|

Merchant Services

Merchant services is a broad category of financial services intended for use by businesses. In its most specific use, it usually refers to merchant processing services that enables a business to accept a transaction payment through a secure (encrypted) channel using the customer's credit card or debit card or NFC/RFID enabled device. More generally, the term may include: * Credit and debit cards payment processing * Check guarantee and check conversion services * Automated clearing house check drafting and payment services * Gift card and loyalty programs * Payment gateway * Merchant cash advances * Online transaction processing * Point of sale (POS) systems * Electronic benefit transfer programs, such as ration stamps (called ''food stamps'' in the U.S.). Merchant service providers work as an intermediary between the bank, a person or organisation wanting to receive funds and the person or organisation looking to purchase goods or services. The merchant service provider w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U.S. (e.g. Japan), non-financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

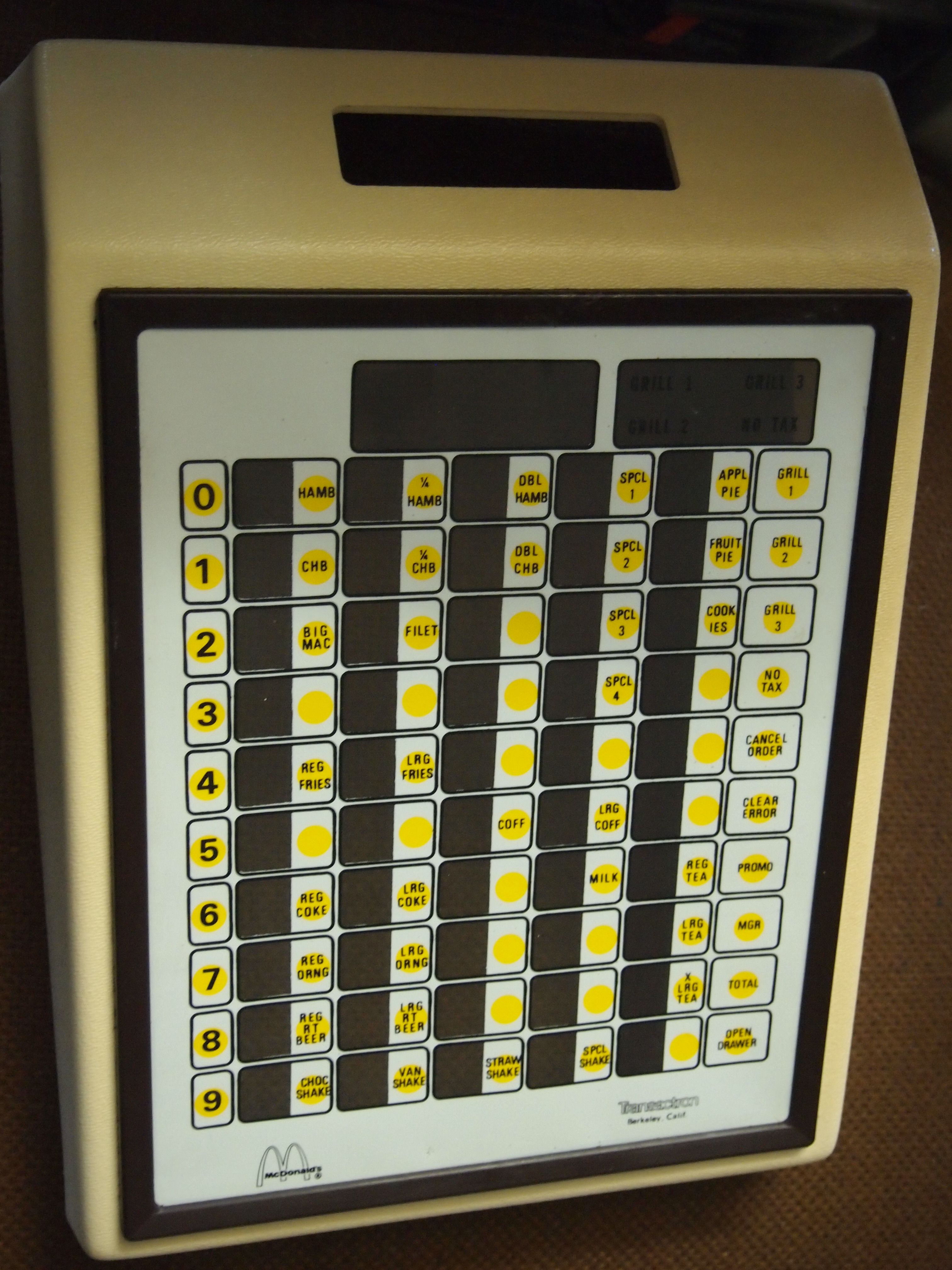

Point Of Sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are availabl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WiFi

Wi-Fi () is a family of wireless network protocols, based on the IEEE 802.11 family of standards, which are commonly used for local area networking of devices and Internet access, allowing nearby digital devices to exchange data by radio waves. These are the most widely used computer networks in the world, used globally in home and small office networks to link desktop and laptop computers, tablet computers, smartphones, smart TVs, printers, and smart speakers together and to a wireless router to connect them to the Internet, and in wireless access points in public places like coffee shops, hotels, libraries and airports to provide visitors with Internet access for their mobile devices. ''Wi-Fi'' is a trademark of the non-profit Wi-Fi Alliance, which restricts the use of the term ''Wi-Fi Certified'' to products that successfully complete interoperability certification testing. the Wi-Fi Alliance consisted of more than 800 companies from around the world. over 3.05 bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bluetooth

Bluetooth is a short-range wireless technology standard that is used for exchanging data between fixed and mobile devices over short distances and building personal area networks (PANs). In the most widely used mode, transmission power is limited to 2.5 milliwatts, giving it a very short range of up to . It employs UHF radio waves in the ISM bands, from 2.402GHz to 2.48GHz. It is mainly used as an alternative to wire connections, to exchange files between nearby portable devices and connect cell phones and music players with wireless headphones. Bluetooth is managed by the Bluetooth Special Interest Group (SIG), which has more than 35,000 member companies in the areas of telecommunication, computing, networking, and consumer electronics. The IEEE standardized Bluetooth as IEEE 802.15.1, but no longer maintains the standard. The Bluetooth SIG oversees development of the specification, manages the qualification program, and protects the trademarks. A manufacturer must mee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MPOS

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are available. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Gateway

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers, but can be provided by a specialised financial service provider as a separate service, such as a payment service provider. A payment gateway facilitates a payment transaction by the transfer of information between a payment portal (such as a website, mobile phone or interactive voice response service) and the front end processor or acquiring bank. Payment gateways are a service that helps merchants initiate ecommerce, in-app, and point of sale payments for a broad variety of payment methods. The gateway is not directly involved in the money flow; typically it is a web server to which a merchant's website or POS system is connected. A payment gateway often connects several acquir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barclaycard

Barclaycard (; stylized as barclaycard) is a brand for credit cards of Barclays PLC. , Barclays had over ten million customers in the United Kingdom. History Barclays launched Barclaycard on 29 June 1966, initially as a charge card, but following Bank of England agreement to the offering of revolving credit, it became the first credit card in the United Kingdom on 8 November 1967. It enjoyed the monopoly of the credit card market in the United Kingdom, until the introduction of the Access Card in October 1972. Barclays was not the first issuer of a credit card in the United Kingdom though; Diners Club and American Express launched their charge cards in 1962 and 1963 respectively. Barclaycard was originally a BankAmericard licensee, and became part of the Visa network on its formation in September 1976. In 2021, Barclaycard cut credit limits for over 100,000 customers. Acquisitions Providian In July 2003, Barclays took over Monument, the United Kingdom branch of the U.S. ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barclays

Barclays () is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services. Barclays traces its origins to the goldsmith banking business established in the City of London in 1690. James Barclay became a partner in the business in 1736. In 1896, twelve banks in London and the English provinces, including Goslings Bank, Backhouse's Bank and Gurney, Peckover and Company, united as a joint-stock bank under the name Barclays and Co. Over the following decades, Barclays expanded to become a nationwide bank. In 1967, Barclays deployed the world's first cash dispenser. Barclays has made numerous corporate acquisitions, including of London, Provincial and South Western Bank in 1918, British Linen Bank in 1919, Mercantile Credit in 1975, the Woolwich in 2000 and the North American operations of Lehman Brothers in 2008. Barclays has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business-to-business

Business-to-business (B2B or, in some countries, BtoB) is a situation where one business makes a commercial transaction with another. This typically occurs when: * A business is sourcing materials for their production process for output (e.g., a food manufacturer purchasing salt), i.e. providing raw material to the other company that will produce output. * A business needs the services of another for operational reasons (e.g., a food manufacturer employing an accountancy firm to audit their finances). * A business re-sells goods and services produced by others (e.g., a retailer buying the end product from the food manufacturer). B2B is often contrasted with business-to-consumer (B2C). In B2B commerce, it is often the case that the parties to the relationship have comparable negotiating power, and even when they do not, each party typically involves professional staff and legal counsel in the negotiation of terms, whereas B2C is shaped to a far greater degree by economic implic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ration Stamp

A ration stamp, ration coupon or ration card is a stamp or card issued by a government to allow the holder to obtain food or other commodities that are in short supply during wartime or in other emergency situations when rationing is in force. Ration stamps were widely used during World War II by both sides after hostilities caused interruption to the normal supply of goods. They were also used after the end of the war while the economies of the belligerents gradually returned to normal. Ration stamps were also used to help maintain the amount of food one could hold at a time. This was so that one person would not have more food than another. India Rationing has been present in India since World War II. A ration card allows households to purchase highly subsidised food grain, sugar and kerosene from their local Public distribution system (PDS) shop. There are two types of ration cards: * Priority ration cards (replaced the erstwhile above poverty line and below poverty li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |