|

Commodity Pools

A commodity pool is an investment structure where many individual investors combine their moneys and trade in futures contracts as a single entity in order to gain leverage. They are analogous to mutual funds wherein a fund is similarly set up expressly for trading in equity, except that mutual funds are open to public subscription whereas commodity pools and hedge funds are private. Commodity pools are also called "managed futures funds". The name "commodity pool" is a National Futures Association (NFA) legal term. In the United States, the Commodity Futures Trading Commission (CFTC) and the NFA, as opposed to the Securities and Exchange Commission, regulate commodity pools. Many hedge funds are commodity pools. Funds that trade in commodities, which include many of the largest funds engaged in macro-strategies, are registered with the Commodity Futures Trading Commission as commodity pools and as commodity trading advisors (CTAs). In an address to the Securities Industry Associ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

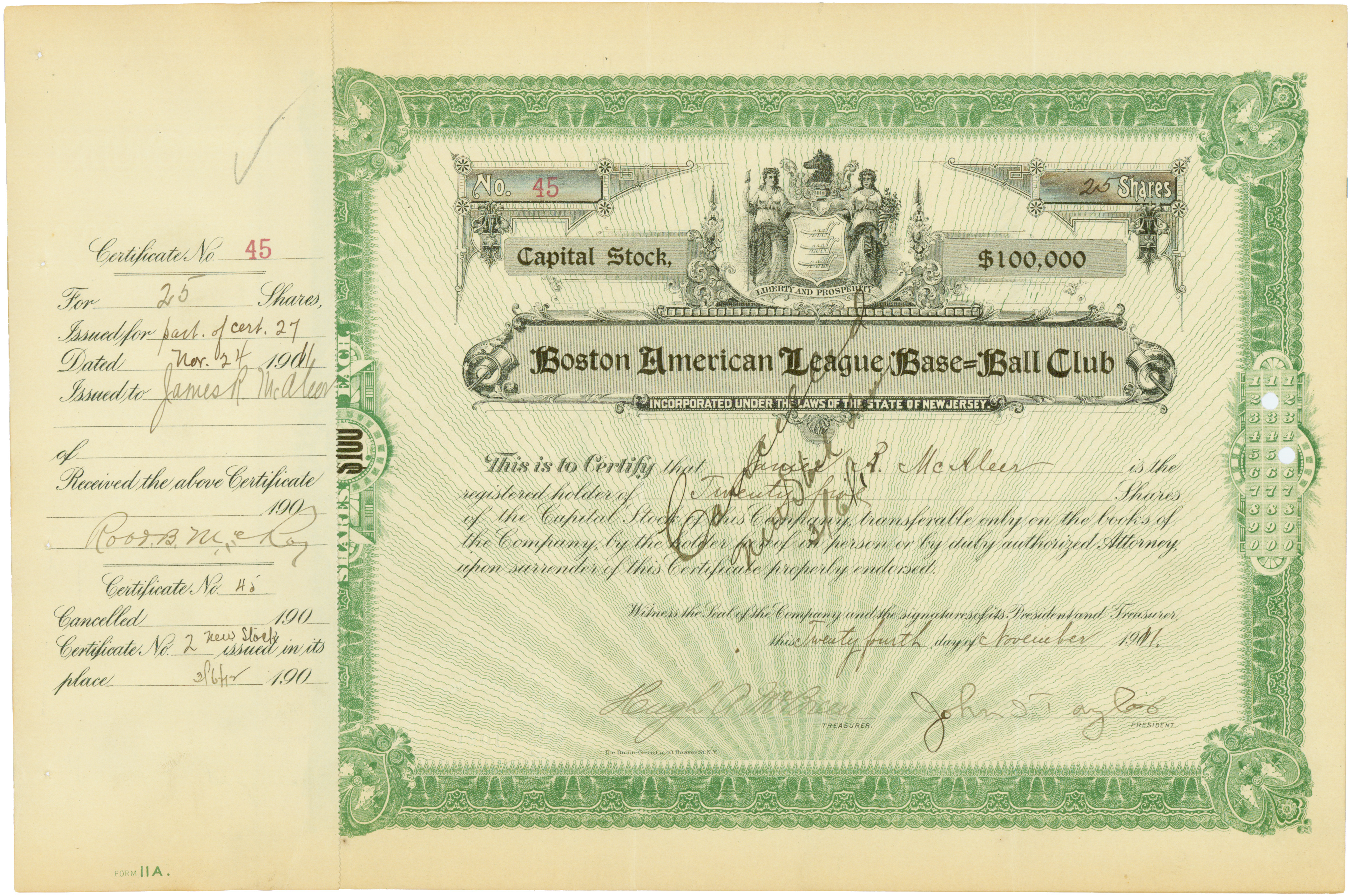

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Hedge Fund

A hedge fund is a Pooling (resource management), pooled investment fund that holds Market liquidity, liquid assets and that makes use of complex trader (finance), trading and risk management techniques to aim to improve investment performance and insulate returns from beta (finance), market risk. Among these portfolio (finance), portfolio techniques are short (finance), short selling and the use of leverage (finance), leverage and derivative (finance), derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and Exchange-traded fund, ETFs. They are also considered distinct from private-equity fund, private equity funds and other similar cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

National Futures Association

The National Futures Association (NFA) is the self-regulatory organization (SRO) for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency (forex) and OTC derivatives ( swaps). NFA is headquartered in Chicago and maintains an office in New York City. NFA is a non-profit, independent regulatory organization. NFA does not operate any markets and is not a trade association. NFA is financed from membership dues and assessment fees, and membership is mandatory for many market participants. History The National Futures Association (NFA) was created by the Commodity Futures Trading Commission The Commodity Futures Trading Commission (CFTC) is an Independent agencies of the United States government, independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures contract, fut ... (CFTC) in September 1981 and began regulatory operations in 1982. Responsibilities NFA chi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is an Independent agencies of the United States government, independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures contract, futures, Swap (finance), swaps, and certain kinds of option (finance), options. The Commodity Exchange Act (CEA), ''et seq.'', prohibits fraudulent conduct in the trading of futures, swaps, and other derivatives. The stated mission of the CFTC is to promote the integrity, resilience, and vibrancy of the U.S. derivatives markets through sound regulation. After the 2008 financial crisis and since 2010 with the Dodd–Frank Wall Street Reform and Consumer Protection Act, the CFTC has been transitioning to bring more transparency and sound regulation to the multitrillion-dollar swaps market. History Futures contracts for agricultural commodities have been traded in the U.S. for more than 150 years and have been under federal regulation sinc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Securities And Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market manipulation. Created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act), the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, and the Sarbanes–Oxley Act of 2002, among other statutes. Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated entities submit quarterly and annual reports, as well as other periodic disclosures. In addition to annual financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Commodity Trading Advisor

A commodity trading advisor (CTA) is US financial regulatory term for an individual or organization who is retained by a fund or individual client to provide advice and services related to trading in futures contracts, commodity options and/or swaps. They are responsible for the trading within managed futures accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CTAs are generally regulated by the United States federal government through registration with the Commodity Futures Trading Commission (CFTC) and membership of the National Futures Association (NFA). Characteristics Trading activities A CTA generally acts as an asset manager, following a set of investment strategies utilizing futures contracts and options on futures contracts on a wide variety of physical goods such as agricultural products, forest products, metals, and energy, plus derivative contrac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

List Of Traded Commodities

The following is a list of futures contracts on physically traded commodities. Agricultural Grains, food and fiber Symbol from "CME Group Website". cmegroup.com. CME Group. Retrieved 2010-10-20. Livestock and meat Dairy Energy Forest products Metals Industrial Metals Precious Metals Other List of 15 largest global commodities trading companies # Vitol # Glencore # Trafigura # Cargill # Salam Investment # Archer Daniels Midland # Gunvor # Beddu-Trading # Mercuria Energy Group # Noble Group # Louis Dreyfus Group # Bunge Global # Wilmar International # Olam International # Cannon Trading Company Commodity exchanges * Chicago Mercantile Exchange * Dubai Mercantile Exchange * Euronext * Intercontinental Exchange * London International Financial Futures and Options Exchange * London Metal Exchange * NASDAQ OMX Commodities * Dalian Commodity Exchange References External links * * * List of Commodity Delivery Dates on Wikinves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

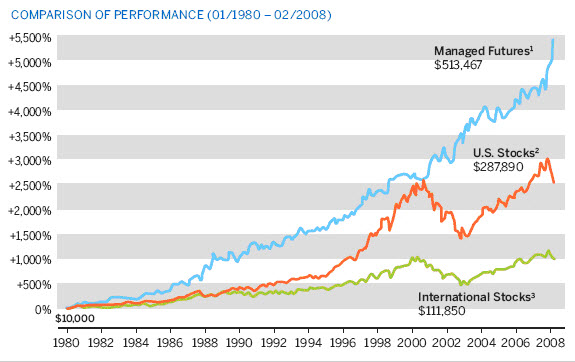

Managed Futures Account

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the Futures exchange, futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or Commodity Pool Operator, commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. , the assets under management held by managed futures accounts totaled $340 billion. Characteristics Managed futures accounts are operated on behalf of an individual by professional money managers such as Commodity trading advisor, CTAs or Commodity Pool Operator, CPOs, trading in Futures contract, futures or other derivative securities. The funds can take both Long (finance), long and Short (finance), short positions in future ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |