|

Audit Risk

Audit risk (also referred to as residual risk) as per International Standards on Auditing , ISA 200 refers to the risk that the auditor expresses an inappropriate opinion when the financial statements are materiality misstated. This risk is composed of: *Inherent risk (accounting), Inherent risk (IR), the risk involved in the nature of business or transaction. Example, transactions involving exchange of cash may have higher IR than transactions involving settlement by cheques. The term ''inherent risk'' may have other definitions in other contexts.; *Control risk (CR), the risk that a misstatement may not be prevented or detected and corrected due to weakness in the entity's internal control mechanism. Example, control risk assessment may be higher in an entity where separation of duties is not well defined; and *Detection risk , Detection risk (DR), the probability that the auditing procedures may fail to detect existence of a material error or fraud. Detection risk may be du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Standards On Auditing

International Standards on Auditing (ISA) are professional standards for the auditing of financial information. These standards are issued by the International Auditing and Assurance Standards Board (IAASB). According to Olung M (CAO - L), ISA guides the auditor to add value to the assignment hence building confidence of investors. The standards cover various areas of auditing, including respective responsibilities, audit planning, Internal Control, audit evidence, using the work of other experts, audit conclusions and audit reports, and standards for specialized areas. Use of the ISAs * European Union: The Audit Directive of 17 May 2006 enforces the use of the ''International Standards on Auditing'' for all Statutory audits to be performed in the European Union. The Audit Directive of 17 May 2006 is important in order to ensure a high quality for all statutory audits required by Community law requiring all statutory audits be carried out on the basis of all international ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inherent Risk (accounting)

Inherent risk, in a financial audit, measures the auditor's assessment at the assertion level of the likelihood that there are material misstatements, either individually or in aggregate, due to error or fraud in a class of transactions, account balance or disclosure before considering the effectiveness of internal control. If the auditor concludes that a high likelihood exist, the auditor will conclude that inherent risk is high. Inherent risk is one of two components of the risk of material misstatement i.e. the risk that the financial statements are materiality misstated prior to audit. The other component is control risk. Audit risk Audit risk (also referred to as residual risk) as per International Standards on Auditing , ISA 200 refers to the risk that the auditor expresses an inappropriate opinion when the financial statements are materiality misstated. This risk is comp ... is a function of the risk of material misstatement and detection risk. See also * Inherent ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inherent Risk

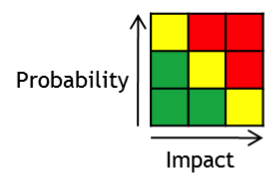

Inherent risk, in risk management, is an assessed level of raw or untreated risk; that is, the natural level of risk inherent in a process or activity without doing anything to reduce the likelihood or mitigate the severity of a mishap, or the amount of risk before the application of the risk reduction effects of controls. Another definition is that inherent risk is the current risk level given the existing set of controls, which may be incomplete or less than ideal, rather than an absence of any controls. Strategic Risk involves risks that affect the organization’s ability to achieve its goals and objectives. Inherent strategic risks could stem from changes in the business environment, competitive pressures, or shifts in consumer preferences. Operational Risk are risks associated with the day-to-day operations of an organization. Inherent operational risks can arise from internal processes, people, systems, or external events that disrupt operations. Financial Risk includes ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Control

Internal control, as defined by accounting and auditing, is a process for assuring of an organization's objectives in operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. A broad concept, internal control involves everything that controls risks to an organization. It is a means by which an organization's resources are directed, monitored, and measured. It plays an important role in detecting and preventing fraud and protecting the organization's resources, both physical (e.g., machinery and property) and intangible (e.g., reputation or intellectual property such as trademarks). At the organizational level, internal control objectives relate to the reliability of financial reporting, timely feedback on the achievement of operational or strategic goals, and compliance with laws and regulations. At the specific transaction level, internal controls refers to the actions taken to achieve a specific objective (e.g., h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Separation Of Duties

Separation of duties (SoD), also known as segregation of duties, is the concept of having more than one person required to complete a task. It is an administrative control used by organisations to prevent fraud, sabotage, theft, misuse of information, and other security compromises. In the political realm, it is known as the separation of powers, as can be seen in democracies where the government is separated into three independent branches: a legislature, an executive, and a judiciary. General description Separation of duties is a key concept of internal controls. Increased protection from fraud and errors must be balanced with the increased cost/effort required. In essence, SoD implements an appropriate level of checks and balances upon the activities of individuals. R. A. Botha and J. H. P. Eloff in the ''IBM Systems Journal'' describe SoD as follows. Separation of duty, as a security principle, has as its primary objective the prevention of fraud and errors. This objective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Detection Risk

Detection Risk (DR) is the risk that the auditor will not detect a misstatement that exists in an assertion that could be material, either individually or when aggregated with other misstatements. In other words, the chance that the auditor will not find material misstatements relating to an assertion in the financial statements through substantive test and analysis. Detection risk results in the auditor's conclusion that no material errors are present where in fact there are. It is a component of audit risk. Detection Risk and quality of audit have an inverse relationship: if detection risk is too high, the lower the quality of the audit and if detection risk is low, generally the quality of the audit increases. References {{reflist See also * Audit risk * Sampling error * Non-sampling error In statistics, non-sampling error is a catch-all term for the deviations of estimates from their true values that are not a function of the sample chosen, including various systematic error ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sampling Error

In statistics, sampling errors are incurred when the statistical characteristics of a population are estimated from a subset, or sample, of that population. Since the sample does not include all members of the population, statistics of the sample (often known as estimators), such as means and quartiles, generally differ from the statistics of the entire population (known as parameters). The difference between the sample statistic and population parameter is considered the sampling error.Sarndal, Swenson, and Wretman (1992), Model Assisted Survey Sampling, Springer-Verlag, For example, if one measures the height of a thousand individuals from a population of one million, the average height of the thousand is typically not the same as the average height of all one million people in the country. Since sampling is almost always done to estimate population parameters that are unknown, by definition exact measurement of the sampling errors will not be possible; however they can often ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sampling Error

In statistics, non-sampling error is a catch-all term for the deviations of estimates from their true values that are not a function of the sample chosen, including various systematic error Observational error (or measurement error) is the difference between a measurement, measured value of a physical quantity, quantity and its unknown true value.Dodge, Y. (2003) ''The Oxford Dictionary of Statistical Terms'', OUP. Such errors are ...s and random errors that are not due to sampling.Dodge, Y. (2003) ''The Oxford Dictionary of Statistical Terms'', OUP. Non-sampling errors are much harder to quantify than sampling errors.Fritz Scheuren (2005). "What is a Margin of Error?", Chapter 10, inWhat is a Survey?", American Statistical Association, Washington, D.C. Accessed 2008-01-08. Non-sampling errors in survey estimates can arise from: * Coverage errors, such as failure to accurately represent all population units in the sample, or the inability to obtain information about all sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-based Auditing

Risk-based auditing is a style of auditing which focuses upon the analysis and management of risk. In the UK, the 1999 Turnbull Report on corporate governance required directors to provide a statement to shareholders of the significant risks to the business. This then encouraged the audit activity of studying these risks rather than just checking compliance with existing controls. Standards for risk management have included the COSO guidelines and the first international standard, AS/NZS 4360. The latter is now the basis for a family of international standards for risk management — ISO 31000. A traditional audit would focus upon the transactions which would make up financial statements such as the balance sheet In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business .... A risk-bas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Federation Of Accountants

The International Federation of Accountants (IFAC) is the global organization for the accountancy profession. Founded in 1977, IFAC has 180 members and associates in 135 jurisdictions, representing more than 3 million accountants in public practice, education, government service, industry, and commerce. The organization supports the development, adoption, and implementation of international standards for accounting education, ethics, and the public sector as well as audit and assurance. It supports four independent standard-setting boards, which establish international standards on ethics Ethics is the philosophy, philosophical study of Morality, moral phenomena. Also called moral philosophy, it investigates Normativity, normative questions about what people ought to do or which behavior is morally right. Its main branches inclu ..., auditing and assurance, accounting education, and public sector accounting. It also issues guidance to professional accountants in small and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auditing

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon." Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, roll forward prior year working papers, and evaluate the propositions in their auditing report. Audits provide third-party assurance to various stakeholders that the subject matter is free from material misstatement. The term is most frequently applied to audits of the financial information relating to a legal person. Other commonly audited areas include: secretarial and compliance, internal controls, quality management, project management, water management, and energy conservation. As a result of an audit, stakeholders may evaluate and improve the effectiveness of ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |