|

Stochastic Modelling (insurance)

:''This page is concerned with the stochastic modelling as applied to the insurance industry. For other stochastic modelling applications, please see Monte Carlo method and Stochastic asset models. For mathematical definition, please see Stochastic process.'' " Stochastic" means being or having a random variable. A stochastic model is a tool for estimating probability distributions of potential outcomes by allowing for random variation in one or more inputs over time. The random variation is usually based on fluctuations observed in historical data for a selected period using standard time-series techniques. Distributions of potential outcomes are derived from a large number of simulations (stochastic projections) which reflect the random variation in the input(s). Its application initially started in physics. It is now being applied in engineering, life sciences, social sciences, and finance. See also Economic capital. Valuation Like any other company, an insurer has to s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monte Carlo Method

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. They are often used in physical and mathematical problems and are most useful when it is difficult or impossible to use other approaches. Monte Carlo methods are mainly used in three problem classes: optimization, numerical integration, and generating draws from a probability distribution. In physics-related problems, Monte Carlo methods are useful for simulating systems with many coupled degrees of freedom, such as fluids, disordered materials, strongly coupled solids, and cellular structures (see cellular Potts model, interacting particle systems, McKean–Vlasov processes, kinetic models of gases). Other examples include modeling phenomena with significant uncertainty in inputs such as the calculation of ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses, inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

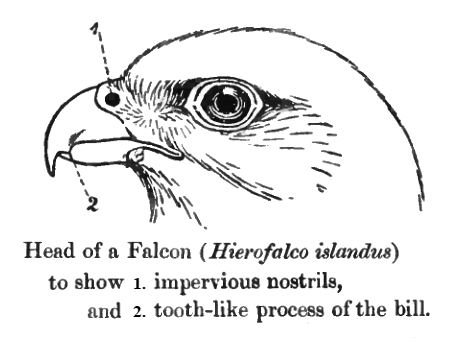

Falcon Model

Falcons () are birds of prey in the genus ''Falco'', which includes about 40 species. Falcons are widely distributed on all continents of the world except Antarctica, though closely related raptors did occur there in the Eocene. Adult falcons have thin, tapered wings, which enable them to fly at high speed and change direction rapidly. Fledgling falcons, in their first year of flying, have longer flight feathers, which make their configuration more like that of a general-purpose bird such as a broad wing. This makes flying easier while learning the exceptional skills required to be effective hunters as adults. The falcons are the largest genus in the Falconinae subfamily of Falconidae, which itself also includes another subfamily comprising caracaras and a few other species. All these birds kill with their beaks, using a tomial "tooth" on the side of their beaks—unlike the hawks, eagles, and other birds of prey in the Accipitridae, which use their feet. The largest fal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thompson Model

Thompson may refer to: People * Thompson (surname) * Thompson M. Scoon (1888–1953), New York politician Places Australia * Thompson Beach, South Australia, a locality Bulgaria * Thompson, Bulgaria, a village in Sofia Province Canada * Thompson, Manitoba * Thompson (electoral district), an electoral district in the above location * Rural Municipality of Thompson, Manitoba * Thompson River, a river in British Columbia ** Thompson Country, a region within the basin of the Thompson River ** Thompson Plateau, a landform in the Interior of British Columbia named for the Thompson River ** Thompson-Nicola Regional District, a regional district in British Columbia * Thompson Sound (British Columbia), a sound in the area of the Broughton Archipelago * Thompson Sound, British Columbia, an unincorporated locality at Thompson Sound * Thompson Station, Nova Scotia England * Thompson, Norfolk New Zealand * Thompson Sound (New Zealand), one of the indentations in the coas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilkie Investment Model

The Wilkie investment model, often just called Wilkie model, is a stochastic asset model developed by A. D. Wilkie that describes the behavior of various economics factors as stochastic time series. These time series are generated by autoregressive models. The main factor of the model which influences all asset prices is the consumer price index. The model is mainly in use for actuarial work and asset liability management. Because of the stochastic properties of that model it is mainly combined with Monte Carlo method Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be determi ...s. Wilkie first proposed the model in 1986, in a paper published in the ''Transactions of the Faculty of Actuaries''. It has since been the subject of extensive study and debate. Wilkie himself updated and expanded ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Investment Model

A stochastic investment model tries to forecast how returns and prices on different assets or asset classes, (e. g. equities or bonds) vary over time. Stochastic models are not applied for making point estimation rather interval estimation and they use different stochastic processes. Investment models can be classified into single-asset and multi-asset models. They are often used for actuarial work and financial planning to allow optimization in asset allocation or asset-liability-management (ALM). Single-asset models Interest rate models Interest rate models can be used to price fixed income products. They are usually divided into one-factor models and multi-factor assets. One-factor models * Black–Derman–Toy model * Black–Karasinski model * Cox–Ingersoll–Ross model * Ho–Lee model * Hull–White model * Kalotay–Williams–Fabozzi model * Merton model * Rendleman–Bartter model * Vasicek model Multi-factor models * Chen model * Longstaff–Schwartz mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Percentile

In statistics, a ''k''-th percentile (percentile score or centile) is a score ''below which'' a given percentage ''k'' of scores in its frequency distribution falls (exclusive definition) or a score ''at or below which'' a given percentage falls (inclusive definition). For example, the 50th percentile (the median) is the score below which 50% of the scores in the distribution are found (by the "exclusive" definition), or at or below which 50% of the scores are found (by the "inclusive" definition). Percentiles are expressed in the same unit of measurement as the input scores; for example, if the scores refer to human weight, the corresponding percentiles will be expressed in kilograms or pounds. The percentile score and the '' percentile rank'' are related terms. The percentile rank of a score is the percentage of scores in its distribution that are less than it, an exclusive definition, and one that can be expressed with a single, simple formula. Percentile scores and per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounted Cash Flow

The discounted cash flow (DCF) analysis is a method in finance of valuing a security, project, company, or asset using the concepts of the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management and patent valuation. It was used in industry as early as the 1700s or 1800s, widely discussed in financial economics in the 1960s, and became widely used in U.S. courts in the 1980s and 1990s. Application To apply the method, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question; see aside. For further context see valuation overview; and for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and venture cap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mean

There are several kinds of mean in mathematics, especially in statistics. Each mean serves to summarize a given group of data, often to better understand the overall value (magnitude and sign) of a given data set. For a data set, the '' arithmetic mean'', also known as "arithmetic average", is a measure of central tendency of a finite set of numbers: specifically, the sum of the values divided by the number of values. The arithmetic mean of a set of numbers ''x''1, ''x''2, ..., x''n'' is typically denoted using an overhead bar, \bar. If the data set were based on a series of observations obtained by sampling from a statistical population, the arithmetic mean is the ''sample mean'' (\bar) to distinguish it from the mean, or expected value, of the underlying distribution, the ''population mean'' (denoted \mu or \mu_x).Underhill, L.G.; Bradfield d. (1998) ''Introstat'', Juta and Company Ltd.p. 181/ref> Outside probability and statistics, a wide range of other notions of mean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |