|

Additional Insured

In insurance policies, an additional insured is a person or organization who enjoys the benefits of being insured under an insurance policy, in addition to whoever originally purchased the insurance policy. The term generally applies within liability insurance and property insurance, but is an element of other policies as well. Most often it applies where the original named insured needs to provide insurance coverage to additional parties so that they enjoy protection from a new risk that arises out of the original named insured's conduct or operations. An additional insured often gains this status by means of an endorsement added to the policy which either identifies the additional party by name or by a general description contained in a "blanket additional insured endorsement". For instance, in vehicle insurance a typical Personal Auto Policy with additional insured provisions will cover not only the original named insured that purchased the auto policy, but will also cover addit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

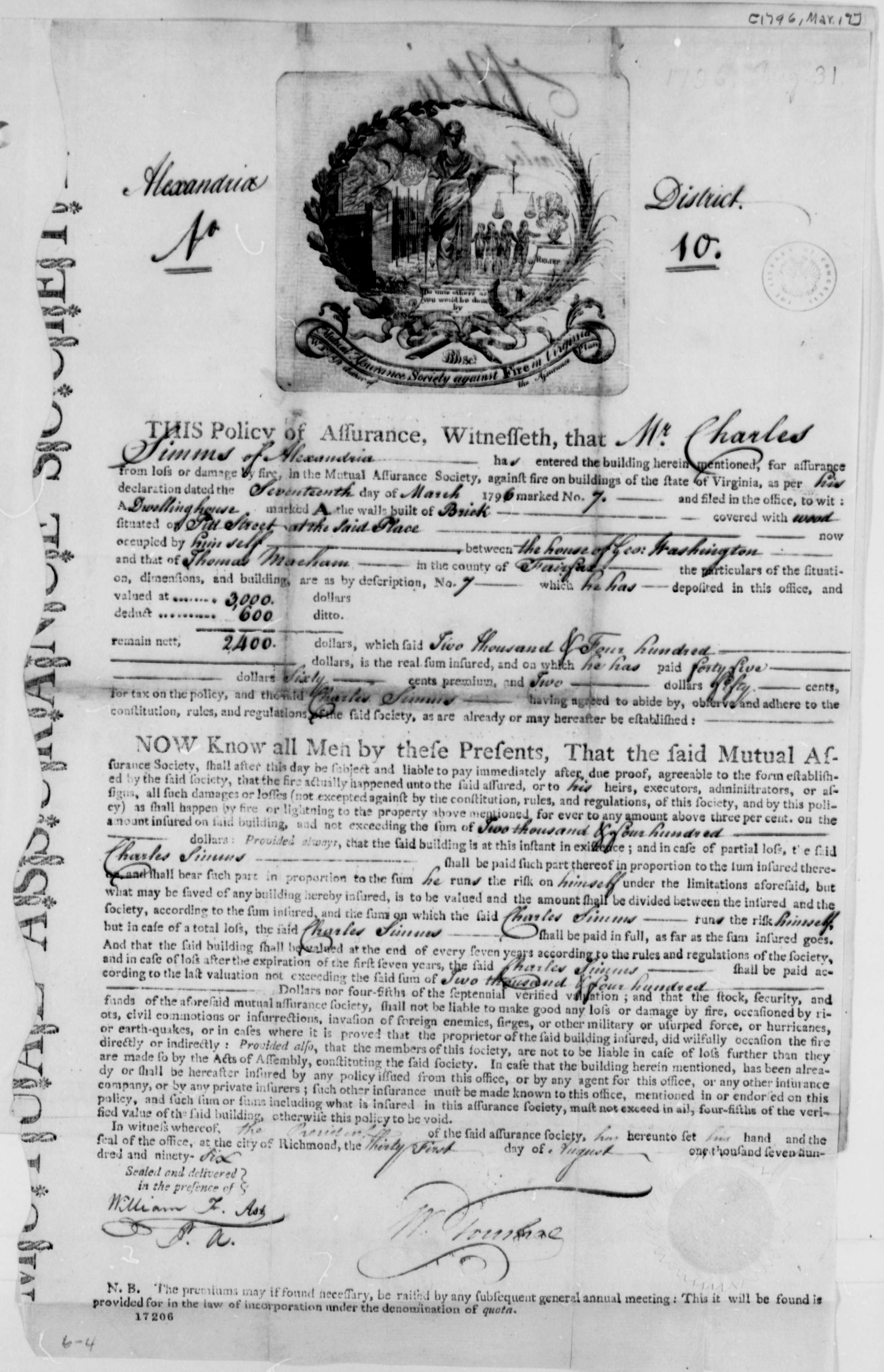

Insurance Policies

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Insurance contracts are designed to meet specific needs and thus have many features not found in many other types of contracts. Since insurance policies are standard forms, they feature boilerplate language which is similar across a wide variety of different types of insurance policies. Available through HeinOnline. The insurance policy is generally an integrated contract, meaning that it includes all forms associated with the agreement between the insured and insurer.Wollner KS. (1999). How to Draft and Interpret Insurance Policies. Casualty Risk Publishing LLC. In some cases, however, supplementary writings such as letters sent after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liability Insurance

Liability insurance (also called third-party insurance) is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. Originally, individual companies that faced a common '' peril'' formed a group and created a self-help fund out of which to pay compensation should any member incur loss (in other words, a mutual insurance arrangement). The modern system relies on dedicated carriers, usually for-profit, to offer protection against specified perils in consideration of a premium. Liability insurance is designed to offer specific protection against third-party insurance claims, i.e., payment is not typically made to the insured, but rather to someone suffering loss who is not a party to the insurance contract. In general, damage caused intentionally as well as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Policy

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claim (legal), claims which the insurer is law, legally required to pay. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Insurance contracts are designed to meet specific needs and thus have many features not found in many other types of contracts. Since insurance policies are standard forms, they feature boilerplate (text), boilerplate language which is similar across a wide variety of different types of insurance policies. Available through HeinOnline. The insurance policy is generally an integrated contract, meaning that it includes all forms associated with the agreement between the insured and insurer.Wollner KS. (1999). How to Draft and Interpret Insurance Policies. Casualty Risk Publishing LLC. In some cases, however, supplementary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vehicle Insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for automobile, cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against legal liability, liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against Motor vehicle theft, theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as vandalism, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region. History Widespread use of the motor car began after the First World War in urban areas. Cars were relatively fast and dangerous by that stage, yet there was still no compulsory form of car insurance anywhere in the world. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

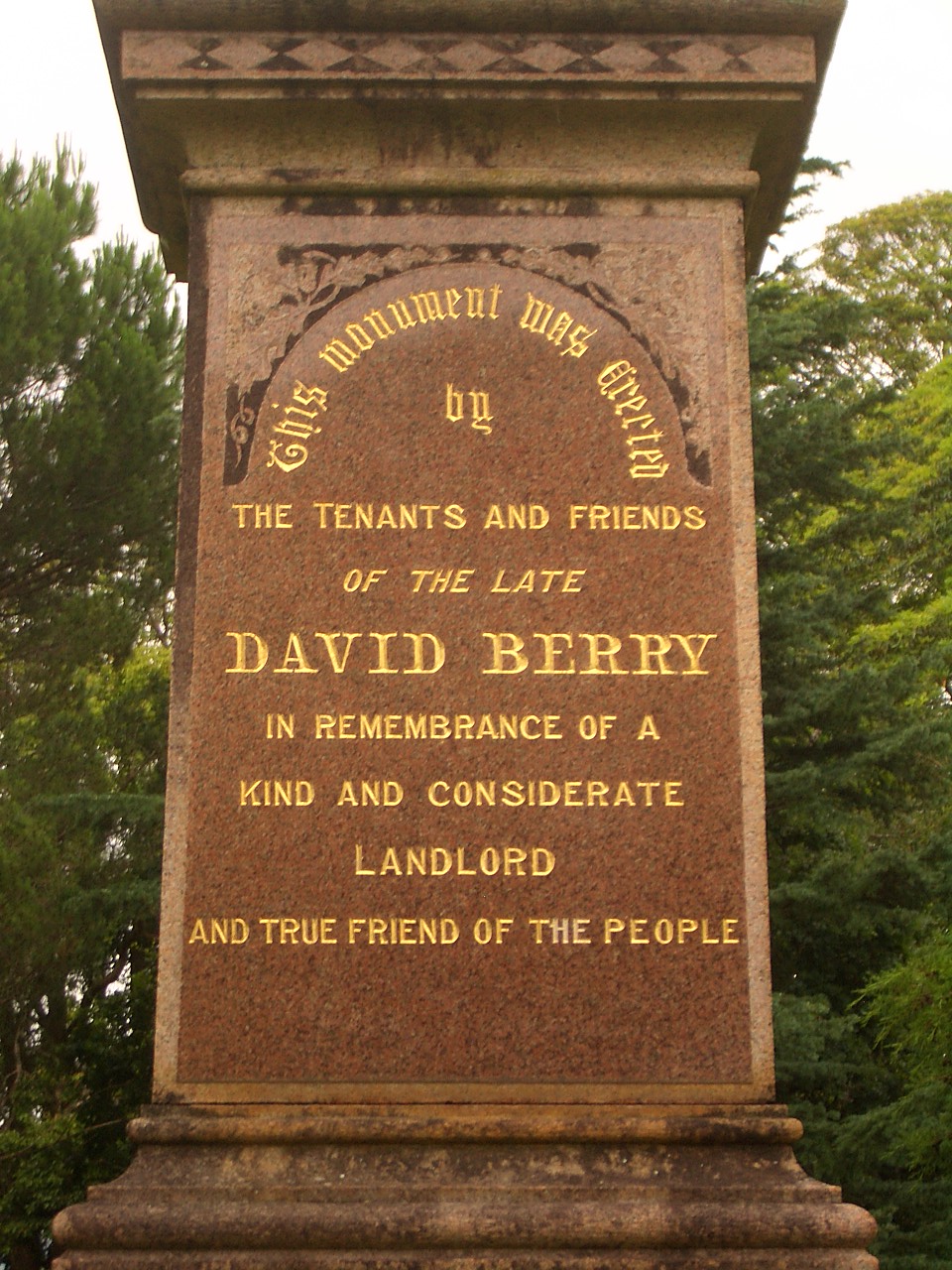

Landlord

A landlord is the owner of property such as a house, apartment, condominium, land, or real estate that is rented or leased to an individual or business, known as a tenant (also called a ''lessee'' or ''renter''). The term landlord applies when a juristic person occupies this position. Alternative terms include lessor and owner. For female property owners, the term landlady may be used. In the United Kingdom, the manager of a pub, officially a licensed victualler, is also referred to as the landlord/landlady. In political economy, landlord specifically refers to someone who owns natural resources (such as land, excluding buildings) from which they derive economic rent, a form of passive income. History The concept of a landlord can be traced to the feudal system of manoralism ( seignorialism), where landed estates were owned by Lords of the Manor ( mesne lords). These lords were typically members of the lower nobility who later formed the rank of knights during ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Building

Commercial may refer to: * (adjective for) commerce, a system of voluntary exchange of products and services ** (adjective for) trade, the trading of something of economic value such as goods, services, information or money * a dose of advertising conveyed through media (such as radio or television) ** Radio advertisement ** Television advertisement * Two functional constituencies in elections for the Legislative Council of Hong Kong: **Commercial (First) **Commercial (Second) * ''Commercial'' (album), a 2009 album by Los Amigos Invisibles * Commercial broadcasting * Commercial style or early Chicago school, an American architectural style * Commercial Drive, Vancouver, a road in Vancouver, British Columbia, Canada * Commercial Township, New Jersey, in Cumberland County, New Jersey See also * * Comercial (other), Spanish and Portuguese word for the same thing * Commercialism Commercialism is the application of both manufacturing and consumption towards personal usag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leasehold Estate

A leasehold estate is an ownership of a temporary right to hold land or property in which a lessee or a tenant has rights of real property by some form of title from a lessor or landlord. Although a tenant does hold rights to real property, a leasehold estate is typically considered personal property. Leasehold is a form of land tenure or property tenure where one party buys the right to occupy land or a building for a given time. As a lease is a legal estate, leasehold estate can be bought and sold on the open market. A leasehold thus differs from a freehold or fee simple where the ownership of a property is purchased outright and after that held for an indeterminate length of time, and also differs from a tenancy where a property is let (rented) periodically such as weekly or monthly. Terminology and types of leasehold vary from country to country. Sometimes, but not always, a residential tenancy under a lease agreement is colloquially known as renting. The leaseholder can r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Contractor

A contractor (North American English) or builder (British English), is responsible for the day-to-day oversight of a construction site, management of vendors and trades, and the communication of information to all involved parties throughout the course of a building project. In the United States, a contractor may be a sole proprietor managing a project and performing labor or carpentry work, have a small staff, or may be a very large company managing billion dollar projects. Some builders build new homes, some are remodelers, some are developers. Description A general contractor is a construction manager employed by a client, usually upon the advice of the project's architect or engineer. General Contractors are mainly responsible for the overall coordination of a project and may also act as building designer and construction foreman (a tradesman in charge of a crew). A general contractor must first assess the project-specific documents (referred to as a bid, proposal, or tend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Of Loss

Risk of loss is a term used in the law of contracts to determine which party should bear the burden of risk for damage occurring to goods after the sale has been completed, but before delivery has occurred. Such considerations generally come into play after the contract is formed but before buyer receives goods, something bad happens. Under the Uniform Commercial Code (UCC), there are four risk of loss rules, in order of application: # Agreement - the agreement of the parties controls # Breach - the breaching party is liable for any uninsured loss even though breach is unrelated to the problem. Hence, if the breach is the time of delivery, ''and'' the goods show up broken, then the breaching rule applies risk of loss on the seller. # Delivery by common carrier other than by seller. ##Risk of loss shifts from seller to buyer at the time that seller completes its delivery obligations ##If it is a destination contract ( FOB (buyer's city)), then risk of loss is on the seller. ##If it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Product Liability

Product liability is the area of law in which manufacturers, distributors, suppliers, retailers, and others who make products available to the public are held responsible for the injuries those products cause. Although the word "product" has broad connotations, product liability as an area of law is traditionally limited to products in the form of tangible personal property. Product liability by country The overwhelming majority of countries have strongly preferred to address product liability through legislative means. Online access to this source requires a subscription to JSTOR or the Oxford Academic database operated by Oxford University Press. In most countries, this occurred either by enacting a separate product liability act, adding product liability rules to an existing civil code, or including strict liability within a comprehensive Consumer Protection Act. In the United States, product liability law was developed primarily through case law from state courts as w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |