|

Snake In The Tunnel

The snake in the tunnel was a system of European monetary cooperation in the 1970s which aimed at limiting fluctuations between different European currencies. It was the first attempt at European monetary cooperation. It attempted to create a single currency band for the European Economic Community (EEC), essentially pegging all the EEC currencies to one another. The ''tunnel'' collapsed in 1973 when the US dollar floated freely. The ''snake'' proved unsustainable, with several currencies leaving and in some cases rejoining; the French franc left in 1974, rejoined, and left again in 1976 despite appreciating against the US dollar. By 1977, it had become a Deutsche Mark zone with just the Belgian and Luxembourg franc, the Dutch guilder and the Danish krone tracking it. The Werner plan was abandoned. The European Monetary System followed the "snake" as a system for monetary coordination in the EEC. Background and implementation Pierre Werner presented a report on economic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Band

A currency band is a range of values for the exchange rate for a country’s currency which the country’s central bank acts to keep the exchange rate within. The central bank selects a range, or "band", of values at which to set their currency, and will intervene in the market or return to a fixed exchange rate if the value of their currency shifts outside this band. This allows for some revaluation, but tends to stabilize the currency's value within the band. In this sense, it is a compromise between a fixed (or "pegged") exchange rate and a floating exchange rate. For example, the exchange rate of the ''renminbi'' of the mainland China, mainland of the People's Republic of China has been based upon a currency band; April 18, 2013 Wall Street Journal the European Econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sterling Area

The sterling area (or sterling bloc, legally scheduled territories) was a group of countries that either pegged their currencies to sterling, or actually used sterling as their own currency. The area began to appear informally during the early 1930s, after sterling had left the gold standard in 1931, with the result that a number of currencies of countries that historically had performed a large amount of their trade in sterling were pegged to sterling instead of to gold. A large number of these countries were part of the British Empire; however, a significant minority were not. Early in the Second World War, emergency legislation united the sterling bloc countries and territories (except Hong Kong) of the British Empire in a single exchange control area to protect the external value of sterling, among other aims. Canada and Newfoundland were already linked to the US dollar and did not join the sterling bloc. The Bank of England in London guided co-ordination of monetar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works thro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of The European Union

The economy of the European Union is the joint economy of the member states of the European Union (EU). It is the third largest economy in the world in nominal terms, after the United States and China, and the third one in purchasing power parity (PPP) terms, after China and the United States. The European Union's GDP estimated to be around $16.6 trillion (nominal) in 2022 representing around one sixth of the global economy. The euro is the second largest reserve currency and the second most traded currency in the world after the United States dollar. The euro is used by 19 of its members, overall, it is the official currency in 25 countries, in the eurozone and in six other European countries, officially or de facto. The European Union economy consists of an internal market of mixed economies based on free market and advanced social models. For instance, it includes an internal single market with free movement of goods, services, capital, and labor. The GDP per capita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Unions

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "currency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1970s Economic History

Year 197 ( CXCVII) was a common year starting on Saturday (link will display the full calendar) of the Julian calendar. At the time, it was known as the Year of the Consulship of Magius and Rufinus (or, less frequently, year 950 ''Ab urbe condita''). The denomination 197 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * February 19 – Battle of Lugdunum: Emperor Septimius Severus defeats the self-proclaimed emperor Clodius Albinus at Lugdunum (modern Lyon). Albinus commits suicide; legionaries sack the town. * Septimius Severus returns to Rome and has about 30 of Albinus's supporters in the Senate executed. After his victory he declares himself the adopted son of the late Marcus Aurelius. * Septimius Severus forms new naval units, manning all the triremes in Italy with heavily armed troops for war in the East. His soldiers embark on an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1970 In The European Economic Community

Year 197 ( CXCVII) was a common year starting on Saturday (link will display the full calendar) of the Julian calendar. At the time, it was known as the Year of the Consulship of Magius and Rufinus (or, less frequently, year 950 ''Ab urbe condita''). The denomination 197 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * February 19 – Battle of Lugdunum: Emperor Septimius Severus defeats the self-proclaimed emperor Clodius Albinus at Lugdunum (modern Lyon). Albinus commits suicide; legionaries sack the town. * Septimius Severus returns to Rome and has about 30 of Albinus's supporters in the Senate executed. After his victory he declares himself the adopted son of the late Marcus Aurelius. * Septimius Severus forms new naval units, manning all the triremes in Italy with heavily armed troops for war in the East. His soldiers embark on an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

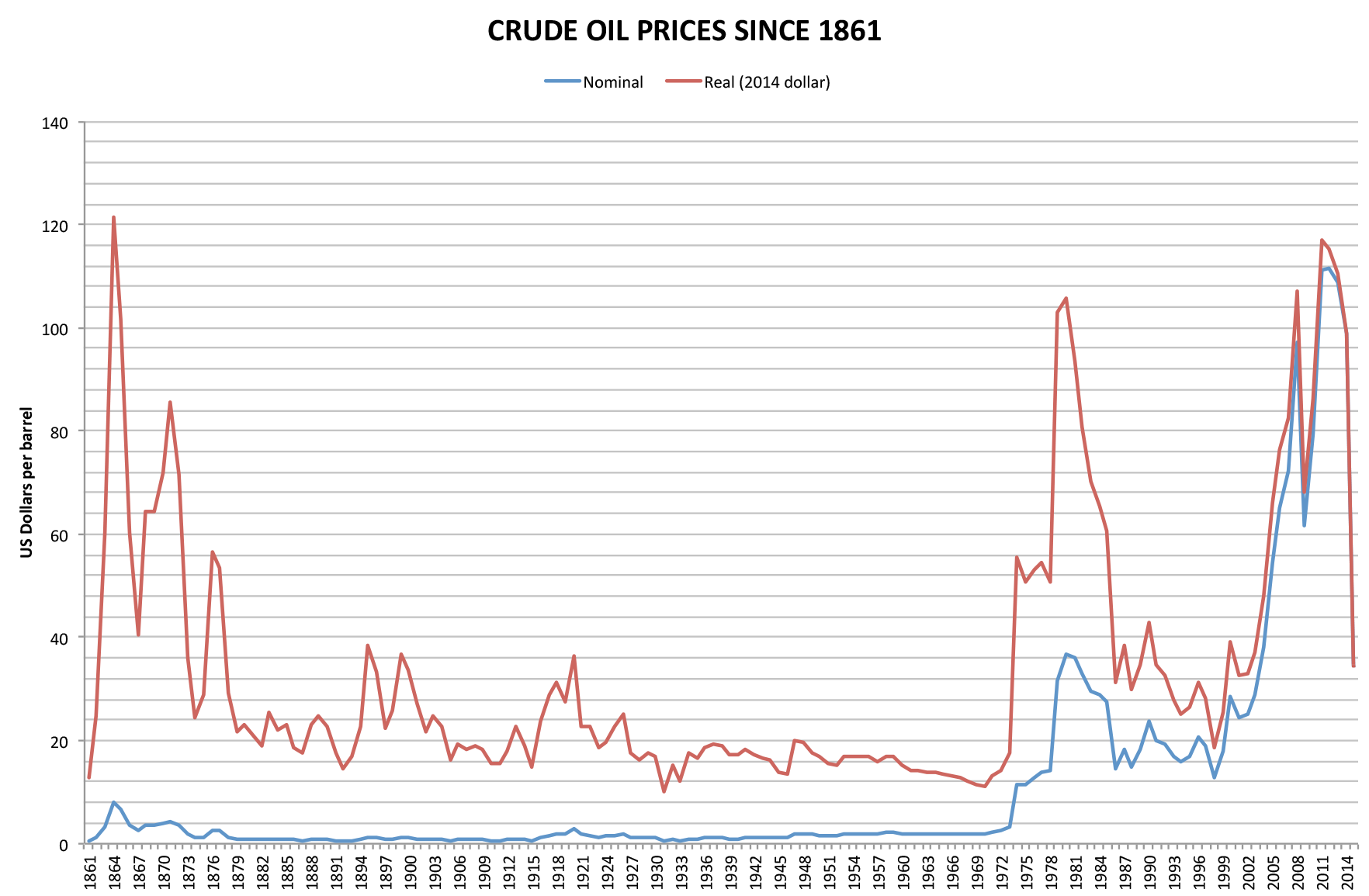

1973 Oil Crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, though the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US to nearly globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock". Background Arab-Israeli conflict Ever since the recreation of the State of Israel in 1948 there has been Arab–Israeli conflict in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shock (economics)

In economics, a shock is an unexpected or unpredictable event that affects an economy, either positively or negatively. Technically, it is an unpredictable change in exogenous factors—that is, factors unexplained by an economic model—which may influence endogenous economic variables. The response of economic variables, such as GDP and employment, at the time of the shock and at subsequent times, is measured by an impulse response function. Types of shocks A technology shock is the kind resulting from a technological development that affects productivity. If the shock is due to constrained supply, it is termed a supply shock and usually results in price increases for a particular product. Supply shocks can be produced when accidents or disasters occur. The 2008 Western Australian gas crisis resulting from a pipeline explosion at Varanus Island is one example. A demand shock is a sudden change of the pattern of private expenditure, especially of consumption spending by cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barry Eichengreen

Barry Julian Eichengreen (born 1952) is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987. Eichengreen currently serves as a research associate at the National Bureau of Economic Research and as a Research Fellow at the Centre for Economic Policy Research. Eichengreen's mother was Lucille Eichengreen, a Holocaust survivor and author. Career Eichengreen has done research and published widely on the history and current operation of the international monetary and financial system. He received his A.B. from UC Santa Cruz in 1974. an M.A. in economics, an M.Phil. in economics, an M.A. in history, and a Ph.D. in economics from Yale University in New Haven, Connecticut. He was a senior policy advisor to the International Monetary Fund in 1997 and 1998, although he has since been critical of the IMF. In 1997, he ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smithsonian Agreement

The Smithsonian Agreement, announced in December 1971, created a new dollar standard, whereby the currencies of a number of industrialized states were pegged to the US dollar. These currencies were allowed to fluctuate by 2.25% against the dollar. The Smithsonian Agreement was created when the Group of Ten (G-10) states (Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, the United Kingdom, and the United States) raised the price of gold to 38 dollars, an 8.5% increase over the previous price at which the US government had promised to redeem dollars for gold. In effect, the changing gold price devalued the dollar by 7.9%. Background The Bretton Woods Conference of 1944 established an international fixed exchange rate system based on the gold standard, in which currencies were pegged to the United States dollar, itself convertible into gold at $35/ounce. A negative balance of payments, growing public debt incurred by the Vietnam War and Great Society pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |