|

Electronic Cash

Electronic cash was, until 2007, the debit card system of the German Banking Industry Committee, the association that represents the top German financial interest groups. Usually paired with a transaction account or current account, cards with an Electronic Cash logo were only handed out by proper credit institutions. An electronic card payment was generally made by the card owner entering their PIN ( Personal Identification Number) at a so-called EFT- POS-terminal ( Electronic-Funds-Transfer-Terminal). The name "EC" originally comes from the unified European checking system Eurocheque. Comparable debit card systems are Maestro and Visa Electron. Banks and credit institutions who issued these cards often paired EC debit cards with Maestro functionality. These combined cards, recognizable by an additional Maestro logo, were referred to as "EC/Maestro cards". Providers All of Germany's providers registered with the Central Credit Committee are connected in the working group ''Ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debit Card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase. Some debit cards carry a stored value with which a payment is made (prepaid card), but most relay a message to the cardholder's bank to withdraw funds from the cardholder's designated bank account. In some cases, the payment card number is assigned exclusively for use on the Internet and there is no physical card. This is referred to as a virtual card. In many countries, the use of debit cards has become so widespread they have overtaken checks in volume, or have entirely replaced them; in some instances, debit ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Postbank

Postbank is the retail banking division of Deutsche Bank, which was formed from the demerger of the postal savings division of Deutsche Bundespost in 1990. Since May 2018, it operates as a brand of Deutsche Bank's retail arm. It serves 13 million customers in around 1,000 branches and 700 advisory centers. History The ''Postscheckdienst'' was introduced in 1909 by the German Reich establishing accounts for payment transactions by mail and linking postal and banking services in German states. In 1990, following the German Postal Services Restructuring Act (''Poststrukturgesetz'') of 1989, the German Postal Service (Deutsche Bundespost) was divided into three companies, Deutsche Post, Deutsche Telekom and Postbank. Later that year, Deutsche Post Postbank of the former East Germany was merged with Postbank. From 1990 to 1997, Günter Schneider was chairman of the board. The first board of Postbank consisted of Günter Schneider, Rudolf Bauer and Bernhard Zurhorst. On 1 January 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point Of Sale

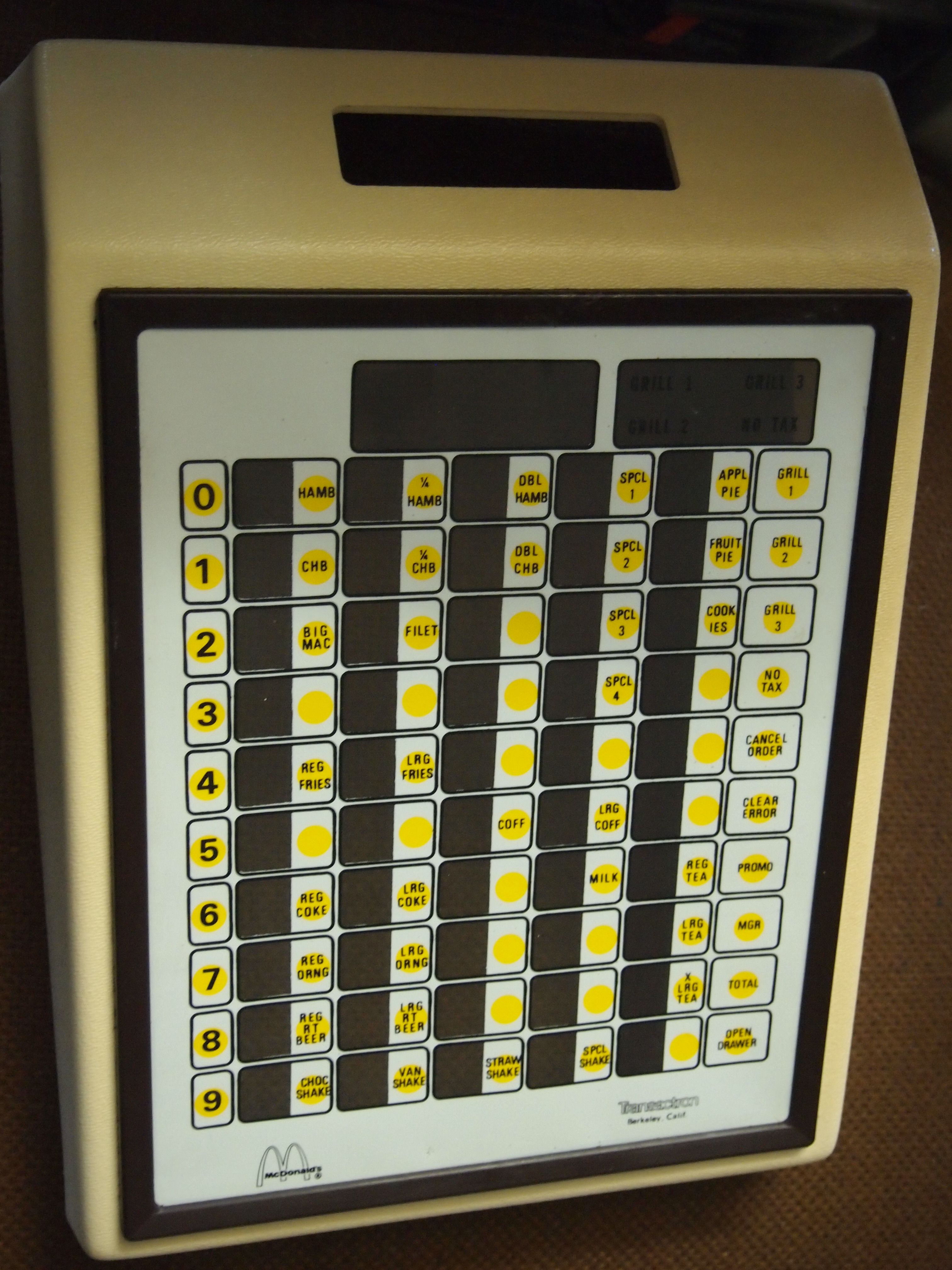

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are availabl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backward Compatibility

Backward compatibility (sometimes known as backwards compatibility) is a property of an operating system, product, or technology that allows for interoperability with an older legacy system, or with input designed for such a system, especially in telecommunications and computing. Modifying a system in a way that does not allow backward compatibility is sometimes called " breaking" backward compatibility. A complementary concept is forward compatibility. A design that is forward-compatible usually has a roadmap for compatibility with future standards and products. A related term from programming jargon is hysterical reasons or hysterical raisins (near-homophones for "historical reasons"), as the purpose of some software features may be solely to support older hardware or software versions. Usage In hardware A simple example of both backward and forward compatibility is the introduction of FM radio in stereo. FM radio was initially mono, with only one audio channel repre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Magnetic Stripe Card

The term digital card can refer to a physical item, such as a memory card on a camera, or, increasingly since 2017, to the digital content hosted as a virtual card or cloud card, as a digital virtual representation of a physical card. They share a common purpose: Identity Management, Credit card, or Debit card. A non-physical digital card, unlike a Magnetic stripe card can can emulate (imitate) any kind of card. Other common uses include loyalty card and health insurance card; physical driver's license and Social Security card are still mandated by some government agencies. A smartphone or smartwatch can store content from the card issuer; discount offers and news updates can be transmitted wirelessly, via Internet These virtual cards are used in very high volumes by the mass transit sector, replacing paper based tickets and earlier MagStrip cards. History Magnetic recording on steel tape and wire was invented by Valdemar Poulsen in Denmark around 1900 for recording aud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Debit

A direct debit or direct withdrawal is a financial transaction in which one organisation withdraws funds from a payer's bank account., https://www.directdebit.co.uk/direct-debit-explained/what-is-direct-debit/ Formally, the organisation that calls for the funds ("the payee") instructs their bank to collect (i.e., debit) an amount directly from another's ("the payer's") bank account designated by the payer and pay those funds into a bank account designated by the payee. Before the payer's banker will allow the transaction to take place, the payer must have advised the bank that they have authorized the payee to directly draw the funds. It is also called pre-authorized debit (PAD) or pre-authorized payment (PAP). After the authorities are set up, the direct debit transactions are usually processed electronically. Direct debits are typically used for recurring payments, such as credit card and utility bills, where the payment amounts vary from one payment to another. However, when the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PIN Pad

A PIN pad or PIN entry device (PED) is an electronic device used in a debit, credit or smart card-based transaction to accept and encrypt the cardholder's personal identification number (PIN). PIN pads are normally used with payment terminals, automated teller machines or integrated point of sale devices in which an electronic cash register is responsible for taking the sale amount and initiating/handling the transaction. The PIN pad is required to read the card and allow the PIN to be securely entered and encrypted before it is sent to the bank. In some cases, with chip cards, the PIN is only transferred from the PIN pad to card and it is verified by the chip card. In this case the PIN does not need to be sent to the bank or card scheme for verification. (This is known as "offline PIN verification".) Like some stand-alone point of sale devices, PIN pads are equipped with hardware and software security features to ensure that the encryption keys and the PIN are erased if so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hardware Security Module

A hardware security module (HSM) is a physical computing device that safeguards and manages secrets (most importantly digital keys), performs encryption and decryption functions for digital signatures, strong authentication and other cryptographic functions. These modules traditionally come in the form of a plug-in card or an external device that attaches directly to a computer or network server. A hardware security module contains one or more secure cryptoprocessor chips. Design HSMs may have features that provide tamper evidence such as visible signs of tampering or logging and alerting, or tamper resistance which makes tampering difficult without making the HSM inoperable, or tamper responsiveness such as deleting keys upon tamper detection. Each module contains one or more secure cryptoprocessor chips to prevent tampering and bus probing, or a combination of chips in a module that is protected by the tamper evident, tamper resistant, or tamper responsive packaging. A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software

Software is a set of computer programs and associated software documentation, documentation and data (computing), data. This is in contrast to Computer hardware, hardware, from which the system is built and which actually performs the work. At the low level language, lowest programming level, executable code consists of Machine code, machine language instructions supported by an individual Microprocessor, processor—typically a central processing unit (CPU) or a graphics processing unit (GPU). Machine language consists of groups of Binary number, binary values signifying Instruction set architecture, processor instructions that change the state of the computer from its preceding state. For example, an instruction may change the value stored in a particular storage location in the computer—an effect that is not directly observable to the user. An instruction System call, may also invoke one of many Input/output, input or output operations, for example displaying some text on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point Of Sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are availabl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gesellschaft Mit Beschränkter Haftung

A ''Gesellschaft mit beschränkter Haftung'' (, abbreviated GmbH and also GesmbH in Austria; ) is a type of Juristic person, legal entity common in Germany, Austria, Switzerland (where it is equivalent to a ''société à responsabilité limitée''), and Liechtenstein. It is an entity broadly equivalent to the private limited company in the United Kingdom and many Commonwealth of Nations, Commonwealth countries, and the limited liability company (LLC) in the United States. The name of the GmbH form emphasizes the fact that the owners (''Gesellschafter'', also known as members) of the entity are not personally liable or credible for the company's debts. GmbHs are considered legal persons under German, Swiss, and Austrian law. Other variations include mbH (used when the term ''Gesellschaft'' is part of the company name itself), and gGmbH (''gemeinnützige'' GmbH) for non-profit companies. The GmbH has become the most common corporation form in Germany because the AG (''Aktiengesel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Credit Committee

The German Banking Industry Committee (GBIC) (german: Die Deutsche Kreditwirtschaft / ''DK''), known until 2011 as the Central Credit Committee (german: Zentraler Kreditausschuss / ''ZKA'') is an industry association of the German banking industry. Its decisions are held normative for the national banking sector – either directly by interbank treaties or indirectly by preparing a corresponding ministerial or Bundesbank decision. History The Central Credit Committee was founded in 1932 as a common interest group of the five federal interest groups that represent the financial sector in Germany. Until August 2011, the association was known as the Central Credit Committee (german: Zentraler Kreditausschuss / ZKA) when it adopted a new name (after almost eighty years). Structure The five founding associations are: * Bundesverband der Deutschen Volksbanken und Raiffeisenbanken (BVR, ; est. 1864 as ) * Bundesverband deutscher Banken (BdB, ; est. 1901 as ) * Bundesverband Öffentli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)