|

Gross Lease

A gross lease is a type of commercial lease where the tenant pays a flat rental amount, and the landlord pays for all operating expenses regularly incurred by the ownership, including taxes, electricity and water. Most apartment leases resemble gross leases. The term "gross lease" is distinguished from the term "net lease In the field of commercial real estate, especially in the United States, a net lease requires the tenant to pay, in addition to rent, some or all of the property expenses that normally would be paid by the property owner (known as the "landlord" ...." Principle of operation A gross lease allows the tenant to pay a fixed fee in exchange for exclusive use of the property. Landlords typically calculate a rent amount that reasonably covers the cost of rent, standard utilities, and other expected and day-to-day expenses. In a gross lease, the rent is primarily paid by the tenant. The landlord assumes the costs of maintaining the building. This includes parking l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lease

A lease is a contractual arrangement calling for the user (referred to as the ''lessee'') to pay the owner (referred to as the ''lessor'') for the use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment are also leased. In essence, a lease agreement is a contract between two parties: the lessor and the lessee. The lessor is the legal owner of the asset, while the lessee obtains the right to use the asset in return for regular rental payments. The lessee also agrees to abide by various conditions regarding their use of the property or equipment. For example, a person leasing a car may agree to the condition that the car will only be used for personal use. The term rental agreement can refer to two kinds of leases: * A lease in which the asset is tangible property. Here, the user '' rents'' the asset (e.g. land or goods) ''let out'' or ''rented out'' by the owner (the verb ''to lease'' is less precise because it c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

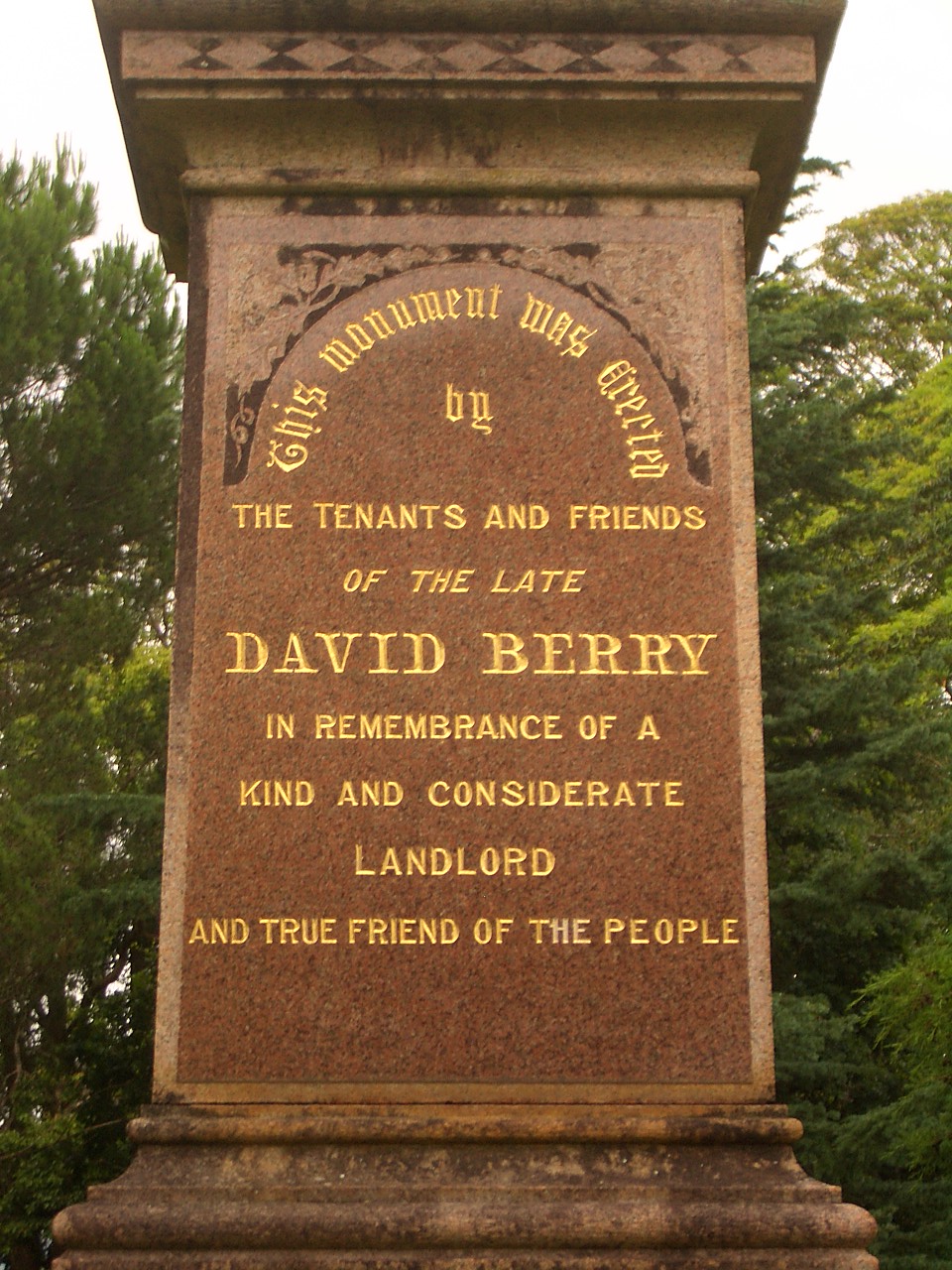

Landlord

A landlord is the owner of property such as a house, apartment, condominium, land, or real estate that is rented or leased to an individual or business, known as a tenant (also called a ''lessee'' or ''renter''). The term landlord applies when a juristic person occupies this position. Alternative terms include lessor and owner. For female property owners, the term landlady may be used. In the United Kingdom, the manager of a pub, officially a licensed victualler, is also referred to as the landlord/landlady. In political economy, landlord specifically refers to someone who owns natural resources (such as land, excluding buildings) from which they derive economic rent, a form of passive income. History The concept of a landlord can be traced to the feudal system of manoralism ( seignorialism), where landed estates were owned by Lords of the Manor ( mesne lords). These lords were typically members of the lower nobility who later formed the rank of knights during ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apartment

An apartment (American English, Canadian English), flat (British English, Indian English, South African English), tenement (Scots English), or unit (Australian English) is a self-contained housing unit (a type of residential real estate) that occupies part of a building, generally on a single story. There are many names for these overall buildings (see below). The housing tenure of apartments also varies considerably, from large-scale public housing, to owner occupancy within what is legally a Condominium (living space), condominium (strata title or commonhold) or leasehold, to tenants renting from a private landlord. Terminology The term ''apartment'' is favoured in North America (although in some Canadian cities, ''flat'' is used for a unit which is part of a house containing two or three units, typically one to a floor). In the UK and Australia, the term ''apartment'' is more usual in professional real estate and architectural circles where otherwise the term ''flat'' is u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Lease

In the field of commercial real estate, especially in the United States, a net lease requires the tenant to pay, in addition to rent, some or all of the property expenses that normally would be paid by the property owner (known as the "landlord" or "lessor"). These include expenses such as property taxes, insurance, maintenance, repair, and operations, utilities, and other items. These expenses are often categorized into the "three nets": property taxes, insurance, and maintenance. In US parlance, a lease where all three of these expenses are paid by the tenant is known as a triple net lease, NNN Lease, or triple-N for short and sometimes written NNN. The term "net lease" is distinguished from the term " gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid. In a gross lease, the tenant pays a gross amount of rent, which the landlord can use to pay expenses or in any other way as the landlord ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |