|

Taxation In Turkey

Taxation is an important part in the Turkish economy. Turkey has a 41.65% tax to GDP ratio (in 2021). Most of the taxes are levied by central government. However some specific taxes are levied by municipalities, with the amount determined by centrally issued legislation. Municipalities have no authority to make their own tax laws. Tax Procedure Law Taxation system in Turkey is regulated by the Tax Procedure (TP) Law. It regulates the rights, burdens, carrying out duties along with principals of accrual. This law consist of procedural and official provisions of all tax laws. The TP has five main sections: taxation, taxpayer duties, valuation, penalty provisions and tax cases. Taxes The Turkish tax legislation can be divided into three main categories: # Income taxes # Taxes on expenditure # Taxes on wealth Income taxes The Turkish tax legislation has two types of income taxes, the individual income tax and corporate income tax. Many rules and provisions are the same for ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Turkey

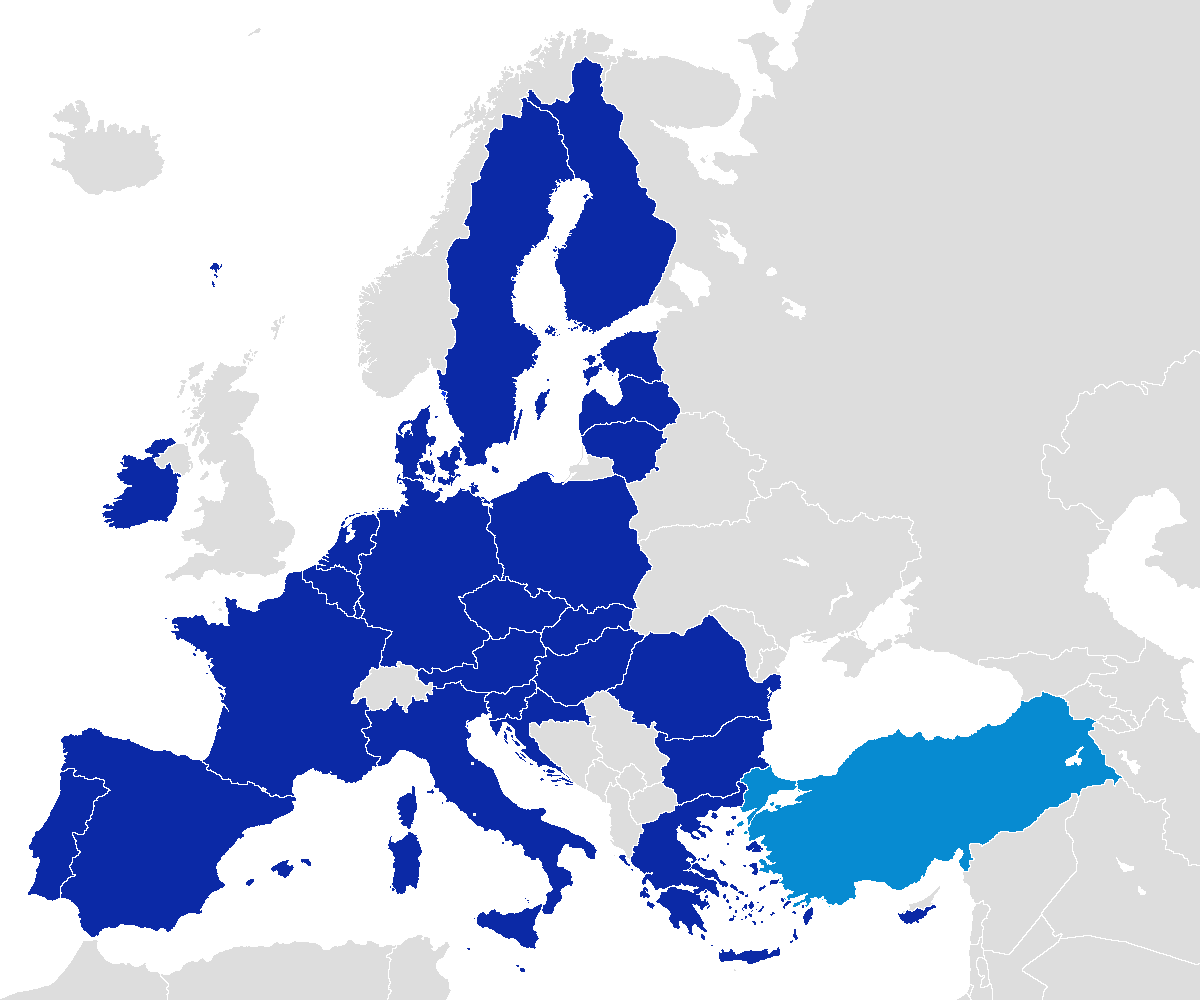

The economy of Turkey is an Emerging market, emerging free-market economy. It ranked as the List of countries by GDP (nominal), 16th-largest in the world and List of sovereign states in Europe by GDP (nominal), 7th-largest in Europe by nominal GDP in 2025. It also ranked as the List of countries by GDP (PPP), 12th-largest in the world and 5th-largest in Europe by purchasing power parity, PPP in 2025. Turkey's 2000s Turkish economic boom, rapid economic growth since the 2000s was stranded by the Turkish economic crisis (2018–current), economic crisis in 2018, but it began to recover in 2021. Turkey's United States dollar, USD-based nominal GDP per capita and GDP-PPP per capita have eventually reached their all-time peak values in 2024. Turkey is a founding member of the OECD and G20. Ratified in 1995, the European Union–Turkey Customs Union has established a European Union Customs Union, free trade area between Turkey and the European Union, which has increased bilateral foreig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the Member states of the United Nations, 193 countries with UN membership employ a VAT, including all OECD members except the Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Varlık Vergisi

The Varlık Vergisi (, "wealth tax" or "capital tax") was a tax mostly levied on non-Muslim citizens under the Republican People's Party (CHP) government in Turkey in 1942, with the stated aim of raising funds for the country's defense in case of an eventual entry into World War II. The underlying reason for the tax was to inflict financial ruin on the minority Dhimmi, non-Muslim citizens of the country, end their prominence in the country's economy and transfer the assets of non-Muslims to the Muslim bourgeoisie. It was a discriminatory measure which taxed non-Muslims up to ten times more heavily and resulted in a significant amount of wealth and property being transferred to Muslims. Background The Şükrü Saracoğlu government introduced a bill for a one-off tax, which was approved by the Turkish Grand National Assembly, Turkish parliament on November 11, 1942. This tax targeted fixed assets, including landed estates, buildings, businesses, and industrial enterprises owned by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Turkey

Taxation is an important part in the Turkish economy. Turkey has a 41.65% tax to GDP ratio (in 2021). Most of the taxes are levied by central government. However some specific taxes are levied by municipalities, with the amount determined by centrally issued legislation. Municipalities have no authority to make their own tax laws. Tax Procedure Law Taxation system in Turkey is regulated by the Tax Procedure (TP) Law. It regulates the rights, burdens, carrying out duties along with principals of accrual. This law consist of procedural and official provisions of all tax laws. The TP has five main sections: taxation, taxpayer duties, valuation, penalty provisions and tax cases. Taxes The Turkish tax legislation can be divided into three main categories: # Income taxes # Taxes on expenditure # Taxes on wealth Income taxes The Turkish tax legislation has two types of income taxes, the individual income tax and corporate income tax. Many rules and provisions are the same for ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |