|

Gift Tax In The United States

A gift tax, known originally as inheritance tax, is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation (measured in money or money's worth) is not received in return." When a taxable gift in the form of cash, stocks, real estate, gift cards, or other tangible or intangible property is made, the tax is usually imposed on the donor (the giver) unless there is a retention of an interest which delays completion of the gift. A transfer is "completely gratuitous" when the donor receives nothing of value in exchange for the given property. A transfer is "gratuitous in part" when the donor receives some value, but the value of the property received by the donor is substantially less than the value of the property given by the donor. In this case, the amount of the gift is the difference. In the United States, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-resident Alien

In law, an alien is generally any person (including an organization) who is not a citizen or a national of a specific country, although definitions and terminology differ across legal systems. Lexicology The term "alien" is derived from the Latin '. The Latin later came to mean a stranger, a foreigner, or someone not related by blood. Similar terms to "alien" in this context include ''foreigner'' and ''lander''. Categories Different countries around the world use varying terms for aliens. The following are several types of aliens: * legal alien any foreign national who is permitted under the law to be in the host country. This is a very broad category which includes travel visa holders or foreign tourists, registered refugees, temporary residents, permanent residents, and those who have relinquished their citizenship and/or nationality. Categories of legal alien include ** temporary resident alien any foreign national who has been lawfully granted permission by the gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Taxes

Personal may refer to: Aspects of persons' respective individualities * Privacy * Personality * Personal, personal advertisement, variety of classified advertisement used to find romance or friendship Companies * Personal, Inc., a Washington, D.C.–based tech startup * The Personal, a Canadian-based group car insurance and home insurance company * Telecom Personal, a mobile phone company in Argentina and Paraguay Music * ''Personal'' (Men of Vizion album), 1996 * Personal (George Howard album), 1990 * Personal (Florrie album), 2023 * ''Personal'', an album by Quique González, or the title song * "Message"/"Personal", a 2003 song by Aya Ueto * "Personal" (Hrvy song), a song from ''Talk to Ya'' * "Personal" (The Vamps song), a song from ''Night & Day'' *"Personal", a song by Kehlani from ''SweetSexySavage'' *"Personal", a song by Olly Murs from his 2012 album '' Right Place Right Time'' *"Personal", a song by Against the Current from their 2018 album '' Past Lives'' Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 709

Form is the shape, visual appearance, or configuration of an object. In a wider sense, the form is the way something happens. Form may also refer to: *Form (document), a document (printed or electronic) with spaces in which to write or enter data *Form (architecture), a combination of external appearance, internal structure, and the unity of the design *Form (education), a class, set, or group of students *Form (religion), an academic term for prescriptions or norms on religious practice *Form, a shallow depression or flattened nest of grass used by a hare *Form, or rap sheet, slang for a criminal record People * Andrew Form, American film producer * Fluent Form, Australian rapper and hip hop musician Arts, entertainment, and media * Form (arts organisation), a Western Australian arts organisation *Form (visual art), a three-dimensional geometrical figure; one of the seven elements of art *Poetic form, a set of structural rules and patterns to which a poem may adhere *Music ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crummey Trust

Crummey is a surname. Notable people with the surname include: * Andrew Crummey (born 1984), American football guard * Joe Crummey, American radio talk show host * Louise McKinney née Crummey (1868–1931), politician and women's rights activist from Alberta, Canada *Michael Crummey Michael Crummey (born November 18, 1965) is a Canadian poet and a writer of historical fiction. His writing often draws on the history and landscape of Newfoundland and Labrador. He won the 2025 International Dublin Literary Award. Life and educ ... (born 1965), Canadian poet and writer * P. W. Crummey (1891–1960), public figure in Newfoundland See also * Crummey Nunatak * Crummey trust for the benefit of a minor * Cramme * Grumme {{surname ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uniform Gifts To Minors Act

The Uniform Gifts to Minors Act (UGMA) is an act in some states of the United States that allows assets such as securities, where the donor has given up all possession and control, to be held in the custodian's name for the benefit of the minor without an attorney needing to set up a special trust fund. This allows a minor in the United States to have property set aside for the minor's benefit and may achieve some income tax benefit for the child's parents. Once the child reaches the age of maturity (18 or 21 depending on the state), the assets become the property of the child and the child can use them for any purpose. Contributing money to an UGMA account on another person's behalf could be subject to gift tax; however, the Internal Revenue Code of the United States allows persons to give up to the annual gift tax exclusion to another person without any gift tax consequences, and gifts exceeding that amount as long as total gifts are below the lifetime limits. In the majority of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SOGRAT

A grantor-retained annuity trust (commonly referred to by the acronym GRAT) is a financial instrument commonly used in the United States to make large financial gifts to family members without paying a U.S. gift tax. Basic mechanism A grantor transfers property into an irrevocable trust in exchange for the right to receive fixed payments at least annually, based on original fair market value of the property transferred. At the end of a specified time, any remaining value in the trust is passed on to a beneficiary of the trust as a gift. Beneficiaries are generally close family members of the grantor, such as children or grandchildren, who are prohibited from being named beneficiaries of another estate freeze technique, the grantor-retained income trust. If a grantor dies before the trust period ends, the assets in the GRAT are included in the grantor's estate by operation of I.R.C. § 2036, eliminating any potential gift tax benefit; this is the GRAT's main weakness as a tax avoid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and business failures around the world. The economic contagion began in 1929 in the United States, the largest economy in the world, with the devastating Wall Street stock market crash of October 1929 often considered the beginning of the Depression. Among the countries with the most unemployed were the U.S., the United Kingdom, and Weimar Republic, Germany. The Depression was preceded by a period of industrial growth and social development known as the "Roaring Twenties". Much of the profit generated by the boom was invested in speculation, such as on the stock market, contributing to growing Wealth inequality in the United States, wealth inequality. Banks were subject to laissez-faire, minimal regulation, resulting in loose lending and wides ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax In The United States

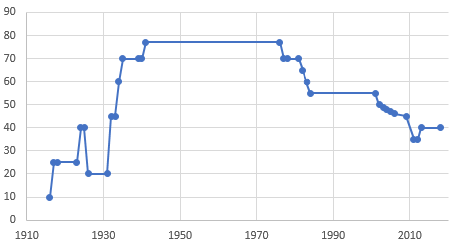

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have " inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

De Minimis Fringe Benefit

De minimis fringe benefits are low-value employee benefit, perks provided by an employer; ''de minimis'' is legal Latin for "minimal". Perks that are determined to be de minimis fringe benefits may not be accounted or taxed in some jurisdictions as having too small value and too complicated accounting. United States Definition Under US Internal Revenue Service Code § Internal Revenue Code section 132(a), 132(a)(4), “de minimis fringe” benefits provided by the employer can be excluded from the employee’s gross income. “De minimis fringe” means any property or service whose value (after taking account of the frequency with which the employer provides smaller fringes to his employees) is so small as to make accounting for it unreasonable or administratively impracticable. As a practical matter, 132(a)(4) is a narrowly defined rule of administrative convenience. Qualification as a de minimis fringe benefit For any property or service to qualify as a "de minimis fringe" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |