|

Cashflow Forecast

Cash flow forecasting is the process of obtaining an estimate or forecast of a company's future financial position; the cash flow forecast is typically based on anticipated payments and receivables. See Financial forecast for general discussion re methodology. Function Cash flow forecasting is an important element of financial management generally; Cash flow is the "life-blood" of all businesses — particularly start-ups and small enterprises — and if the business runs out of cash and is not able to obtain new finance, it will become insolvent. As a result, it is essential that management forecast (predict) cash levels. How often, will depend on the financial security of the business: if the business is "struggling", management may assess, if not forecast, cash flow on a daily basis; if the finances are more stable, then this process may be weekly or monthly. Key dependencies re the forecast: * Identify potential shortfalls in cash balances in advance — the cash f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statement Of Financial Position

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity. Assets are follo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Management

Treasury management (or treasury operations) includes management of an enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a firm's collections, disbursements, concentration, investment and funding activities. In larger firms, it may also include financial risk management. For non-banking entities, the terms ''Treasury Management'' and ''Cash Management'' are sometimes used interchangeably, while, in fact, the scope of treasury management is larger (and includes funding and investment activities mentioned above). In general, a company's treasury operations comes under the control of the CFO, Vice-President / Director of Finance or Treasurer, and is handled on a day-to-day basis by the organization's treasury staff, controller, or comptroller. Most banks have whole departments devoted to treasury management and supporting their clients' needs in this area. Smalle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounts Receivable

Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Accounts receivable is shown in a balance sheet as an asset. It is one of a series of accounting transactions dealing with the billing of a customer for goods and services that the customer has ordered. These may be distinguished from notes receivable, which are debts created through formal legal instruments called promissory notes. Overview Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. In most business entities, accounts receivable is typically executed by generating an invoice and either mailing or electronically delivering it to the customer, who, in turn, must pay it within an es ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forecasting

Forecasting is the process of making predictions based on past and present data. Later these can be compared (resolved) against what happens. For example, a company might estimate their revenue in the next year, then compare it against the actual results. Prediction is a similar but more general term. Forecasting might refer to specific formal statistical methods employing time series, cross-sectional or longitudinal data, or alternatively to less formal judgmental methods or the process of prediction and resolution itself. Usage can vary between areas of application: for example, in hydrology the terms "forecast" and "forecasting" are sometimes reserved for estimates of values at certain specific future times, while the term "prediction" is used for more general estimates, such as the number of times floods will occur over a long period. Risk and uncertainty are central to forecasting and prediction; it is generally considered a good practice to indicate the degree of uncertainty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Owner Earnings

Owner earnings is a valuation method detailed by Warren Buffett in Berkshire Hathaway's annual report in 1986. He stated that the value of a company is simply the total of the net cash flows (owner earnings) expected to occur over the life of the business, minus any reinvestment of earnings. Buffett defined owner earnings as follows: :"These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges... less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume... Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (c) must be a guess - and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes... All of this points up the absurdity of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Treasury

Treasury management (or treasury operations) includes management of an enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a firm's collections, disbursements, concentration, investment and funding activities. In larger firms, it may also include financial risk management. For non-banking entities, the terms ''Treasury Management'' and ''Cash Management'' are sometimes used interchangeably, while, in fact, the scope of treasury management is larger (and includes funding and investment activities mentioned above). In general, a company's treasury operations comes under the control of the CFO, Vice-President / Director of Finance or Treasurer, and is handled on a day-to-day basis by the organization's treasury staff, controller, or comptroller. Most banks have whole departments devoted to treasury management and supporting their clients' needs in this area. Smal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FP&A

A financial analyst is a professional, undertaking financial analysis for external or internal clients as a core feature of the job. The role may specifically be titled securities analyst, research analyst, equity analyst, investment analyst, or ratings analyst.Financial Analysts Bureau of Labor StatisticsFinancial Analysts collegegrad.com The job title is a broad one: [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Recapitalization

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of debt for equity. Overview Such recapitalizations are executed via issuing bonds to raise money and using the proceeds to buy the company's stock or to pay dividends. Such a maneuver is called a leveraged buyout when initiated by an outside party, or a leveraged recapitalization when initiated by the company itself for internal reasons. These types of recapitalization can be minor adjustments to the capital structure of the company, or can be large changes involving a change in the power structure as well. Leveraged recapitalizations are used by privately held companies as a means of refinancing, generally to provide cash to the shareholders while not requiring a total sale of the company. Debt (in the form of bonds) has some advantages over equity as a way of raising money, since it can have tax benefits and can enforce a cash discipline. The reduction in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money ( leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage (or gearing, in the United Kingdom) the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible. Capital structure is an important issue in setting rates charged to customers by regulated utilities in the United States. The utility company has the right to choose any capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

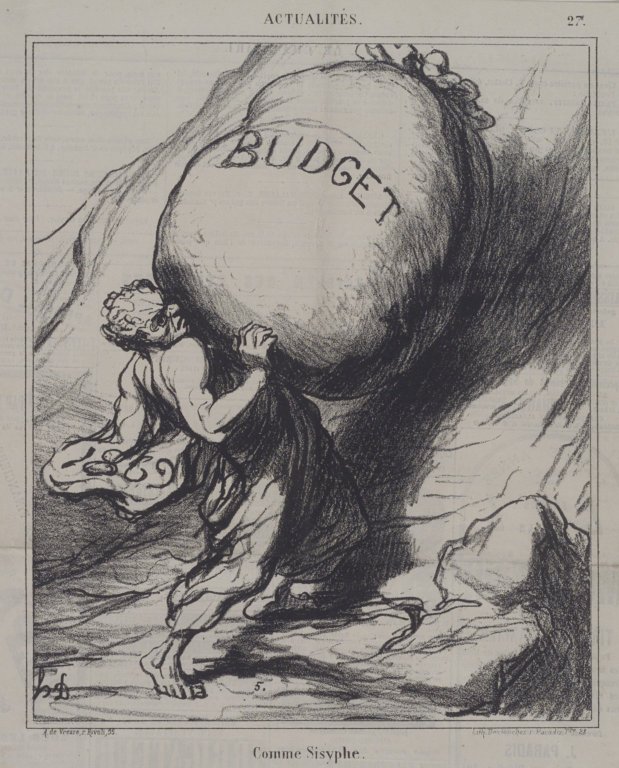

Budgeting

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment bud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |