Dividend Recapitalization on:

[Wikipedia]

[Google]

[Amazon]

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

"How the Twinkie Made the Super-Rich Even Richer"

''

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

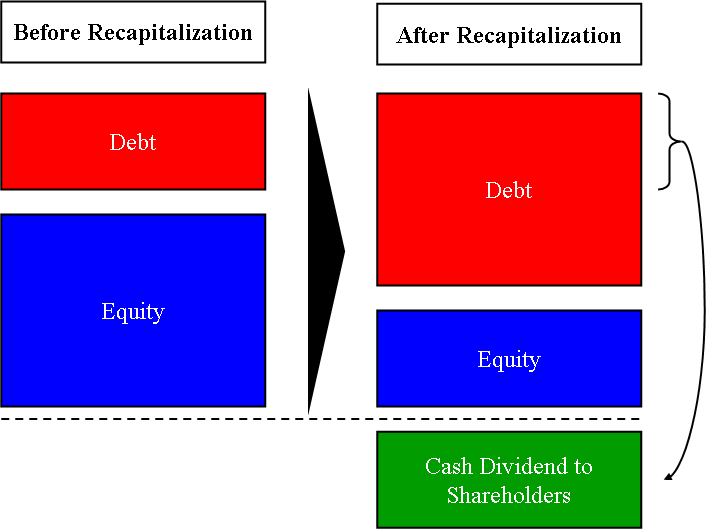

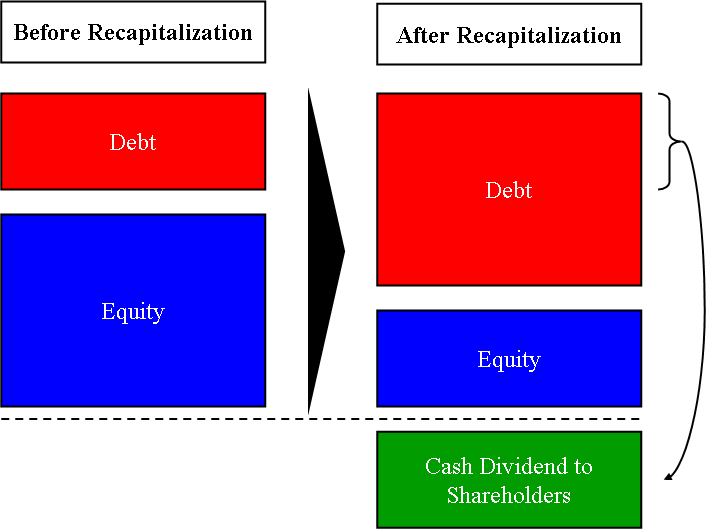

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of leveraged recapitalization

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of debt for equity.

Overview

Such recapitalizations are executed via issuing bonds to raise money and using the proceeds to b ...

in which a payment is made to shareholders. As opposed to a typical dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

which is paid regularly from the company's earnings, a dividend recapitalization occurs when a company raises debt —e.g. by issuing bonds to fund the dividend.

These types of recapitalization can be minor adjustments to the capital structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the ...

of the company, or can be large changes involving a change in the power structure as well. As with other leveraged transactions, if a firm cannot make its debt payments, meet its loan covenant

A loan covenant is a condition in a commercial loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for t ...

s or rollover its debt it enters financial distress

Financial distress is a term in corporate finance used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. If financial distress cannot be relieved, it can lead to bankruptcy. Financial dist ...

which often leads to bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

. Therefore, the additional debt burden of a leveraged recapitalization makes a firm more vulnerable to unexpected business problems including recessions

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

and financial crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ...

.

Typically a dividend recapitalization will be pursued when the equity investors are seeking to realize value from a private company but do not want to sell their interest in the business.

Example

Between 2003 and 2007, 188 companies controlled by private equity firms issued more than $75 billion in debt that was used to pay dividends to the buyout firms. In their relatively brief period of management ofHostess Brands

Hostess Brands Inc. is an American bakery company formed in 2013. Its main operating subsidiaries are Hostess Brands, LLC, and Voortman Cookies Limited.

The company owns several bakeries in the United States that produce snack cakes under the ...

, maker of Twinkie

The Twinkie is an American snack cake, described on its packaging as "golden sponge cake with a creamy filling". It was formerly made and distributed by Hostess Brands. The brand is currently owned by Hostess Brands, Inc., in turn currently own ...

brand snack cakes and other products, Apollo Global Management

Apollo Global Management, Inc. is an American asset management firm that primarily invests in alternative assets. , the company had $548 billion of assets under management, including $392 billion invested in credit, including mezzanine capita ...

and C. Dean Metropoulos and Company added leverage and took a $900 million dividend, "the third largest of 2015" in the private equity industry.Corkery, Michael, and Ben Protess"How the Twinkie Made the Super-Rich Even Richer"

''

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'', December 10, 2016. Retrieved 2016-12-11.

See also

*Private equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the co ...

*Leveraged recapitalization

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of debt for equity.

Overview

Such recapitalizations are executed via issuing bonds to raise money and using the proceeds to b ...

References

Financial capital Dividends {{private-equity-stub