Circular flow on:

[Wikipedia]

[Google]

[Amazon]

The circular flow of income or circular flow is a

The circular flow of income or circular flow is a

The circular flow of income is a concept for better understanding the

The circular flow of income is a concept for better understanding the

, by Bureau of Economic Analysis (BEA), U.S. Department of Commerce, October 2014. These transactions can also be considered in terms of the monetary flows that occur. Businesses provide individuals with income (in the form of compensation) in exchange for their labor, and that income is spent on the goods and services businesses produce. The circular flow diagram illustrates the interdependence of the "flows," or activities, that occur in the economy, such as the production of goods and services (or the "output" of the economy) and the income generated from that production. The circular flow also shows the equality between the income earned from production and the value of goods and services produced. The world economy is more complex than this two-sector model, and involves interactions between not only individuals and businesses, but also federal, state, and local governments and residents of the rest of the world. There are also other aspects of economic activity such as investment in capital (produced—or fixed—assets such as structures, equipment, research and development, and software), flows of

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon, who was influenced by prior economists, especially

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon, who was influenced by prior economists, especially

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique. Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book ''Tableau économique'' (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

* First, regulation impedes the flow of income throughout all social classes and, therefore, economic development.

* Second, taxes on the productive classes, such as farmers, should be reduced in favor of higher taxes for unproductive classes, such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique. Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book ''Tableau économique'' (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

* First, regulation impedes the flow of income throughout all social classes and, therefore, economic development.

* Second, taxes on the productive classes, such as farmers, should be reduced in favor of higher taxes for unproductive classes, such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of

In the basic two-sector circular flow of income model, the economy consists of two

In the basic two-sector circular flow of income model, the economy consists of two

The three-sector model adds the government sector to the two-sector model. Thus, the three-sector model includes (1) households, (2) firms, and (3) government. It excludes the financial sector and the foreign sector. The government sector consists of the economic activities of local, state and federal governments. Flows from households and firms to government are in the form of taxes. The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services. Every payment has a corresponding receipt; that is, every flow of money has a corresponding flow of goods in the opposite direction. As a result, the aggregate expenditure of the economy is identical to its aggregate income, making a circular flow.

The three-sector model adds the government sector to the two-sector model. Thus, the three-sector model includes (1) households, (2) firms, and (3) government. It excludes the financial sector and the foreign sector. The government sector consists of the economic activities of local, state and federal governments. Flows from households and firms to government are in the form of taxes. The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services. Every payment has a corresponding receipt; that is, every flow of money has a corresponding flow of goods in the opposite direction. As a result, the aggregate expenditure of the economy is identical to its aggregate income, making a circular flow.

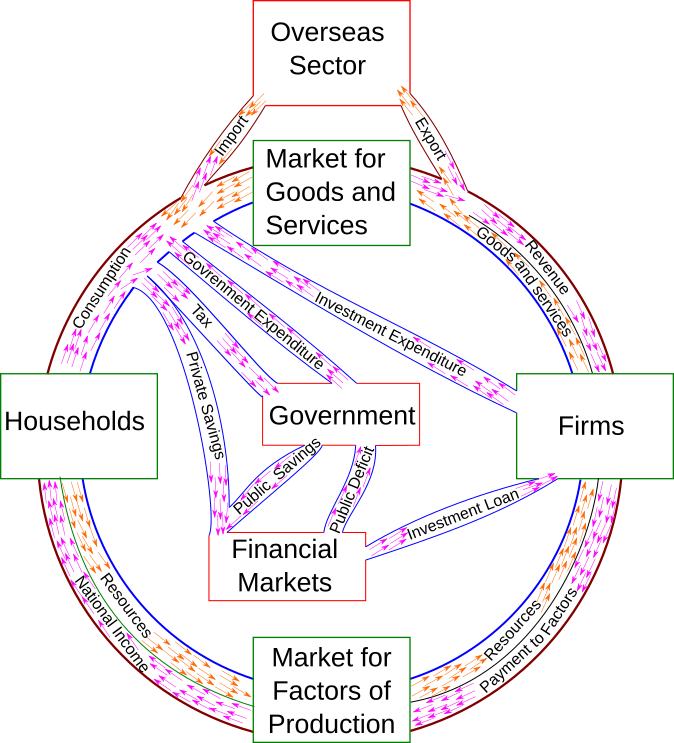

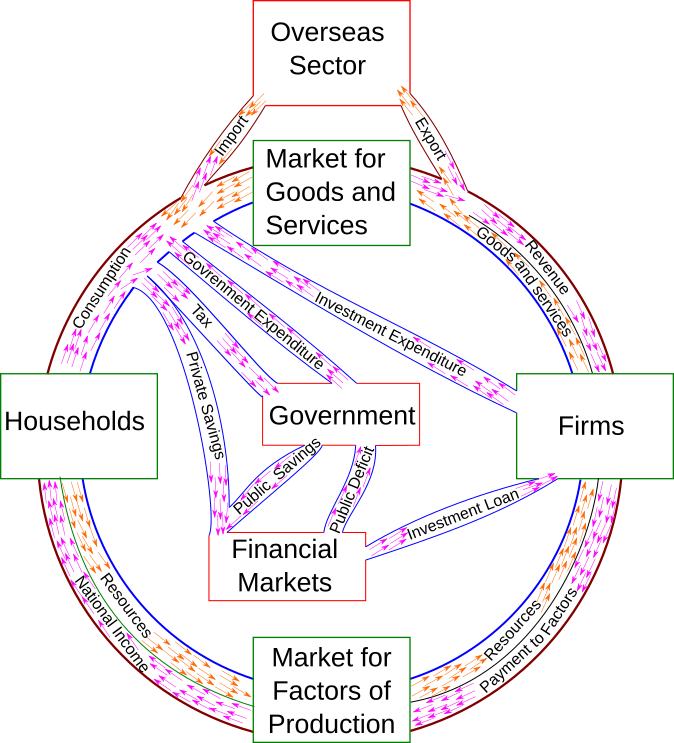

File:Five Sector Circular Flow of Income Model.jpg, Five-sector circular flow of income model

File:04 circular flow diagram.png, Circular flow diagram, five-sectors model

The circular flow diagram is an abstraction of the economy as a whole, which suggests that the economy can reproduce itself. It shows that as households spend money on goods and services from firms, the firms have the means to purchase labor from the households, and this labor is used to produce the goods and services that households can then purchase. The model suggests that this process can and will continue as a perpetual motion machine.

However, according to the

The circular flow diagram is an abstraction of the economy as a whole, which suggests that the economy can reproduce itself. It shows that as households spend money on goods and services from firms, the firms have the means to purchase labor from the households, and this labor is used to produce the goods and services that households can then purchase. The model suggests that this process can and will continue as a perpetual motion machine.

However, according to the

Measuring the Economy : A Primer on GDP and the National Income and Product Accounts

'' 2014, a publication now in the public domain.

An Essay on Economic Theory

'' Auburn, Alabama: Ludwig von Mises Institute. . * Daraban, Bogdan. "Introducing the Circular Flow Diagram to Business Students." ''Journal of Education for Business'' 85.5 (2010): 274–279. * * Marks, Melanie, and Gemma Kotula. "Using the circular flow of income model to teach economics in the middle school classroom." ''The Social Studies'' 100.5 (2009): 233–242. * Lloyd A. Metzler. "Three Lags in the Circular Flow of Income", in: ''Income, Employment and Public; essays in honor of Alvin H. Hansen,'' Lloyd A Metzler; New York, W.W. Norton 948 pp. 11–32 * Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47–62. *

Circular Flow Model

, The Economic Lowdown Video Series at the Federal Reserve Bank of St. Louis {{Authority control Economics models

The circular flow of income or circular flow is a

The circular flow of income or circular flow is a model

A model is an informative representation of an object, person, or system. The term originally denoted the plans of a building in late 16th-century English, and derived via French and Italian ultimately from Latin , .

Models can be divided in ...

of the economy

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

in which the major exchanges are represented as flows of money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: m ...

, goods

In economics, goods are anything that is good, usually in the sense that it provides welfare or utility to someone. Alan V. Deardorff, 2006. ''Terms Of Trade: Glossary of International Economics'', World Scientific. Online version: Deardorffs ...

and services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting Scientific technique, techniques for measuring the economic activity of a nation. These include detailed underlying measures that ...

and hence of macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ ...

.

The idea of the circular flow was already present in the work of Richard Cantillon.Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47–62. François Quesnay developed and visualized this concept in the so-called Tableau économique.Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221–230. Chapter 23. Important developments of Quesnay's tableau were Karl Marx

Karl Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, political theorist, economist, journalist, and revolutionary socialist. He is best-known for the 1848 pamphlet '' The Communist Manifesto'' (written with Friedrich Engels) ...

's reproduction schemes in the second volume of '' Capital: Critique of Political Economy'', and John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

' '' General Theory of Employment, Interest and Money''. Richard Stone further developed the concept for the United Nations

The United Nations (UN) is the Earth, global intergovernmental organization established by the signing of the Charter of the United Nations, UN Charter on 26 June 1945 with the stated purpose of maintaining international peace and internationa ...

(UN) and the Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

to the system, which is now used internationally.

Overview

The circular flow of income is a concept for better understanding the

The circular flow of income is a concept for better understanding the economy

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

as a whole and, for example, the National Income and Product Accounts

The national income and product accounts (NIPA) are part of the national accounts of the United States. They are produced by the Bureau of Economic Analysis of the Department of Commerce. They are one of the main sources of data on general econ ...

(NIPAs). In its simplest form, the model describes a two-sector economy consisting solely of business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for ...

es and individuals, and can be represented by a "circular flow diagram." In this two-sector model, individuals provide the labor that enables businesses to produce goods and services.Measuring the Economy : A Primer on GDP and the National Income and Product Accounts, by Bureau of Economic Analysis (BEA), U.S. Department of Commerce, October 2014. These transactions can also be considered in terms of the monetary flows that occur. Businesses provide individuals with income (in the form of compensation) in exchange for their labor, and that income is spent on the goods and services businesses produce. The circular flow diagram illustrates the interdependence of the "flows," or activities, that occur in the economy, such as the production of goods and services (or the "output" of the economy) and the income generated from that production. The circular flow also shows the equality between the income earned from production and the value of goods and services produced. The world economy is more complex than this two-sector model, and involves interactions between not only individuals and businesses, but also federal, state, and local governments and residents of the rest of the world. There are also other aspects of economic activity such as investment in capital (produced—or fixed—assets such as structures, equipment, research and development, and software), flows of

financial capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any Economic resources, economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their prod ...

(such as stocks, bonds, and bank deposits), and the contributions of these flows to the accumulation of fixed asset

Fixed assets (also known as long-lived assets or property, plant and equipment; PP&E) is a term used in accounting for assets and property that may not easily be converted into cash. They are contrasted with current assets, such as cash, bank ac ...

s.

History

Cantillon

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon, who was influenced by prior economists, especially

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon, who was influenced by prior economists, especially William Petty

Sir William Petty (26 May 1623 – 16 December 1687) was an English economist, physician, scientist and philosopher. He first became prominent serving Oliver Cromwell and the Commonwealth of England, Commonwealth in Cromwellian conquest of I ...

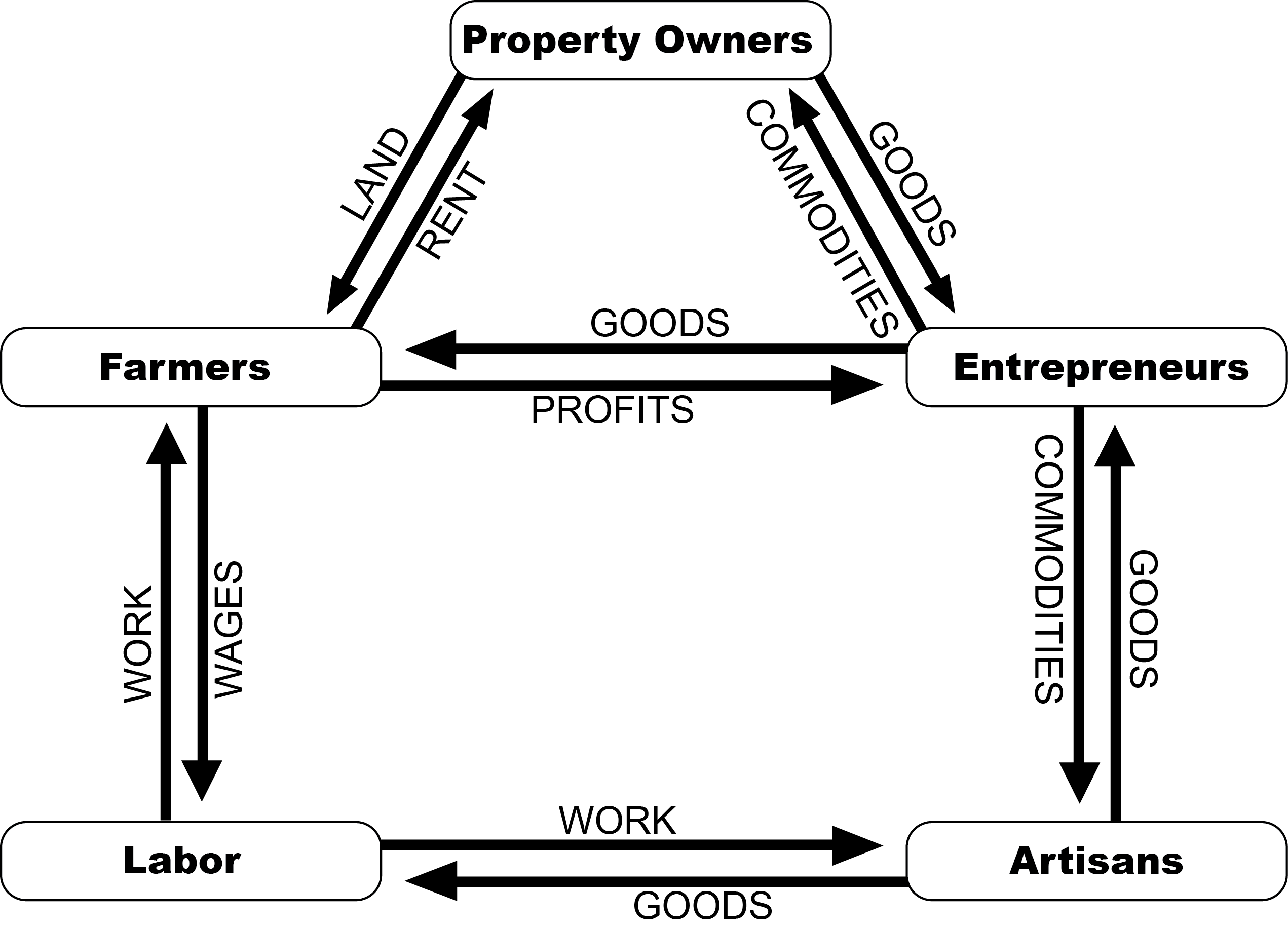

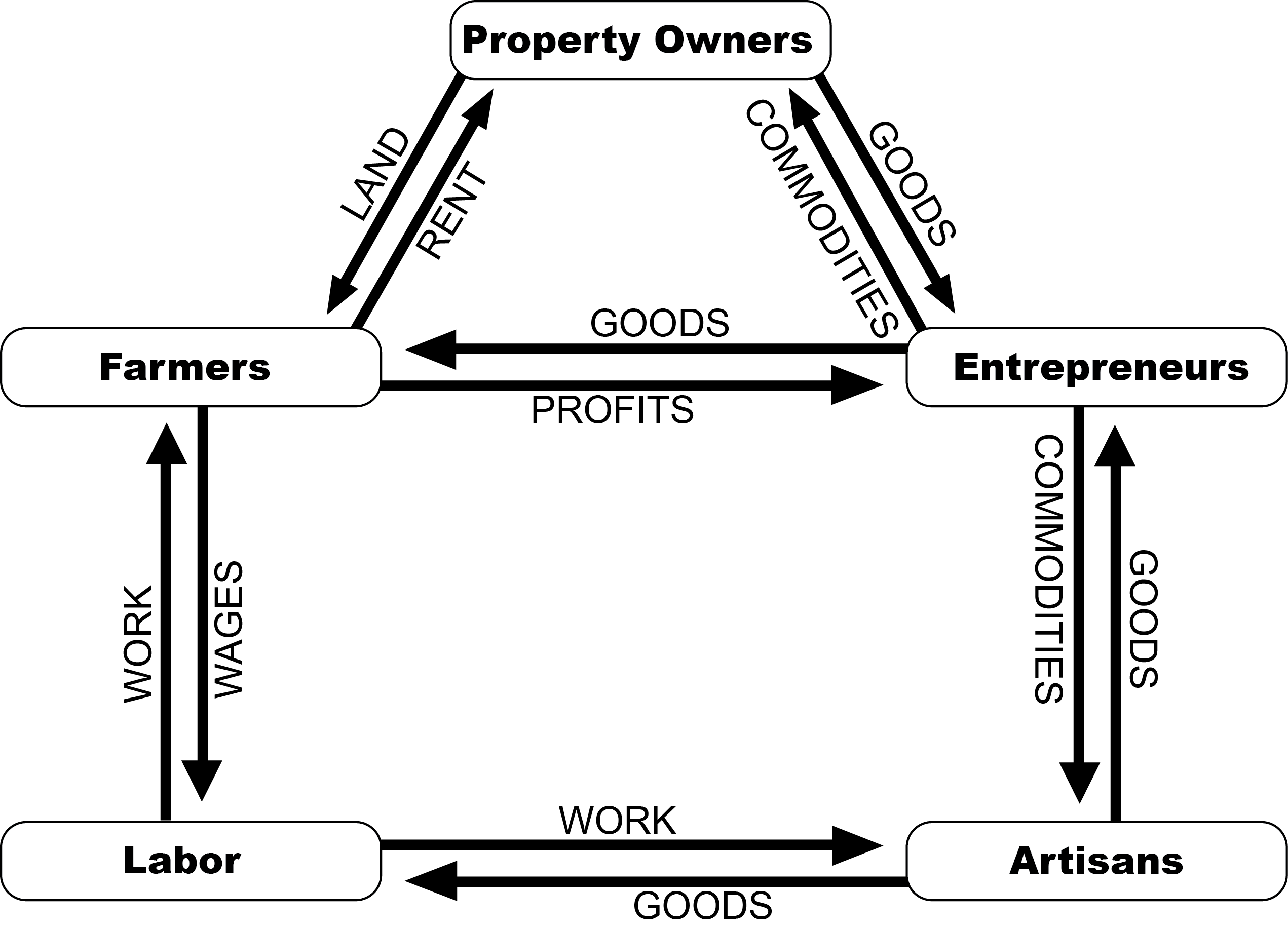

. Cantillon described the concept in his 1730 '' Essay on the Nature of Trade in General,'' in chapter 11, entitled "The Par or Relation between the Value of Land and Labor" to chapter 13, entitled "The Circulation and Exchange of Goods and Merchandise, as well as their Production, are Carried On in Europe by Entrepreneurs, and at a Risk." Thornton eds. (2010) further explained:

:''Cantillon develops a circular-flow model of the economy that shows the distribution of farm production between property owners, farmers, and workers. Farm production is exchanged for the goods and services produced in the cities by entrepreneurs and artisans. While the property owners are "independent," the model demonstrates the mutual interdependence between all the classes of people that Adam Smith

Adam Smith (baptised 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics"——— or ...

dubbed the " invisible hand" in The Theory of Moral Sentiments (1759).'' Cantillon distinguished at least five types of economic agents: property owners, farmers, entrepreneurs, labors and artisans, as expressed in the contemporary diagram of the Cantillon's Circular Flow Economy.

Quesnay

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique. Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book ''Tableau économique'' (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

* First, regulation impedes the flow of income throughout all social classes and, therefore, economic development.

* Second, taxes on the productive classes, such as farmers, should be reduced in favor of higher taxes for unproductive classes, such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique. Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book ''Tableau économique'' (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

* First, regulation impedes the flow of income throughout all social classes and, therefore, economic development.

* Second, taxes on the productive classes, such as farmers, should be reduced in favor of higher taxes for unproductive classes, such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of artisan

An artisan (from , ) is a skilled craft worker who makes or creates material objects partly or entirely by hand. These objects may be functional or strictly decorative, for example furniture, decorative art, sculpture, clothing, food ite ...

s and merchant

A merchant is a person who trades in goods produced by other people, especially one who trades with foreign countries. Merchants have been known for as long as humans have engaged in trade and commerce. Merchants and merchant networks operated i ...

s. The production and/or cash flow between the three classes started with the Proprietary class because they own the land and they buy from the other classes. Quesnay visualised the steps in the process in the Tableau économique.

Marx

In Marxian economics, economic reproduction refers to recurrent (or cyclical) processes by which the initial conditions necessary for economic activity to occur are constantly re-created. Economic reproduction involves the physical ''production'' and ''distribution'' of goods and services, the ''trade'' (the circulation via exchanges and transactions) of goods and services, and the ''consumption'' of goods and services (both productive orintermediate consumption

Intermediate consumption (also called "intermediate expenditure") is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the Europe ...

and final consumption).

Karl Marx

Karl Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, political theorist, economist, journalist, and revolutionary socialist. He is best-known for the 1848 pamphlet '' The Communist Manifesto'' (written with Friedrich Engels) ...

developed the original insights of Quesnay to model the circulation of capital, money, and commodities in the second volume of ''Das Kapital

''Capital: A Critique of Political Economy'' (), also known as ''Capital'' or (), is the most significant work by Karl Marx and the cornerstone of Marxian economics, published in three volumes in 1867, 1885, and 1894. The culmination of his ...

'' to show how the reproduction process that must occur in any type of society can take place in capitalist society through the circulation of capital.

Marx distinguishes between "simple reproduction" and "expanded (or enlarged) reproduction". In the former case, no economic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

occurs, while in the latter case, more is produced than is needed to maintain the economy at the given level, making economic growth possible. In the capitalist mode of production, the difference is that in the former case, the new surplus value

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and ...

created by wage-labour is spent by the employer on consumption (or hoarded), whereas in the latter case, part of it is reinvested in production.

Further developments

An important development wasJohn Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

's 1933 publication of the '' General Theory of Employment, Interest and Money''. Keynes' assistant Richard Stone further developed the concept for the United Nations

The United Nations (UN) is the Earth, global intergovernmental organization established by the signing of the Charter of the United Nations, UN Charter on 26 June 1945 with the stated purpose of maintaining international peace and internationa ...

(UN) and the Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

to the systems, which is now used internationally.

The first to visualize the modern circular flow of income model was Frank Knight in 1933 publication of ''The Economic Organization.'' Knight (1933) explained:

:'' e may view theeconomic organization as a system of prize relations. Seen in the large, free enterprise is an organization of production and distribution in which individuals or family units get their real income, their "living," by selling productive power for money to "business units" or "enterprises", and buying with the money income thus obtained the direct goods and services which they consume. This view, it will be remembered, ignores for the sake of simplicity the fact that an appreciable fraction of the productive power in use at any time is not really employed in satisfying current wants but to make provision for increased want-satisfaction in the future; it treats society as it would be, or would tend to become, with progress absent, or in a "static" state.''

Knight pictured a circulation of money and circulation of economic value

In economics, economic value is a measure of the benefit provided by a goods, good or service (economics), service to an Agent (economics), economic agent, and value for money represents an assessment of whether financial or other resources are ...

between people (individuals, families) and business enterprises as a group, explaining: "The general character of an enterprise system, reduced to its very simplest terms, can be illustrated by a diagram showing the exchange of productive power for consumption goods between individuals and business units, mediated by the ''circulation'' of money, and suggesting the familiar figure of the ''wheel of wealth''."

Types of models

A circular flow of income model is a simplified representation of an economy.Two-sector model

In the basic two-sector circular flow of income model, the economy consists of two

In the basic two-sector circular flow of income model, the economy consists of two sectors

Sector may refer to:

Places

* Sector, West Virginia, U.S.

Geometry

* Circular sector, the portion of a disc enclosed by two radii and a circular arc

* Hyperbolic sector, a region enclosed by two radii and a hyperbolic arc

* Spherical sector, a ...

: (1) households and (2) firms. (Some sources refer to households as "individuals" or the "public" and to firms as "businesses" or the "productive sector.") The model assumes that there is no financial sector, no government sector, and no foreign sector. In addition, the model assumes that (a) through their expenditures, households spend all of their income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. F ...

on goods and services

Goods are items that are usually (but not always) tangible, such as pens or Apple, apples. Services are activities provided by other people, such as teachers or barbers. Taken together, it is the Production (economics), production, distributio ...

or consumption and (b) through their expenditure

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition i ...

s, households purchase all output produced by firms. This means that all household expenditures become income for firms. The firms then spend all of this income on factors of production

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, goods and services. The utilised amounts of the various inputs determine the quantity of output according to the rela ...

such as labor, capital and raw materials, "transferring" all of their income to the factor owners (which are households). The factor owners (households), in turn, spend all of their income on goods, which leads to a circular flow of income.

Three-sector model

The three-sector model adds the government sector to the two-sector model. Thus, the three-sector model includes (1) households, (2) firms, and (3) government. It excludes the financial sector and the foreign sector. The government sector consists of the economic activities of local, state and federal governments. Flows from households and firms to government are in the form of taxes. The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services. Every payment has a corresponding receipt; that is, every flow of money has a corresponding flow of goods in the opposite direction. As a result, the aggregate expenditure of the economy is identical to its aggregate income, making a circular flow.

The three-sector model adds the government sector to the two-sector model. Thus, the three-sector model includes (1) households, (2) firms, and (3) government. It excludes the financial sector and the foreign sector. The government sector consists of the economic activities of local, state and federal governments. Flows from households and firms to government are in the form of taxes. The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services. Every payment has a corresponding receipt; that is, every flow of money has a corresponding flow of goods in the opposite direction. As a result, the aggregate expenditure of the economy is identical to its aggregate income, making a circular flow.

Four-sector model

The four-sector model adds the foreign sector to the three-sector model. (The foreign sector is also known as the "external sector," the "overseas sector," or the "rest of the world.") Thus, the four-sector model includes (1) households, (2) firms, (3) government, and (4) the rest of the world. It excludes the financial sector. The foreign sector comprises (a) foreign trade (imports and exports of goods and services) and (b) inflow and outflow of capital (foreign exchange). Again, each flow of money has a corresponding flow of goods (or services) in the opposite direction. Each of the four sectors receives some payments from the other in lieu of goods and services which makes a regular flow of goods and physical services. The addition of the foreign sectorFive-sector model

The five-sector model adds the financial sector to the four-sector model. Thus, the five-sector model includes (1) households, (2) firms, (3) government, (4) the rest of the world, and (5) the financial sector. The financial sector includes banks and non-bank intermediaries that engage in borrowing (savings from households) and lending (investments in firms). Money facilitates such an exchange smoothly. Residuals from each market enter thecapital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

as savings, which in turn are invested in firms and the government sector. Technically speaking, so long as lending is equal to borrowing (i.e., leakages are equal to injections), the circular flow will continue indefinitely. However, this job is done by financial institutions in the economy.

Alternative models

The progression from the two-sector model to the five sector model as documented above (that is, by starting with households and firms, then successively adding the government sector, the foreign sector, and the financial sector) is common. However, some authors group (1) households, (2) firms, and (3) the financial sector together as the "private sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The private sector employs most of the workfo ...

" and subsequently add (4) the government sector, making the " domestic sector," and (5) the foreign sector. Others use the "capital market" rather than the "financial sector" to account for the flows of savings and investments; in these sources, the fully specified model has four sectors (households, firms, government, and foreign) plus the capital market, which is regarded as a market rather than a sector.

Circular flow of income topics

Leakages and injection

The five-sector model considers leakages and injections. * 'Leakage' means withdrawal from the flow. When households and firms save part of their incomes it constitutes leakage. They may be in form of savings, tax payments, andimports

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receivin ...

. Leakages reduce the flow of income.

* 'Injection' means the introduction of income into the flow. When households and firms borrow savings, they constitute injections. Injections increase the flow of income. Injections can take the forms of investment, government spending and exports. As long as leakages are equal to injections, the circular flow of income continues indefinitely. Financial institutions or capital market play the role of intermediaries. This means that income individuals receive from businesses and the goods and services that are sold to them do not count as injections or leakages, as no new money is being introduced to the flow and no money is being taken out of the flow.

Leakages and injections can occur in the financial sector, government sector and overseas sector:

In the financial sector

In terms of the circular flow of income model, the leakage that financial institutions provide in the economy is the option for households to save their money. This is a leakage because the saved money cannot be spent in the economy and thus is an idle asset that means not all output will be purchased. The injection that the financial sector provides into the economy is investment (I) into the business/firms sector. An example of a group in the finance sector includes banks such as Westpac or financial institutions such as Suncorp.In the government sector

The leakage that the government sector provides is through the collection of revenue through taxes (T) that is provided by households and firms to the government. This is a leakage because it is a leakage out of the current income, thus reducing the expenditure on current goods and services. The injection provided by the government sector is government spending (G) that provides collective services and welfare payments to the community. An example of a tax collected by the government as a leakage isincome tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

, and an injection into the economy can be when the government redistributes this income in the form of welfare payments, that is a form of government spending back into the economy.

In the overseas sector

The main leakage from this sector are imports (M), which represent spending by residents into the rest of the world. The main injection provided by this sector is the exports of goods and services which generate income for the exporters from overseas residents. An example of the use of the overseas sector is Australia exporting wool to China: China pays the exporter of the wool (the farmer), therefore, more money enters the economy, thus making it an injection. Another example is China processing the wool into items such as coats and Australia importing the product by paying the Chinese exporter; since the money paying for the coat leaves the economy, it is a leakage.Summary of leakages and injections

The state of equilibrium

In terms of the ''five sector circular flow of income model'' the state of equilibrium occurs when the total leakages are equal to the total injections that occur in the economy. This can be shown as:Savings + Taxes + Imports = Investment + Government Spending + Exports

OR

S + T + M = I + G + X.

This can be further illustrated through a fictitious economy where:

S + T + M = I + G + X

$100 + $150 + $50 = $50 + $100 + $150

$300 = $300

Therefore, since the leakages are equal to the injections the economy is in a stable state of equilibrium. This state can be contrasted to the state of disequilibrium where unlike that of equilibrium the sum of total leakages does not equal the sum of total injections. By giving values to the leakages and injections the circular flow of income can be used to show the state of disequilibrium. Disequilibrium can be shown as:

Therefore, it can be shown as one of the below equations where:

$100 + $150 + $50 = $50 + $100 + $150

$300 = $300

Total leakages > Total injections

$150 (S) + $250 (T) + $150 (M) > $75 (I) + $200 (G) + $150 (X)

Or

Total Leakages < Total injections

$50 (S) + $200 (T) + $125 (M) < $75 (I) + $200 (G) + $150 (X)

The effects of disequilibrium vary according to which of the above equations they belong to.

If S + T + M > I + G + X the levels of income, output, expenditure and employment will fall causing a recession or contraction in the overall economic activity. But if S + T + M < I + G + X the levels of income, output, expenditure and employment will rise causing a boom or expansion in economic activity.

To manage this problem, if disequilibrium were to occur in the five sector circular flow of income model, changes in expenditure and output will lead to equilibrium being regained. An example of this is if:

S + T + M > I + G + X the levels of income, expenditure and output will fall causing a contraction or recession in the overall economic activity. As the income falls households will cut down on all leakages such as saving, they will also pay less in taxation and with a lower income they will spend less on imports. This will lead to a fall in the leakages until they equal the injections and a lower level of equilibrium will be the result.

The other equation of disequilibrium, if S + T + M < I + G + X in the five sector model the levels of income, expenditure and output will greatly rise causing a boom in economic activity. As the households income increases there will be a higher opportunity to save therefore saving in the financial sector will increase, taxation for the higher threshold will increase and they will be able to spend more on imports. In this case when the leakages increase the situation will be a higher level of equilibrium.

Significance of study of circular flow of income

The circular flow of income is significant in four areas: # Measurement of national income # Knowledge of Interdependence – Circular flow of income signifies the interdependence of each of activity upon one another. If there is no consumption, there will be no demand and expenditure which in fact restricts the amount of production and income. # Unending Nature of Economic Activities – It signifies that production, income and expenditure are of unending nature, therefore, economic activities in an economy can never come to a halt. National income is also bound to rise in future. # Injections and LeakagesCircular flow diagram as a subsystem of the environment

laws of thermodynamics

The laws of thermodynamics are a set of scientific laws which define a group of physical quantities, such as temperature, energy, and entropy, that characterize thermodynamic systems in thermodynamic equilibrium. The laws also use various param ...

, perpetual motion machines are not possible. Daly, Herman E., and Joshua C. Farley. Ecological Economics: Principles and Applications. Washington: Island, 2011. Print. p. 29. The first law states that matter and energy cannot be created or destroyed, and the second law states that matter and energy move from a more useful state of low entropy (order) to a less useful state of higher entropy (disorder). Thus, no system can continue without new inputs of energy, which then exit as high-entropy waste. Just as no animal can live on its own waste, no economy can recycle the waste it produces without the input of new energy to reproduce itself. The economy therefore cannot operate on its own, but must operate as a subsystem within a larger ecosystem

An ecosystem (or ecological system) is a system formed by Organism, organisms in interaction with their Biophysical environment, environment. The Biotic material, biotic and abiotic components are linked together through nutrient cycles and en ...

.

The abstraction

Abstraction is a process where general rules and concepts are derived from the use and classifying of specific examples, literal (reality, real or Abstract and concrete, concrete) signifiers, first principles, or other methods.

"An abstraction" ...

does not account for the linear throughput of matter and energy that must power the continuous motion of money, goods and services, and factors of production. Matter and energy enter the economy through low entropy natural capital, such as solar energy

Solar energy is the radiant energy from the Sun's sunlight, light and heat, which can be harnessed using a range of technologies such as solar electricity, solar thermal energy (including solar water heating) and solar architecture. It is a ...

, oil wells, fisheries, and mines. These materials and energy are used by households and firms to create products and wealth, and then leave the system as high-entropy waste, which is no longer valuable to the economy. The natural materials that power the motion of the economy's circular system come from the environment, and the waste must be absorbed by the larger ecosystem in which the economy exists. Daly, Herman E., and Joshua C. Farley. Ecological Economics: Principles and Applications. Washington: Island, 2011. Print. p. 29–34.

While the circular flow diagram is useful in understanding the basics of an economy, such as leakages and injections, it does not fully address the economy's reliance on natural resource

Natural resources are resources that are drawn from nature and used with few modifications. This includes the sources of valued characteristics such as commercial and industrial use, aesthetic value, scientific interest, and cultural value. ...

s and the creation of waste that must be absorbed in some manner. The economy can only continue functioning if it has the matter and energy to power it, and the ability to absorb the waste it creates. This matter and low entropy energy, and the ability to absorb waste, exist in a finite amount. Thus, there is a finite amount of inputs to the flow and outputs of the flow that the environment can handle, implying there is a sustainable limit to motion

In physics, motion is when an object changes its position with respect to a reference point in a given time. Motion is mathematically described in terms of displacement, distance, velocity, acceleration, speed, and frame of reference to an o ...

and therefore the growth of the economy.

See also

*History of economic thought

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

This field encompasses many d ...

* Barter economy

* Free-market economy

* Market

* Velocity of money

References

;Attribution This article incorporates text fromBureau of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United ...

. Measuring the Economy : A Primer on GDP and the National Income and Product Accounts

'' 2014, a publication now in the public domain.

Further reading

* Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221–230. Chapter 23. * Richard Cantillon, Chantal Saucier (translation) & Mark Thornton (editor) (2010) 755An Essay on Economic Theory

'' Auburn, Alabama: Ludwig von Mises Institute. . * Daraban, Bogdan. "Introducing the Circular Flow Diagram to Business Students." ''Journal of Education for Business'' 85.5 (2010): 274–279. * * Marks, Melanie, and Gemma Kotula. "Using the circular flow of income model to teach economics in the middle school classroom." ''The Social Studies'' 100.5 (2009): 233–242. * Lloyd A. Metzler. "Three Lags in the Circular Flow of Income", in: ''Income, Employment and Public; essays in honor of Alvin H. Hansen,'' Lloyd A Metzler; New York, W.W. Norton 948 pp. 11–32 * Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47–62. *

External links

Circular Flow Model

, The Economic Lowdown Video Series at the Federal Reserve Bank of St. Louis {{Authority control Economics models