|

Trading Floor

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. floor trading hand signals The part of the trading floor where this takes place is called a ''pit''. In an open outcry auction, bids and offers must be made out in the open market, giving all participants a chance to compete for the order with the best price. New bids or offers would be made if better than previous pricing for efficient price discovery. Exchanges also value positions marked to these public market prices on a daily basis. In contrast, over-the-counter markets are where bids and offers are negotiated privately between principals. Since the development of the stock exchange in the 17th century in Amsterdam, open outcry was the main method used to communicate among traders. This started changing in the latter half ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calcutta Stock Exchange

Calcutta Stock Exchange (CSE) was an Indian stock exchange based in Kolkata, India. It is owned by Ministry of Finance, Government of India. It is one of oldest stock exchanges in Asia and third largest bourse in India. It was founded in May 1908 at 2, China Bazar Street. The Calcutta Stock Exchange has been asked to exit by SEBI, but the matter is ''sub judice'' before the Calcutta High Court; thirteen other regional stock exchanges have closed in the last three years under SEBI's exit policy, including the Bangalore Stock Exchange, the Hyderabad Stock Exchange and the Madras Stock Exchange. Since 2013, there has been no trading on the CSE trading platform. History and timeline In 1830, bourse activities in Kolkata were conducted under a neem tree. The earliest record of dealings in securities in India records trading of the British East India Company’s loan stock. The exchange was founded on 1 December 1863 by sixteen leading stockbrokers, beginning life in rented pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bombay Stock Exchange

BSE Limited, also known as the Bombay Stock Exchange (BSE), is an Indian stock exchange based in Mumbai. It is the 6th largest stock exchange in the world by total market capitalization, exceeding $5 trillion in May 2024. Established with the efforts of cotton merchant Premchand Roychand in 1875, it is the oldest stock exchange in Asia, and also the tenth oldest in the world. History Bombay Stock Exchange was founded by Premchand Roychand in 1875. While BSE Limited is now synonymous with Dalal Street, it was not always so. In the 1850s, four Gujarati and one Parsi stockbroker gathered together under a Banyan tree in front of Bombay (now Mumbai) Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their location to under the banyan trees at the junction of Meadows Street and what was then called Esplanade Road, now Mahatma Gandhi Road. With a rapid increase in the number of brokers, they had to shift places repeatedly. At last, in 1874, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Borsa Italiana

Borsa Italiana () or Borsa di Milano (), based in Milan at Palazzo Mezzanotte, Mezzanotte Palace, is the Italy, Italian stock exchange. It manages and organises domestic market, regulating procedures for admission and listing of companies and intermediaries and supervising disclosures for listed companies.italy24.ilsole4ore.com,Borsa Italiana" Following exchange privatisation in 1997, the Italian Bourse was established and became effective on 2 January 1998.source sense.com,Borsa Italiana On 23 June 2007, the Italian Bourse became a subsidiary of the London Stock Exchange Group.news.bbc.co.uk,London Stock Exchange Buys Borsa This changed on 9 October 2020, when a €4.3 billion deal was agreed between the London Stock Exchange Group and pan-European stock exchange group Euronext. Euronext's acquisition of the Italian Bourse was completed on 29 April 2021. It is expected Italian Bourse will be rebranded as Euronext Milan in due course. Borsa Italiana is also informally known as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral. Since 2007, it has been part of the London Stock Exchange Group (LSEG, which the exchange also lists (ticker symbol LSEG)). Despite a post-Brexit exodus of stock listings from the LSE, it was the most valued stock exchange in Europe as of 2023. According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares. According to a 2020 Financial Conduct Authority report, approximately 15% of British adults reported having investments in stocks and shares. History Coffee House The Royal Exchange, London, Royal Exchange had been founded by the English financier Thomas Gresham and Sir Richard Clough on the model of the The Belgian bourse of Antwerp, An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

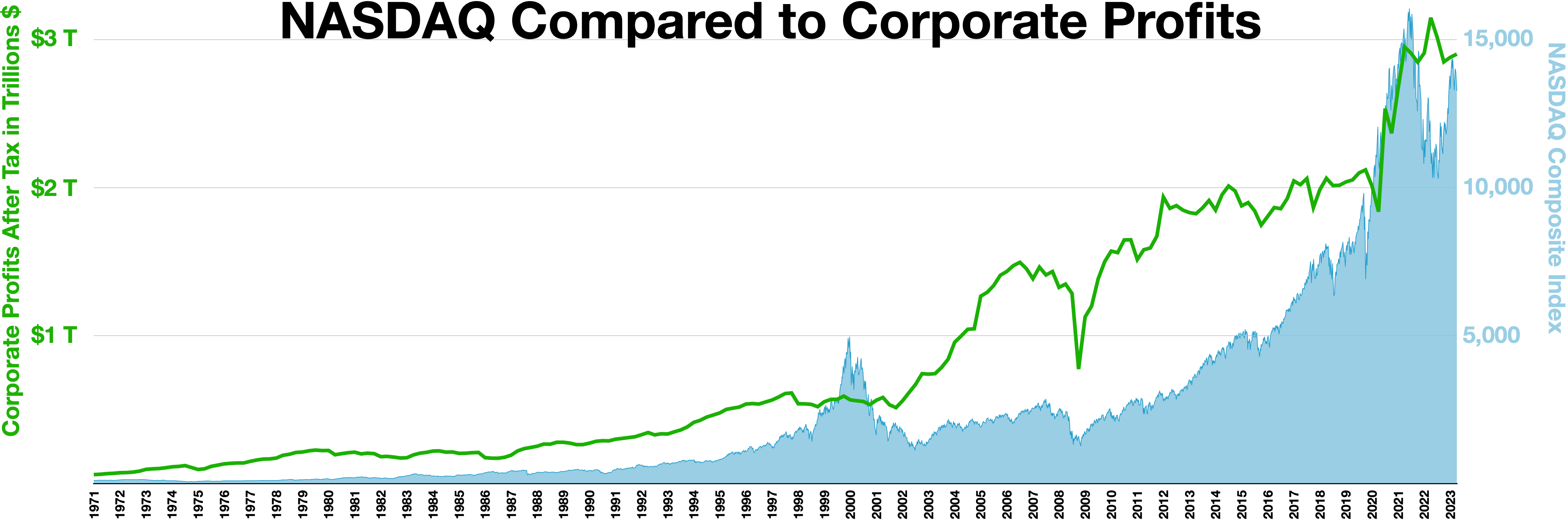

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Metal Exchange

The London Metal Exchange (LME) is a futures and forwards exchange in London, United Kingdom with the world's largest market in standardised forward contracts, futures contracts and options on base metals. The exchange also offers contracts on ferrous metals and precious metals. The company also allows for cash trading. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts. Overview Ring trading Trading times are 11:40 to 17:00. The LME is the last exchange in Europe where open-outcry trading takes place.BBC Radio 4 '' Today'', broadcast 25 October 2011. The ring was temporarily closed in March 2020 due to the COVID-19 pandemic. In January 2021, LME proposed closing the ring, Europe's last open-outcry trading floor, and moving permanently to an electronic system. However, the ring reopened in September of the same year after resistance from members. In addition to the 9 companies that have exclusive rights to trade in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hybrid Market

A hybrid market was a stock exchange that allowed a stockbroker to choose to have an order executed through either an electronic trading system or a traditional trading floor, where it is completed manually via the more traditional live auction method, in the presence of a specialist broker. The fully electronic method has the advantage of speed, often completing orders in less than one second, comparable manual transactions took longer but included the judgment of specialist. This was a transitional stage between wholly physical stock markets and completely electronic stock markets. The live auction method differentiates itself with the human interaction and expert judgment of the specialists, which as of 2010 were mostly obsolete. By 2008, the New York Stock Exchange (NYSE) was working to redefine the role played by the specialists in the market. The NYSE is seen as the world's premier example of a hybrid market. See also * Electronic trading * Open outcry Open out ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stockbroker

A stockbroker is an individual or company that buys and sells stocks and other investments for a financial market participant in return for a commission, markup, or fee. In most countries they are regulated as a broker or broker-dealer and may need to hold a relevant license and may be a member of a stock exchange. They generally act as a financial advisor and investment manager. In this case they may also be licensed as a financial adviser such as a registered investment adviser (in the United States). Examples of professional designations held by individuals in this field, which affects the types of investments they are permitted to sell and the services they provide include chartered financial consultants, certified financial planners or chartered financial analysts (in the United States and UK), chartered financial planners (in the UK). In the United States, the Financial Industry Regulatory Authority provides an online tool designed to help understand professio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Globex

The Chicago Mercantile Exchange (CME) (often called "the Chicago Merc", or "the Merc") is an American derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |