|

Profits Tax

In Hong Kong, profits tax is an income tax chargeable to business carried on in Hong Kong. Applying the International taxation#Taxation systems, territorial taxation concept, only profits sourced in Hong Kong are taxable in general. Capital gains are not taxable in Hong Kong, although it is always arguable whether an income is capital in nature. The persons chargeable to profits tax includes corporations, partnerships, trustees, and sole proprietors. Chargeable scope As a general rule, Hong Kong profits tax is levied on any persons who carries on a #Badges of Trade, trade, profession or business in Hong Kong and assessable profits arising in or derived from Hong Kong for a #Year of Assessment, year of assessment. The profits tax rate applied is 15% for individuals and 16.5% for corporations (''a.k.a. the standard rate'') on their net assessable profits for the year of assessment 2014/15. Source of profits To argue whether profits arising in or derived from Hong Kong, ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a List of cities in China, city and Special administrative regions of China, special administrative region of China on the eastern Pearl River Delta in South China. With 7.5 million residents of various nationalities in a territory, Hong Kong is one of the List of countries and dependencies by population density, most densely populated places in the world. Hong Kong is also a major global financial centre and one of the Global city, most developed cities in the world. Hong Kong was established as a British Hong Kong, colony of the British Empire after the Qing dynasty, Qing Empire ceded Hong Kong Island from Bao'an County, Xin'an County at the end of the First Opium War in 1841 then again in 1842.. The colony expanded to the Kowloon Peninsula in 1860 after the Second Opium War and was further extended when Britain obtaine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Commissioner Of Inland Revenue ("CIR") V

''The'' () is a grammatical article in English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of pronoun '' thee'') when followed by a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inland Revenue Department (Hong Kong)

The Inland Revenue Department (IRD) is the Hong Kong Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a List of cities in China, city and Special administrative regions of China, special ... government department responsible for collecting taxes and duties. History The Inland Revenue Department was established on 1 April 1947. Initially it administered only one piece of legislation, the Inland Revenue Ordinance, which was enacted on 3 May 1947. The department subsequently absorbed various elements of the Treasury, including the Estate Duty Office (in 1949), the Stamp Duty Office (1956), and responsibility for collection of entertainments, bets and sweeps, and public dance-halls taxes (1956). In December 1979, the department's headquarters moved to Windsor House in Causeway Bay, a building that was specially designed with a second lift core for the department. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Approved Charitable Donations

Approved may refer to: *Approved drug, a preparation that has been validated for a therapeutic use by a ruling authority of a government *''Approved'', a 2013 album by Chester Thompson Chester Cortez Thompson (born December 11, 1948) is an American drummer best known for his tenures with Frank Zappa and The Mothers of Invention, Weather Report, Santana, the progressive rock band Genesis and Phil Collins as a solo artist. Thom ... Trio * ''Approved'' (Ubiquitous Synergy Seeker album) {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reference Links

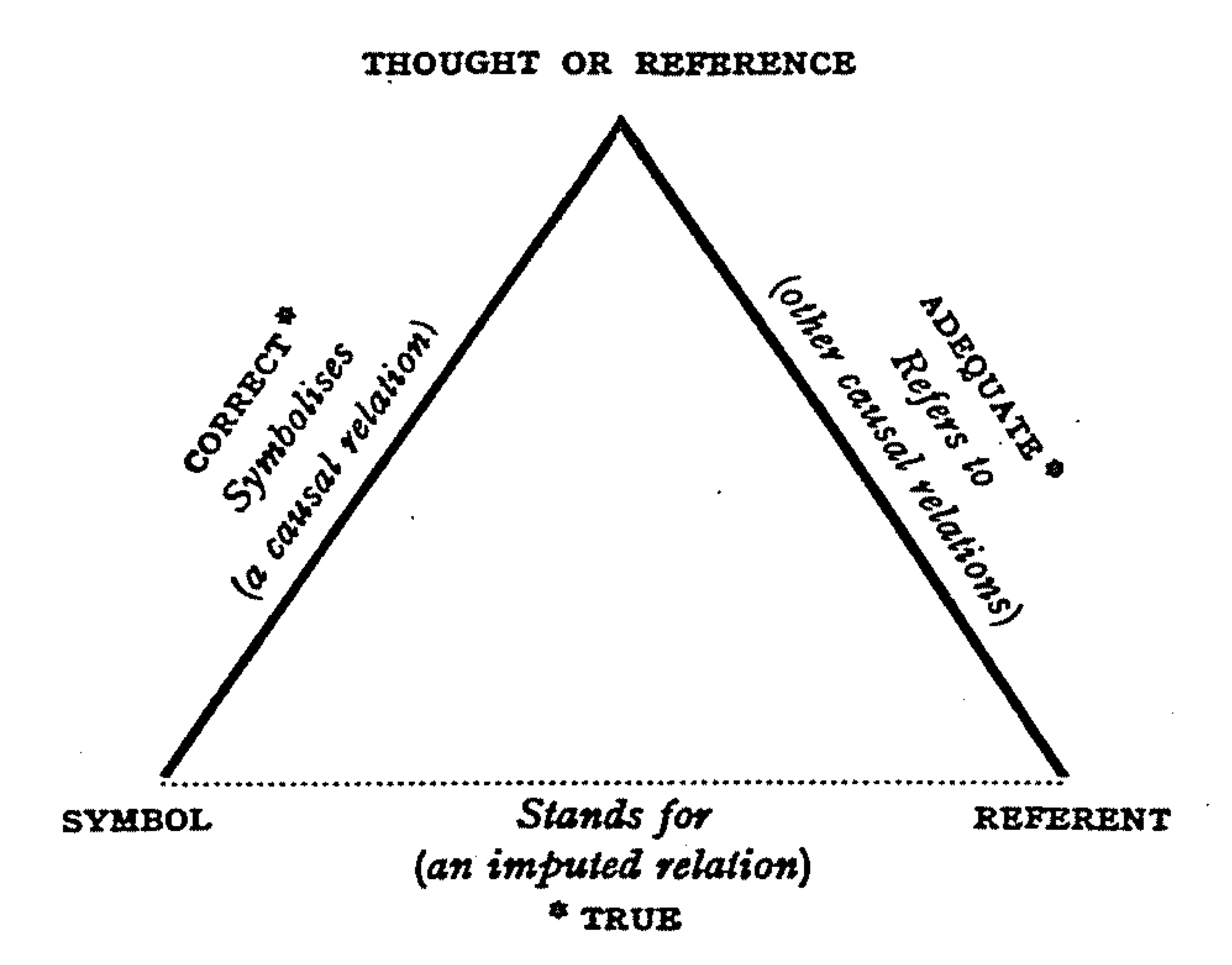

Reference is a relationship between objects in which one object designates, or acts as a means by which to connect to or link to, another object. The first object in this relation is said to ''refer to'' the second object. It is called a ''name'' for the second object. The second object, the one to which the first object refers, is called the ''referent'' of the first object. A name is usually a phrase or expression, or some other symbolic representation. Its referent may be anything – a material object, a person, an event, an activity, or an abstract concept. References can take on many forms, including: a thought, a sensory perception that is audible (onomatopoeia), visual (text), olfactory, or tactile, emotional state, relationship with other, spacetime coordinate, symbolic or alpha-numeric, a physical object or an energy projection. In some cases, methods are used that intentionally hide the reference from some observers, as in cryptography. References feature in many sphe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HK-TVB International Limited V

Television Broadcasts Limited (TVB) is a television broadcasting company based in Hong Kong SAR. The Company operates five free-to-air terrestrial television channels in Hong Kong, with TVB Jade as its main Cantonese language service, and TVB Pearl as its main English service. TVB is headquartered at TVB City at the Tseung Kwan O Industrial Estate. TVB commenced broadcasting on November 19, 1967. The Company was incorporated on July 26, 1965 and was co-founded by Sir Run Run Shaw, who was Chairman from 1980 to 2011, together with Sir Douglas Clague and Harold Lee Hsiao-wo of the Lee Hysan family. When TVB first began broadcasting it was commonly known and promoted as "Wireless Television" () in Chinese to distinguish it from the then cable television broadcaster, Rediffusion Television (), which later became ATV (). It is still usually referred to with that name, although ATV later switched to "wireless" (free-to-air) broadcasting as well. TVB is known primarily for its dra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Year Of Assessment

A year or annus is the orbital period of a planetary body, for example, the Earth, moving in its orbit around the Sun. Due to the Earth's axial tilt, the course of a year sees the passing of the seasons, marked by change in weather, the hours of daylight, and, consequently, vegetation and soil fertility. In temperate and subpolar regions around the planet, four seasons are generally recognized: spring, summer, autumn and winter. In tropical and subtropical regions, several geographical sectors do not present defined seasons; but in the seasonal tropics, the annual wet and dry seasons are recognized and tracked. A calendar year is an approximation of the number of days of the Earth's orbital period, as counted in a given calendar. The Gregorian calendar, or modern calendar, presents its calendar year to be either a common year of 365 days or a leap year of 366 days, as do the Julian calendars. For the Gregorian calendar, the average length of the calendar year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Badges Of Trade

A badge is a device or accessory, often containing the insignia of an organization, which is presented or displayed to indicate some feat of service, a special accomplishment, a symbol of authority granted by taking an oath (e.g., police and fire), a sign of legitimate employment or student status, or as a simple means of identification. They are also used in advertising, publicity, and for branding purposes. Police badges date back to medieval times when knights wore a coat of arms representing their allegiances and loyalty. Badges can be made from metal, plastic, leather, textile, rubber, etc., and they are commonly attached to clothing, bags, footwear, vehicles, home electrical equipment, etc. Textile badges or patches can be either woven or embroidered, and can be attached by gluing, ironing-on, sewing or applique. Badges have become highly collectable: in the UK, for example, the Badge Collectors' Circle has been in existence since 1980. In the military, badges are used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sole Proprietor

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people. The sole trader receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are that of the proprietor. It is a "sole" proprietorship in contrast with a partnership, which has at least two owners. Sole proprietors may use a trade name or business name other than their or its legal name. They may have to trademark their business name legally if it differs from their own legal name, with the process varying depending upon country of residence. Advantages and disadvantages Registration of a business name for a sole propri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)