|

Dollar Gap

Dollar gap is an economic term denoting a situation where the stock of US dollars is insufficient to satisfy the demand of foreign customers. The usage of the word "gap"" specifically refers to the positive difference between exports and imports, i.e. US active trade balance of the U.S. after World War II, which led to the difference between the need for dollars and their limited supply. History The lack of dollars suffered mainly by European states after World War II, specifically from 1944-1960. The result was the risk of a slowdown in foreign trade, which depended on the convertibility of European currencies into US dollars. The Bretton Woods monetary system was a key dollar service used in international transactions. Between 1946 and 1951, the United States accumulated trade surpluses. This created a shortage of dollars, as Europe needed to finance its imports from the United States without being able to balance its balance with its exports. This shortcoming was addressed by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

US Dollars

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The U.S. dollar was originally defined under a bimetallic standard of (0.7734375 troy ounces) fine silver or, from 1834, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per troy ounce. In 1971 all links to gold were repealed. The U.S. dollar became an important international reserve currency after the First World War, and displaced the pound sterling as the world's primary reserve currency by the Bretton Woods Ag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Trade Surplus

Balance of trade is the difference between the monetary value of a nation's exports and imports of goods over a certain time period. Sometimes, trade in services is also included in the balance of trade but the official IMF definition only considers goods. The balance of trade measures a flow variable of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The idea that a trade deficit is detrimental to a nation's economy is often rejected by modern trade experts and economists. Explanation The balance of trade forms part of the current account, which includes other transactions such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

International Trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.) In most countries, such trade represents a significant share of gross domestic product (GDP). While international trade has existed throughout history (for example Uttarapatha, Silk Road, Amber Road, salt roads), its economic, social, and political importance has been on the rise in recent centuries. Carrying out trade at an international level is a complex process when compared to domestic trade. When trade takes place between two or more states, factors like currency, government policies, economy, judicial system, laws, and markets influence trade. To ease and justify the process of trade between countries of different economic standing in the modern era, some international economic organizations were formed, such as the World Trade Organization. These organizations work towards the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

International Trade Theory

International trade theory is a sub-field of economics which analyzes the patterns of international trade, its origins, and its welfare implications. International trade policy has been highly controversial since the 18th century. International trade theory and economics itself have developed as means to evaluate the effects of trade policies. Adam Smith's model Adam Smith describes trade taking place as a result of countries having absolute advantage in production of particular goods, relative to each other. Within Adam Smith's framework, absolute advantage refers to the instance where one country can produce a unit of a good with less labor than another country. In Book IV of his major work ''the Wealth of Nations'', Adam Smith, discussing gains from trade, provides a literary model for absolute advantage based upon the example of growing grapes from Scotland. He makes the argument that while it is possible to grow grapes and produce wine in Scotland, the investment in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Dollar Glut

The dollar glut is a term for the accumulation of American dollars outside of the United States as a reserve currency, contrasted with the dollar gap, which led to the creation of the Marshall Plan following World War II. The eventual shift to a dollar glut forced the end of the gold standard in the United States and led to the collapse of the Bretton Woods system. The stability of the Bretton Woods system The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the ... came to depend upon the ability of the US government to exchange dollars for gold at $35 an ounce. The American ability to fulfill this commitment began to diminish as the postwar dollar shortage was transformed into an overabundance of dollars, also known as the dollar glut.Oatley, International Political Economy 2007 See also * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Balance Of Payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a quarter or a year) and the outflow of money to the rest of the world. In other words, it is economic transactions between countries during a period of time. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services. The balance of payments consists of three primary components: the current account, the financial account, and the capital account. The current account reflects a country's net income, while the financial account reflects the net change in ownership of national assets. The capital account reflects a part that has little effect on the total, and represents the sum of unilateral capital account transfers, and the acquisitions and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

European Payments Union

The European Payments Union (EPU) was an organization in existence from July 1950 to December 1958, when it was replaced by the European Monetary Agreement. With the end of World War II, economic depression struck Europe. Of all the non-neutral powers, only the GDP of the United Kingdom had not decreased because of the war, West Germany's GDP was at its 1908 level and France's at its 1891 level. Trade was based on US dollar reserves (the only acceptable reserve currency), which Europe lacked. Therefore, the transfer of money (immediately after each transaction) increased the opportunity cost of trading. Some trade was reduced to barter. The situation led the Organisation for European Economic Co-operation (OEEC) to create the EPU, all members signing the agreement on 1 July 1950. The EPU accounted for trades but did not transfer money until the end of the month. It changed the landscape from bilateral trades of necessity (trading with partners because of outstanding debts) to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Marshall Plan

The Marshall Plan (officially the European Recovery Program, ERP) was an American initiative enacted in 1948 to provide foreign aid to Western Europe. The United States transferred $13.3 billion (equivalent to $ in ) in economic recovery programs to Western European economies after the end of World War II in Europe. Replacing an earlier proposal for a Morgenthau Plan, it operated for four years beginning on April 3, 1948, though in 1951, the Marshall Plan was largely replaced by the Mutual Security Act. The goals of the United States were to rebuild war-torn regions, remove trade barriers, modernize Manufacturing, industry, improve European prosperity and prevent the spread of communism. The Marshall Plan proposed the reduction of interstate barriers and the economic integration of the Europe, European Continent while also encouraging an increase in productivity as well as the adoption of modern business procedures. The Marshall Plan aid was divided among the participant sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Monetary System

A monetary system is a system where a government manages money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks. Commodity money system A commodity money system is a type of monetary system in which a commodity such as gold or seashells is made the unit of value and physically used as money. The money retains its value because of its physical properties. In some cases, a government may stamp a metal coin with a face, value or mark that indicates its weight or asserts its purity, but the value remains the same even if the coin is melted down. Commodity-backed money One step away from commodity money is "commodity-backed money", also known as "representative money". Many currencies have consisted of bank-issued notes which have no inherent physical value, but which may be exchanged for a precious metal, such as gold. This is known as the gold standard. A silver standard was widespread ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Exports

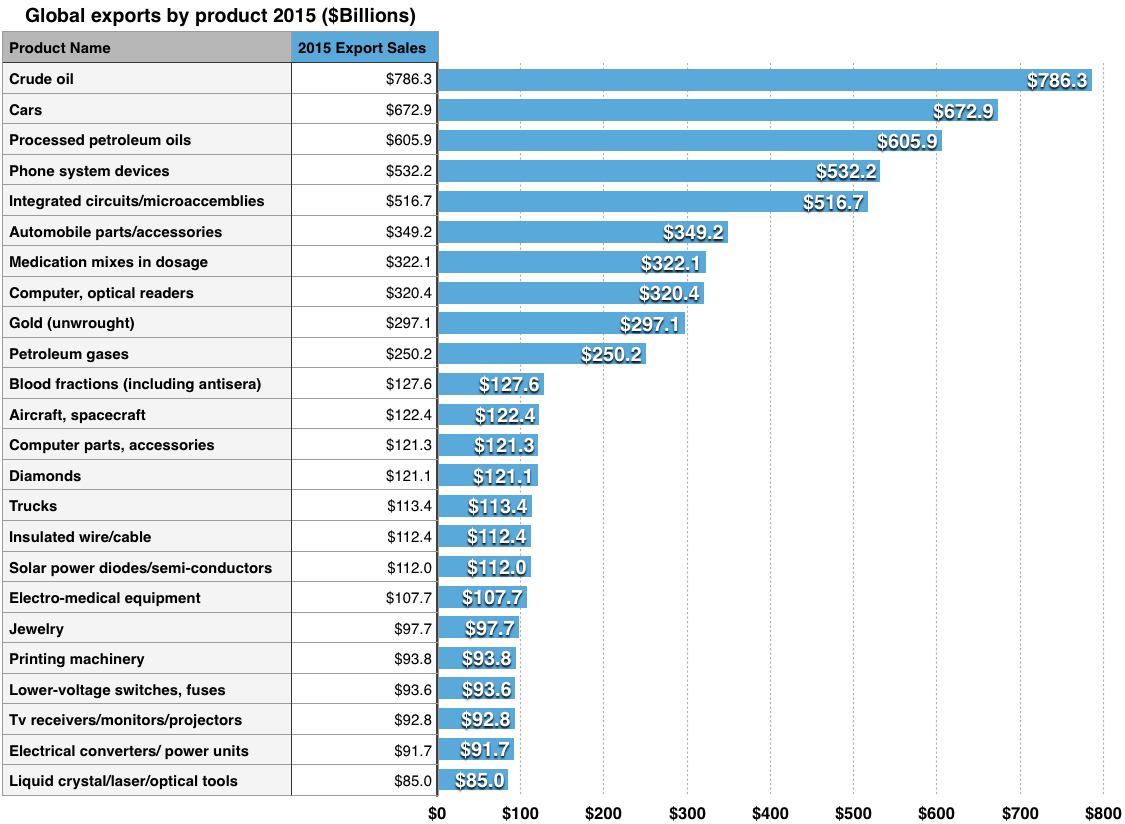

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ''exporter''; the foreign buyer is an '' importer''. Services that figure in international trade include financial, accounting and other professional services, tourism, education as well as intellectual property rights. Exportation of goods often requires the involvement of customs authorities. Firms For any firm, Global expansion strategies may include: * Franchising, * Turn Key Project, * Export, * Joint Venture, * Licensing, * Creating an owned subsidiary, * Acquisition, * Merger, etc. Exporting is mostly a strategy used by product based companies. Many manufacturing firms begin their global expansion as exporters and only later switch to another mode for serving a foreign market. Barriers There are four main types of export ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the Jamaica Accords in 1976. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to countries with balance of payments de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Foreign Trade

International trade is the exchange of Capital (economics), capital, goods, and Service (economics), services across international borders or territories because there is a need or want of goods or services. (See: World economy.) In most countries, such trade represents a significant share of gross domestic product (GDP). While international trade has existed throughout history (for example Uttarapatha, Silk Road, Amber Road, salt roads), its economic, social, and political importance has been on the rise in recent centuries. Carrying out trade at an international level is a complex process when compared to domestic trade. When trade takes place between two or more State (polity), states, factors like currency, government policies, economy, Judiciary, judicial system, laws, and markets influence trade. To ease and justify the process of trade between countries of different economic standing in the modern era, some international economic organizations were formed, such as the Wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |