution" represents the portion of sales revenue that is not consumed by variable costs and so contributes to the covera ...

and operating leverage, and the corresponding monitoring and management of revenue, and of other budgetary elements. In larger firms, specialist Risk Analysts complement this work with model-based analytics more broadly;See §39 "Corporate Planning Models", and §294 "Simulation Model" in David Shimko (2009)Quantifying Corporate Financial Risk

archived 2010-07-17. in some cases, employing sophisticated stochastic models, in, for example, financing activity prediction problems, and for risk analysis ahead of a major investment. # Firm exposure to long term market (and business) risk is a direct result of previous capital investment decisions. Where applicable here — usually in large corporates and under guidance from their investment bankers — risk analysts will manage and hedge their exposures using traded

financial instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form ...

to create commodity-, cash flow- and foreign exchange hedges (see further below). Because company specific, "over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

" (OTC) contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to ...

s tend to be costly to create and monitor — i.e. using financial engineering

Financial engineering is a multidisciplinary field involving financial theory, methods of engineering, tools of mathematics and the practice of programming. It has also been defined as the application of technical methods, especially from mathe ...

and / or structured product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to ...

s — ”standard” derivatives that trade on well-established exchanges are often preferred. These comprise options

Option or Options may refer to:

Computing

*Option key, a key on Apple computer keyboards

*Option type, a polymorphic data type in programming languages

* Command-line option, an optional parameter to a command

*OPTIONS, an HTTP request method

...

, futures

Futures may mean:

Finance

*Futures contract, a tradable financial derivatives contract

*Futures exchange, a financial market where futures contracts are traded

* ''Futures'' (magazine), an American finance magazine

Music

* ''Futures'' (album), a ...

, forwards, and swaps; the "second generation" exotic derivatives

An exotic derivative, in finance, is a derivative (finance), derivative which is more complex than commonly traded "vanilla" products. This complexity usually relates to determination of payoff; see option style.

The category may also include de ...

usually trade OTC. Complementary to this hedging, periodically, Treasury may also adjust the capital structure, reducing debt-funding so as to accommodate increased business risk.

Multinational Corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, i ...

s are faced with additional challenges, particularly as relates to foreign exchange risk, and the scope of financial risk management modifies dramatically in the international realm.

Here, dependent on time horizon and risk sub-type —

transactions exposure (essentially that discussed above),

accounting exposure,

and economic exposure

— so the corporate will manage its risk differently.

Note that the forex risk-management discussed here and above, is additional to the per transaction "forward cover" that importer

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

s and exporters purchase from their bank (alongside other trade finance

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction require ...

mechanisms).

It is common for large corporations to have dedicated risk management teams — typically within FP&A or corporate treasury

Treasury management (or treasury operations) includes management of an enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a fi ...

— reporting to the CRO; often these overlap with the internal audit

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach t ...

function (see Three lines of defence).

For small firms, it is impractical to have a formal risk management function, but these typically apply the above practices, at least the first set, informally, as part of the financial management

Financial management is the business function concerned with profitability, expenses, cash and credit, so that the "organization may have the means to carry out its objective as satisfactorily as possible;"

the latter often defined as maximizi ...

function; see .

Correspondingly, the discipline relies on a range of software, from spreadsheet

A spreadsheet is a computer application for computation, organization, analysis and storage of data in tabular form. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in ce ...

s (invariably as a starting point, and frequently in total) through commercial EPM and BI tools, often BusinessObjects

Business Objects (BO, BOBJ, or BObjects) was an enterprise software company, specializing in business intelligence (BI). Business Objects was acquired in 2007 by German company SAP AG. The company claimed more than 46,000 customers in its final ea ...

(SAP

Sap is a fluid transported in xylem cells (vessel elements or tracheids) or phloem sieve tube elements of a plant. These cells transport water and nutrients throughout the plant.

Sap is distinct from latex, resin, or cell sap; it is a separ ...

), OBI EE (Oracle

An oracle is a person or agency considered to provide wise and insightful counsel or prophetic predictions, most notably including precognition of the future, inspired by deities. As such, it is a form of divination.

Description

The wor ...

), Cognos

Cognos Incorporated was an Ottawa, Ontario-based company making business intelligence (BI) and performance management (PM) software. Founded in 1969, at its peak Cognos employed almost 3,500 people and served more than 23,000 customers in ove ...

( IBM), and Power BI (Microsoft

Microsoft Corporation is an American multinational corporation, multinational technology company, technology corporation producing Software, computer software, consumer electronics, personal computers, and related services headquartered at th ...

).

Hedging-related transactions will attract their own accounting treatment, and corporates (and banks) may then require changes to systems, processes and documentation;

see Hedge accounting

Hedge accounting is an accountancy practice, the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account.

There are two types of hedge recognized. For a fair value hedge, the offse ...

, Mark-to-market accounting

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the " fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fai ...

, Hedge relationship (finance), IFRS 7, IFRS 9, FASB 133, IAS 39

IAS 39: Financial Instruments: Recognition and Measurement was an international accounting standard which outlined the requirements for the recognition and measurement of financial assets, financial liabilities, and some contracts to buy or sell ...

.

Investment management

Fund managers, classically, define the risk of a

Fund managers, classically, define the risk of a portfolio

Portfolio may refer to:

Objects

* Portfolio (briefcase), a type of briefcase

Collections

* Portfolio (finance), a collection of assets held by an institution or a private individual

* Artist's portfolio, a sample of an artist's work or a ...

as its variance

In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its population mean or sample mean. Variance is a measure of dispersion, meaning it is a measure of how far a set of number ...

(or standard deviation), and through diversification the portfolio is optimized so as to achieve the lowest risk for a given targeted return, or equivalently the highest return for a given level of risk;

these risk-efficient portfolios form the " Efficient frontier" (see Markowitz model).

The logic here is that returns from different assets are highly unlikely to be perfectly correlated

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statisti ...

, and in fact the correlation may sometimes be negative.

In this way, market risk particularly, and other financial risks such as inflation risk, can at least partially be moderated by forms of diversification.

A key issue in diversification, however, is that the (assumed) relationships are (implicitly) forward looking.

As observed in the late-2000s recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At t ...

historic relationships can break down, resulting in losses to market participants believing that diversification would provide sufficient protection (in that market, including funds that had been explicitly set up to avoid being affected in this way).

A related issue is that diversification has costs: as correlations are not constant it may be necessary to regularly rebalance the portfolio, incurring transaction costs

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike pro ...

, negatively impacting investment performance Investment performance is the return on an investment portfolio. The investment portfolio can contain a single asset or multiple assets. The investment performance is measured over a specific period of time and in a specific currency.

Investors o ...

;

and as the fund manager diversifies, so this problem compounds (and a large fund may also exert market impact).

See .

Addressing these issues, more sophisticated approaches have been developed in recent times, both to defining risk, and to the optimization itself - (tail) risk parity

Risk parity (or risk premia parity) is an approach to investment management which focuses on allocation of risk, usually defined as volatility, rather than allocation of capital. The risk parity approach asserts that when asset allocations are ad ...

, as an example, focuses on allocation of risk, rather than allocation of capital;

see Post-modern portfolio theory and .

Relatedly, modern financial risk modeling Financial risk modeling is the use of formal mathematical finance, mathematical and econometric techniques to measure, monitor and control the market risk, credit risk, and operational risk on a firm's balance sheet, on a bank's trading book, or re ...

employs a variety of techniques — including value at risk

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by ...

, historical simulation, stress tests, and extreme value theory

Extreme value theory or extreme value analysis (EVA) is a branch of statistics dealing with the extreme deviations from the median of probability distributions. It seeks to assess, from a given ordered sample of a given random variable, the ...

— to analyze the portfolio and to forecast the likely losses incurred for a variety of risks and scenarios.

In parallel,

managers - active and passive

Passive may refer to:

* Passive voice, a grammatical voice common in many languages, see also Pseudopassive

* Passive language, a language from which an interpreter works

* Passivity (behavior), the condition of submitting to the influence of on ...

- also seek to understand any tracking error, i.e. underperformance vs a "benchmark", and here often use attribution analysis preemptively so as to diagnose the source early, and to take corrective action.

Fund Managers typically rely on sophisticated software here (as do banks, above); widely used platforms are provided by BlackRock

BlackRock, Inc. is an American multi-national investment company based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with tri ...

, Eikon, Finastra, Murex

''Murex'' is a genus of medium to large sized predatory tropical sea snails. These are carnivorous marine gastropod molluscs in the family Muricidae, commonly called "murexes" or "rock snails".Houart, R.; Gofas, S. (2010). Murex Linnaeus, 1 ...

, and Numerix

Numerix is a global financial technology company that provides capital markets software and solutions that enable clients to analyze and manage complex trade portfolios that consist of financial instruments, derivatives, and structured products. It ...

.

Additional to these (improved) diversification and optimization measures, and given these analytics, Fund Managers will apply specific risk hedging techniques as appropriate;Pamela Drake and Frank Fabozzi (2009)What Is Finance?

/ref> these may relate to the portfolio as a whole or to individual stocks. *Fund managers may engage in portfolio insurance, a hedging strategy developed to limit the losses an investor might face from a declining index of stocks without having to sell the stocks themselves. This strategy involves selling Stock market index futures during periods of price declines. The proceeds from the sale of the futures help to offset paper losses of the owned portfolio. Alternatively, and more commonly,Staff (2020)

What is index option trading and how does it work?

Investopedia

Investopedia is a financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products such as securities accounts. Investopedia ...

they will buy a put on a Stock market index option Stock market index option is a type of option, a financial derivative, that is based on stock indices like the S&P 500 or the Dow Jones Industrial Average. They give an investor the right to buy or sell the underlying stock index for a defined ti ...

so as to hedge. In both cases the logic is that the (diversified) portfolio is likely highly correlated with the stock index it is part of; thus if stock prices decline, the larger index will likewise decline, and the derivative holder will profit.

*Fund managers, or traders, may also wish to hedge a specific stock's price. Here, they may likewise buy a single-stock put, or sell a single-stock future. Alternative strategies may rely on assumed relationships between stocks, employing, for example, a "Long/short" strategy.

* Bond portfolios are typically managed via Interest rate immunization or cashflow matching. Immunization is a strategy that ensures that a change in interest rates will not affect the value of a fixed-income portfolio (an increase in rates results in a decreased instrument value). It is often used to ensure that the value of a pension fund

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

Pension funds typically have large amounts of money to invest and are the major investors in listed and priva ...

's assets (or an asset manager's fund) increase or decrease in an exactly opposite fashion to their liabilities, thus leaving the value of the pension fund's surplus (or firm's equity) unchanged, regardless of changes in the interest rate. Cashflow matching is similarly a process of hedging in which a company or other entity matches its cash outflows - i.e., financial obligations - with its cash inflows over a given time horizon.

*For derivative portfolios, and positions, "the Greeks" are a vital risk management tool - these measure sensitivity to a small change in a given underlying parameter so that the portfolio can be rebalanced accordingly by including additional derivatives with offsetting characteristics.

See also

Bibliography

* * * * * * * * * *References

External links

CERA - The Chartered Enterprise Risk Analyst Credential - Society of Actuaries (SOA)

Financial Risk Manager Certification Program - Global Association of Risk Professional (GARP)

Professional Risk Manager Certification Program - Professional Risk Managers' International Association (PRMIA)

* ttp://www.risk.net/journal Risk Journals Homepage {{DEFAULTSORT:Financial Risk Management Mathematical science occupations