|

Brass Plate Company

A brass plate company or brass plate trust is a legally constituted company lacking meaningful connection with the location of incorporation. The name is based on a company whose only tangible existence in its jurisdiction of incorporation is the nameplate attached to the wall outside its registered office. The registered office is often the same office and address of the local professional service firm(s) or corporate service provider(s) (CSPs), (i.e. legal, accounting or secretarial etc.) who act as local support to the company. Brass plate structures are associated with tax havens, corporate tax havens, and offshore financial centres. Definitions In the landmark ''Inspire Art'' ruling, the ECJ defined a brass plate company (in an EU context) as being a "... company (formed under the laws of a member state) which lacks any real connection with the State of formation ...". The ECJ ruled that, with certain caveats, brass plate companies were legitimate in the EU. The ECJ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Brass Name Plate Inscribed, "HICKMAN" Wellcome L0017049

Brass is an alloy of copper and zinc, in proportions which can be varied to achieve different colours and mechanical, electrical, acoustic and chemical properties, but copper typically has the larger proportion, generally copper and zinc. In use since prehistoric times, it is a substitutional alloy: atoms of the two constituents may replace each other within the same crystal structure. Brass is similar to bronze, a copper alloy that contains tin instead of zinc. Both bronze and brass may include small proportions of a range of other elements including arsenic, lead, phosphorus, aluminium, manganese and silicon. Historically, the distinction between the two alloys has been less consistent and clear, and increasingly museums use the more general term "copper alloy". Brass has long been a popular material for its bright gold-like appearance and is still used for drawer pulls and doorknobs. It has also been widely used to make sculpture and utensils because of its low melting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Irish Section 110 Special Purpose Vehicle (SPV)

An Irish Section 110 special purpose vehicle (SPV) or section 110 company is an Irish tax resident company, which qualifies under ''Section 110'' of the '' Irish Taxes Consolidation Act 1997'' (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties. Section 110 was created in 1997 to help International Financial Services Centre (IFSC) legal and accounting firms compete for the administration of global securitisation deals, and by 2017 was the largest structured finance vehicle in EU securitisation. Section 110 SPVs have made the IFSC the third largest global Shadow Banking OFC. While they pay no Irish tax, they contribute €100 million annually to the Irish economy in fees paid to IFSC legal and accounting firms. In June 2016, it was discovered that US distressed debt funds used Section 110 SPVs, structured by IFSC service firms, to avoid Irish taxes on €80 billion of Irish domestic investments. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Legal Entities

In law, a legal person is any person or legal entity that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for the term "''legal'' person" is that some legal persons are not human persons: companies and corporations (i.e., business entities) are ''persons'', legally speaking (they can legally do most of the things an ordinary person can do), but they are not, in a literal sense, human beings. Legal personhood is a prerequisite to legal capacity (the ability of any legal person to amend – i.e. enter into, transfer, etc. – rights and obligations): it is a prerequisite for an international organization being able to sign international treaties in its own name. History The concept of legal personhood for organizations of people is at least as old as Ancient Rome: a variety of collegial institutions enjoyed the benefit under Roman law. The doctrine has been ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Shell Corporation

A shell corporation is a company or corporation with no significant assets or operations often formed to obtain financing before beginning business. Shell companies were primarily vehicles for lawfully hiding the identity of their beneficial owners, and this is still the defining feature of shell companies due to the loopholes in the global corporate transparency initiatives. It may hold passive investments or be the registered owner of assets, such as intellectual property, or ships. Shell companies may be registered to the address of a company that provides a service setting up shell companies, and which may act as the agent for receipt of legal correspondence (such as an accountant or lawyer). The company may serve as a vehicle for business transactions without itself having any significant assets or operations. Shell companies are used for legitimate purposes but can be used for tax evasion, tax avoidance, money laundering, to dodge current or future lawsuits or to achi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

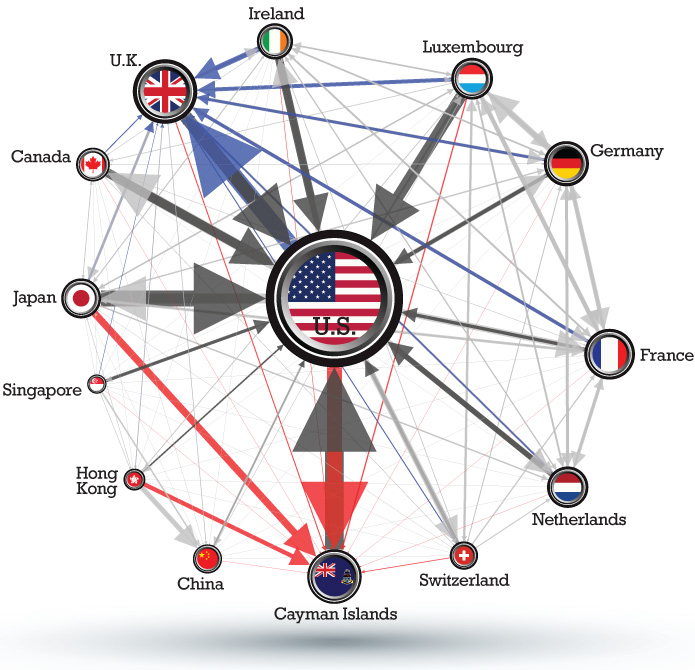

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the Dutch sandwich, and single malt). Corporate tax hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Shadow Banking

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2022, shadow banking held about $63 trillion in financial assets in major jurisdictions around the world, representing 78% of global GDP, up from $28 trillion and 68% of global GDP in 2009. Examples of NBFIs include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. The phrase "shadow banking" is regarded by some as pejorative, and the term "market-based finance" has been proposed as an alternative. Former US Federal Reserve Chair Ben Bernanke provided the following definition in November 2013: Shadow banking has grown in importance to rival traditional depository banking, and was a factor in the subprime mortgage crisis of 2007� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Securitisation

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans, or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Orphan Structure

Orphan structure or Orphan SPV or orphaning are terms used in structured finance closely associated with creating SPVs (" Special Purpose Vehicles") for securitisation transactions where the notional equity of the SPV is deliberately handed over to an unconnected 3rd party who themselves have no control over the SPV; thus the SPV becomes an "orphan" whose equity is controlled by no one. Description In an orphaned SPV, the equity is held by a 3rd party with no legal relationship to the two main parties engaging in the securitisation (the asset user(s), and the lender(s) financing the assets). While this 3rd party legally "owns" the equity of the SPV, the way in which their ownership is structured gives them no control over the SPV. The driver for orphaning is to enable the securitisation transaction to be held off-balance sheet. If the asset users, or the asset lenders, owned (or legally controlled) the SPV equity, then the SPV would be consolidated into their group accounts. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

State Aid (European Union)

State aid in the European Union is the name given to a subsidy or any other aid provided by a government that distorts competition. Under European Union competition law, the term has a legal meaning, being any measure that demonstrates any of the characteristics in Article 107 of the Treaty on the Functioning of the European Union, in that if it distorts competition or the free market, it is classified by the European Union as illegal state aid. Measures that fall within the definition of state aid are considered unlawful unless provided under an exemption or notified by the European Commission. In 2019, the EU member states provided state aid corresponding to 0.81% of the bloc's GDP. EU policy on state aid The Treaty on the Functioning of the European Union (Art. 107, para. 1) reads: "Save as otherwise provided in this Treaty, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |