|

Overdraft Protection

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. By analogy, overdrafting of an aquifer refers to extraction of water faster than it will be replenished. History in finance The first overdraft facility was set up in 1728 by the Royal Bank of Scotland. The merchant William Hogg was having problems in balancing his books and was able to come to an agreement with the newly established bank that allowed him to withdraw money from his empty account to pay his debts before he received his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

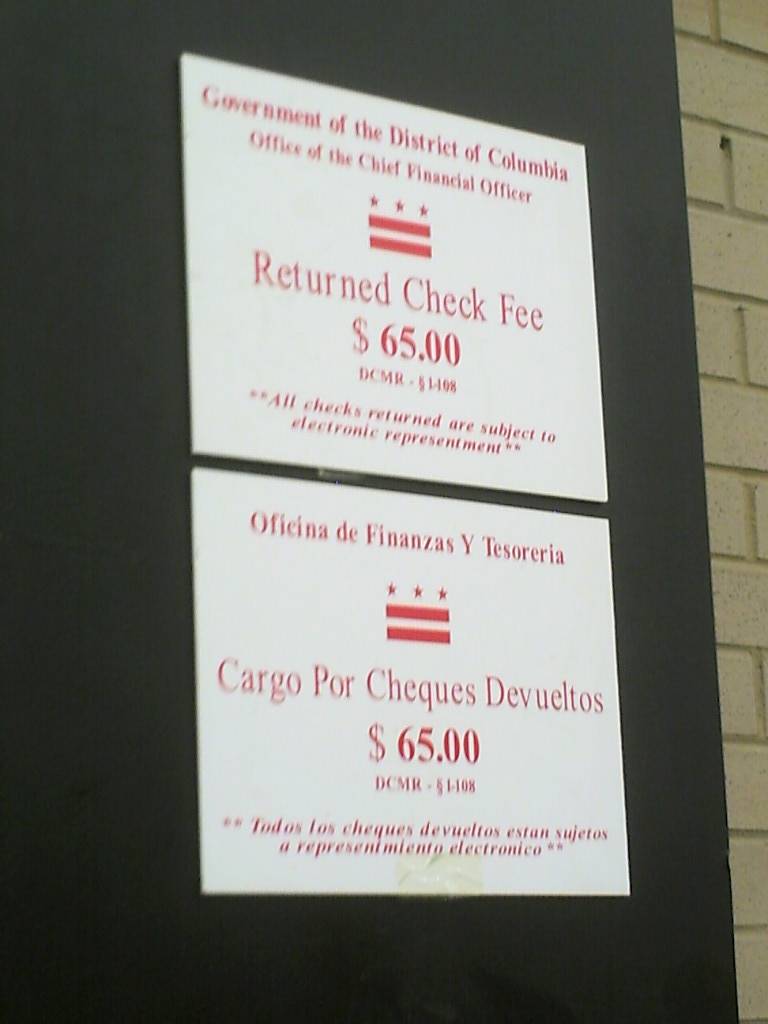

Non-sufficient Funds

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of the longest-running newspapers in the United States, the ''Times'' serves as one of the country's Newspaper of record, newspapers of record. , ''The New York Times'' had 9.13 million total and 8.83 million online subscribers, both by significant margins the List of newspapers in the United States, highest numbers for any newspaper in the United States; the total also included 296,330 print subscribers, making the ''Times'' the second-largest newspaper by print circulation in the United States, following ''The Wall Street Journal'', also based in New York City. ''The New York Times'' is published by the New York Times Company; since 1896, the company has been chaired by the Ochs-Sulzberger family, whose current chairman and the paper's publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Fair Trading

The Office of Fair Trading (OFT) was a non-ministerial government department of the United Kingdom, established by the Fair Trading Act 1973, which enforced both consumer protection and competition law, acting as the United Kingdom's economic regulator. The intention was for the OFT to make markets work well for consumers, ensuring vigorous competition between fair-dealing businesses and prohibiting unfair practices such as rogue trading, scams, and cartels. Its role was modified and its powers changed by the Enterprise Act 2002. The Department for Business, Innovation and Skills (BIS) announced reforms to the consumer protection and competition regimes. Under the provisions of the Enterprise and Regulatory Reform Act 2013, the Competition and Markets Authority (CMA) was established on 1 April 2014, combining many of the functions of the OFT and the Competition Commission and superseding both. Regulation of the consumer credit sector passed from the OFT to the new Financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom. It operates independently of the UK Government and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers, and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms. Like its predecessor the FSA, the FCA is structured as a company limited by guarantee.Goldsworth, J., ''Lexicon of Trust & Foundation Practice'' ( Wendens Ambo: Mulberry House Press, 2016)p. 140 The FCA works alongside the Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements for the financial sector. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the Unite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Halifax (United Kingdom Bank)

Halifax (previously known as Halifax Building Society and colloquially known as The Halifax) is a British banking brand operating as a trading division of Bank of Scotland, itself a wholly owned subsidiary of Lloyds Banking Group. It is named after the town of Halifax, West Yorkshire, where it was founded as a building society in 1853. By 1913 it had developed into the UK's largest building society and continued to grow and prosper and maintained this position within the UK until 1997 when it Demutualization#Building societies, demutualised. In 1996, it became Halifax plc, a public limited company which was a constituent of the FTSE 100 Index. In 2001, Halifax plc merged with The Governor and Company of the Bank of Scotland, forming HBOS. In 2006, the HBOS Group Reorganisation Act 2006 legally transferred the assets and liabilities of the Halifax chain to Bank of Scotland. That bank, originally established by act of parliament, became a standard Public limited company, plc, wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alliance & Leicester

Alliance & Leicester plc was a British bank and former building society, formed by the merger in 1985 of the Alliance Building Society and the Leicester Building Society. The business Demutualisation, demutualised in the middle of 1997, when it was floated on the London Stock Exchange. It was listed in the FTSE 250 Index, and had been listed in the FTSE 100 Index from April 1997 until June 2008. After running into difficulty during the 2008 financial crisis, the bank was acquired by the Santander Group in October 2008, and transferred its business into Santander UK plc in May 2010. It was fully integrated and rebranded as Santander by the end of 2011. The bank's international subsidiary based in Douglas, Isle of Man, Alliance & Leicester International, continued to use the name Alliance & Leicester, until it was fully merged into Santander UK in May 2013. History Early history The Alliance & Leicester Building Society was formed by the merger of the Alliance Building Socie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyds Banking Group

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695. The Group's headquarters are located at 25 Gresham Street in the City of London, while its registered office is on The Mound in Edinburgh. It also operates office sites in Birmingham, Bristol, West Yorkshire and Glasgow. The Group also has overseas operations in the US and Europe. Its headquarters for business in the European Union is in Berlin, Germany. The business operates under a number of distinct brands, including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows. Former Chief Executive António Horta-Osório told ''The Banker'', "We will keep the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Day

A business day normally means any day except a legal holiday. It may also mean a business day of operation, any of the days an organization operates. It depends on the local workweek which is dictated by local customs, religions, and business operations. It is related to '' working time'', the period of time that an individual spends at paid occupational labor. Alternatively, a business day may also be defined as any day which the New York Stock Exchange is open for trading or any day except those on which banking institutions are authorized or required by law or other governmental action to close. Working time The working time in a business day varies by region. For example, in the United States and much of the Western world, a typical workday is from 9am to 5pm. In contrast, for many eastern countries such as Japan, the normal business day is from 8:30am to 7pm. The length of a business day varies by era, by region, by industry, and by company. Prevalent norms have incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debit

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a credit entry represents a transfer ''from'' the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits typically increase the value of assets and expense accounts and reduce the value of liabilities, equity, and revenue accounts. Conversely, credits typically increase the value of liability, equity, and revenue account and reduce the value of asset and expense accounts. Debit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phishing

Phishing is a form of social engineering and a scam where attackers deceive people into revealing sensitive information or installing malware such as viruses, worms, adware, or ransomware. Phishing attacks have become increasingly sophisticated and often transparently mirror the site being targeted, allowing the attacker to observe everything while the victim navigates the site, and transverses any additional security boundaries with the victim. As of 2020, it is the most common type of cybercrime, with the Federal Bureau of Investigation's Internet Crime Complaint Center reporting more incidents of phishing than any other type of cybercrime. The term "phishing" was first recorded in 1995 in the cracking toolkit AOHell, but may have been used earlier in the hacker magazine '' 2600''. It is a variation of ''fishing'' and refers to the use of lures to "fish" for sensitive information. Measures to prevent or reduce the impact of phishing attacks include legislation, user educa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |