The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a

stimulus package enacted by the

111th U.S. Congress and signed into law by President

Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. O ...

in February 2009. Developed in response to the

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. , the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy.

The approximate cost of the economic stimulus package was estimated to be $787 billion at the time of passage, later revised to $831 billion between 2009 and 2019. The ARRA's rationale was based on the

Keynesian economic theory that, during recessions, the government should offset the decrease in private spending with an increase in

public spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual o ...

in order to save jobs and stop further economic deterioration.

The politics around the stimulus were very contentious, with

Republicans criticizing the size of the stimulus. On the right, it spurred the

Tea Party movement

The Tea Party movement was an American fiscally conservative political movement within the Republican Party that began in 2007, catapulted into the mainstream by Congressman Ron Paul's presidential campaign. The movement expanded in resp ...

and may have contributed to Republicans winning the

House

A house is a single-unit residential building. It may range in complexity from a rudimentary hut to a complex structure of wood, masonry, concrete or other material, outfitted with plumbing, electrical, and heating, ventilation, and air c ...

in the

2010 midterm elections.

Not a single Republican member of the House voted for the stimulus, and only three Republican senators voted for it. Most economists agree that the stimulus was smaller than needed.

Surveys of economists show overwhelming agreement that the stimulus reduced unemployment,

and that the benefits of the stimulus outweigh the cost.

Legislative history

Both the House and the Senate versions of the bills were primarily written by

Democratic congressional committee leaders and their staffs. Because work on the bills started before President Obama officially took office on January 20, 2009, top aides to President-Elect Obama held multiple meetings with committee leaders and staffers. On January 10, 2009, President-Elect Obama's administration released a report

that provided a preliminary analysis of the impact to jobs of some of the prototypical recovery packages that were being considered.

House of Representatives assembly

The House version of the bill, H.R. 1, was introduced on January 26, 2009 by

Dave Obey, the chairman of the

House Committee on Appropriations, and was co-sponsored by nine other Democrats. On January 23,

Speaker of the House Nancy Pelosi

Nancy Patricia Pelosi ( ; ; born March 26, 1940) is an American politician who was the List of Speakers of the United States House of Representatives, 52nd speaker of the United States House of Representatives, serving from 2007 to 2011 an ...

said that the bill was on track to be presented to President Obama for him to sign into law before February 16, 2009.

Although 206 amendments were scheduled for floor votes, they were combined into only 11, which enabled quicker passage of the bill.

On January 28, 2009, the House passed the bill by a 244–188 vote.

All but 11 Democrats voted for the bill, but not a single

Republican voted in favor: 177 Republicans voted against it, while one Republican (

Ginny Brown-Waite) did not vote.

Senate

The Senate version of the bill, S. 1, was introduced on January 6, 2009, and later substituted as an amendment to the House bill, SA 570. It was sponsored by

Harry Reid

Harry Mason Reid Jr. (; December 2, 1939 – December 28, 2021) was an American lawyer and politician who served as a United States Senate, United States senator from Nevada from 1987 to 2017. He led the Senate Democratic Caucus from 2005 to 2 ...

, the

Majority Leader, co-sponsored by 16 other Democrats and

Joe Lieberman

Joseph Isadore Lieberman (; February 24, 1942 – March 27, 2024) was an American politician and lawyer who served as a United States senator from Connecticut from 1989 to 2013. Originally a member of the Democratic Party (United States), Dem ...

, an

independent

Independent or Independents may refer to:

Arts, entertainment, and media Artist groups

* Independents (artist group), a group of modernist painters based in Pennsylvania, United States

* Independentes (English: Independents), a Portuguese artist ...

who

caucused with the Democrats.

The Senate then began consideration of the bill starting with the $275 billion tax provisions in the week of February 2, 2009.

A significant difference between the House version and the Senate version was the inclusion of a one-year extension of revisions to the

alternative minimum tax, which added $70 billion to the bill's total.

Republicans proposed several amendments to the bill directed at increasing the share of tax cuts and downsizing spending as well as decreasing the overall price. President Obama and Senate Democrats hinted that they would be willing to compromise on Republican suggestions to increase infrastructure spending and to double the housing tax credit proposed from $7,500 to $15,000 and expand its application to all home buyers, not just first-time buyers.

Other considered amendments included the

Freedom Act of 2009, an amendment proposed by

Senate Finance Committee members

Maria Cantwell (D) and

Orrin Hatch

Orrin Grant Hatch (March 22, 1934 – April 23, 2022) was an American attorney and politician who served as a United States senator from Utah from 1977 to 2019. Hatch's 42-year Senate tenure made him the longest-serving Republican U.S. senat ...

(R) to include tax incentives for

plug-in electric vehicles.

The Senate called a special Saturday debate session for February 7 at the urging of President Obama. The Senate voted, 61–36 (with 2 not voting) on February 9 to end debate on the bill and advance it to the Senate floor to vote on the bill itself. On February 10, the Senate voted 61–37 (with one not voting)

All the Democrats voted in favor, but only three Republicans voted in favor (

Susan Collins

Susan Margaret Collins (born December 7, 1952) is an American politician serving as the senior United States senator from Maine. A member of the Republican Party, she has held her seat since 1997 and is Maine's longest-serving member of ...

,

Olympia Snowe

Olympia Jean Snowe (; born February 21, 1947) is an American businesswoman and politician who was a United States Senate, United States Senator, representing Maine for three terms from 1995 to 2013. A lifelong member of the Republican Party (Unit ...

, and

Arlen Specter

Arlen Specter (February 12, 1930 – October 14, 2012) was an American lawyer, author and politician who served as a United States Senator from Pennsylvania from 1981 to 2011. Specter was a Democrat from 1951 to 1965, then a Republican fr ...

). Specter

switched to the Democratic Party later in the year. At one point, the Senate bill stood at $838 billion.

Comparison of the House, Senate and Conference versions

Senate Republicans forced a near unprecedented level of changes (near $150 billion) in the House bill, which had more closely followed the Obama plan. A comparison of the $827 billion economic recovery plan drafted by Senate Democrats with an $820 billion version passed by the House and the final $787 billion conference version shows huge shifts within these similar totals. Additional debt costs would add about $350 billion or more over 10 years. Many provisions were set to expire in two years.

The main funding differences between the Senate bill and the House bill were: More funds for health care in the Senate ($153.3 vs $140 billion), renewable energy programs ($74 vs. $39.4 billion), for home buyers tax credit ($35.5 vs. $2.6 billion), new payments to the elderly and a one-year increase in AMT limits. The House had more funds appropriated for education ($143 vs. $119.1 billion), infrastructure ($90.4 vs. $62 billion) and for aid to low income workers and the unemployed ($71.5 vs. $66.5 billion).

Spending (Senate – $552 billion, House – $545 billion)

* Aid to low-income workers and the unemployed

** Senate – $47 billion to provide extended unemployment benefits through December 31, increased by $25 a week, and provide job training; $16.5 billion to increase

food stamp

In the United States, the Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a federal government program that provides food-purchasing assistance for low- and no-income persons to help them maintai ...

benefits by 12 percent through fiscal 2011 and issue a one-time bonus payment; $3 billion in temporary welfare payments.

** House – Comparable extension of

unemployment insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

; $20 billion to increase food stamp benefits by 14 percent; $2.5 billion in temporary welfare payments; $1 billion for home heating subsidies and $1 billion for community action agencies.

* Direct cash payments

** Senate – $17 billion to give one-time $300 payments to recipients of

Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social S ...

and

Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

, and veterans receiving disability and pensions.

** House – $4 billion to provide a one-time additional Supplemental Security Income and Social Security Disability Insurance payment to the elderly, of $450 for individuals and $630 for married couples.

** Conference – $250 one-time payment to each recipient of Supplemental Security Income, Social Security (Regular & Disability) Insurance, Veterans pension, Railroad Retirement, or State retirement system

* Infrastructure

** Senate – $46 billion for transportation projects, including $27 billion for highway and bridge construction and repair and $11.5 billion for mass transit and rail projects; $4.6 billion for the Army Corps of Engineers; $5 billion for public housing improvements; $6.4 billion for clean and drinking water projects.

** House – $47 billion for transportation projects, including $27 billion for highway and bridge construction and repair and $12 billion for mass transit, including $7.5 billion to buy transit equipment such as buses; and $31 billion to build and repair federal buildings and other public infrastructures.

* Health care

** Senate – $21 billion to subsidize the cost of continuing health care insurance for the

involuntarily unemployed under the

COBRA

COBRA or Cobra, often stylized as CoBrA, was a European avant-garde art group active from 1948 to 1951. The name was coined in 1948 by Christian Dotremont from the initials of the members' home countries' capital cities: Copenhagen (Co), Brussels ...

program; $87 billion to help states with

Medicaid

Medicaid is a government program in the United States that provides health insurance for adults and children with limited income and resources. The program is partially funded and primarily managed by U.S. state, state governments, which also h ...

; $22 billion to modernize health information technology systems; and $10 billion for health research and construction of

National Institutes of Health

The National Institutes of Health (NIH) is the primary agency of the United States government responsible for biomedical and public health research. It was founded in 1887 and is part of the United States Department of Health and Human Service ...

facilities.

** House – $40 billion to subsidize the cost of continuing health care insurance for the involuntarily unemployed under the COBRA program or provide health care through Medicaid; $87 billion to help states with Medicaid; $20 billion to modernize health information technology systems; $4 billion for preventive care; $1.5 billion for community health centers; $420 million to combat avian flu; $335 million for programs that combat AIDS, sexually transmitted diseases and tuberculosis.

** Conference – A 65% COBRA subsidy for 9 months will apply to workers laid off between Sep 1, 2008 and Dec 31, 2009. Those already laid off have 60 days to apply for COBRA.

* Education

** Senate – $55 billion in state fiscal relief to prevent cuts in education aid and provide block grants; $25 billion to school districts to fund special education and the

No Child Left Behind

The No Child Left Behind Act of 2001 (NCLB) was a 2002 United States Act of Congress promoted by the presidential administration of George W. Bush. It reauthorized the Elementary and Secondary Education Act and included Title I provision ...

K–12 law; $14 billion to boost the maximum

Pell Grant by $400 to $5,250; $2 billion for

Head Start.

** House – Similar aid to states and school districts; $21 billion for school modernization; $16 billion to boost the maximum Pell Grant by $500 to $5,350; $2 billion for Head Start.

** Conference – The Conference Report merged most education aid with the State Fiscal Stabilization fund (administered by the Department of Education) and gave power over the funds to each governor under voluminous restrictions. The Governor is "Required" to spend $45 billion of the money on education to restore funding to 2008 levels but the mechanisms to enforce state maintenance of effort at 2005–06 levels are complex and potentially impossible to implement. Hard hit states such as Nevada cannot possibly find enough funds to get to the 2005–06 state funding levels for education. Some states with no current budget cuts for education, such as Arkansas and North Carolina, may get nothing. This will result in a monumental 50 state legal and political fight over how to re-budget to best take advantage of the federal legislation. Many states will further reduce state funds for education to the 2005–06 minimum so these state resources can be used for other state priorities and the net gain for education will be far less than the total federal appropriation.

* Energy

** Senate – $40 billion for energy efficiency and renewable energy programs, including $2.9 billion to weatherize modest-income homes; $4.6 billion for fossil fuel research and development; $6.4 billion to clean up nuclear weapons production sites; $11 billion toward a smart electricity grid to reduce waste; $8.5 billion to subsidize loans for renewable energy projects; and $2 billion for advanced battery systems.

** House – $28.4 billion for energy efficiency and renewable energy programs, including $6.2 billion to weatherize homes; $11 billion to fund a smart electricity grid.

* Homeland security

** Senate – $4.7 billion for homeland security programs, including $1 billion for airport screening equipment and $800 million for port security.

** House – $1.1 billion, including $500 million for airport screening equipment.

* Law enforcement

** Senate – $3.5 billion in grants to state and local law enforcement to hire officers and purchase equipment.

** House – Comparable provision.

Tax changes ($275 billion)

** House – About $145 billion for $500 per-worker, $1,000 per-couple tax credits in 2009 and 2010. For the last half of 2009, workers could expect to see about $20 a week less withheld from their paychecks starting around June. Millions of Americans who do not make enough money to pay federal income taxes could file returns next year and receive checks. Individuals making more than $75,000 and couples making more than $150,000 would receive reduced amounts.

** Senate – The credit would phase out at incomes of $70,000 for individuals and couples making more than $140,000 and phase out more quickly, reducing the cost to $140 billion.

** Conference – Tax Credit reduced to $400 per worker and $800 per couple in 2009 and 2010 and phaseout begins at $75,000 for individuals and $150,000 for joint filers. Note retirees with no wages get nothing.

[House Conference report 111-? Final partially handwritten report released by Nancy Pelosi's Office 2/13/09]

*

Alternative minimum tax

** House – No provision.

** Senate – About $70 billion to prevent 24 million taxpayers from paying the alternative minimum tax in 2009. The tax was designed to make sure wealthy taxpayers cannot use credits and deductions to avoid paying any taxes or paying at a far lower rate than would otherwise be possible. But it was never indexed to inflation, so critics now contend it taxes people it was not intended to. Congress addresses it each year, usually in the fall.

** Conference – Includes a one-year increase in AMT floor to $70,950 for joint filers for 2009.

* Expanded child credit

** House – $18.3 billion to give greater access to the $1,000 per-child tax credit for low income workers in 2009 and 2010. Under current law, workers must make at least $12,550 to receive any portion of the credit. The change eliminates the floor, meaning more workers who pay no federal income taxes could receive checks.

** Senate – Sets a new income threshold of $8,100 to receive any portion of the credit, reducing the cost to $7.5 billion.

** Conference – The income floor for refunds was set at $3,000 for 2009 & 2010.

[House Conference report 111-16 2/13/09]

* Expanded earned income tax credit

** House – $4.7 billion to increase the

earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

– which provides money to low income workers – for families with at least three children.

** Senate – Same.

* Expanded college credit

** House – $13.7 billion to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000.

** Senate – Reduces the amount that can be refunded to low-income families that pay no income taxes, lowering the cost to $13 billion.

* Homebuyer credit

** House – $2.6 billion to repeal a requirement that a $7,500 first-time homebuyer tax credit be paid back over time for homes purchased from Jan 1 to July 1, unless the home is sold within three years. The credit is phased out for couples making more than $150,000.

** Senate – Doubles the credit to $15,000 for homes purchased for a year after the bill takes effect, increasing the cost to $35.5 billion.

** Conference – $8,000 credit for all homes bought between 1/1/2009 and 12/1/2009 and repayment provision repealed for homes purchased in 2009 and held more than three years.

* Home energy credit

** House – $4.3 billion to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners.

** Senate – Same.

** Conference – Same.

* Unemployment

** House – No similar provision.

** Senate – $4.7 billion to exclude from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009.

** Conference – Same as Senate

* Bonus depreciation

** House – $5 billion to extend a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009.

** Senate – Similar.

* Money-losing companies

** House – $15 billion to allow companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for

tax refunds.

** Senate – Allows companies to use more of their losses to offset previous profits, increasing the cost to $19.5 billion.

** Conference – Limits the carry-back to small companies, revenue under $5 million

* Government contractors

** House – Repeal a law that takes effect in 2011, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year.

** Senate – Delays the law from taking effect until 2012, reducing the cost to $291 million.

* Energy production

** House – $13 billion to extend tax credits for renewable energy production.

** Senate – Same.

** Conference – Extension is to 2014.

* Repeal bank credit

** House – Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years.

** Senate – Same.

** House – $36 billion to subsidize locally issued bonds for school construction, teacher training, economic development and infrastructure improvements.

** Senate – $22.8 billion to subsidize locally issued bonds for school construction, industrial development and infrastructure improvements.

* Auto sales

** House – No similar provision.

** Senate – $11 billion to make interest payments on most auto loans and

sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

on cars deductible.

** Conference – $2 billion for deduction of sales tax, not interest payments phased out for incomes above $250,000.

Conference report

Congressional negotiators said that they had completed the Conference Report on February 11.

On February 12, House Majority Leader

Steny Hoyer

Steny Hamilton Hoyer ( ; born June 14, 1939) is an American politician and retired attorney who has served as the United States House of Representatives, U.S. representative for since 1981. He also served as House Majority Leader from 2007 to 20 ...

scheduled the vote on the bill for the next day, before wording on the bill's content had been completed and despite House Democrats having previously promised to allow a 48-hour public review period before any vote. The Report with final handwritten provisions was posted on a House website that evening. On February 13, the Report passed the House, 246–183, largely along party lines with all 246 Yes votes given by Democrats and the Nay vote split between 176 Republicans and 7 Democrats.

The Senate passed the bill, 60–38, with all Democrats and Independents voting for the bill along with three Republicans. On February 17, 2009, President Barack Obama signed the Recovery Act into law.

[Note that there are deviations in how some sources allocate spending and tax incentives and loans to different categories]

Provisions of the Act

Section 3 of ARRA

Section 3 of ARRA listed the basic intent behind crafting the law. This

Statement of Purpose included the following:

# To preserve and create jobs and promote economic recovery.

# To assist those most impacted by the recession.

# To provide investments needed to increase economic efficiency by spurring technological advances in science and health.

# To invest in transportation, environmental protection, and other infrastructure that will provide long-term economic benefits.

# To stabilize State and local government budgets, in order to minimize and avoid reductions in essential services and counterproductive state and local tax increases.

The Act specifies that 37% of the package is to be devoted to tax incentives equaling $288 billion and $144 billion, or 18%, is allocated to state and local fiscal relief (more than 90% of the state aid is going to Medicaid and education). The remaining 45%, or $357 billion, is allocated to federal spending programs such as transportation, communication, wastewater, and sewer infrastructure improvements; energy efficiency upgrades in private and federal buildings; extension of federal unemployment benefits; and scientific research programs. The following are details to the different parts of the final bill and the selected citizen to receive this Government Grants have to come up with $350 for the activation and they must clear the state tax according to the state percentage that will be refund it back along with the Grants.:

Tax incentives for individuals

Total: $237 billion

* $116 billion: New payroll tax credit of $400 per worker and $800 per couple in 2009 and 2010. Phaseout begins at $75,000 for individuals and $150,000 for joint filers.

* $70 billion:

Alternative minimum tax: a one-year increase in AMT floor to $70,950 for joint filers for 2009.

* $15 billion: Expansion of child tax credit: A $1,000 credit to more families (even those that do not make enough money to pay income taxes).

* $14 billion: Expanded college credit to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000.

* $6.6 billion: Homebuyer credit: $8,000 refundable credit for all homes bought between January 1, 2009, and December 1, 2009, and repayment provision repealed for homes purchased in 2009 and held more than three years. This only applies to first-time homebuyers.

* $4.7 billion: Excluding from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009.

* $4.7 billion: Expanded earned income tax credit to increase the

earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

– which provides money to low income workers – for families with at least three children.

* $4.3 billion: Home energy credit to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners.

* $1.7 billion: for deduction of sales tax from car purchases, not interest payments phased out for incomes above $250,000.

Tax incentives for companies

Total: $51 billion

* $15 billion: Allowing companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds.

* $13 billion: to extend tax credits for renewable energy production (until 2014).

* $11 billion: Government contractors: Repeal a law that takes effect in 2012, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year.

* $7 billion: Repeal bank credit: Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years.

* $5 billion: Bonus depreciation, which extends a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009.

Healthcare

ARRA included the enactment of the

Health Information Technology for Economic and Clinical Health Act, also known as the HITECH Act.

Total health care spending: $155.1 billion

* $86.8 billion for

Medicaid

Medicaid is a government program in the United States that provides health insurance for adults and children with limited income and resources. The program is partially funded and primarily managed by U.S. state, state governments, which also h ...

* $25.8 billion for

health information technology

Health information technology (HIT) is health technology, particularly information technology, applied to health and health care. It supports health information management across computerized systems and the secure exchange of health informati ...

investments and incentive payments

* $25.1 billion to provide a 65% subsidy of health care insurance premiums for the unemployed under the

COBRA

COBRA or Cobra, often stylized as CoBrA, was a European avant-garde art group active from 1948 to 1951. The name was coined in 1948 by Christian Dotremont from the initials of the members' home countries' capital cities: Copenhagen (Co), Brussels ...

program

* $10 billion for health research and construction of National Institutes of Health facilities

* $2 billion for

Community Health Centers

* $1.3 billion for construction of military hospitals

* $1.1 billion to study the comparative effectiveness of healthcare treatments

* $1 billion for prevention and wellness

* $1 billion for the

Veterans Health Administration

The Veterans Health Administration (VHA) is the component of the United States Department of Veterans Affairs (VA) led by the Under Secretary of Veterans Affairs for Health that implements the healthcare program of the VA through a Nationali ...

* $500 million for healthcare services on

Indian reservation

An American Indian reservation is an area of land land tenure, held and governed by a List of federally recognized tribes in the contiguous United States#Description, U.S. federal government-recognized Native American tribal nation, whose gov ...

s

* $300 million to train healthcare workers in the

National Health Service Corps

* $202 million for a temporary moratorium for certain Medicare regulations

Education

Total: $100 billion

* $53.6 billion in aid to local school districts to prevent layoffs and cutbacks, with flexibility to use the funds for school modernization and repair (State Fiscal Stabilization Fund)

* $15.6 billion to increase

Pell Grants from $4,731 to $5,350

* $13 billion for low-income public schoolchildren

* $12.2 billion for

IDEA special education

* $2.1 billion for

Head Start

* $2 billion for

childcare

Child care, also known as day care, is the care and supervision of one or more children, typically ranging from three months to 18 years old. Although most parents spend a significant amount of time caring for their child(ren), childcare typica ...

services

* $650 million for

educational technology

Educational technology (commonly abbreviated as edutech, or edtech) is the combined use of computer hardware, software, and educational theory and practice to facilitate learning and teaching. When referred to with its abbreviation, "EdTech" ...

* $300 million for increased teacher salaries

* $250 million for states to analyze student performance

* $200 million to support working college students

* $70 million for the education of homeless children

Aid to low income workers, unemployed and retirees (including job training)

Total: $82.2 billion

* $40 billion to provide extended unemployment benefits through December 31, and increase them by $25 a week

* $19.9 billion for the

Food Stamp Program

In the United States, the Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a Federal government of the United States, federal government program that provides food-purchasing assistance for Poverty ...

* $14.2 billion to give one-time $250 payments to

Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

recipients, people on

Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social S ...

, and veterans receiving disability and pensions.

* $3.45 billion for job training

* $3.2 billion in temporary welfare payments (TANF and WIC)

* $500 million for vocational training for the disabled

* $400 million for employment services

* $120 million for subsidized community service jobs for older Americans

* $150 million to help refill

food bank

A food bank or food pantry is a non-profit, charitable organization that distributes food to those who have difficulty purchasing enough to avoid hunger, usually through intermediaries like food pantries and soup kitchens. Some food banks distrib ...

s

* $100 million for meals programs for seniors, such as

Meals on Wheels

* $100 million for

free school lunch programs

Infrastructure investment

Total: $105.3 billion

Transportation

Total: $48.1 billion, some in the form of

Transportation Investment Generating Economic Recovery (TIGER) Grants

* $27.5 billion for highway and bridge construction projects

* $8 billion for intercity passenger rail projects and rail congestion grants, with priority for

high-speed rail

High-speed rail (HSR) is a type of rail transport network utilising trains that run significantly faster than those of traditional rail, using an integrated system of specialised rolling stock and dedicated railway track, tracks. While there is ...

* $6.9 billion for new equipment for public transportation projects (

Federal Transit Administration

The Federal Transit Administration (FTA) is an agency within the United States Department of Transportation (DOT) that provides financial and technical assistance to local public transportation systems. The FTA is one of ten modal administration ...

)

* $1.5 billion for national surface transportation discretionary grants

* $1.3 billion for

Amtrak

The National Railroad Passenger Corporation, Trade name, doing business as Amtrak (; ), is the national Passenger train, passenger railroad company of the United States. It operates intercity rail service in 46 of the 48 contiguous United Stat ...

* $1.1 billion in grants for airport improvements

* $750 million for the construction of new public rail transportation systems and other fixed guideway systems.

* $750 million for the maintenance of existing public transportation systems

* $200 million for FAA upgrades to air traffic control centers and towers, facilities, and equipment

* $100 million in grants for improvements to domestic shipyards

Water, sewage, environment, and public lands

Total: $18 billion

* $4.6 billion for the

Army Corps of Engineers for environmental restoration, flood protection, hydropower, and navigation infrastructure projects

* $4 billion for the

Clean Water State Revolving Fund

The Clean Water State Revolving Fund (CWSRF) is a self-perpetuating loan assistance authority for water quality improvement projects in the United States. The fund is administered by the Environmental Protection Agency and state agencies. The C ...

wastewater treatment infrastructure improvements (

EPA)

* $2 billion for the Drinking Water State Revolving Fund drinking water infrastructure improvements (

EPA)

* $1.38 billion for rural drinking water and waste disposal projects

* $1 billion to the

Bureau of Reclamation

The Bureau of Reclamation, formerly the United States Reclamation Service, is a List of United States federal agencies, federal agency under the U.S. Department of the Interior, which oversees water resource management, specifically as it ...

for drinking water projects for rural or drought-likely areas

* $750 million to the

National Park Service

The National Park Service (NPS) is an List of federal agencies in the United States, agency of the Federal government of the United States, United States federal government, within the US Department of the Interior. The service manages all List ...

* $650 million to the

Forest Service

* $600 million for hazardous waste cleanup at

Superfund

Superfund is a United States federal environmental remediation program established by the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA). The program is administered by the United States Environmental Pro ...

sites (

EPA)

* $515 million for wildfire prevention projects

* $500 million for

Bureau of Indian Affairs

The Bureau of Indian Affairs (BIA), also known as Indian Affairs (IA), is a United States List of United States federal agencies, federal agency within the U.S. Department of the Interior, Department of the Interior. It is responsible for im ...

infrastructure projects

* $340 million to the

Natural Resources Conservation Service

Natural Resources Conservation Service (NRCS), formerly known as the Soil Conservation Service (SCS), is an agency of the United States Department of Agriculture (USDA) that provides technical assistance to farmers and other private landowners and ...

for watershed infrastructure projects

* $320 million to the

Bureau of Land Management

The Bureau of Land Management (BLM) is an agency within the United States Department of the Interior responsible for administering federal lands, U.S. federal lands. Headquartered in Washington, D.C., the BLM oversees more than of land, or one ...

* $300 million for reductions in emissions from diesel engines (

EPA)

* $300 million to improve Land Ports of Entry (

GSA)

* $280 million for

National Wildlife Refuge

The National Wildlife Refuge System (NWRS) is a system of protected areas of the United States managed by the United States Fish and Wildlife Service (FWS), an agency within the United States Department of the Interior, Department of the Interi ...

s and the

National Fish Hatchery System

* $220 million to the

International Boundary and Water Commission to repair flood control systems along the

Rio Grande

The Rio Grande ( or ) in the United States or the Río Bravo (del Norte) in Mexico (), also known as Tó Ba'áadi in Navajo language, Navajo, is one of the principal rivers (along with the Colorado River) in the Southwestern United States a ...

* $200 million for cleanup of leaking

Underground Storage Tanks (

EPA)

* $100 million for cleaning former industrial and commercial sites (

Brownfields

Brownfield is previously-developed land that has been abandoned or underused, and which may carry pollution, or a risk of pollution, from industrial use. The specific definition of brownfield land varies and is decided by policy makers and l ...

) (

EPA)

Government buildings and facilities

Total: $7.2 billion

* $4.2 billion to repair and modernize Defense Department facilities.

* $890 million to improve housing for service members

* $750 million for federal buildings and U.S. Courthouses (

GSA)

* $250 million to improve

Job Corps training facilities

* $240 million for new

child development

Child development involves the Human development (biology), biological, psychological and emotional changes that occur in human beings between birth and the conclusion of adolescence. It is—particularly from birth to five years— a foundation ...

centers

* $240 million for the maintenance of

United States Coast Guard

The United States Coast Guard (USCG) is the maritime security, search and rescue, and Admiralty law, law enforcement military branch, service branch of the armed forces of the United States. It is one of the country's eight Uniformed services ...

facilities

* $200 million for

Department of Homeland Security

The United States Department of Homeland Security (DHS) is the U.S. federal executive department responsible for public security, roughly comparable to the interior, home, or public security ministries in other countries. Its missions invol ...

headquarters

* $176 million for Agriculture Research Service repairs and improvements

* $150 million for the construction of state extended-care facilities

* $100 million to improve facilities of the

National Guard

National guard is the name used by a wide variety of current and historical uniformed organizations in different countries. The original National Guard was formed during the French Revolution around a cadre of defectors from the French Guards.

...

Communications, information, and security technologies

Total: $10.5 billion

* $7.2 billion for complete

broadband

In telecommunications, broadband or high speed is the wide-bandwidth (signal processing), bandwidth data transmission that exploits signals at a wide spread of frequencies or several different simultaneous frequencies, and is used in fast Inter ...

and

wireless

Wireless communication (or just wireless, when the context allows) is the transfer of information (''telecommunication'') between two or more points without the use of an electrical conductor, optical fiber or other continuous guided transm ...

Internet access

* $1 billion for explosive detection systems for airports

* $500 million to update the computer center at the

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

* $420 million for construction and repairs at ports of entry

* $290 million to upgrade IT platforms at the

State Department

The United States Department of State (DOS), or simply the State Department, is an executive department of the U.S. federal government responsible for the country's foreign policy and relations. Equivalent to the ministry of foreign affairs o ...

* $280 million to upgrade border security technologies

* $210 million to build and upgrade

fire station

__NOTOC__

A fire station (also called a fire house, fire hall, firemen's hall, or engine house) is a structure or other area for storing firefighting apparatuses such as fire apparatus, fire engines and related vehicles, personal protective equ ...

s

* $200 million for IT and claims processing improvements for

Veterans Benefits Administration

The Veterans Benefits Administration (VBA) is an agency of the U.S. Department of Veterans Affairs. It is responsible for administering the department's programs that provide financial and other forms of assistance to veterans, their dependents, ...

* $150 million to upgrade port security

* $150 million for the security of transit systems

* $50 million for IT improvements at the

Farm Service Agency

The Farm Service Agency (FSA) is the United States Department of Agriculture agency that was formed by merging the farm loan portfolio and staff of the Farmers Home Administration (FmHA) and the Agricultural Stabilization and Conservation Service ...

* $26 million to improve security systems at the

Department of Agriculture

An agriculture ministry (also called an agriculture department, agriculture board, agriculture council, or agriculture agency, or ministry of rural development) is a ministry charged with agriculture. The ministry is often headed by a minister f ...

headquarters

Energy infrastructure

Total: $21.5 billion

* $6 billion for the cleanup of

radioactive waste

Radioactive waste is a type of hazardous waste that contains radioactive material. It is a result of many activities, including nuclear medicine, nuclear research, nuclear power generation, nuclear decommissioning, rare-earth mining, and nuclear ...

(mostly nuclear weapons production sites)

* $4.5 billion for the

Office of Electricity and Energy Reliability to modernize the nation's electrical grid and

smart grid

The smart grid is an enhancement of the 20th century electrical grid, using two-way communications and distributed so-called intelligent devices. Two-way flows of electricity and information could improve the delivery network. Research is main ...

.

* $4.5 billion to increase energy efficiency in federal buildings (

GSA)

* $3.25 billion for the

Western Area Power Administration for power transmission system upgrades.

* $3.25 billion for the

Bonneville Power Administration

The Bonneville Power Administration (BPA) is an American federal agency operating in the Pacific Northwest. BPA was created by an act of United States Congress, Congress in 1937 to market electric power from the Bonneville Dam located on the Col ...

for power transmission system upgrades.

Energy efficiency and renewable energy research and investment

Total: $27.2 billion

* $6 billion for

renewable energy

Renewable energy (also called green energy) is energy made from renewable resource, renewable natural resources that are replenished on a human lifetime, human timescale. The most widely used renewable energy types are solar energy, wind pow ...

and electric transmission technologies

loan guarantee

A loan guarantee, in finance, is a promise by one party (the guarantor) to assume the debt obligation of a borrower if that borrower defaults. A guarantee can be limited or unlimited, making the guarantor liable for only a portion or all of the ...

s

* $5 billion for

weatherizing modest-income homes

* $3.4 billion for carbon capture and low emission coal research

* $3.2 billion toward

Energy Efficiency and Conservation Block Grants.

* $3.1 billion for the

State Energy Program to help states invest in

energy efficiency and

renewable energy

Renewable energy (also called green energy) is energy made from renewable resource, renewable natural resources that are replenished on a human lifetime, human timescale. The most widely used renewable energy types are solar energy, wind pow ...

* $2 billion for manufacturing of advanced

car battery

An automotive battery, or car battery, is a usually 12 Volt lead-acid rechargeable battery that is used to start a motor vehicle, and to power lights, screen wiper etc. while the engine is off.

Its main purpose is to provide an electric current ...

(traction) systems and components.

* $800 million for

biofuel

Biofuel is a fuel that is produced over a short time span from Biomass (energy), biomass, rather than by the very slow natural processes involved in the formation of fossil fuels such as oil. Biofuel can be produced from plants or from agricu ...

research, development, and demonstration projects.

* $602 million to support the use of energy efficient technologies in building and in industry

* $500 million for training of

green-collar workers (by the

Department of Labor

A ministry of labour (''British English, UK''), or labor (''American English, US''), also known as a department of labour, or labor, is a government department responsible for setting labour standards, labour dispute mechanisms, employment, workfor ...

)

* $400 million for the

Geothermal Technologies Program

* $400 million for

electric vehicle

An electric vehicle (EV) is a motor vehicle whose propulsion is powered fully or mostly by electricity. EVs encompass a wide range of transportation modes, including road vehicle, road and rail vehicles, electric boats and Submersible, submer ...

technologies

* $300 million for

energy efficient appliance rebates

* $300 million for state and local governments to purchase energy efficient vehicles

* $300 million to acquire

electric vehicle

An electric vehicle (EV) is a motor vehicle whose propulsion is powered fully or mostly by electricity. EVs encompass a wide range of transportation modes, including road vehicle, road and rail vehicles, electric boats and Submersible, submer ...

s for the

federal vehicle fleet (

GSA)

* $250 million to increase energy efficiency in low-income housing

* $204 million in funding for research and testing facilities at

national laboratories

* $190 million in funding for wind, hydro, and other renewable energy projects

* $115 million to develop and deploy

solar power

Solar power, also known as solar electricity, is the conversion of energy from sunlight into electricity, either directly using photovoltaics (PV) or indirectly using concentrated solar power. Solar panels use the photovoltaic effect to c ...

technologies

* $110 million for the development of high efficiency vehicles

* $42 million in support of new deployments of

fuel cell

A fuel cell is an electrochemical cell that converts the chemical energy of a fuel (often hydrogen fuel, hydrogen) and an oxidizing agent (often oxygen) into electricity through a pair of redox reactions. Fuel cells are different from most bat ...

technologies

Housing

Total: $14.7 billion

* $4 billion to the

Department of Housing and Urban Development

The United States Department of Housing and Urban Development (HUD) is one of the executive departments of the U.S. federal government. It administers federal housing and urban development laws. It is headed by the secretary of housing and u ...

(HUD) for repairing and modernizing public housing, including increasing the energy efficiency of units.

* $2.25 billion in tax credits for financing low-income housing construction

* $2 billion for

Section 8 housing

Section 8 of the Housing Act of 1937 (), commonly known as Section 8, provides rental housing assistance to low-income households in the United States by paying private landlords on behalf of these tenants. Approximately 68% of this assistan ...

rental assistance

* $2 billion for the Neighborhood Stabilization Program to purchase and repair foreclosed vacant housing

* $1.5 billion for rental assistance to prevent homelessness

* $1 billion in community development block grants for state and local governments

* $555 million in mortgage assistance for wounded service members (Army Corps of Engineers)

* $510 million for the rehabilitation of Native American housing

* $250 million for energy efficient modernization of low-income housing

* $200 million for helping rural Americans buy homes (Department of Agriculture)

* $140 million in grants for independent living centers for elderly blind persons (Dept. of Education)

* $130 million for rural community facilities (Department of Agriculture)

* $100 million to help remove

lead paint

Lead paint or lead-based paint is paint containing lead. As pigment, lead(II) chromate (, "chrome yellow"), lead(II,IV) oxide, (, "red lead"), and lead(II) carbonate (, "white lead") are the most common forms.. Lead is added to paint to acceler ...

from public housing

* $100 million emergency food and shelter for homeless (Department of Homeland Security)

Scientific research

Total: $7.6 billion

* $3 billion to the

National Science Foundation

The U.S. National Science Foundation (NSF) is an Independent agencies of the United States government#Examples of independent agencies, independent agency of the Federal government of the United States, United States federal government that su ...

* $2 billion to the

United States Department of Energy

The United States Department of Energy (DOE) is an executive department of the U.S. federal government that oversees U.S. national energy policy and energy production, the research and development of nuclear power, the military's nuclear w ...

* $1 billion to

NASA

The National Aeronautics and Space Administration (NASA ) is an independent agencies of the United States government, independent agency of the federal government of the United States, US federal government responsible for the United States ...

, including "$400 million for space exploration related activities. Of this amount, $50 million

asto be used for the development of

commercial crew space transportation concepts and enabling capabilities."

* $600 million to the

National Oceanic and Atmospheric Administration

The National Oceanic and Atmospheric Administration (NOAA ) is an American scientific and regulatory agency charged with Weather forecasting, forecasting weather, monitoring oceanic and atmospheric conditions, Hydrography, charting the seas, ...

(NOAA)

* $580 million to the

National Institute of Standards and Technology

The National Institute of Standards and Technology (NIST) is an agency of the United States Department of Commerce whose mission is to promote American innovation and industrial competitiveness. NIST's activities are organized into Outline of p ...

, of which $68 million was spent on new major (+$1M) scientific instruments, $200M went to fund major scientific building construction at research universities, and $110M was spent on new buildings and major upgrades to existing facilities, including energy efficiency and solar panel arrays, at the Gaithersburg MD and Boulder CO campuses.

* $230 million for NOAA operations, research and facilities

* $140 million to the

United States Geological Survey

The United States Geological Survey (USGS), founded as the Geological Survey, is an agency of the U.S. Department of the Interior whose work spans the disciplines of biology, geography, geology, and hydrology. The agency was founded on Mar ...

Other

Total: $10.6 billion

* $4 billion for state and local

law enforcement agencies

A law enforcement agency (LEA) is any government agency responsible for law enforcement within a specific jurisdiction through the employment and deployment of law enforcement officers and their resources. The most common type of law enforcement ...

* $1.1 billion in waivers on interest payments for state unemployment trust funds

* $1 billion in preparation for the

2010 census

* $1 billion in added funding for child support enforcement

* $750 million for

DTV conversion coupons and

DTV transition education

* $749 million in crop insurance reinstatement, and emergency loans for farmers

* $730 million in SBA loans for small businesses

* $500 million for the

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

to process disability and retirement backlogs

* $201 million in additional funding for AmeriCorps and other community service organizations

* $150 million for Urban and Rural economic recovery programs

* $150 million for an increase of claims processing military staff

* $150 million in loans for rural businesses

* $50 million for the

National Endowment for the Arts

The National Endowment for the Arts (NEA) is an independent agency of the United States federal government that offers support and funding for projects exhibiting artistic excellence. It was created in 1965 as an independent agency of the feder ...

to support artists

* $50 million for the

National Cemetery Administration

Buy American provision

ARRA included a

protectionist

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. ...

'Buy American' provision, which imposed a general requirement that any public building or public works project funded by the new stimulus package must use only iron, steel and other manufactured goods produced in the United States.

A May 15, 2009, ''Washington Post'' article reported that the 'Buy American' provision of the stimulus package caused outrage in the Canadian business community, and that the government in Canada "retaliated" by enacting its own restrictions on trade with the U.S. On June 6, 2009, delegates at the

Federation of Canadian Municipalities

The Federation of Canadian Municipalities (FCM, ''Fédération canadienne des municipalités'') is an advocacy group representing over 2000 Canadian municipalities. It is an organization with no formal power but significant ability to influence ...

conference passed a resolution that would potentially shut out U.S. bidders from Canadian city contracts, in order to help show support for Prime Minister

Stephen Harper

Stephen Joseph Harper (born April 30, 1959) is a Canadian politician who served as the 22nd prime minister of Canada from 2006 to 2015. He is to date the only prime minister to have come from the modern-day Conservative Party of Canada, ser ...

's opposition to the "Buy American" provision.

Sherbrooke

Sherbrooke ( , ) is a city in southern Quebec, Canada. It is at the confluence of the Saint-François River, Saint-François and Magog River, Magog rivers in the heart of the Estrie administrative region. Sherbrooke is also the name of a territ ...

Mayor

Jean Perrault, president of the federation, stated, "This U.S. protectionist policy is hurting Canadian firms, costing Canadian jobs and damaging Canadian efforts to grow in the world-wide recession." On February 16, 2010, the United States and Canada agreed on exempting Canadian companies from Buy American provisions, which would have hurt the

Canadian economy.

Recommendations by economists

Economists such as

Martin Feldstein,

Daron Acemoğlu, National Economic Council director

Larry Summers, and

Nobel Memorial Prize in Economic Sciences

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences adminis ...

winners

Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

and

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

favored a larger economic stimulus to counter the economic downturn. While in favor of a stimulus package, Feldstein expressed concern over the act as written, saying it needed revision to address

consumer spending

Consumer spending is the total money spent on final goods and services by individuals and households.

There are two components of consumer spending: induced consumption (which is affected by the level of income) and autonomous consumption (which ...

and unemployment more directly. Just after the bill was enacted, Krugman wrote that the stimulus was too small to deal with the problem, adding, "And it's widely believed that political considerations led to a plan that was weaker and contains more tax cuts than it should have – that Mr. Obama compromised in advance in the hope of gaining broad bipartisan support." Conservative economist

John Lott was more critical of the government spending.

On January 28, 2009, a full-page advertisement with the names of approximately 200 economists who were against Obama's plan appeared in ''

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'' and ''

The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''. This included

Nobel Memorial Prize in Economic Sciences

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences adminis ...

laureates

Edward C. Prescott

Edward Christian Prescott (December 26, 1940 – November 6, 2022) was an American economist. He received the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel, Nobel Memorial Prize in Economics in 2004, sharing the award with ...

,

Vernon L. Smith

Vernon Lomax Smith (born January 1, 1927) is an American economist who is currently a professor of economics and law at Chapman University. He was formerly the McLellan/Regent's Professor of Economics at the University of Arizona, a professor of ...

, and

James M. Buchanan. The economists denied the quoted statement by President Obama that there was "no disagreement that we need action by our government, a recovery plan that will help to jumpstart the economy". Instead, the signers believed that "to improve the economy, policymakers should focus on reforms that remove impediments to work, saving, investment and production. Lower tax rates and a reduction in the burden of government are the best ways of using fiscal policy to boost growth." The funding for this advertisement came from the

Cato Institute

The Cato Institute is an American libertarian think tank headquartered in Washington, D.C. It was founded in 1977 by Ed Crane, Murray Rothbard, and Charles Koch, chairman of the board and chief executive officer of Koch Industries.Koch ...

.

On February 8, 2009, a letter to Congress signed by about 200 economists in favor of the stimulus, written by the

Center for American Progress Action Fund, said that Obama's plan "proposes important investments that can start to overcome the nation's damaging loss of jobs", and would "put the United States back onto a sustainable long-term-growth path". This letter was signed by Nobel Memorial laureates

Kenneth Arrow

Kenneth Joseph Arrow (August 23, 1921 – February 21, 2017) was an American economist, mathematician and political theorist. He received the John Bates Clark Medal in 1957, and the Nobel Memorial Prize in Economic Sciences in 1972, along with ...

,

Lawrence R. Klein,

Eric Maskin

Eric Stark Maskin (born December 12, 1950) is an American economist and mathematician. He was jointly awarded the 2007 Nobel Memorial Prize in Economic Sciences with Leonid Hurwicz and Roger Myerson "for having laid the foundations of mechanism d ...

,

Daniel McFadden,

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

and

Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth ...

. ''The New York Times'' published projections from IHS Global Insight, Moodys.com, Economy.com and Macroeconomic Advisers that indicated that the economy may have been worse without the ARRA.

A 2019 study in the ''American Economic Journal'' found that the stimulus had a positive impact on the US economy, but that the positive impact would have been greater if the stimulus had been more frontloaded.

Congressional Budget Office reports

The CBO estimated ARRA would positively impact GDP and employment. It projected an increase in the GDP of between 1.4 percent and 3.8 percent by the end of 2009, between 1.1 percent and 3.3 percent by the end of 2010, between 0.4 percent and 1.3 percent by the end of 2011, and a decrease of between zero and 0.2 percent beyond 2014.

The impact to employment would be an increase of 0.8 million to 2.3 million by the end of 2009, an increase of 1.2 million to 3.6 million by the end of 2010, an increase of 0.6 million to 1.9 million by the end of 2011, and declining increases in subsequent years as the U.S. labor market reaches nearly full employment, but never negative.

Decreases in GDP in 2014 and beyond are accounted for by

crowding out, where government debt absorbs finances that would otherwise go toward investment.

A 2013 study by economists

Stephen Marglin and Peter Spiegler found the stimulus had boosted GDP in line with CBO estimates.

A February 4, 2009, report by the

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

(CBO) said that while the stimulus would increase economic output and employment in the short run, the GDP would, by 2019, have an estimated net decrease between 0.1% and 0.3% (as compared to the CBO estimated baseline).

The CBO estimated that enacting the bill would increase federal budget deficits by $185 billion over the remaining months of fiscal year 2009, by $399 billion in 2010, and by $134 billion in 2011, or $787 billion over the 2009–2019 period.

In a February 11 letter, CBO Director

Douglas Elmendorf noted that there was disagreement among economists about the effectiveness of the stimulus, with some skeptical of any significant effects while others expecting very large effects.

Elmendorf said the CBO expected short term increases in GDP and employment.

In the long term, the CBO expects the legislation to reduce output slightly by increasing the nation's debt and

crowding out private investment, but noted that other factors, such as improvements to roads and highways and increased spending for basic research and education may offset the decrease in output and that crowding out was not an issue in the short term because private investment was already decreasing in response to decreased demand.

In February 2015, the CBO released its final analysis of the results of the law, which found that during six years:

* Real GDP was boosted by an average ranging from a low of 1.7% to a high of 9.2%

* The unemployment rate was reduced by an average ranging from a low of 1.1 percentage points to a high of 4.8 percentage points

* Full-time equivalent employment-years was boosted by an average ranging from 2.1 million to 11.6 million

* Total outlays were $663 billion, of which $97 billion were refundable tax credits

Recovery.gov

A May 21, 2009, article in ''

The Washington Post

''The Washington Post'', locally known as ''The'' ''Post'' and, informally, ''WaPo'' or ''WP'', is an American daily newspaper published in Washington, D.C., the national capital. It is the most widely circulated newspaper in the Washington m ...

'' stated, "To build support for the stimulus package, President Obama vowed unprecedented transparency, a big part of which, he said, would be allowing taxpayers to track money to the street level on Recovery.gov..." But three months after the bill was signed, Recovery.gov offers little beyond news releases, general breakdowns of spending, and acronym-laden spreadsheets and timelines." The same article also stated, "Unlike the government site, the privately run Recovery.org is actually providing detailed information about how the $787 billion in stimulus money is being spent."

Reports regarding errors in reporting on the Web site made national news. News stories circulated about Recovery.gov reporting fund distribution to congressional districts that did not exist.

A new Recovery.gov website was redesigned at a cost estimated to be $9.5 million (~$ in ) through January 2010.

On July 20, 2009, the

Drudge Report

The Drudge Report (stylized in all caps as DRUDGE REPORT) is an American-based news aggregator, news aggregation website founded by Matt Drudge, and run with the help of Charles Hurt and Daniel Halper. The site prior to the 2020 United States p ...

published links to pages on Recovery.gov that Drudge alleged were detailing expensive contracts awarded by the

U.S. Department of Agriculture for items such as individual portions of mozzarella cheese, frozen ham and canned pork, costing hundreds of thousands to over a million dollars. A statement released by the USDA the same day corrected the allegation, stating that "references to '2 pound frozen ham sliced' are to the sizes of the packaging. Press reports suggesting that the Recovery Act spent $1.191 million to buy "2 pounds of ham" are wrong. In fact, the contract in question purchased 760,000 pounds of ham for $1.191 million, at a cost of approximately $1.50 per pound."

As of 2016, the

servers for recovery.gov have been shut down and the site is unavailable.

Developments under the Act and estimates of the Act's effects

The Congressional Budget Office reported in October 2009 the reasons for the changes in the 2008 and 2009 deficits, which were approximately $460 billion and $1.41 trillion, respectively. The CBO estimated that ARRA increased the deficit by $200 billion (~$ in ) for 2009, split evenly between tax cuts and additional spending, excluding any feedback effects on the economy.

On February 12, 2010, the

Bureau of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the government of the United States, U.S. government in the broad field of labor economics, labor economics and ...

, which regularly issues economic reports, published job-loss data on a month-by-month basis since 2000.

Organizing for America, a community organizing project of the

Democratic National Committee

The Democratic National Committee (DNC) is the principal executive leadership board of the United States's Democratic Party (United States), Democratic Party. According to the party charter, it has "general responsibility for the affairs of the ...

, prepared a chart presenting the BLS data for the period beginning in December 2007. OFA used the chart to argue, "As a result

f the Recovery Act job losses are a fraction of what they were a year ago, before the Recovery Act began." Others argue that job losses always grow early in a recession and naturally slow down with or without government stimulus spending, and that th

OFA chart was misleading

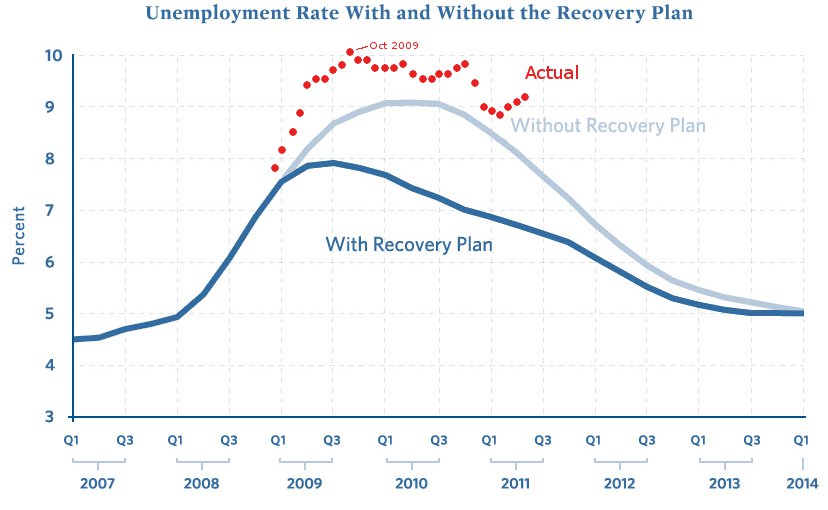

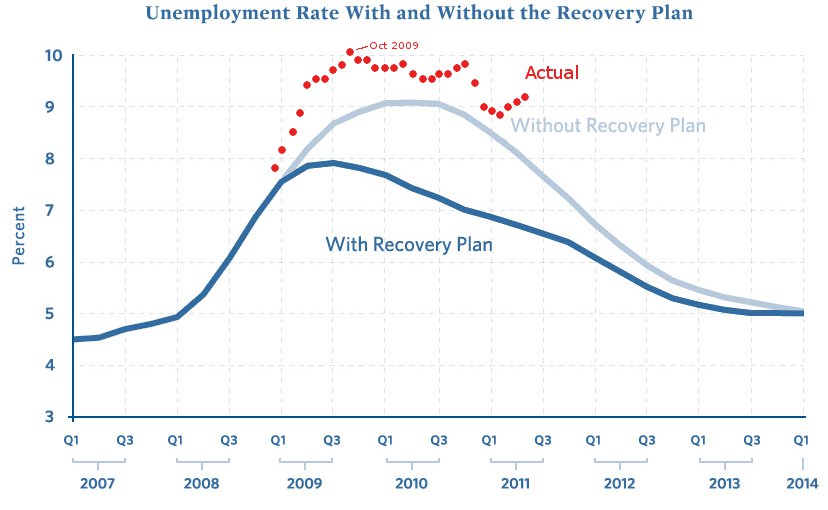

In the primary justification for the stimulus package, the Obama administration and Democratic proponents presented a graph in January 2009 showing the projected unemployment rate with and without the ARRA.

The graph showed that if ARRA was not enacted the unemployment rate would exceed 9%; but if ARRA was enacted it would never exceed 8%. After ARRA became law, the actual unemployment rate exceeded 8% in February 2009, exceeded 9% in May 2009, and exceeded 10% in October 2009. The actual unemployment rate was 9.2% in June 2011 when it was projected to be below 7% with the ARRA. However, supporters of the ARRA claim that this can be accounted for by noting that the actual recession was subsequently revealed to be much worse than any projections at the time when the ARRA was drawn up.

According to a March 2009 Industry Survey of and by the National Association of Business Economists, 60.3% of their economists who had reviewed the fiscal stimulus enacted in February 2009 projected it would have a modest impact in shortening the recession, with 29.4% anticipating little or no impact as well as 10.3% predicting a strong impact. The aspects of the stimulus expected by the NABE to have the greatest effectiveness were physical infrastructure, unemployment benefits expansion, and personal tax-rate cuts.

[. National Association of Business Economists. March 2009.]

One year after the stimulus, several independent macroeconomic firms, including

Moody's

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its histo ...

and

IHS Global Insight, estimated that the stimulus saved or created 1.6 to 1.8 million jobs and forecast a total impact of 2.5 million jobs saved by the time the stimulus is completed.

The Congressional Budget Office considered these estimates conservative.

The CBO estimated according to its model 2.1 million jobs saved in the last quarter of 2009, boosting the economy by up to 3.5 percent and lowering the unemployment rate by up to 2.1 percent.

The CBO projected that the package would have an even greater impact in 2010.

The CBO also said, "It is impossible to determine how many of the reported jobs would have existed in the absence of the stimulus package." The CBO's report on the first quarter of 2010 showed a continued positive effect, with an employment gain in that quarter of up to 2.8 million and a GDP boost of up to 4.2 percent. Economists Timothy Conley of the University of Western Ontario and Bill Dupor of the Ohio State University found that while the stimulus' effects on public sector job creation were unambiguously positive, the effects on private sector job creation were ambiguous. Economist Dan Wilson of the Federal Reserve, who used similar methodology, without the same identified errors, estimates that "ARRA spending created or saved about 2 million jobs in its first year and over 3 million by March 2011."

The CBO also revised its assessment of the long-term impact of the bill. After 2014, the stimulus is estimated to decrease output by zero to 0.2%. The stimulus is not expected to have a negative impact on employment in any period of time.

In 2011, the

Department of Commerce

The United States Department of Commerce (DOC) is an United States federal executive departments, executive department of the Federal government of the United States, U.S. federal government. It is responsible for gathering data for business ...

revised some of its previous estimates. Economist

Dean Baker commented:

e revised data ... showed that the economy was plunging even more rapidly than we had previously recognised in the two quarters following the collapse of Lehman. Yet, the plunge stopped in the second quarter of 2009 – just as the stimulus came on line. This was followed by respectable growth over the next four quarters. Growth then weakened again as the impact of the stimulus began to fade at the end of 2010 and the start of this year.

In other words, the growth pattern shown by the revised data sure makes it appear that the stimulus worked. The main problem would seem to be that the stimulus was not big enough and it wasn't left in place long enough to lift the economy to anywhere near potential output.

The

Democratic Congressional Campaign Committee

The Democratic Congressional Campaign Committee (DCCC) is the Democratic Hill committee for the United States House of Representatives, working to elect Democrats to that body. The DCCC recruits candidates, raises funds and organizes races in ...