|

Leveraged

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and current liabilities; the focus here is on managing cash, inventories, and short-term borrowing and lending (such as the terms on credit extended to customers). The terms corporate finance and corporate financier ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Utility

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and regulation ranging from local community-based groups to statewide government monopolies. Public utilities are meant to supply goods/services that are considered essential; water, gas, electricity, telephone, and other communication systems represent much of the public utility market. The transmission lines used in the transportation of electricity, or natural gas pipelines, have natural monopoly characteristics. If the infrastructure already exists in a given area, minimal benefit is gained through competing. In other words, these industries are characterized by ''economies of scale'' in production. There are many different types of public utilities. Some, especially large companies, offer multiple products, such as electricity and na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Equity

The return on equity (ROE) is a measure of the profitability of a business in relation to the equity. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on ''assets minus liabilities''. ROE measures how many dollars of profit are generated for each dollar of shareholder's equity. ROE is a metric of how well the company utilizes its equity to generate profits. The formula : ROE is equal to a fiscal year net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), expressed as a percentage. Usage ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, a ROE is a measure of management's ability to generate income from the equity available to it. ROEs of 15–20% are generally considered good. ROE is also a factor in stock valuation, in association with other fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Before Interest And Taxes

In accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses (operating and non-operating) except interest expenses and income tax expenses. Operating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non-operating income and non-operating expenses. Formula *EBIT = (net income) + interest + taxes = EBITDA – (depreciation and amortization expenses) *operating income = ( gross income) – OPEX = EBIT – (non-operating profit) + (non-operating expenses) where *EBITDA = earnings before interest, taxes, depreciation, and amortization *OPEX = operating expense Overview A professional investor contemplating a change to the capital structure of a firm (e.g., through a leveraged buyout) first evaluates a firm's fundamental earnings potential (reflected by earnings before interest, taxes, depreciation and amortization ( EBITDA) and EBIT), and then deter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Off-balance Sheet

Off balance sheet (OBS), or incognito leverage, usually means an asset or debt or financing activity not on the company's balance sheet. Total return swaps are an example of an off-balance-sheet item. Some companies may have significant amounts of off-balance-sheet assets and liabilities. For example, financial institutions often offer asset management or brokerage services to their clients. The assets managed or brokered as part of these offered services (often securities) usually belong to the individual clients directly or in trust, although the company provides management, depository or other services to the client. The company itself has no direct claim to the assets, so it does not record them on its balance sheet (they are off-balance-sheet assets), while it usually has some basic fiduciary duties with respect to the client. Financial institutions may report off-balance-sheet items in their accounting statements formally, and may also refer to " assets under management", a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

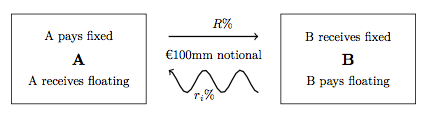

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Bond

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are back ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Equation

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and " financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measureme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Notional Amount

The notional amount (or notional principal amount or notional value) on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument. This amount generally does not change and is thus referred to as ''notional.'' Explanation Contrast a bond with an interest rate swap: * In a bond, the buyer pays the principal amount at issue (start), then receives coupons (computed off this principal) over the life of the bond, then receives the principal back at maturity (end). * In a swap, no principal changes hands at inception (start) or expiry (end), and in the meantime, interest payments are computed based on a notional amount, which acts ''as if'' it were the principal amount of a bond, hence the term ''notional principal amount'', abbreviated to ''notional''. In simple terms, the notional principal amount is essentially how much of an asset or bonds a person owns. For example, if a premium bond were bought for £1, then the notional princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |