|

Minimum Acceptable Rate Of Return

In corporate finance, business, and engineering economics - in both industrial engineering and civil engineering - the minimum acceptable rate of return (often abbreviated MARR) is the minimum rate of return on a project a manager or company is willing to accept. A synonym seen in many contexts is minimum attractive rate of return. The term hurdle rate (or cutoff rate) is also frequently used as a synonym, particularly in corporate finance, where the benchmark is often the cost of capital. See . MARR increases with increased risk, and given the opportunity cost of forgoing other projects. It is typically referenced in the preliminary analysis of proposed projects. Hurdle rate determination The hurdle rate is usually determined by evaluating existing opportunities in operations expansion, rate of return for investments, and other factors deemed relevant by management. As an example, suppose a manager knows that investing in a conservative project, such as a bond investment or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money (which includes the annual effective discount rate). It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The IRR of an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value (NPV) of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the future cash fl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weighted Average Cost Of Capital

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere.Fernandes, Nuno. 2014, Finance for Executives: A Practical Guide for Managers, p. 32. Companies raise money from a number of sources: common stock, preferred stock and related rights, straight debt, convertible debt, exchangeable debt, employee stock options, pension liabilities, executive stock options, governmental subsidies, and so on. Different securities, which represent different sources of finance, are expected to generate different returns. The WACC is calculated taking into account the relative weights ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow Diagram

A cash-flow diagram is a financial tool used to represent the cashflows associated with a security, "project", or business. As per the graphics, cash flow diagrams are widely used in structuring and analyzing securities, particularly swaps. They may also be used to represent payment schedules for bonds, mortgages and other types of loans. In the context of business, and engineering economics, these are used by management accountants and engineers, to represent the cash-transactions which will take place over the course of a given project. Transactions can include initial investments, maintenance costs, projected earnings or savings resulting from the project, as well as salvage and resale value of equipment at the end of the project. These diagrams - and the associated modelling - are then used to determine a break-even point ( "cash flow neutrality"), or to further, and more generally, analyze operations and profitability. See cashflow forecast and operating cash flow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital Firm

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed rounds are the initial stages of funding for a startup company, typically occurring early in its development. During a seed round, entrepreneurs seek investment fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

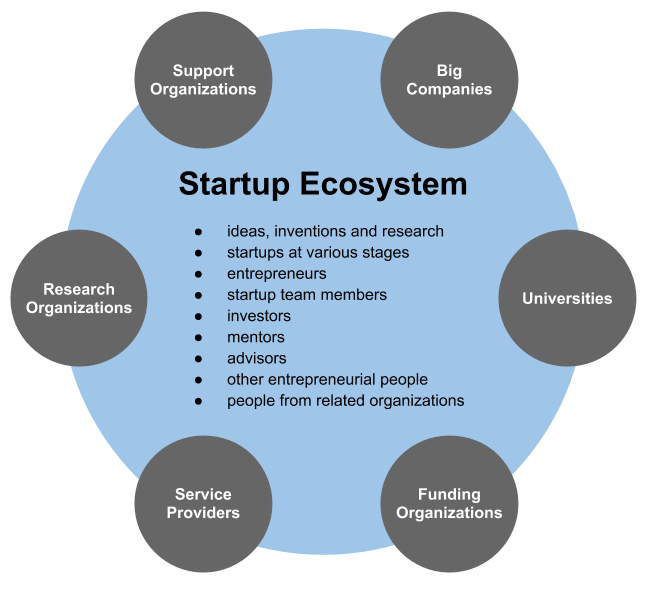

Startup Company

A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to Initial public offering, go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorn (finance), unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $49.8 trillion as of March 31, 2025. The S&P 500 index is a Free-float weighted/ capitalization-weighted index. As of April 2025, the ten largest companies on the list of S&P 500 companies accounted for approximately 35% of the market capitalization of the index and were, in order of highest to lowest weighting: Apple (6.4%), Microsoft (6.2%), Nvidia (6.0%), Amazon.com (3.8%), Alphabet (3.6%, including both class A & C shares), Meta Platforms (2.7%), Berkshire Hathaway (2.0%), Broadcom (1.8%), Tesla (1.6%), and JPMorgan Chase (1.4%). The components that have increased their dividends in 25 consecutive ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounted Cash Flow

The discounted cash flow (DCF) analysis, in financial analysis, is a method used to value a security, project, company, or asset, that incorporates the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. Used in industry as early as the 1700s or 1800s, it was widely discussed in financial economics in the 1960s, and U.S. courts began employing the concept in the 1980s and 1990s. Application In discount cash flow analysis, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question; see aside. For further context see ; and for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Engineering Economics

Engineering economics, previously known as engineering economy, is a subset of economics concerned with the use and "...application of economic principles"Dharmaraj, E.. Engineering Economics. Mumbai, IN: Himalaya Publishing House, 2009. ProQuest ebrary. Web. 9 November 2016. in the analysis of engineering decisions.Morris, W. Thomas. (1960). Engineering economy: the analysis of management decisions. Homewood, Ill.: R. D. Irwin. As a discipline, it is focused on the branch of economics known as microeconomics in that it studies the behavior of individuals and firms in making decisions regarding the allocation of limited resources. Thus, it focuses on the decision making process, its context and environment. It is pragmatic by nature, integrating economic theory with engineering practice. But, it is also a simplified application of microeconomic theory in that it assumes elements such as price determination, competition and demand/supply to be fixed inputs from other sources. As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |