|

Sudden Stop (economics)

A sudden stop in capital flows is defined as a sudden slowdown in private capital inflows into emerging market economies, and a corresponding sharp reversal from large current account deficits into smaller deficits or small surpluses. Sudden stops are usually followed by a sharp decrease in output, private spending and credit to the private sector, and real exchange rate depreciation. The term "sudden stop" was inspired by a banker’s comment on a paper by Rüdiger Dornbusch and Alejandro Werner about Mexico, that "it is not speed that kills, it is the sudden stop." Sudden stops are commonly described as periods that contain at least one observation where the year-on-year fall in capital flows lies at least two standard deviations below its sample mean. The start of the sudden stop period is determined by the first time the annual change in capital flows falls one standard deviation below the mean and the end of the sudden stop period is determined once the annual change in ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. A typical example is the machinery used in a factory. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." The means of production is as a "... series of heterogeneous commodities, each having specific technical characteristics ..." "capital goods", are one of the three types of intermediate goods used in the production process, the other two being land and labour. The three are also known collectively as "primary factors of production". This classification originated during the classical economics period and has remained the dominant method for classification. Capital can be increased by the use of a production process (see production function and factors of production). Outputs of the production process are normally classif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Economic Review

The ''European Economic Review'' is a peer-reviewed academic journal that covers research in economics. The journal was established in 1969 and the editors-in-chief are Evi Pappa (Universidad Carlos III de Madrid), David K. Levine (Royal Holloway University of London), Stefania Garetto (Boston University), Peter Rupert (University of California at Santa Barbara), and Robert Sauer (Royal Holloway University of London). According to the ''Journal Citation Reports'', the journal has a 2022 impact factor of 2.8. References External links * Economics journals Elsevier academic journals Academic journals established in 1969 English-language journals 10 times per year journals {{econ-journal-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe. After the adoption of the euro, policy changed to linking currencies of EU countries outside the eurozone to the euro (having the common currency as a central point). The goal was to improve the stability of those currencies, as well as to gain an evaluation mechanism for potential eurozone members. As of January 2025, two currencies participate in ERM II: the Danish krone and the Bulgarian lev. Intent and operation The ERM is based on the concept of fixed currency exchange rate margins, but with exchange rates variable within those margins. This is also known as a semi-pegged system. Before the introduction of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economic Review

The ''American Economic Review'' is a monthly peer-reviewed academic journal first published by the American Economic Association in 1911. The current editor-in-chief is Erzo FP Luttmer, a professor of economics at Dartmouth College. The journal is based in Pittsburgh. It is one of the " top five" journals in economics. In 2004, the ''American Economic Review'' began requiring "data and code sufficient to permit replication" of a paper's results, which is then posted on the journal's website. Exceptions are made for proprietary data. Until 2017, the May issue of the ''American Economic Review'', titled the ''Papers and Proceedings'' issue, featured the papers presented at the American Economic Association's annual meeting that January. After being selected for presentation, the papers in the ''Papers and Proceedings'' issue did not undergo a formal process of peer review. Starting in 2018, papers presented at the annual meetings have been published in a separate journal, '' AEA Pap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Channel

The credit channel mechanism of monetary policy describes the theory that a central bank's policy changes affect the amount of credit that banks issue to firms and consumers for purchases, which in turn affects the real economy. Credit channel versus conventional monetary policy transmission mechanisms Monetary policy transmission mechanisms describe how policy decisions are translated into effects on the real economy. Conventional monetary policy transmission mechanisms, such as the interest rate channel, focus on direct effects of monetary policy actions. The interest rate channel, for example, suggests that monetary policy makers use their leverage over nominal, short-term interest rates, such as the federal funds rate, to influence the cost of capital, and subsequently, purchases of durable goods and firm investment. Because prices are assumed to be sticky in the short-run, short-term interest rate changes affect the real interest rate. Changes in the real interest rate i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

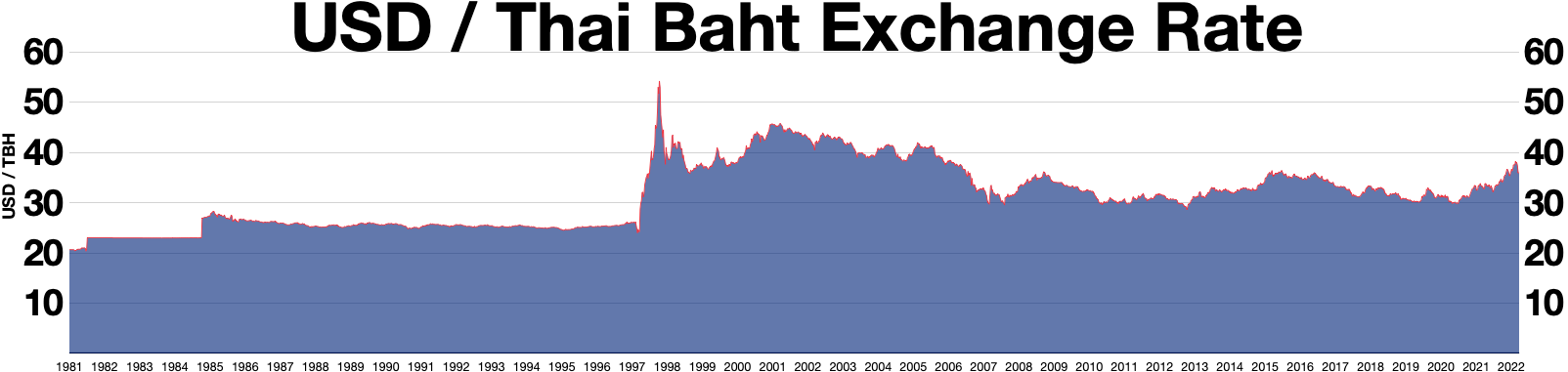

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Empiricism

In philosophy, empiricism is an epistemological view which holds that true knowledge or justification comes only or primarily from sensory experience and empirical evidence. It is one of several competing views within epistemology, along with rationalism and skepticism. Empiricists argue that empiricism is a more reliable method of finding the truth than purely using logical reasoning, because humans have cognitive biases and limitations which lead to errors of judgement. Empiricism emphasizes the central role of empirical evidence in the formation of ideas, rather than innate ideas or traditions. Empiricists may argue that traditions (or customs) arise due to relations of previous sensory experiences. Historically, empiricism was associated with the " blank slate" concept (''tabula rasa''), according to which the human mind is "blank" at birth and develops its thoughts only through later experience. Empiricism in the philosophy of science emphasizes evidence, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1994 Economic Crisis In Mexico

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the Mexican peso, peso against the United States dollar, U.S. dollar in December 1994, which became one of the first international financial crisis, financial crises ignited by capital flight. During the 1994 Mexican general election, 1994 presidential election, the incumbent administration embarked on an expansionary fiscal and monetary policy. The Secretariat of Finance and Public Credit (Mexico), Mexican treasury began issuing maturity (finance), short-term government debt, debt instruments denominated in domestic currency with a guaranteed repayment in U.S. dollars, attracting foreign investors. Mexico enjoyed investor consumer confidence, confidence and new access to international capital following its signing of the North American Free Trade Agreement (NAFTA). However, a Chiapas conflict, violent uprising in the state of Chiapas, as well as the assassination of the presi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Political Economy

The ''Journal of Political Economy'' is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the journal published quarterly from its introduction through 1905, ten issues per volume from 1906 through 1921, and bimonthly from 1922 through 2019. The editor-in-chief is Esteban Rossi-Hansberg (University of Chicago). It is considered one of the top five journals in economics. JPE Micro and JPE Macro In 2023, University of Chicago Press announced the establishment of Journal of Political Economy Microeconomics (JPE Micro) and Journal of Political Economy Macroeconomics (JPE Macro), two new journals that are vertically integrated with the Journal of Political Economy. Abstracting and indexing The journal is abstracted and indexed in EBSCO, ProQuest, EconLit, Research Papers in Economics, Current Contents/Social & Behavioral Scien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Solvency

Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-term fixed expenses and to accomplish long-term expansion and growth. This is best measured using the net liquid balance (NLB) formula. In this formula, solvency is calculated by adding cash and cash equivalents to short-term investments, then subtracting notes payable. There exist cryptographic schemes for both proofs of liabilities and assets, especially in the blockchain space. See also * Accounting liquidity * Debt ratio * Going concern * Insolvency * Quick ratio Notes References * * * * * External links *{{Wiktionary-inline Financial economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvency, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Illiquid Asset

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. A liquid asset is an asset which can be converted into cash within a relatively short period of time, or cash itself, which can be considered the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: it can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |