|

Transfer Pricing

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Joint Transfer Pricing Forum

The 'EU Joint Transfer Pricing Forum'' (EUJTPF) was set up in 2002 from an EU communication on eliminating transfer pricing from the EU (in which it was called the "Joint Forum on Transfer Pricing"). It was to be composed of "Member States and business representatives". The business (non-government) members of the forum (as of 6 Oct 2013) comprises 16 people Eight of these are transfer pricing advisors (including the Chair), and eight are tax A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ... specialists in multinationals. References Taxation in the European Union {{business-org-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arm’s Length Principle

The arm's length principle (ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction". It is used specifically in contract law to arrange an agreement that will stand up to legal scrutiny, even though the parties may have shared interests (e.g., employer-employee) or are too closely related to be seen as completely independent (e.g., the parties have familial ties). An arm's length relationship is distinguished from a fiduciary relationship, where the parties are not on an equal footing, but rather, power and information asymmetries exist. It is also one of the key elements in international taxation as it allows an adequate allocation of profit taxation rights among countries that conclude double tax conventions, through transfer pricing, among each other. Transfer pricing and the arm's length principle was one of the focal points of the Base Erosion and Profit Shif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

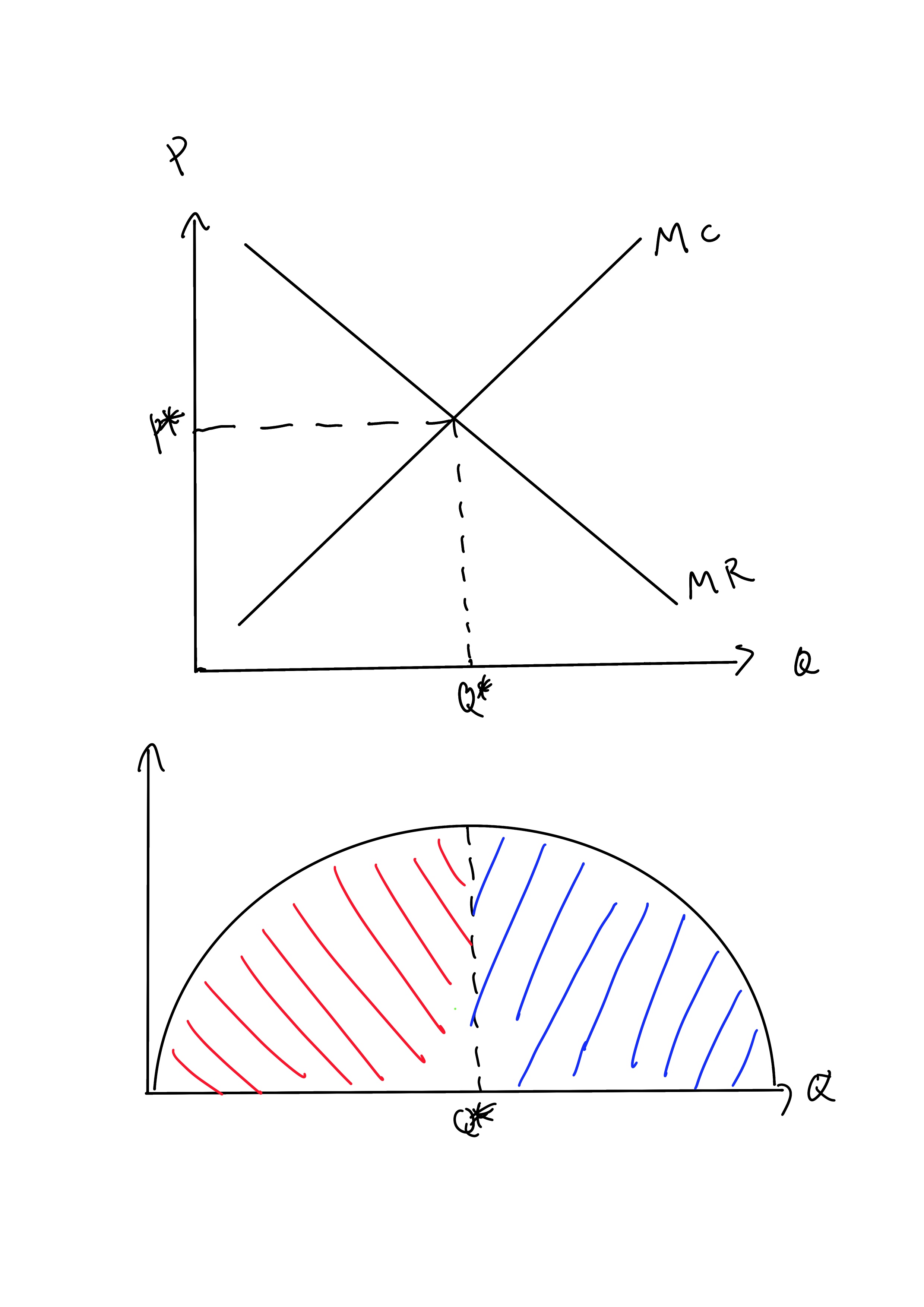

Profit Maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take a more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Revenue

Marginal revenue (or marginal benefit) is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit.Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., 1991.Edwin Mansfield, "Micro-Economics Theory and Applications, 3rd Edition", New York and London:W.W. Norton and Company, 1979.Roger LeRoy Miller, "Intermediate Microeconomics Theory Issues Applications, Third Edition", New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988.John Black, "Oxford Dictionary of Economics", New York: Oxford University Press, 2003. To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production. Marginal revenue is a fundamental too ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Utility

In economics, utility is the satisfaction or benefit derived by consuming a product. The marginal utility of a Goods (economics), good or Service (economics), service describes how much pleasure or satisfaction is gained by consumers as a result of the increase or decrease in Consumption (economics), consumption by one unit. There are three types of marginal utility. They are positive, negative, or zero marginal utility. For instance, you like eating pizza, the second piece of pizza brings you more satisfaction than only eating one piece of pizza. It means your marginal utility from purchasing pizza is positive. However, after eating the second piece you feel full, and you would not feel any better from eating the third piece. This means your marginal utility from eating pizza is zero. Moreover, you might feel sick if you eat more than three pieces of pizza. At this time, your marginal utility is negative. In other words, a negative marginal utility indicates that every unit of good ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pricing

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of product. Pricing is a fundamental aspect of product management and is one of the four Ps of the marketing mix, the other three aspects being product, promotion, and place. Price is the only revenue generating element amongst the four Ps, the rest being cost centers. However, the other Ps of marketing will contribute to decreasing price elasticity and so enable price increases to drive greater revenue and profits. Pricing can be a manual or automatic process of applying prices to purchase and sales orders, based on factors such as: a fixed amount, quantity break, promotion or sales campaign, specific vendor quote, price prevailing o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

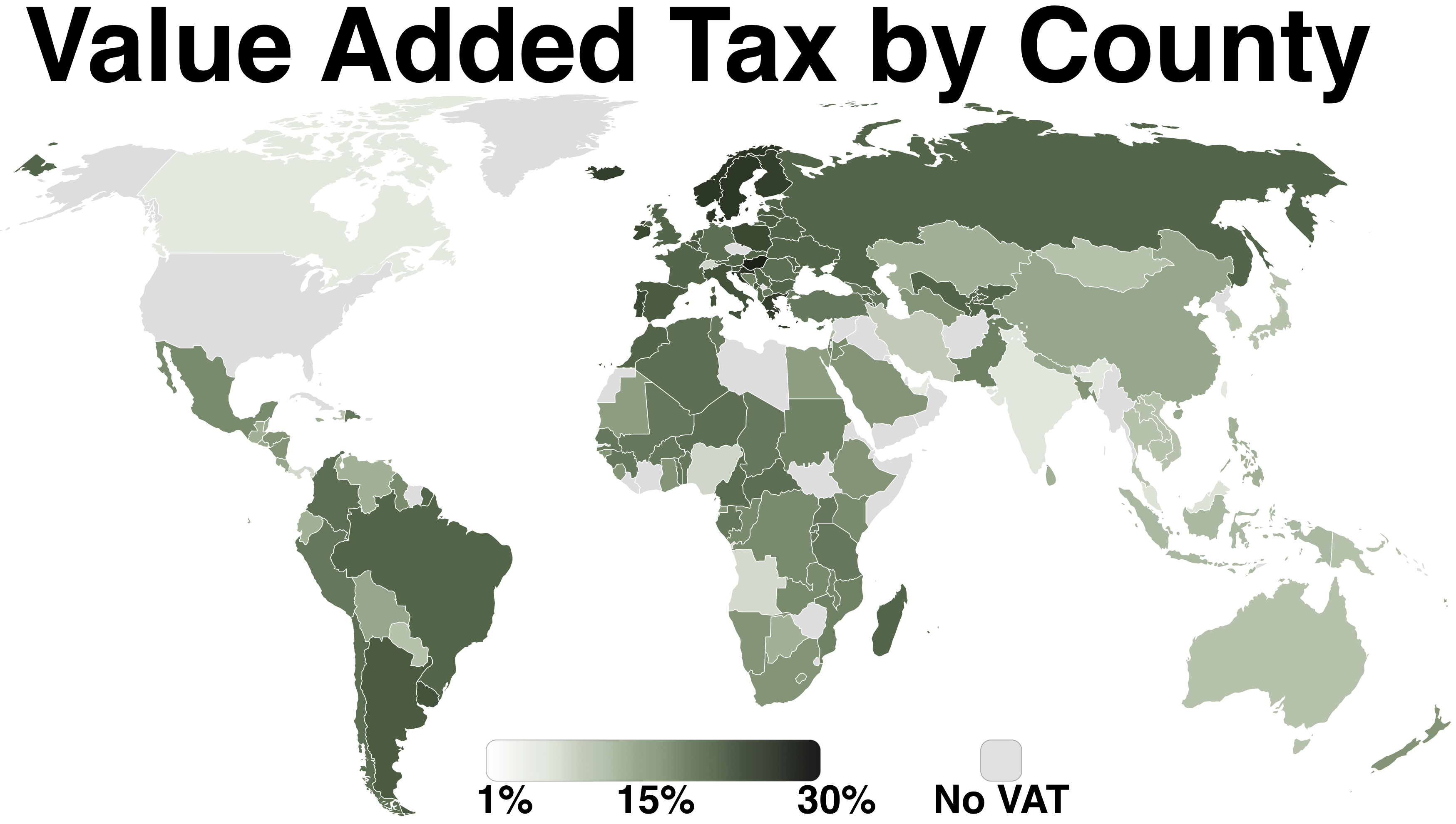

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs Duties

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Import Quotas

An import quota is a type of trade restriction that sets a physical limit on the quantity of a good that can be imported into a country in a given period of time. Quotas, like other trade restrictions, are typically used to benefit the producers of a good in that economy (protectionism). Quota share The quota share is a specified number or percentage of the allotment as a whole quota, that is prescribed to each individual entity. For example, the United States imposes an import quota on cars from Japan. The Japanese government may see fit to impose a quota share program to determine the number of cars each Japanese car manufacturer may export to the United States. Any extra number that a manufacturer wishes to export must be negotiated with another manufacturer that did not or cannot maximize its share of the quota. There are also quota share insurance programs, where the liability and the premiums are divided proportionally among the insurers. For example, three companies take o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)

.png)