|

Deflationary

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from '' disinflation'', a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral . Some economists argue that prolonged deflationary periods are related to the underlying technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when supply is hig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deflationary Spiral

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from ''disinflation'', a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the Real versus nominal value (economics), real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral . Some economists argue that prolonged deflationary periods are related to the underlying technological progress in an economy, because as productivity increases (Total factor productivity, TFP), the cost of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Rate

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in real demand for goods and services (also known as demand shocks, including changes in fiscal or monetary policy), changes in available supplies such as during energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderate inflation affects economies in both positive and negative ways ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autarky

Autarky is the characteristic of self-sufficiency, usually applied to societies, communities, states, and their economic systems. Autarky as an ideology or economic approach has been attempted by a range of political ideologies and movements, particularly leftist ones like African socialism, mutualism, war communism, communalism, swadeshi, syndicalism (especially anarcho-syndicalism), and left-wing populism, generally in an effort to build alternative economic structures or to control resources against structures a particular movement views as hostile. However, some right-wing ones, like nationalism, conservatism, and anti-globalism, along with even some centrist movements, have also adopted autarky, generally on a more limited scale, to develop a particular industry, to gain independence from other national entities or to preserve part of an existing social order. Proponents of autarky have argued for national self-sufficiency to reduce foreign economic, polit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets: Pi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stimulus (economic)

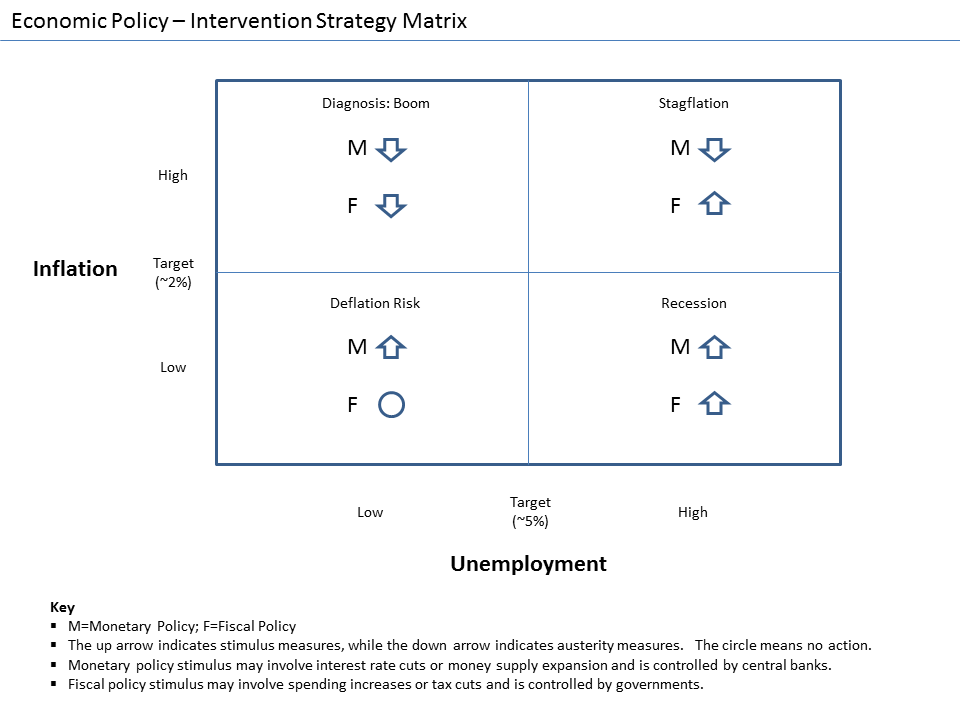

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing. A stimulus is sometimes colloquially referred to as "priming the pump" or "pump priming". Concept During a recession, production and employment are far below their sustainable potential due to lack of demand. It is hoped that increasing demand will stimulate growth and that any adverse side effects from stimulus will be mild. Fiscal stimulus refers to increasing government consumption or transfers or lowering taxes, increasing the rate of growth of public debt. Supporters of Keynesian economics assume the stimulus will cause sufficient economic growth to fill that gap partially or completely via the multiplier effect. Monetary stimulus refers to lowering interest rates, quantitative easing, or other ways of increasing the amount of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions. Even for narrow aggregates like M1, by far the largest part of the money supply consists of deposits in commercial banks, whereas currency (banknotes and coins) issued by central banks only makes up a small part of the total money supply in modern economies. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt (financial instrument) which yields so low a rate of interest."John Maynard Keynes, Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hold cash because they Expectation (epistemic), expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero lower bound and changes in the money supply that fail to translate into changes in inflation.Paul R. Krugman, Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Institution, Brookings Papers on Economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry (investment)

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during a financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. Interest rates carry trade/maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce a particular thing, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge Monopoly price, overly high prices, which is associated with unfair price raises. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry (or market). A monopoly may als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |