|

Working Capital

Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Gross working capital is equal to current assets. Working capital is calculated as current assets minus current liabilities. If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit and negative working capital. A company can be endowed with assets and profitability but may fall short of liquidity if its assets cannot be readily converted into cash. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts rece ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Liquidity

In accounting, liquidity (or accounting liquidity) is a measure of the ability of a debtor to pay their debts as and when they fall due. It is usually expressed as a ratio or a percentage of current liabilities. Liquidity is the ability to pay short-term obligations. Calculating liquidity For a corporation with a published balance sheet there are various ratios used to calculate a measure of liquidity. These include the following: * The current ratio is the simplest measure and calculated by dividing the total current assets by the total current liabilities. A value of over 100% is normal in a non-banking corporation. However, some current assets are more difficult to sell at full value in a hurry. * The quick ratio is calculated by deducting inventories and prepayments from current assets and then dividing by current liabilities, giving a measure of the ability to meet current liabilities from assets that can be readily sold. A better way for a trading corporation to meet l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

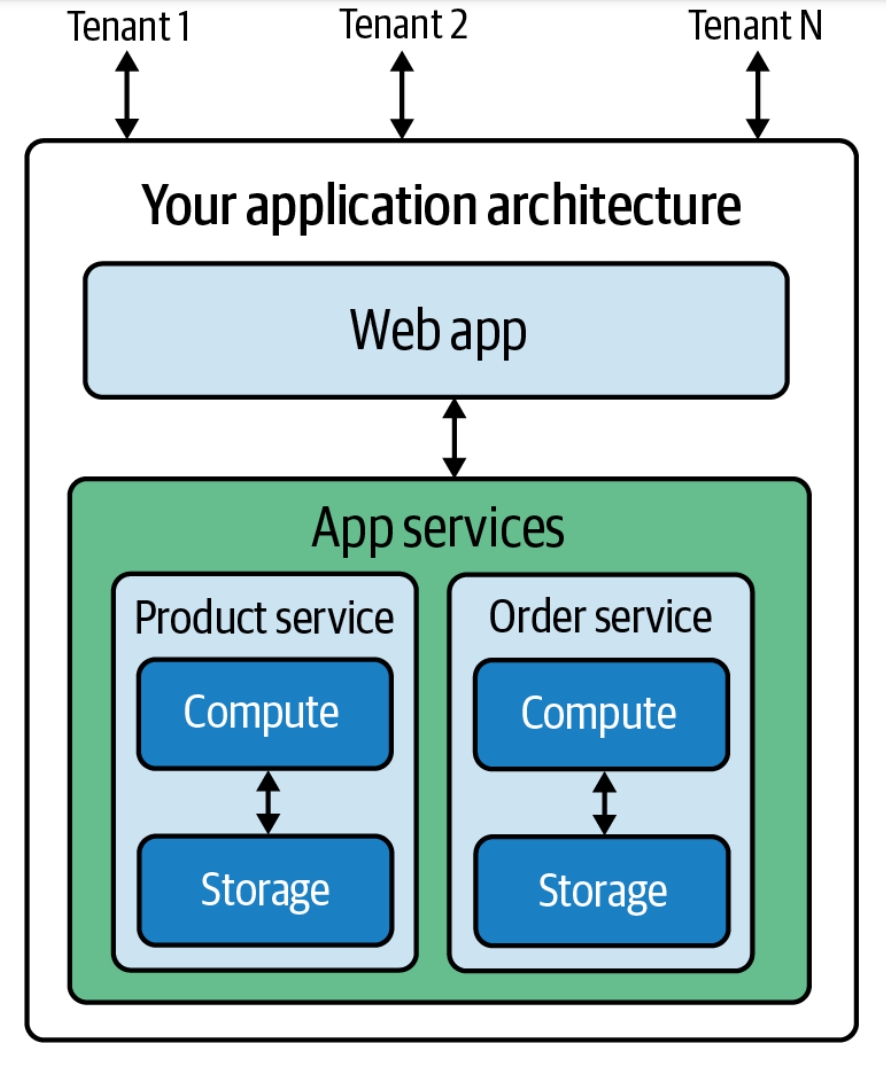

Software As A Service

Software as a service (SaaS ) is a cloud computing service model where the provider offers use of application software to a client and manages all needed physical and software resources. SaaS is usually accessed via a web application. Unlike other software delivery models, it separates "the possession and ownership of software from its use". SaaS use began around 2000, and by 2023 was the main form of software application deployment. Unlike most self-hosted software products, only one version of the software exists and only one operating system and configuration is supported. SaaS products typically run on rented infrastructure as a service (IaaS) or platform as a service (PaaS) systems including hardware and sometimes operating systems and middleware, to accommodate rapid increases in usage while providing instant and continuous availability to customers. SaaS customers have the abstraction of limitless computing resources, while economy of scale drives down the cost. Sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inventory

Inventory (British English) or stock (American English) is a quantity of the goods and materials that a business holds for the ultimate goal of resale, production or utilisation. Inventory management is a discipline primarily about specifying the shape and placement of stocked goods. It is required at different locations within a facility or within many locations of a supply network to precede the regular and planned course of production and stock of materials. The concept of inventory, stock or work in process (or work in progress) has been extended from manufacturing systems to service businesses and projects, by generalizing the definition to be "all work within the process of production—all work that is or has occurred prior to the completion of production". In the context of a manufacturing production system, inventory refers to all work that has occurred—raw materials, partially finished products, finished products prior to sale and departure from the manufacturing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins. In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately (as in the case of money market accounts). Cash is seen either as a reserve for payments, in case of a structural or incidental negative cash flow or as a way to avoid a downturn on financial markets. Etymology The English word ''cash'' originally meant , and later came to have a secondary meaning . This secondary usage became the sole meaning in the 18th century. The word ''cash'' comes from the Middle French , which comes from the Old Italian , and ultimately from the Latin . History In Western Europe, after the fall of the Western Roman Empire, coins, silver jewelry and hacksilver (silver objects hacked into pieces) were for centuries the only form of money, until Venetian merchants started using silver bars for larg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Value Added

In accounting, as part of financial statements analysis, economic value added is an estimate of a firm's economic profit, or the value created in excess of the Required rate of return, required return of the types of companies, company's shareholders. EVA is the net profit less the capital charge ($) for raising the firm's capital. The idea is that value is created when the return on the firm's economic capital employed exceeds the cost of that capital. This amount can be determined by making adjustments to Generally accepted accounting principles, GAAP accounting. There are potentially over 160 adjustments but in practice, only several key ones are made, depending on the company and its industry. Calculation EVA is net operating profit after taxes (or NOPAT) less a capital charge, the latter being the product of the cost of capital and the economic capital. The basic formula is: : \begin \text & = ( \text - \text ) \cdot (\text - \text) \\[8pt] & = \text - \text \cdot (\text - \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Equity

The return on equity (ROE) is a measure of the profitability of a business in relation to its equity; where: : Jason Fernando (2023)"Return on Equity (ROE) Calculation and What It Means" Investopedia Thus, ROE is equal to a fiscal year's net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), expressed as a percentage. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on NAV, or ''assets less liabilities''. Usage ROE measures how many dollars of profit are generated for each dollar of shareholder's equity, and is thus a metric of how well the company utilizes its equity to generate profits. ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, an ROE is a measure of management's ability to generate income from the equity available to it. ROEs of 15–2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Capital

Return on capital (ROC), or return on invested capital (ROIC), is a ratio used in finance, valuation and accounting Accounting, also known as accountancy, is the process of recording and processing information about economic entity, economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activit ..., as a measure of the profitability and value-creating potential of companies relative to the amount of capital invested by shareholders and other debtholders.Fernandes, Nuno. Finance for Executives: A Practical Guide for Managers. NPV Publishing, 2014, p. 36. It indicates how effective a company is at turning capital into profits. The ratio is calculated by dividing the after tax operating income ( NOPAT) by the average book-value of the invested capital (IC). Return on invested capital formula : There are three main components of this measurement: * While ratios such as return on equity and return on assets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Conversion Cycle

In management accounting, the Cash conversion cycle (CCC) measures how long a firm will be deprived of cash if it increases its investment in inventory in order to expand customer sales. It is thus a measure of the liquidity risk entailed by growth. However, shortening the CCC creates its own risks: while a firm could even achieve a negative CCC by collecting from customers before paying suppliers, a policy of strict collections and lax payments is not always sustainable. Definition ''CCC'' is days between ''disbursing cash'' and ''collecting cash'' in connection with undertaking a discrete unit of operations. : Derivation Cashflows insufficient. The term "Cash Conversion Cycle" refers to the timespan between a firm's disbursing and collecting cash. However, the CCC cannot be directly observed in cashflows, because these are also influenced by investment and financing activities; it must be derived from Statement of Financial Position data associated with the firm's operations. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money (which includes the annual effective discount rate). It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Budgeting

Capital budgeting in corporate finance, corporate planning and accounting is an area of capital management that concerns the planning process used to determine whether an organization's long term capital investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structures (debt, equity or retained earnings). It is the process of allocating resources for major capital, or investment, expenditures. An underlying goal, consistent with the overall approach in corporate finance, is to increase the value of the firm to the shareholders. Capital budgeting is typically considered a non-core business activity as it is not part of the revenue model or models of most types of firms, or even a part of daily operations. It holds a strategic financial function within a business. One example of a firm type where capital budgeting is possibly a part of the core bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Operations Management

Operations management is concerned with designing and controlling the production (economics), production of good (economics), goods and service (economics), services, ensuring that businesses are efficiency, efficient in using resources to meet customer requirements. It is concerned with managing an entire production system that converts inputs (in the forms of raw materials, Manual labour, labor, consumers, and energy) into outputs (in the form of goods and services for consumers). Operations management covers sectors like banking systems, hospitals, companies, working with suppliers, customers, and using technology. Operations is one of the major functions in an organization along with supply chains, marketing, finance and human resources. The operations function requires management of both the strategic and day-to-day production of goods and services. In managing manufacturing or service operations, several types of decisions are made including operations strategy, product ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |