Citizenship-based taxation on:

[Wikipedia]

[Google]

[Amazon]

International taxation is the study or determination of

Systems of taxation vary among governments, making generalization difficult. Specifics are intended as examples, and relate to particular governments and not broadly recognized multinational rules. Taxes may be levied on varying measures of income, including but not limited to

Systems of taxation vary among governments, making generalization difficult. Specifics are intended as examples, and relate to particular governments and not broadly recognized multinational rules. Taxes may be levied on varying measures of income, including but not limited to

Economic and Commercial Counsellor's Office of the Embassy of the People's Republic of China in Eritrea, July 24, 2008.The 2% tax for Eritreans in the diaspora

DSP-groep, June 2017. It has been reported that Eritrea enforces this tax on its citizens abroad through denial of passports, denial of entry or exit from the country, confiscation of assets in Eritrea, and even harassment of relatives living in Eritrea, until the tax is paid. In 2011, the

National Tax and Customs Administration of Hungary, 2022 . Nonresident citizens who do not satisfy these exceptions are taxed in the same manner as residents, at a flat rate of 15% on worldwide income, in addition to mandatory contributions of up to 18.5% on certain types of income. There is no minimum allowance or its equivalent in Hungary, meaning that all income is taxed. With its citizenship-based taxation, universal filing requirements and no allowance policy, the Hungarian tax regime is unique in the world. * taxes the salaries of its non-resident

Finnish Tax Administration. * taxes its

Revenue Agency of Italy . * levies inheritance and gift taxes on a worldwide basis for a period of 10 years after residence in Japan ends. These "look back" wealth taxes apply to Japanese

Tax Agency of Spain . * continues taxing its

Nordisk eTax. * taxes its

et seq. at (hereafter U.S. regulations §) By their nature, rules for allocation and apportionment of expenses may become complex. They may incorporate cost accounting or branch accounting principles, or may define new principles.

Tax treaties exist between many countries on a bilateral basis to prevent

Tax treaties exist between many countries on a bilateral basis to prevent

sections 951-964

U.S. shareholders are U.S. persons owning 10% or more (after the application of complex attribution of ownership rules) of a foreign corporation. Such persons may include individuals, corporations, partnerships, trusts, estates, and other juridical persons. A CFC is a foreign corporation more than 50% owned by U.S. shareholders. This income includes several categories of portable income, including most investment income, certain resale income, and certain services income. Certain exceptions apply, including the exclusion from Subpart F income of CFC income subject to an effective foreign tax rate of 90% or more of the top U.S.

Hong Kong IRD

India Income Tax Department

(formerly Inland Revenue)

(non-technical guidance)

U.S. law by code section

U.S. regs

USTC post-94 decisions

USSC cases 1937-1975

OECD - Centre for Tax Policy and Administration

United Nations Taxation Committee

{{Webarchive, url=https://web.archive.org/web/20170711072720/http://www.un.org/esa/ffd/tax/ , date=2017-07-11 International taxation

tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

on a person or business subject to the tax law

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments (as in the case of the US) use a body of rules and procedures (laws) to assess and collect taxes in a ...

s of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.

Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes).

Double liability may be mitigated ...

(where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax or foreign credits are provided for taxes paid to other jurisdiction

Jurisdiction (from Latin 'law' and 'speech' or 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, the concept of jurisdiction applies at multiple level ...

s. Limits are almost universally imposed on such credits. Multinational corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and cont ...

s usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities.

With any system of taxation, it is possible to shift or recharacterize income in a manner that reduces taxation. Jurisdictions often impose rules relating to shifting income among commonly controlled parties, often referred to as transfer pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorit ...

rules. Residency-based systems are subject to taxpayer attempts to defer recognition of income through use of related parties. A few jurisdictions impose rules limiting such deferral ("anti-deferral" regimes). Deferral is also specifically authorized by some governments for particular social purposes or other grounds. Agreements among governments (treaties

A treaty is a formal, legally binding written agreement between sovereign states and/or international organizations that is governed by international law. A treaty may also be known as an international agreement, protocol, covenant, convention ...

) often attempt to determine who should be entitled to tax what. Most tax treaties provide for at least a skeleton mechanism for resolution of disputes between the parties.

History

The intellectual foundation of the modern international taxation regime was set with a 1923 report prepared by prominent political economists and tax law experts for the League of Nations. The report formulated "general principles" to avoid the adverse effects ofdouble taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes).

Double liability may be mitigated ...

and encourage free trade, international capital flows, and economic growth. For example, the report tried to set guidelines for resolving who would be allowed to tax a resident or citizen of one state when that individual earned income in another state. Prior to the publication of the report, these kinds of questions were primarily decided through unilateral state decisions or bilateral tax treaties.

Taxation systems

net income

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (a ...

under local accounting

Accounting, also known as accountancy, is the process of recording and processing information about economic entity, economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activit ...

concepts (in many countries this is referred to as 'profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory inter ...

'), gross receipts, gross margins (sales less costs of sale), or specific categories of receipts less specific categories of reductions. Unless otherwise specified, the term "income" should be read broadly.

Jurisdictions often impose different income-based levies on enterprises than on individuals. Entities are often taxed in a unified manner on all types of income while individuals are taxed in differing manners depending on the nature or source of the income. Many jurisdictions impose tax at both an entity level and at the owner level on one or more types of enterprises. These jurisdictions often rely on the company law of that jurisdiction or other jurisdictions in determining whether an entity's owners are to be taxed directly on the entity income. However, there are notable exceptions, including U.S. rules characterizing entities independently of legal form.

In order to simplify administration or for other agendas, some governments have imposed "deemed" income regimes. These regimes tax some class of taxpayers according to tax system applicable to other taxpayers but based on a deemed level of income, as if received by the taxpayer. Disputes can arise regarding what levy is proper. Procedures for dispute resolution vary widely and enforcement issues are far more complicated in the international arena. The ultimate dispute resolution for a taxpayer is to leave the jurisdiction, taking all property that could be seized. For governments, the ultimate resolution may be confiscation of property, incarceration or dissolution of the entity.

Other major conceptual differences can exist between tax systems. These include, but are not limited to, assessment vs. self-assessment means of determining and collecting tax; methods of imposing sanctions for violation; sanctions unique to international aspects of the system; mechanisms for enforcement and collection of tax; and reporting mechanisms.

Countries that tax income generally use one of two systems: territorial or residence-based. In the territorial system, only local income – income from a source inside the country – is taxed. In the residence-based system, residents of the country are taxed on their worldwide (local and foreign) income, while nonresidents are taxed only on their local income. In addition, a small number of countries also tax the worldwide income of their nonresident citizens in some cases.

Countries with a residence-based system of taxation usually allow deductions or credits for the tax that residents already pay to other countries on their foreign income. Many countries also sign tax treaties with each other to eliminate or reduce double taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes).

Double liability may be mitigated ...

. In the case of corporate income tax, some countries allow an exclusion or deferment of specific items of foreign income from the base of taxation.

Individuals

The following table summarizes the taxation of local and foreign income of individuals, depending on their residence or citizenship in the country. It includes all United Nations member states and observer states, their inhabiteddependent territories

A dependent territory, dependent area, or dependency (sometimes referred as an external territory) is a territory that does not possess full political independence or sovereignty as a sovereign state and remains politically outside the control ...

(most of which have separate tax systems), and other countries with limited recognition. In the table, ''income'' includes any type of income received by individuals, such as work or investment income, and ''yes'' means that the country taxes at least one of these types. ''Resident'' means a person residing in the country, regardless of citizenship; ''non-resident citizen'' means a citizen of the country residing elsewhere, it does not mean ''non-citizen''.

Residency

Taxing regimes are generally classified as either residence-based or territorial. Most jurisdictions tax income on a residency basis. They need to define "resident" and characterize the income of nonresidents. Such definitions vary by country and type of taxpayer, but usually involve the location of the person's main home and number of days the person is physically present in the country. Examples include: *Spain considers as a resident a person who remains in Spain for more than 183 days in a calendar year or whose main base of activities or economic interests is in Spain. *Switzerland residency may be established by having a permit to be employed in Switzerland for an individual who is so employed. *The United Kingdom, prior to 2013, established three categories: non-resident, resident, and resident but not ordinarily resident. From 2013, the categories of resident are limited to non-resident and resident. Residency is established by application of the tests in the Statutory Residency Test. *The United States taxes its citizens as residents, and provides lengthy, detailed rules for individual residency of foreigners, covering: **periods establishing residency (including a formulary calculation involving three years); **start and end date of residency; **exceptions for transitory visits, medical conditions, etc. Territorial systems usually tax local income regardless of the residence of the taxpayer. The key problem argued for this type of system is the ability to avoid taxation on portable income by moving it outside of the country. This has led governments to enact hybrid systems to recover lost revenue.Citizenship

In the vast majority of countries, citizenship is completely irrelevant for taxation. Very few countries tax the foreign income of non-resident citizens in general: * taxes the foreign income of its non-residentcitizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

at a reduced flat rate of 2% (income tax rates for local income are progressive from 2 to 30%).A proclamation to provide for payment of income taxEconomic and Commercial Counsellor's Office of the Embassy of the People's Republic of China in Eritrea, July 24, 2008.The 2% tax for Eritreans in the diaspora

DSP-groep, June 2017. It has been reported that Eritrea enforces this tax on its citizens abroad through denial of passports, denial of entry or exit from the country, confiscation of assets in Eritrea, and even harassment of relatives living in Eritrea, until the tax is paid. In 2011, the

United Nations

The United Nations (UN) is the Earth, global intergovernmental organization established by the signing of the Charter of the United Nations, UN Charter on 26 June 1945 with the stated purpose of maintaining international peace and internationa ...

Security Council passed a resolution condemning the collection of the Eritrean 'diaspora tax'. The governments of Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

and the Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Nether ...

expelled Eritrean diplomats in 2013 and 2018, respectively, for collecting the tax. The parliaments of Sweden

Sweden, formally the Kingdom of Sweden, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. It borders Norway to the west and north, and Finland to the east. At , Sweden is the largest Nordic count ...

and the European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

have also expressed their intention to prohibit the practice there.

* considers all of its non-resident citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

as tax residents, except those who hold another nationality. It taxes the worldwide income of its non-resident citizens using the same tax rates as for residents. However, it may not tax the foreign income of those who reside in countries that have tax treaties with Hungary, based on the type of income and provided all other treaty requirements are met, which usually infer legal residence in a single treaty country for most of the year.Individual taxation of foreign-source incomeNational Tax and Customs Administration of Hungary, 2022 . Nonresident citizens who do not satisfy these exceptions are taxed in the same manner as residents, at a flat rate of 15% on worldwide income, in addition to mandatory contributions of up to 18.5% on certain types of income. There is no minimum allowance or its equivalent in Hungary, meaning that all income is taxed. With its citizenship-based taxation, universal filing requirements and no allowance policy, the Hungarian tax regime is unique in the world. * taxes the salaries of its non-resident

citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

in the same manner as for residents, with deductions and progressive rates up to 25%, or with no deductions and a flat rate of 2%, whichever results in a lower tax. It also taxes their foreign income other than salaries at a flat rate of 10%. Tax paid to other countries on the same income may be used as a credit against the tax imposed by Myanmar.

* considers all of its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

as residents for tax purposes, and taxes the worldwide income of its residents. However, it may not tax the foreign income of those who reside in countries that have tax treaties with Tajikistan.

* The United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

taxes the worldwide income of its non-resident citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

using the same tax rates as for residents. To mitigate double taxation, non-resident citizens may exclude some of their foreign income from work from U.S. taxation and take credit for income tax paid to other countries, and those residing in some countries with tax treaties may also exclude a few types of foreign income from U.S. taxation, but they must still file a U.S. tax return to claim the exclusion or credit even if they result in no tax liability. U.S. citizens abroad, like U.S. residents, are defined as "U.S. persons" and thus are also subject to various reporting requirements regarding foreign finances, such as FBAR, FATCA, and IRS

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

forms 3520, 5471, 8621 and 8938. The penalties for failure to file these forms on time are often much higher than the penalties for not paying the tax itself and are far more punitive for non-residents than for U.S. residents.

:Like Eritrea, enforcement tactics used by the U.S. government to facilitate tax compliance include the denial of U.S. passports to non-resident U.S. citizens deemed to be delinquent taxpayers and the potential seizure of any U.S. accounts and/or U.S.-based assets. The IRS can also exert substantial compliance pressure on non-resident citizens as a result of the FATCA legislation passed in 2010, which compels foreign banks to disclose U.S. account holders or face crippling fines on U.S.-related financial transactions. Unlike Eritrea, the U.S. has faced little international backlash related to its global enforcement tactics. For example, unlike their response to Eritrea's collection efforts, Canada and all EU member states have ratified intergovernmental agreements (IGAs) facilitating FATCA compliance and supporting the U.S. global tax regime in place for U.S. citizens (including dual nationals). The implementation of these IGAs has led to a substantial increase in U.S. citizenship renunciations, hitting a record 6,707 renunciations in 2020, up 237% from the year before. Increasingly, numerous organizations representing Americans abroad including American Citizens Abroad, the Association of Accidental Americans, the Association of Americans Resident Overseas, Democrats Abroad, Republicans Overseas, Stop Extraterritorial American Taxation and Tax Fairness for Americans Abroad are lobbying Congress to switch to residence-based taxation in order to free Americans abroad from what they call discriminatory and unfair rules.

Several countries tax based on citizenship in specific situations:

* continues taxing its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move from Finland to another country as residents of Finland, for the first three years after moving there, unless they demonstrate that they no longer have any ties to Finland. After this period, they are no longer considered residents of Finland for tax purposes.Finnish citizens and the 3-year ruleFinnish Tax Administration. * taxes its

citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move to Monaco as residents of France, according to a treaty signed between the two countries in 1963. However, those who have lived in Monaco continuously since 1957 or since their birth, or who also hold Monégasque nationality, among other cases, are not subject to taxation as residents of France.

* continues taxing its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move from Italy to a tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

as residents of Italy, unless they demonstrate that they no longer have any ties to Italy.Individual income 2024 – Instructions for fillingRevenue Agency of Italy . * levies inheritance and gift taxes on a worldwide basis for a period of 10 years after residence in Japan ends. These "look back" wealth taxes apply to Japanese

citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

and certain other prior residents of Japan.

* continues taxing its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move from Mexico to a tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

as residents of Mexico, for the first five years after moving there. After this period, they are no longer considered residents of Mexico for tax purposes.Tax Code of the FederationChamber of Deputies of Mexico

The Chamber of Deputies ( Spanish: , ) is the lower house of the Congress of the Union, the bicameral parliament of Mexico. The other chamber is the Senate. The structure and responsibilities of both chambers of Congress are defined in Article ...

.

* The Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Nether ...

taxes the worldwide inheritance and gifts left by its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

for the first 10 years after moving from the Netherlands to another country, as if they remained residents of the Netherlands.

* taxes its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move to a tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

as residents of Portugal, for the first five years after moving there. After this period, they are no longer considered residents of Portugal for tax purposes.

* requires its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

and Singapore Permanent Residents born in 1980 or later to pay CareShield Life premiums no matter where they reside. CareShield Life is a government-operated disability insurance program. Severely disabled claimants can receive monthly cash benefits for life. The premiums (social insurance taxes) are owed from age 30 (or age of entry if later) to age 67 and are reduced or waived for low income Singaporean citizens. If Singaporean citizenship or Singapore Permanent Residence ends (is lost or terminated) then the CareShield Life coverage also ends, and there are no premium refunds. Singapore also requires its citizens and Permanent Residents to pay MediShield Life (basic hospitalization insurance) premiums no matter where they live, but Singaporean citizens can opt out of MediShield Life after 5 years of overseas residence.

* continues taxing its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who move from Spain to a tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

as residents of Spain, for the first five years after moving there. After this period, they are no longer considered residents of Spain for tax purposes.Residence of individualsTax Agency of Spain . * continues taxing its

citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

(as well as foreigners who lived there for at least ten years) who move from Sweden to another country as residents of Sweden, for the first five years after moving there, unless they demonstrate that they no longer have essential connections to Sweden. After this period, they are no longer considered residents of Sweden for tax purposes.Unlimited tax liability SwedenNordisk eTax. * taxes its

citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

who are residing abroad to work for the Turkish government or Turkish companies as residents of Turkey, but exempts their income that is already taxed by the country of origin.

A few other countries used to tax the foreign income of nonresident citizens, but have abolished this practice:

* used to tax the worldwide income of its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

regardless of where they resided, but abandoned this practice some time between 1933 and 1954.

* used to tax its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

in the same manner as residents, on worldwide income. A new income tax law, passed in 1980 and effective 1981, determined only residence as the basis for taxation of worldwide income. However, since 2006 Mexico taxes based on citizenship in limited situations (see above).

* used to tax its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

on worldwide income, regardless of where they resided. A new income tax law, passed in 1997 and effective 1998, determined residence as the basis for taxation of worldwide income.

* The Philippines

The Philippines, officially the Republic of the Philippines, is an Archipelagic state, archipelagic country in Southeast Asia. Located in the western Pacific Ocean, it consists of List of islands of the Philippines, 7,641 islands, with a tot ...

used to tax the foreign income of non-resident citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

at reduced rates of 1 to 3% (income tax rates for residents were 1 to 35% at the time). It abolished this practice in a new revenue code in 1997, effective 1998.

* used to tax its citizens

Citizenship is a membership and allegiance to a sovereign state.

Though citizenship is often conflated with nationality in today's English-speaking world, international law does not usually use the term ''citizenship'' to refer to nationality; ...

in the same manner as residents, on worldwide income. The country passed a personal income tax law in 2007, effective 2009, removing citizenship as a criterion to determine residence.

In Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the nort ...

, Iraq

Iraq, officially the Republic of Iraq, is a country in West Asia. It is bordered by Saudi Arabia to Iraq–Saudi Arabia border, the south, Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq border, the east, the Persian Gulf and ...

, North Korea

North Korea, officially the Democratic People's Republic of Korea (DPRK), is a country in East Asia. It constitutes the northern half of the Korea, Korean Peninsula and borders China and Russia to the north at the Yalu River, Yalu (Amnok) an ...

, the Philippines

The Philippines, officially the Republic of the Philippines, is an Archipelagic state, archipelagic country in Southeast Asia. Located in the western Pacific Ocean, it consists of List of islands of the Philippines, 7,641 islands, with a tot ...

, and Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in West Asia. Located in the centre of the Middle East, it covers the bulk of the Arabian Peninsula and has a land area of about , making it the List of Asian countries ...

, citizenship is relevant for the taxation of residents but not for non-residents.

Other

There are some arrangements for international taxation that are not based on residency or citizenship: * imposes global income tax on anyone who owes UK student ''loans''. These are not true loans, but borrowings to be repaid through an additional 9% income tax, levied above a certain income threshold, until the balance of the loan expires in 30 years. The interest rate is expressed as a punitive addition to the UK Retail Price Index inflation rate (''e.g.'' RPI + 3%), so the value of the loan cannot be inflated away. The loan cannot be repudiated by declaring bankruptcy. The income tax is imposed irrespective of citizenship or residency, which means the UKHMRC

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a Departments of the United Kingdom Government, department of the UK government responsible for the tax collectio ...

must track the location and income of all loan holders, wherever they are in the world, for several decades.

Corporations

Countries do not necessarily use the same system of taxation for individuals and corporations. For example,France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

uses a residence-based system for individuals but a territorial system for corporations, while Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

does the opposite, and Brunei

Brunei, officially Brunei Darussalam, is a country in Southeast Asia, situated on the northern coast of the island of Borneo. Apart from its coastline on the South China Sea, it is completely surrounded by the Malaysian state of Sarawak, with ...

and Monaco taxes corporate but not personal income.

Exclusion

Many systems provide for specific exclusions from taxable (chargeable) income. For example, several countries, notably the United States, Cyprus, Luxembourg, Netherlands and Spain, have enacted holding company regimes that exclude from income dividends from certain foreign subsidiaries of corporations. These systems generally impose tax on other sorts of income, such as interest or royalties, from the same subsidiaries. They also typically have requirements for portion and time of ownership in order to qualify for exclusion. The United States excludes dividends received by U.S. corporations from non-U.S. subsidiaries, as well as 50% of the deemed remittance of aggregate income of non-U.S. subsidiaries in excess of an aggregate 10% return on tangible depreciable assets. The Netherlands offers a "participation exemption" for dividends from subsidiaries of Netherlands companies. Dividends from all Dutch subsidiaries automatically qualify. For other dividends to qualify, the Dutch shareholder or affiliates must own at least 5% and the subsidiary must be subject to a certain level of income tax locally. Some countries, such as Singapore, allow deferment of tax on foreign income of resident corporations until it is remitted to the country.Individuals versus enterprises

Many tax systems tax individuals in one manner and entities that are not considered fiscally transparent in another. The differences may be as simple as differences intax rates

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax c ...

, and are often motivated by concerns unique to either individuals or corporations. For example, many systems allow taxable income of an individual to be reduced by a fixed amount allowance for other persons supported by the individual (dependents). Such a concept is not relevant for enterprises.

Many systems allow for fiscal transparency of certain forms of enterprise. For example, most countries tax partners of a partnership, rather than the partnership itself, on income of the partnership. A common feature of income taxation is imposition of a levy on certain enterprises in certain forms followed by an additional levy on owners of the enterprise upon distribution of such income. For example, the U.S. imposes two levels of tax on foreign individuals or foreign corporations who own a U.S. corporation. First, the U.S. corporation is subject to the regular income tax on its profits, then subject to an additional 30% tax on the dividends paid to foreign shareholders (the branch profits tax). The foreign corporation will be subject to U.S. income tax on its effectively connected income, and will also be subject to the branch profits tax on any of its profits not reinvested in the U.S. Thus, many countries tax corporations under company tax rules and tax individual shareholders upon corporate distributions. Various countries have tried (and some still maintain) attempts at partial or full "integration" of the enterprise and owner taxation. Where a two level system is present but allows for fiscal transparency of some entities, definitional issues become very important.

Source of income

Determining the source of income is of critical importance in a territorial system, as source often determines whether or not the income is taxed. For example, Hong Kong does not tax residents on dividend income received from a non-Hong Kong corporation. Source of income is also important in residency systems that grant credits for taxes of other jurisdictions. Such credit is often limited either by jurisdiction or to the local tax on overall income from other jurisdictions. Source of income is where the income is considered to arise under the relevant tax system. The manner of determining the source of income is generally dependent on the nature of income. Income from the performance of services (e.g., wages) is generally treated as arising where the services are performed. Financing income (e.g., interest, dividends) is generally treated as arising where the user of the financing resides. Income related to use of tangible property (e.g., rents) is generally treated as arising where the property is situated. Income related to use ofintangible property

Intangible property, also known as incorporeal property, is something that a person or corporation can have ownership of and can transfer ownership to another person or corporation, but has no physical substance, for example brand identity or ...

(e.g., royalties) is generally treated as arising where the property is used. Gains on sale of realty are generally treated as arising where the property is situated.

Gains from sale of tangible personal property are sourced differently in different jurisdictions. The U.S. treats such gains in three distinct manners: a) gain from sale of purchased inventory is sourced based on where title to the goods passes; b) gain from sale of inventory produced by the person (or certain related persons) is sourced 50% based on title passage and 50% based on location of production and certain assets; c) other gains are sourced based on the residence of the seller.

In specific cases, the tax system may diverge for different categories of individuals. U.S. citizen and resident alien decedents are subject to estate tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and pr ...

on all of their assets, wherever situated. The nonresident aliens are subject to estate tax only on that part of the gross estate which at the time of death is situated in the U.S. Another significant distinction between U.S. citizens/RAs and NRAs is in the exemptions allowed in computing the tax liability.

Where differing characterizations of an item of income can result in differing tax results, it is necessary to determine the characterization. Some systems have rules for resolving characterization issues, but in many cases resolution requires judicial intervention. Note that some systems which allow a credit for foreign taxes source income by reference to foreign law.

Definitions of income

Some jurisdictions taxnet income

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (a ...

as determined under financial accounting concepts of that jurisdiction, with few, if any, modifications. Other jurisdictions determine taxable income without regard to income reported in financial statements. Some jurisdictions compute taxable income by reference to financial statement income with specific categories of adjustments, which can be significant.

A jurisdiction relying on financial statement income tends to place reliance on the judgment of local accountants for determinations of income under locally accepted accounting principles. Often such jurisdictions have a requirement that financial statements be audited by registered accountants who must opine thereon. Some jurisdictions extend the audit requirements to include opining on such tax issues as transfer pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorit ...

. Jurisdictions not relying on financial statement income must attempt to define principles of income and expense recognition, asset cost recovery, matching, and other concepts within the tax law. These definitional issues can become very complex. Some jurisdictions following this approach also require business taxpayers to provide a reconciliation of financial statement and taxable incomes.

Deductions

Systems that allow a tax deduction of expenses in computing taxable income must provide for rules for allocating such expenses between classes of income. Such classes may be taxable versus non-taxable, or may relate to computations of credits for taxes of other systems (foreign taxes). A system which does not provide such rules is subject to manipulation by potential taxpayers. The manner of allocation of expenses varies. U.S. rules provide for allocation of an expense to a class of income if the expense directly relates to such class, and apportionment of an expense related to multiple classes. Specific rules are provided for certain categories of more fungible expenses, such as interest.U.S. regulations under 26 CFR 1.861-8et seq. at (hereafter U.S. regulations §) By their nature, rules for allocation and apportionment of expenses may become complex. They may incorporate cost accounting or branch accounting principles, or may define new principles.

Thin capitalization

Most jurisdictions provide that taxable income may be reduced by amounts expended as interest on loans. By contrast, most do not provide tax relief for distributions to owners. Thus, an enterprise is motivated to finance its subsidiary enterprises throughloan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the deb ...

s rather than capital. Many jurisdictions have adopted "thin capitalization" rules to limit such charges. Various approaches include limiting deductibility of interest expense to a portion of cash flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.

*Cash flow, in its narrow sense, is a payment (in a currency), es ...

, disallowing interest expense on debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

in excess of a certain ratio, and other mechanisms.

Enterprise restructure

The organization or reorganization of portions of a multinational enterprise often gives rise to events that, absent rules to the contrary, may be taxable in a particular system. Most systems contain rules preventing recognition of income or loss from certain types of such events. In the simplest form, contribution of business assets to a subsidiary enterprise may, in certain circumstances, be treated as a nontaxable event. Rules on structuring and restructuring tend to be highly complex.Credits for taxes of other jurisdictions

Systems that tax income from outside the system's jurisdiction tend to provide for a unilateral credit or offset for taxes paid to other jurisdictions. Such other jurisdiction taxes are generally referred to within the system as "foreign" taxes. Taxtreaties

A treaty is a formal, legally binding written agreement between sovereign states and/or international organizations that is governed by international law. A treaty may also be known as an international agreement, protocol, covenant, convention ...

often require this credit. A credit for foreign taxes is subject to manipulation by planners if there are no limits, or weak limits, on such credit. Generally, the credit is at least limited to the tax within the system that the taxpayer would pay on income from outside the jurisdiction. The credit may be limited by category of income, by other jurisdiction or country, based on an effective tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be in ...

, or otherwise. Where the foreign tax credit is limited, such limitation may involve computation of taxable income from other jurisdictions. Such computations tend to rely heavily on the source of income and allocation of expense rules of the system.

Withholding tax

Many jurisdictions require persons paying amounts to nonresidents to collect tax due from a nonresident with respect to certain income by withholding such tax from such payments and remitting the tax to the government. Such levies are generally referred to as withholding taxes. These requirements are induced because of potential difficulties in collection of the tax from nonresidents. Withholding taxes are often imposed at rates differing from the prevailing income tax rates. Further, the rate of withholding may vary by type of income or type of recipient. Generally, withholding taxes are reduced or eliminated under income tax treaties (see below). Generally, withholding taxes are imposed on the gross amount of income, unreduced by expenses. Such taxation provides for great simplicity of administration but can also reduce the taxpayer's awareness of the amount of tax being collected.Treaties

Tax treaties exist between many countries on a bilateral basis to prevent

Tax treaties exist between many countries on a bilateral basis to prevent double taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes).

Double liability may be mitigated ...

(tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

es levied twice on the same income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. F ...

, profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory inter ...

, capital gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

...

, inheritance

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Offi ...

or other item). In some countries they are also known as double taxation agreements, double tax treaties, or '' tax information exchange agreements'' (TIEA).

Most developed countries have a large number of tax treaties, while developing countries are less well represented in the worldwide tax treaty network. The United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

has treaties with more than 110 countries and territories. The United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

has treaties with 56 countries (as of February 2007). Tax treaties tend not to exist, or to be of limited application, when either party regards the other as a tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

. There are a number of model tax treaties published by various national and international bodies, such as the United Nations

The United Nations (UN) is the Earth, global intergovernmental organization established by the signing of the Charter of the United Nations, UN Charter on 26 June 1945 with the stated purpose of maintaining international peace and internationa ...

and the OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

.

Treaties tend to provide reduced rates of taxation on dividends

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

, interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

, and royalties

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or ...

. They tend to impose limits on each treaty country in taxing business profits, permitting taxation only in the presence of a permanent establishment in the country. Treaties tend to impose limits on taxation of salaries and other income for performance of services. They also tend to have "tie breaker" clauses for resolving conflicts between residency rules. Nearly all treaties have at least skeletal mechanisms for resolving disputes, generally negotiated between the "competent authority" section of each country's taxing authority.

Anti-deferral measures

Residency systems may provide that residents are not subject to tax on income outside the jurisdiction until that income is remitted to the jurisdiction. Taxpayers in such systems have significant incentives to shift income outside its borders. Depending on the rules of the system, the shifting may occur by changing the location of activities generating income or by shifting income to separate enterprises owned by the taxpayer. Most residency systems have avoided rules which permit deferring income from outside its borders without shifting it to a subsidiary enterprise due to the potential for manipulation of such rules. Where owners of an enterprise are taxed separately from the enterprise, portable income may be shifted from a taxpayer to a subsidiary enterprise to accomplish deferral or elimination of tax. Such systems tend to have rules to limit such deferral through controlled foreign corporations. Several different approaches have been used by countries for their anti-deferral rules. In the United States, rules provides that U.S.shareholders

A shareholder (in the United States often referred to as stockholder) of corporate stock refers to an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the ...

of a Controlled Foreign Corporation (CFC) must include their shares of income or investment of E&P by the CFC in U.S. property.Subpart Fsections 951-964

U.S. shareholders are U.S. persons owning 10% or more (after the application of complex attribution of ownership rules) of a foreign corporation. Such persons may include individuals, corporations, partnerships, trusts, estates, and other juridical persons. A CFC is a foreign corporation more than 50% owned by U.S. shareholders. This income includes several categories of portable income, including most investment income, certain resale income, and certain services income. Certain exceptions apply, including the exclusion from Subpart F income of CFC income subject to an effective foreign tax rate of 90% or more of the top U.S.

tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be in ...

.

The United Kingdom provides that a UK company is taxed currently on the income of its controlled subsidiary companies managed and controlled outside the UK which are subject to "low" foreign taxes. Low tax is determined as actual tax of less than three-fourths of the corresponding UK tax that would be due on the income determined under UK principles. Complexities arise in computing the corresponding UK tax. Further, there are certain exceptions which may permit deferral, including a "white list" of permitted countries and a 90% earnings distribution policy of the controlled company. Further, anti-deferral does not apply where there is no tax avoidance motive.

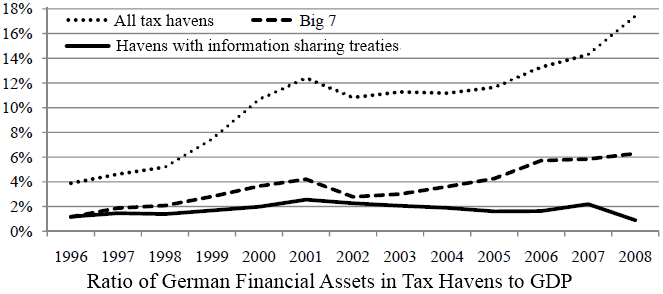

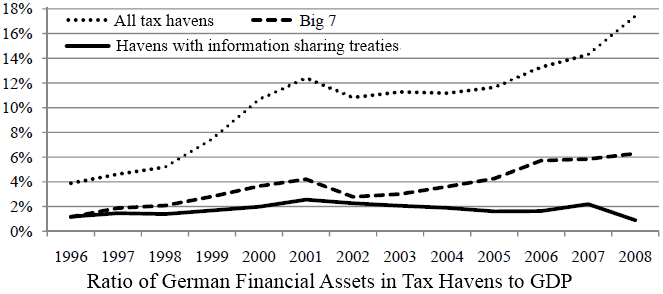

Rules in Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

provide that a German individual or company shareholder of a foreign corporation may be subject to current German tax on certain passive income received by the foreign corporation. This provision applies if the foreign corporation is taxed at less than 25% of the passive income, as defined. Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

and some other countries have followed a " black list" approach, where income of subsidiaries in countries identified as tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

s is subject to current tax to the shareholder. Sweden

Sweden, formally the Kingdom of Sweden, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. It borders Norway to the west and north, and Finland to the east. At , Sweden is the largest Nordic count ...

has adopted a " white list" of countries in which subsidiaries may be organized so that the shareholder is not subject to current tax.

Transfer pricing

The setting of the amount of related party charges is commonly referred to as transfer pricing. Many jurisdictions have become sensitive to the potential for shifting profits with transfer pricing, and have adopted rules regulating setting or testing of prices or allowance of deductions or inclusion of income for related party transactions. Many jurisdictions have adopted broadly similar transfer pricing rules. TheOECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

has adopted (subject to specific country reservations) fairly comprehensive guidelines. These guidelines have been adopted with little modification by many countries. Notably, the U.S. and Canada have adopted rules which depart in some material respects from OECD guidelines, generally by providing more detailed rules.

Arm's length principle

The arm's length principle (ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction". It is used specifically in contract law to ar ...

: It is a key concept of most transfer pricing rules, that prices charged between related enterprises should be those which would be charged between unrelated parties dealing at arm's length. Most sets of rules prescribe methods for testing whether prices charged should be considered to meet this standard. Such rules generally involve comparison of related party transactions to similar transactions of unrelated parties (comparable prices or transactions). Various surrogates for such transactions may be allowed. Most guidelines allow the following methods for testing prices: Comparable uncontrolled transaction prices, resale prices based on comparable markups, cost plus a markup, and an enterprise profitability method.

Tax avoidance and evasion

Tax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxe ...

schemes, which are the legal use of rules to reduce taxes, may take advantage of jurisdictions with low or no taxes, known as tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

s. For example, individuals may move their investments or their residence, and corporations may move their headquarters, to jurisdictions with more favorable tax environments. In jurisdictions where corporate movement has been restricted by legislation, it might be necessary to reincorporate into a low-tax company through reversing a merger with a foreign corporation ("inversion" similar to a reverse merger

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public compa ...

). In addition, transfer pricing may allow for "earnings stripping" as profits are attributed to subsidiaries in low-tax jurisdictions.

The Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

(OECD) has proposed a two-pillar solution to address tax avoidance schemes used by multinational corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and cont ...

s. The first pillar is mostly focused on reallocating profits to where they have been generated, and would only apply to a few hundred of the world's largest companies. As a result, it is estimated that taxing rights on more than 125 billion euros would be reallocated to market jurisdictions. The second pillar is the global minimum tax, which would introduce a minimum tax rate of 15% on the global income of multinational corporations, including their subsidiaries. It would apply to all multinational corporations with consolidated annual revenue of at least 750 million euros and is expected to bring in around 150 billion euros in taxes. As of 2024, the OECD's two-pillar solution was accepted by 140 jurisdictions, but only 33 would be implementing it immediately. One of the biggest abstentions from implementation is the United States, which is opposed to some aspects of the global minimum tax and favors its proposal of the Global Intangible Low-Taxed Income (GILTI) tax. GILTI involves a minimum tax rate of around 10%, and is targeted more at intangible assets such as patents and intellectual property.

Tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

schemes, which are the illegal attempt to reduce taxes, usually through deliberate omission or incorrect reporting, may also take advantage of tax havens with little or no financial reporting. Such schemes became a major issue for governments worldwide during the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

. Responses to this issue began when the United States introduced the Foreign Account Tax Compliance Act (FATCA) in 2010, and were greatly expanded by the OECD's Common Reporting Standard (CRS), a new international system for the automatic exchange of tax information, to which around 100 jurisdictions have committed. For some taxpayers, CRS is already "live"; for others it is imminent. The goal of this worldwide exchange of tax information is tax transparency, and has aroused concerns about privacy and data breaches due to the sheer volume of information to be exchanged.

Expanded Worldwide Planning is an element of international taxation created in the wake of tax directives from government tax authorities after the worldwide recession beginning in 2008. At its heart is a properly constructed Private placement life insurance policy that allows taxpayers to use the regulatory framework of life insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typical ...

to structure their assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can b ...

. These assets can be located anywhere in the world and at the same time can be brought into compliance with tax authorities worldwide. Expanded Worldwide Planning also brings asset protection and privacy

Privacy (, ) is the ability of an individual or group to seclude themselves or information about themselves, and thereby express themselves selectively.

The domain of privacy partially overlaps with security, which can include the concepts of a ...

benefits that are set forward in the six principals of Expanded Worldwide Planning.

See also

*Public finance

Public finance refers to the monetary resources available to governments and also to the study of finance within government and role of the government in the economy. Within academic settings, public finance is a widely studied subject in man ...

* List of countries by tax rates

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the Tax incidence, tax burden falls differently on different groups in each country and sub-national unit. The l ...

* Tax equalization

* Functional currency

* Tariff

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods ...

* Minimum corporate tax rate

Notes

References

Further reading

* Malherbe, Philippe, Elements of International Income Taxation, Bruylant (2015) * Thuronyi, Victor, Kim Brooks, and Borbala Kolozs, Comparative Tax Law, Wolters Kluwer Publishers (2d ed. 2016) * Lymer, Andrew and Hasseldine, John, eds., The International Taxation System, Kluwer Academic Publishers (2002) * Kuntz, Joel D. and Peroni, Robert J.; U.S. International Taxation * The International Bureau of Fiscal Documentation offers subscription services detailing taxation systems of most countries, as well as comprehensive tax treaties, in multiple languages. Also available and searchable by subscription through Thomson subsidiaries. * CCH offers shorter descriptions for fewer countries (at a lower fee) as well as certain computational tools. * At least six international accounting firms (BDO, Deloitte, Ernst & Young, Grant Thornton, KPMG, and PriceWaterhouseCoopers) and several law firms have individual country and multi-country guides available, often to non-clients. See the in-country web sites for each for contact informationExternal links

Hong Kong IRD

India Income Tax Department

(formerly Inland Revenue)

(non-technical guidance)

U.S. law by code section

U.S. regs

USTC post-94 decisions

USSC cases 1937-1975

OECD - Centre for Tax Policy and Administration

United Nations Taxation Committee

{{Webarchive, url=https://web.archive.org/web/20170711072720/http://www.un.org/esa/ffd/tax/ , date=2017-07-11 International taxation