|

Tax Compliance Software

Tax compliance software is software that assists tax compliance, and may cover income tax An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ..., corporate tax, VAT, service tax, customs, sales tax, use tax, or other taxes its users may be required to pay. The software automatically calculates a user's tax liabilities to the government, keeps track of all transactions (in case of indirect taxes), keeps track of eligible tax credits, etc. The software can also generate forms or filings needed for tax compliance. The software will have pre-defined tax rates and slabs and can allocate income or revenue in the right slab itself. The aim of the software is to provide the user with easy way to calculate tax payment and minimize any human error. Tax compliance software has been present in dev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inheri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Streamlined Sales Tax Project

The Streamlined Sales Tax Project (SSTP), first organized in March 2000, is intended to simplify and modernize sales and use tax collection and administration in the United States. It arose in response to efforts by Congress to permanently prohibit states from collecting sales tax on online commerce. Because such a ban would have serious financial consequences for states, the SSTP began as an effort to try to minimize the many differences between the states' sales tax policies and practices. The SSTP was dissolved once the Streamlined Sales and Use Tax Agreement (SSUTA) became effective on October 1, 2005. Mission In prior decisions regarding mail-order sales, the U.S. Supreme Court ruled in '' Quill Corp. v. North Dakota'' (1992) that mail-order retailers were not compelled to collect use tax and remit the tax to states, in part because of the complexities of doing so. (The Supreme Court overruled this case in '' South Dakota v. Wayfair, Inc.'' (2018), which stated that a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since 2023; and, since its independence in 1947, the world's most populous democracy. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is near Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations averag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the 193 countries with UN membership employ a VAT, including all OECD members except the United States. History German indust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enterprise Resource Planning

Enterprise resource planning (ERP) is the integrated management of main business processes, often in real time and mediated by software and technology. ERP is usually referred to as a category of business management software—typically a suite of integrated applications—that an organization can use to collect, store, manage and interpret data from many business activities. ERP systems can be local-based or cloud-based. Cloud-based applications have grown in recent years due to the increased efficiencies arising from information being readily available from any location with Internet access. ERP differs from integrated business management systems by including planning all resources that are required in the future to meet business objectives. This includes plans for getting suitable staff and manufacturing capabilities for future needs. ERP provides an integrated and continuously updated view of the core business processes using common databases maintained by a database manag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

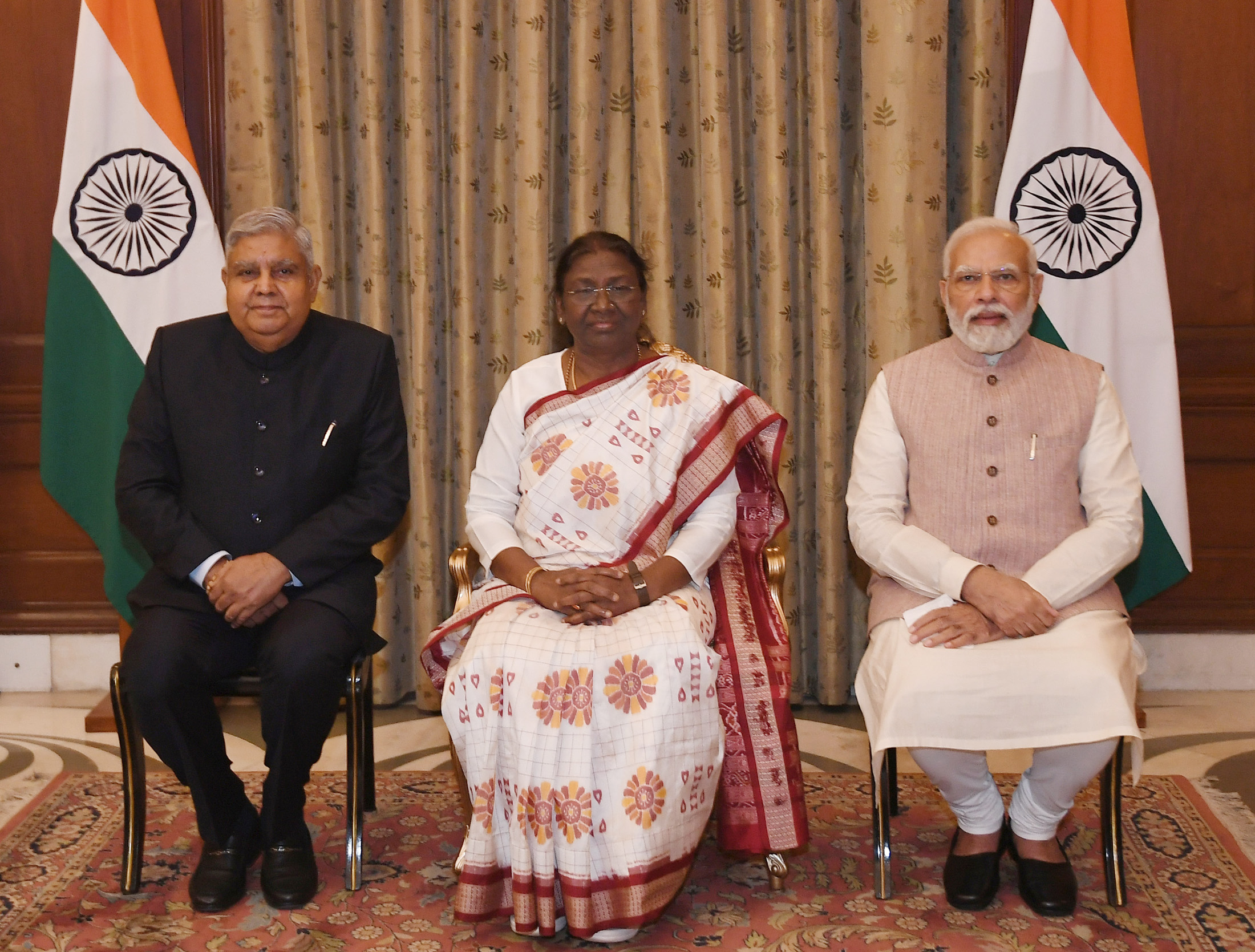

Government Of India

The Government of India (ISO 15919, ISO: Bhārata Sarakāra, legally the Union Government or Union of India or the Central Government) is the national authority of the Republic of India, located in South Asia, consisting of States and union territories of India, 36 states and union territories. The government is led by the president of India (currently ) who largely exercises the executive powers, and selects the Prime Minister of India, prime minister of India and other ministers for aid and advice. Government has been formed by the The prime minister and their senior ministers belong to the Union Council of Ministers, its executive decision-making committee being the Cabinet (government), cabinet. The government, seated in New Delhi, has three primary branches: the legislature, the executive and the judiciary, whose powers are vested in bicameral Parliament of India, Union Council of Ministers (headed by prime minister), and the Supreme Court of India respectively, with a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Tax

Although the actual definitions vary between jurisdictions, in general, a direct tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction between direct and indirect taxes depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third party, usually a client. The term may be used in economic and political analyses, and may have legal implications in some jurisdictions. In the United States of America, the term has special constitutional significance because of two provisions in the U.S. Constitution that any ''direct taxes'' imposed by the national government be apportioned among the states on the basis of population. It is also significant in the European Union, where direct taxation remains the sole responsibility of member states. General meaning In general, a direct tax is one imposed upon an individual person (juristic person, jurist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Error

Human error is an action that has been done but that was "not intended by the actor; not desired by a set of rules or an external observer; or that led the task or system outside its acceptable limits".Senders, J.W. and Moray, N.P. (1991) Human Error: Cause, Prediction, and Reduction'. Lawrence Erlbaum Associates, p.25. . Human error has been cited as a primary cause and contributing factor in disasters and accidents in industries as diverse as Nuclear and radiation accidents and incidents, nuclear power (e.g., the Three Mile Island accident), Pilot error, aviation, List of spaceflight-related accidents and incidents, space exploration (e.g., the Space Shuttle Challenger disaster and Space Shuttle Columbia disaster), and Medical error, medicine. Prevention of human error is generally seen as a major contributor to Data integrity, reliability and safety of (complex) systems. Human error is one of the many contributing causes of risk events. Definition Human error refers to somethi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |