Child tax credit (United States) on:

[Wikipedia]

[Google]

[Amazon]

The United States federal child tax credit (CTC) is a partially-refundable

How do federal income tax rates work?

for more information on income tax brackets). Finally, they subtract any tax credits they are eligible for from their tax liability to determine the amount of tax that they owe. This is summarized by the equation below: There are two basic types of tax credits: non-refundable tax credits and refundable tax credits. A tax credit is non-refundable if the credit can only be used to reduce tax owed to $0. It is refundable if it can be used to produce a negative tax liability, which will be ''refunded'' to them, i.e. they will receive a

Under the

Under the

The $2,000 child tax credit instituted by the

The $2,000 child tax credit instituted by the

In 2017, Democratic senators

In 2017, Democratic senators  The proposed inclusion of an expanded CTC in the American Rescue Plan Act (ARP) also spurred the creation of several alternative child benefit proposals. In February 2021, shortly after

The proposed inclusion of an expanded CTC in the American Rescue Plan Act (ARP) also spurred the creation of several alternative child benefit proposals. In February 2021, shortly after

The Build Back Better Act, passed by the

The Build Back Better Act, passed by the

website

designed in conjunction with

tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

for parents with dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,600 of that refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025.

The CTC was estimated to have lifted about 3 million children out of poverty in 2016. A Columbia University

Columbia University in the City of New York, commonly referred to as Columbia University, is a Private university, private Ivy League research university in New York City. Established in 1754 as King's College on the grounds of Trinity Churc ...

study estimated that the expansion of the CTC in the 2021 American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible households claimed the credit. The expansion also substantially reduced food insufficiency. Research indicates that cash transfers to families, like the refundable portion of the CTC, lead to improved math and reading test scores, a higher likelihood of high school graduation, higher college attendance, and long-term increases in income for both parents and children. Studies have also determined that the CTC increases labor force participation among low-income parents.

The CTC was created in 1997 as part of the Taxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 () was enacted by the 105th United States Congress and signed into law by President Bill Clinton. The legislation reduced several federal taxes in the United States and notably created the Roth IRA.

Provisions ...

. Initially a small $500 per child nonrefundable credit, it was progressively made larger and extended to more taxpayers through subsequent legislation. In particular, it was temporarily raised to $1,000 per child and made refundable, subject to a phase-in, by the Jobs and Growth Tax Relief Reconciliation Act of 2003

The Jobs and Growth Tax Relief Reconciliation Act of 2003 ("JGTRRA", , ), was passed by the United States Congress on May 23, 2003, and signed into law by President George W. Bush on May 28, 2003. Nearly all of the cuts (individual rates, capita ...

; that raise was made permanent by the American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "B ...

; the credit was temporarily raised to $2,000 per child, with up to $1,400 of that refundable, and the number of taxpayers eligible substantially expanded by the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

; and finally the credit was expanded substantially and made fully available to very low-income people for one year by the American Rescue Plan Act of 2021.

Background

Atax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

enables taxpayers to subtract the amount of the credit from their tax liability. In the United States, to calculate taxes owed, a taxpayer first subtracts certain "adjustments" (a particular set of deductions like contributions to certain retirement accounts and student loan interest payments) from their gross income

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes ...

(the sum of all their wages, interest, capital gains or loss, business income, IRA and pension income, Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

income, rents, royalties, and unemployment compensation

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (hu ...

) to determine their adjusted gross income (AGI). They then subtract from their AGI the larger of the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

or itemized deductions

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

...

, as well as the deduction for qualified business income, to determine their taxable income. They then apply the relevant tax rates to their taxable income (SeHow do federal income tax rates work?

for more information on income tax brackets). Finally, they subtract any tax credits they are eligible for from their tax liability to determine the amount of tax that they owe. This is summarized by the equation below: There are two basic types of tax credits: non-refundable tax credits and refundable tax credits. A tax credit is non-refundable if the credit can only be used to reduce tax owed to $0. It is refundable if it can be used to produce a negative tax liability, which will be ''refunded'' to them, i.e. they will receive a

tax refund

A tax refund is a payment to the taxpayer due because the taxpayer has paid more taxes than owed.

United States

According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, with the average refund c ...

that is larger than any taxes they have already paid. For example, if a taxpayer with a tax liability before tax credits of $500 were eligible for a $2,000 ''refundable'' tax credit, they would receive a tax refund that is $1,500 larger than any taxes they have already paid. If the $2,000 credit was ''non-refundable'', by contrast, they would only be able to reduce their taxes owed to $0 and would not receive a refund for the remaining $1,500 of the credit.

Overview

2018–2025, excluding 2021

Under the

Under the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

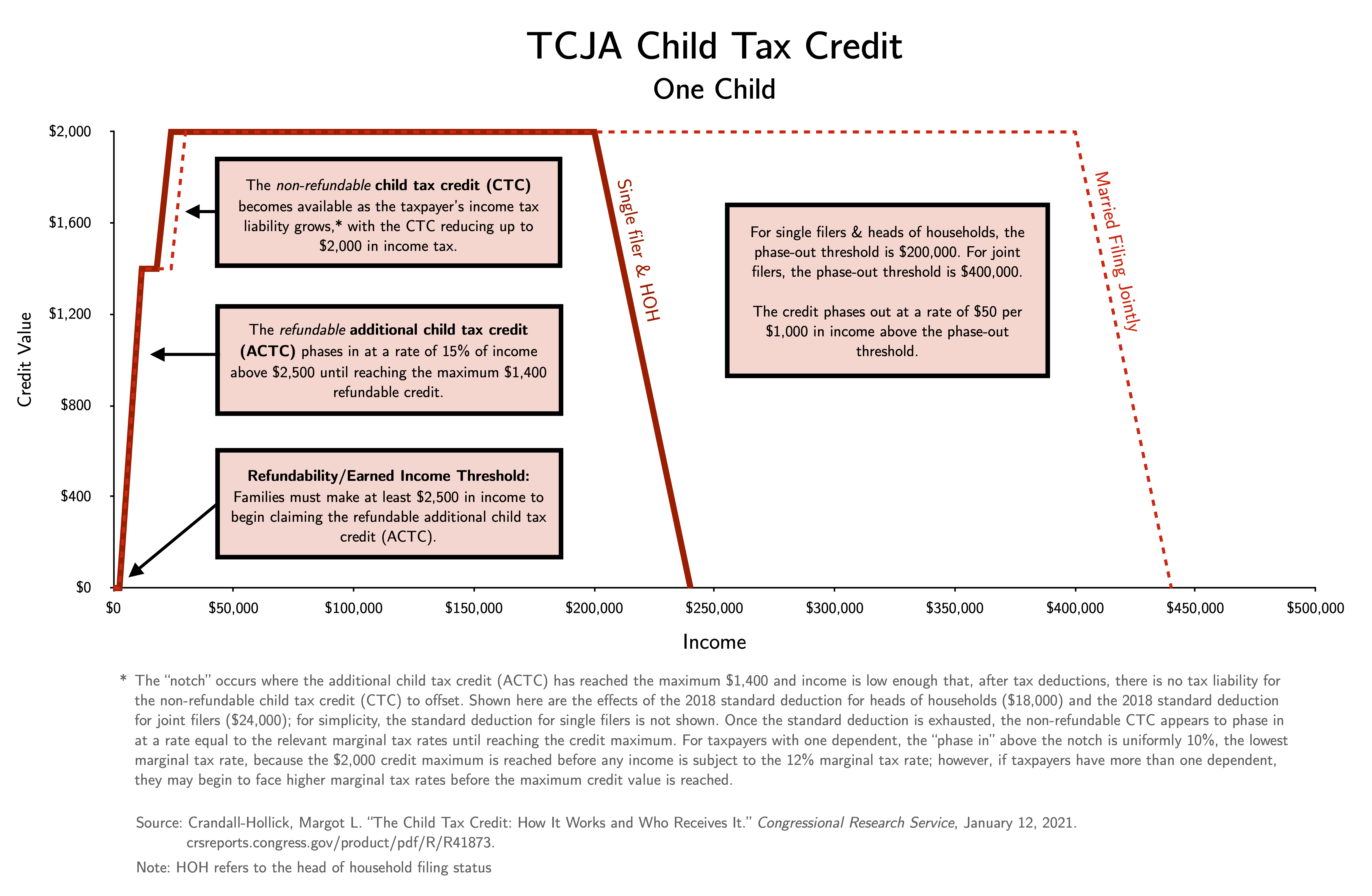

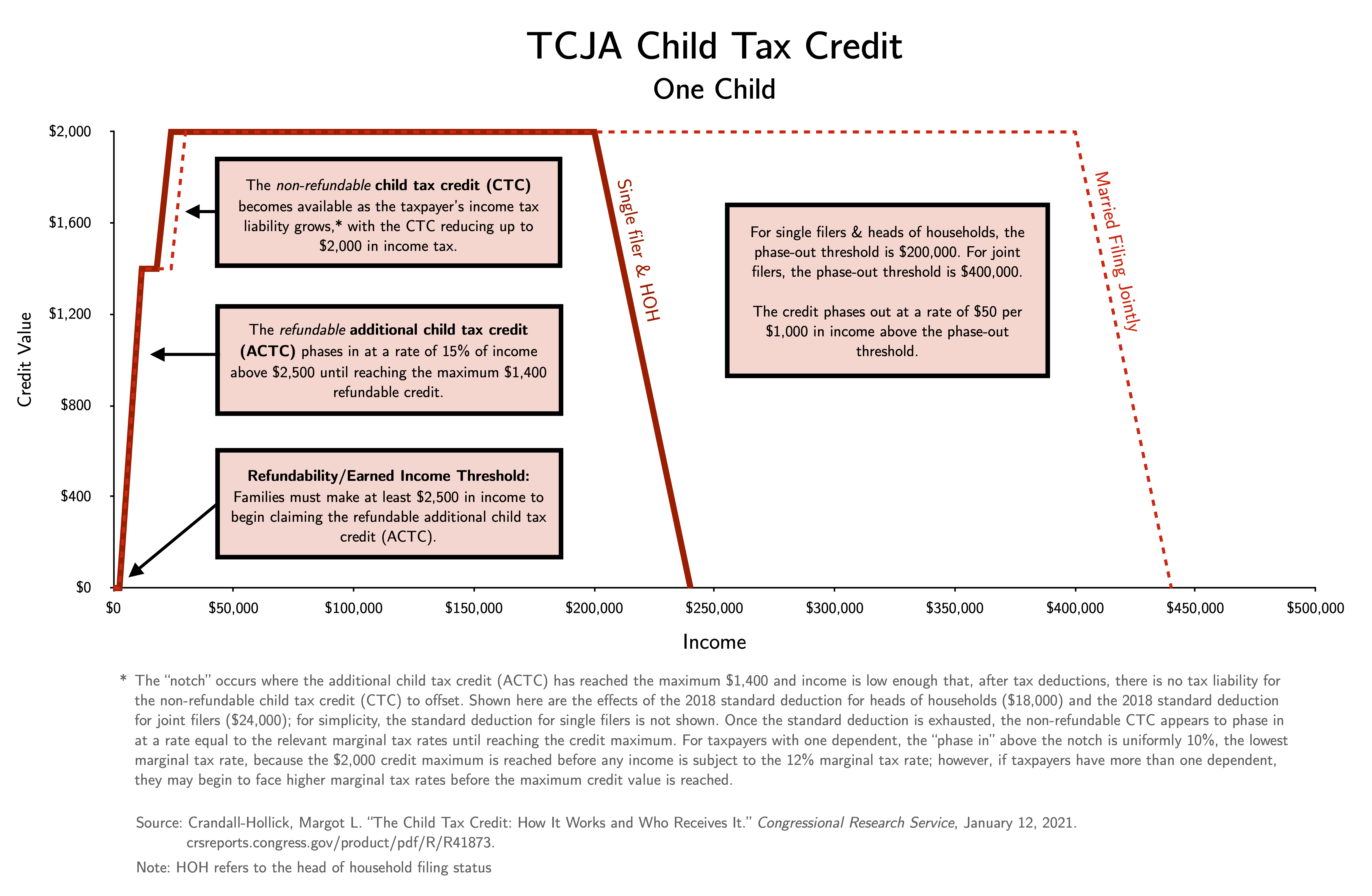

(TCJA), for the years 2018–2025 (excluding 2021, see below section Temporary Expansion in 2021) the CTC allows taxpayers to reduce their federal tax liabilities by $2,000 per qualifying child (see Eligibility). The maximum credit a taxpayer can receive is thus equal to the number of qualifying children multiplied by $2,000 (e.g. a family with 3 qualifying children is eligible for $2,000 x 3 = $6,000 in tax relief). The credit begins to phase out at a rate of $50 for every $1,000 in additional income over $200,000 for single filers and unmarried heads of households or over $400,000 for married joint filers.

Taxpayers whose incomes are too low to claim the full $2,000 credit (i.e. they have tax liabilities below $2,000) are eligible for the additional child tax credit (ACTC), a phased-in $1,400 ($1,600 starting 2023) refundable tax credit with similar qualifications. For example, if a taxpayer has one qualifying child and a tax liability of $100, then they can use $100 of the CTC to reduce their tax liability to $0 and then claim the full $1,400 ACTC (which will be refunded to them) for a total benefit of $1,500. Note, however, that the sum of the ACTC and CTC cannot exceed the maximum credit of $2,000. For instance, a taxpayer with one qualifying child and an $800 tax liability can use $800 of the CTC to reduce their tax liability to $0, but can only claim $1,200 of the ACTC (which will be refunded to them), for the maximum allowable benefit of $2,000.

However, a certain amount of earned income

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

is required to begin taking the credit. The ACTC is calculated only on amount of earned income above $2,500. It phases in above $2,500, at a rate of 15%, up to the maximum-allowable $1,400 per child. For example, a taxpayer who makes $8,000 in earned income and has one qualifying child is eligible for .15($8,000–$2,500)=$825 of the ACTC. Notice that the income range of the phase-in increases with the number of qualifying children: a taxpayer making $30,000, for instance, could claim the full ACTC if they have one child (since .15($30,000 – $2,500) = $4,125 is greater than the maximum allowable $1,400 for one child) but could not claim the full credit if they have three children (since .15($30,000 – $2,500) = $4,125 is less than the maximum allowable $1,400 x 3 = $4,200 for three children).

The Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a ...

estimates that about 1 in 5 taxpayers with eligible children fall into the phase-in range (i.e. they had incomes too low to receive the maximum credit).

Temporary expansion in 2021

The child tax credit was substantially expanded for one year under the American Rescue Plan Act of 2021 (ARP), a stimulus bill passed during the economic downturn caused by theCOVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

. The ARP increased the credit to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17 (note that it increased the maximum age for an eligible child from 16 to 17). More specifically, it increased the tax credit to $3,600/$3,000 per child for single filers with incomes below $75,000, for unmarried heads of households with incomes below $112,500, and for married joint filers with incomes below $150,000. The credit phases down to a $2,000 credit (the value of the TCJA CTC) above these income levels, remains at $2,000 until income reaches $200,000 for single filers and unmarried heads of households or $400,000 for married joint filers, and then phases down to $0.

The ARP also made the credit fully refundable (i.e. it eliminated the income threshold and phase-in, making the credit fully available to people with very low incomes) and offered the option of receiving half of the credit as advance monthly payments, with the other half received as a tax refund

A tax refund is a payment to the taxpayer due because the taxpayer has paid more taxes than owed.

United States

According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, with the average refund c ...

when filing taxes in early 2022. Full refundability made the full value of the credit available to lower-income families, who previously tended to receive little or no benefit.

Post-2025

The $2,000 child tax credit instituted by the

The $2,000 child tax credit instituted by the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

(TCJA) is scheduled to expire in 2025. Unless extended, the credit will revert to the CTC made permanent by the American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "B ...

(ATRA). Under the ATRA, the CTC is a $1,000 non-refundable credit that begins to phase out at a rate of $50 for every $1,000 of income above $75,000 for single filers and unmarried heads of households or $110,000 for married couples filing jointly.

Families receiving less than the non-refundable $1,000 child tax credit will be eligible for the $1,000 refundable additional child tax credit (ACTC). The ACTC has a refundability threshold of $3,000 (i.e. families must make at least $3,000 to claim the credit) and phases in at a rate of 15% of earned income above $3,000. The sum of the ACTC and CTC claimed by a taxpayer cannot exceed the maximum credit of $1,000.

Related credits

The child and dependent care credit allows eligible taxpayers to subtract $3,000 per child from their taxes for certain childcare services, capped at a total of $6,000 annually per taxpayer. TheTax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

created an additional dependent credit, allowing families to claim an additional $500 for an aging parent or older child requiring special care.

Comparison chart

The below chart displays the differences between the three forms of the child tax credit explained above for joint filers.

Eligibility

The child tax credit is available to taxpayers who have a "qualifying child." A person is a "qualifying child" if they are under the age of 17 (or, in 2021, under the age of 18) at the end of the taxable year and meets the requirements of 26 U.S.C. Sec. 152(c). In general, a qualifying child is any individual for whom the taxpayer can claim a dependency exemption and who is the taxpayer's son or daughter (or descendant of either), stepson or stepdaughter (or descendant of either), or eligible foster child. For unmarried couples or married couples filing separately, a qualifying child will be treated as such for the purpose of the CTC for the taxpayer who is the child's parent, or if not a parent, the taxpayer with the highest adjusted gross income (AGI) for the taxable year in accordance with 26 U.S.C. Sec. 152(c)(4)(A). TheTax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

restricted the credit to only those dependent children possessing a Social Security Number

In the United States, a Social Security number (SSN) is a nine-digit number issued to United States nationality law, U.S. citizens, Permanent residence (United States), permanent residents, and temporary (working) residents under section 205(c)(2 ...

(SSN); previously, dependents who did not possess a SSN because of their immigration status could still be eligible for the credit using an Individual Taxpayer Identification Number

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service (IRS). ITINs are issued by the IRS to individuals who do not have and are not eligible to obtain a valid U.S. Soci ...

(ITIN).

To receive the credit as a refund there are income requirements, see Overview

Overview may refer to:

* Overview article, an article that summarizes the current state of understanding on a topic

* Overview map, generalised view of a geographic area

See also

* Summary (disambiguation)

* Outline (list)

* ''A Brief Overview' ...

.

Effects

The child tax credit—especially the fully-refundable 2021 expanded child tax credit—significantly reduces child poverty. According to theCenter on Budget and Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the organization's stated mission is to "advanc ...

, in 2018 the CTC, in conjunction with the earned income tax credit (EITC), lifted 5.5 million children above the poverty line

The poverty threshold, poverty limit, poverty line, or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for ...

. A 2021 Columbia University

Columbia University in the City of New York, commonly referred to as Columbia University, is a Private university, private Ivy League research university in New York City. Established in 1754 as King's College on the grounds of Trinity Churc ...

study estimated that the expansion of the CTC instituted by the American Rescue Plan Act

The American Rescue Plan Act of 2021, also called the COVID-19 Stimulus Package or American Rescue Plan, is a Stimulus (economics), economic stimulus bill passed by the 117th United States Congress and signed into law by President of the Unite ...

reduced child poverty by an additional 26%, and would have decreased child poverty by 40% had all eligible households claimed the credit; the same group found that in the first month after the expansion of the CTC expired, child poverty rose from 12.1% to 17%, a 41% increase representing 3.7 million children. Additionally, changes to official poverty statistics understate the poverty alleviation effects of the child tax credit: the CTC does not raise the incomes of many poor families above the poverty line

The poverty threshold, poverty limit, poverty line, or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for ...

—and thus they do not appear in poverty reduction statistics—even though CTC benefits provide these families with substantial boosts in income.

Research indicates that income from the CTC and EITC leads to improved educational outcomes for young children in low-income households and is associated with decreased child behavioral problems and significant increases in college attendance among high school seniors in low-income families. Studies on the 2021 expanded CTC determined that the additional benefits decreased food insufficiency by about 25%. Evidence on cash transfers, like the refundable portion of the CTC, shows that children in families receiving them have improved math and reading test scores, a higher likelihood of high school graduation, and a 1–2% increase in earnings in adulthood; they also lead to "persistent" increases in parents' earned income. Evidence on the earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

and cash transfer programs in other countries also indicates that cash benefits reduce the rate of violent crime.

Two surveys of people who claimed the 2021 expanded child tax credit, one by the United States Census Bureau

The United States Census Bureau, officially the Bureau of the Census, is a principal agency of the Federal statistical system, U.S. federal statistical system, responsible for producing data about the American people and American economy, econ ...

and another by the University of Michigan

The University of Michigan (U-M, U of M, or Michigan) is a public university, public research university in Ann Arbor, Michigan, United States. Founded in 1817, it is the oldest institution of higher education in the state. The University of Mi ...

in collaboration with Propel, a technology firm, found that most families used the monthly CTC payments to pay for basic needs like food, rent, school supplies, utilities, and clothing, as well as to reduce personal debt. A survey by the American Enterprise Institute

The American Enterprise Institute for Public Policy Research, known simply as the American Enterprise Institute (AEI), is a center-right think tank based in Washington, D.C., that researches government, politics, economics, and social welfare ...

determined that lower income families were most likely to spend the benefit while higher-income families were most likely to save it.

A study of the labor effects of the CTC from 2001 to 2016, which included a phase-in, determined that the CTC increased labor force participation by 9.6 percentage points among low-income parents of older children. While some economic models predicted that the 2021 expansion of the CTC, which increased the credit value and eliminated the phase-in, would lead to modest negative employment effects relative to the prior CTC (while still having substantial anti-poverty effects), empirical research has indicated that, in the six-month period that monthly CTC payments were distributed, effects on employment and labor force participation were minimal.

History

Origins

The child tax credit was created in 1997 as part of theTaxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 () was enacted by the 105th United States Congress and signed into law by President Bill Clinton. The legislation reduced several federal taxes in the United States and notably created the Roth IRA.

Provisions ...

. Initially it was a $500-per-child (up to age 16) nonrefundable credit intended to provide tax relief to middle- and upper-middle-income families. The credit phased out for higher earners at a rate of $50 for every $1,000 in additional income over $110,000 for taxpayers filing as married joint, $75,000 for taxpayers filing as head of household

In the United States, head of household is a filing status for individual United States taxpayers. It provides preferential tax rates and a larger standard deduction for single people caring for qualifying dependents.

To use the head of hous ...

, and $55,000 for taxpayers filing as married separate. While non-refundable for most families, it was refundable for families with more than three children (reduced by the amount of the taxpayer's alternative minimum tax). The credit was not indexed for inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

.

Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA)

A number of significant changes were made to the child tax credit by the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), a signature piece of tax legislation during the George W. Bush presidency (the bill is often referred to as one of the two " Bush tax cuts"). According to Margot L. Crandall-Hollick, a specialist inpublic finance

Public finance refers to the monetary resources available to governments and also to the study of finance within government and role of the government in the economy. Within academic settings, public finance is a widely studied subject in man ...

, the bill made four key alterations to the CTC:

# It increased the maximum amount of the credit per child in scheduled increments until it reached $1,000 per child in 2010

# It made the credit refundable for families irrespective of size using the earned income formula (10% of a taxpayer's earned income in excess of $10,000, up to the maximum amount of the credit for that tax year, and scheduled to increase to 15% for tax years 2005 through 2010)

# It allowed the child tax credit to offset alternative minimum tax liability

# It temporarily repealed the prior law provision that reduced the refundable portion of the child tax credit by the amount of the AMT

All of these provisions were scheduled to expire at the end of 2010 (restrictions imposed by the rules of budget reconciliation, a special parliamentary procedure

Parliamentary procedures are the accepted Procedural law, rules, ethics, and Norm (sociology), customs governing meetings of an deliberative assembly, assembly or organization. Their object is to allow orderly deliberation upon questions of inte ...

that allows expedited passage of certain budgetary legislation, often necessitates placing time limits on budget policies, even if legislators hope they will be made permanent).

The earned income tax credit originated in the 1970s with the intent to offset high regressive payroll taxes that supported Social Security and Medicare. ''See e.g., https://www.epi.org/publication/ib370-earned-income-tax-credit-and-the-child-tax-credit-history-purpose-goals-and-effectiveness/''

Adjustments to EGTRRA

TheJobs and Growth Tax Relief Reconciliation Act of 2003

The Jobs and Growth Tax Relief Reconciliation Act of 2003 ("JGTRRA", , ), was passed by the United States Congress on May 23, 2003, and signed into law by President George W. Bush on May 28, 2003. Nearly all of the cuts (individual rates, capita ...

(JGTRRA) increased the size of the CTC to $1,000 for 2003 and 2004 (under EGTRRA, the credit would not have reached $1,000 until 2010). The Working Families Tax Relief Act of 2004 extended this amount through 2010. The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (), also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on Decem ...

extended this $1,000 cap through the end of 2012. The American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "B ...

, signed into law by President Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. O ...

, made the $1,000 credit permanent.

Tax Cuts and Jobs Act of 2017 (TCJA)

The Tax Cuts and Jobs Act of 2017 (TCJA), with efforts led by Sen. Marco Rubio (R-FL) and Ivanka Trump, made three major changes to the CTC: # It doubled the amount per qualifying child to $2,000 # It made up to $1,400 of the credit refundable # It increased income thresholds to make the CTC available to more families. Before 2018, the full CTC was only available to single parents making less than $75,000 and families making less than $110,000 per year. The TCJA significantly increased these income thresholds to $200,000 for single parents and $400,000 for married couples filing jointly. Above these limits, the CTC is phased out at the rate of $50 for each additional $1,000 (or portion of $1,000) earned.Expansion Proposals

In 2017, Democratic senators

In 2017, Democratic senators Michael Bennet

Michael Farrand Bennet (born November 28, 1964) is an American attorney, businessman, and politician serving as the Seniority in the United States Senate, senior United States Senate, United States senator from Colorado, a seat he has held sinc ...

and Sherrod Brown

Sherrod Campbell Brown ( ; born November 9, 1952) is an American politician who served from 2007 to 2025 as a United States senator from Ohio. A member of the Democratic Party, he was the U.S. representative for from 1993 to 2007 and the 47t ...

proposed the American Family Act (AFA). The bill would have increased the child tax credit's refundable portion to $3,600 per child under age six and to $3,000 per child age six to 16, eliminated the income threshold and phase-in (opening up the credit to the lowest-income families), and made the credit a monthly rather than annual benefit.

Researchers at Columbia University

Columbia University in the City of New York, commonly referred to as Columbia University, is a Private university, private Ivy League research university in New York City. Established in 1754 as King's College on the grounds of Trinity Churc ...

estimated that the AFA would have reduced child poverty by nearly half. However, with the House of Representatives

House of Representatives is the name of legislative bodies in many countries and sub-national entities. In many countries, the House of Representatives is the lower house of a bicameral legislature, with the corresponding upper house often ...

and Senate

A senate is a deliberative assembly, often the upper house or chamber of a bicameral legislature. The name comes from the ancient Roman Senate (Latin: ''Senatus''), so-called as an assembly of the senior (Latin: ''senex'' meaning "the el ...

under Republican control, the bill failed to advance. Bennet and Brown re-introduced a modified version of the bill in 2019, this time garnering 39 co-sponsors in the Senate and 186 in the House (all Democrats), but it again failed to advance in the Republican-controlled Senate. The proposal did ultimately influence the expanded child tax credit included in the American Rescue Plan Act of 2021, however (see section below).

The proposed inclusion of an expanded CTC in the American Rescue Plan Act (ARP) also spurred the creation of several alternative child benefit proposals. In February 2021, shortly after

The proposed inclusion of an expanded CTC in the American Rescue Plan Act (ARP) also spurred the creation of several alternative child benefit proposals. In February 2021, shortly after Joe Biden

Joseph Robinette Biden Jr. (born November 20, 1942) is an American politician who was the 46th president of the United States from 2021 to 2025. A member of the Democratic Party (United States), Democratic Party, he served as the 47th vice p ...

assumed the presidency and Democrats gained a narrow majority in the Senate, Republican Senator Mitt Romney

Willard Mitt Romney (born March 12, 1947) is an American businessman and retired politician. He served as a United States Senate, United States senator from Utah from 2019 to 2025 and as the 70th governor of Massachusetts from 2003 to 2007 ...

released his "Family Security Act", a proposal to provide families with a yearly benefit of $3,000 per child ages 6–16 and $4,200 per child ages 0–5, with a maximum allowable benefit of $15,000 and the same phaseout structure as the CTC under the TCJA. Like the child tax credit expansion proposed in the American Family Plan and instituted by the ARP, the benefit would be delivered as monthly payments; additionally, it would also allow families to begin claiming the benefit four months before the expected birth date of their child. Unlike the Democratic proposals, Romney's plan would have the benefit administered by the Social Security Administration (SSA) rather than the Internal Revenue Service (IRS). The child benefit under Romney's plan would be larger than that of the ARP (except for very large families, who would have their benefit capped under Romney's plan) and would substantially reduce child poverty, though to a lesser extent than the ARP because Romney's plan would be financed in part by substantially reducing the earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

for taxpayers with children and eliminating Temporary Assistance for Needy Families (TANF) and the Child and Dependent Care Tax Credit (as a result, the proposal would actually increase poverty among many single-parent families). Romney also proposed eliminating the state and local tax deduction The state and local tax deduction (SALT deduction) is a United States federal itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income.

The SALT deduction is intended to ...

(which primarily benefits wealthy households and has a negligible effect on child poverty) and the head of household tax filing status to raise revenue for the benefit.

In April 2021, Republican Senator Josh Hawley

Joshua David Hawley (born December 31, 1979) is an American politician and attorney serving as the Seniority in the United States Senate, senior United States Senate, United States senator from Missouri, a seat he has held since 2019. A member ...

introduced a related proposal called the "Parent Tax Credit" (PTC). The PTC would have been a new, refundable tax credit of $6,000 annually for single parents with at least one child under the age 13 and $12,000 annually for married couples with at least one child under the age of 13 (the larger benefit for married couples was intended to act as a "marriage bonus"); the benefit would be paid out monthly (i.e. $500 per month for single parents and $1,000 per month for married couples). It would have had a larger income threshold than the CTC, requiring parents to make at least $7,540 in income (the equivalent of 20 hours of work per week at the federal minimum wage of $7.25 per hour) to claim the credit; it would have no income phase-out. Children would need to possess a Social Security number

In the United States, a Social Security number (SSN) is a nine-digit number issued to United States nationality law, U.S. citizens, Permanent residence (United States), permanent residents, and temporary (working) residents under section 205(c)(2 ...

to qualify.

American Rescue Plan Act of 2021

The American Rescue Plan Act (ARP) of 2021, a stimulus bill advanced by Democratic lawmakers and signed into law by PresidentJoe Biden

Joseph Robinette Biden Jr. (born November 20, 1942) is an American politician who was the 46th president of the United States from 2021 to 2025. A member of the Democratic Party (United States), Democratic Party, he served as the 47th vice p ...

in response to the economic downturn caused by the COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, expanded the child tax credit by allowing qualifying families to offset, for the 2021 tax year, $3,000 per child up to age 17 and $3,600 per child under age 6. The size of the benefit gradually diminished for single filers earning more than $75,000 per year, heads of households earning more than $112,500 per year, and married couples filing jointly making more than $150,000 a year. Additionally, it made the credit fully refundable, and half of the benefit was sent out to eligible households as monthly payments (i.e. it was delivered as 6 monthly payments + one lump-sum payment for the remaining half of the benefit). Full refundability made the full value of the credit available to lower-income families, who previously tended to receive little or no benefit.

39 million households covering 88% of children in the United States began receiving payments automatically on July 15, 2021. A Columbia University

Columbia University in the City of New York, commonly referred to as Columbia University, is a Private university, private Ivy League research university in New York City. Established in 1754 as King's College on the grounds of Trinity Churc ...

study estimated that the expanded CTC reduced child poverty by 26 percent. The expanded CTC expired on December 31, 2021.

Build Back Better Act and Family Security Act 2.0

The Build Back Better Act, passed by the

The Build Back Better Act, passed by the House of Representatives

House of Representatives is the name of legislative bodies in many countries and sub-national entities. In many countries, the House of Representatives is the lower house of a bicameral legislature, with the corresponding upper house often ...

on November 19, 2021, would extend the expansion of the CTC made by the American Rescue Plan Act of 2021 for one year. Significantly, it would also make the full-refundability of the CTC permanent (i.e. it would permanently eliminate the earned income threshold and phase-in, so that low-income families can access the full value of the credit). The bill stalled in the Senate

A senate is a deliberative assembly, often the upper house or chamber of a bicameral legislature. The name comes from the ancient Roman Senate (Latin: ''Senatus''), so-called as an assembly of the senior (Latin: ''senex'' meaning "the el ...

and was ultimately replaced by the Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 (IRA) is a United States federal law which aims to reduce the federal government budget deficit, lower prescription drug prices, and invest in domestic energy production while promoting clean energy. It was ...

, which did not include an expansion to the child tax credit.

On June 15, 2022, Senator Mitt Romney

Willard Mitt Romney (born March 12, 1947) is an American businessman and retired politician. He served as a United States Senate, United States senator from Utah from 2019 to 2025 and as the 70th governor of Massachusetts from 2003 to 2007 ...

, along with Senators Richard Burr

Richard Mauze Burr (born November 30, 1955) is an American businessman and politician who served as a United States senator from North Carolina from 2005 to 2023. A member of the Republican Party, Burr was previously a member of the United Stat ...

and Steve Daines

Steven David Daines ( ; born August 20, 1962) is an American politician and former corporate executive serving as the Seniority in the United States Senate, senior United States Senate, United States senator from Montana, a seat he has held since ...

, introduced the Family Security Act 2.0 (FSA 2.0), a modification of Romney's earlier plan. Like his earlier plan, the FSA 2.0 would substantially raise the child benefit relative to the existing child tax credit. However, the FSA 2.0 includes a $10,000 income phase-in (i.e. a family must make at least $10,000 to qualify for the full benefit) and retains the substantial reductions to the earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

from his earlier plan, which would result in many low and moderate income single families seeing their combined benefits cut under the plan.

Criticism

Lower benefits for low-income people

The child tax credit has been criticized for excluding low income-families—who are in most desperate need of financial assistance and who reap the largest relative gain in income from the benefit—from obtaining the full benefit or even any of the benefit. Under the current CTC, very low-income families making less than $2,500 receive ''no benefit'' and low-income families with incomes above $2,500 are subjected to a 15% phase-in. As a result, about one-in-five families with eligible children have incomes too low to receive the full credit. Furthermore, according to Columbia University's Center on Poverty and Social Policy, over 50% of black and Hispanic children are in families with incomes too low to receive the full benefit and nearly 1-in-5 black children are in families with incomes too low to receive ''any'' of the credit. Excluding the poorest families from the full benefit substantially reduces the poverty alleviation effects of the CTC: the Jain Family Institute, for instance, estimates that making the child tax credit fully refundable—without any change to benefit levels—would reduce child poverty by 19%.Complexity

The child tax credit has been criticized for its complexity. In many countries, a simple monthly child allowance is sent to all families. In the United States, by contrast, the CTC has a complicated structure: it includes an income threshold, a phase-in formula, a separate phase-out formula, and mixes reduction of tax liability with direct payments. The 2021 expansion scrapped the income threshold and phase-in, but has a more complicated phase-out structure: it first phases down to a $2,000 plateau and then at higher incomes phases down to $0; the phase-out structure also differs depending on the number of qualifying children (see chart). The CTC also interacts with other tax credits in ways that may be confusing to claimers. Many families can simultaneously claim the child tax credit, theearned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

and the child and dependent care tax credit—each with its own set of eligibility rules—and may find it difficult to understand how these programs interact with each other or even which programs they are eligible for. The large number of tax benefits also makes tax forms long and confusing. According to the US Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States. It is one of 15 current U.S. government departments.

The department oversees the Bureau of Engraving and ...

:

igibility rules for refundable credits are complex and lead to high improper payment rates... les differ by credit and are complex because they must address complicated family relationships and residency arrangements to determine eligibility...The complexity of the rules causes taxpayers to erroneously claim the credits. Much of the complexity that leads to errors stems from claims involving qualifying children. This is because of the intricacy of the rules regarding who can claim a child in instances of divorce, separation, and three-generation families. The complexity of these rules increases compliance burden for taxpayers and administrative costs for the IRS...Our analysis of EITC and ACTC eligibility rules found that the qualifying child relationship rules are difficult to understand. In addition, the definition of key eligibility requirements is different between the two credits. This can cause confusion for taxpayers when trying to determine which credit(s) they are eligible to claim.

Administered through tax code

The child tax credit is a tax expenditure, i.e. a social benefit administered through the tax code. Accordingly, it is delivered as most tax breaks are: as a reduction in the amount of taxes a taxpayer owes to the government or, for the refundable portion, as a lump-sum payment delivered at the end of the tax year (the temporary expansion of the CTC for the year 2021, however, allowed beneficiaries to receive half of the CTC as a series of six monthly payments, with the other half delivered as a lump-sum payment at the end of 2021). A number of scholars and political commentators have argued that a monthly child allowance (a simple direct cash payment to parents) would be more effective than the CTC at easing the costs ofchildcare

Child care, also known as day care, is the care and supervision of one or more children, typically ranging from three months to 18 years old. Although most parents spend a significant amount of time caring for their child(ren), childcare typica ...

and reducing child poverty

Child poverty refers to the state of children living in poverty and applies to children from poor families and orphans being raised with limited or no state resources. UNICEF estimates that 356 million children live in extreme poverty. It is esti ...

.

One reason for this focuses on the Internal Revenue Service's (IRS) inability to deliver benefits to all eligible households, particularly low-income households. This became especially acute during the temporary expansion of the CTC in 2021, which made the lowest income families eligible for the full benefit for the first time (prior to the change, the CTC had an income threshold and phase-in, so administrative problems affecting low-income families were less substantial for the simple reason that many low-income families were ineligible for the benefit). To determine eligibility, the IRS uses taxpayers' tax returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax.

Tax returns are usually processed by each country's tax authority, known as a ...

. Many low-income households, however, are not required to file tax returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax.

Tax returns are usually processed by each country's tax authority, known as a ...

. As a result, many eligible low-income families may not receive the CTC despite being eligible for it.

The IRS attempted to remedy this by offering an online non-filer sign-up tool. However, that, too, has been criticized. It was derided for being poorly designed: thwebsite

designed in conjunction with

Intuit

Intuit Inc. is an American multinational business software company that specializes in financial software. The company is headquartered in Mountain View, California, and the CEO is Sasan Goodarzi. Intuit's products include the tax preparati ...

through the Free File Alliance

The Free File Alliance is a group of tax preparation companies which operate a public-private partnership with the Internal Revenue Service (IRS) to provide free IRS e-file, electronic tax filing services under the IRS Free File, Free File program ...

, was not mobile friendly, contained little indication that it was an official government portal (it used a .com rather than .gov domain name, for instance), and was only available in English. To log in to the website, users faced a number of requirements that ordinary taxpayers do not have to satisfy when filing their tax returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax.

Tax returns are usually processed by each country's tax authority, known as a ...

, including providing an email address An email address identifies an email box to which messages are delivered. While early messaging systems used a variety of formats for addressing, today, email addresses follow a set of specific rules originally standardized by the Internet Enginee ...

, receiving a log-in code on their phone, scanning a photo ID, and taking a picture of themselves with a computer or smartphone (which is run through facial recognition software

A facial recognition system is a technology potentially capable of matching a human face from a digital image or a video frame against a database of faces. Such a system is typically employed to authenticate users through ID verification ser ...

)—all administrative burdens that make completing the online form more difficult, particularly for low-income families. (The Biden White House collaborated later that year with Code for America

Code for America is a 501(c)(3) civic tech non-profit organization that was founded by Jennifer Pahlka in 2009, "to promote ‘civic hacking’, and to bring 21st century technology to government." Federal, state, and local governments often lack ...

to create a more accessible website). Critics also noted that relying on non-filers to sign up online fails to accommodate people without access to the internet, which especially impacts low-income people (according to the Department of Health and Human Services

The United States Department of Health and Human Services (HHS) is a cabinet-level executive branch department of the US federal government created to protect the health of the US people and providing essential human services. Its motto is ...

(HHS), more than one in six people in poverty do not have internet access in their home)—precisely the group that is most likely not to file and the group that reaps the greatest relative gain in income from the refundable CTC.

See also

*Canada Child Benefit

The Canada Child Benefit (CCB), previously the Canada Child Tax Benefit (CCTB), is an income-tested basic income program for Canadian families. It is delivered as a income tax, tax-free monthly payment available to eligible Canadians, Canadian fa ...

* Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

* Social programs in the United States

In the United States, the federal and state social programs include cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometime ...

* Tax expenditure

* Temporary Assistance for Needy Families

Temporary Assistance for Needy Families (TANF ) is a federal assistance program of the United States. It began on July 1, 1997, and succeeded the Aid to Families with Dependent Children (AFDC) program, providing cash assistance to indigent Ame ...

* Tax Relief for American Families and Workers Act

Notes

References

{{reflist Tax credits Taxation in the United States Personal taxes in the United States Child welfare in the United States