The "national debt of the United States" is the total national debt owed by the

federal government

A federation (also called a federal state) is an entity characterized by a political union, union of partially federated state, self-governing provinces, states, or other regions under a #Federal governments, federal government (federalism) ...

of the

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

to

treasury security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as a supplement to taxation. Since 2012, the U.S. ...

holders. The national debt at a given point in time is the

face value

The face value, sometimes called nominal value, is the value of a coin, bond, stamp or paper money as printed on the coin, stamp or bill itself by the issuing authority.

The face value of coins, stamps, or bill is usually its legal value. Ho ...

of the then outstanding treasury securities that have been issued by the

Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

and other federal agencies.

Related terms such as "national deficit" and "national surplus" most often refer to the federal

government budget balance

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting ( ...

from year to year and not the cumulative amount of

debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

held. In a deficit year, the national debt increases as the government needs to borrow funds to finance the deficit. In a surplus year, the debt decreases as more money is received than spent, enabling the government to

reduce the debt by buying back Treasury securities. Broadly, US government debt increases as a result of

government spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or ...

and decreases from

tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

or other funding receipts, both of which fluctuate during a

fiscal year

A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. La ...

. The aggregate, gross amount that Treasury can borrow is limited by the

United States debt ceiling

In the United States, the debt ceiling is a law limiting the National debt of the United States, total amount of money the federal government can borrow.

Since the federal government has consistently run a Deficit spending, budget deficit since ...

.

There are two components of gross national debt:

* "Debt held by the public" – such as Treasury securities held by investors outside the federal government, including those held by individuals,

corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

s, the

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

, and foreign,

state

State most commonly refers to:

* State (polity), a centralized political organization that regulates law and society within a territory

**Sovereign state, a sovereign polity in international law, commonly referred to as a country

**Nation state, a ...

and

local governments.

* "Debt held by government accounts" or "

intragovernmental debt

In public finance, intragovernmental holdings (also known as intragovernmental debt or intragovernmental obligations) are debt obligations that a government owes to its own agencies. These agencies may receive or spend money unevenly throughou ...

" – is non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and ...

. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

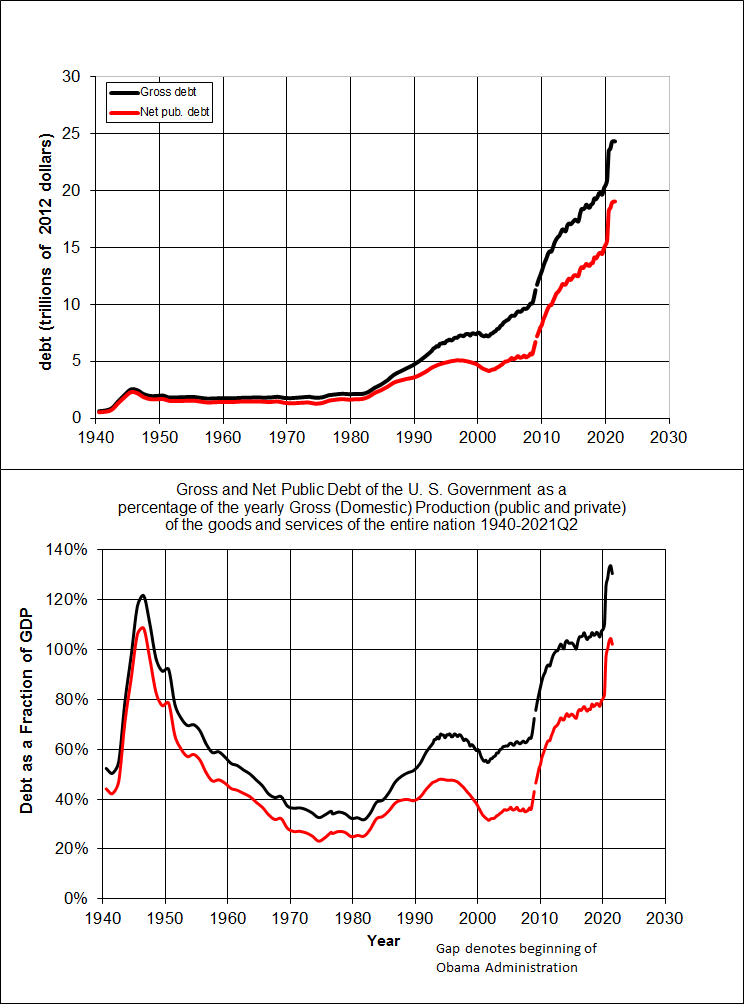

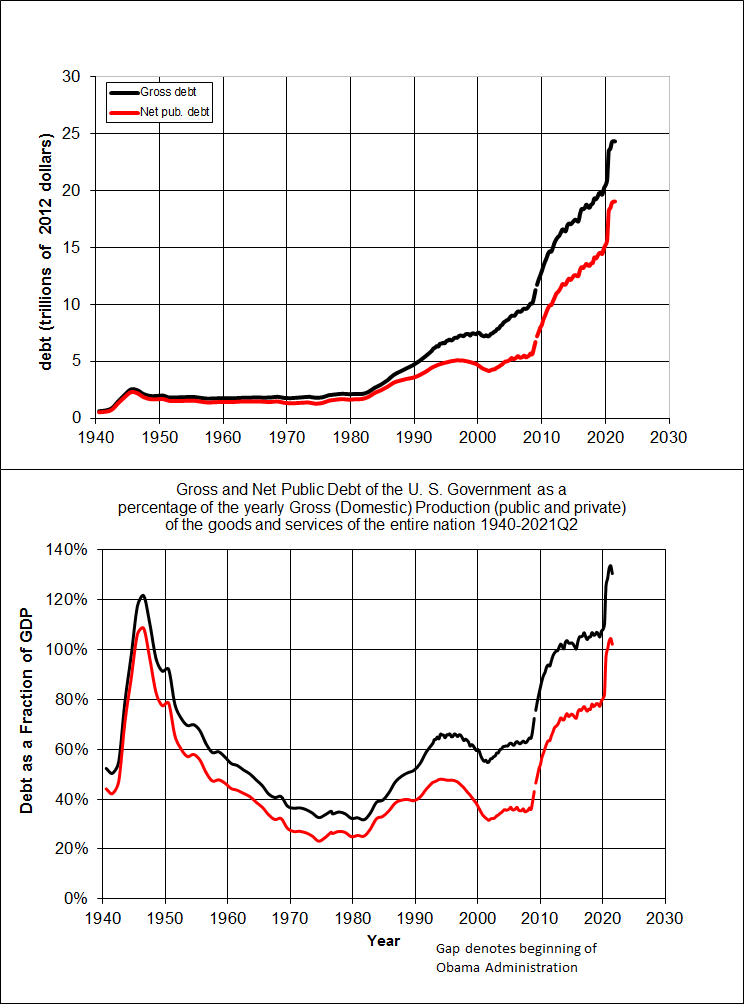

Historically, the U.S. public debt as a share of

gross domestic product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

(GDP) increases during wars and

recessions

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

and then subsequently declines. For instance, most recently, during the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, the

federal government spent trillions in virus aid and economic relief. The

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

(CBO) estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as a percentage of GDP since 1945.

In December 2021, debt held by the public was estimated at 96.19% of GDP, and approximately 33% of this public debt was owned by foreigners (government and private).

The

ratio of debt to GDP may decrease as a result of a government surplus or via

growth of GDP and

inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

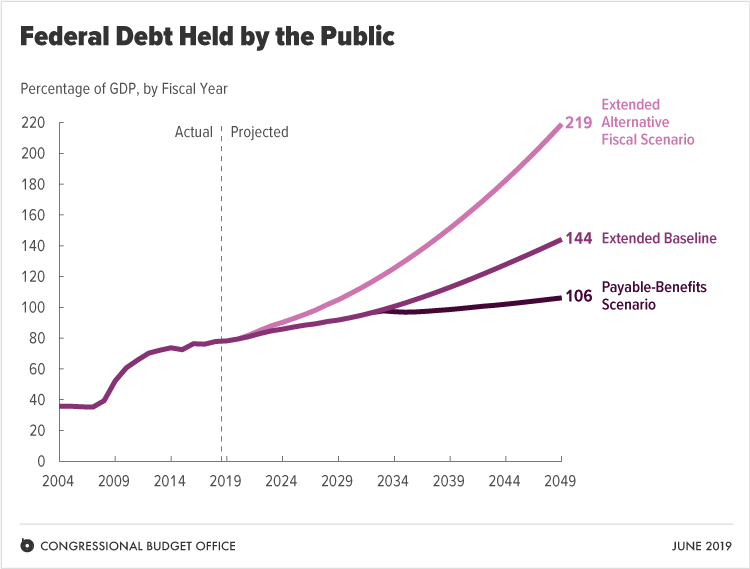

. The CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034, and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. If those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The United States has the largest

external debt in the world. The total amount of U.S. Treasury securities held by foreign entities in December 2021 was $7.7 trillion, up from $7.1 trillion in December 2020. Total US federal government debt breached the $30 trillion mark for the first time in history in February 2022. As of December 2023, total federal debt was $33.1 trillion; $26.5 trillion held by the public and $12.1 trillion in intragovernmental debt. The annualized cost of servicing this debt was $726 billion in July 2023, which accounted for 14% of the total federal spending.

Additionally, in recent decades, aging

demographics

Demography () is the statistical study of human populations: their size, composition (e.g., ethnic group, age), and how they change through the interplay of fertility (births), mortality (deaths), and migration.

Demographic analysis examin ...

and rising

healthcare costs have led to concern about the long-term sustainability of the federal government's

fiscal policies.

In February 2024, the total federal government debt rose to $34.4 trillion, after increasing by approximately $1 trillion during each of two separate 100-day periods since the previous June. As of March 6, 2025, the federal government debt is $36.56 trillion.

History

The

United States federal government

The Federal Government of the United States of America (U.S. federal government or U.S. government) is the Federation#Federal governments, national government of the United States.

The U.S. federal government is composed of three distinct ...

has continuously had a fluctuating

public debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occu ...

since its formation in 1789, except for about a year during 1835–1836, a period in which the nation, during the presidency of

Andrew Jackson

Andrew Jackson (March 15, 1767 – June 8, 1845) was the seventh president of the United States from 1829 to 1837. Before Presidency of Andrew Jackson, his presidency, he rose to fame as a general in the U.S. Army and served in both houses ...

, completely paid the national debt. To allow comparisons over the years, public debt is often expressed as a ratio to

GDP

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance o ...

. The United States public debt as a percentage of GDP reached its highest level during

Harry Truman

Harry S. Truman (May 8, 1884December 26, 1972) was the 33rd president of the United States, serving from 1945 to 1953. As the 34th vice president in 1945, he assumed the presidency upon the death of Franklin D. Roosevelt that year. Subsequen ...

's first presidential term, during and after

World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

. Public debt as a percentage of GDP fell rapidly in the

post-World War II period and reached a low in 1974 under

Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 until Resignation of Richard Nixon, his resignation in 1974. A member of the Republican Party (United States), Republican ...

. Debt as a share of GDP has consistently increased since then, except during the presidencies of

Jimmy Carter

James Earl Carter Jr. (October 1, 1924December 29, 2024) was an American politician and humanitarian who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party (United States), Democratic Party ...

and

Bill Clinton

William Jefferson Clinton (né Blythe III; born August 19, 1946) is an American politician and lawyer who was the 42nd president of the United States from 1993 to 2001. A member of the Democratic Party (United States), Democratic Party, ...

.

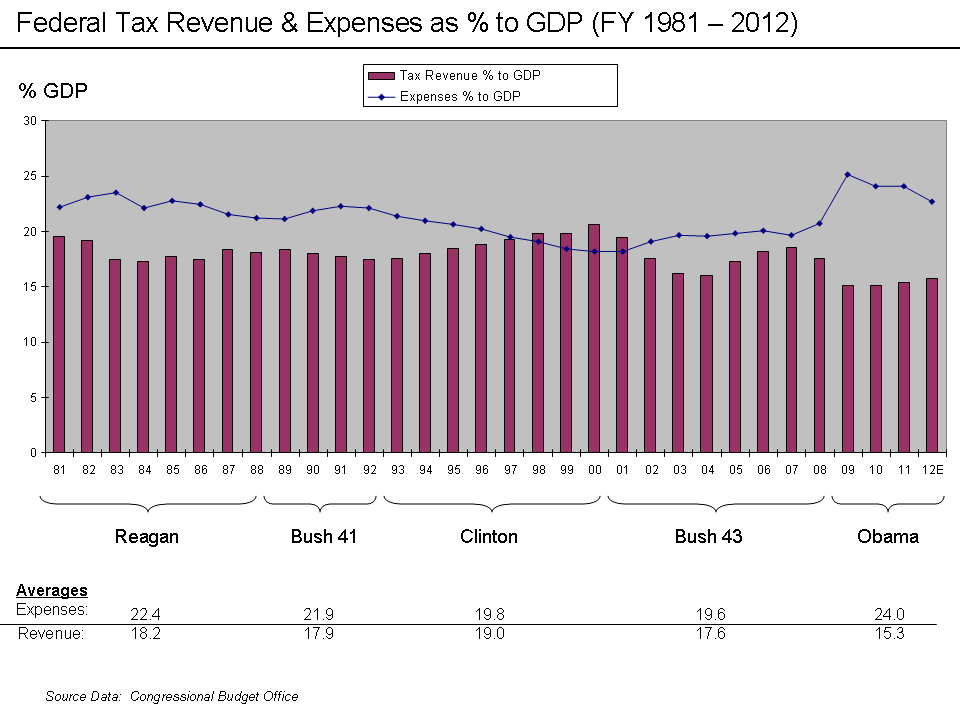

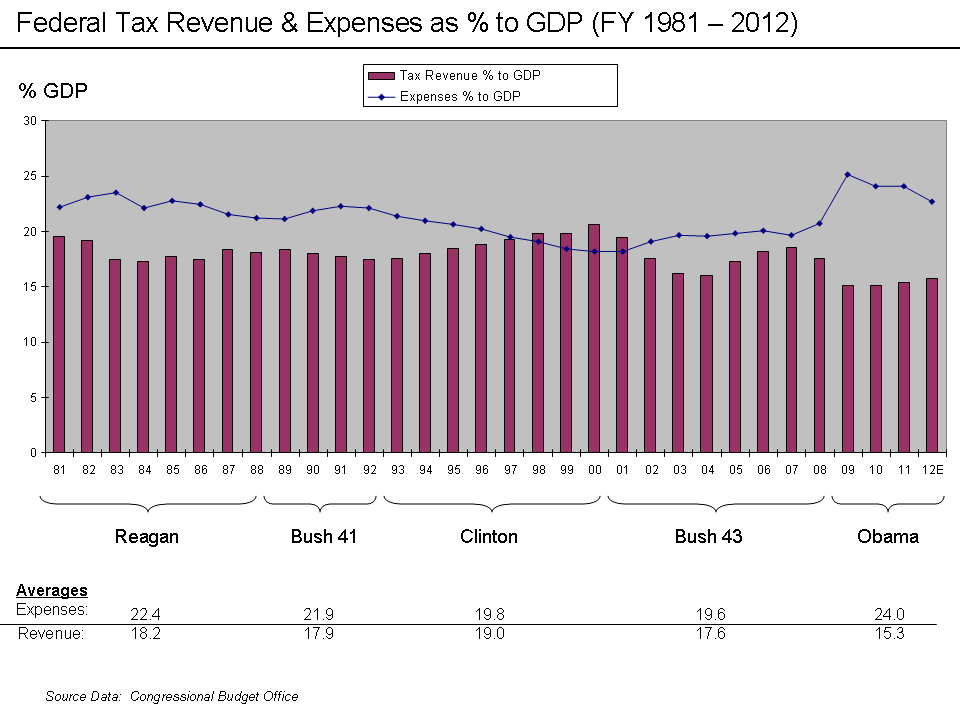

Public debt rose sharply during the 1980s, as

Ronald Reagan

Ronald Wilson Reagan (February 6, 1911 – June 5, 2004) was an American politician and actor who served as the 40th president of the United States from 1981 to 1989. He was a member of the Republican Party (United States), Republican Party a ...

negotiated with

Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

to cut tax rates and increase

military spending. It fell during the 1990s because of decreased military spending, increased taxes and the

1990s boom. Public debt rose sharply during

Presidency of George W. Bush

George W. Bush's tenure as the 43rd president of the United States began with his first inauguration on January 20, 2001, and ended on January 20, 2009. Bush, a Republican from Texas, took office following his narrow electoral college victo ...

and after the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, with resulting significant tax revenue declines and spending increases, such as the

Emergency Economic Stabilization Act of 2008

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing fi ...

and the

American Recovery and Reinvestment Act of 2009

The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a Stimulus (economics), stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed ...

.

In their September 2018 monthly report published on October 5 and based on data from the Treasury Department's "Daily Treasury Statements" (DTS), the Congressional Budget Office (CBO) wrote that the federal budget deficit was c.$782 billion for the fiscal year 2018—which runs from October 2017 through September 2018. This is $116 billion more than in FY2017.

The Treasury statements as summarized by in the CBO report that corporate taxes for 2017 and 2018 declined by $92 billion representing a drop of 31%. The CBO added that "about half of the decline ... occurred since June" when some of the provisions of the

Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

took effect, which included the "new lower corporate tax rate and the expanded ability to immediately deduct the full value of equipment purchases". (~$ in )

According to articles in ''

The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''

and ''

Business Insider

''Business Insider'' (stylized in all caps: BUSINESS INSIDER; known from 2021 to 2023 as INSIDER) is a New York City–based multinational financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Inside ...

'',

based on documents released on October 29, 2018, by the Treasury Department,

the department's projection

estimated that by the fourth quarter of the FY2018, it would have issued c. $1.338 trillion (~$ in ) in debt. This would have been the highest debt issuance since 2010, when it reached $1.586 trillion (~$ in ). The Treasury anticipated that the total "net marketable debt"—net marketable securities—issued in the fourth quarter would reach $425 billion; which would raise the 2018 "total debt issuance" to over a trillion dollars of new debt, representing a "146% jump from 2017".

According to the ''Journal'' that is the highest fourth quarter issuance "since 2008, at the height of the financial crisis."

As cited by the ''Journal'' and the ''Business Insider'', the primary drivers of new debt issuance are "stagnant", "sluggish tax revenues", a decrease in "corporate tax revenue",

due to the

GOP

The Republican Party, also known as the Grand Old Party (GOP), is a right-wing political party in the United States. One of the two major parties, it emerged as the main rival of the then-dominant Democratic Party in the 1850s, and the tw ...

Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

,

the "bipartisan budget agreement", and "higher government spending".

Due to the Coronavirus epidemic, the national debt rose to levels that exceeded what had been seen during World War Two, meaning that the U.S. had officially grown its debt amount to never before seen numbers.

Valuation and measurements

Public and government accounts

As of March 6, 2025, debt held by the public was $29 trillion, and

intragovernmental holdings were $7.4 trillion, for a total of $36.4 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries.

The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are

Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the "government account series" owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion (~$ in ) in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, the cash is received but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the

Federal Savings and Loan Corporation's Resolution Fund and the Federal Hospital Insurance Trust Fund (Medicare).

Accounting treatment

Only debt held by the public is reported as a liability on the consolidated financial statements of the United States government. Debt held by US government accounts is an asset to those accounts but a liability to the Treasury; they offset each other in the consolidated financial statements. Government receipts and expenditures are normally presented on a

cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

rather than an

accrual

In accounting and finance, an accrual is an asset or liability that represents revenue or expenses that are receivable or payable but which have not yet been paid.

In accrual accounting, the term accrued revenue refers to income that is recogni ...

basis, although the accrual basis may provide more information on the longer-term implications of the government's annual operations. The United States public debt is often expressed as a ratio of public debt to GDP. The ratio of debt to GDP may decrease as a result of a government surplus as well as from growth of GDP and inflation.

Fannie Mae and Freddie Mac obligations excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of

Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New ...

and

Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.[government-sponsored enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of Credit (finance), credit to targeted sectors of the economy, to make tho ...]

(GSE) debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, some pundits began to question this accounting treatment, noting that changes in August 2012 "makes them even more permanent wards of the state and turns the government's preferred stock into a permanent, perpetual kind of security".

The federal government controls the

Public Company Accounting Oversight Board

The Public Company Accounting Oversight Board (PCAOB) is a nonprofit corporation created by the Sarbanes–Oxley Act of 2002 to oversee the audits of US-listed public companies. The PCAOB also oversees the audits of broker-dealers, including co ...

, which would normally criticize inconsistent accounting practices, but it does not oversee its own government's accounting practices or the standards set by the

Federal Accounting Standards Advisory Board

The Federal Accounting Standards Advisory Board (FASAB) is a United States federal advisory committee whose mission is to improve federal financial reporting through issuing federal financial accounting standards and providing guidance after co ...

. The on- or off-

balance sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business ...

obligations of those two independent GSEs was just over $5 trillion at the time the conservatorship was put in place, consisting mainly of mortgage payment guarantees and

agency bonds.

[Barr, Colin (September 7, 2008)]

"Paulson readies the 'bazooka'"

CNN.com; retrieved January 17, 2011. The confusing ''independent but government-controlled'' status of the GSEs resulted in investors of the legacy common shares and preferred shares launching various activist campaigns in 2014.

Guaranteed obligations excluded

U.S. federal government guarantees were not included in the public debt total as they were not drawn against. In late 2008, the federal government had guaranteed large amounts of obligations of mutual funds, banks, and corporations under several programs designed to deal with the problems arising from the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. The guarantee program lapsed at the end of 2012, when Congress declined to extend the scheme. The funding of direct investments made in response to the crisis, such as those made under the

Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by U.S. Presi ...

, was included in the debt totals.

Unfunded obligations excluded

The U.S. federal government is obligated under current law to make mandatory payments for programs such as

Medicare,

Medicaid

Medicaid is a government program in the United States that provides health insurance for adults and children with limited income and resources. The program is partially funded and primarily managed by U.S. state, state governments, which also h ...

and Social Security. The

Government Accountability Office

The United States Government Accountability Office (GAO) is an independent, nonpartisan government agency within the legislative branch that provides auditing, evaluative, and investigative services for the United States Congress. It is the s ...

(GAO) projects that payouts for these programs will significantly exceed tax revenues over the next 75 years. The Medicare Part A (hospital insurance) payouts already exceed program tax revenues, and social security payouts exceeded payroll taxes in fiscal year 2010. These deficits require funding from other tax sources or borrowing.

The present value of these deficits or unfunded obligations is an estimated $45.8 trillion. This is the amount that would have had to be set aside in 2009 in order to pay for the unfunded obligations which, under current law, will have to be raised by the government in the future. Approximately $7.7 trillion relates to Social Security, while $38.2 trillion relates to Medicare and Medicaid. In other words, health care programs will require nearly five times more funding than Social Security. Adding this to the national debt and other federal obligations would bring total obligations to nearly $62 trillion. However, these unfunded obligations are not counted in the national debt, as shown in monthly Treasury reports of the national debt.

Measuring burden of debt

GDP is a measure of the total size and output of the economy. One measure of the debt burden is its size relative to GDP, called the "

debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an ...

". Mathematically, this is the debt divided by the GDP amount. The Congressional Budget Office includes historical budget and debt tables along with its annual "Budget and Economic Outlook". Debt held by the public as a percentage of GDP rose from 34.7% GDP in 2000 to 40.5% in 2008 and 67.7% in 2011. Mathematically, the ratio can decrease even while debt grows if the rate of increase in GDP (which also takes account of inflation) is higher than the rate of increase of debt. Conversely, the debt to GDP ratio can increase even while debt is being reduced, if the decline in GDP is sufficient. Because much of the debt that was incurred as a result of World War Two could not be passed onto American citizens who also had no money to spare, the debt was never addressed and continued to grow.

According to the ''

CIA World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a reference resource produced by the United States' Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The official print ve ...

'', during 2015, the U.S. debt to GDP ratio of 73.6% was the 39th highest in the world. This was measured using "debt held by the public." However, $1 trillion in additional borrowing since the end of FY 2015 raised the ratio to 76.2% as of April 2016

ee Appendix#National debt for selected years Also, this number excludes state and local debt. According to the OECD, general government gross debt (federal, state, and local) in the United States in the fourth quarter of 2015 was $22.5 trillion (125% of GDP); subtracting out $5.25 trillion for intragovernmental federal debt to count only federal "debt held by the public" gives 96% of GDP.

The ratio is higher if the total national debt is used, by adding the "intragovernmental debt" to the "debt held by the public." For example, on April 29, 2016, debt held by the public was approximately $13.84 trillion (~$ in ) or about 76% of GDP. Intra-governmental holdings stood at $5.35 trillion, giving a combined total public debt of $19.19 trillion. U.S. GDP for the previous 12 months was approximately $18.15 trillion, for a total debt to GDP ratio of approximately 106%. Increasing and untreated national debt leads to a significantly diminished ability for the economy to operate at its highest level.

Calculating annual change in debt

Conceptually, an annual deficit (or surplus) should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media (the "total deficit") considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

[

Social Security payroll taxes and benefit payments, along with the net balance of the ]U.S. Postal Service

The United States Postal Service (USPS), also known as the Post Office, U.S. Mail, or simply the Postal Service, is an independent agencies of the United States government, independent agency of the executive branch of the federal governmen ...

, are considered "off-budget", while most other expenditure and receipt categories are considered "on-budget". The total federal deficit is the sum of the on-budget deficit (or surplus) and the off-budget deficit (or surplus). Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998–FY2001.

For example, in January 2009 the CBO reported that for FY2008, the "on-budget deficit" was $638 billion, offset by an "off-budget surplus" (mainly due to Social Security revenue in excess of payouts) of $183 billion, for a "total deficit" of $455 billion. This latter figure is the one commonly reported in the media. However, an additional $313 billion was required for "the Treasury actions aimed at stabilizing the financial markets," an unusually high amount because of the subprime mortgage crisis

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many busines ...

. This meant that the "debt held by the public" increased by $768 billion ($455B + $313B = $768B). The "off-budget surplus" was borrowed and spent (as is typically the case), increasing the "intra-governmental debt" by $183 billion. So the total increase in the "national debt" in FY2008 was $768B +$183B = $951 billion.Iraq

Iraq, officially the Republic of Iraq, is a country in West Asia. It is bordered by Saudi Arabia to Iraq–Saudi Arabia border, the south, Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq border, the east, the Persian Gulf and ...

and Afghanistan

Afghanistan, officially the Islamic Emirate of Afghanistan, is a landlocked country located at the crossroads of Central Asia and South Asia. It is bordered by Pakistan to the Durand Line, east and south, Iran to the Afghanistan–Iran borde ...

wars was accounted for this way prior to the Obama administration.[ Certain stimulus measures and earmarks were also outside the budget process. The federal government publishes the total debt owed (public and intragovernmental holdings) daily.

]

Holders of debt

Because a large variety of people own the notes, bills, and bonds in the "public" portion of the debt, the Treasury also publishes information that groups the types of holders by general categories to portray who owns United States debt. In this data set, some of the public portion is moved and combined with the total government portion, because this amount is owned by the Federal Reserve as part of United States monetary policy. (See

Because a large variety of people own the notes, bills, and bonds in the "public" portion of the debt, the Treasury also publishes information that groups the types of holders by general categories to portray who owns United States debt. In this data set, some of the public portion is moved and combined with the total government portion, because this amount is owned by the Federal Reserve as part of United States monetary policy. (See Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

.)

As is apparent from the chart, a little less than half of the total national debt is owed to the "Federal Reserve and intragovernmental holdings". The foreign and international holders of the debt are also put together from the notes, bills, and bonds sections. To the right is a chart for the data as of June 2008:

Foreign holdings

As of October 2018, foreigners owned $6.2 trillion of U.S. debt, or approximately 39% of the debt held by the public of $16.1 trillion and 28% of the total debt of $21.8 trillion. In December 2020, foreigners held 33% ($7 trillion out of $21.6 trillion) of publicly held US debt; of this $7 trillion, $4.1 trillion (59.2%) belonged to foreign governments and $2.8 trillion (40.8%) to foreign investors. Including both private and public debt holders, the top three December 2020 national holders of American public debt are

As of October 2018, foreigners owned $6.2 trillion of U.S. debt, or approximately 39% of the debt held by the public of $16.1 trillion and 28% of the total debt of $21.8 trillion. In December 2020, foreigners held 33% ($7 trillion out of $21.6 trillion) of publicly held US debt; of this $7 trillion, $4.1 trillion (59.2%) belonged to foreign governments and $2.8 trillion (40.8%) to foreign investors. Including both private and public debt holders, the top three December 2020 national holders of American public debt are Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

($1.2 trillion or 17.7%), China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

($1.1 trillion or 15.2%), and the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

($0.4 trillion or 6.2%).

Historically, the share held by foreign governments had grown over time, rising from 13% of the public debt in 1988 to 34% in 2015. In more recent years, foreign ownership has retreated both in percent of total debt and total dollar amounts. China's maximum holding of 9.1% or $1.3 trillion of U.S. debt occurred in 2011, subsequently reduced to 5% in 2018. Japan's maximum holding of 7% or $1.2 trillion occurred in 2012, subsequently reduced to 4% in 2018.

According to

According to Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

, "America actually earns more from its assets abroad than it pays to foreign investors." Nonetheless, the country's net international investment position

__FORCETOC__

The net international investment position (NIIP) is the difference between the external financial assets and liabilities of a country. External debt of a country includes government debt and private debt. External assets publicly and ...

represents a debt of more than $9 trillion.

Forecasts

CBO ten-year outlook 2018–2028 (pre–COVID-19 pandemic)

The CBO estimated the impact of the Tax Cuts and Jobs Act and separate spending legislation over the 2018–2028 period in their annual "Budget & Economic Outlook", released in April 2018:

* The budget deficit in fiscal 2018 (which runs from October 1, 2017, to September 30, 2018, the first fiscal year of President Trump's administration) is forecast to be $804 billion, an increase of $139 billion (21%) from the $665 billion in 2017 and up $242 billion (39%) over the previous baseline forecast (June 2017) of $580 billion for 2018. The June 2017 forecast was essentially the budget trajectory inherited from President Obama; it was prepared prior to the Tax Act and spending increases under President Trump.

* For the 2018–2027 period, CBO projects the sum of the annual deficits (i.e., debt increase) to be $11.7 trillion, an increase of $1.6 trillion (16%) over the previous baseline (June 2017) forecast of $10.1 trillion.

* The $1.6 trillion debt increase includes three main elements:

*#$1.7 trillion less in revenues due to the tax cuts;

*#$1.0 trillion more in spending; and

*#Partially offsetting incremental revenue of $1.1 trillion due to higher economic growth than previously forecast.

* Debt held by the public is expected (Congressional Budget Office Outlook) to rise from 78% of GDP ($16 trillion) at the end of 2018 to 96% GDP ($29 trillion) by 2028. That would be the highest level since the end of World War II.

* CBO estimated under an alternative scenario (in which policies in place as of April 2018 are maintained beyond scheduled initiation or expiration) that deficits would be considerably higher, rising by $13.7 trillion over the 2018–2027 period, an increase of $3.6 trillion over the June 2017 baseline forecast. Maintaining current policies for example would include extending the individual Trump tax cuts past their scheduled expiration in 2025, among other changes.

* The debt increase of $1.6 trillion represents approximately $12,700 per household (assuming 126.2 million households in 2017), while the $3.6 trillion represents $28,500 per household.

CBO ten-year outlook 2020–2030 (during the COVID-19 pandemic)

The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945, because of the impact of the COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

. CBO also forecast the debt held by the public would rise to 98% GDP in 2020, compared with 79% in 2019 and 35% in 2007 before the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. .

CBO long-term outlook

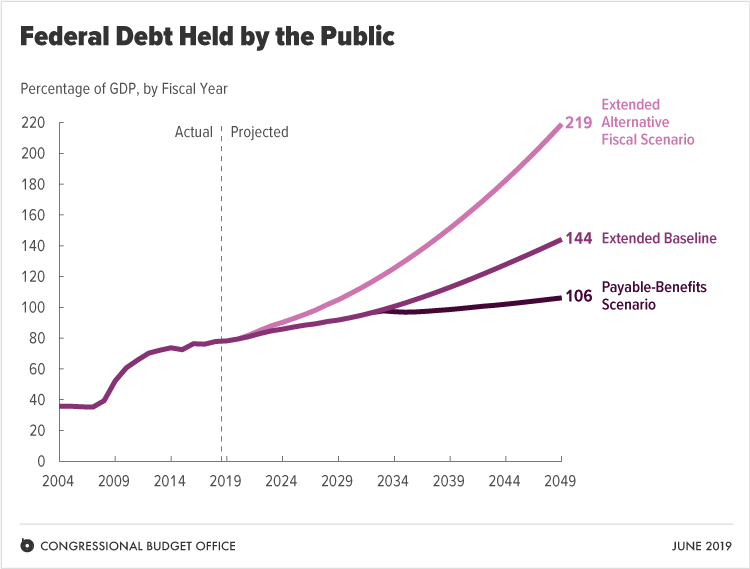

The CBO reports its ''Long-Term Budget Outlook'' annually, providing at least two scenarios for spending, revenue, deficits, and debt. The 2019 Outlook mainly covers the 30-year period through 2049. The CBO reported:

The CBO reports its ''Long-Term Budget Outlook'' annually, providing at least two scenarios for spending, revenue, deficits, and debt. The 2019 Outlook mainly covers the 30-year period through 2049. The CBO reported:

Large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 78 percent of gross domestic product (GDP) in 2019 to 144 percent by 2049. That projection incorporates CBO's central estimates of various factors, such as productivity growth and interest rates on federal debt. CBO's analysis indicates that even if values for those factors differed from the agency's projections, debt several decades from now would probably be much higher than it is today.[CBO The 2019 Long-Term Budget Outlook](_blank)

cbo.gov; accessed June 25, 2019.

Furthermore, under alternative scenarios:

If lawmakers changed current laws to maintain certain major policies now in place—most significantly, if they prevented a cut in discretionary spending in 2020 and an increase in individual income taxes in 2026—then debt held by the public would increase even more, reaching 219 percent of GDP by 2049. By contrast, if Social Security benefits were limited to the amounts payable from revenues received by the Social Security trust funds, debt in 2049 would reach 106 percent of GDP, still well above its current level.

Over the long term, the CBO projects that interest expense and mandatory spending categories (e.g., Medicare, Medicaid and Social Security) will continue to grow relative to GDP, while discretionary categories (e.g., Defense and other Cabinet Departments) continue to fall relative to GDP. Debt is projected to continue rising relative to GDP under the above two scenarios, although the CBO did also offer other scenarios that involved austerity measures that would bring the debt to GDP ratio down.

Debt reduction proposals

Negative real interest rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", wh ...

s, or bond, money market, and balanced mutual fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in ...

s are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk.[Carmen M. Reinhart and M. Belen Sbrancia (March 2011]

"The Liquidation of Government Debt"

National Bureau of Economic Research working paper No. 16893 Economist Lawrence Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as United States Secretary of the Treasury from 1999 to 2001 and as the director of the National Economic Council from 2009 to 2010. He also served as presiden ...

states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low.

Raising reserve requirements and full reserve banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

, published a working paper called ''The Chicago Plan Revisited

The Chicago Plan was introduced by University of Chicago economists in 1933 as a comprehensive plan to reform the monetary and banking system of the United States. The Great Depression had been caused in part by excessive private bank lending, ...

'' suggesting that the debt could be eliminated by raising bank reserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the Bank reserves, commercial bank's reserve, is generally determined ...

s and converting from fractional-reserve banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to ...

to full-reserve banking

Full-reserve banking (also known as 100% reserve banking, or sovereign money system) is a system of banking where banks do not lend Demand deposit, demand deposits and instead only lend from time deposits. It differs from fractional-reserve bankin ...

. Economists at the Paris School of Economics

The Paris School of Economics (PSE; French: ''École d'économie de Paris'') is a French research institute in the field of economics. It offers MPhil, MSc, and PhD level programmes in various fields of theoretical and applied economics, incl ...

have commented on the plan, stating that it is already the ''status quo'' for coinage currency, and a Norges Bank

Norges Bank (, , ) is the central bank of Norway. It is responsible for managing the Government Pension Fund of Norway, which is the world's largest sovereign wealth fund, as well as the bank's own foreign exchange reserves.

History

The histor ...

economist has examined the proposal in the context of considering the finance industry

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns finan ...

as part of the real economy

The real economy concerns the production, purchase and flow of goods and services (like oil, bread and labour) within an economy. It is contrasted with the financial economy, which concerns the aspects of the economy that deal purely in transa ...

. A Centre for Economic Policy Research

The Centre for Economic Policy Research (CEPR) is an independent, non-partisan, pan-European non-profit organisation. It aims to enhance the quality of policy decisions through providing policy-relevant research, based soundly in economic schola ...

paper agrees with the conclusion that "no real liability is created by new fiat money

Fiat money is a type of government-issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tende ...

creation and therefore public debt does not rise as a result."

Economic risks and debates

CBO risk factors

The CBO reported several types of risk factors related to rising debt levels in a July 2010 publication:

* A growing portion of savings would go towards purchases of government debt, rather than investments in productive capital goods such as factories and computers, leading to lower output and incomes than would otherwise occur;

* If higher marginal tax rates were used to pay rising interest costs, savings would be reduced and work would be discouraged;

* Rising interest costs would force reductions in government programs;

* Restrictions to the ability of policymakers to use fiscal policy to respond to economic challenges; and

* An increased risk of a sudden fiscal crisis, in which investors demand higher interest rates.[Huntley, Jonathan (July 27, 2010)]

"Federal debt and the risk of a fiscal crisis"

Congressional Budget Office: Macroeconomic Analysis Division; retrieved February 2, 2011.

Credit default

The U.S. has never fully defaulted.Treasury bills

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as a supplement to taxation. Since 2012, the U.S. ...

, which was less than 1% of U.S. debt. The Treasury Department characterized it as a delay rather than as a default, but it did have consequences for short-term interest rates, which jumped 0.6%.

Debt ceiling

The United States debt ceiling is a legislative constraint on the amount of national debt that can be incurred by the U.S. Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments.

...

. It limits how much money the federal government may pay on the debt it already has by borrowing even more money. The debt ceiling applies to almost all federal debt, including accounts owned by the public and intra-government funds for Medicare and Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

.[The Debt Limit: History and Recent Increases, October 2013](_blank)

p 4.

Sustainability

In 2009 the Government Accountability Office (GAO) reported that the United States was on a "fiscally unsustainable" path because of projected future increases in Medicare and Social Security spending.[Congress of the United States, Government Accountability Office (February 13, 2009)]

"The federal government's financial health: a citizen's guide to the 2008 financial report of the United States government", pp. 7–8

, gao.gov; retrieved February 1, 2011. According to the Treasury report in October 2018, summarized by ''Business Insider

''Business Insider'' (stylized in all caps: BUSINESS INSIDER; known from 2021 to 2023 as INSIDER) is a New York City–based multinational financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Inside ...

s Bob Bryan, the U.S. federal budget deficit rose as a result of the Tax Cuts and Jobs Act of 2017Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

on December 22, 2017Consolidated Appropriations Act, 2018

The Consolidated Appropriations Act, 2018 () is a United States omnibus spending bill for the United States federal government for fiscal year 2018 enacted by the 115th United States Congress and signed into law by President Donald Trump on Ma ...

signed into law on March 23, 2018.

Risks to economic growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff

Kenneth Saul Rogoff (born March 22, 1953) is an American economist and chess Grandmaster.

He is the Maurits C. Boas Chair of International Economics at Harvard University. During the Great Recession, Rogoff was an influential proponent of auste ...

and Carmen Reinhart

Carmen M. Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fe ...

reported that among the 20 developed countries studied, average annual GDP growth was 3–4% when debt was relatively moderate or low (i.e., under 60% of GDP), but it dips to just 1.6% when debt was high (i.e., above 90% of GDP).[U.S. House of Representatives Republican Caucus (May 27, 2010)]

"The perils of rising government debt"

budget.house.gov; retrieved February 2, 2011. In April 2013, the conclusions of Rogoff and Reinhart's study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst

The University of Massachusetts Amherst (UMass Amherst) is a public land-grant research university in Amherst, Massachusetts, United States. It is the flagship campus of the University of Massachusetts system and was founded in 1863 as the ...

. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

, have argued that it is low growth which causes national debt to increase, rather than the other way around.[Krugman, Paul (May 27, 2010)]

"Bad analysis at the deficit commission"

''The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'': The Opinion Pages: Conscience of a Liberal Blog. Retrieved February 9, 2011.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

stated in April 2010 that "Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time."

Interest and debt service costs

Interest expense on the public debt was approximately $678 billion in FY 2023. During FY 2023, the government also accrued a non-cash interest expense of $197 billion for intragovernmental debt, primarily the Social Security Trust Fund, for a total interest expense of $875 billion. This accrued interest is added to the Social Security Trust Fund and therefore the national debt each year and will be paid to Social Security recipients in the future. However, since it is a non-cash expense it is excluded from the budget deficit calculation.

Interest expense on the public debt was approximately $678 billion in FY 2023. During FY 2023, the government also accrued a non-cash interest expense of $197 billion for intragovernmental debt, primarily the Social Security Trust Fund, for a total interest expense of $875 billion. This accrued interest is added to the Social Security Trust Fund and therefore the national debt each year and will be paid to Social Security recipients in the future. However, since it is a non-cash expense it is excluded from the budget deficit calculation.Committee for a Responsible Federal Budget

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington, D.C. that addresses United States federal budget, federal budget and fiscal issues. It was founded in 1981 by former United Sta ...

(CRFB), the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

In October 2023, yields for 10-year Treasury notes breached 5% as traders adjusted their assessment of United States' fiscal position and lowered their expectation that Congress or the White House would take any action to improve it. The impact was felt by homebuyers, with 30-year mortgage rate at its highest in two decades, and corporations facing higher costs of borrowing. Interests paid by the federal government jumped by $184 billion during the 2022 fiscal year and are still climbing.

Recent statistics

Chinese holdings of U.S. debt

According to a 2013 Forbes

''Forbes'' () is an American business magazine founded by B. C. Forbes in 1917. It has been owned by the Hong Kong–based investment group Integrated Whale Media Investments since 2014. Its chairman and editor-in-chief is Steve Forbes. The co ...

article, many American and other economic analysts have expressed concerns on the amount of United States government debt the People's Republic of China is holding as part of their reserves.["... Should Americans be concerned that China has started dumping some of its Treasury holdings? After all, it raises serious questions about whether China will keep lending Washington money to help finance the federal deficit in the future.": Fro]

"China is dumping U.S. debt"

CNN.com, September 11, 2015. The National Defense Authorization Act

The National Defense Authorization Act (NDAA) is any of a series of United States federal laws specifying the annual budget and expenditures of the U.S. Department of Defense. The first NDAA was passed in 1961. The U.S. Congress oversees the de ...

of FY 2012 included a provision requiring the Secretary of Defense to conduct a "national security risk assessment of U.S. federal debt held by China." The department issued its report in July 2012, stating that "attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States.” An August 19, 2013 Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a ...

report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer "China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war."[Report](_blank)

on "China's Holdings of U.S. Securities: Implications for the U.S. Economy" by Wayne M. Morrison & Marc Labonte, Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a ...

, 19 August 2013

A 2010 article by James K. Galbraith in ''The Nation

''The Nation'' is a progressive American monthly magazine that covers political and cultural news, opinion, and analysis. It was founded on July 6, 1865, as a successor to William Lloyd Garrison's '' The Liberator'', an abolitionist newspaper ...

'', defends deficits and dismisses concerns over foreign holdings of United States government debt denominated in U.S. dollars, including China's holdings.[: "... What about indebtedness to foreigners? ... To acquire .S. gov't bonds China must export goods to us, not offset by equivalent imports. That is a cost to China. It's a cost ]Beijing

Beijing, Chinese postal romanization, previously romanized as Peking, is the capital city of China. With more than 22 million residents, it is the world's List of national capitals by population, most populous national capital city as well as ...

is prepared to pay, for its own reasons: export industries promote learning, technology transfer and product quality improvement, and they provide jobs to migrants from the countryside. But that's China's business. For China, the bonds themselves are a sterile hoard

A hoard or "wealth deposit" is an archaeological term for a collection of valuable objects or artifacts, sometimes purposely buried in the ground, in which case it is sometimes also known as a cache. This would usually be with the intention of ...

. There is almost nothing that Beijing can do with them; ... its stock of T-bonds will just go on growing. And we will pay interest on it, not with real effort but by typing numbers into computers. There is no burden associated with this; not now and not later." Fro

"In Defense of Deficits"

by James K. Galbraith, ''The Nation

''The Nation'' is a progressive American monthly magazine that covers political and cultural news, opinion, and analysis. It was founded on July 6, 1865, as a successor to William Lloyd Garrison's '' The Liberator'', an abolitionist newspaper ...

'', March 4, 2010. In 2010, Warren Mosler, wrote that "When verthe Chinese redeem those T-securities, the money is transferred back to China's checking account at the Fed. During the entire purchase and redemption process, the dollars never leave the Fed."["... The Chinese buy U.S. T-securities by transferring U.S. dollars (not yuan) from their checking account at the Federal Reserve Bank to China's T-security account, also at the Federal Reserve Bank. When verthe Chinese redeem those T-securities, the money is transferred back to China's checking account at the Fed. During the entire purchase and redemption process, the dollars never leave the Fed.]

"What Policies for Global Prosperity?"

by Warren Mosler, September 23, 2010. Australian economist Bill Mitchell argued that the United States government had a "nearly infinite capacity...to spend."[ Mitchell, Bill, ]University of Newcastle (Australia)

The University of Newcastle is a public university in Newcastle, New South Wales, Australia. Established in 1965, it has a primary campus in the Newcastle suburb of Callaghan. The university also operates campuses in Central Coast, Singapore, ...

"The nearly infinite capacity of the US government to spend"

(March 28, 2012)

"The US government can buy as much of its own debt as it chooses"

(August 27, 2013) Against the backdrop of escalating Sino-U.S. tensions in 2020, Yuzo Sakai, a manager at Ueda Totan Forex Ltd., said that if China undertakes a massive sales of U.S. bonds, investors may flock to the Japanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar and the euro. It is also widely used as a third reserve currency after the US dollar and the euro.

Th ...

as a safe-haven currency. Since 2018, China had been gradually decreasing its holdings of U.S. federal debt, bringing the total to $1.07 trillion in June 2020, behind Japan who became the biggest foreign creditor of the United States. Stephen Nagy, a professor at the International Christian University

is a non-denominational private university located in Mitaka, Tokyo. With the efforts of Prince Takamatsu, General Douglas MacArthur, and Bank of Japan, BOJ Governor Hisato Ichimada, ICU was established in 1949 as the first liberal arts coll ...

, said a sell-off by China "might damage the United States in the short term" but also cause "critical economic instability" in the Chinese and global economy. Jeff Kingston, a professor and director of Asian Studies at Temple University, Japan, echoed the view, adding that dumping would lower the price of U.S. bonds, making it more attractive to other countries. According to an institutional investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked ...

, however, it may be difficult for Japan to boost its already large holdings of U.S. government debt, as such a move could be seen as "currency manipulation".

Definition dispute of public debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President's Fiscal Reform Commission that gross debt is the appropriate measure.Center on Budget and Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the organization's stated mission is to "advanc ...

(CBPP) cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.[Horney, James R. (May 27, 2010)]

"Recommendation that president's fiscal commission focus on gross debt is misguided"

Center on Budget and Policy Priorities ebsite retrieved February 9, 2011.

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. For example, the CBPP argues: that "large increases in ebt held by the publiccan also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans' income. By contrast, intragovernmental debt (the other component of the gross debt) has no such effects because it is simply money the federal government owes (and pays interest on) to itself."

Intergenerational equity

One debate about the national debt relates to intergenerational equity. For example, if one generation is receiving the benefit of government programs or employment enabled by deficit spending and debt accumulation, to what extent does the resulting higher debt impose risks and costs on future generations? There are several factors to consider:

* For every dollar of debt held by the public, there is a government obligation (generally marketable Treasury securities) counted as an asset by investors. Future generations benefit to the extent these assets are passed on to them.

COVID-19 pandemic and aftermath

The COVID-19 pandemic in the United States

On December 31, 2019, China announced the discovery of a cluster of pneumonia cases in Wuhan. The first American case was reported on January 20, and United States Department of Health and Human Services, Health and Human Services Secreta ...

impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel. About 16 million people filed for unemployment insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

in the three weeks ending April 9. It caused the number of unemployed persons to increase significantly, which is expected to reduce tax revenues while increasing automatic stabilizer

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and Welfare (financial aid), welfare spending, that act to damp out fluctuations in real GDP.

The size of the government ...

spending for unemployment insurance and nutritional support. As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.

To help address lost income for millions of workers and assist businesses, Congress and President Trump enacted the Coronavirus Aid, Relief, and Economic Security Act

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th United States Congress, 116th U.S. Congress and signed into law by Presiden ...

(CARES Act) on March 27, 2020. It included loans and grants for businesses, along with direct payments to individuals and additional funding for unemployment insurance. The act carried an estimated $2.3 trillion price tag, with an expectation that some or all of the loans would ultimately be paid back including interest. While the law would have almost certainly increased budget deficits relative to the January 2020 10-year CBO baseline (completed prior to the COVID-19 pandemic), in the absence of the legislation, a complete economic collapse could have occurred. However, as of 2023, many of these loans have been forgiven.

CBO provided a preliminary score for the CARES Act on April 16, 2020, estimating that it would increase federal deficits by about $1.8 trillion over the 2020-2030 period. The estimate includes:

*A $988 billion increase in mandatory outlays;

*A $446 billion decrease in revenues; and

*A $326 billion increase in discretionary outlays, stemming from emergency supplemental appropriations.

CBO reported that not all parts of the bill will increase deficits: “Although the act provides financial assistance totaling more than $2 trillion, the projected cost is less than that because some of that assistance is in the form of loan guarantees, which are not estimated to have a net effect on the budget. In particular, the act authorizes the Secretary of the Treasury to provide up to $454 billion to fund emergency lending facilities established by the Board of Governors of the Federal Reserve System

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the m ...

. Because the income and costs stemming from that lending are expected to roughly offset each other, CBO estimates no deficit effect from that provision.”Committee for a Responsible Federal Budget

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington, D.C. that addresses United States federal budget, federal budget and fiscal issues. It was founded in 1981 by former United Sta ...

estimated that the budget deficit for fiscal year 2020 would increase to a record $3.8 trillion (~$ in ), or 18.7% GDP.Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. . CBO forecast in January 2020 that the budget deficit in FY2020 would be $1.0 trillion (~$ in ), prior to considering the impact of the COVID-19 pandemic or CARES. CFRB further estimated that the national debt would reach 106% of U.S. GDP in September 2020, a record since the aftermath of World War II.

President Biden

Joseph Robinette Biden Jr. (born November 20, 1942) is an American politician who was the 46th president of the United States from 2021 to 2025. A member of the Democratic Party, he served as the 47th vice president from 2009 to 2017 and re ...

also allocated significant amounts of money towards relief of the COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

. According to a May 2021 report, Biden has or plans to spend $5.72 (~$ in ) trillion dollars toward this effort and others such as climate change including providing stimulus checks and serving schools and low-income children. Economists are divided if this unprecedented level of spending from the Biden Administration

Joe Biden's tenure as the List of presidents of the United States, 46th president of the United States began with Inauguration of Joe Biden, his inauguration on January 20, 2021, and ended on January 20, 2025. Biden, a member of the Democr ...

has, in part, contributed to the inflation spike from 2021 to 2022 as a result of increasing the money supply in the economy.

Appendix

National debt for selected years

Interest paid

According to federal government data, interest payment on debt has crossed above one trillion on October 1, 2023, meaning a $3 billion-a-day interest payment.

Note that this is all interest the U.S. paid, including interest credited to Social Security and other government trust funds, not just "interest on debt" frequently cited elsewhere.

Foreign holders of U.S. Treasury securities

The following is a list of the top foreign holders of Treasury securities as listed by the Federal Reserve Board (revised by March 2025 survey):

Statistics

* U.S. official gold reserves total 261.5 million

* U.S. official gold reserves total 261.5 million troy ounce

Troy weight is a system of units of mass that originated in the Kingdom of England in the 15th century and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 p ...

s with a book value of approximately $11.04 billion.

* Foreign exchange reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, ...

$140 billion .  * The national debt was up to $80,885 per person as of 2020.

* The national debt equated to $59,143 per person U.S. population, or $159,759 per member of the U.S. working taxpayers, back in March 2016.

* In 2008, $242 billion was spent on

* The national debt was up to $80,885 per person as of 2020.

* The national debt equated to $59,143 per person U.S. population, or $159,759 per member of the U.S. working taxpayers, back in March 2016.

* In 2008, $242 billion was spent on interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

payments servicing the debt, out of a total tax revenue of $2.5 trillion, or 9.6%. Including non-cash interest accrued primarily for Social Security, interest was $454 billion or 18% of tax revenue.household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

, including mortgage loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners t ...

and consumer debt

In economics, consumer debt is the amount owed by consumers (as opposed to amounts owed by businesses or governments). It includes debts incurred on purchase of goods that are consumable and/or do not appreciate. In macroeconomic terms, it ...

, was $11.4 trillion in 2005. By comparison, total U.S. household assets, including real estate, equipment, and financial instruments such as mutual fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in ...

s, was $62.5 trillion in 2005.

* Total U.S. Consumer Credit Card revolving credit

Revolving credit is a type of credit that does not have a fixed number of payments, in contrast to installment credit. Credit cards are an example of revolving credit used by consumers. Corporate revolving credit facilities are typically used t ...

was $931.0 billion in April 2009.

* The U.S. balance of trade

Balance of trade is the difference between the monetary value of a nation's exports and imports of goods over a certain time period. Sometimes, trade in Service (economics), services is also included in the balance of trade but the official IMF d ...

deficit in goods and services was $725.8 billion in 2005.

* According to the U.S. Department of Treasury Preliminary 2014 Annual Report on U.S. Holdings of Foreign Securities, the United States valued its foreign treasury securities portfolio at $2.7 trillion. The largest debtors are Canada, the United Kingdom, Cayman Islands, and Australia, whom account for $1.2 trillion of sovereign debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occ ...

owed to residents of the U.S.