Bank Of Montreal on:

[Wikipedia]

[Google]

[Amazon]

The Bank of Montreal (BMO; french: Banque de Montréal, link=no) is a Canadian multinational

By 1822, the bank converted from the status it had held since its founding as a private company owned by a small group of people into a public company owned by 144. At this time, it became officially known by its current name.

Expansion into Upper Canada was halted in 1824, after legislation from the

By 1822, the bank converted from the status it had held since its founding as a private company owned by a small group of people into a public company owned by 144. At this time, it became officially known by its current name.

Expansion into Upper Canada was halted in 1824, after legislation from the

In 1984, the bank acquired Chicago-based Harris Bank (through its parent, Harris Bankcorp), later rebranded as BMO Harris Bank. In 1987, the bank acquired stock brokerage

In 1984, the bank acquired Chicago-based Harris Bank (through its parent, Harris Bankcorp), later rebranded as BMO Harris Bank. In 1987, the bank acquired stock brokerage

In October 2010, the bank became the first Canadian bank to incorporate in China, with branches in China operating as BMO ChinaCo. In December 2010, BMO announced the purchase of

In October 2010, the bank became the first Canadian bank to incorporate in China, with branches in China operating as BMO ChinaCo. In December 2010, BMO announced the purchase of

* Personal and Commercial Client Group ( retail banking), including

** BMO Bank of Montreal (commercial and retail banking in Canada), including BMO's MasterCard credit cards; ''BMO Life'', a life insurance company; and the former virtual bank division mbanx

** BMO Harris Bank (commercial and retail banking in the United States, headquartered in Chicago)

* Investment Banking Group (known as

* Personal and Commercial Client Group ( retail banking), including

** BMO Bank of Montreal (commercial and retail banking in Canada), including BMO's MasterCard credit cards; ''BMO Life'', a life insurance company; and the former virtual bank division mbanx

** BMO Harris Bank (commercial and retail banking in the United States, headquartered in Chicago)

* Investment Banking Group (known as

* The Bank of Montreal, 4896 Delta Street, Delta,

* The Bank of Montreal, 4896 Delta Street, Delta,  Buildings that formerly housed a branch of the bank have also seen later notable use. A branch in Montreal has been designated as a

Buildings that formerly housed a branch of the bank have also seen later notable use. A branch in Montreal has been designated as a

The bank is a sponsor of sports teams. The bank has been a sponsor of the Toronto FC of Major League Soccer since 2007 and of its home stadium named '' BMO Field'' at Exhibition Place. In 2010, BMO extended its agreement with the Toronto FC through the 2016 season. The bank is also a sponsor of the CF Montréal, announcing a five-year agreement to become lead sponsor and jersey sponsor on 14 June 2011.

From at least 2007 through 2011, BMO was formerly the sponsor for the Toronto Maple Leafs and the Toronto Raptors. In July 2008, BMO announced a one-year sponsorship of IndyCar team

The bank is a sponsor of sports teams. The bank has been a sponsor of the Toronto FC of Major League Soccer since 2007 and of its home stadium named '' BMO Field'' at Exhibition Place. In 2010, BMO extended its agreement with the Toronto FC through the 2016 season. The bank is also a sponsor of the CF Montréal, announcing a five-year agreement to become lead sponsor and jersey sponsor on 14 June 2011.

From at least 2007 through 2011, BMO was formerly the sponsor for the Toronto Maple Leafs and the Toronto Raptors. In July 2008, BMO announced a one-year sponsorship of IndyCar team

BMO Nesbitt Burns

{{Portal bar, Banks, Canada, Companies 1817 establishments in Lower Canada Banks established in 1817 Banks of Canada Canadian brands Companies listed on the New York Stock Exchange Companies listed on the Toronto Stock Exchange Exchange-traded funds Mortgage lenders of Canada Multinational companies headquartered in Canada S&P/TSX 60 Canadian companies established in 1817

investment bank

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

and financial services company.

The bank was founded in Montreal

Montreal ( ; officially Montréal, ) is the second-most populous city in Canada and most populous city in the Canadian province of Quebec. Founded in 1642 as '' Ville-Marie'', or "City of Mary", it is named after Mount Royal, the triple- ...

, Quebec

Quebec ( ; )According to the Canadian government, ''Québec'' (with the acute accent) is the official name in Canadian French and ''Quebec'' (without the accent) is the province's official name in Canadian English is one of the thirte ...

, in 1817 as Montreal Bank; while its head office remains in Montreal, the operational headquarters and executive offices have been located in Toronto

Toronto ( ; or ) is the capital city of the Canadian province of Ontario. With a recorded population of 2,794,356 in 2021, it is the most populous city in Canada and the fourth most populous city in North America. The city is the anch ...

, Ontario

Ontario ( ; ) is one of the thirteen provinces and territories of Canada.Ontario is located in the geographic eastern half of Canada, but it has historically and politically been considered to be part of Central Canada. Located in Central Ca ...

since 1977. One of the Big Five banks in Canada, it is the fourth-largest bank in Canada by market capitalization and assets, and one of the eight largest banks in North America and the top 50 in the world. It is commonly known by its ticker symbol BMO (pronounced ), on both the Toronto Stock Exchange and the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

. In October 2021, it had CA$634 billion in assets under administration (AUA). The Bank of Montreal swift code is BOFMCAM2 and the institution number is 001.

On 23 June 1817, John Richardson and eight merchants signed the Articles of Association to establish the Montreal Bank in a rented house in Montreal

Montreal ( ; officially Montréal, ) is the second-most populous city in Canada and most populous city in the Canadian province of Quebec. Founded in 1642 as '' Ville-Marie'', or "City of Mary", it is named after Mount Royal, the triple- ...

, Quebec

Quebec ( ; )According to the Canadian government, ''Québec'' (with the acute accent) is the official name in Canadian French and ''Quebec'' (without the accent) is the province's official name in Canadian English is one of the thirte ...

. The bank officially began conducting business on 3 November 1817, making it Canada's oldest bank. It underwent a name change to its current in 1822. BMO's Institution Number (or bank number) is 001. In Canada, the bank operates as BMO Bank of Montreal and has more than 800 branches, serving over seven million customers. In the United States, it does business as BMO Financial Group, where it has substantial operations in the Chicago

(''City in a Garden''); I Will

, image_map =

, map_caption = Interactive Map of Chicago

, coordinates =

, coordinates_footnotes =

, subdivision_type = List of sovereign states, Count ...

area and elsewhere in the country, where it operates '' BMO Harris Bank''. BMO Capital Markets

BMO Capital Markets is the investment banking subsidiary of Canadian Bank of Montreal. The company offers corporate, institutional and government clients access to a range of financial services. These include equity and debt underwriting, co ...

is BMO's investment and corporate banking division, while the wealth management division is branded as BMO Nesbitt Burns. The company is ranked at number 131 on the Forbes Global 2000 list.

The company has not missed a dividend payment since 1829, paying dividends consistently through major world crises such as World War I, the Great Depression, World War II, and the 2008 financial crisis; this makes the Bank of Montreal's dividend payment history one of the longest in the world.

On December 12, 2021 Bank of Montreal announced the strategic acquisition of Bank of the West

Bank of the West is an American financial institution headquartered in San Francisco, California, United States. It is a subsidiary of the French international banking group BNP Paribas and has more than 600 branches and offices in the Midwes ...

from BNP Paribas for US$16.3 billion.

History

19th century

The bank was established on 23 June 1817, when a group of merchants signed the Articles of Association, formally creating the "Montreal Bank". The signors of the document include Robert Armour, John C. Bush,Austin Cuvillier

Austin Cuvillier (August 20, 1779 – July 11, 1849) was a businessman and political figure in Lower Canada and Canada East. He was a successful ''Canadien'' businessmen, unusual when most businessmen in Lower Canada were British. He also w ...

, George Garden, Horatio Gates

Horatio Lloyd Gates (July 26, 1727April 10, 1806) was a British-born American army officer who served as a general in the Continental Army during the early years of the Revolutionary War. He took credit for the American victory in the Battl ...

, James Leslie, George Moffatt, John Richardson, and Thomas A. Turner. The bank was first located in rooms rented on Rue Saint-Paul, Montreal

Montreal ( ; officially Montréal, ) is the second-most populous city in Canada and most populous city in the Canadian province of Quebec. Founded in 1642 as '' Ville-Marie'', or "City of Mary", it is named after Mount Royal, the triple- ...

, before moving to its permanent building on Rue Saint-Paul in 1818. In the same year, the bank opened its first branch in Quebec City

Quebec City ( or ; french: Ville de Québec), officially Québec (), is the capital city of the Canadian province of Quebec. As of July 2021, the city had a population of 549,459, and the metropolitan area had a population of 839,311. It is t ...

; and several offices in Upper Canada

The Province of Upper Canada (french: link=no, province du Haut-Canada) was a Province, part of The Canadas, British Canada established in 1791 by the Kingdom of Great Britain, to govern the central third of the lands in British North Americ ...

, including Amherstburg, Kingston, Perth

Perth is the capital and largest city of the Australian state of Western Australia. It is the fourth most populous city in Australia and Oceania, with a population of 2.1 million (80% of the state) living in Greater Perth in 2020. Perth is ...

, and York

York is a cathedral city with Roman origins, sited at the confluence of the rivers Ouse and Foss in North Yorkshire, England. It is the historic county town of Yorkshire. The city has many historic buildings and other structures, such as a ...

(present day Toronto

Toronto ( ; or ) is the capital city of the Canadian province of Ontario. With a recorded population of 2,794,356 in 2021, it is the most populous city in Canada and the fourth most populous city in North America. The city is the anch ...

). The bank also opened its first foreign permanent office in 1818, opening an office in Willam Street in New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

.

By 1822, the bank converted from the status it had held since its founding as a private company owned by a small group of people into a public company owned by 144. At this time, it became officially known by its current name.

Expansion into Upper Canada was halted in 1824, after legislation from the

By 1822, the bank converted from the status it had held since its founding as a private company owned by a small group of people into a public company owned by 144. At this time, it became officially known by its current name.

Expansion into Upper Canada was halted in 1824, after legislation from the Parliament of Upper Canada

The Parliament of Upper Canada was the legislature for Upper Canada. It was created when the old Province of Quebec was split into Upper Canada and Lower Canada by the Constitutional Act of 1791.

As in other Westminster-style legislatures, ...

forbade bank branches whose head offices were not based in Upper Canada from operating. In 1838, the bank reentered the Upper Canadian market with the purchase of the Bank of the People

The Bank of the People was created by radical Reform politicians James Lesslie, James Hervey Price, and Dr John Rolph in Toronto in 1835. It was founded after they failed to establish a "Provincial Loan Office" in which farmers could borrow s ...

, a bank based in Toronto. BMO was permitted to open its own branches in the area, after Upper Canada and Lower Canada

The Province of Lower Canada (french: province du Bas-Canada) was a British colony on the lower Saint Lawrence River and the shores of the Gulf of Saint Lawrence (1791–1841). It covered the southern portion of the current Province of Quebec ...

were united to create the Province of Canada

The Province of Canada (or the United Province of Canada or the United Canadas) was a British colony in North America from 1841 to 1867. Its formation reflected recommendations made by John Lambton, 1st Earl of Durham, in the Report on the ...

in 1841. Shortly after the two colonies merged, the bank opened branches into Cobourg, Belleville, Brockville, and Ottawa

Ottawa (, ; Canadian French: ) is the capital city of Canada. It is located at the confluence of the Ottawa River and the Rideau River in the southern portion of the province of Ontario. Ottawa borders Gatineau, Quebec, and forms the c ...

.

Expansion into the Maritimes and Western Canada

Western Canada, also referred to as the Western provinces, Canadian West or the Western provinces of Canada, and commonly known within Canada as the West, is a Canadian region that includes the four western provinces just north of the Canada� ...

was facilitated following Canadian Confederation

Canadian Confederation (french: Confédération canadienne, link=no) was the process by which three British North American provinces, the Province of Canada, Nova Scotia, and New Brunswick, were united into one federation called the Dominio ...

. In 1877, the bank opened its first branch into Western Canada, with the opening of a branch in Winnipeg

Winnipeg () is the capital and largest city of the province of Manitoba in Canada. It is centred on the confluence of the Red and Assiniboine rivers, near the longitudinal centre of North America. , Winnipeg had a city population of 749 ...

. New branches were also opened in the Maritimes, in Halifax, Moncton, and Saint John completed shortly after Confederation. The Bank of Montreal established branches in Newfoundland Colony on 31 January 1895, at the behest of the colonial government. The colonial government of Newfoundland made the request to the Bank of Montreal four days after the collapse of the Commercial Bank and Union Bank of Newfoundland on 10 December 1894.

20th century

By 1907, the bank had branches in every province of Atlantic Canada, with the opening of a branch in Charlottetown. Expansion into the Maritimes was further facilitated with the acquisition of the Exchange Bank of Yarmouth in 1903, the People’s Bank of Halifax in 1905, and the People's Bank of New Brunswick in 1906. The early 20th century also saw the bank acquire several financial institutions that helped increase its presence in Newfoundland, and areas west of Quebec, including the Ontario Bank in 1906, theBank of British North America

The Bank of British North America was founded by Royal Charter issued in 1836 in London, England with offices in Toronto, Montreal, Quebec City, Saint John, New Brunswick, Halifax and St. John's, Newfoundland. It was the first bank operating in ...

in 1918, and the Merchants Bank of Canada in 1921. During this period, the bank also acquired the Montreal-based Molson Bank in 1925.

In 1942, the bank ended production of its own bank notes, which were in circulation in Canada since 1871. By 1944, the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a centra ...

of the country, the Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: C ...

became the sole issuer of currency in Canada, and notes from private banks were withdrawn.

In 1960, the Bank of Montreal moved its operational headquarters to a seventeen-storey structure next to its historic head office. The building served as the bank's operational headquarters until 1977, when it was moved to First Canadian Place

First Canadian Place (originally First Bank Building) is a skyscraper in the Financial District of Toronto, Ontario, at the northwest corner of King and Bay streets, and serves as the global operational headquarters of the Bank of Montreal. A ...

on Bay Street

Bay Street is a major thoroughfare in Downtown Toronto, Ontario, Canada. It is the centre of Toronto's Financial District and is often used by metonymy to refer to Canada's financial services industry since succeeding Montreal's St. James ...

in Toronto

Toronto ( ; or ) is the capital city of the Canadian province of Ontario. With a recorded population of 2,794,356 in 2021, it is the most populous city in Canada and the fourth most populous city in North America. The city is the anch ...

in 1977. The structure's was named after the slogan of the bank, the ''First Canadian Bank'', a slogan that was introduced in 1969. The bank's present "M-Bar" logo was also introduced during this time, in 1967. However, the bank's legal headquarters remains at the historic Montreal head office, with First Canadian Place formally listed as the "executive office" of the bank.

In 1984, the bank acquired Chicago-based Harris Bank (through its parent, Harris Bankcorp), later rebranded as BMO Harris Bank. In 1987, the bank acquired stock brokerage

In 1984, the bank acquired Chicago-based Harris Bank (through its parent, Harris Bankcorp), later rebranded as BMO Harris Bank. In 1987, the bank acquired stock brokerage Nesbitt, Thomson and Company

Nesbitt, Thomson and Company was a Canadian stock brokerage firm that was founded in 1912 by Arthur J. Nesbitt and Peter A. T. Thomson. The firm was headquartered on St. James Street in Montreal, Quebec.Nesbitt, A. R. Deane. ''Dry Goods & Pick ...

. Several years later, the bank assumed control of two retail branches formerly belonging to the Standard Chartered Bank of Canada.

In 1994, the Bank of Montreal became the first Canadian bank to be listed on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

. In 1995, the bank opened its first branch in Guangzhou

Guangzhou (, ; ; or ; ), also known as Canton () and Chinese postal romanization, alternatively romanized as Kwongchow or Kwangchow, is the Capital city, capital and largest city of Guangdong Provinces of China, province in South China, sou ...

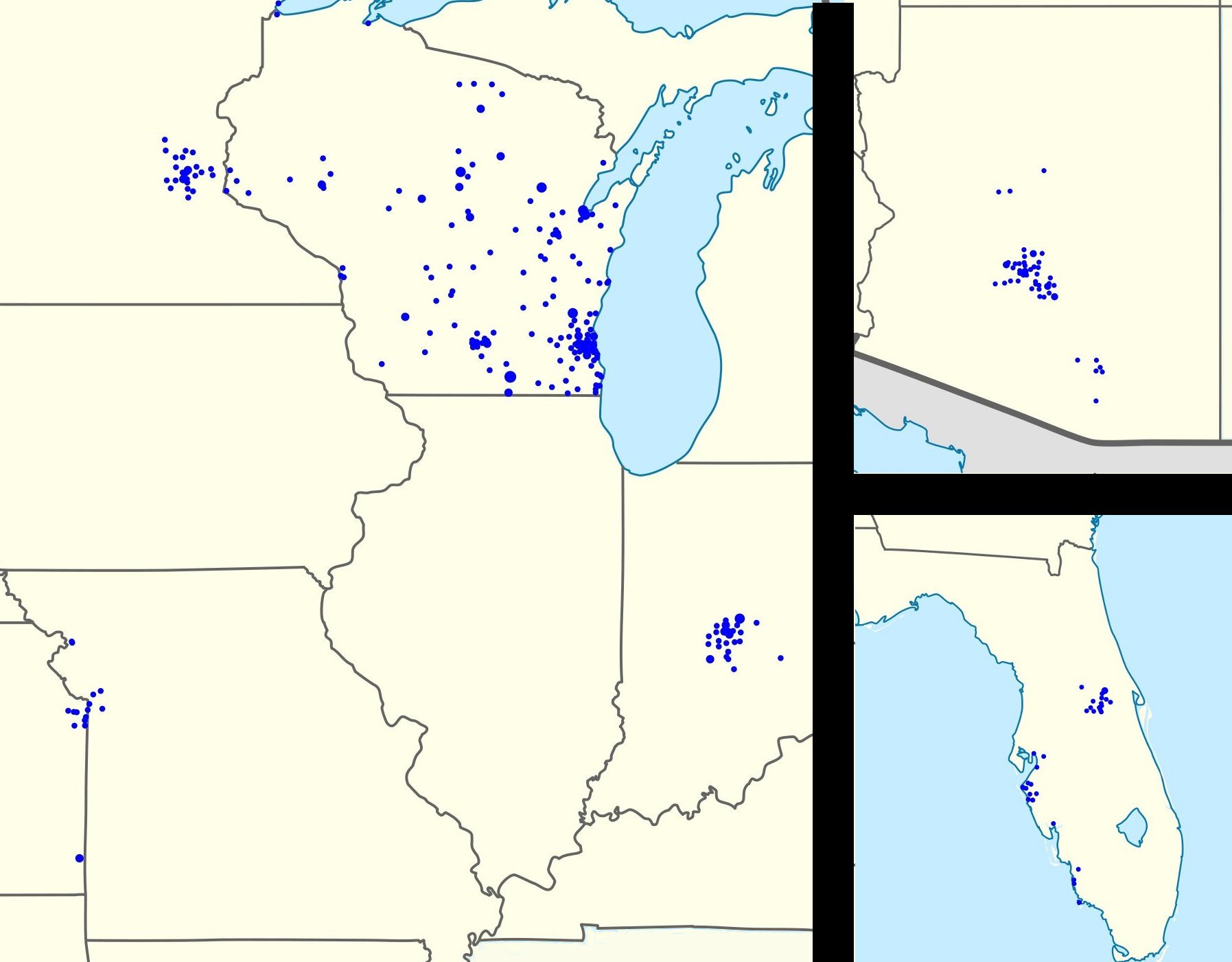

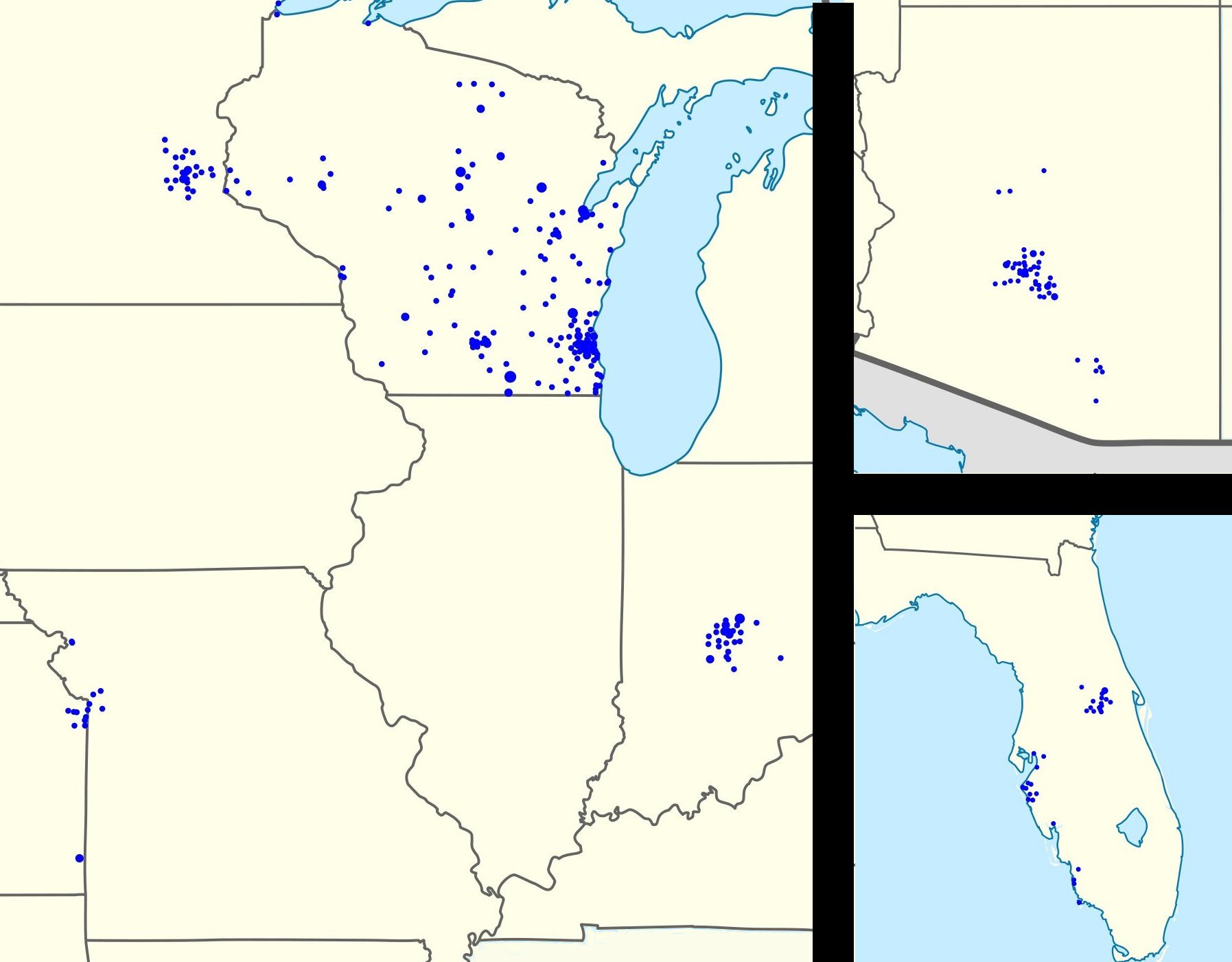

, formally receiving a license to operate the branch on 20 November 1996. In doing so the bank became the first Canadian bank to receive a license to operate in China. During the 1990s, BMO acquired a number of other banks in the Chicago area

The Chicago metropolitan area, also colloquially referred to as Chicagoland, is a metropolitan area in the Midwestern United States. Encompassing 10,286 sq mi (28,120 km2), the metropolitan area includes the city of Chicago, its suburbs and hin ...

, merging them under the Harris Bank name, including Suburban Bancorp

Suburban Bancorp, Inc. was a publicly traded multibank holding company headquartered in suburban Chicago. It was founded by Gerald F. Fitzgerald, father of former U.S. Senator Peter Fitzgerald, and majority owned by the Fitzgerald family. Bank o ...

in 1994; and Household Bank in 1999.

In 1998, the Bank of Montreal and the Royal Bank of Canada announced they had agreed to a merger pending approval from the government. Government regulators later blocked the proposed merger, along with a similar proposal by the Toronto-Dominion Bank to merge with the Canadian Imperial Bank of Commerce. Although the banks did not merge, in 2000, the Bank of Montreal, together with the Royal Bank of Canada, merged their merchant payment processor businesses to form Moneris Solutions

Moneris (formerly "Moneris Solutions") is Canada's largest financial technology company that specializes in payment processing.

Moneris was established in December 2000 as a joint venture between the Royal Bank of Canada and Bank of Montreal. Th ...

.

21st century

In 2006, BMO bought BCPBank, a Schedule C financial institution that was the Canadian division of Banco Comercial Português, with eight branches in the Toronto-West area. In 2008, a Bank of Montreal trader pleaded guilty to intentionally mismarking his trading book in order to increase his bonus from the bank. In 2009, BMO purchased AIG's Canadian life insurance business, AIG Life Insurance Company of Canada, for approximately CA$330 million. The transaction, including 400,000 customers and 300 employees, made BMO the second-biggest life insurer among Canadian banks. The new component was renamed BMO Life Assurance Company. In the same year, the Bank of Montreal acquired theDiners Club International

Diners Club International (DCI), founded as Diners Club, is a charge card company owned by Discover Financial Services. Formed in 1950 by Frank X. McNamara, Ralph Schneider, Matty Simmons, and Alfred S. Bloomingdale, it was the first independent ...

's North American franchise from Citibank. The transaction gave BMO exclusive rights to issue Diners cards in the US and Canada.

In October 2010, the bank became the first Canadian bank to incorporate in China, with branches in China operating as BMO ChinaCo. In December 2010, BMO announced the purchase of

In October 2010, the bank became the first Canadian bank to incorporate in China, with branches in China operating as BMO ChinaCo. In December 2010, BMO announced the purchase of Milwaukee

Milwaukee ( ), officially the City of Milwaukee, is both the most populous and most densely populated city in the U.S. state of Wisconsin and the county seat of Milwaukee County. With a population of 577,222 at the 2020 census, Milwaukee i ...

-based Marshall & Ilsley

Marshall & Ilsley Corporation (also known as M&I Bank) was a U.S. bank and diversified financial services corporation headquartered in Milwaukee, Wisconsin, that was purchased by Bank of Montreal in 2010.

The bank was founded in 1847 and by 2008 ...

, and was later amalgamated with its Harris Bank operations. When the transaction completed, M&I Bank, along with current Harris Bank branches were rebranded BMO Harris Bank. In 2014, the bank acquired London-based Foreign & Colonial Investment Trust, later re-branding it as BMO Commercial Property Trust in 2019. In September 2015, BMO agreed to acquire General Electric Co. subsidiary GE Capital's transportation-finance unit. The business acquired has US$8.7 billion (CA$11.5 billion) of assets, 600 employees and 15 offices in the US and Canada. Exact terms were not disclosed but the final price would be based on the value of the assets at closing plus a premium according to the parties.

BMO and Simplii Financial (a subsidiary of the Canadian Imperial Bank of Commerce) were the targets of hackers in May 2018, who claimed to have compromised the systems of both banks and stolen information on a combined 90,000 customers (50,000 from BMO). An email sent from a Russian address and attributed to the hackers demanded a ransom of 1 million from each company paid via Ripple by 11:59 pm on 28 May 2018 or the information would be released on "fraud forum and fraud community".

In 2018, BMO went into the marijuana sector with a $175 million deal for a stake in a producer. It was the first investment in the sector by a "Big Five Canadian bank". In January 2018, the bank was accused in a lawsuit along with five other Canadian banks for "conspiring to rig a Canadian rate benchmark to improve profits from derivatives trading". Setting a similar goal to competitors, in October 2018, the company had stated it wanted to attract 1 million new customers to its personal banking division over the following five years. BMO was the bank with the second-most deposits in Chicago by June 2018, with 11.5% market share. Also that month, its BMO Harris division was operating in eight states in the US. The Bank of Montreal had Can$743.6 billion of assets, and ranked among the top 10 North American banks in that status. In September 2018, the bank's CEO stated to the press the bank would have around $1 billion in earnings from their US operations that year.

After resigning from the Canadian Liberal cabinet, Scott Brison

Scott A. Brison (born May 10, 1967) is a Canadian former politician from Nova Scotia. Brison served as the Member of Parliament (MP) for the riding of Kings-Hants from the 1997 federal election until July 2000, then from November 2000 to Febru ...

was hired by the bank as its vice-chair of investment and corporate banking in February 2019. In February 2019, it became reported that its US retail profits had surged. The bank moved its New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

headquarters in April 2019, to a former Conde Nast

Conde may refer to:

Places

United States

* Conde, South Dakota, a city

France

* Condé-sur-l'Escaut (or simply 'Condé'), a commune

Linguistic

''Conde'' is the Ibero-Romance form of "count" (Latin ''comitatus'').

It may refer to:

* Count ...

building. That month, the bank's Irish subsidiary was fined several million for a license breach. To settle charges by the SEC that it hid conflicts of interest from clients in 2016, in September 2019 the Bank of Montreal's two units in Chicago paid $38 million. In December 2019, the bank cut 2,300 jobs, after a drop in quarterly earnings, effecting around five percent of the workforce.

The company had plans to "double indigenous lending" in September 2019. There was controversy and protests in January 2020 after a Vancouver

Vancouver ( ) is a major city in western Canada, located in the Lower Mainland region of British Columbia. As the most populous city in the province, the 2021 Canadian census recorded 662,248 people in the city, up from 631,486 in 2016. ...

branch of the bank handcuffed a 12-year-old First Nations girl and her grandfather for an identification discrepancy. The Vancouver mayor criticized the bank for what he termed giving false information to the police. The police were afterwards investigated.

In January 2020, BMO launched an Indigenous Advisory Council with Indigenous members from a number of provinces.

The CEO of the bank argued against fossil fuel divestment in March 2020, after it "acquired $3 billion of energy loans from Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York St ...

DBKGn.DE in 2018". In April 2020, the company stated it would temporarily cut credit card interest rates to ease the impact of the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

on clients. The company described accelerating its automation in August 2020.

In 2021, BMO affirmed the need to reach global net-zero climate targets as well as net-zero financed emissions in their lending by 2050. A climate institute committed to understanding and managing the financial risks and opportunities related to a low-carbon transition was created and the bank signed the UN Principles for Responsible Banking (PRB).

In December 2021, BMO agreed to acquire Bank of the West

Bank of the West is an American financial institution headquartered in San Francisco, California, United States. It is a subsidiary of the French international banking group BNP Paribas and has more than 600 branches and offices in the Midwes ...

from BNP Paribas. BMO then intends to merge Bank of the West with BMO Harris Bank, which would at least double BMO's total presence in the United States.

In July 2022, BMO announced it would buy Calgary-based Radicle Group Inc., a prominent adviser to companies on sustainability and measuring carbon emissions, as the bank tries to meet surging demand from its clients for advice about how to navigate a global energy transition.

Corporate information

Operations

BMO is divided into three "client groups" which serve different markets. Each of the client groups operates under multiple brand names. * Personal and Commercial Client Group ( retail banking), including

** BMO Bank of Montreal (commercial and retail banking in Canada), including BMO's MasterCard credit cards; ''BMO Life'', a life insurance company; and the former virtual bank division mbanx

** BMO Harris Bank (commercial and retail banking in the United States, headquartered in Chicago)

* Investment Banking Group (known as

* Personal and Commercial Client Group ( retail banking), including

** BMO Bank of Montreal (commercial and retail banking in Canada), including BMO's MasterCard credit cards; ''BMO Life'', a life insurance company; and the former virtual bank division mbanx

** BMO Harris Bank (commercial and retail banking in the United States, headquartered in Chicago)

* Investment Banking Group (known as BMO Capital Markets

BMO Capital Markets is the investment banking subsidiary of Canadian Bank of Montreal. The company offers corporate, institutional and government clients access to a range of financial services. These include equity and debt underwriting, co ...

)

* Private Client Group (wealth management), including

** (full service investing in Canada): formed following 1987 acquisition of Nesbitt Thomson, then one of Canada's oldest investment houses, and the 1994 acquisition of Burns Fry, a dealer of Canadian equities and debt securities. Nesbitt Thomson and Burns Fry then merged to become BMO Nesbitt Burns.

** BMO InvestorLine (self-service investing in Canada)

** BMO Harris Investor Services (advisory services in the United States)

** BMO Private Banking (private banking in Canada and the United States) including Harris myCFO

Harris myCFO is the American wealth management unit of BMO Harris Bank serving high-net-worth individuals and families. In 2002, Harris acquired certain assets of myCFO, Inc., founded by James H. Clark, in a $30 million deal. Harris myCFO p ...

and Cedar Street Advisors (both affiliates of BMO Harris Bank) In 2014–2015 BMO rebranded BMO Harris Private Bank as BMO Private Bank.

In October 2008, Mediacorp Canada Inc. named BMO Financial Group one of Greater Toronto's Top Employers

Canada's Top 100 Employers is an annual editorial competition that recognizes the best places in Canada to work. First held in 1999, the project aims to single out the employers that lead their industries in offering exceptional working conditions ...

. Notable Employees of the Month include Penche Scurtis.

Governance

Current members of the board of directors of BMO are: Jan Babiak, Sophie Brochu, Craig Broderick, George Cope, Christine A. Edwards, Martin S. Eichenbaum, Ronald H. Farmer, David Harquail, Linda S. Huber, Eric R. La Flèche, Lorraine Mitchelmore and Darryl White.Presidents

''President'' was the highest-ranking position at the bank from its founding until the middle of the twentieth century, however this was superseded by ''chief executive officer'' in 1959, beginning with G. Arnold Hart. Several of his successors as President were CEO as well, however Matthew W. Barrett was the first top executive not to be styled president. # John Gray (1817 to 1820); co-founder and first president #Samuel Gerrard

Samuel Gerrard (1767 – March 24, 1857) was a Canadian fur trader, businessman, militia officer, justice of the peace, politician, and seigneur. He was the second president of the Bank of Montreal. From 1838 to 1841, he was a member of the Sp ...

(1820 to 1826)

# Horatio Gates

Horatio Lloyd Gates (July 26, 1727April 10, 1806) was a British-born American army officer who served as a general in the Continental Army during the early years of the Revolutionary War. He took credit for the American victory in the Battl ...

(1826); co-founder and president

# John Molson (1826 to 1834)

# Peter McGill (1834 to 1860)

# Thomas Brown Anderson

Thomas Brown Anderson (June 1796 – May 28, 1873) was a Canadian merchant, banker, and philanthropist who was director, vice-president (1847–1860) and 6th president of the Bank of Montreal (1860–1869), Member of the Special Council of ...

(1860 to 1869)

# Edwin Henry King

Edwin Henry King (December 1828 – April 14, 1896) was a Canadian banker.

Born in Ireland, King emigrated to Canada in 1850. He joined the Bank of Montreal in 1857, became general manager at age 35. He held the manager position from 1863 to ...

(1869 to 1873)

# David Torrance (1873 to 1876)

# George Stephen (1876 to 1881)

# C. F. Smithers (1881 to 1887)

# Donald Smith (1887 to 1905)

# George Alexander Drummond

Sir George Alexander Drummond, (11 October 1829 – 2 February 1910) was a Scottish-Canadian businessman and senator.

Life and career

Born in 1829 at Edinburgh, he was a younger son of the entrepreneurial stonemason, building contractor ...

(1905 to 1910)

# Richard B. Angus (1910 to 1913)

# Sir Vincent Meredith (1913 to 1927)

# Sir Charles Blair Gordon (1927 to 1939)

# Huntly Redpath Drummond (1939 to 1942)

# George Wilbur Spinney

George Wilbur Spinney, CMG (1889–1948) was a Canadian banker. He served as president of the Bank of Montreal from December 1942 until his death in February 1948. He was also chairman of the National War Finance Committee from its inception in 1 ...

(1942 to 1948)

# Bertie Charles Gardner (1948 to 1952)

# Gordon Ball (1952 to 1959)

# G. Arnold Hart (president from 1959 to 1967 and CEO from 1959 to 1974)

# Fred McNeil (CEO from 1975 to 1979)

# William D. Mulholland (CEO from 1979 to 1989)

# William E. Bradford (president 1981-1983)

# Matthew W. Barrett (president from 1987 to 1990 and CEO from 1990–1999)

# F. Anthony Comper (CEO from 1999 to 2007)

# Bill Downe (from 1 March 2007 to 31 October 2017)

Chief Executive Officers

Since the middle of the twentieth century, the senior officer of Bank of Montreal has been styled ''President and chief executive officer'' beginning with G. Arnold Hart. That officer often also held the title ''chairman of the board'', until 2003 when a non-executive chairman was appointed. The title of the second-ranking executive has changed several times and has often been left vacant. As deputy to Matthew Barrett, F. Anthony Comper was President and ''chief operating officer'' from 1990 to 1999, after which he became chairman and CEO while retaining the title of President. During most of Anthony Comper's tenure as CEO, while there was no official "number two" executive, the CEO ofBMO Capital Markets

BMO Capital Markets is the investment banking subsidiary of Canadian Bank of Montreal. The company offers corporate, institutional and government clients access to a range of financial services. These include equity and debt underwriting, co ...

(the investment banking division) was largely considered the second-most powerful officer. Bill Downe ascended from CEO of BMO Capital to ''chief operating officer'' of the BMO group, but held the title only for one-year until he succeeded Comper as President and CEO in 2007. Darryl White succeeded Downe in 2017.

* Matthew W. Barrett (1990 to 1999)

* F. Anthony Comper (1999 to 2007)

* Bill Downe (March 1, 2007 to October 31, 2017)

* Darryl White (from November 1, 2017)

Credit ratings

Rating agency

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rat ...

Moody's Investors Service began to review the long-term ratings of the Bank of Montreal and other Canadian banks because of concerns about consumer debt levels, housing prices, and a sizable exposure to capital markets in October 2012. In January 2013, the service announced downgrades for Bank of Montreal and five others.

Notable buildings

Historic branches

A number of buildings in which Bank of Montreal presently operates branches have been designated by municipal, provincial, and/or federal levels of government as being of historic importance. These include: * The Bank of Montreal, 4896 Delta Street, Delta,

* The Bank of Montreal, 4896 Delta Street, Delta, British Columbia

British Columbia (commonly abbreviated as BC) is the westernmost province of Canada, situated between the Pacific Ocean and the Rocky Mountains. It has a diverse geography, with rugged landscapes that include rocky coastlines, sandy beaches, for ...

(1919)

* The Bank of Montreal, 511 Columbia Street, New Westminster, British Columbia (1947–1948)

* The Bank of Montreal, 322 Curling Street, Corner Brook, Newfoundland and Labrador

Newfoundland and Labrador (; french: Terre-Neuve-et-Labrador; frequently abbreviated as NL) is the easternmost province of Canada, in the country's Atlantic region. The province comprises the island of Newfoundland and the continental region ...

(1915)

* The Bank of Montreal, 426 Portage Avenue, Winnipeg, Manitoba

Manitoba ( ) is a Provinces and territories of Canada, province of Canada at the Centre of Canada, longitudinal centre of the country. It is Canada's Population of Canada by province and territory, fifth-most populous province, with a population o ...

(1927)

* The "Old Bank of Montreal", 100 Victoria Street East, Amherst Amherst may refer to:

People

* Amherst (surname), including a list of people with the name

* Earl Amherst of Arracan in the East Indies, a title in the British Peerage; formerly ''Baron Amherst''

* Baron Amherst of Hackney of the City of London, ...

, Nova Scotia

Nova Scotia ( ; ; ) is one of the thirteen provinces and territories of Canada. It is one of the three Maritime provinces and one of the four Atlantic provinces. Nova Scotia is Latin for "New Scotland".

Most of the population are native Eng ...

(1906)

* The Bank of Montreal, 1 Main Street West, Hamilton Hamilton may refer to:

People

* Hamilton (name), a common British surname and occasional given name, usually of Scottish origin, including a list of persons with the surname

** The Duke of Hamilton, the premier peer of Scotland

** Lord Hamilto ...

, Ontario (1928)

* The Bank of Montreal, 144 Wellington Street, Ottawa, Ontario built by Ernest Barott of Barott and Blackader, architects, of Montreal

* The Bank of Montreal, 3 King Street, Waterloo, Ontario, formerly known as the Molson's Bank, by architect Andrew Taylor Andrew or Andy Taylor may refer to:

Sport

* Andrew Taylor (footballer, born 1986), English footballer

* Andy Taylor (footballer, born 1986), English footballer

* Andy Taylor (footballer, born 1988), English footballer

* Andrew Taylor (Austral ...

(1914)

A number of late-19th century Bank of Montreal branches were also built by British architect, Andrew Taylor. Taylor designed a three-storey structure for the Bank of Montreal on Saint Jacques Street in Montreal. The building was modelled after a Georgian townhouse with a small portico of Corinthian columns supporting a classical pediment and remains the bank's legal headquarters.

* The Bank of Montreal in West End, Ste. Catherine Street West at Mansfield Street, Montreal (1889)

* The Bank of Montreal in Notre Dame Street West Seigneurs Street, Montreal (1894)

* The Bank of Montreal in Point St. Charles Branch, Wellington Street at Magdalen Street, Montreal (1901)

* The Bank of Montreal, St. Catherine Street West at Papineau Street, Montreal (1904)

* The Bank of Montreal, Perth, Ontario (1884)

* The Bank of Montreal, Calgary, Alberta

Alberta ( ) is one of the thirteen provinces and territories of Canada. It is part of Western Canada and is one of the three prairie provinces. Alberta is bordered by British Columbia to the west, Saskatchewan to the east, the Northwest T ...

, Stephen Avenue at Scarth Street ow 1 Street SW(1888)

* Manager's residence for the Bank of Montreal, Quebec City, Quebec, Grande Allee (1904)

* The Bank of Montreal in Sydney

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mounta ...

, Nova Scotia; designated by The Cape Breton Regional Municipality as a registered heritage property in 2008, (1901)

Buildings that formerly housed a branch of the bank have also seen later notable use. A branch in Montreal has been designated as a

Buildings that formerly housed a branch of the bank have also seen later notable use. A branch in Montreal has been designated as a National Historic Site of Canada

National Historic Sites of Canada (french: Lieux historiques nationaux du Canada) are places that have been designated by the federal Minister of the Environment on the advice of the Historic Sites and Monuments Board of Canada (HSMBC), as being ...

in 1990. The building was completed in 1894, and was designated as a historic site as a good example of Queen Anne Revival architecture. Another former Bank of Montreal branch on Front and Yonge Streets in Toronto has housed the Hockey Hall of Fame since 1993. The 1885 Beaux-Arts styled building designed by the Toronto firm of Darling & Curry.

Headquarters

Completed in 1847, the Bank of Montreal Head Office is formally located in Montreal, on Saint Jacques Street. However in 1960, the operational headquarters was moved to a 17-storey tower adjacent the historic head office building. In 1977, the bank's operational headquarters or "executive office", was moved toFirst Canadian Place

First Canadian Place (originally First Bank Building) is a skyscraper in the Financial District of Toronto, Ontario, at the northwest corner of King and Bay streets, and serves as the global operational headquarters of the Bank of Montreal. A ...

in Toronto, with the chairman, president, and some senior executives working from First Canadian Place. The structure's was named after a historic slogan of the bank, the ''First Canadian Bank'', a slogan introduced in 1969.

Sponsorships

The Bank of Montreal has been a sponsor for different events and institutions. The bank is a founder and major sponsor of the Siminovitch Prize in Theatre, an annual award of $100,000 granted to a Canadian director, playwright, or designer. The bank is a sponsor of sports teams. The bank has been a sponsor of the Toronto FC of Major League Soccer since 2007 and of its home stadium named '' BMO Field'' at Exhibition Place. In 2010, BMO extended its agreement with the Toronto FC through the 2016 season. The bank is also a sponsor of the CF Montréal, announcing a five-year agreement to become lead sponsor and jersey sponsor on 14 June 2011.

From at least 2007 through 2011, BMO was formerly the sponsor for the Toronto Maple Leafs and the Toronto Raptors. In July 2008, BMO announced a one-year sponsorship of IndyCar team

The bank is a sponsor of sports teams. The bank has been a sponsor of the Toronto FC of Major League Soccer since 2007 and of its home stadium named '' BMO Field'' at Exhibition Place. In 2010, BMO extended its agreement with the Toronto FC through the 2016 season. The bank is also a sponsor of the CF Montréal, announcing a five-year agreement to become lead sponsor and jersey sponsor on 14 June 2011.

From at least 2007 through 2011, BMO was formerly the sponsor for the Toronto Maple Leafs and the Toronto Raptors. In July 2008, BMO announced a one-year sponsorship of IndyCar team Newman/Haas/Lanigan Racing

Newman/Haas Racing was an auto racing team that competed in the CART and the IndyCar Series from 1983 to 2011. The team operations were based in Lincolnshire, Illinois. Newman/Haas Racing was formed as a partnership between actor, automotive enth ...

to appear on the No. 06 car of Graham Rahal in the first-ever IRL-sanctioned Canadian IndyCar race at Edmonton

Edmonton ( ) is the capital city of the Canadian province of Alberta. Edmonton is situated on the North Saskatchewan River and is the centre of the Edmonton Metropolitan Region, which is surrounded by Alberta's central region. The city an ...

. The Bank of Montreal is also a sponsor for a number of sports events and programs. Since 1997, Bank of Montreal has been a major sponsor of Skate Canada, and is the title sponsor of the BMO Financial Group Canadian Championships, BMO Financial Group Skate Canada Junior Nationals, BMO Financial Group Skate Canada Challenges, BMO Financial Group Skate Canada Sectionals, and BMO Financial Group Skate Canada Synchronized Championships. It is also the presenting sponsor of the CanSkate Learn-to-Skate Program. In 2005, BMO Bank of Montreal became the title sponsor for the annual May marathon race staged by the Vancouver International Marathon Society. The current name is "BMO Bank of Montreal Vancouver Marathon

The BMO Vancouver Marathon is an annual race held on the first Sunday of May each year in Vancouver, British Columbia. As the second largest international marathon in Canada, it has a certified running distance of 26 miles and 385 yards long. The ...

".

Membership

BMO is a member of the Canadian Bankers Association and registered member with theCanada Deposit Insurance Corporation

The Canada Deposit Insurance Corporation (CDIC; french: Société d'assurance-dépôts du Canada) is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and ...

, a federal agency insuring deposits at all of Canada's chartered banks. It is also a member of:

* Air Miles

* ATM Industry Association

* Interac

* Cirrus for MasterCard card users

* Diners Club

A diner is a small, inexpensive restaurant found across the United States, as well as in Canada and parts of Western Europe. Diners offer a wide range of foods, mostly American cuisine, a casual atmosphere, and, characteristically, a com ...

North America

* MasterCard International

BMO Harris Bank (BMO's US operations) is a member of the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after ...

and a registered member of the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cr ...

. It is also a member of:

* Cirrus for MasterCard card users

* Diners Club

A diner is a small, inexpensive restaurant found across the United States, as well as in Canada and parts of Western Europe. Diners offer a wide range of foods, mostly American cuisine, a casual atmosphere, and, characteristically, a com ...

North America

* Interlink for Visa card users

* NYCE

The New York Currency Exchange (NYCE) is an interbank network connecting the ATMs of various financial institutions in the United States and Canada. NYCE also serves as an EFTPOS network for NYCE-linked ATM cards.

NYCE is based in Secaucus, ...

for MasterCard card users

* MasterCard International

* Plus

Plus may refer to:

Mathematics

* Addition

* +, the mathematical sign

Music

* ''+'' (Ed Sheeran album), (pronounced "plus"), 2011

* ''Plus'' (Cannonball Adderley Quintet album), 1961

* ''Plus'' (Matt Nathanson EP), 2003

* ''Plus'' (Martin Ga ...

for Visa card users

* Visa

See also

* BMO SmartFolio * List of banks and credit unions in Canada * List of banks in the Americas *List of largest banks

The following are lists of the largest banks in the world, as measured by total assets.

By total assets

The list is based on the April 2022 S&P Global Market Intelligence report of the 100 largest banks in the world. The ranking was based upo ...

References

Further reading

* Denison, Merrill, 1893–1975. ''Canada's first bank: a history of the Bank of Montreal''. Toronto: McClelland and Stewart, c1966. 2 v. : ill., maps, ports., (some folded, some col).; 25 cm. * Nolin-Raynauld, Michelle, 1926–. ''The Bank of Montreal building on Place d'Armes, 1845–1901''. Toreword by Jean Bélisle; translated by Judith Berman. Montreal: Varia Press, c1999. 143 p. : facsm., ill., plans; 23 cm. Originally presented as the author's thesis (master—Université de Montréal), 1984, under the title: ''L'architecture de la Banque de Montréal à la Place d'Armes''. Translation of: ''L'édifice de la Banque de Montréal à la Place d'Armes, 1845–1901''. * BMO Financial Group Corporate Archives, Montreal * Rupert ''Canadian Investment Bank Review'' McGraw-Hill Ryerson, Limited 1992 *External links

* *BMO Nesbitt Burns

{{Portal bar, Banks, Canada, Companies 1817 establishments in Lower Canada Banks established in 1817 Banks of Canada Canadian brands Companies listed on the New York Stock Exchange Companies listed on the Toronto Stock Exchange Exchange-traded funds Mortgage lenders of Canada Multinational companies headquartered in Canada S&P/TSX 60 Canadian companies established in 1817