|

Securities Acts Amendments Of 1975

The Securities Acts Amendments of 1975 is an act of Congress. It was passed as a United States Public Law () on June 4, 1975, and amended the Securities Act of 1933 ( ''et seq.'') and the Securities Exchange Act of 1934 ( ''et seq.''). The Securities Acts Amendments imposed an obligation on the Securities and Exchange Commission to consider the impacts that any new regulation would have on competition. The law also empowered the Securities and Exchange Commission (SEC) to establish a national market system and a system for nationwide clearance and settlement of securities transactions, enabling the SEC to enact Regulation NMS, and created the Municipal Securities Rulemaking Board (MSRB), a self-regulatory organization that writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market. References See also *National Market System The National Market System (NMS) is a regulatory mechanism that governs the opera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

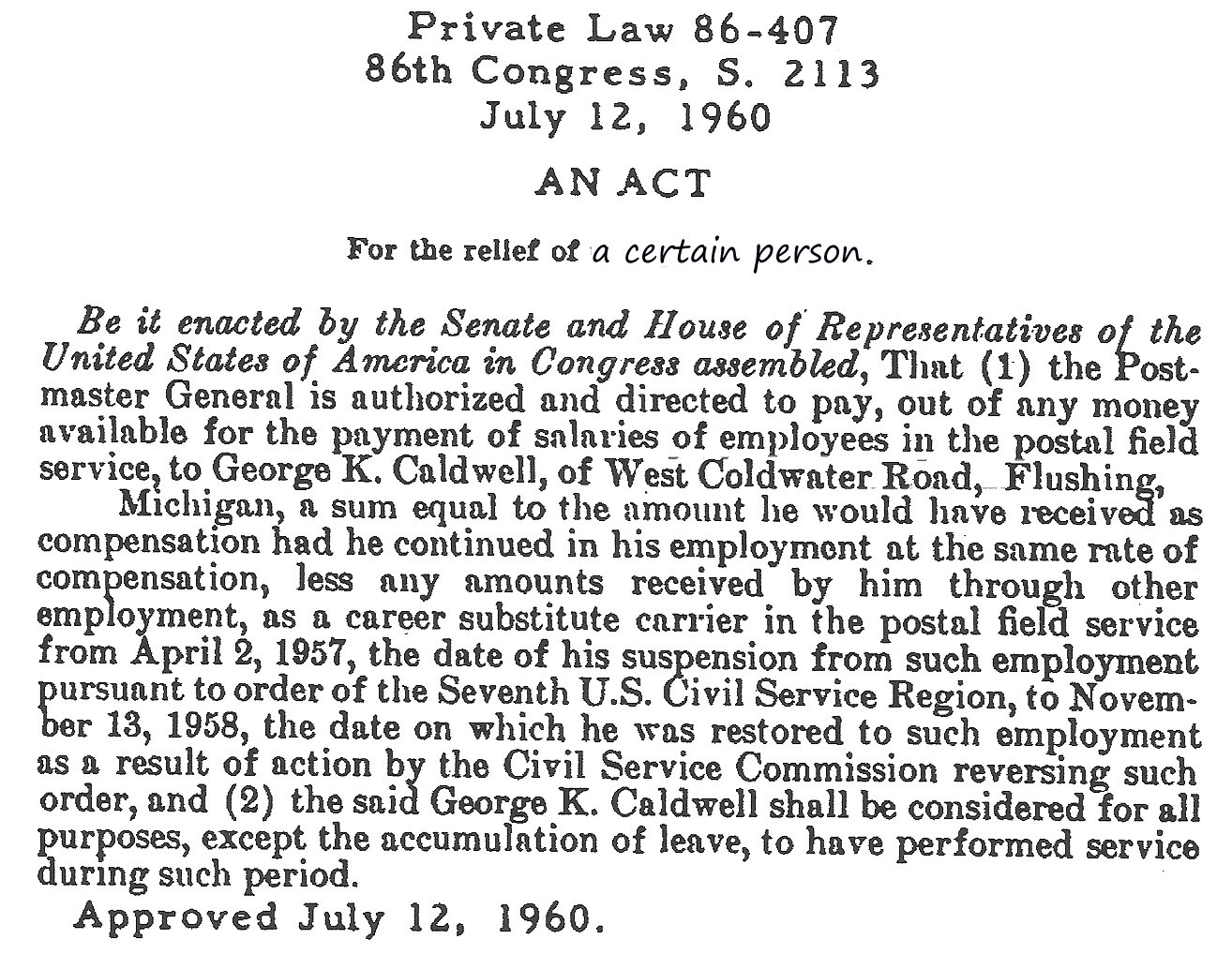

Act Of Congress

An Act of Congress is a statute enacted by the United States Congress. Acts may apply only to individual entities (called Public and private bills, private laws), or to the general public (Public and private bills, public laws). For a Bill (law), bill to become an act, the text must pass through both houses with a majority, then be either signed into law by the president of the United States, be left unsigned for ten days (excluding Sundays) while Congress remains in session, or, if vetoed by the president, receive a congressional override from of both houses. Public law, private law, designation In the United States, Acts of Congress are designated as either public laws, relating to the general public, or private laws, relating to specific institutions or individuals. Since 1957, all Acts of Congress have been designated as "Public Law X–Y" or "Private Law X–Y", where X is the number of the Congress and Y refers to the sequential order of the bill (when it was enacted). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Congress

An Act of Congress is a statute enacted by the United States Congress. Acts may apply only to individual entities (called Public and private bills, private laws), or to the general public (Public and private bills, public laws). For a Bill (law), bill to become an act, the text must pass through both houses with a majority, then be either signed into law by the president of the United States, be left unsigned for ten days (excluding Sundays) while Congress remains in session, or, if vetoed by the president, receive a congressional override from of both houses. Public law, private law, designation In the United States, Acts of Congress are designated as either public laws, relating to the general public, or private laws, relating to specific institutions or individuals. Since 1957, all Acts of Congress have been designated as "Public Law X–Y" or "Private Law X–Y", where X is the number of the Congress and Y refers to the sequential order of the bill (when it was enacted). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Act Of 1933

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution. It requires every offer or sale of securities that uses the means and instrumentalities of interstate commerce to be registered with the SEC pursuant to the 1933 Act, unless an exemption from registration exists under the law. The term "means and instrumentalities of interstate commerce" is extremely broad and it is virtually impossible to avoid the operation of the statute by attempting to offer or sell a security without using an "instrumentality" of interstate commerce. Any use of a telephone, for example, or the mails would probably be enough to subject the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Exchange Act Of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law. Companies raise billions of dollars by issuing securities in what is known as the primary market. Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, frequently through brokers or dealers. Trillions of dollars are made and lost each year through t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation NMS

Regulation National Market System (or Reg NMS) is a US financial regulation promulgated and described by the United States Securities and Exchange Commission (SEC) as "a series of initiatives designed to modernize and strengthen the National Market System for equity securities". The Reg NMS is intended to assure that investors receive the best ( NBBO) price executions for their orders by encouraging competition in the marketplace. Some contend that the rule has contributed to the rise of high-frequency trading, which is sometimes regarded as controversial. History Established in 2005, its aim was to foster both "competition among individual markets and competition among individual orders" in order to promote efficient and fair price formation across securities markets. In 1972, before the SEC began its pursuit of a national market system, the market for securities was quite fragmented. The same stock sometimes traded at different prices at different trading venues, and the NYSE ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Securities Rulemaking Board

The Municipal Securities Rulemaking Board (MSRB) writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market, including tax-exempt and taxable municipal bonds, municipal notes, and other securities issued by states, cities, and counties or their agencies to help finance public projects or for other public policy purposes. Operations Like the Financial Industry Regulatory Authority (FINRA), the MSRB is a self-regulatory organization that is subject to oversight by the Securities and Exchange Commission (SEC). The MSRB is authorized to create rules designed "to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade, to foster cooperation and coordination with persons engaged in regulating, clearing, settling, and processing information with respect to, and facilitating transactions in municipal securities, to remove impediments to and perfect the mechanism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-regulatory Organization

A self-regulatory organization (SRO) is an organization that exercises some degree of regulatory authority over an industry or profession. The regulatory authority could exist in place of government regulation, or applied in addition to government regulation. The ability of an SRO to exercise regulatory authority does not necessarily derive from a grant of authority from the government. United States In United States securities law, a self-regulatory organization is a defined term. The principal federal regulatory authority—the Securities and Exchange Commission (SEC)—was established by the Federal Securities Exchange Act of 1934. The SEC originally delegated authority to the National Association of Securities Dealers (NASD, now Financial Industry Regulatory Authority (FINRA)) and to the national stock exchanges (e.g., the NYSE) to enforce certain industry standards and requirements related to securities trading and brokerage. On July 26, 2007 the SEC approved a merger ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process. Although many broker-dealers are "independent" firms solely involved in broker-dealer services, many others are business units or subsidiaries of commercial banks, investment banks or investment companies. When executing trade orders on behalf of a customer, the institution is said to be acting as a broker. When executing trades for its own account, the institution is said to be acting as a dealer. Securities bought from clients or other firms in the capacity of dealer may be sold to clients or other firms acting again in the capacity of dealer, or they may become a part of the firm's holdings. In addition to execution of securities transactions, broker-dealers are also the main sellers and distributors of mut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Bond

A municipal bond, commonly known as a muni, is a Bond (finance), bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories. The U.S. municipal debt market is relatively small compared to the corporate market. Total municipal debt outstanding was $4 trillion as of the first quarter of 2021, compared to nearly $15 trillion in the corporate and foreign markets. Local authorities in many #In other countries, other countries in the world issue similar bonds, sometimes called local authority bonds or other names. History Municipal debt predates corporate debt b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |