Legislative history

Both the House and the Senate versions of the bills were primarily written by Democratic congressional committee leaders and their staffs. Because work on the bills started before President Obama officially took office on January 20, 2009, top aides to President-Elect Obama held multiple meetings with committee leaders and staffers. On January 10, 2009, President-Elect Obama's administration released a report that provided a preliminary analysis of the impact to jobs of some of the prototypical recovery packages that were being considered.House of Representatives assembly

The House version of the bill, , was introduced on January 26, 2009. chairman, and was co-sponsored by nine other Democrats. On January 23,

The House version of the bill, , was introduced on January 26, 2009. chairman, and was co-sponsored by nine other Democrats. On January 23, Senate

The Senate version of the bill, {{USBill, 111, S., 1, was introduced on January 6, 2009, and later substituted as an amendment to the House bill, {{USBill, 111, SA, 570. It was sponsored by{{webarchive, url=https://web.archive.org/web/20090130013720/http://cantwell.senate.gov/news/record.cfm?id=306895 , date=January 30, 2009 The Senate called a special Saturday debate session for February 7 at the urging of President Obama. The Senate voted, 61–36 (with 2 not voting) on February 9 to end debate on the bill and advance it to the Senate floor to vote on the bill itself. On February 10, the Senate voted 61–37 (with one not voting) All the Democrats voted in favor, but only three Republicans voted in favor (

Comparison of the House, Senate and Conference versions

Senate Republicans forced a near unprecedented level of changes (near $150 billion) in the House bill, which had more closely followed the Obama plan. A comparison of the $827 billion economic recovery plan drafted by Senate Democrats with an $820 billion version passed by the House and the final $787 billion conference version shows huge shifts within these similar totals. Additional debt costs would add about $350 billion or more over 10 years. Many provisions were set to expire in two years.

The main funding differences between the Senate bill and the House bill were: More funds for health care in the Senate ($153.3 vs $140 billion), renewable energy programs ($74 vs. $39.4 billion), for home buyers tax credit ($35.5 vs. $2.6 billion), new payments to the elderly and a one-year increase in AMT limits. The House had more funds appropriated for education ($143 vs. $119.1 billion), infrastructure ($90.4 vs. $62 billion) and for aid to low income workers and the unemployed ($71.5 vs. $66.5 billion).

Senate Republicans forced a near unprecedented level of changes (near $150 billion) in the House bill, which had more closely followed the Obama plan. A comparison of the $827 billion economic recovery plan drafted by Senate Democrats with an $820 billion version passed by the House and the final $787 billion conference version shows huge shifts within these similar totals. Additional debt costs would add about $350 billion or more over 10 years. Many provisions were set to expire in two years.

The main funding differences between the Senate bill and the House bill were: More funds for health care in the Senate ($153.3 vs $140 billion), renewable energy programs ($74 vs. $39.4 billion), for home buyers tax credit ($35.5 vs. $2.6 billion), new payments to the elderly and a one-year increase in AMT limits. The House had more funds appropriated for education ($143 vs. $119.1 billion), infrastructure ($90.4 vs. $62 billion) and for aid to low income workers and the unemployed ($71.5 vs. $66.5 billion).

Spending (Senate – $552 billion, House – $545 billion)

{{listen , title=Address Before a Joint Session of Congress (February 24, 2009) , filename=Address Before a Joint Session of Congress (February 24, 2009) - Barack Obama (WhiteHouse.gov).ogv , description =Tax changes ($275 billion)

** House – About $145 billion for $500 per-worker, $1,000 per-couple tax credits in 2009 and 2010. For the last half of 2009, workers could expect to see about $20 a week less withheld from their paychecks starting around June. Millions of Americans who don't make enough money to pay federal income taxes could file returns next year and receive checks. Individuals making more than $75,000 and couples making more than $150,000 would receive reduced amounts. ** Senate – The credit would phase out at incomes of $70,000 for individuals and couples making more than $140,000 and phase out more quickly, reducing the cost to $140 billion. ** Conference – Tax Credit reduced to $400 per worker and $800 per couple in 2009 and 2010 and phaseout begins at $75,000 for individuals and $150,000 for joint filers. Note retirees with no wages get nothing.House Conference report 111-? Final partially handwritten report released by Nancy Pelosi's Office 2/13/09 * Alternative minimum tax ** House – No provision. ** Senate – About $70 billion to prevent 24 million taxpayers from paying the alternative minimum tax in 2009. The tax was designed to make sure wealthy taxpayers can't use credits and deductions to avoid paying any taxes or paying at a far lower rate than would otherwise be possible. But it was never indexed to inflation, so critics now contend it taxes people it was not intended to. Congress addresses it each year, usually in the fall. ** Conference – Includes a one-year increase in AMT floor to $70,950 for joint filers for 2009. * Expanded child credit ** House – $18.3 billion to give greater access to the $1,000 per-child tax credit for low income workers in 2009 and 2010. Under current law, workers must make at least $12,550 to receive any portion of the credit. The change eliminates the floor, meaning more workers who pay no federal income taxes could receive checks. ** Senate – Sets a new income threshold of $8,100 to receive any portion of the credit, reducing the cost to $7.5 billion. ** Conference – The income floor for refunds was set at $3,000 for 2009 & 2010.House Conference report 111-16 2/13/09 * Expanded earned income tax credit ** House – $4.7 billion to increase the earned income tax credit – which provides money to low income workers – for families with at least three children. ** Senate – Same. * Expanded college credit ** House – $13.7 billion to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000. ** Senate – Reduces the amount that can be refunded to low-income families that pay no income taxes, lowering the cost to $13 billion. * Homebuyer credit ** House – $2.6 billion to repeal a requirement that a $7,500 first-time homebuyer tax credit be paid back over time for homes purchased from Jan 1 to July 1, unless the home is sold within three years. The credit is phased out for couples making more than $150,000. ** Senate – Doubles the credit to $15,000 for homes purchased for a year after the bill takes effect, increasing the cost to $35.5 billion. ** Conference – $8,000 credit for all homes bought between 1/1/2009 and 12/1/2009 and repayment provision repealed for homes purchased in 2009 and held more than three years. * Home energy credit ** House – $4.3 billion to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners. ** Senate – Same. ** Conference – Same. * Unemployment ** House – No similar provision. ** Senate – $4.7 billion to exclude from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009. ** Conference – Same as Senate * Bonus depreciation ** House – $5 billion to extend a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009. ** Senate – Similar. * Money-losing companies ** House – $15 billion to allow companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds. ** Senate – Allows companies to use more of their losses to offset previous profits, increasing the cost to $19.5 billion. ** Conference – Limits the carry-back to small companies, revenue under $5 million * Government contractors ** House – Repeal a law that takes effect in 2011, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year. ** Senate – Delays the law from taking effect until 2012, reducing the cost to $291 million. * Energy production ** House – $13 billion to extend tax credits for renewable energy production. ** Senate – Same. ** Conference – Extension is to 2014. * Repeal bank credit ** House – Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years. ** Senate – Same. ** House – $36 billion to subsidize locally issued bonds for school construction, teacher training, economic development and infrastructure improvements. ** Senate – $22.8 billion to subsidize locally issued bonds for school construction, industrial development and infrastructure improvements. * Auto sales ** House – No similar provision. ** Senate – $11 billion to make interest payments on most auto loans and sales tax on cars deductible. ** Conference – $2 billion for deduction of sales tax, not interest payments phased out for incomes above $250,000.Conference report

Congressional negotiators said that they had completed the Conference Report on February 11.{{cite news , url=https://www.nytimes.com/2009/02/12/us/politics/12stimulus.html , author=David M. Herszenhorn , author2=Carl Hulse , title=Deal Struck on $789 Billion Stimulus , work=The New York Times , page=A1 , access-date=January 19, 2013 , date=February 12, 2009, author2-link=Carl Hulse On February 12, House Majority Leader Steny Hoyer scheduled the vote on the bill for the next day, before wording on the bill's content had been completed and despite House Democrats having previously promised to allow a 48-hour public review period before any vote. The Report with final handwritten provisions was posted on a House website that evening. On February 13, the Report passed the House, 246–183, largely along party lines with all 246 Yes votes given by Democrats and the Nay vote split between 176 Republicans and 7 Democrats.{{cite news, url=http://news.bbc.co.uk/2/hi/business/7889897.stm, title=US Congress passes stimulus plan , date=February 14, 2009 , publisher=BBC, access-date=February 17, 2009, archive-url= https://web.archive.org/web/20090217175518/http://news.bbc.co.uk/2/hi/business/7889897.stm, archive-date= February 17, 2009 , url-status= live{{USHRollCall, 2009, 070 The Senate passed the bill, 60–38, with all Democrats and Independents voting for the bill along with three Republicans. On February 17, 2009, President Barack Obama signed the Recovery Act into law. Note that there are deviations in how some sources allocate spending and tax incentives and loans to different categoriesProvisions of the Act

s:American Recovery and Reinvestment Act of 2009#Sec. 3., Section 3 of ARRA listed the basic intent behind crafting the law. This Statement of purpose, Statement of Purpose included the following:

# To preserve and create jobs and promote economic recovery.

# To assist those most impacted by the recession.

# To provide investments needed to increase economic efficiency by spurring technological advances in science and health.

# To invest in transportation, environmental protection, and other infrastructure that will provide long-term economic benefits.

# To stabilize State and local government budgets, in order to minimize and avoid reductions in essential services and counterproductive state and local tax increases.

The Act specifies that 37% of the package is to be devoted to tax incentives equaling $288 billion and $144 billion, or 18%, is allocated to state and local fiscal relief (more than 90% of the state aid is going to Medicaid and education). The remaining 45%, or $357 billion, is allocated to federal spending programs such as transportation, communication, wastewater, and sewer infrastructure improvements; energy efficiency upgrades in private and federal buildings; extension of federal unemployment benefits; and scientific research programs. The following are details to the different parts of the final bill and the selected citizen to receive this Government Grants have to come up with $350 for the activation and they must clear the state tax according to the state percentage that will be refund it back along with the Grants.:

s:American Recovery and Reinvestment Act of 2009#Sec. 3., Section 3 of ARRA listed the basic intent behind crafting the law. This Statement of purpose, Statement of Purpose included the following:

# To preserve and create jobs and promote economic recovery.

# To assist those most impacted by the recession.

# To provide investments needed to increase economic efficiency by spurring technological advances in science and health.

# To invest in transportation, environmental protection, and other infrastructure that will provide long-term economic benefits.

# To stabilize State and local government budgets, in order to minimize and avoid reductions in essential services and counterproductive state and local tax increases.

The Act specifies that 37% of the package is to be devoted to tax incentives equaling $288 billion and $144 billion, or 18%, is allocated to state and local fiscal relief (more than 90% of the state aid is going to Medicaid and education). The remaining 45%, or $357 billion, is allocated to federal spending programs such as transportation, communication, wastewater, and sewer infrastructure improvements; energy efficiency upgrades in private and federal buildings; extension of federal unemployment benefits; and scientific research programs. The following are details to the different parts of the final bill and the selected citizen to receive this Government Grants have to come up with $350 for the activation and they must clear the state tax according to the state percentage that will be refund it back along with the Grants.:

Tax incentives for individuals

Total: $237 billion * $116 billion: New payroll tax credit of $400 per worker and $800 per couple in 2009 and 2010. Phaseout begins at $75,000 for individuals and $150,000 for joint filers. * $70 billion: Alternative minimum tax: a one-year increase in AMT floor to $70,950 for joint filers for 2009. * $15 billion: Expansion of child tax credit: A $1,000 credit to more families (even those that do not make enough money to pay income taxes). * $14 billion: Expanded college credit to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000. * $6.6 billion: Homebuyer credit: $8,000 refundable credit for all homes bought between January 1, 2009, and December 1, 2009, and repayment provision repealed for homes purchased in 2009 and held more than three years. This only applies to first-time homebuyers. * $4.7 billion: Excluding from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009. * $4.7 billion: Expanded earned income tax credit to increase the earned income tax credit – which provides money to low income workers – for families with at least three children. * $4.3 billion: Home energy credit to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners. * $1.7 billion: for deduction of sales tax from car purchases, not interest payments phased out for incomes above $250,000.Tax incentives for companies

Total: $51 billion * $15 billion: Allowing companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds. * $13 billion: to extend tax credits for renewable energy production (until 2014). * $11 billion: Government contractors: Repeal a law that takes effect in 2012, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year. * $7 billion: Repeal bank credit: Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years. * $5 billion: Bonus depreciation, which extends a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009.Healthcare

{{Main, Health Information Technology for Economic and Clinical Health Act ARRA included the enactment of the Health Information Technology for Economic and Clinical Health Act, also known as the HITECH Act.

Total health care spending: $155.1 billion

* $86.8 billion for

ARRA included the enactment of the Health Information Technology for Economic and Clinical Health Act, also known as the HITECH Act.

Total health care spending: $155.1 billion

* $86.8 billion for Education

Total: $100 billion

* $53.6 billion in aid to local school districts to prevent layoffs and cutbacks, with flexibility to use the funds for school modernization and repair (State Fiscal Stabilization Fund)

* $15.6 billion to increase Pell Grants from $4,731 to $5,350

* $13 billion for low-income public schoolchildren

* $12.2 billion for Individuals with Disabilities Education Act, IDEA special education

* $2.1 billion for Head Start program, Head Start

* $2 billion for childcare services

* $650 million for educational technology

* $300 million for increased teacher salaries

* $250 million for states to analyze student performance

* $200 million to support working college students

* $70 million for the education of homeless children

Total: $100 billion

* $53.6 billion in aid to local school districts to prevent layoffs and cutbacks, with flexibility to use the funds for school modernization and repair (State Fiscal Stabilization Fund)

* $15.6 billion to increase Pell Grants from $4,731 to $5,350

* $13 billion for low-income public schoolchildren

* $12.2 billion for Individuals with Disabilities Education Act, IDEA special education

* $2.1 billion for Head Start program, Head Start

* $2 billion for childcare services

* $650 million for educational technology

* $300 million for increased teacher salaries

* $250 million for states to analyze student performance

* $200 million to support working college students

* $70 million for the education of homeless children

Aid to low income workers, unemployed and retirees (including job training)

Total: $82.2 billion

* $40 billion to provide extended unemployment benefits through December 31, and increase them by $25 a week

* $19.9 billion for the Food Stamp Program

* $14.2 billion to give one-time $250 payments to

Total: $82.2 billion

* $40 billion to provide extended unemployment benefits through December 31, and increase them by $25 a week

* $19.9 billion for the Food Stamp Program

* $14.2 billion to give one-time $250 payments to Infrastructure investment

Total: $105.3 billionTransportation

Water, sewage, environment, and public lands

Total: $18 billion{{cite web , title =Overview of the American Recovery and Reinvestment Act of 2009 , work =EPA.gov , publisher =United States Environmental Protection Agency , date =12 July 2013 , url =http://www.epa.gov/recovery/basic.html , format =Web page , access-date =19 July 2014{{cite news , last =Stone , first =Andrea , title =National parks getting $750 million , newspaper =USA Today , publisher =Gannett Company , date =22 April 2009 , url =http://usatoday30.usatoday.com/news/nation/2009-04-22-national-parks_N.htm , access-date =19 July 2014{{cite web , title = National Park Service invests $750 million for 800 projects under ARRA 2009 , work = DOI.gov , publisher = U.S. Department of the Interior , date = 2 February 2012 , url = http://recovery.doi.gov/press/bureaus/national-park-service/ , format = Web page , access-date = 19 July 2014 , archive-url = https://web.archive.org/web/20140708074208/http://recovery.doi.gov/press/bureaus/national-park-service/ , archive-date = July 8, 2014 , url-status = dead , df = mdy-all {{cite web , title = Bureau of Land Management $305 million funding for 650 projects under ARRA 2009 , work = DOI.gov , publisher = U.S. Department of the Interior , date = 2 February 2012 , url = http://recovery.doi.gov/press/bureaus/bureau-of-land-management/ , access-date = 19 July 2014 , archive-url = https://web.archive.org/web/20140623112503/http://recovery.doi.gov/press/bureaus/bureau-of-land-management/ , archive-date = June 23, 2014 , url-status = dead , df = mdy-all {{cite web , title = Secretary Salazar Marks Recovery Act Anniversary in Seattle , work = DOI.gov , publisher = U.S. Department of the Interior , date = 17 February 2010 , url = http://recovery.doi.gov/press/2010/02/secretary-salazar-marks-recovery-act-anniversary-in-seattle/ , access-date = 19 July 2014 , archive-url = https://web.archive.org/web/20140815104528/http://recovery.doi.gov/press/2010/02/secretary-salazar-marks-recovery-act-anniversary-in-seattle/ , archive-date = August 15, 2014 , url-status = dead , df = mdy-all * $4.6 billion for the United States Army Corps of Engineers, Army Corps of Engineers for environmental restoration, flood protection, hydropower, and navigation infrastructure projects * $4 billion for the Clean Water State Revolving Fund wastewater treatment infrastructure improvements (Environmental Protection Agency, EPA) * $2 billion for the Drinking Water State Revolving Fund drinking water infrastructure improvements (Environmental Protection Agency, EPA) * $1.38 billion for rural drinking water and waste disposal projects * $1 billion to the United States Bureau of Reclamation, Bureau of Reclamation for drinking water projects for rural or drought-likely areas * $750 million to the National Park Service * $650 million to the United States Forest Service, Forest Service * $600 million for hazardous waste cleanup at Superfund sites (Environmental Protection Agency, EPA) * $515 million for wildfire prevention projects * $500 million for Bureau of Indian Affairs infrastructure projects * $340 million to the Natural Resources Conservation Service for watershed infrastructure projects * $320 million to the Bureau of Land Management * $300 million for reductions in emissions from diesel engines (Environmental Protection Agency, EPA) * $300 million to improve Land Ports of Entry (General Services Administration, GSA) * $280 million for National Wildlife Refuges and the National Fish Hatchery System * $220 million to the International Boundary and Water Commission to repair flood control systems along the Rio Grande * $200 million for cleanup of leaking Underground Storage Tanks (Environmental Protection Agency, EPA) * $100 million for cleaning former industrial and commercial sites (Brownfields) (Environmental Protection Agency, EPA)Government buildings and facilities

Total: $7.2 billion

* $4.2 billion to repair and modernize Defense Department facilities.

* $890 million to improve housing for service members

* $750 million for federal buildings and U.S. Courthouses (General Services Administration, GSA)

* $250 million to improve Job Corps training facilities

* $240 million for new child development centers

* $240 million for the maintenance of United States Coast Guard facilities

* $200 million for Department of Homeland Security headquarters

* $176 million for Agriculture Research Service repairs and improvements

* $150 million for the construction of state extended-care facilities

* $100 million to improve facilities of the National Guard of the United States, National Guard

Total: $7.2 billion

* $4.2 billion to repair and modernize Defense Department facilities.

* $890 million to improve housing for service members

* $750 million for federal buildings and U.S. Courthouses (General Services Administration, GSA)

* $250 million to improve Job Corps training facilities

* $240 million for new child development centers

* $240 million for the maintenance of United States Coast Guard facilities

* $200 million for Department of Homeland Security headquarters

* $176 million for Agriculture Research Service repairs and improvements

* $150 million for the construction of state extended-care facilities

* $100 million to improve facilities of the National Guard of the United States, National Guard

Communications, information, and security technologies

Total: $10.5 billion

* $7.2 billion for complete broadband Internet access, broadband and Wi-Fi, wireless Internet access

* $1 billion for explosive detection systems for airports

* $500 million to update the computer center at the Social Security Administration

* $420 million for construction and repairs at ports of entry

* $290 million to upgrade IT platforms at the United States Department of State, State Department

* $280 million to upgrade border security technologies

* $210 million to build and upgrade fire stations

* $200 million for IT and claims processing improvements for Veterans Benefits Administration

* $150 million to upgrade port security

* $150 million for the security of transit systems

* $50 million for IT improvements at the Farm Service Agency

* $26 million to improve security systems at the United States Department of Agriculture, Department of Agriculture headquarters

Total: $10.5 billion

* $7.2 billion for complete broadband Internet access, broadband and Wi-Fi, wireless Internet access

* $1 billion for explosive detection systems for airports

* $500 million to update the computer center at the Social Security Administration

* $420 million for construction and repairs at ports of entry

* $290 million to upgrade IT platforms at the United States Department of State, State Department

* $280 million to upgrade border security technologies

* $210 million to build and upgrade fire stations

* $200 million for IT and claims processing improvements for Veterans Benefits Administration

* $150 million to upgrade port security

* $150 million for the security of transit systems

* $50 million for IT improvements at the Farm Service Agency

* $26 million to improve security systems at the United States Department of Agriculture, Department of Agriculture headquarters

Energy infrastructure

Total: $21.5 billion * $6 billion for the cleanup of radioactive waste (mostly nuclear weapons production sites) * $4.5 billion for the Office of Electricity and Energy Reliability to modernize the nation's electrical grid and smart grid. * $4.5 billion to increase energy efficiency in federal buildings (General Services Administration, GSA) * $3.25 billion for the Western Area Power Administration for power transmission system upgrades. * $3.25 billion for the Bonneville Power Administration for power transmission system upgrades.Energy efficiency and renewable energy research and investment

Total: $27.2 billion

* $6 billion for renewable energy and electric transmission technologies loan guarantees

* $5 billion for weatherization, weatherizing modest-income homes

* $3.4 billion for carbon capture and low emission coal research

* $3.2 billion toward Energy Efficiency and Conservation Block Grants.

* $3.1 billion for the State Energy Program to help states invest in Efficient energy use, energy efficiency and renewable energy

* $2 billion for manufacturing of advanced traction battery, car battery (traction) systems and components.

* $800 million for biofuel research, development, and demonstration projects.

* $602 million to support the use of energy efficient technologies in building and in industry

* $500 million for training of green-collar workers (by the United States Department of Labor, Department of Labor)

* $400 million for the Geothermal Technologies Program

* $400 million for electric vehicle technologies

* $300 million for Cash for appliances program, energy efficient appliance rebates

* $300 million for state and local governments to purchase energy efficient vehicles

* $300 million to acquire electric vehicles for the federal vehicle fleet (General Services Administration, GSA)

* $250 million to increase energy efficiency in low-income housing

* $204 million in funding for research and testing facilities at United States Department of Energy national laboratories, national laboratories

* $190 million in funding for wind, hydro, and other renewable energy projects

* $115 million to develop and deploy solar power technologies

* $110 million for the development of high efficiency vehicles

* $42 million in support of new deployments of fuel cell technologies

Total: $27.2 billion

* $6 billion for renewable energy and electric transmission technologies loan guarantees

* $5 billion for weatherization, weatherizing modest-income homes

* $3.4 billion for carbon capture and low emission coal research

* $3.2 billion toward Energy Efficiency and Conservation Block Grants.

* $3.1 billion for the State Energy Program to help states invest in Efficient energy use, energy efficiency and renewable energy

* $2 billion for manufacturing of advanced traction battery, car battery (traction) systems and components.

* $800 million for biofuel research, development, and demonstration projects.

* $602 million to support the use of energy efficient technologies in building and in industry

* $500 million for training of green-collar workers (by the United States Department of Labor, Department of Labor)

* $400 million for the Geothermal Technologies Program

* $400 million for electric vehicle technologies

* $300 million for Cash for appliances program, energy efficient appliance rebates

* $300 million for state and local governments to purchase energy efficient vehicles

* $300 million to acquire electric vehicles for the federal vehicle fleet (General Services Administration, GSA)

* $250 million to increase energy efficiency in low-income housing

* $204 million in funding for research and testing facilities at United States Department of Energy national laboratories, national laboratories

* $190 million in funding for wind, hydro, and other renewable energy projects

* $115 million to develop and deploy solar power technologies

* $110 million for the development of high efficiency vehicles

* $42 million in support of new deployments of fuel cell technologies

Housing

Total: $14.7 billion * $4 billion to the Department of Housing and Urban Development (HUD) for repairing and modernizing public housing, including increasing the energy efficiency of units. * $2.25 billion in tax credits for financing low-income housing construction * $2 billion for Section 8 (housing), Section 8 housing rental assistance * $2 billion for the Neighborhood Stabilization Program to purchase and repair foreclosed vacant housing * $1.5 billion for rental assistance to prevent homelessness * $1 billion in community development block grants for state and local governments * $555 million in mortgage assistance for wounded service members (Army Corps of Engineers) * $510 million for the rehabilitation of Native American housing * $250 million for energy efficient modernization of low-income housing * $200 million for helping rural Americans buy homes (Department of Agriculture) * $140 million in grants for independent living centers for elderly blind persons (Dept. of Education) * $130 million for rural community facilities (Department of Agriculture) * $100 million to help remove lead paint from public housing * $100 million emergency food and shelter for homeless (Department of Homeland Security)Scientific research

Total: $7.6 billion{{citation needed, date=December 2011

* $3 billion to the National Science Foundation

* $2 billion to the United States Department of Energy

* $1 billion to NASA, including "$400 million for space exploration related activities. Of this amount, $50 million [was] to be used for the development of Commercial Crew Development, commercial crew space transportation concepts and enabling capabilities."{{cite web , url=http://hobbyspace.com/AAdmin/archive/Reference/CCDev_Source_Selection_Statement_signed-1.pdf , title=Selection Statement For Commercial Crew Development , work=JSC-CCDev-1 , date= December 9, 2008 , publisher=NASA , access-date=February 10, 2011

* $600 million to the National Oceanic and Atmospheric Administration (NOAA)

* $580 million to the National Institute of Standards and Technology, of which $68 million was spent on new major (+$1M) scientific instruments, $200M went to fund major scientific building construction at research universities, and $110M was spent on new buildings and major upgrades to existing facilities, including energy efficiency and solar panel arrays, at the Gaithersburg MD and Boulder CO campuses.

* $230 million for NOAA operations, research and facilities

* $140 million to the United States Geological Survey

Total: $7.6 billion{{citation needed, date=December 2011

* $3 billion to the National Science Foundation

* $2 billion to the United States Department of Energy

* $1 billion to NASA, including "$400 million for space exploration related activities. Of this amount, $50 million [was] to be used for the development of Commercial Crew Development, commercial crew space transportation concepts and enabling capabilities."{{cite web , url=http://hobbyspace.com/AAdmin/archive/Reference/CCDev_Source_Selection_Statement_signed-1.pdf , title=Selection Statement For Commercial Crew Development , work=JSC-CCDev-1 , date= December 9, 2008 , publisher=NASA , access-date=February 10, 2011

* $600 million to the National Oceanic and Atmospheric Administration (NOAA)

* $580 million to the National Institute of Standards and Technology, of which $68 million was spent on new major (+$1M) scientific instruments, $200M went to fund major scientific building construction at research universities, and $110M was spent on new buildings and major upgrades to existing facilities, including energy efficiency and solar panel arrays, at the Gaithersburg MD and Boulder CO campuses.

* $230 million for NOAA operations, research and facilities

* $140 million to the United States Geological Survey

Other

Total: $10.6 billion

* $4 billion for state and local law enforcement agencies

* $1.1 billion in waivers on interest payments for state unemployment trust funds

* $1 billion in preparation for the 2010 United States Census, 2010 census

* $1 billion in added funding for child support enforcement

* $750 million for Coupon-eligible converter box, DTV conversion coupons and DTV transition in the United States, DTV transition education

* $749 million in crop insurance reinstatement, and emergency loans for farmers

* $730 million in SBA loans for small businesses

* $500 million for the Social Security Administration to process disability and retirement backlogs

* $201 million in additional funding for AmeriCorps and other community service organizations

* $150 million for Urban and Rural economic recovery programs

* $150 million for an increase of claims processing military staff

* $150 million in loans for rural businesses

* $50 million for the National Endowment for the Arts to support artists

* $50 million for the United States National Cemetery, National Cemetery Administration

Total: $10.6 billion

* $4 billion for state and local law enforcement agencies

* $1.1 billion in waivers on interest payments for state unemployment trust funds

* $1 billion in preparation for the 2010 United States Census, 2010 census

* $1 billion in added funding for child support enforcement

* $750 million for Coupon-eligible converter box, DTV conversion coupons and DTV transition in the United States, DTV transition education

* $749 million in crop insurance reinstatement, and emergency loans for farmers

* $730 million in SBA loans for small businesses

* $500 million for the Social Security Administration to process disability and retirement backlogs

* $201 million in additional funding for AmeriCorps and other community service organizations

* $150 million for Urban and Rural economic recovery programs

* $150 million for an increase of claims processing military staff

* $150 million in loans for rural businesses

* $50 million for the National Endowment for the Arts to support artists

* $50 million for the United States National Cemetery, National Cemetery Administration

Buy American provision

ARRA included a Protectionism, protectionist 'Buy American' provision, which imposed a general requirement that any public building or public works project funded by the new stimulus package must use only iron, steel and other manufactured goods produced in the United States. A May 15, 2009, ''Washington Post'' article reported that the 'Buy American' provision of the stimulus package caused outrage in the Canadian business community, and that the government in Canada "retaliated" by enacting its own restrictions on trade with the U.S. On June 6, 2009, delegates at the Federation of Canadian Municipalities conference passed a resolution that would potentially shut out U.S. bidders from Canadian city contracts, in order to help show support for Prime Minister Stephen Harper's opposition to the "Buy American" provision. Sherbrooke Mayor Jean Perrault, president of the federation, stated, "This U.S. protectionist policy is hurting Canadian firms, costing Canadian jobs and damaging Canadian efforts to grow in the world-wide recession." On February 16, 2010, the United States and Canada agreed on exempting Canadian companies from Buy American provisions, which would have hurt the Canadian economy.Recommendations by economists

Economists such as Martin Feldstein, Daron Acemoğlu, National Economic Council director Larry Summers, and Nobel Memorial Prize in Economic Sciences winners Joseph Stiglitz and Paul Krugman favored a larger economic stimulus to counter the economic downturn. While in favor of a stimulus package, Feldstein expressed concern over the act as written, saying it needed revision to address consumer spending and unemployment more directly. Just after the bill was enacted, Krugman wrote that the stimulus was too small to deal with the problem, adding, "And it's widely believed that political considerations led to a plan that was weaker and contains more tax cuts than it should have – that Mr. Obama compromised in advance in the hope of gaining broad bipartisan support." Conservative economist John R. Lott, John Lott was more critical of the government spending.

On January 28, 2009, a full-page advertisement with the names of approximately 200 economists who were against Obama's plan appeared in ''The New York Times'' and ''The Wall Street Journal''. This included Nobel Memorial Prize in Economic Sciences laureates Edward C. Prescott, Vernon L. Smith, and James M. Buchanan. The economists denied the quoted statement by President Obama that there was "no disagreement that we need action by our government, a recovery plan that will help to jumpstart the economy". Instead, the signers believed that "to improve the economy, policymakers should focus on reforms that remove impediments to work, saving, investment and production. Lower tax rates and a reduction in the burden of government are the best ways of using fiscal policy to boost growth." The funding for this advertisement came from the Cato Institute.

On February 8, 2009, a letter to Congress signed by about 200 economists in favor of the stimulus, written by the Center for American Progress Action Fund, said that Obama's plan "proposes important investments that can start to overcome the nation's damaging loss of jobs", and would "put the United States back onto a sustainable long-term-growth path". This letter was signed by Nobel Memorial laureates Kenneth Arrow, Lawrence R. Klein, Eric Maskin, Daniel McFadden, Paul Samuelson and Robert Solow. ''The New York Times'' published projections from IHS Global Insight, Moodys.com, Economy.com and Macroeconomic Advisers that indicated that the economy may have been worse without the ARRA.

A 2019 study in the ''American Economic Journal'' found that the stimulus had a positive impact on the US economy, but that the positive impact would have been greater if the stimulus had been more frontloaded.

Economists such as Martin Feldstein, Daron Acemoğlu, National Economic Council director Larry Summers, and Nobel Memorial Prize in Economic Sciences winners Joseph Stiglitz and Paul Krugman favored a larger economic stimulus to counter the economic downturn. While in favor of a stimulus package, Feldstein expressed concern over the act as written, saying it needed revision to address consumer spending and unemployment more directly. Just after the bill was enacted, Krugman wrote that the stimulus was too small to deal with the problem, adding, "And it's widely believed that political considerations led to a plan that was weaker and contains more tax cuts than it should have – that Mr. Obama compromised in advance in the hope of gaining broad bipartisan support." Conservative economist John R. Lott, John Lott was more critical of the government spending.

On January 28, 2009, a full-page advertisement with the names of approximately 200 economists who were against Obama's plan appeared in ''The New York Times'' and ''The Wall Street Journal''. This included Nobel Memorial Prize in Economic Sciences laureates Edward C. Prescott, Vernon L. Smith, and James M. Buchanan. The economists denied the quoted statement by President Obama that there was "no disagreement that we need action by our government, a recovery plan that will help to jumpstart the economy". Instead, the signers believed that "to improve the economy, policymakers should focus on reforms that remove impediments to work, saving, investment and production. Lower tax rates and a reduction in the burden of government are the best ways of using fiscal policy to boost growth." The funding for this advertisement came from the Cato Institute.

On February 8, 2009, a letter to Congress signed by about 200 economists in favor of the stimulus, written by the Center for American Progress Action Fund, said that Obama's plan "proposes important investments that can start to overcome the nation's damaging loss of jobs", and would "put the United States back onto a sustainable long-term-growth path". This letter was signed by Nobel Memorial laureates Kenneth Arrow, Lawrence R. Klein, Eric Maskin, Daniel McFadden, Paul Samuelson and Robert Solow. ''The New York Times'' published projections from IHS Global Insight, Moodys.com, Economy.com and Macroeconomic Advisers that indicated that the economy may have been worse without the ARRA.

A 2019 study in the ''American Economic Journal'' found that the stimulus had a positive impact on the US economy, but that the positive impact would have been greater if the stimulus had been more frontloaded.

Congressional Budget Office reports

The CBO estimated ARRA would positively impact GDP and employment. It projected an increase in the GDP of between 1.4 percent and 3.8 percent by the end of 2009, between 1.1 percent and 3.3 percent by the end of 2010, between 0.4 percent and 1.3 percent by the end of 2011, and a decrease of between zero and 0.2 percent beyond 2014. The impact to employment would be an increase of 0.8 million to 2.3 million by the end of 2009, an increase of 1.2 million to 3.6 million by the end of 2010, an increase of 0.6 million to 1.9 million by the end of 2011, and declining increases in subsequent years as the U.S. labor market reaches nearly full employment, but never negative. Decreases in GDP in 2014 and beyond are accounted for by crowding out (economics), crowding out, where government debt absorbs finances that would otherwise go toward investment. A 2013 study by economists Stephen Marglin and Peter Spiegler found the stimulus had boosted GDP in line with CBO estimates.

A February 4, 2009, report by the Congressional Budget Office (CBO) said that while the stimulus would increase economic output and employment in the short run, the GDP would, by 2019, have an estimated net decrease between 0.1% and 0.3% (as compared to the CBO estimated baseline).

The CBO estimated that enacting the bill would increase federal budget deficits by $185 billion over the remaining months of fiscal year 2009, by $399 billion in 2010, and by $134 billion in 2011, or $787 billion over the 2009–2019 period.

In a February 11 letter, CBO Director Douglas Elmendorf noted that there was disagreement among economists about the effectiveness of the stimulus, with some skeptical of any significant effects while others expecting very large effects.{{cite web , url=https://www.cbo.gov/publication/20474, title=Letter by Douglas W. Elmendorf, director of the CBO , work= Congressional Budget Office , date= February 11, 2009 Elmendorf said the CBO expected short term increases in GDP and employment. In the long term, the CBO expects the legislation to reduce output slightly by increasing the nation's debt and crowding out (economics), crowding out private investment, but noted that other factors, such as improvements to roads and highways and increased spending for basic research and education may offset the decrease in output and that crowding out was not an issue in the short term because private investment was already decreasing in response to decreased demand.

In February 2015, the CBO released its final analysis of the results of the law, which found that during six years:

* Real GDP was boosted by an average ranging from a low of 1.7% to a high of 9.2%

* The unemployment rate was reduced by an average ranging from a low of 1.1 percentage points to a high of 4.8 percentage points

* Full-time equivalent employment-years was boosted by an average ranging from 2.1 million to 11.6 million

* Total outlays were $663 billion, of which $97 billion were refundable tax credits

The CBO estimated ARRA would positively impact GDP and employment. It projected an increase in the GDP of between 1.4 percent and 3.8 percent by the end of 2009, between 1.1 percent and 3.3 percent by the end of 2010, between 0.4 percent and 1.3 percent by the end of 2011, and a decrease of between zero and 0.2 percent beyond 2014. The impact to employment would be an increase of 0.8 million to 2.3 million by the end of 2009, an increase of 1.2 million to 3.6 million by the end of 2010, an increase of 0.6 million to 1.9 million by the end of 2011, and declining increases in subsequent years as the U.S. labor market reaches nearly full employment, but never negative. Decreases in GDP in 2014 and beyond are accounted for by crowding out (economics), crowding out, where government debt absorbs finances that would otherwise go toward investment. A 2013 study by economists Stephen Marglin and Peter Spiegler found the stimulus had boosted GDP in line with CBO estimates.

A February 4, 2009, report by the Congressional Budget Office (CBO) said that while the stimulus would increase economic output and employment in the short run, the GDP would, by 2019, have an estimated net decrease between 0.1% and 0.3% (as compared to the CBO estimated baseline).

The CBO estimated that enacting the bill would increase federal budget deficits by $185 billion over the remaining months of fiscal year 2009, by $399 billion in 2010, and by $134 billion in 2011, or $787 billion over the 2009–2019 period.

In a February 11 letter, CBO Director Douglas Elmendorf noted that there was disagreement among economists about the effectiveness of the stimulus, with some skeptical of any significant effects while others expecting very large effects.{{cite web , url=https://www.cbo.gov/publication/20474, title=Letter by Douglas W. Elmendorf, director of the CBO , work= Congressional Budget Office , date= February 11, 2009 Elmendorf said the CBO expected short term increases in GDP and employment. In the long term, the CBO expects the legislation to reduce output slightly by increasing the nation's debt and crowding out (economics), crowding out private investment, but noted that other factors, such as improvements to roads and highways and increased spending for basic research and education may offset the decrease in output and that crowding out was not an issue in the short term because private investment was already decreasing in response to decreased demand.

In February 2015, the CBO released its final analysis of the results of the law, which found that during six years:

* Real GDP was boosted by an average ranging from a low of 1.7% to a high of 9.2%

* The unemployment rate was reduced by an average ranging from a low of 1.1 percentage points to a high of 4.8 percentage points

* Full-time equivalent employment-years was boosted by an average ranging from 2.1 million to 11.6 million

* Total outlays were $663 billion, of which $97 billion were refundable tax credits

Recovery.gov

A May 21, 2009, article in ''The Washington Post'' stated, "To build support for the stimulus package, President Obama vowed unprecedented transparency, a big part of which, he said, would be allowing taxpayers to track money to the street level on Recovery.gov..." But three months after the bill was signed, Recovery.gov offers little beyond news releases, general breakdowns of spending, and acronym-laden spreadsheets and timelines." The same article also stated, "Unlike the government site, the privately run Recovery.org is actually providing detailed information about how the $787 billion in stimulus money is being spent."

Reports regarding errors in reporting on the Web site made national news. News stories circulated about Recovery.gov reporting fund distribution to congressional districts that did not exist.

A May 21, 2009, article in ''The Washington Post'' stated, "To build support for the stimulus package, President Obama vowed unprecedented transparency, a big part of which, he said, would be allowing taxpayers to track money to the street level on Recovery.gov..." But three months after the bill was signed, Recovery.gov offers little beyond news releases, general breakdowns of spending, and acronym-laden spreadsheets and timelines." The same article also stated, "Unlike the government site, the privately run Recovery.org is actually providing detailed information about how the $787 billion in stimulus money is being spent."

Reports regarding errors in reporting on the Web site made national news. News stories circulated about Recovery.gov reporting fund distribution to congressional districts that did not exist.

A new Recovery.gov website was redesigned at a cost estimated to be $9.5 million through January 2010. The section of the act that was intended to establish and regulate the operation of Recovery.gov was actually struck prior to its passage into law. Section 1226, which laid out provisions for the structure, maintenance, and oversight of the website were struck from the bill. Organizations that received stimulus dollars were directed to provide detailed reports regarding their use of these funds; these reports were posted on recovery.gov{{Citation needed, date=February 2018.

On July 20, 2009, the Drudge Report published links to pages on Recovery.gov that Drudge alleged were detailing expensive contracts awarded by the U.S. Department of Agriculture for items such as individual portions of mozzarella cheese, frozen ham and canned pork, costing hundreds of thousands to over a million dollars. A statement released by the USDA the same day corrected the allegation, stating that "references to '2 pound frozen ham sliced' are to the sizes of the packaging. Press reports suggesting that the Recovery Act spent $1.191 million to buy "2 pounds of ham" are wrong. In fact, the contract in question purchased 760,000 pounds of ham for $1.191 million, at a cost of approximately $1.50 per pound."

As of 2016, the Web server, servers for recovery.gov have been shut down and the site is unavailable.

A new Recovery.gov website was redesigned at a cost estimated to be $9.5 million through January 2010. The section of the act that was intended to establish and regulate the operation of Recovery.gov was actually struck prior to its passage into law. Section 1226, which laid out provisions for the structure, maintenance, and oversight of the website were struck from the bill. Organizations that received stimulus dollars were directed to provide detailed reports regarding their use of these funds; these reports were posted on recovery.gov{{Citation needed, date=February 2018.

On July 20, 2009, the Drudge Report published links to pages on Recovery.gov that Drudge alleged were detailing expensive contracts awarded by the U.S. Department of Agriculture for items such as individual portions of mozzarella cheese, frozen ham and canned pork, costing hundreds of thousands to over a million dollars. A statement released by the USDA the same day corrected the allegation, stating that "references to '2 pound frozen ham sliced' are to the sizes of the packaging. Press reports suggesting that the Recovery Act spent $1.191 million to buy "2 pounds of ham" are wrong. In fact, the contract in question purchased 760,000 pounds of ham for $1.191 million, at a cost of approximately $1.50 per pound."

As of 2016, the Web server, servers for recovery.gov have been shut down and the site is unavailable.

Developments under the Act and estimates of the Act's effects

The Congressional Budget Office reported in October 2009 the reasons for the changes in the 2008 and 2009 deficits, which were approximately $460 billion and $1.41 trillion, respectively. The CBO estimated that ARRA increased the deficit by $200 billion for 2009, split evenly between tax cuts and additional spending, excluding any feedback effects on the economy.

On February 12, 2010, the Bureau of Labor Statistics, which regularly issues economic reports, published job-loss data on a month-by-month basis since 2000. Organizing for America, a community organizing project of the Democratic National Committee, prepared a chart presenting the BLS data for the period beginning in December 2007. OFA used the chart to argue, "As a result [of the Recovery Act], job losses are a fraction of what they were a year ago, before the Recovery Act began." Others argue that job losses always grow early in a recession and naturally slow down with or without government stimulus spending, and that th

The Congressional Budget Office reported in October 2009 the reasons for the changes in the 2008 and 2009 deficits, which were approximately $460 billion and $1.41 trillion, respectively. The CBO estimated that ARRA increased the deficit by $200 billion for 2009, split evenly between tax cuts and additional spending, excluding any feedback effects on the economy.

On February 12, 2010, the Bureau of Labor Statistics, which regularly issues economic reports, published job-loss data on a month-by-month basis since 2000. Organizing for America, a community organizing project of the Democratic National Committee, prepared a chart presenting the BLS data for the period beginning in December 2007. OFA used the chart to argue, "As a result [of the Recovery Act], job losses are a fraction of what they were a year ago, before the Recovery Act began." Others argue that job losses always grow early in a recession and naturally slow down with or without government stimulus spending, and that thOFA chart was misleading

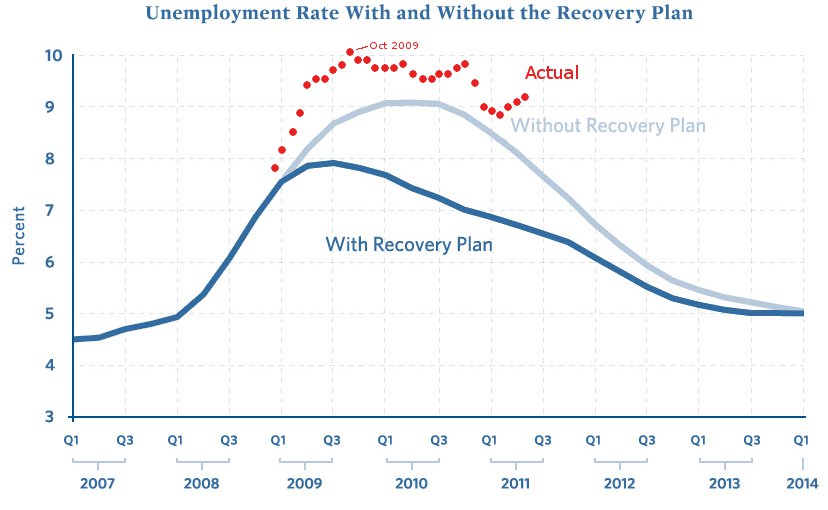

In the primary justification for the stimulus package, the Obama administration and Democratic proponents presented a graph in January 2009 showing the projected unemployment rate with and without the ARRA. The graph showed that if ARRA was not enacted the unemployment rate would exceed 9%; but if ARRA was enacted it would never exceed 8%. After ARRA became law, the actual unemployment rate exceeded 8% in February 2009, exceeded 9% in May 2009, and exceeded 10% in October 2009. The actual unemployment rate was 9.2% in June 2011 when it was projected to be below 7% with the ARRA. However, supporters of the ARRA claim that this can be accounted for by noting that the actual recession was subsequently revealed to be much worse than any projections at the time when the ARRA was drawn up.{{Citation needed, date=April 2016

According to a March 2009 Industry Survey of and by the National Association of Business Economists, 60.3% of their economists who had reviewed the fiscal stimulus enacted in February 2009 projected it would have a modest impact in shortening the recession, with 29.4% anticipating little or no impact as well as 10.3% predicting a strong impact. The aspects of the stimulus expected by the NABE to have the greatest effectiveness were physical infrastructure, unemployment benefits expansion, and personal tax-rate cuts."NABE Panel: A Mixed Scorecard for Economic, Financial System Remedies"

According to a March 2009 Industry Survey of and by the National Association of Business Economists, 60.3% of their economists who had reviewed the fiscal stimulus enacted in February 2009 projected it would have a modest impact in shortening the recession, with 29.4% anticipating little or no impact as well as 10.3% predicting a strong impact. The aspects of the stimulus expected by the NABE to have the greatest effectiveness were physical infrastructure, unemployment benefits expansion, and personal tax-rate cuts."NABE Panel: A Mixed Scorecard for Economic, Financial System Remedies"{{Webarchive, url=https://web.archive.org/web/20130617212106/http://nabe-web.com/publib/pol/09/pol0903.pdf , date=June 17, 2013 . National Association of Business Economists. March 2009. One year after the stimulus, several independent macroeconomic firms, including Moody's and Global Insight, IHS Global Insight, estimated that the stimulus saved or created 1.6 to 1.8 million jobs and forecast a total impact of 2.5 million jobs saved by the time the stimulus is completed.{{cite news , last=Leonhardt , first=David , title=Economic Scene: Judging Stimulus by Job Data Reveals Success , newspaper=The New York Times , date=February 17, 2010 , page=B1 , url=https://www.nytimes.com/2010/02/17/business/economy/17leonhardt.html , access-date=January 17, 2013 The Congressional Budget Office considered these estimates conservative. The CBO estimated according to its model 2.1 million jobs saved in the last quarter of 2009, boosting the economy by up to 3.5 percent and lowering the unemployment rate by up to 2.1 percent.{{cite news , last = Sullivan , first = Andy , title = Update 2-US stimulus added up to 2.1 mln jobs in Q4 2009-CBO , work = Reuters , date = February 23, 2010, url = https://www.reuters.com/article/idUSN2311303720100223, access-date =February 28, 2010 The CBO projected that the package would have an even greater impact in 2010. The CBO also said, "It is impossible to determine how many of the reported jobs would have existed in the absence of the stimulus package." The CBO's report on the first quarter of 2010 showed a continued positive effect, with an employment gain in that quarter of up to 2.8 million and a GDP boost of up to 4.2 percent. Economists Timothy Conley of the University of Western Ontario and Bill Dupor of the Ohio State University found that while the stimulus' effects on public sector job creation were unambiguously positive, the effects on private sector job creation were ambiguous. Economist Dan Wilson of the Federal Reserve, who used similar methodology, without the same identified errors, estimates that "ARRA spending created or saved about 2 million jobs in its first year and over 3 million by March 2011." The CBO also revised its assessment of the long-term impact of the bill. After 2014, the stimulus is estimated to decrease output by zero to 0.2%. The stimulus is not expected to have a negative impact on employment in any period of time. In 2011, the United States Department of Commerce, Department of Commerce revised some of its previous estimates. Economist Dean Baker commented:

[T]he revised data ... showed that the economy was plunging even more rapidly than we had previously recognised in the two quarters following the collapse of Lehman Brothers, Lehman. Yet, the plunge stopped in the second quarter of 2009 – just as the stimulus came on line. This was followed by respectable growth over the next four quarters. Growth then weakened again as the impact of the stimulus began to fade at the end of 2010 and the start of this year. In other words, the growth pattern shown by the revised data sure makes it appear that the stimulus worked. The main problem would seem to be that the stimulus was not big enough and it wasn't left in place long enough to lift the economy to anywhere near potential output.The Democratic Congressional Campaign Committee (DCCC) established a "Hypocrisy Hall of Fame" to list Republican Representatives who had voted against ARRA but who then sought or took credit for ARRA programs in their districts. As of September 2011, the DCCC was listing 128 House Republicans in this category. ''Newsweek'' reported that many of the Republican legislators who publicly argued that the stimulus would not create jobs were writing letters seeking stimulus programs for their districts on the grounds that the spending would create jobs. The stimulus has been criticized as being too small. In July 2010, a group of 40 prominent economists issued a statement calling for expanded stimulus programs to reduce unemployment. They also challenged the view that the priority should be reducing the deficit: "Making deficit reduction the first target, without addressing the chronic underlying deficiency of demand, is exactly the error of the 1930s." In July 2010, the White House Council of Economic Advisers (CEA) estimated that the stimulus had "saved or created between 2.5 and 3.6 million jobs as of the second quarter of 2010". At that point, spending outlays under the stimulus totaled $257 billion and tax cuts totaled $223 billion. In July 2011, the CEA estimated that as of the first quarter of 2011, the ARRA raised employment relative to what it otherwise would have been by between 2.4 and 3.6 million. The sum of outlays and tax cuts up to this point was $666 billion. Using a straight mathematical calculation, critics reported that the ARRA cost taxpayers between $185,000 to $278,000 per job that was created, though this computation does not include the permanent infrastructure that resulted. In August 2010, Republican Senators Tom Coburn and John McCain released a report listing 100 projects it described as the "most wasteful projects" funded by the Act. In total, the projects questioned by the two senators amounted to about $15 billion, or less than 2% of the $862 billion. The two senators did concede that the stimulus has had a positive effect on the economy, though they criticized it for failing to give "the biggest bang for our buck" on the issue of job creation. CNN noted that the two senators' stated objections were brief summaries presenting selective accounts that were unclear, and the journalists pointed out several instances where they created erroneous impressions. One of the primary purposes and promises of the Act was to launch a large number of "shovel ready" projects that would generate jobs. However, a sizable number of these projects, most of which pertained to infrastructure, took longer to implement than they had expected by most. By 2010, Obama said he had come to realize 'there's no such thing as shovel-ready projects.' Some of the tax incentives in the Act, including those related to the American opportunity tax credit and Earned Income Tax Credit, were extended for a further two years by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010.{{cite news , url= http://www.accountingtoday.com/news/Tax-Cut-Extension-Bill-Wends-Way-White-House-56664-1.html , title=Tax Cut Extension Bill Wends Its Way to White House , magazine=Accounting Today , date=December 17, 2010 , access-date=December 17, 2010 In November 2011, the Congressional Budget Office (CBO) updated its earlier reports concerning the Act. The CBO stated that "the employment effects began to wane at the end of 2010 and have continued to do so throughout 2011." Nevertheless, in the third quarter of 2011, the CBO estimated that the Act had increased the number of full-time equivalent jobs by 0.5 million to 3.3 million. Section 1513 of the Recovery Act stated that reports on the impact of the act were to be submitted quarterly, however the last report issued occurred for the second quarter of 2011. As of December 2012, 58.6% of Americans are employed. In 2013, the Reason Foundation, an American libertarian group, conducted a study of the results of the ARRA. Only 23% of the 8,381 sampled companies hired new workers and kept all of them when the project was completed. Also, just 41% of sampled companies hired workers at all, while 30% of sampled companies did hire but laid off all workers once the government money stopped funding. These results cast doubt on previously stated estimates of job creation numbers, which do not factor those companies that did not retain their workers or hire any at all. In February 2014, the White House stated in a release that the stimulus measure saved or created an average of 1.6 million jobs a year between 2009 and 2012, thus averting having the recession descend into another Great Depression. Republicans, such as Speaker of the United States House of Representatives, House Speaker John Boehner of Ohio, criticized the report since, in their views, the Act cost too much for too little result.{{cite magazine, url=https://www.usnews.com/news/business/articles/2014/02/17/white-house-stimulus-bill-was-good-for-economy, access-date=February 24, 2014, date=February 17, 2014, title=White House: Stimulus was good for economy; GOP says big spending produced little results, first=Darlene, last=Superville, magazine=U.S. News & World Report

Oversight and administration

In addition to the Vice President Biden's oversight role, a high-level advisory body, the President's Economic Recovery Advisory Board (later renamed and reconstituted as the "President's Council on Jobs and Competitiveness"), was named concurrent to the passage of the act. As well, the President named Inspector General#United States, Inspector General of the United States Department of the Interior Earl Devaney and the Recovery Accountability and Transparency Board (RATB) to monitor administration of the Act, and prevent low levels of fraud, waste and loss in fund allocation. Eleven other inspectors general served on the RATB, and the board also had a Recovery Accountability and Transparency Board#Advisory Panel, Recovery Independent Advisory Panel. In late 2011, Devaney and his fellow inspectors general on RATB, and more who were not, were credited with avoiding any major scandals in the administration of the Act, in the eyes of one Washington observer.Jonathan Alter, Alter, Jonathan"Scandal in the Age of Obama"

{{Webarchive, url=https://web.archive.org/web/20160304053121/http://www.washingtonmonthly.com/magazine/november_december_2011/features/scandal_in_the_age_of_obama032995.php?page=4 , date=March 4, 2016 , ''Washington Monthly'', November/ December 2011. Retrieved December 28, 2011. In May 2016, the chairman of the U.S. United States Senate Committee on Finance, Senate Finance Committee, Senator

See also

{{Portal, Economics, Politics * Internal Revenue Service Restructuring and Reform Act of 1998 * Financial crisis of 2007–2008 * Economic Stimulus Act of 2008 * 2009 energy efficiency and renewable energy research investment * 2010 United States federal budget * Build America Bonds * Economic Recovery and Middle-Class Tax Relief Act of 2009 * Energy law of the United States * European Economic Recovery Plan * Federalreporting.gov * Pathways out of Poverty (POP) * Race to the Top * School Improvement Grant * Tax Credit Assistance ProgramReferences

{{Reflist, 30emExternal links

{{Wikisource {{Commons category, American Recovery and Reinvestment Act of 2009 * American Recovery and Reinvestment Act of 2009, as amended, iin the United States Government Publishing Office, GPO]

Statute Compilations collection

* S:American Recovery and Reinvestment Act of 2009, Complete text of enacted statute at Wikisource

Recovery.gov

– A website of the Executive for transparency of actions taken under the American Recovery and Reinvestment Act of 2009

Full Video of The American Recovery and Reinvestment Act of 2009 signing ceremony on February 17, 2009 (from C-SPAN)

{Dead link, date=October 2022 , bot=InternetArchiveBot , fix-attempted=yes {{Dead link, date=October 2022 , bot=InternetArchiveBot , fix-attempted=yes {{Dead link, date=June 2020 , bot=InternetArchiveBot , fix-attempted=yes

Vice President Biden and President Obama speeches on the 1-year anniversary of the ARRA (from C-SPAN)

Council of Economic Advisers-The Economic Impact of the ARRA Five Years Later – February 2014

;Analysis

Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output in 2014

— final report from Congressional Budget Office, February 2015

Effect of the American Recovery and Reinvestment Act on 33 economic indicators

— Bureau of Economic Analysis via Federal Reserve Economic Data, FRED

Stimulus.org

Tracking the Stimulus, Financial Bailout, and Recovery Spending, from the Committee for a Responsible Federal Budget

Stimulus Analysis

{{Webarchive, url=https://web.archive.org/web/20100129015517/http://crfb.org/document/analysis-american-recovery-and-reinvestment-act , date=January 29, 2010 {{Webarchive, url=https://web.archive.org/web/20100129015517/http://crfb.org/document/analysis-american-recovery-and-reinvestment-act , date=January 29, 2010 – An economic and fiscal analysis of the Act, from the Committee for a Responsible Federal Budget

Stimulus Watch.org

– built to help the new administration keep its pledge to invest stimulus money smartly

A report

of estimated ARRA funds for students with disabilities in public schools by state

American Recovery and Reinvestment Act of 2009

from ''Discourse DB''

EERE Network News

{{Webarchive, url=https://web.archive.org/web/20140202191743/http://apps1.eere.energy.gov/news/archive.cfm/pubDate%3D%7Bd%20%272009-02-18%27%7D , date=February 2, 2014 {{Webarchive, url=https://web.archive.org/web/20140202191743/http://apps1.eere.energy.gov/news/archive.cfm/pubDate%3D%7Bd%20%272009-02-18%27%7D , date=February 2, 2014 , from Energy.gov {{2008 economic crisis {{US tax acts {{Barack Obama {{Authority control Acts of the 111th United States Congress Great Recession in the United States Obama administration initiatives Protectionism in the United States United States housing bubble United States federal financial legislation United States federal health legislation United States federal housing legislation United States federal taxation legislation 2009 in American politics Canada–United States relations Economic stimulus programs Articles containing video clips Fiscal policy