|

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. * Let t be the total tax liability. * Let i be the total tax base. ::= \frac. In a proportional tax, the tax rate is fixed and the average tax rate equals this tax rate. In case of tax brackets, commonly used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ratio

In mathematics, a ratio shows how many times one number contains another. For example, if there are eight oranges and six lemons in a bowl of fruit, then the ratio of oranges to lemons is eight to six (that is, 8:6, which is equivalent to the ratio 4:3). Similarly, the ratio of lemons to oranges is 6:8 (or 3:4) and the ratio of oranges to the total amount of fruit is 8:14 (or 4:7). The numbers in a ratio may be quantities of any kind, such as counts of people or objects, or such as measurements of lengths, weights, time, etc. In most contexts, both numbers are restricted to be Positive integer, positive. A ratio may be specified either by giving both constituting numbers, written as "''a'' to ''b''" or "''a'':''b''", or by giving just the value of their quotient Equal quotients correspond to equal ratios. Consequently, a ratio may be considered as an ordered pair of numbers, a Fraction (mathematics), fraction with the first number in the numerator and the second in the denom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

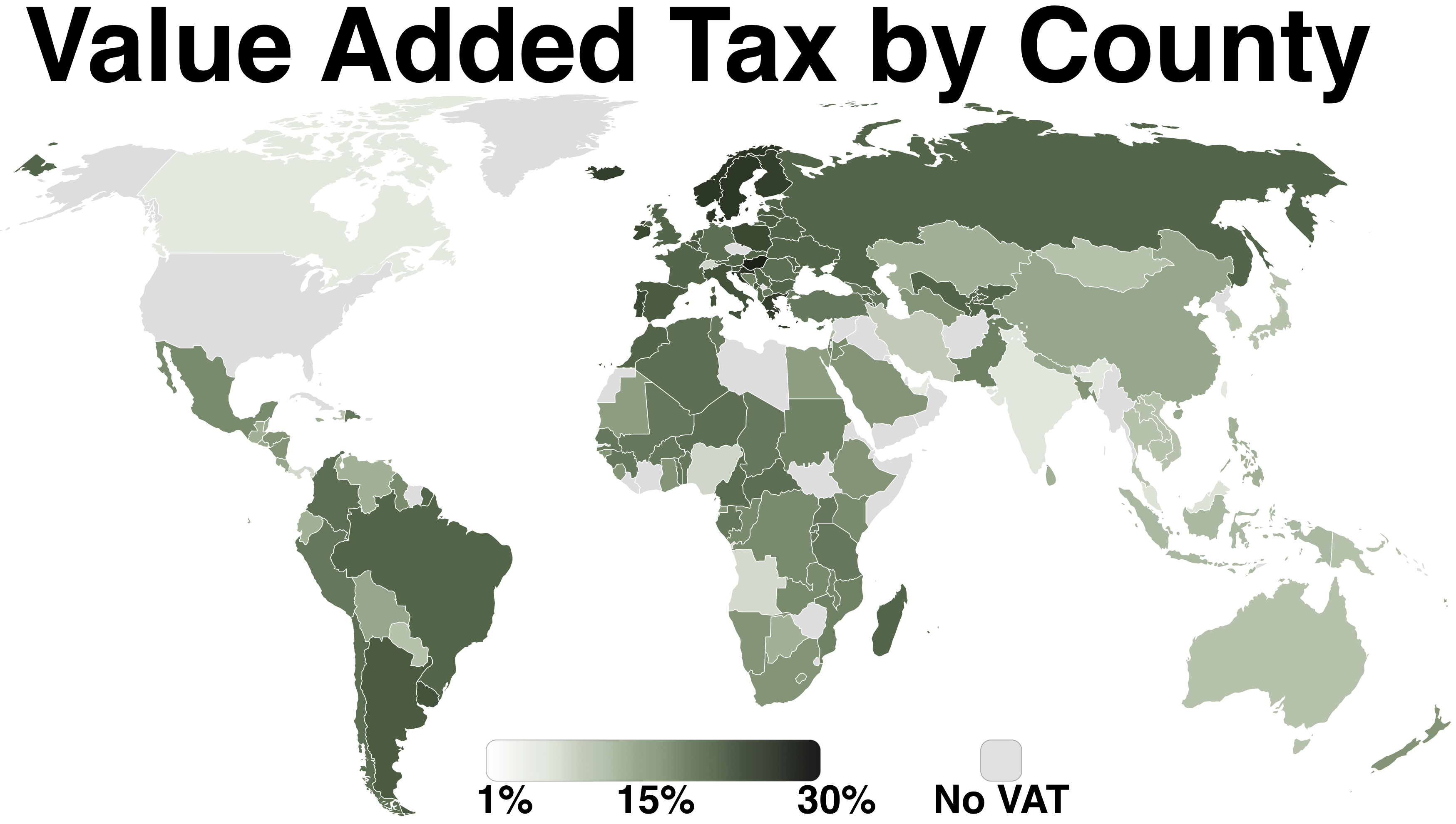

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rates Of Europe

This is a list of the maximum potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country. Graphs File:Top Marginal Tax Rates In Europe.webp, Top Marginal Tax Rates In Europe 2022 10% 20% 30% 40% 50% 60% File:Payroll and income tax by country.png, Payroll and income tax by OECD Country (2013) File:Federal Sales Taxes.png, Federal Sales Taxes Summary list The quoted income tax rate is, except where noted, the top rate of tax: most jurisdictions have lower rate of taxes for low levels of income. Some countries also have lower rates of corporation tax for smaller companies. In 1980, the top rates of most European countries were above 60%. Today most European countries have rates below 50%. Per country information: income tax bands Austria Austria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

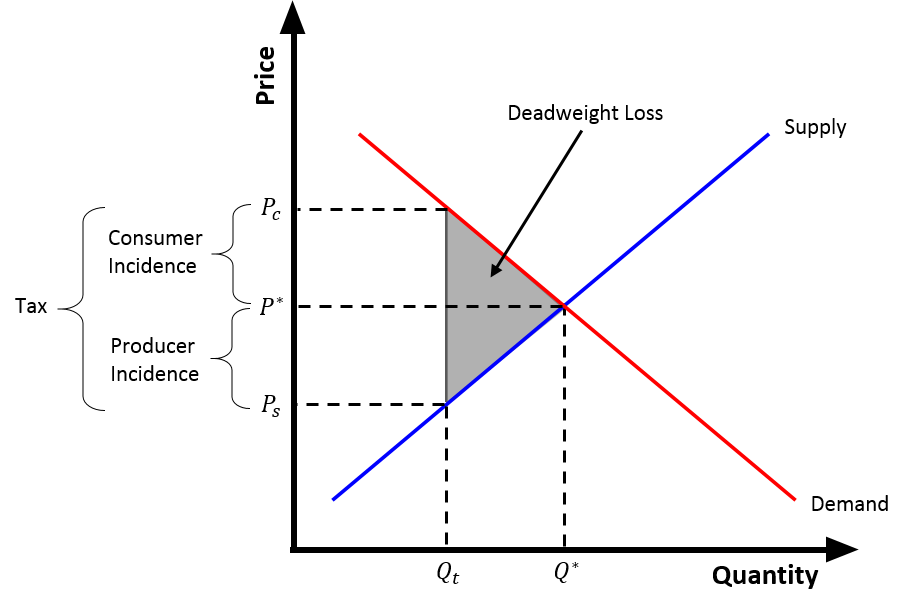

Tax Incidence

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The tax burden measures the true economic weight of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, taking into account how the tax leads prices to change. If a 10% tax is imposed on sellers of butter, for example, but the market price rises 8% as a result, most of the burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exporting

Tax exporting occurs when a country (or other jurisdiction) shifts its tax burden (partially) abroad. For example, if residents of country A hold shares of a company in country B, the government in B might want to levy an inefficiently high tax on this company's profits since the tax is partially borne by the shareholders in A. Tax exporting does not necessarily involve direct taxation of foreign residents. It can also work through other economic channels, such as price changes. See also * Capital flight * Capital strike * Luxembourg leaks * Tax avoidance * Tax competition * Tax inversion * Double Irish arrangement The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ... References Further reading * * * * International taxation Tax {{tax-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regressive Tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA In terms of individual income and wealth, a regressive tax imposes a greater burden (relative to resources) on the poor than on the rich: there is an inverse relationship between the tax rate and the taxpayer's ability to pay, as measured by assets, consumption, or income. These taxes tend to reduce the tax burden of the people with a higher ability to pay, as they shift the relative burden increasingly to those with a lower ability to pay. The regressivity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proportional Tax

A proportional tax is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. The amount of the tax is in proportion to the amount subject to taxation. "Proportional" describes a distribution effect on income or expenditure, referring to the way the rate remains consistent (does not progress from "low to high" or "high to low" as income or consumption changes), where the marginal tax rate is equal to the average tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA It can be applied to individual taxes or to a tax system as a whole; a year, multi-year, or lifetime. Proportional taxes maintain equal tax incidence regardless of the ability-to-pay and do not shift the incidence disproportionately to those with a higher or lower economic well-being. Flat tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Countries By Tax Revenue As Percentage Of GDP

This article lists countries alphabetically, with total tax revenue as a percentage of gross domestic product (GDP) for the listed countries. The tax percentage for each country listed in the source has been added to the chart. Tax as % of GDP (2020) See also *List of countries by government budget *List of countries by government spending as percentage of GDP *List of countries by social welfare spending *Taxation in the United States *List of countries by tax rates *Tax rates in Europe This is a list of the maximum potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to eith ... References {{DEFAULTSORT:Countries By Tax Revenue To Gdp Ratio Tax Revenue To Gdp Ratio Gross domestic product *Tax Revenue To Gdp Ratio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Countries By Tax Rates

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance tax. Some other taxes (for instance property tax, substantial in many countries, such as the United States) and payroll tax are not shown here. The table is not exhaustive in representing the true tax burden to either the corporation or the individual in the listed country. The tax rates displayed are marginal and do not account for deductions, exemptions or rebates. The effective rate is usually lower than the marginal rate. The tax rates given for federations (such as the United States and Canada) are averages and vary depending on the state or province. Territories t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

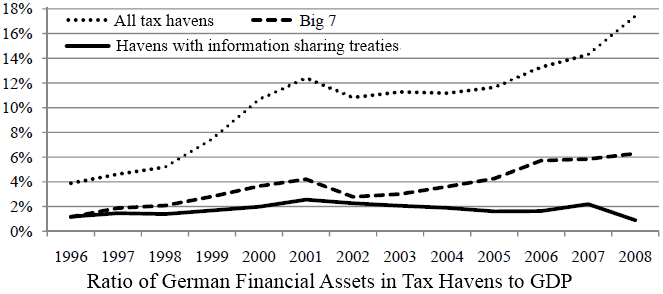

Capital Flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength. This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. This fall is particularly damaging when the capital belongs to the people of the affected country because not only are the citizens now burdened by the loss in the economy and devaluation of their currency but their assets have lost much of their nominal valu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |