|

Glossary Of Economics

This glossary of economics is a list of definitions containing terms and concepts used in economics, its sub-disciplines, and related fields. A B C D E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Absolute Advantage

In economics, the principle of absolute advantage is the ability of a party (an individual, or firm, or country) to produce a good or service more efficiently than its competitors. The Scottish economist Adam Smith first described the principle of absolute advantage in the context of international trade in 1776, using labor as the only input. Since absolute advantage is determined by a simple comparison of labor productiveness, it is possible for a party to have no absolute advantage in anything. Origin of the theory The concept of absolute advantage is generally attributed to the Scottish economist Adam Smith in his 1776 publication '' The Wealth of Nations,'' in which he countered mercantilist ideas. Smith argued that it was impossible for all nations to become rich simultaneously by following mercantilism because the export of one nation is another nation's import and instead stated that all nations would gain simultaneously if they practiced free trade and specialized i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision Maker

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be either rational or irrational. The decision-making process is a reasoning process based on assumptions of values, preferences and beliefs of the decision-maker. Every decision-making process produces a final choice, which may or may not prompt action. Research about decision-making is also published under the label problem solving, particularly in European psychological research. Overview Decision-making can be regarded as a problem-solving activity yielding a solution deemed to be optimal, or at least satisfactory. It is therefore a process which can be more or less rational or irrational and can be based on explicit or tacit knowledge and beliefs. Tacit knowledge is often used to fill the gaps in complex decision-making processes. Usually, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amoroso–Robinson Relation

The Amoroso–Robinson relation, named after economists Luigi Amoroso and Joan Robinson, describes the relation between price, marginal revenue, and price elasticity of demand. \frac=p\left( 1+\frac\right), where *\scriptstyle \frac is the marginal revenue, *x is the particular Good (economics), good, *p is the good's price, *\epsilon_<0 is the price elasticity of demand. Extension and generalization In 1967, Ernst Lykke Jensen published two extensions, one deterministic, the other probabilistic, of Amoroso–Robinson's formula.See also * Lerner index * Ramsey problemReferences Citations Bibliography * *Further reading * Revenue {{microeconomics-stub ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American School (economics)

The American School, also known as the National System, represents three different yet related constructs in politics, policy and philosophy. The policy existed from the 1790s to the 1970s, waxing and waning in actual degrees and details of implementation. Historian Michael Lind describes it as a coherent applied economic philosophy with logical and conceptual relationships with other economic ideas. "Free Trade Fallacy" New America It is the philosophy that dominated national po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ambiguity Aversion

In decision theory and economics, ambiguity aversion (also known as uncertainty aversion) is a preference for known risks over unknown risks. An ambiguity-averse individual would rather choose an alternative where the probability distribution of the outcomes is known over one where the probabilities are unknown. This behavior was first introduced through the Ellsberg paradox (people prefer to bet on the outcome of an urn with 50 red and 50 black balls rather than to bet on one with 100 total balls but for which the number of black or red balls is unknown). There are two categories of imperfectly predictable events between which choices must be made: risky and ambiguous events (also known as Knightian uncertainty). Risky events have a known probability distribution over outcomes while in ambiguous events the probability distribution is not known. The reaction is behavioral and still being formalized. Ambiguity aversion can be used to explain incomplete contracts, volatility in stoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Haven

New Haven is a city of the U.S. state of Connecticut. It is located on New Haven Harbor on the northern shore of Long Island Sound. With a population of 135,081 as determined by the 2020 U.S. census, New Haven is the third largest city in Connecticut after Bridgeport and Stamford, the largest city in the South Central Connecticut Planning Region, and the principal municipality of Greater New Haven metropolitan area, which had a total population of 864,835 in 2020. New Haven was one of the first planned cities in the U.S. A year after its founding by English Puritans in 1638, eight streets were laid out in a four-by-four grid, creating the "Nine Square Plan". The central common block is the New Haven Green, a square at the center of Downtown New Haven. The Green is now a National Historic Landmark, and the "Nine Square Plan" is recognized by the American Planning Association as a National Planning Landmark. New Haven is the home of Yale University, New Haven's big ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yale University Press

Yale University Press is the university press of Yale University. It was founded in 1908 by George Parmly Day and Clarence Day, grandsons of Benjamin Day, and became a department of Yale University in 1961, but it remains financially and operationally autonomous. , Yale University Press publishes approximately 300 new hardcover A hardcover, hard cover, or hardback (also known as hardbound, and sometimes as casebound (At p. 247.)) book is one bookbinding, bound with rigid protective covers (typically of binder's board or heavy paperboard covered with buckram or other clo ... and 150 new paperback books annually and has a backlist of about 5,000 books in print. Its books have won five National Book Awards, two National Book Critics Circle Awards and eight Pulitzer Prizes. The press maintains offices in New Haven, Connecticut and London, England. Yale is the only American university press with a full-scale publishing operation in Europe. It was a co-founder of the dist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York University Press

New York University Press (or NYU Press) is a university press that is part of New York University New York University (NYU) is a private university, private research university in New York City, New York, United States. Chartered in 1831 by the New York State Legislature, NYU was founded in 1832 by Albert Gallatin as a Nondenominational .... History NYU Press was founded in 1916 by the then chancellor of NYU, Elmer Ellsworth Brown. Directors * Arthur Huntington Nason, 1916–1932 * No director, 1932–1946 * Jean B. Barr (interim director), 1946–1952 * Filmore Hyde, 1952–1957 * Wilbur McKee, acting director, 1957–1958 * William B. Harvey, 1958–1966 * Christopher Kentera, 1966–1974 * Malcolm C. Johnson, 1974–1981 * Colin Jones, 1981–1996 * Niko Pfund, 1996–2000 * Steve Maikowski, 2001–2014 * Ellen Chodosh, 2014–2024 * Eric Schwartz, 2024–present Notable publications Once best known for publishing '' The Collected Writings of Walt Whitman'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

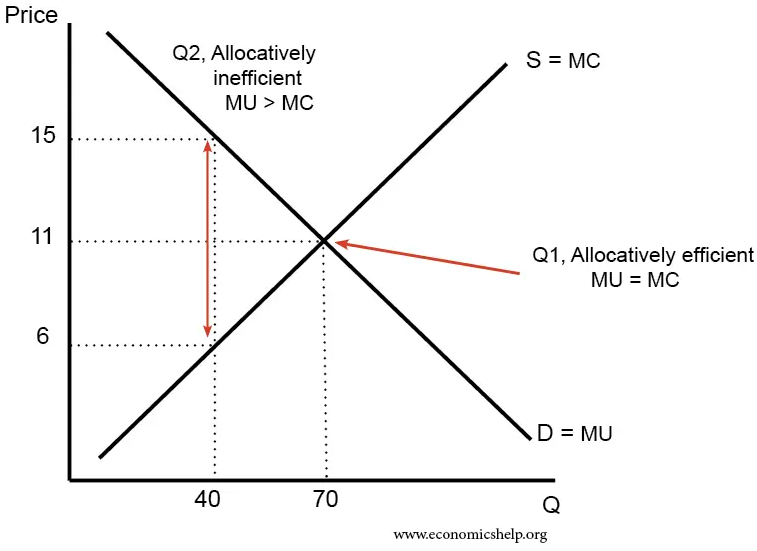

Allocative Efficiency

Allocative efficiency is a state of the economy in which production is aligned with the preferences of consumers and producers; in particular, the set of outputs is chosen so as to maximize the Economic surplus, social welfare of society. This is achieved if every produced good or service has a marginal benefit equal to or greater than the marginal cost of production. Description In economics, allocative efficiency entails production at the point on the production possibilities frontier that is optimal for society. In contract theory, allocative efficiency is achieved in a contract in which the skill demanded by the offering party and the skill of the agreeing party are the same. Resource allocation efficiency includes two aspects: # At the macro aspect, it is the allocation efficiency of social resources, which is achieved through the economic system arrangements of the entire society. # The micro aspect is the efficient use of resources, which can be understood as the produ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Allais Paradox

The Allais paradox is a choice problem designed by to show an inconsistency of actual observed choices with the predictions of expected utility theory. The Allais paradox demonstrates that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox. Statement of the problem The Allais paradox arises when comparing participants' choices in two different experiments, each of which consists of a choice between two gambles, A and B. The payoffs for each gamble in each experiment are as follows: Several studies involving hypothetical and small monetary payoffs, and recently involving health outcomes, have supported the assertion that when presented with a choice between 1A and 1B, most people would choose 1A. Likewise, when presented with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alchian–Allen Effect

The Alchian–Allen effect was described in 1964 by Armen Alchian and William R Allen in the book ''University Economics'' (now called ''Exchange and Production''). It states that when the prices of two substitute goods, such as high and low grades of the same product, are both increased by a fixed per-unit amount such as a transportation cost or a lump-sum tax, consumption will shift toward the higher-grade product. This is because the added per-unit amount decreases the relative price of the higher-grade product. Suppose, for example, that high-grade coffee beans are $3/pound and low-grade beans $1.50/pound; in this example, high-grade beans cost twice as much as low-grade beans. If a per-pound international shipping cost of $1 is added, the effective prices are now $4 and $2.50: High-grade beans now cost only 1.6 times as much as low-grade beans. This reduced ratio of difference will induce distant coffee-buyers to now choose a higher ratio of high-to-low grade beans than local ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |