|

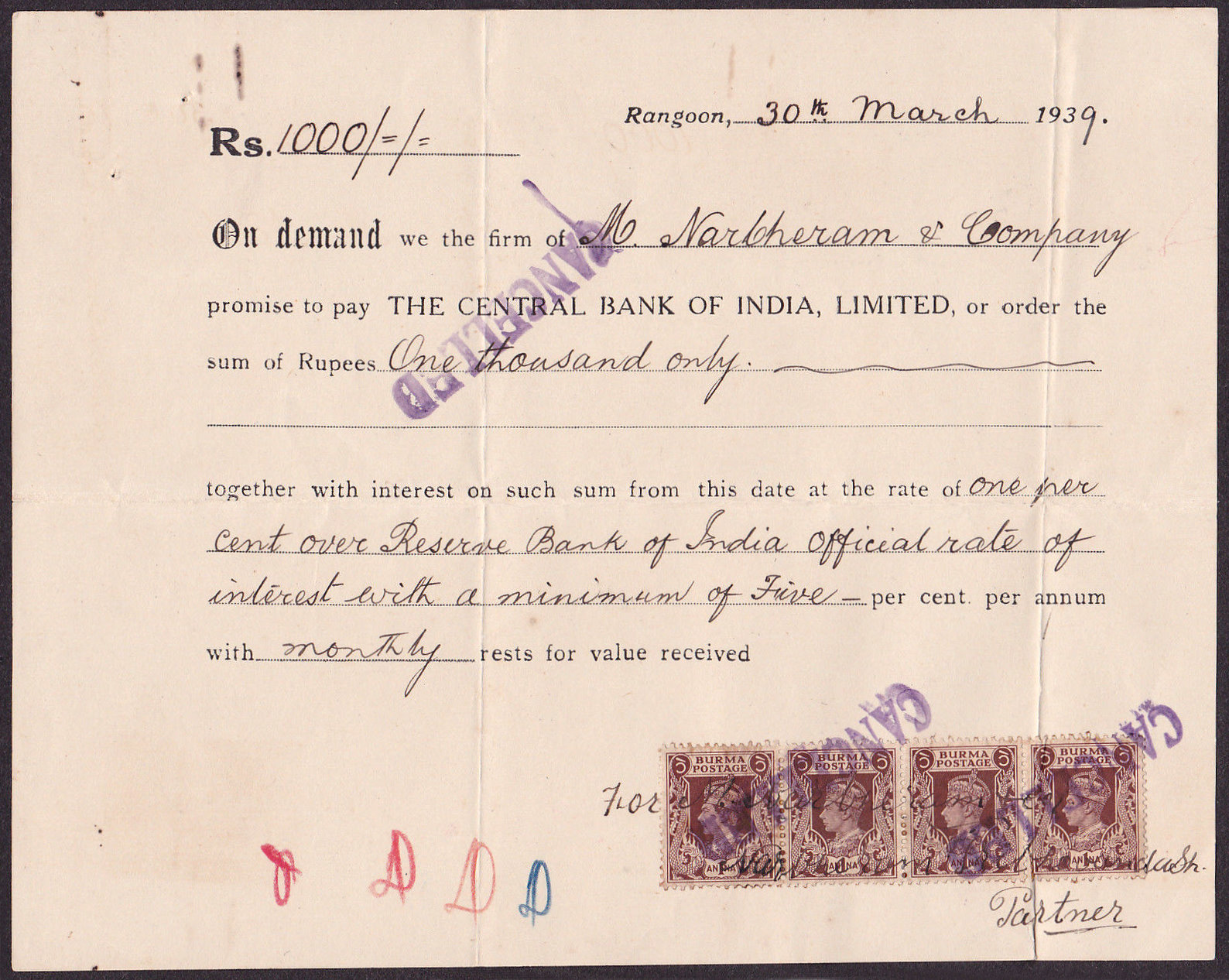

Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchequer

In the Civil Service (United Kingdom), civil service of the United Kingdom, His Majesty's Exchequer, or just the Exchequer, is the accounting process of central government and the government's ''Transaction account, current account'' (i.e., money held from taxation and other government revenues) in the Consolidated Fund. The term is used in various financial documents, including the latest departmental and agency annual accounts. Historically, it was the name of a British government departments, British government department responsible for the collection and the management of taxes and revenues, making payments on behalf of the sovereign, and auditing official accounts. It also developed a judicial role along with its accountancy responsibilities and tried legal cases relating to revenue. Similar offices were later created in Normandy around 1180, in Scotland around 1200 and in Ireland in 1210. Etymology The Exchequer was named after a table used to perform calculations for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payee

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless the partie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debit Card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase. Some debit cards carry a Stored-value card, stored value with which a payment is made (prepaid cards), but most relay a message to the cardholder's bank to withdraw funds from the cardholder's designated bank account. In some cases, the payment card number is assigned exclusively for use on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payor

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless the partie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negotiable Instrument

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings, depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferability, and " instrument" refers to a document giving legal effect by the virtue of the law. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Consideration is p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American And British English Spelling Differences

Despite the various list of dialects of English, English dialects spoken from country to country and within different regions of the same country, there are only slight regional variations in English orthography, the two most notable variations being British and American spelling. Many of Comparison of American and British English, the differences between American English, American and British English, British or English in the Commonwealth of Nations, Commonwealth English date back to a time before spelling standards were developed. For instance, some spellings seen as "American" today were once commonly used in Britain, and some spellings seen as "British" were once commonly used in the United States. A "British standard" began to emerge following the 1755 publication of Samuel Johnson's ''A Dictionary of the English Language'', and an "American standard" started following the work of Noah Webster and, in particular, his ''Webster's Dictionary, An American Dictionary of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transactional Account

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash. Transaction accounts are known by a variety of descriptions, including a current account (British English), chequing account or checking account when held by a bank, share draft account when held by a credit union in North America. In the Commonwealth of Nations, United Kingdom, Hong Kong, India, Ireland, Australia, New Z ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. Money was historically an emergent market phenomenon that possessed intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government or regulatory entity to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar. The money supply of a country comprises all currency in circulation (banknotes and coins currently issued) and, depending on the particular definition used, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bearer Instrument

A bearer instrument is a document that entitles the holder of the document to rights of ownership or title to the underlying property. In the case of shares (bearer shares) or bonds (bearer bonds), they are called bearer certificates. Unlike normal registered instruments, no record is kept of who owns bearer instruments or of transactions involving transfer of ownership, enabling the owner, as well as a purchaser, to deal with the property anonymously. Whoever physically holds the bearer document is assumed to be the owner of the property, and the rights arising therefrom, such as dividends. Bearer instruments are used especially by investors and corporate officers who wish to retain anonymity. The OECD in a 2003 report concluded that the use of bearer shares is "perhaps the single most important (and perhaps the most widely used) mechanism" to protect the anonymity of a ship's beneficial owner.OECD 2003, p. 8. Physically possessing a bearer share accords ownership of the corpo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |