Economic Interventionism on:

[Wikipedia]

[Google]

[Amazon]

Economic interventionism, sometimes also called state interventionism, is an economic policy position favouring government intervention in the

The effects of government economic interventionism are widely disputed.

Regulatory authorities do not consistently close markets, yet as seen in economic liberalization efforts by states and various institutions (

The effects of government economic interventionism are widely disputed.

Regulatory authorities do not consistently close markets, yet as seen in economic liberalization efforts by states and various institutions (

President

President

Pollution Issues. Retrieved 8 July 2012. United States pollution control statutes tend to be numerous and diverse and many of the environmental statutes passed by

Carbon Offsets Daily. 3 August 2010. Retrieved July 8, 2012. It is possible that government mandated carbon taxes could be used to improve technology and make cars like the Volt more affordable to consumers. However, current bills suggest carbon prices would only add a few cents to the price of gasoline, which has negligible effects compared to what is needed to change fuel consumption. Washington is beginning to invest in car manufacturing industry by partially providing $6 billion in battery-related public and private investments since 2008 and the White House has taken credit for putting a down payment on the American battery industry that may reduce battery prices in the coming years. Currently, opponents believe that the carbon dioxide emissions tax the United States government introduced on new cars is unfair on consumers and looks like a revenue-raising fiscal intervention instead of limiting harm caused to the environment."State puts cart before horse on vehicle carbon tax"

Carbon Offsets Daily. 13 August 2010. Retrieved 8 July 2012. A national fuel tax means everyone will pay the tax and the amount of tax each individual or company pays will be proportional to the emissions they generate. The more they drive, the more that they would need to pay. While this tax is supported by the motor manufacturers, stipulations confirmed by the National Treasury state that minibuses and midibuses will receive a special exclusion from the emissions tax on cars and light commercial vehicles which went into effect on 1 September 2010. This exclusion is because these taxi vehicles are used for public transport, which opponents of the tax disagree with. During George W. Bush’s 2000 campaign, he promised to commit $2 billion over ten years to advance clean coal technology through research and development initiatives. According to Bush supporters, he fulfilled that promise in his fiscal year 2008 budget request, allocating $426 million for the Clean Coal Technology Program."U.S. Coal Facts"

''The Indypendent''. 7 June 2007. Retrieved July 8, 2012. During his administration, Congress passed the

Zvw-algemeen: Hoe werkt de Zorgverzekeringswet? – Verzekerde zorg – Zorginstituut Nederland

Zorgverzekering (Nederland)

Related adversities:

* While this system allows for a broad private enterprise market of health care services offered only to public basic insurance policy prescribed patients, it has as a side-effect the driving out of health care offered to patient seeking individually contracted medical services without gatekeeper doctors prescription. It therefore eliminates the market economy in health care.

* The income of people working in the market-driven welfare state consisting of the public health care policy basic insurance, the corresponding insurance companies and the public health care service providers like public hospitals, private clinics and practices, which is based on mandatory premiums and state tax revenue contribution, does no longer directly depend on the forces of supply and demand, this works out particularly bad in country wide medical emergency situations, where the

market process

Market is a term used to describe concepts such as:

*Market (economics), system in which parties engage in transactions according to supply and demand

*Market economy

*Marketplace, a physical marketplace or public market

Geography

*Märket, an ...

with the intention of correcting market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where indiv ...

s and promoting the general welfare of the people. An economic intervention is an action taken by a government or international institution in a market economy in an effort to impact the economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with th ...

beyond the basic regulation of fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compen ...

, enforcement of contracts, and provision of public goods and services. Economic intervention can be aimed at a variety of political or economic objectives, such as promoting economic growth, increasing employment, raising wages, raising or reducing prices, promoting income equality, managing the money supply and interest rates, increasing profits, or addressing market failures.

The term ''intervention'' is typically used by advocates of ''laissez-faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups ...

'' and free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

capitalism, and assumes that, on a philosophical level, the state and economy should be inherently separated from each other and that government action is inherently exogenous to the economy. The terminology applies to capitalist

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private ...

market-based economies where government actions interrupt the market forces at play through regulations, subsidies, and price controls; state-owned enterprises

A state-owned enterprise (SOE) is a government entity which is established or nationalised by the ''national government'' or ''provincial government'' by an executive order or an act of legislation in order to earn profit for the governme ...

that operate as market entities do not constitute an intervention. Capitalist market economies that feature high degrees of state intervention are often referred to as a type of mixed economy.

Political perspectives

Liberals and other advocates offree market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

or ''laissez-faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups ...

'' economics generally view government interventions as harmful due to the law of unintended consequences, belief in government's inability to effectively manage economic concerns and other considerations. However, modern liberals (in the United States) and contemporary social democrats (in Europe) are inclined to support interventionism, seeing state economic interventions as an important means of promoting greater income equality and social welfare. Furthermore, many center-right groups such as Gaullists, paternalistic conservatives and Christian democrats

__NOTOC__

Christian democratic parties are political parties that seek to apply Christian principles to public policy. The underlying Christian democracy movement emerged in 19th-century Europe, largely under the influence of Catholic social tea ...

also support state economic interventionism to promote social order and stability. National-conservatives also frequently support economic interventionism as a means of protecting the power and wealth of a country or its people, particularly via advantages granted to industries seen as nationally vital. Such government interventions are usually undertaken when potential benefits outweigh the external costs.

On the other hand, Marxists often feel that interventions in the form of social welfare policies might interfere with the goal of replacing capitalism

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private ...

with socialism because a developed welfare state makes capitalism more tolerable to the average worker, thereby perpetuating the continued existence of capitalism to society's detriment. Socialist

Socialism is a left-wing economic philosophy and movement encompassing a range of economic systems characterized by the dominance of social ownership of the means of production as opposed to private ownership. As a term, it describes the ...

s often criticize interventionism (as supported by social democrats and social liberals) as being untenable and liable to cause more economic distortion in the long-run. While interventions might solve single issues in the short term, they cause distortions and hamper the efficiency of the capitalist economy. From this perspective, any attempt to patch up capitalism

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private ...

's contradictions would lead to distortions in the economy elsewhere, with the only lasting solution being the replacement of capitalism with a socialist economy.

Effects

The effects of government economic interventionism are widely disputed.

Regulatory authorities do not consistently close markets, yet as seen in economic liberalization efforts by states and various institutions (

The effects of government economic interventionism are widely disputed.

Regulatory authorities do not consistently close markets, yet as seen in economic liberalization efforts by states and various institutions (International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

and World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

) in Latin America

Latin America or

* french: Amérique Latine, link=no

* ht, Amerik Latin, link=no

* pt, América Latina, link=no, name=a, sometimes referred to as LatAm is a large cultural region in the Americas where Romance languages — languages derived ...

, "financial liberalization and privatization coincided with democratization". One study suggests that after the lost decade an increasing "diffusion of regulatory authorities" emerged and these actors engaged in restructuring the economies within Latin America. Through the 1980s, Latin America had undergone a debt crisis and hyperinflation (during 1989 and 1990). These international stakeholders restricted the state's economic leverage and bound it in contract to co-operate. After multiple projects and years of failed attempts for the Argentine state to comply, the renewal and intervention seemed stalled. Two key intervention factors that instigated economic progress in Argentina were substantially increasing privatization

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

and the establishment of a currency board. This exemplifies global institutions, including the International Monetary Fund and the World Bank, to instigate and propagate openness to increase foreign investments and economic development within places, including Latin America.

In Western countries, government officials theoretically weigh the cost benefit for an intervention for the population or they succumb beneath coercion by a third private party and must take action. Intervention for economic development is also at the discretion and self-interest of the stake holders, the multifarious interpretations of progress and development theory. To illustrate this, the government and international institutions did not prop up Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, ...

during the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

, therefore allowing the company to file bankruptcy. Days later, when American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/amer ...

waned towards collapsing, the state spent public money to keep it from falling. These corporations have interconnected interests with the state, therefore their incentive is to influence the government to designate regulatory policies that will not inhibit their accumulation of assets. In Japan, Abenomics is a form of intervention with respect to Prime Minister Shinzō Abe's desire to restore the country's former glory in the midst of a globalized economy.

United States government interventions

President

President Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was ...

signed amendments to the Clean Air Act in 1970 that expanded it to mandate state and federal regulation of both automobiles and industry. It was further amended in 1977 and 1990. One of the first modern environmental protection laws enacted in the United States was the National Environmental Policy Act of 1969

The National Environmental Policy Act (NEPA) is a United States environmental law that promotes the enhancement of the environment and established the President's Council on Environmental Quality (CEQ). The law was enacted on January 1, 1970.Un ...

(NEPA), which requires the government to consider the impact of its actions or policies on the environment. NEPA remains one of the most commonly used environmental laws in the nation. In addition to NEPA, there are numerous pollution-control statutes that apply to such specific environmental media as air and water. The best known of these laws are the Clean Air Act (CAA), Clean Water Act

The Clean Water Act (CWA) is the primary federal law in the United States governing water pollution. Its objective is to restore and maintain the chemical, physical, and biological integrity of the nation's waters; recognizing the responsibiliti ...

(CWA), and the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) commonly referred to as Superfund

Superfund is a United States federal environmental remediation program established by the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA). The program is administered by the Environmental Protection Agency ...

. Among the many other important pollution control laws are the Resource Conservation and Recovery Act (RCRA), Toxic Substances Control Act (TSCA), Oil Pollution Prevention Act (OPP), Emergency Planning and Community Right-to-Know Act (EPCRA), and the Pollution Prevention Act (PPA)."Laws and Regulations, United States"Pollution Issues. Retrieved 8 July 2012. United States pollution control statutes tend to be numerous and diverse and many of the environmental statutes passed by

Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

are aimed at pollution prevention. However, they often need to be expanded and updated before their impact is fully realized. Pollution-control laws are generally too broad to be managed by existing legal bodies, so Congress must find or create an agency for each that will be able to implement the mandated mission effectively.

During World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

, the United States government intervention mandated that the manufacturing of cars be replaced with machinery to successfully fight the war. Government intervention could be used to break the United States dependence on oil by mandating American automakers to produce electric cars such as the Chevrolet Volt. Michigan Governor Jennifer Granholm said: "We need help from Congress", namely renewing the clean energy manufacturing tax credit and the tax incentives that make plug-ins cheaper to buy for consumers."Electric Carmakers Focus on Incentives, Not Carbon Prices"Carbon Offsets Daily. 3 August 2010. Retrieved July 8, 2012. It is possible that government mandated carbon taxes could be used to improve technology and make cars like the Volt more affordable to consumers. However, current bills suggest carbon prices would only add a few cents to the price of gasoline, which has negligible effects compared to what is needed to change fuel consumption. Washington is beginning to invest in car manufacturing industry by partially providing $6 billion in battery-related public and private investments since 2008 and the White House has taken credit for putting a down payment on the American battery industry that may reduce battery prices in the coming years. Currently, opponents believe that the carbon dioxide emissions tax the United States government introduced on new cars is unfair on consumers and looks like a revenue-raising fiscal intervention instead of limiting harm caused to the environment."State puts cart before horse on vehicle carbon tax"

Carbon Offsets Daily. 13 August 2010. Retrieved 8 July 2012. A national fuel tax means everyone will pay the tax and the amount of tax each individual or company pays will be proportional to the emissions they generate. The more they drive, the more that they would need to pay. While this tax is supported by the motor manufacturers, stipulations confirmed by the National Treasury state that minibuses and midibuses will receive a special exclusion from the emissions tax on cars and light commercial vehicles which went into effect on 1 September 2010. This exclusion is because these taxi vehicles are used for public transport, which opponents of the tax disagree with. During George W. Bush’s 2000 campaign, he promised to commit $2 billion over ten years to advance clean coal technology through research and development initiatives. According to Bush supporters, he fulfilled that promise in his fiscal year 2008 budget request, allocating $426 million for the Clean Coal Technology Program."U.S. Coal Facts"

''The Indypendent''. 7 June 2007. Retrieved July 8, 2012. During his administration, Congress passed the

Energy Policy Act of 2005

The Energy Policy Act of 2005 () is a federal law signed by President George W. Bush on August 8, 2005, at Sandia National Laboratories in Albuquerque, New Mexico. The act, described by proponents as an attempt to combat growing energy probl ...

, funding research into carbon-capture technology to remove and bury the carbon in coal after it is burned. The coal industry received $9 billion in subsidies under the act as part of an initiative supposedly to reduce American dependence on foreign oil and reduce carbon emissions. This included $6.2 billion for new power plants, $1.1 billion in tax breaks to install pollution-control technology and another $1.1 billion to make coal a cost efficient fuel. The act also allowed redefinitions of coal processing, such as spraying on diesel or starch, to qualify them as "non-traditional", allowing coal producers to avoid paying $1.3 billion in taxes per year.

The Waxman-Markey

The American Clean Energy and Security Act of 2009 (ACES) was an energy bill in the 111th United States Congress () that would have established a variant of an emissions trading plan similar to the European Union Emission Trading Scheme. The bill ...

bill, also called the American Clean Energy and Security Act

The American Clean Energy and Security Act of 2009 (ACES) was an energy bill in the 111th United States Congress () that would have established a variant of an emissions trading plan similar to the European Union Emission Trading Scheme. The bill ...

, passed by the House Energy and Commerce Committee

The Committee on Energy and Commerce is one of the oldest standing committees of the United States House of Representatives. Established in 1795, it has operated continuously—with various name changes and jurisdictional changes—for more tha ...

in 2010, targets dramatic reductions after 2020, when the price of the permits would rise to further limit consumers' demand for -intensive goods and services. The legislation is targeting 83 percent reduction in emissions from 2005 levels in the year 2050. A study by the Environmental Protection Agency

A biophysical environment is a biotic and abiotic surrounding of an organism or population, and consequently includes the factors that have an influence in their survival, development, and evolution. A biophysical environment can vary in scale ...

estimates that the price of the permit would rise from about $20 a ton in 2020 to more than $75 a ton in 2050.

The Office of Management and Budget (OMB) shows that federal subsidies for coal in the United States were planned to be reduced significantly between 2011 and 2020, provided the budget passed through Congress and reduces four coal tax preferences, namely Expensing of Exploration and Development Costs, Percent Depletion for Hard Mineral Fossil Fuels, Royalty Taxation and Domestic Manufacturing Deduction for Hard Mineral Fossil Fuels. The fiscal 2011 budget proposed by the Obama administration

Barack Obama's tenure as the 44th president of the United States began with his first inauguration on January 20, 2009, and ended on January 20, 2017. A Democrat from Illinois, Obama took office following a decisive victory over Republican ...

would cut approximately $2.3 billion in coal subsidies during the next decade.

Forms of regulation and state-intervention

Market-driven medical welfare state

Insurance companies that are regulated to accept all customers or patients within the state-regulated public basic insurance policy, which requires egalitarian treatment of all customers or patients and reimbursement of all health care treatment prescribed by a gatekeeper medical doctor, covered by the policy and charged to a patient. This basic health care insurance policy may be obligatory for all residents in a country, effectively putting all residents on a market-driven medicalwelfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifical ...

program, like for example in the Netherlands, where these insurance companies receive, from tax revenue, an additional leverage sum with respect to the premium of about a factor 9. This policy is known to be very effective at eliminating waiting lines in health care.Zorgverzekering (Nederland)

self-preservation

Self-preservation is a behavior or set of behaviors that ensures the survival of an organism. It is thought to be universal among all living organisms. For sentient organisms, pain and fear are integral parts of this mechanism. Pain motivates th ...

of the medical welfare-state workers does not ultimately depend on servicing the patient customers. A principle that is firmly secured by Adam Smith's invisible hand

The invisible hand is a metaphor used by the British moral philosopher Adam Smith that describes the unintended greater social benefits and public good brought about by individuals acting in their own self-interests. Smith originally mention ...

serving the common good

In philosophy, economics, and political science, the common good (also commonwealth, general welfare, or public benefit) is either what is shared and beneficial for all or most members of a given community, or alternatively, what is achieved by c ...

.

See also

*American School (economics)

The American School, also known as the National System, represents three different yet related constructs in politics, policy and philosophy. The policy existed from the 1790s to the 1970s, waxing and waning in actual degrees and details of imp ...

* Austrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian scho ...

* Crowding out

* Deficit spending

* Developmentalism

* Dirigisme

Dirigisme or dirigism () is an economic doctrine in which the state plays a strong directive (policies) role contrary to a merely regulatory interventionist role over a market economy. As an economic doctrine, dirigisme is the opposite of ''lai ...

* Indicative planning

* Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output ...

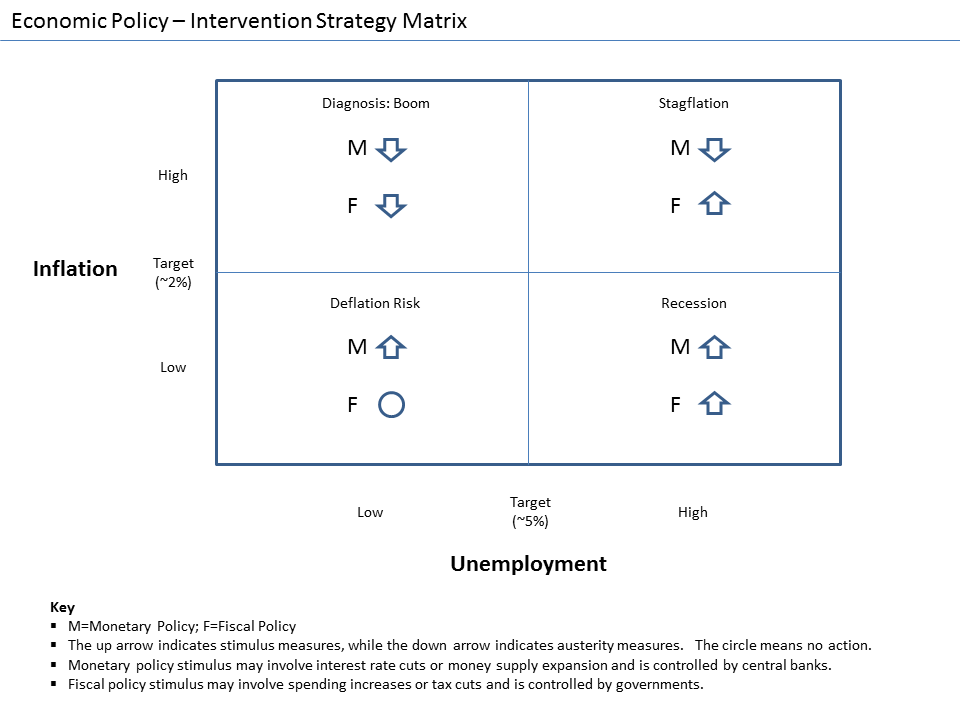

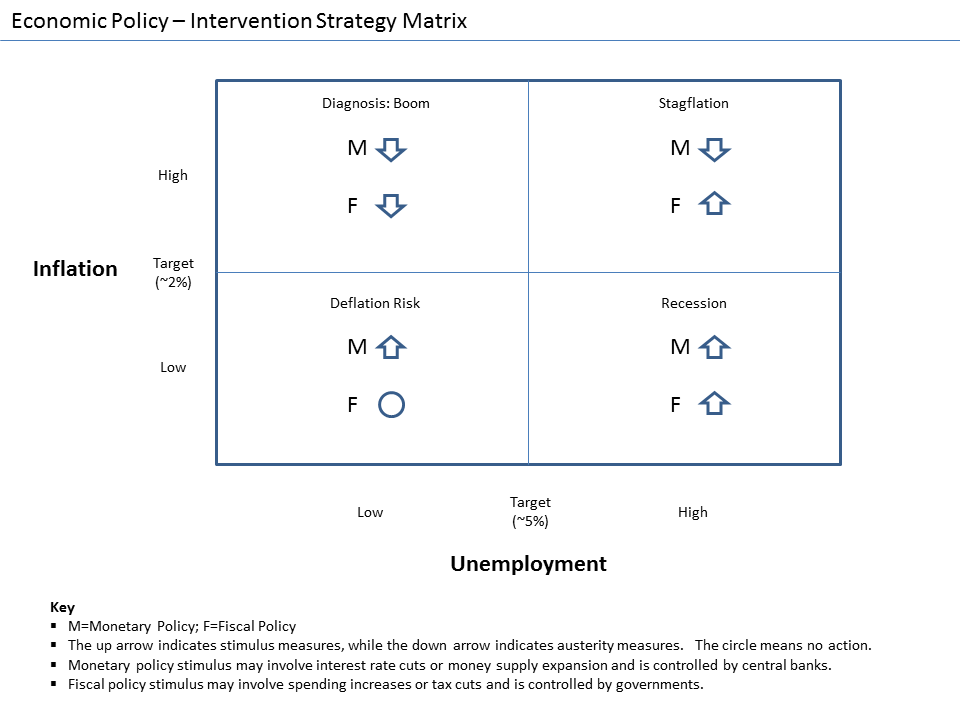

* Monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for federal funds, very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money s ...

* National debt of the United States

* Regulatory economics

Regulatory economics is the economics of regulation. It is the application of law by government or regulatory agencies for various purposes, including remedying market failure, protecting the environment and economic management.

Regulation

Reg ...

* Rent-seeking

* Sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a gove ...

References

Further reading

* {{cite encyclopedia, last=Ikeda , first=Simon , author-link=, editor-first=Ronald , editor-last=Hamowy , editor-link=Ronald Hamowy , encyclopedia=The Encyclopedia of Libertarianism , chapter=Interventionism, chapter-url=https://sk.sagepub.com/reference/libertarianism/n154.xml, url= https://books.google.com/books?id=yxNgXs3TkJYC , doi=10.4135/9781412965811.n154 , year=2008 , publisher= Sage;Cato Institute

The Cato Institute is an American libertarian think tank headquartered in Washington, D.C. It was founded in 1977 by Ed Crane, Murray Rothbard, and Charles Koch, chairman of the board and chief executive officer of Koch Industries.Koch Ind ...

, location= Thousand Oaks, CA , isbn= 978-1412965804 , oclc=750831024, lccn = 2008009151 , pages=253–256

Ideologies of capitalism

Libertarian theory

Economic policy

Market failure

Economic nationalism