|

Private Pension

A private pension is a plan into which individuals privately contribute from their earnings, which then will pay them a pension after retirement. It is an alternative to the state pension. Usually, individuals invest funds into saving schemes or mutual funds, run by insurance companies. Often private pensions are also run by the employer and are called occupational pensions. The contributions into private pension schemes are usually tax-deductible. History The first evidence of pension payments comes from the Roman Empire in the 1st century BC, but beginnings of private pensions go back to the 19th century. The first private pension plan in the USA was created in 1875 by the American Express, American Express Co. But the growth of people coveraged by private pensions was relatively slow. In 1950, only 25 percent of employees in nonagricultural field were anticipated in some private pension system. Situation in the 21st century At the start of the 2000s, governments of develope ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People And Households Without Private Pensions

The term "the people" refers to the public or Common people, common mass of people of a polity. As such it is a concept of human rights law, international law as well as constitutional law, particularly used for claims of popular sovereignty. In contrast, a people is any plurality of Person, persons considered as a whole. Used in politics and law, the term "a people" refers to the collective or community of an ethnic group or nation. Concepts Legal Chapter One, Article One of the Charter of the United Nations states that "peoples" have the right to self-determination. Though the mere status as peoples and the right to self-determination, as for example in the case of Declaration on the Rights of Indigenous Peoples, Indigenous peoples (''peoples'', as in all groups of indigenous people, not merely all indigenous persons as in ''indigenous people''), does not automatically provide for independence, independent sovereignty and therefore secession. Indeed, judge Ivor Jennings i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or " book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term "portfolio" refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio dominates A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Fund

An investment fund is a way of investment, investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification (finance), diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annuity

In investment, an annuity is a series of payments made at equal intervals based on a contract with a lump sum of money. Insurance companies are common annuity providers and are used by clients for things like retirement or death benefits. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. Annuities can be classified by the frequency of payment dates. The payments (deposits) may be made weekly, monthly, quarterly, yearly, or at any other regular interval of time. Annuities may be calculated by mathematical functions known as "annuity functions". An annuity which provides for payments for the remainder of a person's lifetime is a life annuity. An annuity which continues indefinitely is a perpetuity. Types Annuities may be classified in several ways. Timing of payments Payments of an ''annuity-immediate'' are made at the end of payment periods, so that interest accrues between the issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

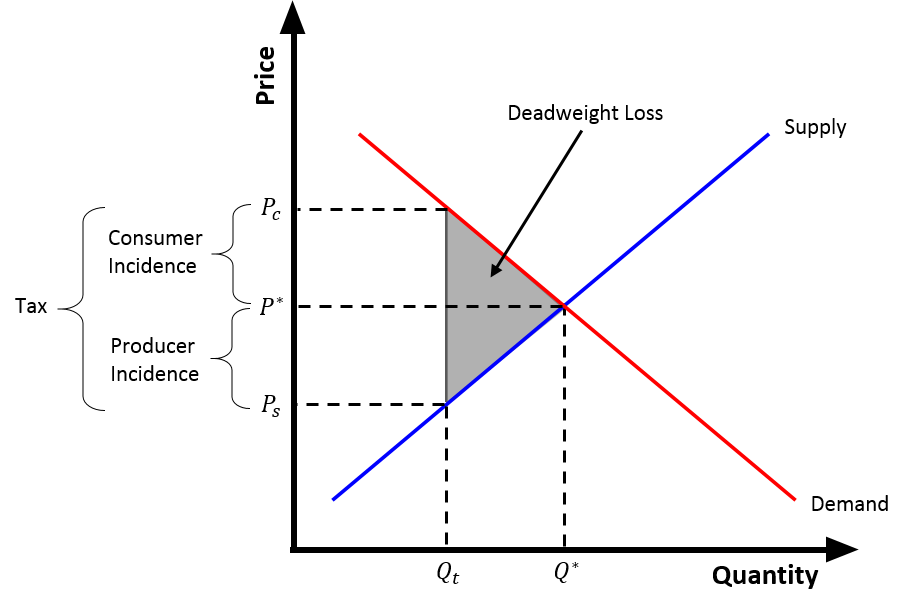

Tax Burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bert Rürup

Hans-Adalbert Rürup (born 7 November 1943) is a German economist and former chairman of the German Council of Economic Experts. He was formerly a professor of economics at the Darmstadt University of Technology. From 2010 to 2012, he was president of the International School of Management in Dortmund. In 2013 he changed into the ISM's board of trustees and took up a position as the president of the newly founded ''Handelsblatt The ''Handelsblatt'' (literally "commerce paper" in English) is a German-language business newspaper published in Düsseldorf by Handelsblatt Media Group, formerly known as Verlagsgruppe Handelsblatt. History and profile ''Handelsblatt'' was es ... Research Institute'' . See also * Rürup-Rente, part of the private pensions in Germany References External links * 1943 births Living people German economists University of Cologne alumni Academic staff of Technische Universität Darmstadt Commanders Crosses of the Order of Merit of the Feder ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic. Subsidies take various forms— such as direct government expenditures, tax incentives, soft loans, price support, and government provision of goods and services. For instance, the government may distribute direct payment subsidies to individuals and households during an economic downturn in order to help its citizens pay their bills and to stimulate economic activity. Here, subsidies act as an effective financial aid issued when the ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-Invested Personal Pension

A self-invested personal pension (SIPP) is the name given to the type of UK government-registered personal pension scheme which allows individuals to make their own investment decisions from a wide range of investments by HM Revenue and Customs (HMRC). SIPPs are "tax wrappers", allowing tax rebates on contributions in exchange for limits on accessibility. SIPPs are tax-efficient investment vehicles as they allow investors to receive income tax relief on their contributions at their highest Tax_rate#Marginal, marginal tax rate. Any contributions from employers will reduce their corporate tax liability. The investments can grow tax-free, a lump sum can be taken by the investor tax-free on retirement, and SIPPs attract better inheritance tax treatment if the beneficiary dies before the age of 75. The HMRC rules allow for a greater range of investments to be held than personal pension schemes, notably equities and property. Rules for contributions, benefit withdrawal etc. are the sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stakeholder Pension Scheme

A stakeholder pension scheme is a type of personal pension in the United Kingdom. Aims The schemes were introduced on 6 April 2001 as a consequence of the Welfare Reform and Pensions Act 1999. They were intended to encourage more long-term saving for retirement, particularly among those on low to moderate earnings. They are required to meet a number of conditions set out in legislation, including a cap on charges, low minimum contributions, and flexibility in relation to stopping and starting contributions. Employers with five or more employees are required to provide access to a stakeholder pension scheme for their employees unless they offer a suitable alternative pension scheme. The features of stakeholder pensions were intended to make them cheaper to sell than existing personal pensions and to provide a more transparent and attractive saving vehicle. Although many stakeholder pensions have been taken out, they have largely not been successful in encouraging lower earner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Pension Scheme

A personal pension scheme (PPS), sometimes called a personal pension plan (PPP), is a UK tax-privileged individual investment vehicle, with the primary purpose of building a capital sum to provide retirement benefits, although it will usually also provide death benefits. These plans first became available on 1 July 1988 and replaced retirement annuity plans. Both the individual can contribute as well as their employer. Benefits can be taken at any time after age 55 if the plan rules allow, or earlier in the case of ill health. In the past, legislation required benefits to be taken before age 75, and many plans still contain this restriction. Part of the fund (usually 25%) may be taken as a tax-free lump sum at retirement. New rules on drawing on the retirement fund, known as "Pension Freedom", came into effect on 5 April 2015. There are two types of personal pension scheme: insured personal pensions, where each contract will have a set range of investment funds for planholde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workplace Pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a "defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a "defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual; the terminology vari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |