|

UK Commercial Law

United Kingdom commercial law is the law which regulates the sale and purchase of goods and services, when doing business in the United Kingdom. History *Lex Mercatoria *Hanseatic league *Guild *Mercantilism * Freedom of contract *''Laissez faire'' Foundations Personal property *Real property and personal property *Ownership * Equitable ownership * Possession * Attornment *Bailment Contracts * Commercial contracts Agency In the case of '' Watteau v Fenwick'', Lord Coleridge CJ on the Queen's Bench concurred with an opinion by Wills J that a third party could hold personally liable a principal who he did know about when he sold cigars to an agent that was acting outside of its authority. Wills J held that "the principal is liable for all the acts of the agent which are within the authority usually confided to an agent of that character, notwithstanding limitations, as between the principal and the agent, put upon that authority." This decision is heavily criticised and dou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

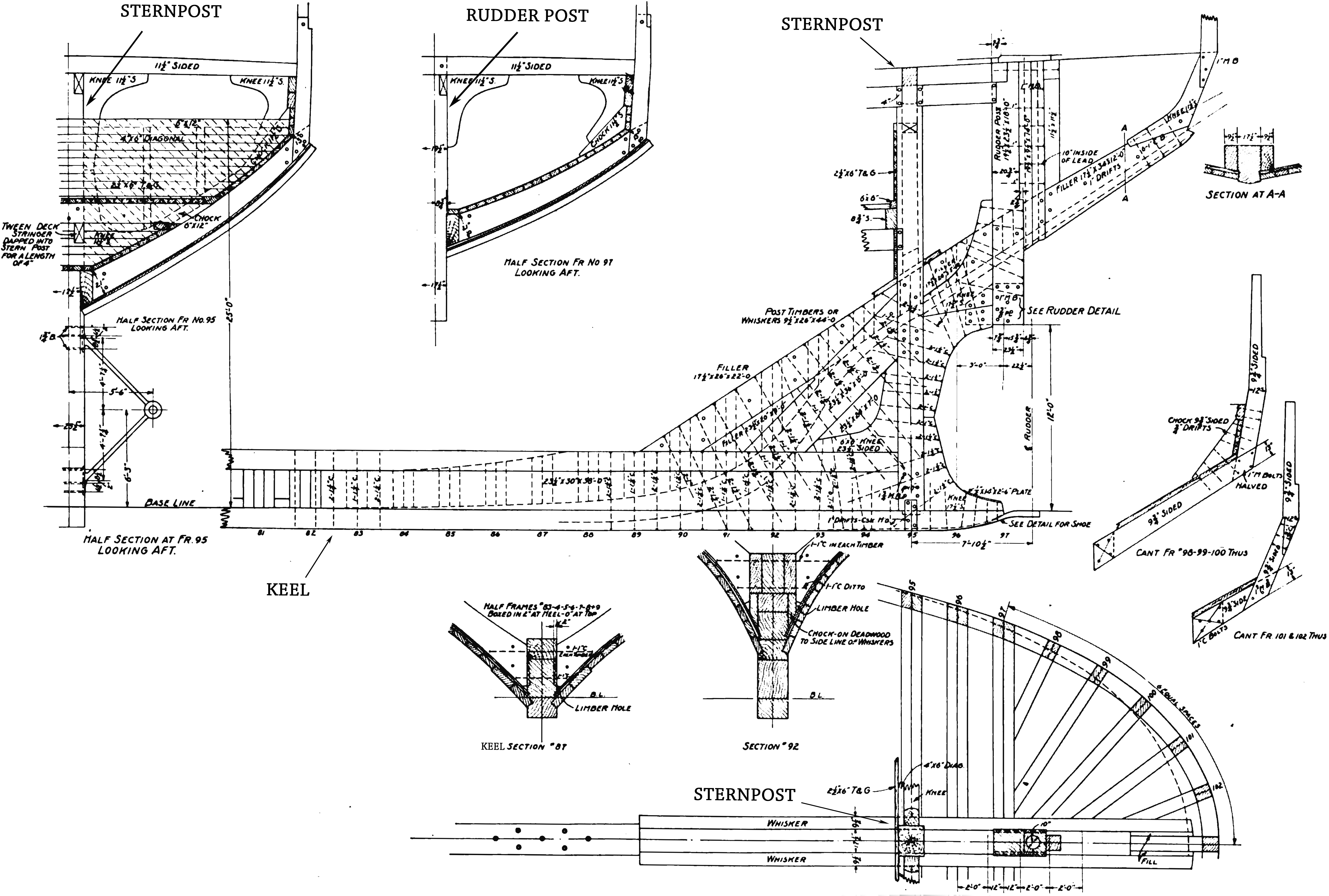

Stern Of The Colombo Express

The stern is the back or aft-most part of a ship or boat, technically defined as the area built up over the sternpost, extending upwards from the counter rail to the taffrail. The stern lies opposite the bow, the foremost part of a ship. Originally, the term only referred to the aft port section of the ship, but eventually came to refer to the entire back of a vessel. The stern end of a ship is indicated with a white navigation light at night. Sterns on European and American wooden sailing ships began with two principal forms: the ''square'' or ''transom'' stern and the ''elliptical'', ''fantail'', or ''merchant'' stern, and were developed in that order. The hull sections of a sailing ship located before the stern were composed of a series of U-shaped rib-like frames set in a sloped or "cant" arrangement, with the last frame before the stern being called the ''fashion timber(s)'' or ''fashion piece(s)'', so called for "fashioning" the after part of the ship. This frame is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Watteau V Fenwick

''Watteau v Fenwick'' 8931 QB 346 is an 1893 English case decided by the Queen's Bench. The case addresses the liability of an undisclosed principal. The plaintiff, Watteau, supplied cigars to a beer house named the "Victoria," which was located at Middlesbrough. The establishment was operated by a man named Humble. Prior to 1888, he had operated the business on his own account, but in that year, he had assigned his interest to the defendants, Messrs. Fenwick and Company. However, Humble remained the manager and continued to operate the business as before. The sign bore his name, and the license was held in his name. The plaintiff supplied cigars and bovril to Humble. He was at all times unaware of Fenwick's involvement. Indeed, Fenwick had never given Humble any authority to act on their behalf. But when Watteau was not paid the 25 pounds owed him, he eventually sued Fenwick. The County Court held that the defendants had held Humble out to the world as having general auth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Alongside Ship

The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. Incoterms define the responsibilities of exporters and importers in the arrangement of shipments and the transfer of liability involved at various stages of the transaction. They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment System

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible.Biago Bossone and Massimo Cirasino, "The Oversight of the Payment Systems: A Framework for the Development and Governance of Payment Systems in Emerging Economies"The World Bank, July 2001, p.7 A payment system is an operational network which links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions. This consists of a major service provided by banks and other financial institutions. Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, with semantic variations across jurisdictions. By and large, banking regulation and supervision aims at ensuring that banks are safe and sound and at fostering market transparency between banks and the individuals and corporations with whom they conduct business. Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient ("safe and sound") so as to reduce the likelihood and impact of bank failures that may trigger systemic risk. Prudential regulation and supervision requires banks to control risks and hold adequate capital as defined by capital requirements, liquidity requirements, the imposition of concentration risk (or large exposures) limits, and related reporting and public di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Of Exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings, depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferability, and "Legal instrument, instrument" refers to a document giving legal effect by the virtue of the law. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UNCITRAL Model Law On International Commercial Arbitration

The UNCITRAL Model Law on International Commercial Arbitration is a model law prepared and adopted by the United Nations Commission on International Trade Law (UNCITRAL) on 21 June 1985. In 2006, it was amended and now includes more detailed provisions on interim measures. The model law is not binding, but individual states may adopt the model law by incorporating it into their domestic law (as, for example, Australia Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ... did, in the International Arbitration Act 1974, as amended). The model law was published in English and in French. Translations in all six United Nations languages now exist. Note that there is a difference between the UNCITRAL ''Model Law'' on International Commercial Arbitration (1985) and the UNCITRAL ''Arbitr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Nations Convention On Contracts For The International Sale Of Goods

The United Nations Convention on Contracts for the International Sale of Goods (CISG), sometimes known as the Vienna Convention, is a multilateral treaty that establishes a uniform framework for international commerce.Not to be confused with other treaties signed in Vienna. As of December 2023, it has been ratified by 97 countries, representing two-thirds of world trade. The CISG facilitates international trade by removing legal barriers among state parties (known as "Contracting States") and providing uniform rules that govern most aspects of a commercial transaction, such as contract formation, the means of delivery, parties' obligations, and remedies for breach of contract. Unless expressly excluded by the contract, the convention is automatically incorporated into the domestic laws of Contracting States and applies directly to a transaction of goods between their nationals. The CISG is rooted in two earlier international sales treaties first developed in 1930 by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Protection (Distance Selling) Regulations 2000

The Consumer Protection (Distance Selling) Regulations 2000, SI 2000/2334, implementedEnacted pursuant to European Communities Act 1972 European Directivebr>97/7/ECas UK law.By Regulation 3(2) it is implied they apply in Scotland, and by 1(2) they are expressly extended to Northern Ireland. They applied to contracts "concluded between a supplier and a consumer under an organised distance sales or services provision scheme run by the supplier who, for the purposes of the contract, makes use of one or more means of distance communication" up to and including the moment the contract is agreed.Reg 3(1) The legislation provided rights to the consumer and obligations which the seller must fulfill. Typical cases where the regulations apply include goods or services ordered by telephone or over the Internet. The regulations were revoked in June 2014 by the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013, which in many respects, however, are simil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unfair Contract Terms Act 1977

The Unfair Contract Terms Act 1977 (c. 50) is an act of Parliament of the United Kingdom which regulates contracts by restricting the operation and legality of some contract terms. It extends to nearly all forms of contract and one of its most important functions is limiting the applicability of disclaimers of liability. The terms extend to both actual contract terms and notices that are seen to constitute a contractual obligation. The Act renders terms excluding or limiting liability ineffective or subject to reasonableness, depending on the nature of the obligation purported to be excluded and whether the party purporting to exclude or limit business liability, acting against a ''consumer''. It is normally used in conjunction with the Unfair Terms in Consumer Contracts Regulations 1999 ( Statutory Instrument 1999 No. 2083), as well as the Sale of Goods Act 1979 and the Supply of Goods and Services Act 1982. The Law Commission and the Scottish Law Commission have recomme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |