|

Cost Allocation

Cost allocation is a process of providing relief to shared service organization's cost centers that provide a product or service. In turn, the associated expense is assigned to internal clients' cost centers that consume the products and services. For example, the CIO may provide all IT services within the company and assign the costs back to the business units that consume each offering. The core components of a cost allocation system consist of a way to track which organizations provides a product and/or service, the organizations that consume the products and/or services, and a list of portfolio offerings (e.g. service catalog). Depending on the operating structure within a company, the cost allocation data may generate an internal invoice or feed an ERP system's chargeback module. Accessing the data via an invoice or chargeback module are the typical methods that drive personnel behavior. In return, the consumption data becomes a great source of quantitative information ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Center (business)

A cost centre is a department within a business to which costs can be allocated. The term includes departments which do not produce directly but incur costs to the business, when the manager and employees of the cost centre are not accountable for the profitability and investment decisions of the business but they are responsible for some of its costs. Types There are two main types of cost centres: * Production cost centres, where the products are manufactured or processed. Example of this is an assembly area. * Service cost centres, where services are provided to other cost centres. Example of this is the personnel department or the canteen. Examples * Marketing department * Human resources * Research and development * Work office * Quality assurance * Engineering * Logistics * Procurement Cost centres can be trimmed down to the smallest segregated tasks within Departments. It is not necessary to consider departments as outright cost centres. Some companies adopt a different ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

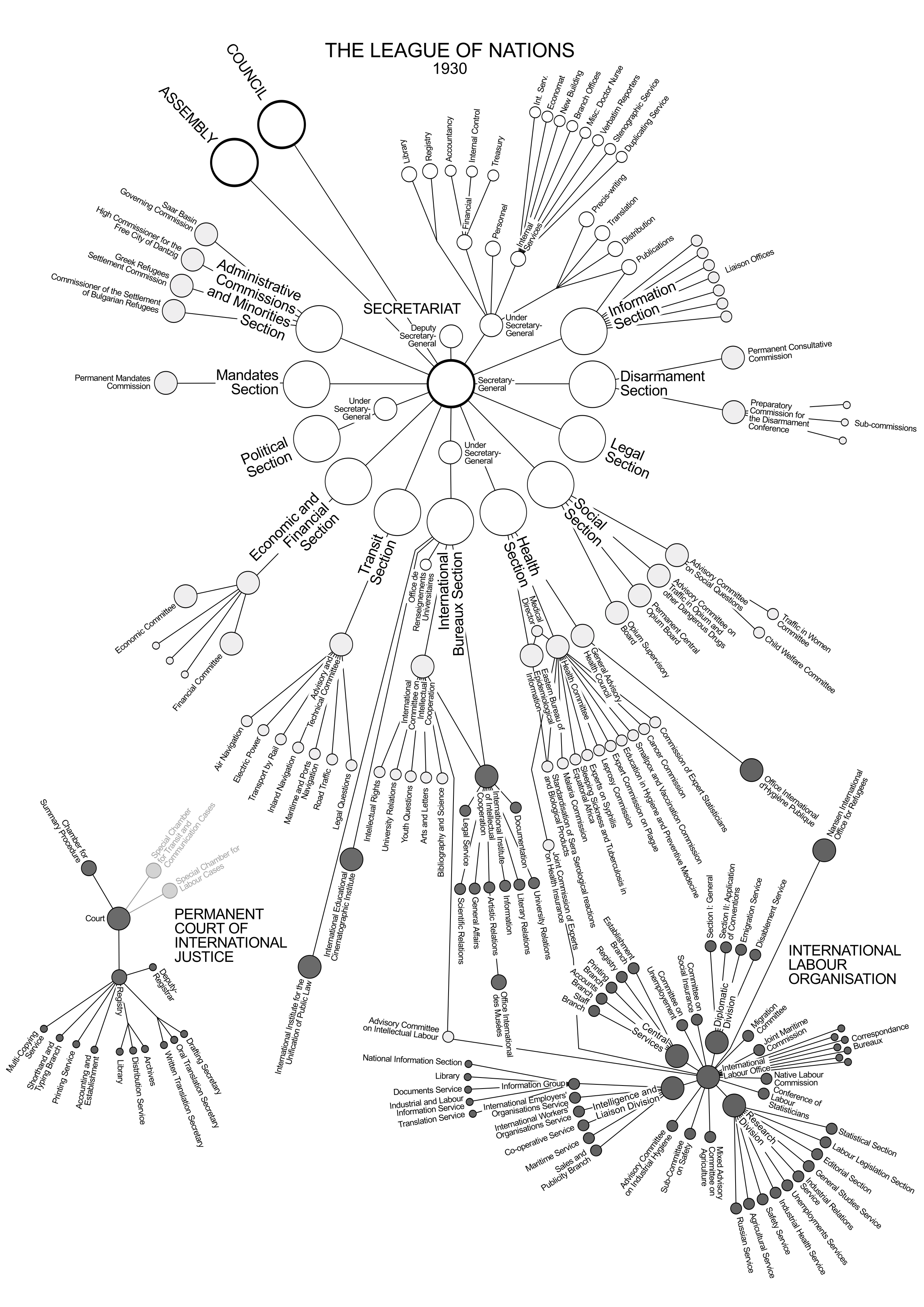

Organizational Structure

An organizational structure defines how activities such as task allocation, coordination, and supervision are directed toward the achievement of organizational aims. Organizational structure affects organizational action and provides the foundation on which standard operating procedures and routines rest. It determines which individuals get to participate in which decision-making processes, and thus to what extent their views shape the organization's actions.Jacobides., M. G. (2007). The inherent limits of organizational structure and the unfulfilled role of hierarchy: Lessons from a near-war. Organization Science, 18, 3, 455-477. Organizational structure can also be considered as the viewing glass or perspective through which individuals see their organization and its environment. Organizations are a variant of clustered entities. An organization can be structured in many different ways, depending on its objectives. The structure of an organization will determine the modes in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Costs

Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product). Like direct costs, indirect costs may be either fixed or variable. Indirect costs include administration, personnel and security costs. These are those costs which are not directly related to production. Some indirect costs may be overhead, but other overhead costs can be directly attributed to a project and are direct costs. There are two types of indirect costs. One are the fixed indirect costs, which are unchanged for a particular project or company, like transportation of labor to the working site, building temporary roads, etc. The other are recurring indirect costs, which repeat for a particular company, like maintenance of records or the payment of salaries. Indirect vs direct costs Most cost estimates are broken down into direct costs and indirect costs. Direct costs are directly attributable to the object. In construction, the co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |