|

Statement Of Changes In Equity

A statement of changes in equity is one of the four basic financial statements. It is also known as the statement of changes in owner's equity for a sole trader, statement of changes in partners' equity for a partnership, statement of changes in shareholders' equity for a company, and statement of changes in taxpayers' equity for a government. The statement explains the changes in a company's share capital, accumulated reserves and retained earnings over the reporting period. It breaks down changes in the owners' interest in the organization, and in the application of retained profit or surplus from one accounting period to the next. Line items typically include profits or losses from operations, dividends paid, issue or redemption of shares, revaluation reserve and any other items charged or credited to accumulated other comprehensive income. It also includes the non-controlling interest attributable to other individuals and organisations. The statement is expected under the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Financial Statement

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity reports on the changes in equity of the company over a stated period. # A cash flow statement reports on a company's cash flow activities, particularly its operating, investing and financing activities over a stated pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Generally Accepted Accounting Principles (United States)

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC), and is the default accounting standard used by companies based in the United States. The Financial Accounting Standards Board (FASB) publishes and maintains the Accounting Standards Codification (ASC), which is the single source of authoritative nongovernmental U.S. GAAP. The FASB published U.S. GAAP in Extensible Business Reporting Language (XBRL) beginning in 2008. Sources The FASB Accounting Standards Codification is the source of authoritative GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC Securities Exchange Act of 1934, registrants. In addition to the SEC's rules and interpretive releases, the SEC staff issues Staff Accounting Bulletins that represent practices followed by the staff in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Share Premium

Capital surplus, also called share premium, is an account which may appear on a corporation's balance sheet, as a component of shareholders' equity, which represents the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of the shares ( common stock). This is called Additional paid in capital in US GAAP terminology but, additional paid in capital is not limited to share premium. It is a very broad concept and includes tax related and conversion related adjustments. Taken together, common stock (and sometimes preferred stock) issued and paid (plus capital surplus) represent the total amount actually paid by investors for shares when issued (assuming no subsequent adjustments or changes). Shares for which there is no par value will generally not have any form of capital surplus on the balance sheet; all funds from issuing shares will be credited to common stock issued. Some other scenarios for triggering a capital surplus include wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

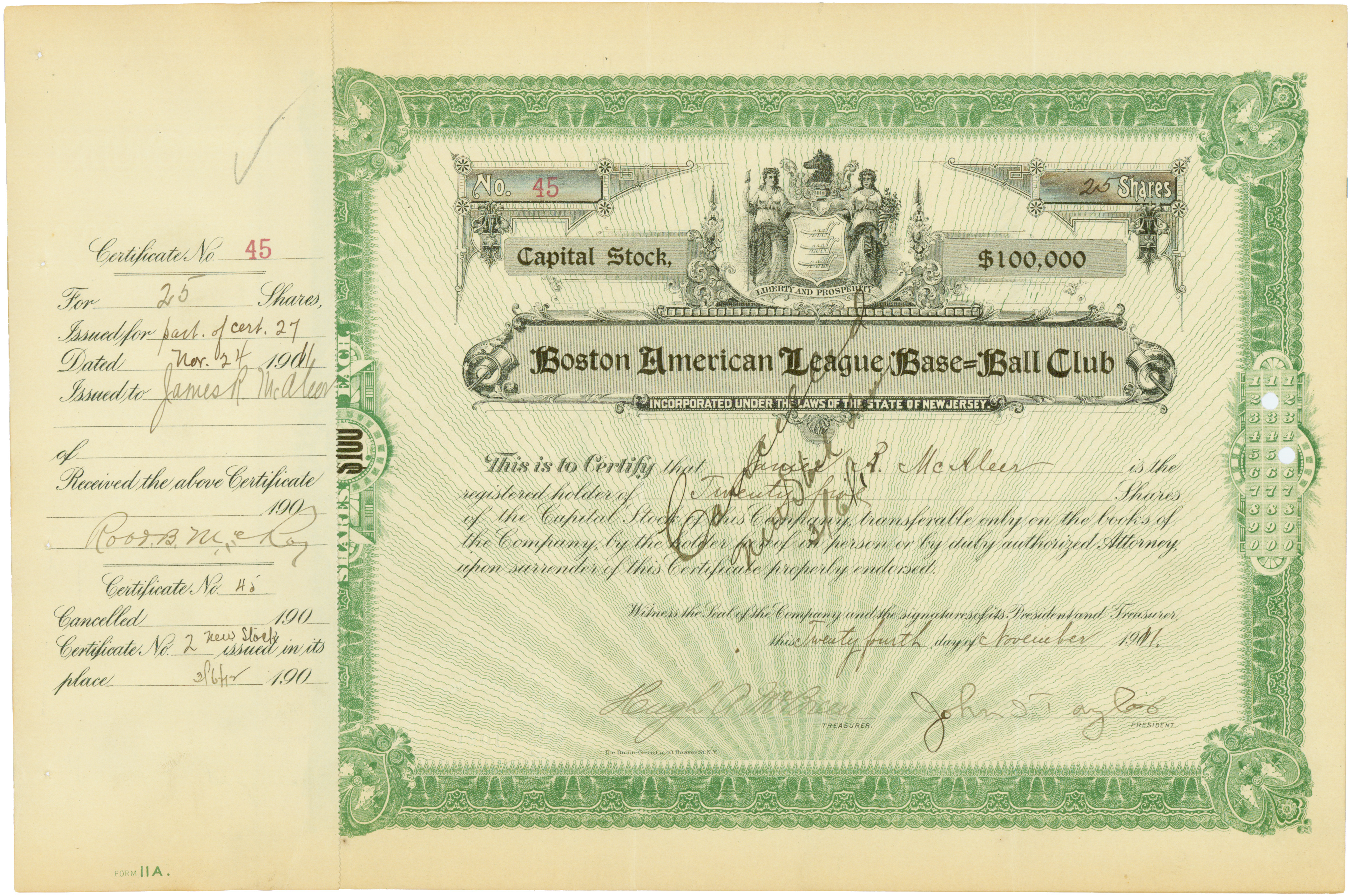

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consolidated Financial Statement

A consolidated financial statement (CFS) is the " financial statement of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity", according to the definitions stated in International Accounting Standard 27, "Consolidated and separate financial statements", and International Financial Reporting Standard 10, "Consolidated financial statements". Consolidated statement of financial position Consolidated accounts are prepared after the accounts for the constituent companies have been prepared. While preparing a consolidated financial statement, there are two basic procedures that need to be followed: first, cancelling out all the items that are accounted as an asset in one company and a liability in another, and then adding together all uncancelled items. There are two main type of items that cancel each other out from the consolidated statement of fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Minority Interest

In accounting, minority interest (or non-controlling interest) is the portion of a subsidiary corporation's stock that is not owned by the parent corporation. The magnitude of the minority interest in the subsidiary company is generally less than 50% of outstanding shares, or the corporation would generally cease to be a subsidiary of the parent. It is, however, possible (such as through special voting rights) for a controlling interest requiring consolidation to be achieved without exceeding 50% ownership, depending on the accounting standards being employed. Minority interest belongs to other investors and is reported on the consolidated balance sheet of the owning company to reflect the claim on assets belonging to other, non-controlling shareholders. Also, minority interest is reported on the consolidated income statement as a share of profit belonging to minority shareholders. The reporting of 'minority interest' is a consequence of the requirement by accounting standards ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Small And Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by many national agencies and international organizations such as the World Bank, the OECD, European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs outnumber large companies by a wide margin and also employ many more people. On a global scale, SMEs make up 90% of all companies and more than 50% of all employment. For example, in the EU, 99% of all businesses are SMEs. Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees acco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Notes To The Financial Statements

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity reports on the changes in equity of the company over a stated period. # A cash flow statement reports on a company's cash flow activities, particularly its operating, investing and financing activities over a stated period. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Owners

Ownership is the state or fact of legal possession and control over property, which may be any asset, tangible or intangible. Ownership can involve multiple rights, collectively referred to as ''title'', which may be separated and held by different parties. The process and mechanics of ownership are fairly complex: one can gain, transfer, and lose ownership of property in a number of ways. To acquire property one can purchase it with money, trade it for other property, win it in a bet, receive it as a gift, inherit it, find it, receive it as damages, earn it by doing work or performing services, make it, or homestead it. One can transfer or lose ownership of property by selling it for money, exchanging it for other property, giving it as a gift, misplacing it, or having it stripped from one's ownership through legal means such as eviction, foreclosure, seizure, or taking. Ownership implies that the owner of a property also owns any economic benefits or deficits associated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Accumulated Other Comprehensive Income

Note: Reference cited below, FAS130, remains the most current accounting literature in the United States on this topic. In 1997 the United States Financial Accounting Standards Board issued Statement on Financial Accounting Standards No. 130 entitled "Reporting Comprehensive Income". This statement required all income statement items to be reported either as a regular item in the income statement or a special item as other comprehensive income. It is commonly referred to as FAS130. The International Accounting Standards Board issued the International Accounting Standard 1 with a slightly different terminology but an conceptually identical meaning. Comprehensive income ''Comprehensive income'' (IAS 1: "Total Comprehensive Income") is the total non-owner change in equity for a reporting period. This change encompasses all changes in equity other than transactions from owners and distributions to owners. Most of these changes appear in the income statement. A few special types ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Net Income

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (accounting), amortization, interest, and taxes, and other expenses for an accounting period. It is computed as the residual of all revenues and gains less all expenses and losses for the period,Weil, Schipper, Francis. (2009) Financial Accounting: An Introduction to Concepts, Methods, and Uses. Cengage Learning and has also been defined as the net increase in Equity (finance), shareholders' equity that results from a company's operations.Weil, Schipper, Francis. (2010) Financial Accounting. Cengage Learning. It is different from gross income, which only deducts the cost of goods sold from revenue. For Household, households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Equity (finance)

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. When liabilities attached to an asset exceed its value, the difference is called a deficit and the asset is informally said to be "underwater" or "upside-down". In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that devel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |