|

Haraç

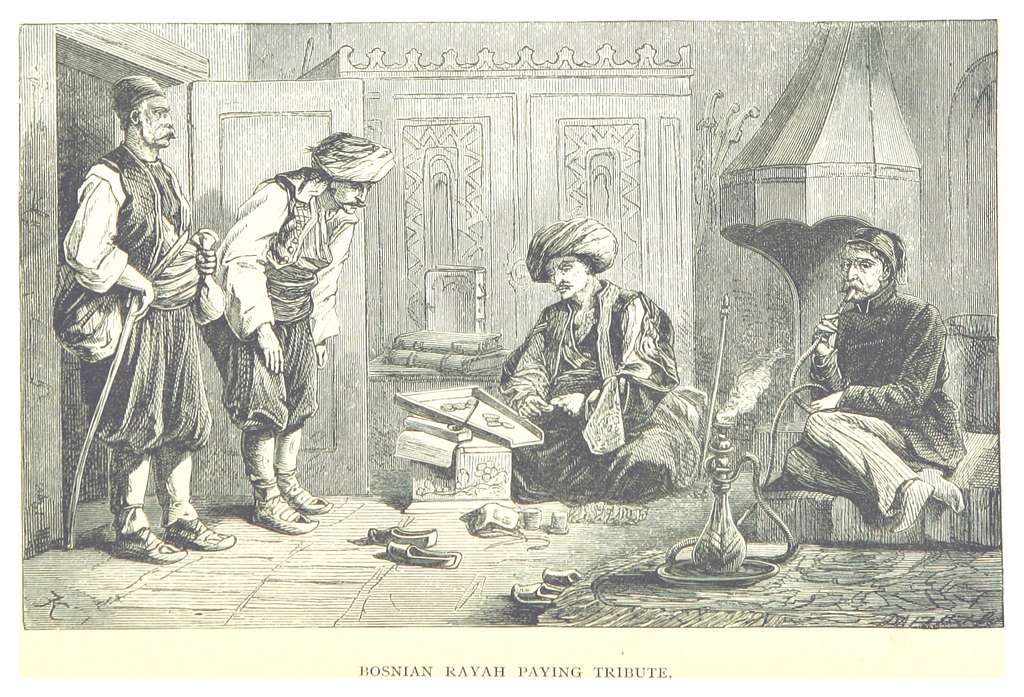

Haraç (, , , sh-Cyrl-Latn, харач, harač) was a land tax levied on non-Muslim subjects in the Ottoman Empire. ''Haraç'' was developed from an earlier form of land taxation, ''kharaj'' (''harac''), and was, in principle, only payable by non-Muslims; it was seen as a counterpart to zakat paid by Muslims.Hunter, Malik and Senturk, p. 77 The ''haraç'' system later merged into the cizye taxation system. While the taxes collected from non Muslims were higher than those collected from Muslims, the rights and opportunities provided to non Muslims were much more limited. It often incentivised people to convert to Islam. Haraç collection was reformed by a firman of 1834, which abolished the old levying system, and required that ''haraç'' be raised by a commission composed of the kadı and the ''ayans'', or municipal chiefs of '' rayas'' in each district. The firman made several other changes to taxation as part of the wider Tanzimat The (, , lit. 'Reorganization') was a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Rayah

A raiyah or reaya (from , a plural of "countryman, animal, sheep pasturing, subjects, nationals, flock", also spelled ''raiya'', ''raja'', ''raiah'', ''re'aya''; , ; Modern Turkish ''râiya'' or ''reaya''; related to the Arabic word ''rā'ī'' راعي which means "shepherd, herdsman, patron") was a member of the tax-paying lower class of Ottoman society, in contrast to the askeri and kul. The raiyah made up over 90% of the general population in the millet communities. In the Muslim Muslims () are people who adhere to Islam, a Monotheism, monotheistic religion belonging to the Abrahamic religions, Abrahamic tradition. They consider the Quran, the foundational religious text of Islam, to be the verbatim word of the God ... world, raiyah is literally ''subject'' of a government or sovereign. The raiyah (literally 'members of the flock') included Christians, Muslims, and Jews who were 'shorn' (''i.e.'' taxed) to support the state and the associated 'professional Ott ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Ottoman Empire

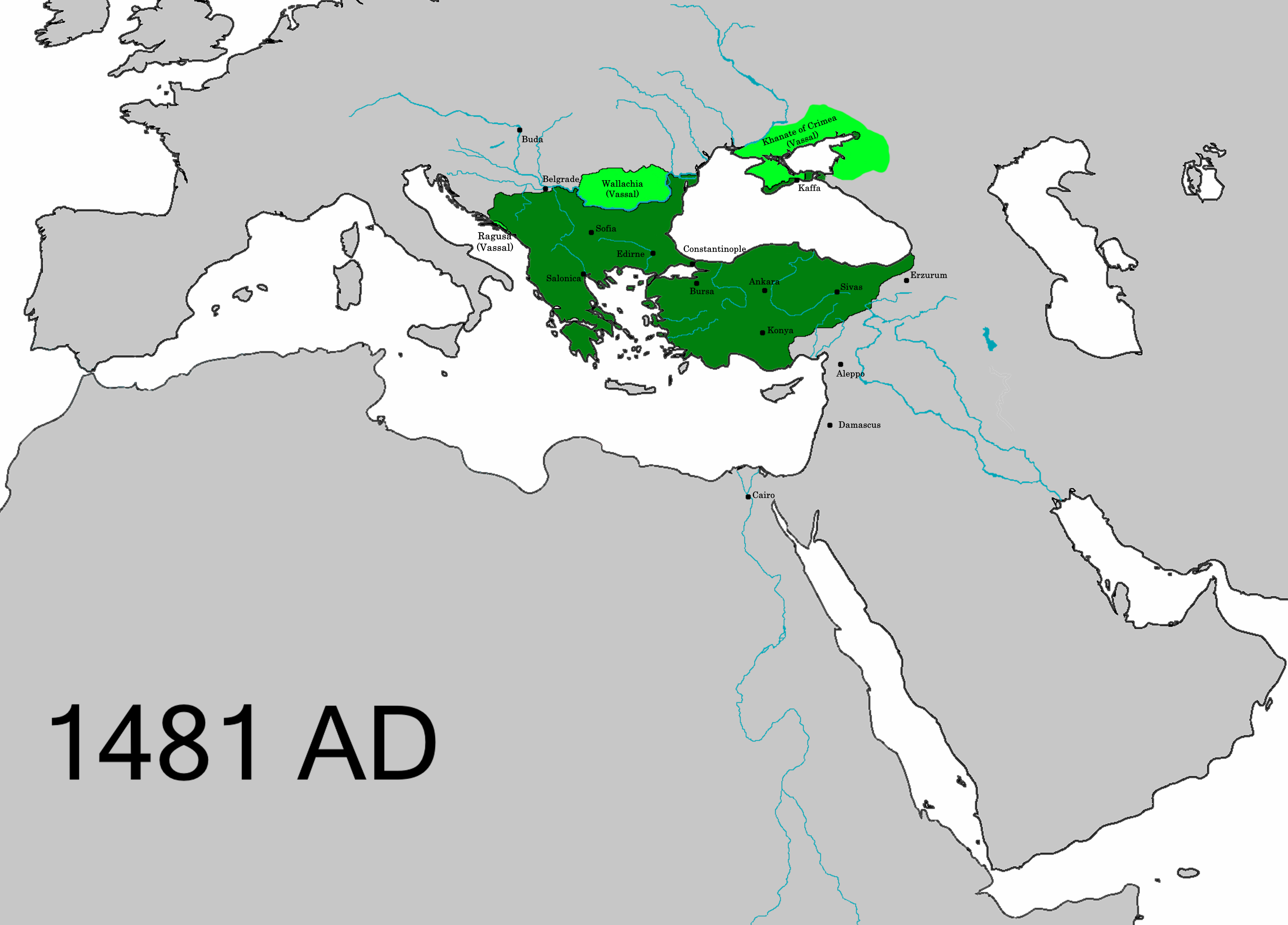

The Ottoman Empire (), also called the Turkish Empire, was an empire, imperial realm that controlled much of Southeast Europe, West Asia, and North Africa from the 14th to early 20th centuries; it also controlled parts of southeastern Central Europe, between the early 16th and early 18th centuries. The empire emerged from a Anatolian beyliks, ''beylik'', or principality, founded in northwestern Anatolia in by the Turkoman (ethnonym), Turkoman tribal leader Osman I. His successors Ottoman wars in Europe, conquered much of Anatolia and expanded into the Balkans by the mid-14th century, transforming their petty kingdom into a transcontinental empire. The Ottomans ended the Byzantine Empire with the Fall of Constantinople, conquest of Constantinople in 1453 by Mehmed II. With its capital at History of Istanbul#Ottoman Empire, Constantinople (modern-day Istanbul) and control over a significant portion of the Mediterranean Basin, the Ottoman Empire was at the centre of interacti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Kharaj

Kharāj () is a type of individual Islamic tax on agricultural land and its produce, regardless of the religion of the owners, developed under Islamic law. With the first Muslim conquests in the 7th century, the ''kharaj'' initially was synonymous with '' jizyah'' and denoted a lump-sum duty levied upon the lands of conquered provinces, which was collected by hold-over officials of the defeated Byzantine Empire in the west and the Sassanid Empire in the east; later and more broadly, ''kharaj'' refers to a land-tax levied by Muslim rulers on their non-Muslim subjects, collectively known as '' dhimmi''. Muslim landowners, on the other hand, paid '' ushr'', a religious tithe on land, which carried a lower rate of taxation,Lewis (2002), p. 72 and ''zakat''. '' Ushr'' was a reciprocal 10% levy on agricultural land as well as merchandise imported from states that taxed Muslims on their products. Changes soon eroded the established tax base of the early Arab Caliphates. Additionally, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Zakat

Zakat (or Zakāh زكاة) is one of the Five Pillars of Islam. Zakat is the Arabic word for "Giving to Charity" or "Giving to the Needy". Zakat is a form of almsgiving, often collected by the Muslim Ummah. It is considered in Islam a religious obligation, and by Quranic ranking, is next after prayer (''salat'') in importance. Eight heads of zakat are mentioned in the Quran. As one of the Five Pillars of Islam, zakat is a religious duty for all Muslims who meet the necessary criteria of wealth to help the needy. It is a mandatory charitable contribution, often considered to be a tax.Muḥammad ibn al-Ḥasan Ṭūsī (2010), ''Concise Description of Islamic Law and Legal Opinions'', , pp. 131–135. The payment and disputes on zakat have played a major role in the history of Islam, notably during the Ridda wars. Zakat on wealth is based on the value of all of one's possessions. It is customarily 2.5% (or ) of a Muslim's total savings and wealth above a minimum amount known ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Muslims

Muslims () are people who adhere to Islam, a Monotheism, monotheistic religion belonging to the Abrahamic religions, Abrahamic tradition. They consider the Quran, the foundational religious text of Islam, to be the verbatim word of the God in Abrahamic religions, God of Abraham (or ''Allah'') as it was revealed to Muhammad, the last Islamic prophet. Alongside the Quran, Muslims also believe in previous Islamic holy books, revelations, such as the Tawrat (Torah), the Zabur (Psalms), and the Injeel (Gospel). These earlier revelations are associated with Judaism and Christianity, which are regarded by Muslims as earlier versions of Islam. The majority of Muslims also follow the teachings and practices attributed to Muhammad (''sunnah'') as recorded in traditional accounts (hadith). With an estimated population of almost 2 billion followers, Muslims comprise around 26% of the world's total population. In descending order, the percentage of people who identify as Muslims on each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Cizye

Jizya (), or jizyah, is a type of taxation levied on non-Muslim subjects of a state governed by Islamic law. The Quran and hadiths mention jizya without specifying its rate or amount,Sabet, Amr (2006), ''The American Journal of Islamic Social Sciences'' 24:4, Oxford; pp. 99–100. and the application of jizya varied in the course of Islamic history. However, scholars largely agree that early Muslim rulers adapted some of the existing systems of taxation and modified them according to Islamic religious law.online Historically, the jizya tax has been understood in Islam as a fee for protection provided by the Muslim ruler to non-Muslims, for the exemption from military service for non-Muslims, for the permission to practice a non-Muslim faith with some communal autonomy in a Muslim state, and as material proof of the non-Muslims' allegiance to the Muslim state and its laws. The majority of Muslim jurists required adult, free, sane males among the dhimma community to pay the jizya, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Firman

A firman (; ), at the constitutional level, was a royal mandate or decree issued by a sovereign in an Islamic state. During various periods such firmans were collected and applied as traditional bodies of law. The English word ''firman'' comes from the Persian meaning "decree" or "order". Etymology ''Farmān'' is the modern Persian form of the word and descends from Middle Persian (Pahlavi) , ultimately from Old Persian ( = "fore"). The difference between the modern Persian and Old Persian forms stems from "dropping the ending ''ā'' and insertion of a vowel owing to the initial double consonant". This feature (i.e. ''fra-'') was still used in the Middle Persian form. The Turkish form of the word ''farmān'' is ''fermān'', whereas the Arabized plural form of the word is . Origins of firmans in the Ottoman Empire In the Ottoman Empire, the Sultan derived his authority from his role as upholder of the Shar'ia, but the Shar'ia did not cover all aspects of Ottoman so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Kadı

A kadi (, ) was an official in the Ottoman Empire. In Arabic, the term () typically refers to judges who preside over matters in accordance with sharia Islamic law; under Ottoman rule, however, the kadi also became a crucial part of the imperial administration. After Mehmed II Mehmed II (; , ; 30 March 14323 May 1481), commonly known as Mehmed the Conqueror (; ), was twice the sultan of the Ottoman Empire from August 1444 to September 1446 and then later from February 1451 to May 1481. In Mehmed II's first reign, ... codified his '' Kanun'', kadis relied on this dynastic secular law, local customs, and sharia to guide their rulings. Along with adjudicating over criminal and civil matters, the kadi oversaw the administration of religious endowments and was the legal guardian of orphans and others without a guardian. Although Muslims, in particular Muslim men, possessed a higher status in the kadi's court, non-Muslims and foreigners also had access to the judicial system. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tanzimat

The (, , lit. 'Reorganization') was a period of liberal reforms in the Ottoman Empire that began with the Edict of Gülhane of 1839 and ended with the First Constitutional Era in 1876. Driven by reformist statesmen such as Mustafa Reşid Pasha, Mehmed Emin Âli Pasha, and Fuad Pasha, under Sultans Abdülmecid I and Abdülaziz, the Tanzimat sought to reverse the empire's decline by modernizing legal, military, and administrative systems while promoting Ottomanism (equality for all subjects). Though it introduced secular courts, modern education, and infrastructure like railways, the reforms faced resistance from conservative clerics, exacerbated ethnic tensions in the Balkans, and saddled the empire with crippling foreign debt. The Tanzimat’s legacy remains contested: some historians credit it with establishing a powerful national government, while others argue it accelerated imperial fragmentation. Different functions of government received reform, were completely reor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Christianity In The Ottoman Empire

Under the Ottoman Empire's millet system, Christians and Jews were considered ''dhimmi'' (meaning "protected") under Ottoman law in exchange for loyalty to the state and payment of the jizya tax. Eastern Orthodoxy, Orthodox Christians were the largest non-Muslim group. With the rise of Imperial Russia, the Russians became a kind of protector of the Orthodox Christians in the Ottoman Empire. Conversion to Islam in the Ottoman Empire involved a combination of individual, family, communal and institutional initiatives and motives. The process was also influenced by the balance of power between the Ottomans and the neighboring Christian states. However, most Ottoman subjects in Eastern Europe remained Orthodox Christian, such as Greeks, Serbs, Romanians, Bulgarians, while present-day Albania, Bosnia and Herzegovina, Bosnia and Kosovo had larger Muslim populations as a result of Ottoman influence. Civil status Under Ottoman rule, dhimmis (non-Muslim subjects) were allowed to "pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

History Of Taxation

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |