|

Head Of Household

In the United States, head of household is a filing status for individual United States taxpayers. It provides preferential tax rates and a larger standard deduction for single people caring for qualifying dependents. To use the head of household filing status, a taxpayer must: * Be unmarried or considered unmarried at the end of the year * Have paid more than half the cost of keeping up a home for the tax year (either one's own home or the home of a qualifying parent) * Usually have a qualifying person who lived with the head in the home for more than half of the tax year unless the qualifying person is a dependent parent Advocates of the head of household filing status argue that it is an important financial benefit to single parents, and particularly single mothers, who have reduced tax burdens as a result of the status. Critics, however, argue that it is poorly targeted, delivering larger benefits to those with high incomes and smaller benefits to those with low incomes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Filing Status (federal Income Tax)

Under United States The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ... federal income tax law, filing status is an important factor in computing taxable income. Filing status depends in part on marital status and family situation. There are five possible filing status categories: single individual, married person filing jointly or surviving spouse, married person filing separately, head of household, and qualifying widow(er) with dependent children. A taxpayer who qualifies for more than one filing status may choose a status.26 U.S.C. 1, Section 1 Determining filing status Generally, the marital status on the last day of the year determines the status for the entire year.26 U.S.C. 1, Section 2 Single Generally, if someone is unmarried, divorced, a registered domestic partner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty In The United States

In the United States, poverty has both social and political implications. Based on Measuring poverty, poverty measures used by the Census Bureau (which exclude non-cash factors such as food stamps or medical care or public housing), America had 37 million people defined as living in poverty in 2023; this is 11 percent of the population. Some of the many causes include income, inequality, inflation, unemployment, debt traps and poor education.Western, B. & Pettit, B., (2010)Incarceration and social inequality.Daedalus, 139(3), 8-19 The majority of adults living in poverty are employed and have at least a high school education. Although the US is a relatively wealthy country by international standards, it has a persistently high poverty rate compared to other developed countries due in part to a less generous welfare system. Efforts to alleviate poverty include New Deal-era legislation during the Great Depression, to the national war on poverty in the 1960s and poverty alleviat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on Taxation in the United States, U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) Tax exemption, tax-exempt Non-profit organization, non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Global Tax Policy. The group is known for its annual reports such as the ''State Tax Competitiveness Index'', ''International Tax Competitiveness Index'', and ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941. History The Tax Foundation was organized on December 5, 1937, in New York City by Alfred P. Sloan Jr., Chai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marriage Penalties

The marriage penalty in the United States refers to the higher tax rate applicable to the lower-earning spouse when a married couple files jointly, as compared to if the spouses each filed his or her tax return using “single” status. There is also a marriage bonus that applies in other cases if the couple jointly is taxed at a lower effective tax rate than if they each filed using single status. Multiple factors are involved, but in general, in the current U.S. system, single-income married couples usually benefit from filing as a married couple (similar to so-called income splitting), while dual-income married couples are often penalized. The percentage of couples affected has varied over the years, depending on shifts in tax rates. Progressive taxation rates combined with income splitting The US tax code fixes different income levels for passing from one marginal tax rate to another, depending on whether the filing is done as a single person or as a married couple. For lowe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

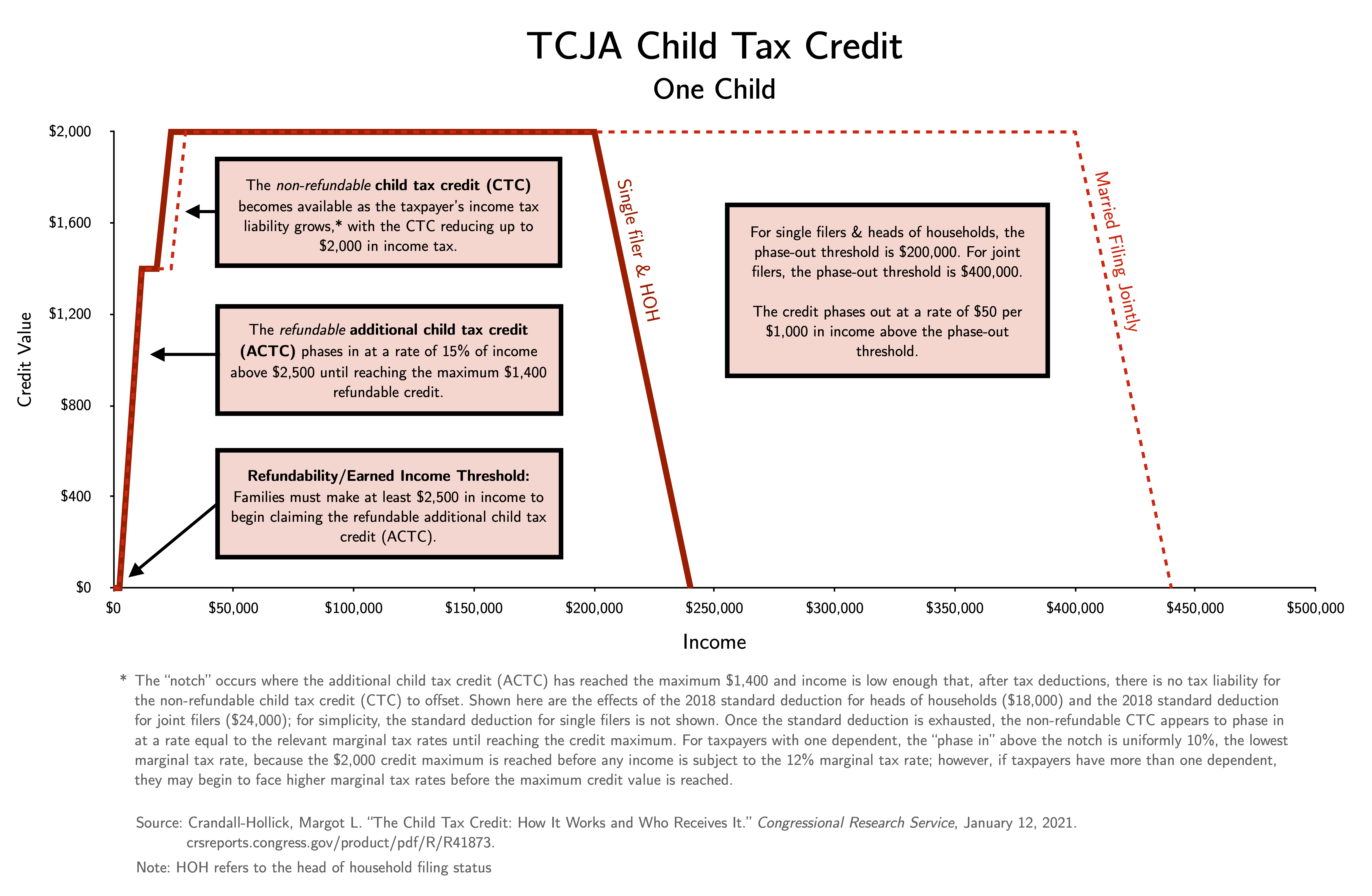

Child Tax Credit (United States)

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with Dependant, dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,600 of that Tax credit#Refundable vs non Refundable, refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025. The CTC was estimated to have lifted about 3 million children out of poverty in 2016. A Columbia University study estimated that the expansion of the CTC in the American Rescue Plan Act, 2021 American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mitt Romney

Willard Mitt Romney (born March 12, 1947) is an American businessman and retired politician. He served as a United States Senate, United States senator from Utah from 2019 to 2025 and as the 70th governor of Massachusetts from 2003 to 2007. He was the Republican Party (United States), Republican Party's nominee in the 2012 United States presidential election, 2012 U.S. presidential election. Mitt Romney is a son of George W. Romney, a former governor of Michigan. Raised in Bloomfield Hills, Michigan, Mitt spent over two years in France as a Mormon missionary. He married Ann Romney, Ann Davies in 1969; they have five sons. Active in the Church of Jesus Christ of Latter-day Saints (LDS Church) throughout his adult life, Romney served as Bishop (Latter Day Saints), bishop of his Ward (LDS Church), ward and later as a Stake (LDS Church), stake president for an area covering Boston and many of its suburbs. By 1971, he had participated in the political campaigns of both his paren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People's Policy Project

People's Policy Project (abbreviated 3P) is an American think tank focused on social, economic, and political equity issues. It has been described as "Centre-left politics, left-leaning", "left-wing", "democratic socialist–leaning", and "socialist". The organization has been noted for its unique funding structure: Unlike conventional think tanks, 3P relies on crowdfunding small donations, as opposed to financial support from corporations. The founder and president of 3P is Matt Bruenig, a former lawyer at the National Labor Relations Board and former contributor to the US think tank Demos (U.S. think tank), Demos. 3P's work has been covered by ''Vox (website), Vox'', ''Jacobin (magazine), Jacobin'', and ''HuffPost, Huffington Post''. History and funding People's Policy Project (3P) primarily relies on small-dollar donations for funding. All funding is done through small donors on crowdfunding websites such as Patreon and a loan from the Paycheck Protection Program. This contra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Committee On Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at . Structure The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House Ways and Means Committee. The Committee is chaired on a rotating basis by the Chair of the Senate Finance Committee and the Chair of the House Ways and Means Committee. During the first Session of each Congress the House has the joint committee chair and the Senate has the vice-chair; during the second session the roles are reversed. The Members of the Joint Committee choose the Chief of Staff of the Joint Committee, who is responsible for selecting the remainder of the staff on a nonpartisan basis. Since May 15, 2009, the Chief of Staff of the Joint Committee has been Thomas A. Barthold. Duties The duties of the Joint Committee are: # Investigate the operation, effects, and administration of internal revenue taxes # Investigate meas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Output (economics), output of an economy in a given year or over a period of time. The rate of growth is typically calculated as List of countries by real GDP growth rate, real gross domestic product (GDP) growth rate, List of countries by real GDP per capita growth, real GDP per capita growth rate or List of countries by GNI per capita growth, GNI per capita growth. The "rate" of economic growth refers to the Exponential growth, geometric annual rate of growth in GDP or GDP per capita between the first and the last year over a period of time. This growth rate represents the trend in the average level of GDP over the period, and ignores any fluctuations in the GDP around this trend. Growth is usually calculated in "real" value, which is real v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Right-wing Politics

Right-wing politics is the range of Ideology#Political ideologies, political ideologies that view certain social orders and Social stratification, hierarchies as inevitable, natural, normal, or desirable, typically supporting this position based on natural law, economics, authority, property, religion, or tradition. Hierarchy and Social inequality, inequality may be seen as natural results of traditional social differences or competition in market economies. Right-wing politics are considered the counterpart to left-wing politics, and the left–right political spectrum is the most common political spectrum. The right includes social conservatives and fiscal conservatives, as well as right-libertarianism, right-libertarians. "Right" and "right-wing" have been variously used as compliments and pejoratives describing neoliberal, conservative, and fascist economic and social ideas. Positions The following positions are typically associated with right-wing politics. Anti-com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |