|

Tax Efficiency

Economic theory evaluates how taxes are able to provide the government with required amount of the financial resources (fiscal efficiency) and what are the impacts of this tax system on overall economic efficiency. If tax efficiency needs to be assessed, tax cost must be taken into account, including administrative costs and excessive tax burden also known as the dead weight loss of taxation (DWL). Direct administrative costs include state administration costs for the organisation of the tax system, for the evidence of taxpayers, tax collection and control. Indirect administrative costs can include time spent filling out tax returns or money spent on paying tax advisors. Achieving an ideal tax system is not possible in practice. However, there is an effort to find the optimal form of taxation. For example personal income taxation should guarantee a high level of equity through progressiveness. A financial process is said to be tax efficient if it is taxed at a lower rate than an a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Heir

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Grantor Retained Annuity Trust

A grantor-retained annuity trust (commonly referred to by the acronym GRAT) is a financial instrument commonly used in the United States to make large financial gifts to family members without paying a U.S. gift tax. Basic mechanism A grantor transfers property into an irrevocable trust in exchange for the right to receive fixed payments at least annually, based on original fair market value of the property transferred. At the end of a specified time, any remaining value in the trust is passed on to a beneficiary of the trust as a gift. Beneficiaries are generally close family members of the grantor, such as children or grandchildren, who are prohibited from being named beneficiaries of another estate freeze technique, the grantor-retained income trust. If a grantor dies before the trust period ends, the assets in the GRAT are included in the grantor's estate by operation of I.R.C. § 2036, eliminating any potential gift tax benefit; this is the GRAT's main weakness as a tax avoi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Inheritance

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

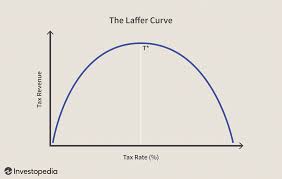

Laffer Curve Img

Laffer may refer to: * Laffer, South Australia, locality * Arthur Laffer Arthur Betz Laffer (; born August 14, 1940) is an American Economics, economist and author who first gained prominence during the Presidency of Ronald Reagan, Reagan administration as a member of Reagan's Economic Policy Advisory Board (1981–19 ... (born 1940), American economist * George Laffer (1866–1933), South Australian politician * Jae Laffer, Australian rock singer-songwriter * Larry Laffer, a fictional character from the ''Leisure Suit Larry'' game series See also * * Lafer, surname * Laugher (other) {{disambig, surname ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consent Of The Governed

In political philosophy, consent of the governed is the idea that a government's political legitimacy, legitimacy and natural and legal rights, moral right to use state power is justified and lawful only when consented to by the people or society over which that political power is exercised. This theory of consent is starkly contrasted with the divine right of kings and has often been invoked against the legitimacy of colonialism. Article 21 of the United Nations' 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government". Consensus democracy is the application of consensus decision-making and supermajority to democracy. History The idea that a law derives its validity from the approval of those subject to it can already be found in early Christian author Tertullian, who, in his Apologeticum claims The earliest utterance of the specific term "consent of the governed" seemingly appears in the writings of Scottis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Economic Justice

Economic justice is a component of social justice and welfare economics. It is a set of moral and ethical principles for building economic institutions, where the ultimate goal is to create an opportunity for each person to establish a sufficient material foundation upon which to have a dignified, productive, and creative life. Justice in economics is a subcategory of social justice and welfare economics. It is a "set of moral and ethical principles for building economic institutions". Economic justice aims to create opportunities for every person to have a dignified, productive and creative life that extends beyond simple economics. Models of economic justice frequently represent the ethical-social requirements of a given theory, whether "in the large", as of a just social order, or "in the small", as in the equity of "how institutions distribute specific benefits and burdens". That theory may or may not elicit acceptance. In the Journal of Economic Literature classificat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Taxation As Theft

The position that taxation is theft, and therefore immoral, is found in a number of political philosophies. Its popularization marks a significant departure from conservatism and classical liberalism, and has been considered radical by many as a result. The position is often held by anarcho-capitalists, objectivists, most minarchists, right-wing libertarians, and voluntaryists, as well as left-anarchists, libertarian socialists and some anarcho-communists. Proponents of this position see taxation as a violation of the non-aggression principle. Under this view, government transgresses property rights by enforcing compulsory tax collection, regardless of what the amount may be. Some opponents of taxation, like Michael Huemer, argue that rightful ownership of property should be based on what he calls "natural property rights", not those determined by the law of the state. Defenders of taxation argue that the notions of both legal private property rights and theft are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |