|

Forensic Accountant

Forensic accountants are experienced auditors, accountants, and investigators of legal and financial documents that are hired to look into possible suspicions of fraudulent activity within a company; or are hired by a company who may just want to prevent fraudulent activities from occurring. They also provide services in areas such as accounting, antitrust, damages, analysis, valuation, and general consulting. Forensic accountants have also been used in divorces, bankruptcy, insurance claims, personal injury claims, fraudulent claims, construction, royalty audits, and tracking terrorism by investigating financial records. Many forensic accountants work closely with law enforcement personnel and lawyers during investigations and often appear as expert witnesses during trials. Tasks performed Forensic accounting or forensic accountancy has been used since the time of the ancient Egyptians when Pharaoh had scribes account for his gold and other assets. These scribes worked in Pharaoh' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auditor

An auditor is a person or a firm appointed by a company to execute an audit.Practical Auditing, Kul Narsingh Shrestha, 2012, Nabin Prakashan, Nepal To act as an auditor, a person should be certified by the regulatory authority of accounting and auditing or possess certain specified qualifications. Generally, to act as an external auditor of the company, a person should have a certificate of practice from the regulatory authority. Types of auditors * External auditor/ Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company's financial statements are free of material misstatements, whether due to fraud or error. For publicly traded companies, external auditors may also be required to express an opinion over the effectiveness of internal controls over financial reporting. External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements. Mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Model

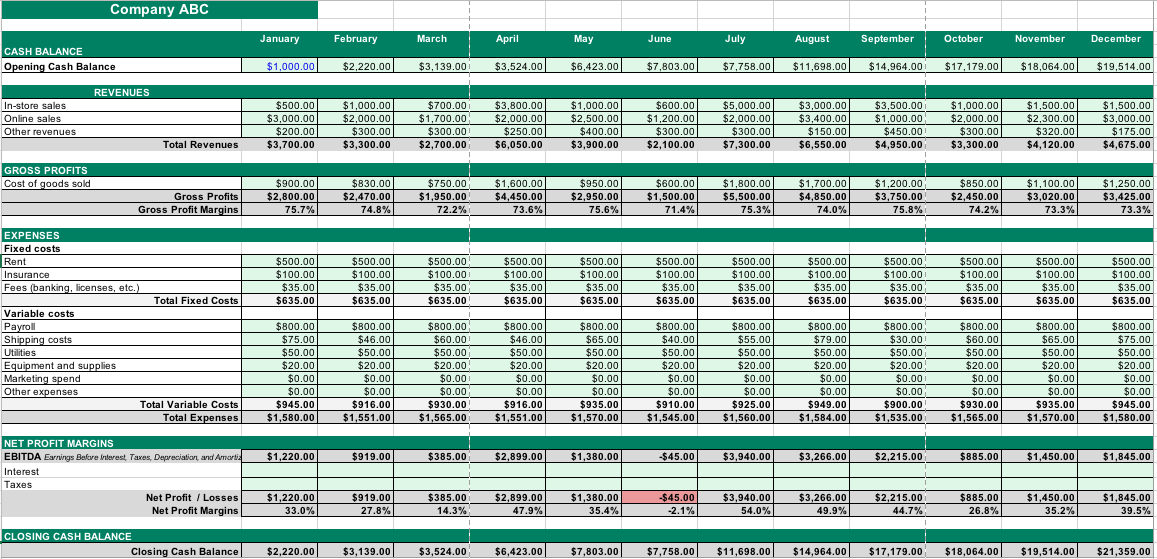

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. Accounting In corporate finance and the accounting profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certified Fraud Examiner

The Certified Fraud Examiner (CFE) is a credential awarded by the '' Association of Certified Fraud Examiners'' (ACFE) since 1989. The ACFE association is a provider of anti-fraud training and education. Founded in 1988 by Dr. Joseph T Wells. The ACFE established and administers the Certified Fraud Examiner (CFE) credential. To become a Certified Fraud Examiner (CFE), one must meet the following requirements: * Be an Associate Member of the ACFE in good standing * Meet minimum academic and professional requirements (undergraduate degree and professional experience (Note: a combination of graduate or post-graduate education and experience can be used to increase eligibility, however most importantly a candidate must score 40 points or above based on eligibility criteria). * Be of high moral character * Agree to abide by the Bylaws and Code of Professional Ethics of the Association of Certified Fraud Examiners * Pass the CFE Examination Academic requirements Generally, applicants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chartered Professional Accountant

Chartered Professional Accountant (CPA; ) is the professional certification, professional designation which united the three Canadian accounting designations that previously existed: :* Canadian Institute of Chartered Accountants, Chartered Accountant (Chartered accountant, CA), :* Certified General Accountants Association of Canada, Certified General Accountant (Certified general accountant, CGA) :* Certified Management Accountants of Canada, Certified Management Accountant (Certified Management Accountant, CMA). CPA Canada is the national organization that represents the profession, and the CPA designation has been in use by members of all constituent accounting bodies in the provinces, territories and Bermuda since 2014. The legislative process for implementing the new designation began in Quebec in May 2012, and was completed in the Northwest Territories and Nunavut in January 2019. CPA Competency Map The CPA Competency Map lays the foundation for the CPA certification pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |