|

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lagrange Multiplier

In mathematical optimization, the method of Lagrange multipliers is a strategy for finding the local maxima and minima of a function (mathematics), function subject to constraint (mathematics), equation constraints (i.e., subject to the condition that one or more equations have to be satisfied exactly by the chosen values of the variable (mathematics), variables). It is named after the mathematician Joseph-Louis Lagrange. Summary and rationale The basic idea is to convert a constrained problem into a form such that the derivative test of an unconstrained problem can still be applied. The relationship between the gradient of the function and gradients of the constraints rather naturally leads to a reformulation of the original problem, known as the Lagrangian function or Lagrangian. In the general case, the Lagrangian is defined as \mathcal(x, \lambda) \equiv f(x) + \langle \lambda, g(x)\rangle for functions f, g; the notation \langle \cdot, \cdot \rangle denotes an inner prod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

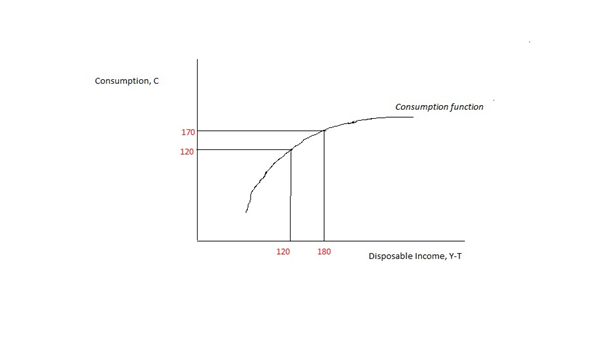

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Helmut Lütkepohl

Helmut Lütkepohl (born 26 July 1951) is a German econometrician specializing in time series analysis. Since January 2012, he has been Bundesbank Professor in the field of "Methods of Empirical Economics" at the Free University of Berlin and Dean of the Graduate Center at the German Institute for Economic Research. Education and career After a diplom (1977) and doctorate (1981) from Bielefeld University, Lütkepohl was a Visiting Assistant Professor at the University of California, San Diego (1984–85). He became Professor of Statistics at the University of Kiel in 1987, and later moved on to become Professor of Econometrics at Humboldt University of Berlin.http://www.diw.de/documents/dokumentenarchiv/17/diw_01.c.414305.de/diwcvlong_en_hluetkepohl_jan2013.pdf Lütkepohl has been on the editorial boards of several scientific journals like '' Econometric Theory'', ''Journal of Econometrics The ''Journal of Econometrics'' is a monthly peer-reviewed academic journal covering eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Impulse Response

In signal processing and control theory, the impulse response, or impulse response function (IRF), of a dynamic system is its output when presented with a brief input signal, called an impulse (). More generally, an impulse response is the reaction of any dynamic system in response to some external change. In both cases, the impulse response describes the reaction of the system as a function of time (or possibly as a function of some other independent variable that parameterizes the dynamic behavior of the system). In all these cases, the dynamic system and its impulse response may be actual physical objects, or may be mathematical systems of equations describing such objects. Since the impulse function contains all frequencies (see the Fourier transform of the Dirac delta function, showing infinite frequency bandwidth that the Dirac delta function has), the impulse response defines the response of a linear time-invariant system for all frequencies. Mathematical considerat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implicit Function Theorem

In multivariable calculus, the implicit function theorem is a tool that allows relations to be converted to functions of several real variables. It does so by representing the relation as the graph of a function. There may not be a single function whose graph can represent the entire relation, but there may be such a function on a restriction of the domain of the relation. The implicit function theorem gives a sufficient condition to ensure that there is such a function. More precisely, given a system of equations (often abbreviated into ), the theorem states that, under a mild condition on the partial derivatives (with respect to each ) at a point, the variables are differentiable functions of the in some neighborhood of the point. As these functions generally cannot be expressed in closed form, they are ''implicitly'' defined by the equations, and this motivated the name of the theorem. In other words, under a mild condition on the partial derivatives, the set of zero ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Endogenous (economics)

Endogenous money is an economy’s supply of money that is determined endogenously—that is, as a result of the interactions of other economic variables, rather than exogenously (autonomously) by an external authority such as a central bank. The theoretical basis of this position is that money comes into existence through the requirements of the real economy and that the banking system reserves expand or contract as needed to accommodate loan demand at prevailing interest rates. Central banks implement policy primarily through controlling short-term interest rates. The money supply then adapts to the changes in demand for reserves and credit caused by the interest rate change. The supply curve shifts to the right when financial intermediaries issue new substitutes for money, reacting to profit opportunities during the cycle. History Theories of endogenous money date to the 19th century, with the work of Knut Wicksell, and later Joseph Schumpeter. Early versions of this theor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comparative Statics

In economics, comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous variable, exogenous parameter. As a type of ''static analysis'' it compares two different economic equilibrium, equilibrium states, after the process of adjustment (if any). It does not study the motion towards equilibrium, nor the process of the change itself. Comparative statics is commonly used to study changes in supply and demand when analyzing a single Market (economics), market, and to study changes in monetary policy, monetary or fiscal policy when analyzing the whole macroeconomics, economy. Comparative statics is a tool of analysis in microeconomics (including general equilibrium analysis) and macroeconomics. Comparative statics was formalized by Sir John Richard Hicks, John R. Hicks (1939) and Paul A. Samuelson (1947) (Kehoe, 1987, p. 517) but was presented graphically from at least the 1870s. For models of stable equili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Import

The marginal propensity to import (MPM) is the fractional change in import expenditure that occurs with a change in disposable income (income after taxes and transfers). For example, if a household earns one extra dollar of disposable income, and the marginal propensity to import is 0.2, then the household will spend 20 cents of that dollar on imported goods and services. Mathematically, the marginal propensity to import (MPM) function is expressed as the derivative of the import (M) function with respect to disposable income (Y).\mathrm=\fracIn other words, the marginal propensity to import is measured as the ratio of the change in imports to the change in income, thus giving us a figure between 0 and 1. Imports are also considered to be automatic stabilisers that work to lessen fluctuations in real GDP. The UK government assumes that UK citizens have a high marginal propensity to import and thus will use a decrease in disposable income as a tool to control the current accou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation Marginal propensity to save (MPS) can be calculated as the change in savings (S) divided by the change in disposable income (Y). :MPS=\frac = \frac \big(= \frac\big) Notes #MPS is the complement of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nominal GDP

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance of a country or region. Several national and international economic organizations maintain definitions of GDP, such as the OECD and the International Monetary Fund. GDP is often used as a metric for international comparisons as well as a broad measure of economic progress. It is often considered to be the world's most powerful statistical indicator of national development and progress. The GDP can be divided by the total population to obtain the average GDP per capita. Total GDP can also be broken down into the contribution of each industry or sector of the economy. Nominal GDP is useful when comparing national economies on the international market according to the exchange rate. To compare economies over time inflation can be adjusted b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ricardian Equivalence

The Ricardian equivalence proposition (also known as the Ricardo–de Viti–Barro equivalence theorem) is an economic hypothesis holding that consumers are forward-looking and so internalize the government's budget constraint when making their consumption decisions. This leads to the result that, for a given pattern of government spending, the method of financing such spending does not affect agents' consumption decisions, and thus, it does not change aggregate demand. Introduction Governments can finance their expenditures by creating new money, by levying taxes, or by issuing bonds. Since bonds are loans, they must eventually be repaid—presumably by raising taxes in the future. The choice is therefore "tax now or tax later." Suppose that the government finances some extra spending through deficits; i.e. it chooses to tax later. According to the hypothesis, taxpayers will anticipate that they will have to pay higher taxes in future. As a result, they will save, rather than s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |