Chemical Bank on:

[Wikipedia]

[Google]

[Amazon]

Chemical Bank was a bank with headquarters in

Chemical Bank was the principal operating subsidiary of the Chemical Banking Corporation, a

Chemical Bank was the principal operating subsidiary of the Chemical Banking Corporation, a

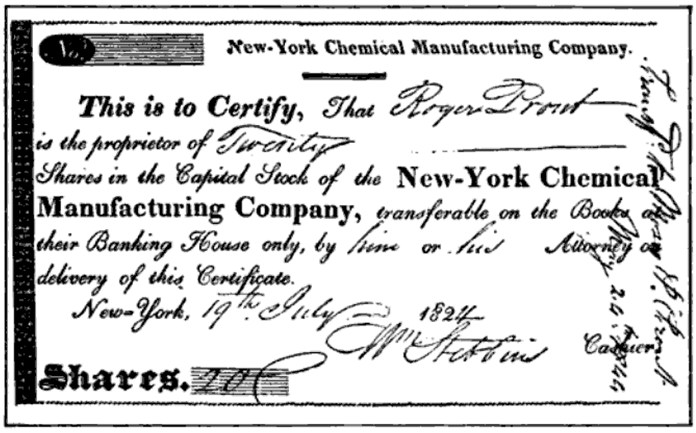

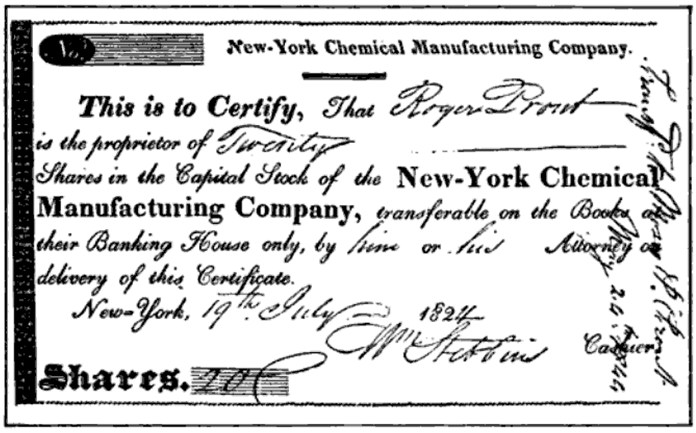

Chemical Bank’s roots lie in the 1823 foundation of the New York Chemical Manufacturing Company by Balthazar P. Melick and directors John C. Morrison, Mark Spenser, Gerardus Post, James Jenkins, William A. Seely, and William Stebbins. Additionally, Joseph Sampson, although not a director, was among the largest of the original shareholders of the later bank. During the 1820s prospective bankers found that they were more likely to be able to successfully secure a state bank charter if the bank was part of a larger business. Accordingly, the founders used the manufacturing company (which produced

Chemical Bank’s roots lie in the 1823 foundation of the New York Chemical Manufacturing Company by Balthazar P. Melick and directors John C. Morrison, Mark Spenser, Gerardus Post, James Jenkins, William A. Seely, and William Stebbins. Additionally, Joseph Sampson, although not a director, was among the largest of the original shareholders of the later bank. During the 1820s prospective bankers found that they were more likely to be able to successfully secure a state bank charter if the bank was part of a larger business. Accordingly, the founders used the manufacturing company (which produced

By the first decade of the 20th century, Chemical had one of the strongest reputations in banking but as a business was in decline, losing accounts each year. Unlike many of its peers, Chemical had been reluctant to expand into securities and other businesses and had not paid interest on bank accounts. Both practices, considered to be highly conservative, had allowed Chemical to develop a large capital reserve but were not attracting customers. William H. Porter, a prominent banker of the era, was named president of the bank in 1903 after the death of the previous president George G. Williams. Porter would leave Chemical seven years later to become a partner at J.P. Morgan & Co. in 1910 and was succeeded by Joseph B. Martindale, who was named president in 1911.

By the first decade of the 20th century, Chemical had one of the strongest reputations in banking but as a business was in decline, losing accounts each year. Unlike many of its peers, Chemical had been reluctant to expand into securities and other businesses and had not paid interest on bank accounts. Both practices, considered to be highly conservative, had allowed Chemical to develop a large capital reserve but were not attracting customers. William H. Porter, a prominent banker of the era, was named president of the bank in 1903 after the death of the previous president George G. Williams. Porter would leave Chemical seven years later to become a partner at J.P. Morgan & Co. in 1910 and was succeeded by Joseph B. Martindale, who was named president in 1911.

In 1917, Chemical named a new president of the bank, Herbert Twitchell, after the death of Joseph B. Martindale. It was uncovered, just months after Martindale's death, that the former Chemical president had stolen as much as $300,000 from the account of Ellen D. Hunt, a niece of Wilson G. Hunt.

Twitchell initiated a major turnaround of Chemical, setting up a trust business and reversing Chemical's policy of not paying interest on cash accounts. These steps along with other initiatives, resulted in an increase in deposits from $35 million to $81 million by 1920. In 1920, Twitchell was succeeded by Percy H. Johnston and remained with the bank as chairman of the board. Johnston would hold the presidency of the bank through 1946 at which time the bank had grown to become the seventh largest in the U.S.

In 1920, Chemical completed its first major acquisition, merging with Citizens National Bank. The acquisition of Citizens National, a small New York commercial bank, increased Chemical's assets to more than $200 million with more than $140 million of deposits.Chemical Bank to Absorb Citizens

In 1917, Chemical named a new president of the bank, Herbert Twitchell, after the death of Joseph B. Martindale. It was uncovered, just months after Martindale's death, that the former Chemical president had stolen as much as $300,000 from the account of Ellen D. Hunt, a niece of Wilson G. Hunt.

Twitchell initiated a major turnaround of Chemical, setting up a trust business and reversing Chemical's policy of not paying interest on cash accounts. These steps along with other initiatives, resulted in an increase in deposits from $35 million to $81 million by 1920. In 1920, Twitchell was succeeded by Percy H. Johnston and remained with the bank as chairman of the board. Johnston would hold the presidency of the bank through 1946 at which time the bank had grown to become the seventh largest in the U.S.

In 1920, Chemical completed its first major acquisition, merging with Citizens National Bank. The acquisition of Citizens National, a small New York commercial bank, increased Chemical's assets to more than $200 million with more than $140 million of deposits.Chemical Bank to Absorb Citizens

''The New York Times'', March 19, 1920 In 1923, Chemical established its first branch and by the end of the 1920s had opened a dozen branches in Manhattan and Brooklyn as well as a branch in London, its first international presence. In 1929, Chemical reincorporated as a state bank in New York as Chemical Bank & Trust Company and merged with the United States Mortgage & Trust Company, headquartered on the

In 1947, after the retirement of Percy Johnston, Harold Holmes Helm was named the new president of Chemical and would serve first as president and later as chairman of the bank for the next 18 years until his retirement in 1965. Under Helm, Chemical completed a series of large mergers in the late 1940s and early 1950s that again made the bank among the largest in the U.S. In 1947, Chemical merged with

In 1947, after the retirement of Percy Johnston, Harold Holmes Helm was named the new president of Chemical and would serve first as president and later as chairman of the bank for the next 18 years until his retirement in 1965. Under Helm, Chemical completed a series of large mergers in the late 1940s and early 1950s that again made the bank among the largest in the U.S. In 1947, Chemical merged with

''The New York Times'', March 8, 1989 Chemical completed its largest transaction of the 1980s in December 1986, when the bank agreed to acquire Texas Commerce Bank. The $1.1 billion transaction represented the largest interstate banking merger in U.S. history to that time. Texas Commerce, which was officially acquired in May 1987, was one of the largest bank holding companies in the Southwestern U.S., with a strong presence in corporate banking for small and medium-sized businesses. Chemical did not seek

''The New York Times'', January 11, 1987 Nationally, the combined Chemical Bank became one of the largest lenders to U.S. companies and was arguably the leader in loan syndication globally. Additionally, Chemical took a leading role providing foreign exchange, interest rate and currency swaps, corporate finance services, cash management, corporate and institutional trust, trade services and funds transfer. Chemical operated one of the nation's largest bank credit card franchises and was a major originator and servicer of home mortgages. In 1996, Chemical acquired Chase Manhattan Corporation in a merger valued at $10 billion to create the largest financial institution in the United States. Although Chemical was the acquiring company and the nominal survivor, the merged bank adopted the Chase name, which was considered to be better known, particularly internationally. Chase, which at its height had been the largest bank in the U.S., had fallen to sixth, while Chemical was the third largest bank at the time of the merger. The merger resulted in the reduction of more than 12,000 jobs between the two banks and merger related expenses of approximately $1.9 billion. The bank continued to operate under the Chase brand until its acquisition of J.P. Morgan & Co. in December 2000 to form JPMorgan Chase & Co. Throughout all of these acquisitions, Chemical's original management team, led by

''The New York Times'', March 29, 1983 Chemical had spent $20 million to develop the software for Pronto. The system, which worked with the

''Time'', July 15, 1985 By 1985, it was clear that Pronto, which was heavily promoted by Chemical, was growing much slower than anticipated. In 1985, Chemical and"Technology: Back to The Velvet-Roped Lines"

''Time'', January 9, 1989

History of the Chemical Bank: 1823–1913

1913

Lehman Brothers Collections – Twentieth Century Business Archives, Harvard Business School {{authority control Defunct banks of the United States Banks established in 1823 Banks disestablished in 1996 JPMorgan Chase Banks based in New York City Defunct companies based in New York City American companies established in 1823 American companies disestablished in 1996 1823 establishments in New York (state) 1996 disestablishments in New York (state)

New York City

New York, often called New York City or NYC, is the most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the most densely populated major city in the Un ...

from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

Beginning in 1920 and accelerating in the 1980s and 1990s, Chemical was a leading consolidator of the U.S. banking industry, acquiring Chase Manhattan Bank

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and fina ...

, Manufacturers Hanover

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufac ...

, Texas Commerce Bank and Corn Exchange Bank

The Corn Exchange Bank was a retail bank founded in 1853 in New York state. Over the years, the company acquired many community banks.

History

In 1855, the Corn Exchange Bank moved into an existing building in New York City at the northwest ...

among others. After 1968, the bank operated as the primary subsidiary of a bank holding company

A bank holding company is a company that controls one or more banks, but does not necessarily engage in banking itself. The compound bancorp (''banc''/''bank'' + '' corp ration') is often used to refer to these companies as well.

United States ...

that was eventually renamed Chemical Banking Corporation.

In 1996, Chemical acquired Chase Manhattan Corporation in a merger valued at $10 billion to create the largest financial institution in the United States. Although Chemical was the acquiring company and the nominal survivor, the merged bank adopted the Chase name, which was considered to be better known, particularly internationally.

Overview of the company

Chemical Bank was the principal operating subsidiary of the Chemical Banking Corporation, a

Chemical Bank was the principal operating subsidiary of the Chemical Banking Corporation, a bank holding company

A bank holding company is a company that controls one or more banks, but does not necessarily engage in banking itself. The compound bancorp (''banc''/''bank'' + '' corp ration') is often used to refer to these companies as well.

United States ...

. As of the end of 1995, before its merger with the Chase Manhattan Bank

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and fina ...

, Chemical was the third-largest bank in the United States by total assets, with $182.9 billion. The Chemical Banking Corporation was the fifth-largest bank holding company in terms of total assets. It is not to be confused with the totally unrelated entity Chemical Bank and Trust (headquartered in the state of Michigan) which is currently a division of TCF Financial Corporation

TCF Financial Corporation was a bank holding company based in Detroit, Michigan. The current incarnation of the company was formed by a 2019 merger between the former TCF, which was established in 1923 in Wayzata, Minnesota, and the Michigan- ...

but will be the surviving brand in their merger.

Of Chemical's $182.9 billion, the bank held about $82.1 billion of loans, including mortgage loans, other consumer loans, and commercial loans in the U.S. and internationally. Among Chemical's largest international exposure was to Japan, Germany, and the United Kingdom. The other assets on the bank's balance sheet included cash as well as various debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The d ...

and equity securities.

Chemical reported record net income of $1.8 billion for 1995. Chemical's level of capital at the end of 1995 remained strong, with capital adequacy ratio Capital Adequacy Ratio (CAR) is also known as ''Capital to Risk (Weighted) Assets Ratio'' (CRAR), is the ratio of a bank's capital to its risk. National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and com ...

s well in excess of regulatory requirements. The Corporation's Tier 1 and Total Capital ratios were 8.5% and 12.1%, respectively.

Chemical was one of the leading banks in the U.S., active both in corporate banking

Wholesale banking is the provision of services by banks to larger customers or organizations such as mortgage brokers, large corporate clients, mid-sized companies, real estate developers and investors, international trade finance businesses, in ...

as well as retail banking

Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking. Banking ser ...

. Within retail banking, Chemical provided personal and commercial checking accounts

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the ...

, savings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an I ...

and time deposit accounts, personal loans, consumer financing and mortgage banking as well as trust and estate administration.

Chemical's corporate banking business provided a wide variety business loans, leasing, real estate financing, money transfer and cash management among other services. Chemical was among the leading bank lenders to small and medium-sized businesses. Chemical also had a significant presence in investment banking

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with ...

as well as underwriting corporate debt

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity o ...

and equity securities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

.

Lines of business

Before its 1996 merger with Chase, Chemical had two operating segments: the Global Bank and Consumer & Relationship Banking. * ''Global Bank'' The Global Bank served the bank's large corporate clients and was made up of a traditionalinvestment banking

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with ...

division, known as Global Banking & Investment Banking as well as a sales and trading Sales and trading is one of the primary front-office divisions of major investment banks. The term is typically reserved for the trading activities done by sell-side investment banks who are primarily engaged in making markets for institutional clie ...

division, known as Global Markets. Global Banking & Investment Banking performed advisory services such as mergers and acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect ...

and restructuring

Restructuring is the corporate management term for the act of reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs. Other reasons ...

as well as capital raising functions, such as leveraged loan syndication, high yield financing and other debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The d ...

and equity underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabilit ...

. The bank's private equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a typ ...

and venture capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which hav ...

functions were also housed in this division. Global Markets was primarily focused on sales and trading activities, foreign exchange dealing; derivatives trading and structuring, risk management and other market related functions. In 1995, Chemicals Global Bank revenue was roughly balanced between investment banking and markets activities

* ''Consumer & Relationship Banking''. Consumer and Relationship Banking was made up of a number of businesses, including consumer banking, commercial banking

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with corp ...

; credit card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the o ...

s; mortgage banking (and other consumer finance, i.e. – home equity loan

A home equity loan is a type of loan in which the borrowers use the equity of their home as collateral. The loan amount is determined by the value of the property, and the value of the property is determined by an appraiser from the lending ins ...

s, student loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest r ...

s) as well as a number of smaller businesses. Chemical maintained a leading market share position in providing financial services to middle market companies nationally and small businesses in the New York metropolitan area

The New York metropolitan area, also commonly referred to as the Tri-State area, is the largest metropolitan area in the world by urban landmass, at , and one of the most populous urban agglomerations in the world. The vast metropolitan area ...

. This division also included a small private banking

Private banking is banking, investment and other financial services provided by banks and financial institutions primarily serving high-net-worth individuals (HNWIs)—defined as those with very high levels of income or sizable assets. A bank that ...

business, although Chemical was not a leading player in this market.

Offices

The bank opened its first offices at 216 Broadway in Downtown New York in 1824 at the corner of Ann Street. In 1848, the bank agreed to sell its building to its neighborBarnum's American Museum

Barnum's American Museum was located at the corner of Broadway, Park Row, and Ann Street in what is now the Financial District of Manhattan, New York City, from 1841 to 1865. The museum was owned by famous showman P. T. Barnum, who purc ...

(the building collapsed during Barnum's subsequent remodeling) and in 1850 the bank moved into its newly constructed headquarters at 270 Broadway. Chemical bought additional land next to its building in 1879 and 1887 but its offices remained modest through the start of the 20th century.

In 1907, the bank constructed a new headquarters on the original and adjacent properties at 270 Broadway, with architect Goodhue Livingston

Goodhue Livingston (February 23, 1867 – June 3, 1951) was an American architect who co-founded the firm of Trowbridge & Livingston. He designed the St. Regis Hotel, the Hayden Planetarium, and numerous buildings listed on the National Register ...

of Trowbridge & Livingston

Trowbridge & Livingston was an architectural practice based in New York City in the early 20th-century. The firm's partners were Samuel Beck Parkman Trowbridge and Goodhue Livingston.

Often commissioned by well-heeled clients, much of the firm ...

. In 1921, Chemical acquired a 13-story building belonging to the Shoe & Leather Bank on Broadway, next door to and surrounded by its existing properties. Despite expanding its 1907 headquarters over the years, by the mid-1920s Chemical needed more space to accommodate its growth and reflect its increasing profile.

In 1926, the bank made plans to move again, this time constructing a new six-story building at 165 Broadway, on the corner of Broadway

Broadway may refer to:

Theatre

* Broadway Theatre (disambiguation)

* Broadway theatre, theatrical productions in professional theatres near Broadway, Manhattan, New York City, U.S.

** Broadway (Manhattan), the street

**Broadway Theatre (53rd Stree ...

and Cortlandt Street, closer to the Financial District

A financial district is usually a central area in a city where financial services firms such as banks, insurance companies and other related finance corporations have their head offices. In major cities, financial districts are often home to s ...

. Chemical moved in after the building was completed in 1928, and the bank's headquarters remained there for more than five decades.

Under Chairman Donald Platten, Chemical's headquarters was to move to 277 Park Avenue in 1979. The bank moved across Park Avenue in 1991 to occupy the former headquarters of Manufacturers Hanover Corporation at 270 Park Avenue, which remained the headquarters of Chemical's successor, JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, t ...

, until the building was vacated in 2018 in preparation for demolition and construction of a new JPMorgan Chase headquarters on the same site. JPMorgan Chase would return to 277 Park Avenue

277 Park Avenue is an office building in the Midtown Manhattan neighborhood of New York City. It stands on the east side of Park Avenue between East 47th and 48th Streets, and is tall, with 50 floors. It is tied with two other buildings, 55 Wat ...

in 2000, following the departure of its previous tenant, Donaldson Lufkin & Jenrette

Donaldson, Lufkin & Jenrette (DLJ) was a U.S. investment bank founded by William H. Donaldson, Richard Jenrette, and Dan Lufkin in 1959. Its businesses included securities underwriting; sales and trading; investment and merchant banking; finan ...

. In 2008, after JPMorgan acquired Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

, the bank moved its investment banking groups from Chemical's old headquarters to 383 Madison Avenue

383 Madison Avenue, formerly known as the Bear Stearns Building, is a , 47-story skyscraper in the Midtown Manhattan neighborhood of New York City, United States. Built in 2002 for financial services firm Bear Stearns, it was designed by archi ...

, and eventually the entire headquarters on a temporary basis until the new 270 Park Avenue is finished.

History

Founding and early history

Chemical Bank’s roots lie in the 1823 foundation of the New York Chemical Manufacturing Company by Balthazar P. Melick and directors John C. Morrison, Mark Spenser, Gerardus Post, James Jenkins, William A. Seely, and William Stebbins. Additionally, Joseph Sampson, although not a director, was among the largest of the original shareholders of the later bank. During the 1820s prospective bankers found that they were more likely to be able to successfully secure a state bank charter if the bank was part of a larger business. Accordingly, the founders used the manufacturing company (which produced

Chemical Bank’s roots lie in the 1823 foundation of the New York Chemical Manufacturing Company by Balthazar P. Melick and directors John C. Morrison, Mark Spenser, Gerardus Post, James Jenkins, William A. Seely, and William Stebbins. Additionally, Joseph Sampson, although not a director, was among the largest of the original shareholders of the later bank. During the 1820s prospective bankers found that they were more likely to be able to successfully secure a state bank charter if the bank was part of a larger business. Accordingly, the founders used the manufacturing company (which produced chemical

A chemical substance is a form of matter having constant chemical composition and characteristic properties. Some references add that chemical substance cannot be separated into its constituent elements by physical separation methods, i.e., w ...

s such as blue vitriol

Copper(II) sulfate, also known as copper sulphate, is an inorganic compound with the chemical formula . It forms hydrates , where ''n'' can range from 1 to 7. The pentahydrate (''n'' = 5), a bright blue crystal, is the most commonly encountered h ...

, alum

An alum () is a type of chemical compound, usually a hydrated double sulfate salt of aluminium with the general formula , where is a monovalent cation such as potassium or ammonium. By itself, "alum" often refers to potassium alum, with the ...

, nitric acid

Nitric acid is the inorganic compound with the formula . It is a highly corrosive mineral acid. The compound is colorless, but older samples tend to be yellow cast due to decomposition into oxides of nitrogen. Most commercially available ni ...

, camphor

Camphor () is a waxy, colorless solid with a strong aroma. It is classified as a terpenoid and a cyclic ketone. It is found in the wood of the camphor laurel (''Cinnamomum camphora''), a large evergreen tree found in East Asia; and in the k ...

, and saltpeter

Potassium nitrate is a chemical compound with the chemical formula . This alkali metal nitrate Salt (chemistry), salt is also known as Indian saltpetre (large deposits of which were historically mined in India). It is an ionic salt of potassium ...

, as well as medicines, paints, and dye

A dye is a colored substance that chemically bonds to the substrate to which it is being applied. This distinguishes dyes from pigments which do not chemically bind to the material they color. Dye is generally applied in an aqueous solution and ...

s) as a means of securing a charter from the New York State legislature. In April 1824 the company amended its charter to allow Chemical to enter into banking, creating a separate division for the new activity. Melick was named the first president of the bank, which catered to merchants in New York City.

In 1826, John Mason became a shareholder of the bank and would serve as Chemical's second president. Mason, who would later be referred to as "the father of the Chemical Bank" and was one of the richest merchants of his day in New York, succeeded Baltus Melick in 1831. Mason was responsible for establishing the highly conservative business culture of the young bank that would persist for nearly 90 years. For its first twenty-five years, the bank paid no dividends, nor did it pay interest on customer deposits. Mason was also responsible for leading Chemical through the Panic of 1837

The Panic of 1837 was a financial crisis in the United States that touched off a major depression, which lasted until the mid-1840s. Profits, prices, and wages went down, westward expansion was stalled, unemployment went up, and pessimism abound ...

. When a speculative bubble collapsed on May 10, 1837, banks suspended payment of gold and silver specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

. Although in the 1837 crisis Chemical followed others in suspending payments, they stood alone in the Panic of 1857

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was ...

, when they continued to make payments in specie. Even in 1837, Chemical was still one of the earliest to resume payments in specie.

Mason died on September 26, 1839, but his legacy of conservatism was taken on by his successors. Isaac Jones and later his cousin John Quentin Jones would lead Chemical, both serving as president, across the next forty years through 1878. Both Isaac and John Jones had close connections to John Mason, particularly Isaac who married one of John Mason's three daughters. The Mason and Jones families would maintain effective control of Chemical for much of its first five decades. John Q. Jones was succeeded in 1878 by George G. Williams, who had joined the bank in 1842 and served as cashier of the bank from 1855 onward. In that position, Williams was also inculcated in Chemical's conservative style of banking. Williams would serve as president from 1878 through 1903.

In 1844, when New York Chemical Manufacturing Company's original charter expired, the chemical company was liquidated and was reincorporated as a bank only, becoming the Chemical Bank of New York in 1844. Among the bank's first directors under its new charter were Cornelius Roosevelt

Cornelius Van Schaack "C.V.S." Roosevelt (January 30, 1794 – July 17, 1871) was an American businessman from New York City. He was a member of the prominent Roosevelt family and the paternal grandfather of U.S. President Theodore Roosevelt.

Ea ...

, John D. Wolfe, Isaac Platt, and Bradish Johnson

Bradish Johnson (April 22, 1811 – November 3, 1892) was an American industrialist. He owned plantations and sugar refineries in Louisiana and a large distillery in New York City. In 1858 his distillery was at the heart of a scandal when an expo ...

, as well as bank president John Q. Jones. The company sold all remaining inventories from the chemical division as well as the corresponding real-estate holdings by 1851.

Two years later, in 1853, Chemical became a charter member of the New York Clearing House

The Clearing House is a banking association and payments company owned by the largest commercial banks in the United States. The Clearing House is the parent organization of The Clearing House Payments Company L.L.C., which owns and operates core ...

, the first and largest bank clearing house in the U.S. Two Chemical presidents would also serve as head of the clearing house, with John Q. Jones serving from 1865–1871 and George G. Williams serving in 1886 and from 1893–1894.

During the Panic of 1857

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was ...

, Chemical Bank earned the nickname "Old Bullion" by taking a stand that it would continue to redeem its bank notes in specie throughout the crisis. The panic, which had hit banks and caused a number of failures, led banks across the country to suspend specie payments and turn to issuing paper promissory notes. Chemical's decision was highly unpopular among its fellow banks and led to the bank's temporary suspension from the New York Clearing House, of which Chemical was a charter member. While hundreds of banks closed, including 18 banks in New York in a single day, Chemical developed a reputation for stability. This reputation proved extremely important in Chemical's growth during subsequent recessions during the 1860s. Chemical frequently used the refrain "Good as gold then, good as gold today" in advertisements from the 1860s well into the 20th century.

Chemical received its national charter as the Chemical National Bank of New York in 1865, at the urging of the secretary of the treasury. This allowed Chemical to issue government-backed national bank notes, the forerunner to paper money. By the early 1870s, Chemical had accumulated deposits in excess of $6 million (equivalent to $ million in ).

A contemporary perspective of Chemical from 1893 described the bank as follows:

1900–1946

By the first decade of the 20th century, Chemical had one of the strongest reputations in banking but as a business was in decline, losing accounts each year. Unlike many of its peers, Chemical had been reluctant to expand into securities and other businesses and had not paid interest on bank accounts. Both practices, considered to be highly conservative, had allowed Chemical to develop a large capital reserve but were not attracting customers. William H. Porter, a prominent banker of the era, was named president of the bank in 1903 after the death of the previous president George G. Williams. Porter would leave Chemical seven years later to become a partner at J.P. Morgan & Co. in 1910 and was succeeded by Joseph B. Martindale, who was named president in 1911.

By the first decade of the 20th century, Chemical had one of the strongest reputations in banking but as a business was in decline, losing accounts each year. Unlike many of its peers, Chemical had been reluctant to expand into securities and other businesses and had not paid interest on bank accounts. Both practices, considered to be highly conservative, had allowed Chemical to develop a large capital reserve but were not attracting customers. William H. Porter, a prominent banker of the era, was named president of the bank in 1903 after the death of the previous president George G. Williams. Porter would leave Chemical seven years later to become a partner at J.P. Morgan & Co. in 1910 and was succeeded by Joseph B. Martindale, who was named president in 1911.

In 1917, Chemical named a new president of the bank, Herbert Twitchell, after the death of Joseph B. Martindale. It was uncovered, just months after Martindale's death, that the former Chemical president had stolen as much as $300,000 from the account of Ellen D. Hunt, a niece of Wilson G. Hunt.

Twitchell initiated a major turnaround of Chemical, setting up a trust business and reversing Chemical's policy of not paying interest on cash accounts. These steps along with other initiatives, resulted in an increase in deposits from $35 million to $81 million by 1920. In 1920, Twitchell was succeeded by Percy H. Johnston and remained with the bank as chairman of the board. Johnston would hold the presidency of the bank through 1946 at which time the bank had grown to become the seventh largest in the U.S.

In 1920, Chemical completed its first major acquisition, merging with Citizens National Bank. The acquisition of Citizens National, a small New York commercial bank, increased Chemical's assets to more than $200 million with more than $140 million of deposits.Chemical Bank to Absorb Citizens

In 1917, Chemical named a new president of the bank, Herbert Twitchell, after the death of Joseph B. Martindale. It was uncovered, just months after Martindale's death, that the former Chemical president had stolen as much as $300,000 from the account of Ellen D. Hunt, a niece of Wilson G. Hunt.

Twitchell initiated a major turnaround of Chemical, setting up a trust business and reversing Chemical's policy of not paying interest on cash accounts. These steps along with other initiatives, resulted in an increase in deposits from $35 million to $81 million by 1920. In 1920, Twitchell was succeeded by Percy H. Johnston and remained with the bank as chairman of the board. Johnston would hold the presidency of the bank through 1946 at which time the bank had grown to become the seventh largest in the U.S.

In 1920, Chemical completed its first major acquisition, merging with Citizens National Bank. The acquisition of Citizens National, a small New York commercial bank, increased Chemical's assets to more than $200 million with more than $140 million of deposits.Chemical Bank to Absorb Citizens''The New York Times'', March 19, 1920 In 1923, Chemical established its first branch and by the end of the 1920s had opened a dozen branches in Manhattan and Brooklyn as well as a branch in London, its first international presence. In 1929, Chemical reincorporated as a state bank in New York as Chemical Bank & Trust Company and merged with the United States Mortgage & Trust Company, headquartered on the

Madison Avenue

Madison Avenue is a north-south avenue in the borough of Manhattan in New York City, United States, that carries northbound one-way traffic. It runs from Madison Square (at 23rd Street) to meet the southbound Harlem River Drive at 142nd Str ...

and 74th Street. During the Depression-era of the 1930s, Chemical's deposits grew by more than 40% and in 1941, the bank reached $1 billion of assets. During this period, Chemical also established Chemical National Company, a securities underwriting business.

1947–1979

In 1947, after the retirement of Percy Johnston, Harold Holmes Helm was named the new president of Chemical and would serve first as president and later as chairman of the bank for the next 18 years until his retirement in 1965. Under Helm, Chemical completed a series of large mergers in the late 1940s and early 1950s that again made the bank among the largest in the U.S. In 1947, Chemical merged with

In 1947, after the retirement of Percy Johnston, Harold Holmes Helm was named the new president of Chemical and would serve first as president and later as chairman of the bank for the next 18 years until his retirement in 1965. Under Helm, Chemical completed a series of large mergers in the late 1940s and early 1950s that again made the bank among the largest in the U.S. In 1947, Chemical merged with Continental Bank and Trust Company

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in th ...

. Then in 1954, Chemical would merge with the Corn Exchange Bank

The Corn Exchange Bank was a retail bank founded in 1853 in New York state. Over the years, the company acquired many community banks.

History

In 1855, the Corn Exchange Bank moved into an existing building in New York City at the northwest ...

and only five years later merge again with the New York Trust Company

The New York Trust Company was a large trust and wholesale-banking business that specialized in servicing large industrial accounts. It merged with the Chemical Corn Exchange Bank and eventually the merged entity became Chemical Bank.

History

On ...

.

Chemical completed its largest acquisition to that point, in 1954, merging with the Corn Exchange Bank to become the Chemical Corn Exchange Bank. Founded in 1853, the Corn Exchange Bank was based in New York City, but had built a network of branches in other states through the acquisition of community banks. The merger with the Corn Exchange Bank added 98 additional branches to Chemical's system largely in the New York City and $774 million in deposits.

In 1959, the bank, now known as Chemical Corn Exchange Bank, merged with New York Trust Company, effectively doubling the size of the company. New York Trust Company, which had a large trust and wholesale-banking business, specialized in servicing large industrial accounts. At the time of the merger, Chemical Corn was the fourth largest bank in New York and New York Trust was the ninth largest bank and the merger created the third largest bank in New York, and the fourth largest in the U.S. with $3.8 billion of assets. Following the merger, the bank dropped the usage of the "corn exchange" from the corporate name to become the Chemical Bank New York Trust Company.

In 1968, Chemical reorganized itself as a bank holding company, Chemical New York Corporation, which allowed for more rapid expansion. Throughout the early 1960s Chemical had begun to expand into New York's suburbs, opening branches on Long Island

Long Island is a densely populated island in the southeastern region of the U.S. state of New York, part of the New York metropolitan area. With over 8 million people, Long Island is the most populous island in the United States and the 18 ...

and in Westchester County

Westchester County is located in the U.S. state of New York. It is the seventh most populous county in the State of New York and the most populous north of New York City. According to the 2020 United States Census, the county had a population ...

. However, by the late 1960s and early 1970s, Chemical was focused on building its international business. In these years, Chemical opened new offices in Frankfurt, Germany

Frankfurt, officially Frankfurt am Main (; Hessian: , " Frank ford on the Main"), is the most populous city in the German state of Hesse. Its 791,000 inhabitants as of 2022 make it the fifth-most populous city in Germany. Located on its ...

(1969), Zurich, Switzerland (1971), Brussels, Belgium

Brussels (french: Bruxelles or ; nl, Brussel ), officially the Brussels-Capital Region (All text and all but one graphic show the English name as Brussels-Capital Region.) (french: link=no, Région de Bruxelles-Capitale; nl, link=no, Bruss ...

(1971), Paris, France

Paris () is the capital and most populous city of France, with an estimated population of 2,165,423 residents in 2019 in an area of more than 105 km² (41 sq mi), making it the 30th most densely populated city in the world in 2020. Si ...

(1971) and Tokyo, Japan

Tokyo (; ja, 東京, , ), officially the Tokyo Metropolis ( ja, 東京都, label=none, ), is the capital and largest city of Japan. Formerly known as Edo, its metropolitan area () is the most populous in the world, with an estimated 37.468 ...

(1972).

In 1975, Chemical acquired Security National Bank, which had a branch network on Long Island.

1980s

Chemical continued pursuing acquisitions, throughout the 1980s notably its acquisitions of Texas Commerce Bank (1986) and Horizon Bancorp (1986) as well as its attempted takeover ofFlorida National Bank

Florida National Bank (FNB), founded in 1905, was the second largest commercial bank in Florida. Florida National Group was acquired in 1990 by First Union Corporation, which was renamed Wachovia in 2001; Wachovia was subsequently acquired by Wel ...

(1982).

Chemical and Florida National Bank agreed, in 1982, to enter into a merger, after laws preventing interstate banking were lifted, giving Chemical an option to acquire the business. In February, 1982, Southeast Banking Corporation

Southeast Banking Corporation was a bank holding company based in Miami, Florida. On Friday, September 19, 1991, during the savings and loan crisis, Southeast failed and was seized by the Office of the Comptroller of the Currency. It was placed i ...

(SBC), which had been rebuffed in its attempted to acquire Florida National sued to obtain an injunction against the Chemical merger. In early 1983, Southeast Banking Corporation dropped its takeover attempt and agreed to exchange their Florida National shares for 24 FNB branch offices and other consideration. Following the deal with SBC, Florida National was cleared to merge with Chemical, however interstate banking acquisitions were still prohibited by Federal law and required state legislative approval. With the 1990 deadline running out for its option to buy Florida National and no sign of state legislative approval, Chemical Bank sold their 4.9% interest to First Union Corporation

First Union Corporation was a bank holding company that provided commercial and retail banking services in eleven states in the eastern U.S. First Union also provided various other financial services, including mortgage banking, credit card, inv ...

for $115 million.First Union to Acquire Florida National Bank''The New York Times'', March 8, 1989 Chemical completed its largest transaction of the 1980s in December 1986, when the bank agreed to acquire Texas Commerce Bank. The $1.1 billion transaction represented the largest interstate banking merger in U.S. history to that time. Texas Commerce, which was officially acquired in May 1987, was one of the largest bank holding companies in the Southwestern U.S., with a strong presence in corporate banking for small and medium-sized businesses. Chemical did not seek

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cr ...

backing for its acquisition of Texas Commerce although other large Texas banks, First RepublicBank Corporation (Acquired by NationsBank

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

) and MCorp Bank (acquired by Bank One

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, ...

), received over $5 billion of support. Ultimately Chemical contributed $300 million to shore Texas Commerce as it continued to suffer losses.

Also in 1986, Chemical agreed to a merger with New Jersey-based Horizon Bancorp, although the merger was not completed until 1989, due again to interstate banking rules.

The bank's holding company, Chemical New York Corporation, was renamed the Chemical Banking Corporation in 1988 following its series of out of state mergers and acquisitions, including Texas Commerce Bank and Horizon Bancorp.

It was during this period, in the 1980s and early 1990s, that Chemical emerged as one of the leaders in the financing of leveraged buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money ( leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loa ...

transactions. By the late 1980s, Chemical developed its reputation for financing buyouts, building a syndicated leveraged finance business and related advisory businesses under the auspices of pioneering investment banker, Jimmy Lee. It was not until 1993 that Chemical would receive permission to underwrite corporate bonds, however within a few years, Chemical (and later Chase) became a major underwriter of below-investment-grade debt under Lee. Additionally, in 1984, Chemical launched Chemical Venture Partners to invest in private equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a typ ...

transactions alongside various financial sponsors.

1990s

In July 1991, Chemical announced that it would acquire Manufacturers Hanover Corporation in a $135 billion merger transaction. At the time of the merger, Chemical and Manufacturers Hanover were the sixth and ninth largest banks, respectively, by assets. The transaction, when it closed at the end of 1991, made the combined bank, which retained the Chemical name, the second largest bank in the U.S., behindCiticorp

Citigroup Inc. or Citi (stylized as citi) is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomer ...

both in terms of assets and customers (approximately 1.2 million household accounts in 1991). Chemical adopted Manufacturers Hanover's logo design and moved into its headquarters at 270 Park Avenue in New York. In corporate banking, Manufacturers Hanover was better established with larger, blue-chip companies, whereas Chemical had been stronger with small- and medium-sized businesses.A Market Where Chemical is King''The New York Times'', January 11, 1987 Nationally, the combined Chemical Bank became one of the largest lenders to U.S. companies and was arguably the leader in loan syndication globally. Additionally, Chemical took a leading role providing foreign exchange, interest rate and currency swaps, corporate finance services, cash management, corporate and institutional trust, trade services and funds transfer. Chemical operated one of the nation's largest bank credit card franchises and was a major originator and servicer of home mortgages. In 1996, Chemical acquired Chase Manhattan Corporation in a merger valued at $10 billion to create the largest financial institution in the United States. Although Chemical was the acquiring company and the nominal survivor, the merged bank adopted the Chase name, which was considered to be better known, particularly internationally. Chase, which at its height had been the largest bank in the U.S., had fallen to sixth, while Chemical was the third largest bank at the time of the merger. The merger resulted in the reduction of more than 12,000 jobs between the two banks and merger related expenses of approximately $1.9 billion. The bank continued to operate under the Chase brand until its acquisition of J.P. Morgan & Co. in December 2000 to form JPMorgan Chase & Co. Throughout all of these acquisitions, Chemical's original management team, led by

Walter V. Shipley

Walter Vincent Shipley II (November 2, 1935 – January 11, 2019) was the chairman and chief executive officer of Chase Manhattan Bank and, previous to that, the company with which it merged Chemical Bank. Shipley was named chief executive of Che ...

, remained in charge of the bank. When the combined bank purchased J.P. Morgan & Co., William B. Harrison, Jr., who had been a longtime Chemical executive, was named CEO of the combined firm. Additionally, many of Chemical's businesses remained intact through the various mergers. Chemical's private equity group for example, was renamed multiple times, ultimately becoming JP Morgan Partners

CCMP Capital is an American private equity investment firm that focuses on leveraged buyout and growth capital transactions. Formerly known as JP Morgan Partners, the investment professionals of JP Morgan Partners separated from JPMorgan Chase o ...

before completing a spin-out from the bank, as CCMP Capital

CCMP Capital is an American private equity investment firm that focuses on leveraged buyout and growth capital transactions. Formerly known as JP Morgan Partners, the investment professionals of JP Morgan Partners separated from JPMorgan Chase o ...

, after the bank's 2004 merger with Bank One. Additionally, JPMorgan Chase retains Chemical's pre-1996 stock price history, as well as Chemical's old headquarters at 270 Park Avenue.

Acquisition history

Electronic banking

Chemical was among the pioneers of electroniconline banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial ins ...

. On September 2, 1969, Chemical installed the first automated teller machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, fund ...

(ATM) at its branch in Rockville Centre, New York

Rockville Centre, commonly abbreviated as RVC, is an incorporated village located in the Town of Hempstead in Nassau County, on the South Shore of Long Island, in New York, United States. The population was 24,023 at the 2010 census.

Hist ...

. The first ATMs were designed to dispense a fixed amount of cash when a user inserted a specially coded card. A Chemical Bank advertisement boasted "On Sept. 2 our bank will open at 9:00 and never close again." Chemical's ATM, initially known as a Docuteller, was designed by Donald Wetzel

Donald C. Wetzel (born January 3, 1929) is an American businessman known for holding the USA patent to the automatic teller machine.

Born in New Orleans, Louisiana, he graduated from Jesuit High School (New Orleans) in 1947 and got a B.Sc. in for ...

and his company Docutel. Chemical executives were initially hesitant about the electronic banking transition given the high cost of the early machines. Additionally, executives were concerned that customers would resist having machines handling their money.

In 1982, Chemical initiated the first personal computer based banking system when it launched a pilot electronic banking program called Pronto.Home Banking by Computer''The New York Times'', March 29, 1983 Chemical had spent $20 million to develop the software for Pronto. The system, which worked with the

Atari

Atari () is a brand name that has been owned by several entities since its inception in 1972. It is currently owned by French publisher Atari SA through a subsidiary named Atari Interactive. The original Atari, Inc., founded in Sunnyvale, Ca ...

console, began in New York and served 200 Chemical Bank customers. Pronto was an extension of other electronic banking services offered by Chemical that included a corporate cash-management system and its growing ATM network and was one of the largest early forays by a bank into home computer based banking. However, a year after launching Pronto only 21,000 of Chemical's 1.15 million customers were using the system, in large part due to the high monthly subscription costs that Chemical charged customers to use it."Brave New Piggy Bank"''Time'', July 15, 1985 By 1985, it was clear that Pronto, which was heavily promoted by Chemical, was growing much slower than anticipated. In 1985, Chemical and

BankAmerica

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank ...

, another pioneer in electronic banking, entered into a joint venture with AT&T Corporation

AT&T Corporation, originally the American Telephone and Telegraph Company, is the subsidiary of AT&T Inc. that provides voice, video, data, and Internet telecommunications and professional services to businesses, consumers, and government agen ...

and Time Inc., known as Covidea, to market banking and discount stock-brokerage services to computer-equipped households. By combining resources and sharing costs, the four firms hoped to reduce the risk of large and protracted losses. Eventually Chemical discontinued its efforts in 1989 at a loss of nearly $30 million.''Time'', January 9, 1989

Notable employees and executives

Executives and directors

* Earl C. Sandmeyer, a founder of the New York Society of Security Analysts, New York Financial Writers Association, International Public Relations Association (IPRA), Public Relations Society, Public Relations Society of America, Public Utilities Advertising Association, Newcomen Society, Christ Church Day School, Corporate Intelligence, Inc. public relations and publishing, and Lifelighters' Associatesrecord company

A record label, or record company, is a brand or trademark of music recordings and music videos, or the company that owns it. Sometimes, a record label is also a publishing company that manages such brands and trademarks, coordinates the produ ...

, financial editor of the Rochester ''Times-Union'' from 1929 to 1933, financial editor and columnist of the Gannett

Gannett Co., Inc. () is an American mass media holding company headquartered in McLean, Virginia, in the Washington, D.C., metropolitan area.New York Herald Tribune

The ''New York Herald Tribune'' was a newspaper published between 1924 and 1966. It was created in 1924 when Ogden Mills Reid of the ''New-York Tribune'' acquired the '' New York Herald''. It was regarded as a "writer's newspaper" and competed ...

'' from 1938 to 1940.

* William B. Harrison, Jr., later CEO of JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, t ...

* James B. Lee, Jr.

James Bainbridge Lee, Jr. (October 30, 1952 – June 17, 2015) was an American investment banker, notable for his role in the development of the leveraged finance markets in the U.S. in the 1980s. He is widely credited as the architect of the mo ...

, investment banker and senior executive at JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, t ...

, notable for his role in the development of the leveraged finance markets in the U.S.

* Robert I. Lipp, partner of Brysam Global Partners

Brysam Global Partners is a private equity firm that specializes in consumer financial services in emerging markets. It was founded in January 2007 by Marjorie Magner and Robert Willumstad.

On September 7, 2007, Brysam completed a $228m (US) ...

, a private equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a typ ...

firm, and former member of the board of JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, t ...

* John McGillicuddy, former chairman and CEO of Manufacturers Hanover

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufac ...

* John Mason, early shareholder and second president of Chemical Bank

* Balthazar P. Melick, founder and first president of Chemical Bank

* John L. Notter

John L. Notter (born 1935) is an American financier and developer who manages and has substantial interests in a wide variety of companies, including Westlake Properties, Inc., and Sailview Associates, Inc., of Westlake Village, California; and Cl ...

, international financier and developer, former director

* Cornelius Roosevelt

Cornelius Van Schaack "C.V.S." Roosevelt (January 30, 1794 – July 17, 1871) was an American businessman from New York City. He was a member of the prominent Roosevelt family and the paternal grandfather of U.S. President Theodore Roosevelt.

Ea ...

, original director of Chemical Bank of New York when it was rechartered in 1844

* Emlen Roosevelt

William Emlen Roosevelt (April 30, 1857 – May 15, 1930) was a prominent New York City banker who held a wide range of positions in numerous organizations and was a cousin of United States President Theodore Roosevelt. He was president of Roos ...

, cousin of Theodore Roosevelt and president of Roosevelt & Son

Roosevelt & Son was an American investment banking firm connected with the Roosevelt family for nearly two centuries. The firm was among the oldest banking houses on Wall Street. Many of the male members of the Roosevelt family worked for the fi ...

* James A. Roosevelt

James Alfred Roosevelt (June 13, 1825 – July 15, 1898) was an American businessman and philanthropist. A member of the Roosevelt family, he was an uncle of President Theodore Roosevelt.

Early life

Roosevelt was born on June 13, 1825, to Corn ...

, uncle of Theodore Roosevelt and founder of Roosevelt & Son

Roosevelt & Son was an American investment banking firm connected with the Roosevelt family for nearly two centuries. The firm was among the oldest banking houses on Wall Street. Many of the male members of the Roosevelt family worked for the fi ...

* Walter V. Shipley

Walter Vincent Shipley II (November 2, 1935 – January 11, 2019) was the chairman and chief executive officer of Chase Manhattan Bank and, previous to that, the company with which it merged Chemical Bank. Shipley was named chief executive of Che ...

, former chairman and CEO of Chemical and later Chase Manhattan Bank

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and fina ...

and chairman of JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, t ...

Other former employees

* Henry B. R. Brown, the originator of the world's firstmoney market fund

A money market fund (also called a money market mutual fund) is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a ...

* Granger K. Costikyan, founder of Costikyan Freres

* Alan H. Fishman, the last CEO of Washington Mutual

Washington Mutual (often abbreviated to WaMu) was the United States' largest savings and loan association until its collapse in 2008.

A savings bank holding company is defined in United States Code: Title 12: Banks and Banking; Section 1842: Def ...

before the bank was seized in 2008

* Ford M. Fraker, former ambassador to Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the fifth-largest country in Asia, the second-largest in the Ara ...

* Christopher C. Ashby, former ambassador to Uruguay

Uruguay (; ), officially the Oriental Republic of Uruguay ( es, República Oriental del Uruguay), is a country in South America. It shares borders with Argentina to its west and southwest and Brazil to its north and northeast; while bordering ...

* Abraham George

Abraham M. George is an Indian-American businessman, academic, and philanthropist. He is the founder of The George Foundation (TGF), a non-profit organization based in Bangalore, India dedicated to the welfare and empowerment of economically an ...

, businessman, academic, and philanthropist and founder of The George Foundation

* Glenn Hutchins

Glenn Hutchins is an American businessman and investor. He is a private equity investor focused on the technology sector, chairman of North Island and co-founder of Silver Lake Partners.

Career

After studying at The Lawrenceville School and grad ...

, founder of Silver Lake Partners

Silver Lake is an American global private equity firm focused on investments in technology, technology-enabled and related industries. Founded in 1999, the firm is one of the largest technology investors in the world. Its investment holdings hav ...

* Kathryn V. Marinello

Kathryn V. Marinello (born June 2, 1956) is an American businesswoman, and president and chief executive officer (CEO) of PODS, a moving and storage company.

Previously, she was president and CEO of The Hertz Corporation.

Early life

Kathryn Mar ...

, former president and CEO of Ceridian Corporation

Ceridian HCM is an American provider of human resources software and services with employees in the USA, Canada, Europe, Australia and Mauritius. It is a publicly traded company on the New York Stock Exchange.

History

Ceridian is a descen ...

* Darla Moore

Darla Dee Moore (born August 1, 1954) is an American investor and philanthropist. She is the former president and a partner of the private investment firm Rainwater Inc. and was married to Richard Rainwater, who founded the firm.

Early life and ...

, partner of Rainwater, Inc. and wife of Richard Rainwater

Richard Edward Rainwater (June 15, 1944 – September 27, 2015) was an American investor and philanthropist. With an estimated net worth of $3 billion, he ranked 211th on the Forbes 400 in 2015.

His investing style was described as "analytically ...

* Nancy Naples, director of Amtrak

The National Railroad Passenger Corporation, doing business as Amtrak () , is the national passenger railroad company of the United States. It operates inter-city rail service in 46 of the 48 contiguous U.S. States and nine cities in Canada. ...

* Peggy Post

Peggy Post is an American author and consultant on etiquette. She is Emily Post's great-granddaughter-in-law and continues her work as director and spokesperson for The Emily Post Institute in Vermont.

Background

Post was born in Washington, D.C ...

, American author and consultant on etiquette

* Pat Toomey

Patrick Joseph Toomey Jr. (born November 17, 1961) is an American businessman and politician serving as the junior United States senator for Pennsylvania since 2011. A member of the Republican Party, he served three terms as the U.S. representa ...

, United States senator from Pennsylvania

* Kathleen Waldron, an American author, financial executive and educator

References

Sources

History of the Chemical Bank: 1823–1913

1913

Lehman Brothers Collections – Twentieth Century Business Archives, Harvard Business School {{authority control Defunct banks of the United States Banks established in 1823 Banks disestablished in 1996 JPMorgan Chase Banks based in New York City Defunct companies based in New York City American companies established in 1823 American companies disestablished in 1996 1823 establishments in New York (state) 1996 disestablishments in New York (state)